Professional Documents

Culture Documents

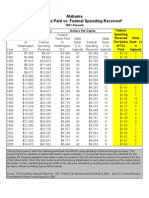

Proptax 08 10 Taxespaid

Uploaded by

Tax FoundationOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Proptax 08 10 Taxespaid

Uploaded by

Tax FoundationCopyright:

Available Formats

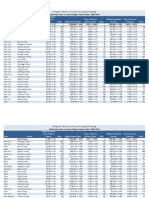

Property Taxes on Owner-Occupied Housing

Ranked by total tax paid, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

Median Home Value

$2,018 +/- 4

New York

Westchester County

New York

New Jersey

New York

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

Median Household Taxes as Percent of

Rank

Income

Income

$64,519 +/- 62

3.13% +/- 0.01

Rank

$9,424 +/- 140

$546,900 +/- 6,269

1.72% +/- 0.03

195

$110,211 +/- 1,823

8.55% +/- 0.19

Nassau County

$8,968 +/- 42

$479,500 +/- 2,238

1.87% +/- 0.01

120

$105,507 +/- 1,028

8.50% +/- 0.09

Bergen County

$8,780 +/- 50

$475,200 +/- 3,504

1.85% +/- 0.02

132

$102,269 +/- 1,340

8.59% +/- 0.12

Rockland County

$8,673 +/- 112

$468,000 +/- 4,687

1.85% +/- 0.03

129

$105,342 +/- 2,525

8.23% +/- 0.22

New Jersey

Hunterdon County

$8,582 +/- 154

$433,700 +/- 9,072

1.98% +/- 0.05

89

$115,029 +/- 4,283

7.46% +/- 0.31

11

New Jersey

Essex County

$8,344 +/- 78

$389,100 +/- 3,996

2.14% +/- 0.03

50

$95,309 +/- 1,727

8.75% +/- 0.18

New Jersey

Morris County

$7,917 +/- 89

$462,600 +/- 4,032

1.71% +/- 0.02

202

$112,395 +/- 2,340

7.04% +/- 0.17

15

New Jersey

Passaic County

$7,863 +/- 100

$373,800 +/- 3,452

2.10% +/- 0.03

58

$84,705 +/- 2,309

9.28% +/- 0.28

New Jersey

Somerset County

$7,853 +/- 95

$416,000 +/- 6,991

1.89% +/- 0.04

113

$110,451 +/- 2,946

7.11% +/- 0.21

14

New Jersey

Union County

$7,714 +/- 106

10

$386,300 +/- 3,715

2.00% +/- 0.03

79

$92,195 +/- 2,102

8.37% +/- 0.22

New York

Putnam County

$7,627 +/- 227

11

$408,500 +/- 9,972

1.87% +/- 0.07

122

$98,508 +/- 2,615

7.74% +/- 0.31

New York

Suffolk County

$7,411 +/- 53

12

$408,800 +/- 2,713

1.81% +/- 0.02

148

$95,286 +/- 1,097

7.78% +/- 0.11

New Jersey

Monmouth County

$7,051 +/- 50

13

$413,800 +/- 4,300

1.70% +/- 0.02

205

$100,800 +/- 1,229

7.00% +/- 0.10

18

New Jersey

Hudson County

$6,625 +/- 102

14

$377,100 +/- 5,881

1.76% +/- 0.04

178

$87,516 +/- 2,828

7.57% +/- 0.27

10

New Jersey

Mercer County

$6,481 +/- 97

15

$306,500 +/- 5,833

2.11% +/- 0.05

55

$92,769 +/- 2,310

6.99% +/- 0.20

19

Illinois

Lake County

$6,433 +/- 62

16

$284,200 +/- 3,127

2.26% +/- 0.03

38

$91,577 +/- 1,346

7.02% +/- 0.12

17

New Jersey

Middlesex County

$6,416 +/- 41

17

$350,000 +/- 2,225

1.83% +/- 0.02

140

$93,389 +/- 1,569

6.87% +/- 0.12

20

Connecticut

Fairfield County

$6,375 +/- 44

18

$465,400 +/- 5,466

1.37% +/- 0.02

401

$102,183 +/- 1,167

6.24% +/- 0.08

35

New Jersey

Sussex County

$6,178 +/- 63

19

$309,800 +/- 5,622

1.99% +/- 0.04

81

$90,359 +/- 2,319

6.84% +/- 0.19

21

New Jersey

Warren County

$6,077 +/- 108

20

$299,000 +/- 7,397

2.03% +/- 0.06

71

$86,333 +/- 2,437

7.04% +/- 0.23

16

New York

New York County

$6,063 +/- 139

21

$841,800 +/- 16,391

0.72% +/- 0.02

1168

$132,791 +/- 4,759

4.57% +/- 0.19

133

New York

Orange County

$5,831 +/- 102

22

$306,000 +/- 4,933

1.91% +/- 0.05

110

$87,141 +/- 2,243

6.69% +/- 0.21

25

New Jersey

Burlington County

$5,740 +/- 69

23

$272,000 +/- 3,206

2.11% +/- 0.04

57

$86,640 +/- 1,591

6.63% +/- 0.15

27

New Jersey

Camden County

$5,716 +/- 48

24

$226,400 +/- 2,253

2.52% +/- 0.03

20

$77,151 +/- 1,411

7.41% +/- 0.15

12

Illinois

DuPage County

$5,658 +/- 46

25

$314,700 +/- 2,579

1.80% +/- 0.02

158

$90,276 +/- 1,159

6.27% +/- 0.10

32

California

Marin County

$5,631 +/- 201

26

$839,100 +/- 13,145

0.67% +/- 0.03

1276

$113,651 +/- 2,568

4.95% +/- 0.21

93

Illinois

Kendall County

$5,585 +/- 134

27

$245,500 +/- 5,997

2.27% +/- 0.08

37

$89,293 +/- 3,312

6.25% +/- 0.28

34

New Jersey

Gloucester County

$5,544 +/- 80

28

$239,700 +/- 2,396

2.31% +/- 0.04

33

$81,702 +/- 1,554

6.79% +/- 0.16

22

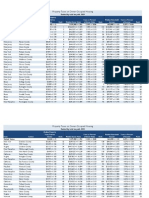

Property Taxes on Owner-Occupied Housing

Ranked by total tax paid, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

$2,018 +/- 4

Median Home Value

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

Median Household Taxes as Percent of

Rank

Income

Income

$64,519 +/- 62

3.13% +/- 0.01

Rank

New Hampshire

Rockingham County

$5,410 +/- 70

29

$294,900 +/- 3,603

1.83% +/- 0.03

138

$87,316 +/- 1,817

6.20% +/- 0.15

37

Illinois

McHenry County

$5,333 +/- 83

30

$246,800 +/- 2,661

2.16% +/- 0.04

47

$82,851 +/- 1,514

6.44% +/- 0.15

29

Illinois

Kane County

$5,292 +/- 86

31

$245,500 +/- 2,989

2.16% +/- 0.04

48

$79,495 +/- 1,480

6.66% +/- 0.16

26

Illinois

Will County

$5,099 +/- 60

32

$240,200 +/- 1,942

2.12% +/- 0.03

52

$82,727 +/- 1,504

6.16% +/- 0.13

40

New York

Dutchess County

$5,073 +/- 109

33

$311,600 +/- 4,982

1.63% +/- 0.04

239

$84,620 +/- 1,891

6.00% +/- 0.19

42

Virginia

Loudoun County

$5,065 +/- 94

34

$460,800 +/- 6,756

1.10% +/- 0.03

625

$130,470 +/- 1,918

3.88% +/- 0.09

270

New Hampshire

Hillsborough County

$4,865 +/- 46

35

$264,300 +/- 2,506

1.84% +/- 0.02

134

$84,845 +/- 1,735

5.73% +/- 0.13

53

California

Santa Clara County

$4,829 +/- 68

36

$674,100 +/- 4,286

0.72% +/- 0.01

1175

$111,702 +/- 1,289

4.32% +/- 0.08

174

Connecticut

New Haven County

$4,824 +/- 33

37

$274,300 +/- 2,137

1.76% +/- 0.02

176

$81,885 +/- 954

5.89% +/- 0.08

48

New Hampshire

Merrimack County

$4,806 +/- 75

38

$244,300 +/- 4,131

1.97% +/- 0.05

93

$77,585 +/- 2,528

6.19% +/- 0.22

39

California

San Mateo County

$4,691 +/- 97

39

$756,400 +/- 10,453

0.62% +/- 0.02

1412

$110,335 +/- 1,808

4.25% +/- 0.11

184

Virginia

Arlington County

$4,673 +/- 96

40

$574,900 +/- 8,603

0.81% +/- 0.02

993

$129,429 +/- 4,158

3.61% +/- 0.14

346

New Jersey

Atlantic County

$4,634 +/- 64

41

$257,700 +/- 4,682

1.80% +/- 0.04

157

$65,005 +/- 2,003

7.13% +/- 0.24

13

Connecticut

Middlesex County

$4,618 +/- 79

42

$307,500 +/- 6,920

1.50% +/- 0.04

305

$87,873 +/- 2,889

5.26% +/- 0.19

69

Rhode Island

Bristol County

$4,592 +/- 111

43

$357,500 +/- 8,423

1.28% +/- 0.04

465

$89,171 +/- 4,336

5.15% +/- 0.28

74

New Jersey

Salem County

$4,571 +/- 122

44

$204,000 +/- 7,660

2.24% +/- 0.10

42

$71,587 +/- 3,681

6.39% +/- 0.37

30

Maryland

Howard County

California

San Francisco County

Virginia

$4,537 +/- 68

45

$445,400 +/- 6,097

1.02% +/- 0.02

714

$124,993 +/- 2,883

3.63% +/- 0.10

341

$4,524 +/- 129

46

$773,600 +/- 11,416

0.58% +/- 0.02

1490

$106,418 +/- 2,508

4.25% +/- 0.16

186

Fairfax County

$4,515 +/- 41

47

$479,500 +/- 3,753

0.94% +/- 0.01

816

$127,252 +/- 1,558

3.55% +/- 0.05

361

Connecticut

Hartford County

$4,469 +/- 37

48

$251,400 +/- 2,020

1.78% +/- 0.02

168

$82,118 +/- 957

5.44% +/- 0.08

60

Connecticut

Tolland County

$4,466 +/- 82

49

$273,100 +/- 3,938

1.64% +/- 0.04

236

$92,032 +/- 2,552

4.85% +/- 0.16

102

New Jersey

Ocean County

$4,447 +/- 40

50

$285,800 +/- 2,653

1.56% +/- 0.02

275

$65,908 +/- 1,376

6.75% +/- 0.15

24

New Hampshire

Cheshire County

$4,414 +/- 108

51

$204,800 +/- 7,336

2.16% +/- 0.09

49

$65,241 +/- 2,409

6.77% +/- 0.30

23

Massachusetts

Middlesex County

$4,407 +/- 30

52

$407,800 +/- 2,993

1.08% +/- 0.01

641

$99,714 +/- 1,152

4.42% +/- 0.06

155

New Hampshire

Strafford County

$4,392 +/- 82

53

$227,000 +/- 4,135

1.93% +/- 0.05

100

$71,571 +/- 3,219

6.14% +/- 0.30

41

New York

Ulster County

$4,386 +/- 127

54

$241,500 +/- 4,049

1.82% +/- 0.06

146

$69,981 +/- 1,926

6.27% +/- 0.25

33

Illinois

DeKalb County

$4,340 +/- 98

55

$189,700 +/- 4,626

2.29% +/- 0.08

35

$69,923 +/- 3,415

6.21% +/- 0.33

36

Texas

Collin County

$4,264 +/- 47

56

$204,400 +/- 2,458

2.09% +/- 0.03

61

$100,299 +/- 1,228

4.25% +/- 0.07

185

Property Taxes on Owner-Occupied Housing

Ranked by total tax paid, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

$2,018 +/- 4

Median Home Value

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

Median Household Taxes as Percent of

Rank

Income

Income

$64,519 +/- 62

3.13% +/- 0.01

Rank

Massachusetts

Norfolk County

$4,262 +/- 41

57

$396,800 +/- 2,903

1.07% +/- 0.01

652

$100,364 +/- 1,446

4.25% +/- 0.07

188

Pennsylvania

Chester County

$4,250 +/- 49

58

$334,000 +/- 4,038

1.27% +/- 0.02

479

$98,858 +/- 1,917

4.30% +/- 0.10

179

Pennsylvania

Bucks County

$4,227 +/- 40

59

$320,500 +/- 2,991

1.32% +/- 0.02

436

$87,463 +/- 1,440

4.83% +/- 0.09

104

Vermont

Chittenden County

$4,169 +/- 83

60

$264,700 +/- 4,480

1.57% +/- 0.04

266

$78,152 +/- 2,479

5.33% +/- 0.20

64

Texas

Fort Bend County

$4,162 +/- 86

61

$176,100 +/- 2,883

2.36% +/- 0.06

28

$91,753 +/- 1,536

4.54% +/- 0.12

139

Wisconsin

Dane County

$4,157 +/- 43

62

$233,800 +/- 1,875

1.78% +/- 0.02

167

$81,499 +/- 1,446

5.10% +/- 0.10

81

California

Alameda County

$4,134 +/- 61

63

$543,100 +/- 5,030

0.76% +/- 0.01

1079

$99,064 +/- 1,600

4.17% +/- 0.09

202

Connecticut

Litchfield County

$4,103 +/- 73

64

$279,700 +/- 4,594

1.47% +/- 0.04

327

$80,384 +/- 2,028

5.10% +/- 0.16

80

Virginia

Alexandria city

$4,030 +/- 138

65

$473,500 +/- 14,184

0.85% +/- 0.04

933

$119,510 +/- 5,406

3.37% +/- 0.19

427

Rhode Island

Washington County

$4,019 +/- 107

66

$346,400 +/- 7,066

1.16% +/- 0.04

571

$85,179 +/- 3,600

4.72% +/- 0.24

117

Texas

Travis County

$4,012 +/- 63

67

$213,800 +/- 2,985

1.88% +/- 0.04

117

$81,153 +/- 1,156

4.94% +/- 0.10

95

Wisconsin

Ozaukee County

$4,002 +/- 102

68

$260,600 +/- 7,321

1.54% +/- 0.06

285

$86,452 +/- 2,916

4.63% +/- 0.20

126

Texas

Rockwall County

$3,984 +/- 141

69

$194,800 +/- 5,932

2.05% +/- 0.10

70

$84,311 +/- 4,917

4.73% +/- 0.32

116

New York

Schenectady County

$3,975 +/- 112

70

$165,500 +/- 2,767

2.40% +/- 0.08

23

$66,411 +/- 1,807

5.99% +/- 0.23

44

Pennsylvania

Delaware County

$3,958 +/- 47

71

$240,100 +/- 2,851

1.65% +/- 0.03

232

$77,779 +/- 1,360

5.09% +/- 0.11

82

New Hampshire

Sullivan County

$3,947 +/- 145

72

$188,900 +/- 9,403

2.09% +/- 0.13

59

$60,378 +/- 3,525

6.54% +/- 0.45

28

Wisconsin

Waukesha County

$3,943 +/- 28

73

$265,200 +/- 2,259

1.49% +/- 0.02

318

$87,026 +/- 1,622

4.53% +/- 0.09

143

New York

Tompkins County

$3,919 +/- 178

74

$169,200 +/- 4,434

2.32% +/- 0.12

32

$70,448 +/- 3,461

5.56% +/- 0.37

56

Wyoming

Teton County

$3,919 +/- 465

74

$709,100 +/- 65,706

0.55% +/- 0.08

1545

$90,929 +/- 8,835

4.31% +/- 0.66

176

New York

Monroe County

$3,899 +/- 40

76

$133,500 +/- 1,232

2.92% +/- 0.04

$66,847 +/- 911

5.83% +/- 0.10

50

Michigan

Washtenaw County

$3,898 +/- 54

77

$205,100 +/- 4,198

1.90% +/- 0.05

112

$80,402 +/- 1,728

4.85% +/- 0.12

103

Pennsylvania

Montgomery County

$3,894 +/- 36

78

$299,600 +/- 2,720

1.30% +/- 0.02

455

$92,314 +/- 1,367

4.22% +/- 0.07

192

Rhode Island

Newport County

$3,887 +/- 107

79

$380,300 +/- 9,140

1.02% +/- 0.04

708

$85,767 +/- 4,010

4.53% +/- 0.25

140

California

Contra Costa County

$3,870 +/- 56

80

$467,200 +/- 5,280

0.83% +/- 0.02

966

$96,633 +/- 1,411

4.00% +/- 0.08

235

New Jersey

Cumberland County

$3,869 +/- 77

81

$182,800 +/- 3,504

2.12% +/- 0.06

54

$65,021 +/- 2,104

5.95% +/- 0.23

46

New Jersey

Cape May County

$3,857 +/- 84

82

$337,100 +/- 8,164

1.14% +/- 0.04

587

$66,073 +/- 3,761

5.84% +/- 0.36

49

Illinois

Cook County

$3,810 +/- 19

83

$262,000 +/- 1,277

1.45% +/- 0.01

329

$71,818 +/- 472

5.31% +/- 0.04

66

Texas

Williamson County

$3,806 +/- 55

84

$175,700 +/- 2,553

2.17% +/- 0.04

44

$80,317 +/- 1,402

4.74% +/- 0.11

114

Property Taxes on Owner-Occupied Housing

Ranked by total tax paid, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

$2,018 +/- 4

Median Home Value

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

Median Household Taxes as Percent of

Rank

Income

Income

$64,519 +/- 62

3.13% +/- 0.01

Rank

Maryland

Montgomery County

$3,800 +/- 36

85

$463,200 +/- 3,378

0.82% +/- 0.01

985

$115,878 +/- 1,634

3.28% +/- 0.06

455

Ohio

Delaware County

$3,796 +/- 91

86

$255,100 +/- 5,064

1.49% +/- 0.05

316

$100,557 +/- 2,262

3.77% +/- 0.12

298

Massachusetts

Essex County

$3,793 +/- 33

87

$361,500 +/- 2,716

1.05% +/- 0.01

678

$87,384 +/- 1,399

4.34% +/- 0.08

167

Texas

Denton County

$3,764 +/- 34

88

$181,900 +/- 2,265

2.07% +/- 0.03

62

$93,980 +/- 1,586

4.01% +/- 0.08

234

New York

Sullivan County

$3,756 +/- 122

89

$188,700 +/- 7,013

1.99% +/- 0.10

83

$59,050 +/- 2,584

6.36% +/- 0.35

31

Virginia

Fairfax city

$3,754 +/- 127

90

$473,200 +/- 16,795

0.79% +/- 0.04

1030

$110,103 +/- 7,566

3.41% +/- 0.26

413

Vermont

Addison County

$3,750 +/- 101

91

$232,400 +/- 6,089

1.61% +/- 0.06

245

$65,777 +/- 3,524

5.70% +/- 0.34

54

Wisconsin

Milwaukee County

$3,739 +/- 21

92

$166,400 +/- 912

2.25% +/- 0.02

41

$62,433 +/- 863

5.99% +/- 0.09

43

New York

Columbia County

$3,731 +/- 133

93

$232,900 +/- 8,114

1.60% +/- 0.08

252

$64,351 +/- 4,638

5.80% +/- 0.47

51

New York

Rensselaer County

$3,730 +/- 87

94

$180,800 +/- 4,774

2.06% +/- 0.07

63

$70,618 +/- 3,428

5.28% +/- 0.28

67

Massachusetts

Plymouth County

$3,721 +/- 33

95

$348,400 +/- 3,192

1.07% +/- 0.01

661

$85,257 +/- 1,445

4.36% +/- 0.08

163

Vermont

Windsor County

$3,712 +/- 118

96

$213,500 +/- 10,820

1.74% +/- 0.10

185

$59,922 +/- 2,659

6.19% +/- 0.34

38

New York

Albany County

$3,711 +/- 70

97

$211,600 +/- 4,306

1.75% +/- 0.05

180

$79,370 +/- 1,839

4.68% +/- 0.14

121

California

Santa Cruz County

$3,704 +/- 144

98

$600,700 +/- 11,617

0.62% +/- 0.03

1419

$86,320 +/- 2,726

4.29% +/- 0.21

182

Illinois

Grundy County

$3,701 +/- 132

99

$190,900 +/- 6,520

1.94% +/- 0.10

98

$72,970 +/- 3,437

5.07% +/- 0.30

83

Texas

Kendall County

$3,657 +/- 317

100

$270,900 +/- 28,122

1.35% +/- 0.18

414

$80,701 +/- 5,988

4.53% +/- 0.52

141

Washington

King County

$3,652 +/- 21

101

$406,800 +/- 2,881

0.90% +/- 0.01

865

$92,263 +/- 1,063

3.96% +/- 0.05

246

Connecticut

New London County

$3,647 +/- 44

102

$268,700 +/- 4,348

1.36% +/- 0.03

409

$81,277 +/- 1,305

4.49% +/- 0.09

145

New Hampshire

Belknap County

$3,638 +/- 90

103

$224,900 +/- 6,480

1.62% +/- 0.06

244

$62,781 +/- 2,471

5.79% +/- 0.27

52

Alaska

Anchorage Municipality

$3,595 +/- 62

104

$273,200 +/- 4,119

1.32% +/- 0.03

439

$93,888 +/- 2,520

3.83% +/- 0.12

283

Illinois

Boone County

$3,591 +/- 148

105

$178,100 +/- 8,668

2.02% +/- 0.13

75

$68,652 +/- 2,721

5.23% +/- 0.30

71

New Hampshire

Grafton County

$3,580 +/- 115

106

$214,700 +/- 5,690

1.67% +/- 0.07

222

$60,455 +/- 2,679

5.92% +/- 0.32

47

Pennsylvania

Monroe County

$3,579 +/- 76

107

$208,800 +/- 4,739

1.71% +/- 0.05

198

$62,799 +/- 1,907

5.70% +/- 0.21

55

Rhode Island

Kent County

$3,579 +/- 51

107

$240,900 +/- 3,020

1.49% +/- 0.03

320

$71,732 +/- 1,423

4.99% +/- 0.12

90

Wisconsin

Kenosha County

$3,569 +/- 42

109

$182,200 +/- 4,024

1.96% +/- 0.05

94

$67,670 +/- 2,223

5.27% +/- 0.18

68

Wisconsin

Pierce County

$3,557 +/- 99

110

$197,600 +/- 6,047

1.80% +/- 0.07

155

$71,281 +/- 3,236

4.99% +/- 0.27

89

California

San Benito County

$3,553 +/- 225

111

$410,700 +/- 27,792

0.87% +/- 0.08

911

$81,873 +/- 4,662

4.34% +/- 0.37

168

Vermont

Windham County

$3,552 +/- 105

112

$209,200 +/- 8,237

1.70% +/- 0.08

208

$59,647 +/- 2,588

5.96% +/- 0.31

45

Property Taxes on Owner-Occupied Housing

Ranked by total tax paid, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

$2,018 +/- 4

Median Home Value

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

Median Household Taxes as Percent of

Rank

Income

Income

$64,519 +/- 62

3.13% +/- 0.01

Rank

Michigan

Oakland County

$3,547 +/- 26

113

$188,400 +/- 1,484

1.88% +/- 0.02

114

$78,084 +/- 1,289

4.54% +/- 0.08

137

Wisconsin

Washington County

$3,525 +/- 46

114

$234,900 +/- 3,275

1.50% +/- 0.03

306

$75,033 +/- 2,695

4.70% +/- 0.18

120

New York

Saratoga County

$3,491 +/- 77

115

$230,500 +/- 3,910

1.51% +/- 0.04

296

$78,879 +/- 2,633

4.43% +/- 0.18

154

Vermont

Washington County

$3,485 +/- 106

116

$206,200 +/- 7,116

1.69% +/- 0.08

210

$62,984 +/- 2,834

5.53% +/- 0.30

57

California

Napa County

$3,482 +/- 184

117

$495,900 +/- 14,626

0.70% +/- 0.04

1206

$88,539 +/- 4,160

3.93% +/- 0.28

250

Rhode Island

Providence County

$3,474 +/- 30

118

$249,000 +/- 2,362

1.40% +/- 0.02

372

$70,989 +/- 1,207

4.89% +/- 0.09

101

California

Orange County

$3,470 +/- 29

119

$560,100 +/- 3,137

0.62% +/- 0.01

1414

$94,176 +/- 929

3.68% +/- 0.05

324

California

Placer County

$3,428 +/- 78

120

$375,400 +/- 4,025

0.91% +/- 0.02

850

$86,382 +/- 2,357

3.97% +/- 0.14

242

Wisconsin

Walworth County

$3,428 +/- 56

120

$204,200 +/- 5,802

1.68% +/- 0.06

214

$66,644 +/- 1,792

5.14% +/- 0.16

76

Pennsylvania

Northampton County

$3,421 +/- 45

122

$225,900 +/- 3,208

1.51% +/- 0.03

297

$69,758 +/- 1,460

4.90% +/- 0.12

98

Maryland

Prince George's County

Vermont

Lamoille County

Virginia

$3,420 +/- 28

123

$316,400 +/- 2,747

1.08% +/- 0.01

640

$89,678 +/- 1,935

3.81% +/- 0.09

288

$3,404 +/- 214

124

$217,600 +/- 12,864

1.56% +/- 0.13

271

$63,526 +/- 3,714

5.36% +/- 0.46

63

Prince William County

$3,396 +/- 49

125

$343,800 +/- 4,223

0.99% +/- 0.02

755

$107,802 +/- 3,194

3.15% +/- 0.10

507

California

Ventura County

$3,379 +/- 58

126

$497,000 +/- 5,786

0.68% +/- 0.01

1259

$92,892 +/- 2,036

3.64% +/- 0.10

338

Wisconsin

Racine County

$3,357 +/- 43

127

$179,900 +/- 3,245

1.87% +/- 0.04

123

$65,387 +/- 1,564

5.13% +/- 0.14

77

Wisconsin

St. Croix County

$3,352 +/- 59

128

$223,700 +/- 5,008

1.50% +/- 0.04

307

$77,677 +/- 3,021

4.32% +/- 0.18

175

Illinois

Monroe County

$3,349 +/- 135

129

$200,900 +/- 7,394

1.67% +/- 0.09

223

$84,469 +/- 5,492

3.96% +/- 0.30

245

Texas

Hays County

$3,332 +/- 106

130

$174,300 +/- 4,193

1.91% +/- 0.08

107

$74,192 +/- 2,782

4.49% +/- 0.22

144

Maryland

Frederick County

$3,309 +/- 59

131

$334,100 +/- 4,690

0.99% +/- 0.02

749

$94,336 +/- 2,311

3.51% +/- 0.11

377

Nebraska

Sarpy County

$3,305 +/- 61

132

$161,500 +/- 1,747

2.05% +/- 0.04

69

$80,674 +/- 1,292

4.10% +/- 0.10

214

New York

Onondaga County

$3,293 +/- 49

133

$129,600 +/- 1,812

2.54% +/- 0.05

19

$67,193 +/- 1,029

4.90% +/- 0.10

99

New York

Ontario County

$3,281 +/- 104

134

$136,700 +/- 4,580

2.40% +/- 0.11

25

$65,830 +/- 3,162

4.98% +/- 0.29

91

Illinois

McLean County

$3,246 +/- 75

135

$157,600 +/- 2,383

2.06% +/- 0.06

64

$75,378 +/- 2,036

4.31% +/- 0.15

177

New York

Wayne County

$3,231 +/- 83

136

$109,600 +/- 2,569

2.95% +/- 0.10

$60,668 +/- 2,355

5.33% +/- 0.25

65

Massachusetts

Hampshire County

$3,220 +/- 81

137

$266,800 +/- 4,456

1.21% +/- 0.04

534

$78,025 +/- 2,381

4.13% +/- 0.16

207

Ohio

Geauga County

$3,219 +/- 106

138

$231,400 +/- 5,611

1.39% +/- 0.06

376

$69,133 +/- 2,953

4.66% +/- 0.25

122

Vermont

Bennington County

$3,215 +/- 134

139

$199,600 +/- 9,520

1.61% +/- 0.10

248

$58,906 +/- 3,169

5.46% +/- 0.37

59

New York

Erie County

$3,204 +/- 35

140

$121,800 +/- 1,167

2.63% +/- 0.04

15

$62,489 +/- 881

5.13% +/- 0.09

78

Property Taxes on Owner-Occupied Housing

Ranked by total tax paid, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

$2,018 +/- 4

Wisconsin

Jefferson County

Texas

Montgomery County

Illinois

Ogle County

Wisconsin

Median Home Value

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

Median Household Taxes as Percent of

Rank

Income

Income

$64,519 +/- 62

3.13% +/- 0.01

Rank

$3,187 +/- 64

141

$187,600 +/- 3,959

1.70% +/- 0.05

207

$64,493 +/- 2,169

4.94% +/- 0.19

96

$3,180 +/- 85

142

$162,500 +/- 2,728

1.96% +/- 0.06

95

$76,129 +/- 1,523

4.18% +/- 0.14

201

$3,166 +/- 120

143

$160,000 +/- 4,449

1.98% +/- 0.09

90

$65,964 +/- 3,075

4.80% +/- 0.29

106

Green County

$3,163 +/- 83

144

$156,100 +/- 4,774

2.03% +/- 0.08

73

$61,457 +/- 1,939

5.15% +/- 0.21

75

Massachusetts

Worcester County

$3,162 +/- 29

145

$275,500 +/- 2,024

1.15% +/- 0.01

582

$83,782 +/- 1,364

3.77% +/- 0.07

299

Illinois

Winnebago County

$3,150 +/- 56

146

$132,200 +/- 1,952

2.38% +/- 0.06

26

$60,335 +/- 1,619

5.22% +/- 0.17

72

New York

Livingston County

$3,150 +/- 130

146

$117,200 +/- 3,563

2.69% +/- 0.14

12

$63,073 +/- 2,907

4.99% +/- 0.31

88

Virginia

Manassas city

$3,149 +/- 182

148

$259,100 +/- 25,127

1.22% +/- 0.14

525

$87,256 +/- 8,700

3.61% +/- 0.42

348

California

Sonoma County

$3,147 +/- 70

149

$458,600 +/- 6,067

0.69% +/- 0.02

1246

$79,324 +/- 2,201

3.97% +/- 0.14

244

Texas

Tarrant County

$3,141 +/- 36

150

$137,000 +/- 1,026

2.29% +/- 0.03

34

$72,965 +/- 1,051

4.30% +/- 0.08

178

California

San Luis Obispo County

$3,129 +/- 93

151

$475,800 +/- 9,468

0.66% +/- 0.02

1311

$74,551 +/- 2,501

4.20% +/- 0.19

196

Minnesota

Carver County

$3,116 +/- 86

152

$285,200 +/- 7,037

1.09% +/- 0.04

630

$88,381 +/- 2,648

3.53% +/- 0.14

372

California

Los Angeles County

$3,113 +/- 22

153

$465,400 +/- 1,747

0.67% +/- 0.01

1282

$81,030 +/- 421

3.84% +/- 0.03

280

Vermont

Rutland County

$3,113 +/- 102

153

$176,800 +/- 7,095

1.76% +/- 0.09

174

$60,098 +/- 2,603

5.18% +/- 0.28

73

Pennsylvania

Berks County

$3,107 +/- 61

155

$177,700 +/- 2,633

1.75% +/- 0.04

181

$65,216 +/- 1,043

4.76% +/- 0.12

112

Washington

Snohomish County

$3,082 +/- 29

156

$335,800 +/- 2,776

0.92% +/- 0.01

846

$80,609 +/- 967

3.82% +/- 0.06

286

Connecticut

Windham County

New York

Orleans County

Maine

Cumberland County

Massachusetts

Franklin County

Pennsylvania

Pike County

New York

$3,078 +/- 93

157

$230,000 +/- 4,031

1.34% +/- 0.05

421

$71,180 +/- 3,032

4.32% +/- 0.23

173

$3,072 +/- 116

158

$90,700 +/- 4,071

3.39% +/- 0.20

$56,163 +/- 4,400

5.47% +/- 0.48

58

$3,059 +/- 64

159

$249,200 +/- 3,469

1.23% +/- 0.03

515

$71,206 +/- 1,859

4.30% +/- 0.14

181

$3,058 +/- 84

160

$226,500 +/- 4,520

1.35% +/- 0.05

413

$64,174 +/- 2,914

4.77% +/- 0.25

111

$3,025 +/- 118

161

$222,800 +/- 7,475

1.36% +/- 0.07

408

$63,180 +/- 3,192

4.79% +/- 0.31

107

Niagara County

$3,020 +/- 65

162

$102,500 +/- 2,359

2.95% +/- 0.09

$57,698 +/- 1,927

5.23% +/- 0.21

70

Pennsylvania

Lehigh County

$3,020 +/- 64

162

$209,400 +/- 3,476

1.44% +/- 0.04

339

$68,225 +/- 1,662

4.43% +/- 0.14

153

New York

Queens County

$3,014 +/- 33

164

$478,500 +/- 3,627

0.63% +/- 0.01

1382

$74,082 +/- 1,085

4.07% +/- 0.07

222

Wisconsin

Columbia County

$3,011 +/- 87

165

$182,400 +/- 4,819

1.65% +/- 0.06

230

$65,768 +/- 1,747

4.58% +/- 0.18

130

California

San Diego County

$3,010 +/- 38

166

$438,300 +/- 2,860

0.69% +/- 0.01

1242

$83,932 +/- 1,095

3.59% +/- 0.07

355

Texas

Harris County

$3,006 +/- 30

167

$133,700 +/- 733

2.25% +/- 0.03

40

$70,996 +/- 649

4.23% +/- 0.06

190

Wisconsin

Iowa County

$3,001 +/- 101

168

$157,100 +/- 4,818

1.91% +/- 0.09

108

$62,970 +/- 3,525

4.77% +/- 0.31

110

Property Taxes on Owner-Occupied Housing

Ranked by total tax paid, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

$2,018 +/- 4

Vermont

Orange County

Illinois

New York

North Carolina

Median Home Value

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

Median Household Taxes as Percent of

Rank

Income

Income

Rank

$64,519 +/- 62

3.13% +/- 0.01

227

$55,939 +/- 1,778

5.36% +/- 0.26

62

$2,998 +/- 109

169

$180,800 +/- 6,834

1.66% +/- 0.09

Champaign County

$2,996 +/- 84

170

$148,000 +/- 3,174

2.02% +/- 0.07

74

$67,261 +/- 1,949

4.45% +/- 0.18

152

Kings County

$2,975 +/- 37

171

$573,200 +/- 4,394

0.52% +/- 0.01

1604

$74,369 +/- 1,520

4.00% +/- 0.10

236

Orange County

$2,970 +/- 126

172

$270,700 +/- 10,804

1.10% +/- 0.06

629

$85,339 +/- 3,541

3.48% +/- 0.21

384

Maryland

Carroll County

$2,953 +/- 55

173

$341,600 +/- 5,783

0.86% +/- 0.02

912

$90,151 +/- 2,409

3.28% +/- 0.11

457

Massachusetts

Suffolk County

$2,935 +/- 59

174

$369,100 +/- 4,280

0.80% +/- 0.02

1026

$88,327 +/- 2,788

3.32% +/- 0.12

447

New York

Richmond County

$2,935 +/- 41

174

$455,700 +/- 3,986

0.64% +/- 0.01

1343

$87,662 +/- 2,196

3.35% +/- 0.10

435

Wisconsin

Calumet County

Illinois

Woodford County

Minnesota

$2,931 +/- 79

176

$162,100 +/- 3,801

1.81% +/- 0.06

150

$68,224 +/- 2,407

4.30% +/- 0.19

180

$2,927 +/- 146

177

$153,800 +/- 5,924

1.90% +/- 0.12

111

$72,226 +/- 2,981

4.05% +/- 0.26

227

Scott County

$2,923 +/- 48

178

$270,100 +/- 5,221

1.08% +/- 0.03

637

$88,338 +/- 2,775

3.31% +/- 0.12

451

Illinois

Kankakee County

$2,916 +/- 82

179

$152,500 +/- 3,764

1.91% +/- 0.07

105

$63,936 +/- 1,836

4.56% +/- 0.18

134

Wisconsin

La Crosse County

$2,916 +/- 55

179

$152,700 +/- 2,771

1.91% +/- 0.05

109

$63,788 +/- 3,609

4.57% +/- 0.27

131

Oregon

Clackamas County

$2,910 +/- 37

181

$330,900 +/- 4,466

0.88% +/- 0.02

889

$76,166 +/- 1,464

3.82% +/- 0.09

287

Alaska

Juneau City and Borough

$2,901 +/- 176

182

$297,400 +/- 15,353

0.98% +/- 0.08

770

$96,332 +/- 8,544

3.01% +/- 0.32

567

Oregon

Washington County

$2,901 +/- 29

182

$303,200 +/- 4,542

0.96% +/- 0.02

798

$81,111 +/- 1,412

3.58% +/- 0.07

356

California

Santa Barbara County

$2,900 +/- 83

184

$507,200 +/- 19,842

0.57% +/- 0.03

1510

$79,696 +/- 2,363

3.64% +/- 0.15

337

Maryland

Calvert County

$2,895 +/- 69

185

$384,100 +/- 8,800

0.75% +/- 0.02

1095

$99,768 +/- 3,205

2.90% +/- 0.12

611

New York

Washington County

$2,895 +/- 119

185

$145,600 +/- 6,754

1.99% +/- 0.12

85

$57,844 +/- 2,019

5.00% +/- 0.27

87

New York

Cortland County

$2,891 +/- 108

187

$101,500 +/- 5,060

2.85% +/- 0.18

$57,269 +/- 3,241

5.05% +/- 0.34

84

Wisconsin

Dunn County

$2,891 +/- 89

187

$160,600 +/- 3,963

1.80% +/- 0.07

154

$59,048 +/- 2,482

4.90% +/- 0.26

100

Minnesota

Hennepin County

$2,890 +/- 17

189

$246,100 +/- 1,483

1.17% +/- 0.01

558

$81,689 +/- 926

3.54% +/- 0.05

365

Wisconsin

Brown County

$2,888 +/- 37

190

$159,700 +/- 1,826

1.81% +/- 0.03

149

$66,776 +/- 1,410

4.32% +/- 0.11

172

Wisconsin

Sheboygan County

$2,887 +/- 47

191

$155,600 +/- 3,107

1.86% +/- 0.05

127

$62,181 +/- 1,450

4.64% +/- 0.13

124

Wisconsin

Dodge County

$2,883 +/- 52

192

$157,900 +/- 2,860

1.83% +/- 0.05

141

$62,054 +/- 1,730

4.65% +/- 0.15

123

New York

Genesee County

$2,869 +/- 91

193

$104,900 +/- 3,783

2.73% +/- 0.13

11

$59,992 +/- 1,939

4.78% +/- 0.22

108

Oregon

Multnomah County

California

Yolo County

Maryland

Charles County

$2,859 +/- 24

194

$287,400 +/- 2,477

0.99% +/- 0.01

742

$70,775 +/- 1,021

4.04% +/- 0.07

229

$2,855 +/- 117

195

$356,600 +/- 9,587

0.80% +/- 0.04

1020

$85,272 +/- 2,588

3.35% +/- 0.17

434

$2,840 +/- 61

196

$343,800 +/- 5,687

0.83% +/- 0.02

970

$99,863 +/- 3,414

2.84% +/- 0.11

640

Property Taxes on Owner-Occupied Housing

Ranked by total tax paid, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

$2,018 +/- 4

Median Home Value

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

$446,300 +/- 14,327

0.63% +/- 0.03

Median Household Taxes as Percent of

Rank

Income

Income

Rank

$64,519 +/- 62

3.13% +/- 0.01

1370

$77,545 +/- 2,563

3.65% +/- 0.16

332

California

Monterey County

$2,828 +/- 87

197

Vermont

Franklin County

$2,826 +/- 80

198

$206,100 +/- 6,191

1.37% +/- 0.06

399

$63,006 +/- 2,653

4.49% +/- 0.23

146

Virginia

Fauquier County

$2,812 +/- 89

199

$375,500 +/- 10,396

0.75% +/- 0.03

1111

$98,700 +/- 5,910

2.85% +/- 0.19

635

Nebraska

Douglas County

$2,808 +/- 29

200

$143,600 +/- 1,110

1.96% +/- 0.03

96

$68,329 +/- 1,422

4.11% +/- 0.10

210

Texas

Galveston County

$2,808 +/- 90

200

$146,300 +/- 3,919

1.92% +/- 0.08

102

$76,385 +/- 3,228

3.68% +/- 0.19

325

Texas

Brazoria County

$2,801 +/- 83

202

$146,000 +/- 3,756

1.92% +/- 0.08

103

$78,851 +/- 2,874

3.55% +/- 0.17

360

California

Nevada County

$2,800 +/- 97

203

$405,300 +/- 12,486

0.69% +/- 0.03

1232

$66,686 +/- 4,252

4.20% +/- 0.30

195

Washington

Pierce County

$2,798 +/- 21

204

$268,700 +/- 2,209

1.04% +/- 0.01

690

$73,099 +/- 976

3.83% +/- 0.06

284

Nebraska

Washington County

$2,794 +/- 92

205

$173,600 +/- 9,088

1.61% +/- 0.10

249

$70,855 +/- 4,796

3.94% +/- 0.30

248

Texas

Comal County

$2,793 +/- 110

206

$202,100 +/- 7,919

1.38% +/- 0.08

385

$75,724 +/- 2,343

3.69% +/- 0.18

323

Wisconsin

Sauk County

$2,790 +/- 58

207

$170,200 +/- 4,127

1.64% +/- 0.05

235

$61,312 +/- 2,743

4.55% +/- 0.22

136

Wisconsin

Outagamie County

$2,787 +/- 28

208

$156,600 +/- 1,987

1.78% +/- 0.03

164

$65,621 +/- 1,694

4.25% +/- 0.12

187

New York

Madison County

$2,786 +/- 111

209

$115,900 +/- 5,253

2.40% +/- 0.15

22

$58,956 +/- 1,913

4.73% +/- 0.24

115

Massachusetts

Hampden County

$2,783 +/- 24

210

$204,100 +/- 2,604

1.36% +/- 0.02

406

$66,454 +/- 1,452

4.19% +/- 0.10

198

Wisconsin

Winnebago County

$2,781 +/- 36

211

$142,700 +/- 2,579

1.95% +/- 0.04

97

$63,377 +/- 2,336

4.39% +/- 0.17

158

Georgia

Fulton County

$2,780 +/- 45

212

$255,900 +/- 5,510

1.09% +/- 0.03

635

$86,554 +/- 1,500

3.21% +/- 0.08

480

Pennsylvania

York County

$2,779 +/- 38

213

$183,200 +/- 1,817

1.52% +/- 0.03

294

$67,241 +/- 1,130

4.13% +/- 0.09

206

Massachusetts

Bristol County

$2,772 +/- 20

214

$295,500 +/- 2,320

0.94% +/- 0.01

821

$74,286 +/- 1,304

3.73% +/- 0.07

309

New York

Bronx County

$2,768 +/- 49

215

$394,800 +/- 8,474

0.70% +/- 0.02

1210

$68,565 +/- 1,704

4.04% +/- 0.12

231

Michigan

Ingham County

$2,766 +/- 49

216

$130,300 +/- 2,823

2.12% +/- 0.06

53

$62,905 +/- 1,603

4.40% +/- 0.14

157

North Dakota

Cass County

$2,761 +/- 53

217

$151,300 +/- 3,016

1.82% +/- 0.05

142

$71,756 +/- 2,256

3.85% +/- 0.14

278

Florida

St. Johns County

$2,757 +/- 89

218

$278,200 +/- 7,388

0.99% +/- 0.04

748

$71,097 +/- 2,807

3.88% +/- 0.20

272

Nebraska

Lancaster County

$2,756 +/- 35

219

$147,200 +/- 2,037

1.87% +/- 0.04

119

$68,970 +/- 1,799

4.00% +/- 0.12

237

California

El Dorado County

$2,755 +/- 75

220

$409,000 +/- 9,079

0.67% +/- 0.02

1271

$81,607 +/- 3,089

3.38% +/- 0.16

425

Texas

Dallas County

$2,753 +/- 26

221

$130,200 +/- 1,245

2.11% +/- 0.03

56

$65,111 +/- 771

4.23% +/- 0.06

191

Oregon

Benton County

$2,743 +/- 75

222

$272,800 +/- 6,931

1.01% +/- 0.04

728

$72,886 +/- 2,929

3.76% +/- 0.18

303

Maryland

Harford County

$2,735 +/- 42

223

$297,300 +/- 5,118

0.92% +/- 0.02

842

$85,931 +/- 2,497

3.18% +/- 0.10

487

Michigan

Macomb County

$2,735 +/- 18

223

$145,800 +/- 1,633

1.88% +/- 0.02

118

$61,273 +/- 915

4.46% +/- 0.07

150

Property Taxes on Owner-Occupied Housing

Ranked by total tax paid, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

$2,018 +/- 4

Illinois

LaSalle County

Alaska

Fairbanks North Star Borough

Florida

Miami-Dade County

Ohio

Median Home Value

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

Median Household Taxes as Percent of

Rank

Income

Income

$64,519 +/- 62

3.13% +/- 0.01

Rank

$2,731 +/- 85

225

$130,800 +/- 3,775

2.09% +/- 0.09

60

$61,084 +/- 1,487

4.47% +/- 0.18

149

$2,729 +/- 119

226

$215,100 +/- 6,134

1.27% +/- 0.07

482

$86,822 +/- 2,693

3.14% +/- 0.17

512

$2,723 +/- 29

227

$246,000 +/- 2,120

1.11% +/- 0.02

613

$57,381 +/- 951

4.75% +/- 0.09

113

Warren County

$2,719 +/- 53

228

$193,900 +/- 3,253

1.40% +/- 0.04

363

$80,421 +/- 2,345

3.38% +/- 0.12

423

New Hampshire

Coos County

$2,718 +/- 80

229

$134,100 +/- 6,686

2.03% +/- 0.12

72

$50,540 +/- 3,819

5.38% +/- 0.44

61

Wisconsin

Rock County

$2,718 +/- 37

229

$140,300 +/- 2,433

1.94% +/- 0.04

99

$59,494 +/- 1,721

4.57% +/- 0.15

132

Michigan

Livingston County

$2,707 +/- 38

231

$202,000 +/- 4,014

1.34% +/- 0.03

420

$76,501 +/- 1,743

3.54% +/- 0.09

364

Pennsylvania

Lancaster County

$2,706 +/- 27

232

$191,100 +/- 2,170

1.42% +/- 0.02

356

$65,265 +/- 960

4.15% +/- 0.07

204

Kansas

Johnson County

$2,705 +/- 20

233

$213,800 +/- 1,760

1.27% +/- 0.01

486

$90,862 +/- 1,146

2.98% +/- 0.04

578

Nebraska

Cass County

$2,700 +/- 105

234

$147,000 +/- 6,858

1.84% +/- 0.11

136

$68,872 +/- 3,670

3.92% +/- 0.26

255

New York

Montgomery County

$2,700 +/- 112

234

$98,700 +/- 3,610

2.74% +/- 0.15

10

$53,790 +/- 1,892

5.02% +/- 0.27

85

Ohio

Cuyahoga County

$2,700 +/- 19

234

$135,900 +/- 983

1.99% +/- 0.02

86

$58,485 +/- 895

4.62% +/- 0.08

128

Ohio

Franklin County

$2,688 +/- 23

237

$156,600 +/- 1,160

1.72% +/- 0.02

197

$69,156 +/- 920

3.89% +/- 0.06

268

Wisconsin

Polk County

$2,682 +/- 51

238

$169,000 +/- 3,236

1.59% +/- 0.04

262

$54,145 +/- 1,863

4.95% +/- 0.19

94

California

Solano County

$2,680 +/- 54

239

$321,000 +/- 4,944

0.83% +/- 0.02

959

$82,528 +/- 2,014

3.25% +/- 0.10

469

Georgia

Fayette County

$2,677 +/- 68

240

$254,900 +/- 7,307

1.05% +/- 0.04

676

$88,753 +/- 3,521

3.02% +/- 0.14

564

Virginia

Chesapeake city

$2,669 +/- 63

241

$278,500 +/- 4,874

0.96% +/- 0.03

796

$80,426 +/- 2,222

3.32% +/- 0.12

448

New Hampshire

Carroll County

$2,663 +/- 109

242

$238,800 +/- 7,472

1.12% +/- 0.06

608

$53,559 +/- 3,788

4.97% +/- 0.41

92

California

Riverside County

$2,658 +/- 32

243

$266,800 +/- 2,289

1.00% +/- 0.01

739

$68,535 +/- 973

3.88% +/- 0.07

271

Washington

Clark County

Texas

Kaufman County

Wisconsin

$2,635 +/- 27

244

$258,000 +/- 3,087

1.02% +/- 0.02

711

$71,386 +/- 1,050

3.69% +/- 0.07

322

$2,628 +/- 148

245

$131,600 +/- 5,540

2.00% +/- 0.14

78

$70,205 +/- 3,216

3.74% +/- 0.27

306

Eau Claire County

$2,628 +/- 48

245

$151,700 +/- 3,322

1.73% +/- 0.05

188

$62,353 +/- 2,123

4.21% +/- 0.16

194

Florida

Palm Beach County

$2,625 +/- 28

247

$233,700 +/- 2,126

1.12% +/- 0.02

603

$60,353 +/- 685

4.35% +/- 0.07

164

Massachusetts

Barnstable County

$2,625 +/- 42

247

$381,400 +/- 5,115

0.69% +/- 0.01

1238

$65,142 +/- 1,797

4.03% +/- 0.13

233

Wisconsin

Marathon County

$2,622 +/- 34

249

$143,000 +/- 2,495

1.83% +/- 0.04

139

$62,646 +/- 2,143

4.19% +/- 0.15

200

New York

Wyoming County

$2,621 +/- 83

250

$98,100 +/- 2,464

2.67% +/- 0.11

14

$57,847 +/- 3,720

4.53% +/- 0.32

142

Wisconsin

Fond du Lac County

$2,618 +/- 35

251

$146,100 +/- 2,875

1.79% +/- 0.04

160

$63,060 +/- 1,743

4.15% +/- 0.13

203

Vermont

Caledonia County

$2,617 +/- 78

252

$161,400 +/- 4,601

1.62% +/- 0.07

242

$51,264 +/- 2,494

5.10% +/- 0.29

79

Property Taxes on Owner-Occupied Housing

Ranked by total tax paid, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

$2,018 +/- 4

Median Home Value

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

Median Household Taxes as Percent of

Rank

Income

Income

$64,519 +/- 62

3.13% +/- 0.01

Rank

Iowa

Johnson County

$2,615 +/- 75

253

$183,200 +/- 4,948

1.43% +/- 0.06

348

$75,368 +/- 2,209

3.47% +/- 0.14

389

Colorado

Douglas County

$2,605 +/- 29

254

$339,100 +/- 3,792

0.77% +/- 0.01

1068

$106,546 +/- 1,608

2.44% +/- 0.05

853

Texas

Brazos County

$2,600 +/- 79

255

$146,200 +/- 3,993

1.78% +/- 0.07

166

$66,543 +/- 2,721

3.91% +/- 0.20

259

Florida

Broward County

$2,599 +/- 35

256

$218,800 +/- 2,286

1.19% +/- 0.02

547

$58,902 +/- 1,018

4.41% +/- 0.10

156

Florida

Monroe County

$2,593 +/- 127

257

$442,500 +/- 20,647

0.59% +/- 0.04

1485

$63,567 +/- 4,839

4.08% +/- 0.37

218

New York

Warren County

$2,591 +/- 83

258

$189,600 +/- 6,580

1.37% +/- 0.06

403

$63,091 +/- 3,109

4.11% +/- 0.24

211

Ohio

Medina County

$2,589 +/- 50

259

$187,500 +/- 2,954

1.38% +/- 0.03

388

$74,625 +/- 1,956

3.47% +/- 0.11

390

Minnesota

Washington County

$2,584 +/- 30

260

$262,900 +/- 3,893

0.98% +/- 0.02

759

$85,402 +/- 1,529

3.03% +/- 0.06

557

New York

Cayuga County

$2,582 +/- 91

261

$99,800 +/- 3,590

2.59% +/- 0.13

17

$56,692 +/- 2,079

4.55% +/- 0.23

135

Wisconsin

Portage County

$2,565 +/- 47

262

$146,800 +/- 3,057

1.75% +/- 0.05

182

$63,290 +/- 2,340

4.05% +/- 0.17

226

North Dakota

Grand Forks County

$2,564 +/- 82

263

$144,100 +/- 3,254

1.78% +/- 0.07

165

$68,959 +/- 2,491

3.72% +/- 0.18

313

New York

Greene County

$2,559 +/- 129

264

$185,200 +/- 9,826

1.38% +/- 0.10

386

$54,438 +/- 3,969

4.70% +/- 0.42

119

Washington

Kitsap County

$2,557 +/- 42

265

$286,700 +/- 4,112

0.89% +/- 0.02

875

$74,440 +/- 1,750

3.43% +/- 0.10

400

Pennsylvania

Allegheny County

$2,554 +/- 22

266

$119,300 +/- 1,091

2.14% +/- 0.03

51

$62,508 +/- 790

4.09% +/- 0.06

217

New York

Oneida County

$2,553 +/- 54

267

$106,300 +/- 2,337

2.40% +/- 0.07

24

$60,290 +/- 1,647

4.23% +/- 0.15

189

Colorado

Eagle County

$2,549 +/- 141

268

$566,300 +/- 39,403

0.45% +/- 0.04

1706

$86,860 +/- 7,163

2.93% +/- 0.29

598

Minnesota

Chisago County

$2,544 +/- 52

269

$222,200 +/- 6,752

1.14% +/- 0.04

586

$69,980 +/- 2,538

3.64% +/- 0.15

339

South Dakota

Lincoln County

$2,543 +/- 66

270

$174,900 +/- 6,002

1.45% +/- 0.06

330

$76,243 +/- 2,666

3.34% +/- 0.15

443

Iowa

Dallas County

$2,542 +/- 91

271

$183,900 +/- 7,215

1.38% +/- 0.07

384

$84,587 +/- 4,078

3.01% +/- 0.18

569

Minnesota

Dakota County

$2,529 +/- 24

272

$240,300 +/- 2,313

1.05% +/- 0.01

674

$83,311 +/- 1,218

3.04% +/- 0.05

553

Illinois

Peoria County

$2,528 +/- 68

273

$123,100 +/- 2,672

2.05% +/- 0.07

66

$64,379 +/- 1,796

3.93% +/- 0.15

252

Virginia

Charlottesville city

$2,523 +/- 118

274

$284,400 +/- 13,560

0.89% +/- 0.06

883

$66,494 +/- 4,671

3.79% +/- 0.32

293

New York

Seneca County

$2,521 +/- 115

275

$91,800 +/- 3,770

2.75% +/- 0.17

$52,362 +/- 2,309

4.81% +/- 0.31

105

Maryland

Anne Arundel County

$2,516 +/- 31

276

$360,500 +/- 3,287

0.70% +/- 0.01

1217

$95,916 +/- 2,433

2.62% +/- 0.07

751

Michigan

Wayne County

$2,511 +/- 16

277

$107,700 +/- 1,025

2.33% +/- 0.03

30

$53,329 +/- 588

4.71% +/- 0.06

118

Texas

Bexar County

$2,511 +/- 27

277

$122,600 +/- 1,165

2.05% +/- 0.03

68

$61,334 +/- 771

4.09% +/- 0.07

215

Washington

Skagit County

$2,508 +/- 62

279

$285,200 +/- 6,639

0.88% +/- 0.03

890

$65,269 +/- 2,133

3.84% +/- 0.16

279

Washington

Thurston County

$2,506 +/- 37

280

$261,400 +/- 4,316

0.96% +/- 0.02

795

$72,391 +/- 2,068

3.46% +/- 0.11

392

Property Taxes on Owner-Occupied Housing

Ranked by total tax paid, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

$2,018 +/- 4

Maine

York County

Ohio

Ohio

Wisconsin

Median Home Value

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

Median Household Taxes as Percent of

Rank

Income

Income

$64,519 +/- 62

3.13% +/- 0.01

Rank

$2,503 +/- 42

281

$232,300 +/- 4,006

1.08% +/- 0.03

648

$64,469 +/- 1,762

3.88% +/- 0.12

269

Greene County

$2,502 +/- 63

282

$159,100 +/- 3,002

1.57% +/- 0.05

267

$69,120 +/- 2,659

3.62% +/- 0.17

343

Union County

$2,494 +/- 107

283

$176,900 +/- 7,415

1.41% +/- 0.08

361

$76,600 +/- 4,436

3.26% +/- 0.23

465

Trempealeau County

$2,487 +/- 59

284

$133,600 +/- 5,036

1.86% +/- 0.08

125

$53,805 +/- 2,888

4.62% +/- 0.27

127

New York

Broome County

$2,486 +/- 56

285

$104,700 +/- 2,377

2.37% +/- 0.08

27

$56,688 +/- 1,365

4.39% +/- 0.14

159

Virginia

Stafford County

$2,486 +/- 60

285

$324,900 +/- 8,083

0.77% +/- 0.03

1073

$103,503 +/- 3,233

2.40% +/- 0.09

867

Alaska

Matanuska-Susitna Borough

$2,483 +/- 84

287

$214,600 +/- 4,450

1.16% +/- 0.05

573

$78,595 +/- 2,220

3.16% +/- 0.14

497

Texas

Ellis County

$2,477 +/- 72

288

$138,100 +/- 3,288

1.79% +/- 0.07

159

$72,160 +/- 1,839

3.43% +/- 0.13

404

Texas

Parker County

$2,475 +/- 97

289

$153,500 +/- 5,389

1.61% +/- 0.08

247

$70,861 +/- 2,628

3.49% +/- 0.19

383

Iowa

Polk County

$2,471 +/- 28

290

$153,800 +/- 1,914

1.61% +/- 0.03

250

$70,702 +/- 1,296

3.49% +/- 0.08

382

Maryland

Baltimore County

$2,471 +/- 20

290

$273,600 +/- 1,871

0.90% +/- 0.01

856

$79,380 +/- 1,418

3.11% +/- 0.06

520

Michigan

Clinton County

$2,460 +/- 76

292

$167,000 +/- 3,239

1.47% +/- 0.05

325

$64,918 +/- 2,891

3.79% +/- 0.21

296

Ohio

Lake County

$2,455 +/- 33

293

$158,700 +/- 1,835

1.55% +/- 0.03

282

$62,896 +/- 1,469

3.90% +/- 0.11

260

Virginia

James City County

$2,452 +/- 95

294

$346,400 +/- 8,279

0.71% +/- 0.03

1194

$85,369 +/- 4,489

2.87% +/- 0.19

622

New York

Oswego County

$2,442 +/- 79

295

$91,200 +/- 1,814

2.68% +/- 0.10

13

$55,758 +/- 2,146

4.38% +/- 0.22

161

Massachusetts

Berkshire County

$2,438 +/- 52

296

$212,500 +/- 6,411

1.15% +/- 0.04

584

$60,360 +/- 1,832

4.04% +/- 0.15

230

Illinois

St. Clair County

$2,433 +/- 65

297

$127,200 +/- 3,671

1.91% +/- 0.08

104

$62,372 +/- 1,924

3.90% +/- 0.16

263

Wisconsin

Waupaca County

$2,433 +/- 59

297

$139,600 +/- 4,173

1.74% +/- 0.07

184

$54,522 +/- 2,344

4.46% +/- 0.22

151

Michigan

Kalamazoo County

$2,426 +/- 40

299

$145,300 +/- 2,296

1.67% +/- 0.04

219

$61,091 +/- 1,488

3.97% +/- 0.12

241

Florida

Collier County

$2,423 +/- 56

300

$299,000 +/- 7,042

0.81% +/- 0.03

1003

$64,645 +/- 2,205

3.75% +/- 0.15

305

Minnesota

Ramsey County

$2,419 +/- 22

301

$218,600 +/- 1,734

1.11% +/- 0.01

614

$71,924 +/- 1,149

3.36% +/- 0.06

428

Maryland

Queen Anne's County

$2,418 +/- 96

302

$369,000 +/- 13,002

0.66% +/- 0.03

1317

$92,338 +/- 5,042

2.62% +/- 0.18

754

North Dakota

Burleigh County

$2,414 +/- 45

303

$160,600 +/- 3,200

1.50% +/- 0.04

304

$70,153 +/- 2,993

3.44% +/- 0.16

396

Missouri

St. Charles County

$2,411 +/- 21

304

$198,800 +/- 2,083

1.21% +/- 0.02

528

$78,583 +/- 1,336

3.07% +/- 0.06

543

Maryland

Cecil County

$2,406 +/- 63

305

$269,900 +/- 5,937

0.89% +/- 0.03

877

$75,330 +/- 3,300

3.19% +/- 0.16

485

Nebraska

Saunders County

$2,406 +/- 86

305

$136,600 +/- 6,353

1.76% +/- 0.10

173

$60,335 +/- 3,867

3.99% +/- 0.29

239

Wisconsin

Door County

$2,406 +/- 92

305

$199,300 +/- 11,315

1.21% +/- 0.08

533

$56,104 +/- 2,059

4.29% +/- 0.23

183

New York

Tioga County

$2,403 +/- 113

308

$101,700 +/- 4,956

2.36% +/- 0.16

29

$59,546 +/- 2,243

4.04% +/- 0.24

232

Property Taxes on Owner-Occupied Housing

Ranked by total tax paid, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

$2,018 +/- 4

Median Home Value

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

Median Household Taxes as Percent of

Rank

Income

Income

Rank

$64,519 +/- 62

3.13% +/- 0.01

43

$58,660 +/- 4,073

4.09% +/- 0.33

216

Illinois

Livingston County

$2,399 +/- 101

309

$107,500 +/- 6,556

2.23% +/- 0.17

New York

Clinton County

$2,398 +/- 156

310

$121,200 +/- 4,512

1.98% +/- 0.15

91

$62,670 +/- 2,762

3.83% +/- 0.30

285

Pennsylvania

Dauphin County

$2,395 +/- 43

311

$160,000 +/- 2,356

1.50% +/- 0.03

309

$66,352 +/- 1,569

3.61% +/- 0.11

347

Wisconsin

Monroe County

$2,383 +/- 76

312

$132,500 +/- 6,821

1.80% +/- 0.11

156

$54,973 +/- 3,921

4.33% +/- 0.34

170

Illinois

Tazewell County

$2,375 +/- 57

313

$129,300 +/- 3,132

1.84% +/- 0.06

135

$62,904 +/- 2,158

3.78% +/- 0.16

297

Virginia

Virginia Beach city

$2,375 +/- 36

313

$280,700 +/- 2,592

0.85% +/- 0.02

939

$77,061 +/- 1,934

3.08% +/- 0.09

535

Illinois

Stephenson County

$2,359 +/- 84

315

$103,300 +/- 4,687

2.28% +/- 0.13

36

$52,698 +/- 2,348

4.48% +/- 0.26

148

Texas

Webb County

$2,359 +/- 94

315

$109,000 +/- 3,509

2.16% +/- 0.11

46

$48,073 +/- 2,217

4.91% +/- 0.30

97

New York

Yates County

$2,356 +/- 116

317

$115,000 +/- 6,682

2.05% +/- 0.16

67

$57,500 +/- 2,456

4.10% +/- 0.27

212

Wisconsin

Vernon County

$2,353 +/- 80

318

$135,400 +/- 5,877

1.74% +/- 0.10

186

$49,240 +/- 2,313

4.78% +/- 0.28

109

California

Calaveras County

$2,349 +/- 139

319

$312,500 +/- 18,185

0.75% +/- 0.06

1102

$64,301 +/- 5,258

3.65% +/- 0.37

329

Wisconsin

Manitowoc County

$2,348 +/- 50

320

$127,000 +/- 3,892

1.85% +/- 0.07

131

$57,062 +/- 1,788

4.11% +/- 0.16

209

Oregon

Deschutes County

$2,340 +/- 67

321

$295,400 +/- 8,299

0.79% +/- 0.03

1032

$60,416 +/- 1,899

3.87% +/- 0.16

274

Minnesota

Anoka County

$2,334 +/- 19

322

$217,400 +/- 1,935

1.07% +/- 0.01

653

$74,720 +/- 1,536

3.12% +/- 0.07

516

New York

Chemung County

$2,332 +/- 86

323

$90,200 +/- 2,680

2.59% +/- 0.12

18

$55,322 +/- 2,425

4.22% +/- 0.24

193

Virginia

Albemarle County

$2,330 +/- 83

324

$346,200 +/- 12,058

0.67% +/- 0.03

1273

$82,897 +/- 3,074

2.81% +/- 0.14

664

Michigan

Ottawa County

$2,329 +/- 37

325

$160,000 +/- 1,670

1.46% +/- 0.03

328

$61,384 +/- 1,058

3.79% +/- 0.09

294

Kentucky

Oldham County

$2,328 +/- 89

326

$240,500 +/- 6,918

0.97% +/- 0.05

780

$91,596 +/- 4,208

2.54% +/- 0.15

798

Missouri

St. Louis County

$2,326 +/- 24

327

$181,600 +/- 1,837

1.28% +/- 0.02

470

$71,574 +/- 905

3.25% +/- 0.05

468

Michigan

Kent County

$2,325 +/- 25

328

$146,100 +/- 1,477

1.59% +/- 0.02

257

$61,120 +/- 933

3.80% +/- 0.07

290

Wisconsin

Kewaunee County

$2,323 +/- 86

329

$150,700 +/- 5,885

1.54% +/- 0.08

283

$59,755 +/- 2,407

3.89% +/- 0.21

267

Maine

Sagadahoc County

$2,322 +/- 77

330

$194,700 +/- 6,604

1.19% +/- 0.06

542

$64,689 +/- 3,733

3.59% +/- 0.24

354

Ohio

Hamilton County

$2,316 +/- 29

331

$149,400 +/- 1,747

1.55% +/- 0.03

279

$68,297 +/- 1,242

3.39% +/- 0.07

419

Kansas

Douglas County

$2,308 +/- 77

332

$181,800 +/- 5,361

1.27% +/- 0.06

481

$72,020 +/- 4,565

3.20% +/- 0.23

482

New York

Schoharie County

$2,303 +/- 146

333

$147,000 +/- 7,366

1.57% +/- 0.13

269

$57,906 +/- 3,394

3.98% +/- 0.34

240

Illinois

Rock Island County

$2,302 +/- 71

334

$114,700 +/- 2,397

2.01% +/- 0.07

77

$56,561 +/- 1,980

4.07% +/- 0.19

221

Texas

Guadalupe County

$2,301 +/- 99

335

$151,900 +/- 3,540

1.51% +/- 0.07

295

$70,634 +/- 1,948

3.26% +/- 0.17

462

California

San Joaquin County

$2,298 +/- 55

336

$246,000 +/- 3,921

0.93% +/- 0.03

827

$71,043 +/- 1,201

3.23% +/- 0.09

471

Property Taxes on Owner-Occupied Housing

Ranked by total tax paid, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

$2,018 +/- 4

Median Home Value

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

Median Household Taxes as Percent of

Rank

Income

Income

$64,519 +/- 62

3.13% +/- 0.01

Rank

Wisconsin

Barron County

$2,298 +/- 73

336

$137,600 +/- 3,652

1.67% +/- 0.07

218

$49,517 +/- 1,643

4.64% +/- 0.21

125

Illinois

Clinton County

$2,294 +/- 123

338

$130,000 +/- 6,711

1.76% +/- 0.13

172

$64,703 +/- 3,616

3.55% +/- 0.27

362

New York

Fulton County

$2,294 +/- 123

338

$101,600 +/- 6,951

2.26% +/- 0.20

39

$52,796 +/- 3,178

4.35% +/- 0.35

165

Michigan

Eaton County

$2,292 +/- 61

340

$151,000 +/- 3,165

1.52% +/- 0.05

293

$62,547 +/- 2,438

3.66% +/- 0.17

327

Maryland

St. Mary's County

$2,284 +/- 71

341

$317,500 +/- 8,012

0.72% +/- 0.03

1169

$92,086 +/- 3,962

2.48% +/- 0.13

831

Iowa

Warren County

$2,269 +/- 71

342

$156,500 +/- 5,204

1.45% +/- 0.07

333

$70,999 +/- 3,066

3.20% +/- 0.17

484

Pennsylvania

Adams County

$2,259 +/- 72

343

$209,600 +/- 5,519

1.08% +/- 0.04

647

$64,957 +/- 2,449

3.48% +/- 0.17

386

Indiana

Hamilton County

$2,258 +/- 67

344

$216,600 +/- 3,969

1.04% +/- 0.04

688

$92,258 +/- 2,246

2.45% +/- 0.09

849

Illinois

Lee County

$2,257 +/- 119

345

$113,100 +/- 5,685

2.00% +/- 0.15

80

$57,600 +/- 3,147

3.92% +/- 0.30

256

Oregon

Polk County

$2,253 +/- 69

346

$234,800 +/- 6,683

0.96% +/- 0.04

794

$67,196 +/- 4,572

3.35% +/- 0.25

432

Ohio

Wood County

$2,249 +/- 62

347

$156,200 +/- 3,280

1.44% +/- 0.05

342

$66,920 +/- 2,434

3.36% +/- 0.15

429

Texas

Bastrop County

$2,249 +/- 105

347

$126,200 +/- 5,480

1.78% +/- 0.11

163

$61,781 +/- 2,598

3.64% +/- 0.23

335

Illinois

Madison County

$2,247 +/- 53

349

$126,000 +/- 3,340

1.78% +/- 0.06

162

$61,702 +/- 1,419

3.64% +/- 0.12

334

Texas

Gillespie County

$2,245 +/- 190

350

$196,400 +/- 17,806

1.14% +/- 0.14

588

$58,562 +/- 4,611

3.83% +/- 0.44

281

Florida

Martin County

$2,239 +/- 81

351

$230,100 +/- 7,804

0.97% +/- 0.05

772

$57,296 +/- 2,164

3.91% +/- 0.20

258

Illinois

Sangamon County

$2,239 +/- 59

351

$121,000 +/- 2,463

1.85% +/- 0.06

130

$66,965 +/- 1,700

3.34% +/- 0.12

437

Maine

Androscoggin County

$2,233 +/- 58

353

$158,900 +/- 2,908

1.41% +/- 0.04

362

$56,655 +/- 2,619

3.94% +/- 0.21

249

Missouri

Platte County

$2,231 +/- 71

354

$186,100 +/- 5,246

1.20% +/- 0.05

536

$80,593 +/- 3,011

2.77% +/- 0.14

681

Washington

Island County

$2,229 +/- 76

355

$311,000 +/- 11,077

0.72% +/- 0.04

1173

$64,224 +/- 2,909

3.47% +/- 0.20

387

Washington

Whatcom County

$2,229 +/- 58

355

$293,900 +/- 5,475

0.76% +/- 0.02

1086

$64,520 +/- 1,684

3.45% +/- 0.13

393

Illinois

Jo Daviess County

$2,224 +/- 161

357

$143,700 +/- 7,962

1.55% +/- 0.14

280

$56,702 +/- 4,073

3.92% +/- 0.40

254

District of Columbia

District of Columbia

$2,222 +/- 70

358

$446,300 +/- 7,082

0.50% +/- 0.02

1640

$100,204 +/- 1,850

2.22% +/- 0.08

982

Vermont

Orleans County

$2,222 +/- 99

358

$154,600 +/- 6,867

1.44% +/- 0.09

343

$44,355 +/- 1,860

5.01% +/- 0.31

86

Maine

Knox County

$2,221 +/- 99

360

$201,800 +/- 9,278

1.10% +/- 0.07

622

$51,212 +/- 3,243

4.34% +/- 0.34

169

New York

Chautauqua County

$2,218 +/- 63

361

$80,800 +/- 2,196

2.75% +/- 0.11

$50,757 +/- 1,547

4.37% +/- 0.18

162

Texas

Randall County

$2,214 +/- 72

362

$134,600 +/- 3,420

1.64% +/- 0.07

233

$69,624 +/- 2,806

3.18% +/- 0.16

489

Minnesota

Sherburne County

$2,213 +/- 50

363

$211,200 +/- 4,729

1.05% +/- 0.03

680

$76,816 +/- 2,317

2.88% +/- 0.11

619

California

Sacramento County

$2,208 +/- 39

364

$272,400 +/- 2,413

0.81% +/- 0.02

1002

$73,770 +/- 1,003

2.99% +/- 0.07

571

Property Taxes on Owner-Occupied Housing

Ranked by total tax paid, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

$2,018 +/- 4

Median Home Value

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

Median Household Taxes as Percent of

Rank

Income

Income

$64,519 +/- 62

3.13% +/- 0.01

Rank

Pennsylvania

Centre County

$2,206 +/- 67

365

$187,500 +/- 5,056

1.18% +/- 0.05

555

$66,707 +/- 2,776

3.31% +/- 0.17

452

Kansas

Miami County

$2,203 +/- 100

366

$169,300 +/- 7,265

1.30% +/- 0.08

454

$67,628 +/- 4,738

3.26% +/- 0.27

463

Ohio

Summit County

$2,199 +/- 32

367

$142,100 +/- 1,657

1.55% +/- 0.03

281

$60,759 +/- 922

3.62% +/- 0.08

344

Wisconsin

Oconto County

$2,198 +/- 64

368

$147,400 +/- 5,457

1.49% +/- 0.07

315

$52,477 +/- 1,942

4.19% +/- 0.20

197

Montana

Missoula County

$2,186 +/- 72

369

$243,900 +/- 6,619

0.90% +/- 0.04

866

$60,692 +/- 1,886

3.60% +/- 0.16

350

Virginia

Richmond city

$2,184 +/- 81

370

$208,800 +/- 6,875

1.05% +/- 0.05

683

$61,316 +/- 1,649

3.56% +/- 0.16

357

Ohio

Butler County

$2,183 +/- 39

371

$160,900 +/- 2,106

1.36% +/- 0.03

411

$69,238 +/- 1,731

3.15% +/- 0.10

502

Texas

Wilson County

$2,178 +/- 159

372

$136,000 +/- 15,360

1.60% +/- 0.22

253

$63,837 +/- 3,394

3.41% +/- 0.31

411

Oregon

Yamhill County

$2,176 +/- 69

373

$242,800 +/- 7,092

0.90% +/- 0.04

867

$64,422 +/- 2,908

3.38% +/- 0.19

424

Minnesota

Wright County

$2,174 +/- 47

374

$217,400 +/- 3,862

1.00% +/- 0.03

733

$75,164 +/- 1,766

2.89% +/- 0.09

613

New York

Steuben County

$2,171 +/- 70

375

$83,800 +/- 1,417

2.59% +/- 0.09

16

$52,992 +/- 1,741

4.10% +/- 0.19

213

Pennsylvania

Carbon County

$2,166 +/- 80

376

$144,700 +/- 6,410

1.50% +/- 0.09

308

$55,510 +/- 2,797

3.90% +/- 0.24

262

New York

Herkimer County

$2,162 +/- 103

377

$89,500 +/- 2,640

2.42% +/- 0.14

21

$53,169 +/- 2,470

4.07% +/- 0.27

223

Texas

Bell County

$2,161 +/- 63

378

$117,400 +/- 2,381

1.84% +/- 0.07

133

$63,019 +/- 1,384

3.43% +/- 0.13

406

Ohio

Montgomery County

$2,146 +/- 41

379

$119,100 +/- 1,491

1.80% +/- 0.04

153

$57,243 +/- 1,118

3.75% +/- 0.10

304

Florida

Orange County

$2,144 +/- 37

380

$209,600 +/- 2,586

1.02% +/- 0.02

707

$61,778 +/- 867

3.47% +/- 0.08

388

New York

Cattaraugus County

$2,144 +/- 81

380

$78,200 +/- 1,961

2.74% +/- 0.12

$49,375 +/- 1,601

4.34% +/- 0.22

166

Texas

El Paso County

$2,144 +/- 38

380

$108,300 +/- 1,348

1.98% +/- 0.04

88

$47,223 +/- 1,015

4.54% +/- 0.13

138

Wisconsin

Chippewa County

$2,142 +/- 62

383

$150,700 +/- 3,879

1.42% +/- 0.06

352

$57,864 +/- 2,003

3.70% +/- 0.17

320

Wisconsin

Douglas County

$2,137 +/- 87

384

$136,800 +/- 5,327

1.56% +/- 0.09

274

$56,652 +/- 2,988

3.77% +/- 0.25

301

Wisconsin

Taylor County

$2,136 +/- 93

385

$123,400 +/- 4,923

1.73% +/- 0.10

189

$49,288 +/- 2,961

4.33% +/- 0.32

171

Ohio

Clermont County

$2,132 +/- 54

386

$163,000 +/- 2,534

1.31% +/- 0.04

447

$70,785 +/- 1,905

3.01% +/- 0.11

566

New York

Otsego County

$2,131 +/- 113

387

$126,000 +/- 6,375

1.69% +/- 0.12

209

$52,457 +/- 2,860

4.06% +/- 0.31

224

Wisconsin

Lincoln County

$2,128 +/- 94

388

$133,100 +/- 7,858

1.60% +/- 0.12

254

$57,339 +/- 2,711

3.71% +/- 0.24

316

Florida

Lee County

$2,127 +/- 60

389

$174,600 +/- 2,803

1.22% +/- 0.04

521

$54,295 +/- 902

3.92% +/- 0.13

257

Florida

St. Lucie County

$2,127 +/- 66

389

$154,200 +/- 2,895

1.38% +/- 0.05

392

$47,458 +/- 1,534

4.48% +/- 0.20

147

Illinois

Henry County

$2,123 +/- 101

391

$112,900 +/- 5,719

1.88% +/- 0.13

115

$56,260 +/- 3,649

3.77% +/- 0.30

300

Washington

Jefferson County

$2,123 +/- 146

391

$301,500 +/- 18,631

0.70% +/- 0.07

1203

$57,107 +/- 4,141

3.72% +/- 0.37

314

Property Taxes on Owner-Occupied Housing

Ranked by total tax paid, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

$2,018 +/- 4

New York

Essex County

Pennsylvania

Wisconsin

Virginia

Powhatan County

Michigan

Grand Traverse County

New York

Jefferson County

Wisconsin

Wood County

Wisconsin

Texas

Median Home Value

of Home Value

$187,500 +/- 198