Professional Documents

Culture Documents

Proptax10 Home Value

Uploaded by

Tax FoundationOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Proptax10 Home Value

Uploaded by

Tax FoundationCopyright:

Available Formats

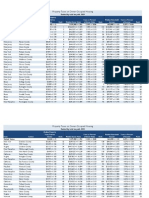

Property Taxes on Owner-Occupied Housing

Ranked by Taxes as a Percent of Home Value, 2010

Median Property

Taxes Paid on

State

County

United States

New York Wayne County

New York Monroe County

New York Cattaraugus County

New York Livingston County

New York Oswego County

New York Niagara County

Michigan

Wayne County

New York Chautauqua County

New Jersey Camden County

New York Steuben County

New York Erie County

New York Schenectady County

New York Cayuga County

New York Onondaga County

New York Chemung County

Illinois

Kendall County

Illinois

Lake County

New Jersey Gloucester County

Illinois

DeKalb County

New York Ontario County

New York Oneida County

Illinois

Winnebago County

Texas

Fort Bend County

Illinois

McHenry County

New York St. Lawrence County

New York Broome County

Wisconsin Milwaukee County

New Jersey Essex County

New York Madison County

Homes

$2,043 +/- 5

$3,142 +/- 196

$4,035 +/- 102

$2,257 +/- 123

$3,136 +/- 234

$2,605 +/- 140

$3,023 +/- 121

$2,430 +/- 32

$2,275 +/- 116

$5,889 +/- 89

$2,318 +/- 175

$3,278 +/- 52

$4,383 +/- 209

$2,632 +/- 119

$3,439 +/- 96

$2,340 +/- 143

$5,646 +/- 253

$6,590 +/- 140

$5,707 +/- 137

$4,523 +/- 172

$3,291 +/- 231

$2,578 +/- 100

$3,156 +/- 112

$4,237 +/- 167

$5,495 +/- 158

$2,017 +/- 149

$2,533 +/- 92

$3,832 +/- 53

$8,755 +/- 178

$2,781 +/- 205

Taxes as Percent

Rank

135

72

283

136

209

149

249

280

24

272

121

55

203

112

264

28

17

27

50

120

217

134

61

29

344

230

84

5

181

Median Home Value

$179,900 +/- 292

$104,200 +/- 6,265

$134,600 +/- 2,409

$77,800 +/- 3,929

$110,400 +/- 6,092

$92,700 +/- 3,659

$107,700 +/- 4,053

$89,500 +/- 1,446

$84,300 +/- 3,760

$218,300 +/- 3,906

$86,300 +/- 3,662

$123,700 +/- 1,981

$168,000 +/- 4,429

$102,400 +/- 6,835

$134,700 +/- 4,183

$92,100 +/- 6,155

$223,100 +/- 8,041

$268,000 +/- 6,467

$232,100 +/- 4,404

$184,300 +/- 7,481

$134,500 +/- 6,626

$105,600 +/- 4,369

$129,900 +/- 3,473

$176,100 +/- 5,215

$231,700 +/- 4,939

$85,300 +/- 4,444

$107,300 +/- 4,664

$162,500 +/- 1,962

$374,000 +/- 6,181

$118,900 +/- 8,129

of Home Value

1.14% +/- 0.00

3.02% +/- 0.26

3.00% +/- 0.09

2.90% +/- 0.22

2.84% +/- 0.26

2.81% +/- 0.19

2.81% +/- 0.15

2.72% +/- 0.06

2.70% +/- 0.18

2.70% +/- 0.06

2.69% +/- 0.23

2.65% +/- 0.06

2.61% +/- 0.14

2.57% +/- 0.21

2.55% +/- 0.11

2.54% +/- 0.23

2.53% +/- 0.15

2.46% +/- 0.08

2.46% +/- 0.08

2.45% +/- 0.14

2.45% +/- 0.21

2.44% +/- 0.14

2.43% +/- 0.11

2.41% +/- 0.12

2.37% +/- 0.08

2.36% +/- 0.21

2.36% +/- 0.13

2.36% +/- 0.04

2.34% +/- 0.06

2.34% +/- 0.24

Median Household

Rank

Income

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

$62,898 +/- 113

$60,054 +/- 4,216

$66,297 +/- 1,988

$49,559 +/- 2,823

$64,230 +/- 6,874

$54,006 +/- 3,589

$59,650 +/- 3,440

$51,722 +/- 707

$50,653 +/- 3,320

$75,344 +/- 2,615

$55,307 +/- 3,790

$60,403 +/- 1,713

$65,917 +/- 4,829

$55,797 +/- 2,537

$66,549 +/- 2,070

$58,610 +/- 4,523

$85,993 +/- 7,607

$88,040 +/- 3,261

$78,891 +/- 3,219

$67,744 +/- 5,185

$61,885 +/- 3,151

$60,985 +/- 2,858

$57,907 +/- 2,692

$87,929 +/- 3,398

$76,997 +/- 2,711

$51,269 +/- 3,849

$55,213 +/- 2,978

$61,427 +/- 1,321

$92,652 +/- 3,341

$57,282 +/- 2,809

Taxes as Percent

of Income

3.25% +/- 0.01

5.23% +/- 0.49

6.09% +/- 0.24

4.55% +/- 0.36

4.88% +/- 0.64

4.82% +/- 0.41

5.07% +/- 0.36

4.70% +/- 0.09

4.49% +/- 0.37

7.82% +/- 0.30

4.19% +/- 0.43

5.43% +/- 0.18

6.65% +/- 0.58

4.72% +/- 0.30

5.17% +/- 0.22

3.99% +/- 0.39

6.57% +/- 0.65

7.49% +/- 0.32

7.23% +/- 0.34

6.68% +/- 0.57

5.32% +/- 0.46

4.23% +/- 0.26

5.45% +/- 0.32

4.82% +/- 0.27

7.14% +/- 0.32

3.93% +/- 0.41

4.59% +/- 0.30

6.24% +/- 0.16

9.45% +/- 0.39

4.85% +/- 0.43

Rank

68

47

111

88

93

76

102

118

11

168

60

33

101

70

194

37

16

22

31

64

163

56

94

25

206

109

42

2

90

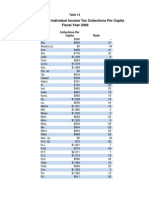

Property Taxes on Owner-Occupied Housing

Ranked by Taxes as a Percent of Home Value, 2010

Median Property

Taxes Paid on

State

County

United States

New Jersey Cumberland County

New Jersey Salem County

Illinois

Kane County

Illinois

Will County

New York Tompkins County

Texas

Tarrant County

Texas

Harris County

New Jersey Passaic County

New Jersey Mercer County

Michigan

Ingham County

New Jersey Warren County

Illinois

LaSalle County

New Hampshire

Cheshire County

New Jersey Burlington County

Texas

Williamson County

Michigan

Macomb County

Texas

Webb County

Illinois

McLean County

New Jersey Sussex County

New York Rensselaer County

Pennsylvania Allegheny County

Illinois

Peoria County

New Jersey Union County

Texas

Dallas County

Illinois

Macon County

Texas

Denton County

Wisconsin Kenosha County

Illinois

Champaign County

Illinois

Vermilion County

Homes

$2,043 +/- 5

$4,153 +/- 189

$4,571 +/- 159

$5,471 +/- 145

$5,249 +/- 126

$3,856 +/- 283

$3,115 +/- 57

$3,008 +/- 54

$8,281 +/- 156

$6,637 +/- 148

$2,757 +/- 77

$6,446 +/- 210

$2,899 +/- 177

$4,656 +/- 254

$5,878 +/- 104

$3,856 +/- 103

$2,695 +/- 28

$2,386 +/- 185

$3,446 +/- 135

$6,308 +/- 165

$3,804 +/- 189

$2,551 +/- 40

$2,621 +/- 127

$8,041 +/- 169

$2,739 +/- 59

$1,938 +/- 97

$3,775 +/- 72

$3,574 +/- 115

$3,278 +/- 121

$1,542 +/- 158

Taxes as Percent

Rank

68

47

30

33

81

140

151

7

16

184

19

160

44

25

81

197

254

111

21

87

223

206

9

189

356

91

100

121

468

Median Home Value

$179,900 +/- 292

$177,600 +/- 6,982

$196,100 +/- 8,418

$235,100 +/- 6,203

$227,200 +/- 3,880

$167,600 +/- 5,973

$137,100 +/- 1,924

$132,500 +/- 1,618

$365,200 +/- 5,770

$293,600 +/- 7,804

$122,600 +/- 4,622

$287,700 +/- 9,792

$130,200 +/- 8,350

$209,900 +/- 11,756

$265,500 +/- 5,467

$175,100 +/- 4,233

$123,000 +/- 2,136

$109,900 +/- 5,834

$159,600 +/- 4,475

$293,700 +/- 8,480

$177,200 +/- 7,250

$119,000 +/- 1,993

$123,200 +/- 4,921

$378,300 +/- 7,173

$129,300 +/- 2,620

$91,800 +/- 5,134

$179,800 +/- 5,102

$170,700 +/- 4,567

$157,300 +/- 5,992

$74,000 +/- 6,454

of Home Value

1.14% +/- 0.00

2.34% +/- 0.14

2.33% +/- 0.13

2.33% +/- 0.09

2.31% +/- 0.07

2.30% +/- 0.19

2.27% +/- 0.05

2.27% +/- 0.05

2.27% +/- 0.06

2.26% +/- 0.08

2.25% +/- 0.11

2.24% +/- 0.11

2.23% +/- 0.20

2.22% +/- 0.17

2.21% +/- 0.06

2.20% +/- 0.08

2.19% +/- 0.04

2.17% +/- 0.20

2.16% +/- 0.10

2.15% +/- 0.08

2.15% +/- 0.14

2.14% +/- 0.05

2.13% +/- 0.13

2.13% +/- 0.06

2.12% +/- 0.06

2.11% +/- 0.16

2.10% +/- 0.07

2.09% +/- 0.09

2.08% +/- 0.11

2.08% +/- 0.28

Median Household

Rank

Income

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

$62,898 +/- 113

$67,914 +/- 5,393

$69,022 +/- 6,694

$77,957 +/- 3,382

$80,839 +/- 1,495

$70,039 +/- 7,277

$70,294 +/- 1,552

$69,142 +/- 1,584

$87,009 +/- 5,263

$91,187 +/- 3,898

$61,723 +/- 2,775

$85,464 +/- 6,829

$61,141 +/- 2,592

$62,603 +/- 8,469

$85,744 +/- 2,323

$78,955 +/- 3,138

$58,085 +/- 2,186

$47,301 +/- 3,572

$74,746 +/- 3,686

$93,303 +/- 3,809

$67,387 +/- 4,219

$61,516 +/- 861

$63,787 +/- 3,269

$94,845 +/- 5,428

$64,880 +/- 1,616

$51,641 +/- 3,853

$93,145 +/- 2,900

$65,762 +/- 4,187

$73,658 +/- 5,081

$46,545 +/- 2,851

Taxes as Percent

of Income

3.25% +/- 0.01

6.12% +/- 0.56

6.62% +/- 0.68

7.02% +/- 0.36

6.49% +/- 0.20

5.51% +/- 0.70

4.43% +/- 0.13

4.35% +/- 0.13

9.52% +/- 0.60

7.28% +/- 0.35

4.47% +/- 0.24

7.54% +/- 0.65

4.74% +/- 0.35

7.44% +/- 1.08

6.86% +/- 0.22

4.88% +/- 0.23

4.64% +/- 0.18

5.04% +/- 0.55

4.61% +/- 0.29

6.76% +/- 0.33

5.65% +/- 0.45

4.15% +/- 0.09

4.11% +/- 0.29

8.48% +/- 0.52

4.22% +/- 0.14

3.75% +/- 0.34

4.05% +/- 0.15

5.43% +/- 0.39

4.45% +/- 0.35

3.31% +/- 0.40

Rank

46

34

26

38

55

124

140

1

18

119

15

99

17

28

87

104

79

108

29

52

173

178

6

164

237

185

59

121

332

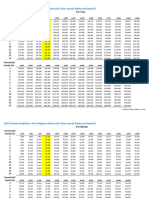

Property Taxes on Owner-Occupied Housing

Ranked by Taxes as a Percent of Home Value, 2010

Median Property

Taxes Paid on

State

County

United States

Ohio

Cuyahoga County

New York Orange County

New York Sullivan County

Illinois

Rock Island County

Texas

Collin County

Texas

Kaufman County

Texas

Rockwall County

New Jersey Hunterdon County

Texas

Montgomery County

Michigan

Oakland County

Nebraska

Sarpy County

New Hampshire

Merrimack County

Illinois

St. Clair County

Texas

Bexar County

Michigan

Genesee County

Texas

El Paso County

New York Putnam County

New Hampshire

Strafford County

New York Nassau County

Wisconsin Rock County

Illinois

Kankakee County

Wisconsin Winnebago County

New York Suffolk County

New Jersey Atlantic County

New Jersey Somerset County

Illinois

DuPage County

Michigan

Washtenaw County

New York Rockland County

Nebraska

Douglas County

Homes

$2,043 +/- 5

$2,752 +/- 48

$5,940 +/- 208

$3,806 +/- 383

$2,338 +/- 112

$4,210 +/- 95

$2,729 +/- 260

$4,075 +/- 222

$8,431 +/- 284

$3,266 +/- 146

$3,404 +/- 39

$3,321 +/- 109

$4,753 +/- 150

$2,527 +/- 118

$2,533 +/- 53

$1,900 +/- 45

$2,180 +/- 74

$7,841 +/- 316

$4,359 +/- 152

$9,289 +/- 96

$2,735 +/- 72

$3,136 +/- 182

$2,810 +/- 74

$7,768 +/- 102

$4,733 +/- 108

$7,897 +/- 205

$5,899 +/- 73

$3,768 +/- 89

$8,861 +/- 228

$2,838 +/- 50

Taxes as Percent

Rank

188

22

86

265

64

191

71

6

125

113

118

39

232

230

369

299

11

57

2

190

136

174

12

41

10

23

92

4

173

Median Home Value

$179,900 +/- 292

$132,200 +/- 2,372

$286,600 +/- 5,946

$183,800 +/- 13,401

$113,000 +/- 4,763

$203,700 +/- 4,860

$132,200 +/- 10,435

$198,500 +/- 9,379

$411,400 +/- 15,336

$159,800 +/- 5,658

$166,600 +/- 1,989

$162,800 +/- 4,154

$234,700 +/- 6,044

$124,900 +/- 6,506

$125,300 +/- 2,966

$94,100 +/- 3,326

$108,200 +/- 3,011

$390,400 +/- 18,718

$217,200 +/- 7,345

$463,200 +/- 3,393

$137,000 +/- 5,886

$157,500 +/- 5,811

$141,200 +/- 5,320

$390,800 +/- 3,663

$238,400 +/- 6,119

$398,200 +/- 10,553

$297,700 +/- 4,619

$190,600 +/- 4,678

$448,300 +/- 7,696

$143,900 +/- 2,290

of Home Value

1.14% +/- 0.00

2.08% +/- 0.05

2.07% +/- 0.08

2.07% +/- 0.26

2.07% +/- 0.13

2.07% +/- 0.07

2.06% +/- 0.26

2.05% +/- 0.15

2.05% +/- 0.10

2.04% +/- 0.12

2.04% +/- 0.03

2.04% +/- 0.08

2.03% +/- 0.08

2.02% +/- 0.14

2.02% +/- 0.06

2.02% +/- 0.09

2.01% +/- 0.09

2.01% +/- 0.13

2.01% +/- 0.10

2.01% +/- 0.03

2.00% +/- 0.10

1.99% +/- 0.14

1.99% +/- 0.09

1.99% +/- 0.03

1.99% +/- 0.07

1.98% +/- 0.07

1.98% +/- 0.04

1.98% +/- 0.07

1.98% +/- 0.06

1.97% +/- 0.05

Median Household

Rank

Income

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

$62,898 +/- 113

$56,411 +/- 1,218

$82,036 +/- 2,991

$57,950 +/- 4,194

$56,055 +/- 3,873

$96,698 +/- 2,919

$69,888 +/- 5,259

$90,476 +/- 8,737

$109,651 +/- 4,725

$75,059 +/- 3,042

$73,471 +/- 1,930

$81,432 +/- 3,546

$74,055 +/- 3,802

$59,736 +/- 2,649

$61,929 +/- 1,145

$50,126 +/- 1,789

$45,301 +/- 1,738

$94,471 +/- 6,478

$64,692 +/- 3,179

$105,441 +/- 2,260

$56,841 +/- 2,729

$61,836 +/- 5,339

$61,750 +/- 3,704

$93,768 +/- 2,458

$62,630 +/- 2,635

$108,618 +/- 4,846

$88,481 +/- 2,449

$76,659 +/- 3,704

$106,167 +/- 6,363

$67,448 +/- 2,909

Taxes as Percent

of Income

3.25% +/- 0.01

4.88% +/- 0.14

7.24% +/- 0.37

6.57% +/- 0.81

4.17% +/- 0.35

4.35% +/- 0.16

3.90% +/- 0.47

4.50% +/- 0.50

7.69% +/- 0.42

4.35% +/- 0.26

4.63% +/- 0.13

4.08% +/- 0.22

6.42% +/- 0.39

4.23% +/- 0.27

4.09% +/- 0.11

3.79% +/- 0.16

4.81% +/- 0.25

8.30% +/- 0.66

6.74% +/- 0.41

8.81% +/- 0.21

4.81% +/- 0.26

5.07% +/- 0.53

4.55% +/- 0.30

8.28% +/- 0.24

7.56% +/- 0.36

7.27% +/- 0.38

6.67% +/- 0.20

4.92% +/- 0.26

8.35% +/- 0.54

4.21% +/- 0.20

Rank

89

20

36

172

136

211

115

12

139

105

183

39

161

182

227

95

8

30

5

96

75

112

9

14

19

32

84

7

166

Property Taxes on Owner-Occupied Housing

Ranked by Taxes as a Percent of Home Value, 2010

Median Property

Taxes Paid on

State

County

United States

Texas

Travis County

Texas

Nueces County

New York Clinton County

New Jersey Bergen County

Wisconsin Racine County

New Jersey Middlesex County

Wisconsin La Crosse County

New Hampshire

Hillsborough County

New Hampshire

Rockingham County

Texas

Brazoria County

New York Ulster County

Texas

Hays County

Ohio

Montgomery County

Wisconsin Sheboygan County

New York Westchester County

Illinois

Tazewell County

Michigan

Bay County

Wisconsin Manitowoc County

New Jersey Hudson County

Texas

Potter County

Texas

Bell County

Pennsylvania Monroe County

Connecticut Hartford County

Wisconsin Dodge County

Nebraska

Lancaster County

Wisconsin Marathon County

Illinois

Madison County

Texas

Galveston County

Wisconsin Fond du Lac County

Homes

$2,043 +/- 5

$4,211 +/- 115

$2,213 +/- 142

$2,567 +/- 290

$9,081 +/- 117

$3,477 +/- 80

$6,674 +/- 69

$2,954 +/- 102

$4,984 +/- 112

$5,431 +/- 119

$2,804 +/- 135

$4,468 +/- 247

$3,394 +/- 172

$2,185 +/- 65

$2,988 +/- 100

$9,945 +/- 232

$2,546 +/- 129

$1,810 +/- 63

$2,349 +/- 90

$6,645 +/- 185

$1,594 +/- 187

$2,154 +/- 120

$3,781 +/- 165

$4,639 +/- 66

$2,888 +/- 84

$2,767 +/- 57

$2,647 +/- 78

$2,308 +/- 118

$2,757 +/- 198

$2,722 +/- 85

Taxes as Percent

Rank

63

293

219

3

109

14

155

35

31

177

52

114

297

154

1

226

390

259

15

456

305

89

45

162

183

201

276

184

193

Median Home Value

$179,900 +/- 292

$214,100 +/- 6,110

$112,700 +/- 4,660

$131,100 +/- 10,373

$463,800 +/- 6,647

$177,600 +/- 5,576

$341,300 +/- 3,322

$151,900 +/- 5,765

$257,100 +/- 5,282

$281,200 +/- 6,585

$146,700 +/- 5,845

$234,300 +/- 5,216

$178,500 +/- 8,008

$115,200 +/- 2,890

$158,000 +/- 4,713

$526,000 +/- 11,294

$134,700 +/- 7,122

$95,800 +/- 3,266

$124,600 +/- 5,852

$352,600 +/- 7,736

$84,800 +/- 9,422

$115,200 +/- 5,267

$202,300 +/- 9,508

$248,300 +/- 3,231

$154,600 +/- 6,818

$148,200 +/- 3,084

$142,900 +/- 4,967

$124,700 +/- 5,953

$149,500 +/- 6,454

$147,700 +/- 5,910

of Home Value

1.14% +/- 0.00

1.97% +/- 0.08

1.96% +/- 0.15

1.96% +/- 0.27

1.96% +/- 0.04

1.96% +/- 0.08

1.96% +/- 0.03

1.94% +/- 0.10

1.94% +/- 0.06

1.93% +/- 0.06

1.91% +/- 0.12

1.91% +/- 0.11

1.90% +/- 0.13

1.90% +/- 0.07

1.89% +/- 0.08

1.89% +/- 0.06

1.89% +/- 0.14

1.89% +/- 0.09

1.89% +/- 0.11

1.88% +/- 0.07

1.88% +/- 0.30

1.87% +/- 0.13

1.87% +/- 0.12

1.87% +/- 0.04

1.87% +/- 0.10

1.87% +/- 0.05

1.85% +/- 0.08

1.85% +/- 0.13

1.84% +/- 0.15

1.84% +/- 0.09

Median Household

Rank

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

Income

$62,898 +/- 113

$80,235 +/- 2,232

$57,190 +/- 3,462

$66,367 +/- 5,575

$100,688 +/- 2,677

$64,263 +/- 4,771

$92,228 +/- 2,632

$64,637 +/- 4,738

$85,957 +/- 2,142

$85,781 +/- 4,195

$76,981 +/- 5,293

$65,030 +/- 4,507

$73,460 +/- 5,162

$54,832 +/- 2,195

$58,867 +/- 3,059

$106,892 +/- 3,624

$59,122 +/- 3,185

$51,020 +/- 3,942

$55,842 +/- 2,683

$84,529 +/- 5,624

$46,881 +/- 5,529

$62,236 +/- 2,385

$60,844 +/- 3,962

$80,555 +/- 1,984

$58,772 +/- 3,724

$69,244 +/- 3,968

$61,360 +/- 2,451

$61,736 +/- 2,864

$76,120 +/- 5,921

$62,920 +/- 3,836

Taxes as Percent

of Income

3.25% +/- 0.01

5.25% +/- 0.20

3.87% +/- 0.34

3.87% +/- 0.54

9.02% +/- 0.27

5.41% +/- 0.42

7.24% +/- 0.22

4.57% +/- 0.37

5.80% +/- 0.19

6.33% +/- 0.34

3.64% +/- 0.31

6.87% +/- 0.61

4.62% +/- 0.40

3.98% +/- 0.20

5.08% +/- 0.31

9.30% +/- 0.38

4.31% +/- 0.32

3.55% +/- 0.30

4.21% +/- 0.26

7.86% +/- 0.57

3.40% +/- 0.57

3.46% +/- 0.23

6.21% +/- 0.49

5.76% +/- 0.16

4.91% +/- 0.34

4.00% +/- 0.24

4.31% +/- 0.21

3.74% +/- 0.26

3.62% +/- 0.38

4.33% +/- 0.30

Rank

67

215

216

4

61

21

110

49

40

259

27

106

196

74

3

150

278

167

10

315

300

43

50

85

192

148

239

266

142

Property Taxes on Owner-Occupied Housing

Ranked by Taxes as a Percent of Home Value, 2010

Median Property

Taxes Paid on

State

County

United States

Texas

Hidalgo County

Connecticut New Haven County

Ohio

Lucas County

New York Albany County

New Jersey Morris County

Wisconsin Brown County

Ohio

Franklin County

Illinois

Sangamon County

Pennsylvania Berks County

Wisconsin Outagamie County

Texas

San Patricio County

Texas

Ellis County

Wisconsin Dane County

Wisconsin Portage County

New Jersey Monmouth County

New Mexico McKinley County

Michigan

Calhoun County

Texas

Brazos County

Texas

Bastrop County

Wisconsin Eau Claire County

Wisconsin Jefferson County

New York Dutchess County

Texas

Cameron County

Kansas

Wyandotte County

Texas

Coryell County

Wisconsin Wood County

Texas

Victoria County

Texas

Johnson County

Wisconsin Walworth County

Homes

$2,043 +/- 5

$1,477 +/- 69

$4,943 +/- 71

$2,118 +/- 79

$3,914 +/- 151

$8,147 +/- 153

$2,917 +/- 64

$2,840 +/- 45

$2,218 +/- 126

$3,204 +/- 94

$2,894 +/- 54

$1,603 +/- 219

$2,440 +/- 102

$4,171 +/- 90

$2,574 +/- 87

$7,182 +/- 118

$1,090 +/- 329

$1,847 +/- 84

$2,476 +/- 172

$2,234 +/- 197

$2,601 +/- 92

$3,271 +/- 92

$5,282 +/- 185

$1,330 +/- 83

$1,715 +/- 74

$1,684 +/- 268

$2,154 +/- 101

$1,920 +/- 256

$1,856 +/- 151

$3,544 +/- 116

Taxes as Percent

Rank

494

36

318

80

8

159

172

292

129

161

452

248

67

218

13

624

380

242

287

210

123

32

540

417

430

305

364

378

105

Median Home Value

$179,900 +/- 292

$80,400 +/- 2,334

$269,200 +/- 4,239

$115,400 +/- 2,816

$213,300 +/- 6,723

$444,100 +/- 8,101

$159,200 +/- 3,080

$155,000 +/- 2,383

$121,100 +/- 5,389

$175,700 +/- 5,291

$159,000 +/- 4,062

$88,200 +/- 7,687

$135,200 +/- 4,706

$231,200 +/- 3,779

$143,100 +/- 4,675

$399,900 +/- 8,766

$60,800 +/- 7,100

$103,100 +/- 4,591

$138,800 +/- 7,095

$125,700 +/- 10,480

$146,900 +/- 7,214

$185,000 +/- 6,110

$299,100 +/- 7,487

$75,400 +/- 3,354

$97,400 +/- 4,478

$95,800 +/- 6,694

$124,000 +/- 5,597

$111,100 +/- 10,506

$107,500 +/- 7,600

$205,300 +/- 10,718

of Home Value

1.14% +/- 0.00

1.84% +/- 0.10

1.84% +/- 0.04

1.84% +/- 0.08

1.83% +/- 0.09

1.83% +/- 0.05

1.83% +/- 0.05

1.83% +/- 0.04

1.83% +/- 0.13

1.82% +/- 0.08

1.82% +/- 0.06

1.82% +/- 0.29

1.80% +/- 0.10

1.80% +/- 0.05

1.80% +/- 0.08

1.80% +/- 0.05

1.79% +/- 0.58

1.79% +/- 0.11

1.78% +/- 0.15

1.78% +/- 0.22

1.77% +/- 0.11

1.77% +/- 0.08

1.77% +/- 0.08

1.76% +/- 0.14

1.76% +/- 0.11

1.76% +/- 0.31

1.74% +/- 0.11

1.73% +/- 0.28

1.73% +/- 0.19

1.73% +/- 0.11

Median Household

Rank

117

118

119

120

121

122

123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

138

139

140

141

142

143

144

145

Income

$62,898 +/- 113

$40,781 +/- 1,695

$79,948 +/- 2,172

$54,176 +/- 2,119

$78,896 +/- 4,449

$106,655 +/- 4,014

$65,705 +/- 2,710

$67,147 +/- 1,662

$65,186 +/- 4,052

$63,510 +/- 2,220

$64,418 +/- 3,621

$57,279 +/- 6,549

$67,702 +/- 7,383

$80,931 +/- 1,773

$62,259 +/- 4,434

$99,951 +/- 2,717

$31,518 +/- 3,623

$50,104 +/- 2,428

$58,835 +/- 6,710

$60,970 +/- 4,749

$60,561 +/- 3,951

$60,168 +/- 4,891

$84,214 +/- 3,715

$39,285 +/- 2,969

$51,058 +/- 3,125

$65,055 +/- 6,250

$53,085 +/- 2,855

$60,899 +/- 2,889

$60,009 +/- 3,616

$66,387 +/- 2,180

Taxes as Percent

of Income

3.25% +/- 0.01

3.62% +/- 0.23

6.18% +/- 0.19

3.91% +/- 0.21

4.96% +/- 0.34

7.64% +/- 0.32

4.44% +/- 0.21

4.23% +/- 0.12

3.40% +/- 0.29

5.04% +/- 0.23

4.49% +/- 0.27

2.80% +/- 0.50

3.60% +/- 0.42

5.15% +/- 0.16

4.13% +/- 0.33

7.19% +/- 0.23

3.46% +/- 1.12

3.69% +/- 0.24

4.21% +/- 0.56

3.66% +/- 0.43

4.29% +/- 0.32

5.44% +/- 0.47

6.27% +/- 0.35

3.39% +/- 0.33

3.36% +/- 0.25

2.59% +/- 0.48

4.06% +/- 0.29

3.15% +/- 0.45

3.09% +/- 0.31

5.34% +/- 0.25

Rank

267

44

209

82

13

123

162

313

77

117

444

269

72

175

23

303

247

165

253

154

58

41

320

322

490

184

360

381

63

Property Taxes on Owner-Occupied Housing

Ranked by Taxes as a Percent of Home Value, 2010

Median Property

Taxes Paid on

State

County

United States

Pennsylvania Erie County

Michigan

Kalamazoo County

Pennsylvania Armstrong County

Texas

Randall County

North DakotaCass County

Michigan

Midland County

New Hampshire

Grafton County

Iowa

Polk County

Pennsylvania Delaware County

Connecticut Tolland County

North DakotaGrand Forks County

Texas

Lubbock County

Illinois

Adams County

Texas

McLennan County

New York Jefferson County

New Jersey Ocean County

Texas

Liberty County

Texas

Wichita County

Michigan

Kent County

Illinois

Cook County

Michigan

St. Clair County

Michigan

Eaton County

Ohio

Hamilton County

Michigan

Muskegon County

Michigan

Lenawee County

Ohio

Greene County

Michigan

Van Buren County

Pennsylvania Beaver County

Vermont

Chittenden County

Homes

$2,043 +/- 5

$2,026 +/- 80

$2,478 +/- 66

$1,538 +/- 101

$2,312 +/- 116

$2,644 +/- 101

$2,144 +/- 145

$3,624 +/- 277

$2,537 +/- 48

$4,087 +/- 105

$4,530 +/- 159

$2,481 +/- 166

$1,831 +/- 123

$1,621 +/- 150

$1,821 +/- 131

$2,139 +/- 210

$4,620 +/- 78

$1,424 +/- 134

$1,437 +/- 76

$2,342 +/- 43

$4,015 +/- 42

$2,017 +/- 82

$2,349 +/- 101

$2,447 +/- 47

$1,701 +/- 77

$1,928 +/- 98

$2,523 +/- 126

$2,016 +/- 132

$1,877 +/- 66

$4,407 +/- 134

Taxes as Percent

Rank

340

241

469

274

202

308

95

229

70

49

240

386

449

387

309

46

513

510

262

73

344

259

247

423

359

233

346

374

54

Median Home Value

$179,900 +/- 292

$117,500 +/- 4,438

$143,800 +/- 4,724

$90,200 +/- 6,470

$136,200 +/- 6,961

$155,800 +/- 6,268

$126,700 +/- 7,670

$215,200 +/- 9,840

$150,800 +/- 3,251

$243,400 +/- 7,075

$270,000 +/- 8,255

$148,000 +/- 5,925

$109,300 +/- 3,931

$96,800 +/- 6,134

$109,000 +/- 5,568

$128,200 +/- 9,923

$279,200 +/- 5,285

$86,100 +/- 8,329

$86,900 +/- 3,990

$141,700 +/- 3,083

$244,400 +/- 2,110

$122,900 +/- 5,118

$143,300 +/- 7,121

$149,400 +/- 3,158

$103,900 +/- 4,355

$118,000 +/- 6,256

$155,200 +/- 6,468

$124,200 +/- 9,138

$115,700 +/- 4,366

$271,800 +/- 7,321

of Home Value

1.14% +/- 0.00

1.72% +/- 0.09

1.72% +/- 0.07

1.71% +/- 0.17

1.70% +/- 0.12

1.70% +/- 0.09

1.69% +/- 0.15

1.68% +/- 0.15

1.68% +/- 0.05

1.68% +/- 0.07

1.68% +/- 0.08

1.68% +/- 0.13

1.68% +/- 0.13

1.67% +/- 0.19

1.67% +/- 0.15

1.67% +/- 0.21

1.65% +/- 0.04

1.65% +/- 0.22

1.65% +/- 0.12

1.65% +/- 0.05

1.64% +/- 0.02

1.64% +/- 0.10

1.64% +/- 0.11

1.64% +/- 0.05

1.64% +/- 0.10

1.63% +/- 0.12

1.63% +/- 0.11

1.62% +/- 0.16

1.62% +/- 0.08

1.62% +/- 0.07

Median Household

Rank

146

147

148

149

150

151

152

153

154

155

156

157

158

159

160

161

162

163

164

165

166

167

168

169

170

171

172

173

174

Income

$62,898 +/- 113

$57,142 +/- 2,662

$59,921 +/- 2,995

$50,923 +/- 3,760

$68,237 +/- 4,622

$72,733 +/- 3,679

$58,162 +/- 4,670

$59,024 +/- 4,961

$67,560 +/- 3,137

$75,072 +/- 3,235

$89,799 +/- 4,531

$68,905 +/- 3,723

$58,811 +/- 2,675

$53,286 +/- 4,921

$55,152 +/- 3,678

$54,639 +/- 5,605

$64,314 +/- 2,580

$50,806 +/- 5,054

$48,344 +/- 3,011

$59,939 +/- 2,359

$70,016 +/- 841

$51,693 +/- 2,654

$61,056 +/- 4,058

$66,583 +/- 1,995

$48,409 +/- 2,494

$52,096 +/- 4,025

$63,089 +/- 5,363

$50,631 +/- 3,273

$53,843 +/- 2,395

$79,879 +/- 3,539

Taxes as Percent

of Income

3.25% +/- 0.01

3.55% +/- 0.22

4.14% +/- 0.23

3.02% +/- 0.30

3.39% +/- 0.29

3.64% +/- 0.23

3.69% +/- 0.39

6.14% +/- 0.70

3.76% +/- 0.19

5.44% +/- 0.27

5.04% +/- 0.31

3.60% +/- 0.31

3.11% +/- 0.25

3.04% +/- 0.40

3.30% +/- 0.32

3.91% +/- 0.56

7.18% +/- 0.31

2.80% +/- 0.38

2.97% +/- 0.24

3.91% +/- 0.17

5.73% +/- 0.09

3.90% +/- 0.26

3.85% +/- 0.30

3.68% +/- 0.13

3.51% +/- 0.24

3.70% +/- 0.34

4.00% +/- 0.39

3.98% +/- 0.37

3.49% +/- 0.20

5.52% +/- 0.30

Rank

279

174

398

318

262

248

45

234

57

78

271

373

391

336

208

24

442

407

210

51

212

221

251

286

245

191

197

291

53

Property Taxes on Owner-Occupied Housing

Ranked by Taxes as a Percent of Home Value, 2010

Median Property

Taxes Paid on

State

County

United States

Michigan

Saginaw County

Ohio

Lake County

Pennsylvania Carbon County

Wisconsin Ozaukee County

Ohio

Delaware County

Wisconsin St. Croix County

Ohio

Summit County

Pennsylvania Northampton County

Rhode Island Kent County

Pennsylvania Crawford County

Texas

Parker County

Texas

Jefferson County

Texas

Hunt County

Pennsylvania York County

Texas

Grayson County

Michigan

Jackson County

Florida

St. Lucie County

Connecticut Middlesex County

Texas

Guadalupe County

Connecticut Litchfield County

Rhode Island Providence County

Wisconsin Washington County

Michigan

Clinton County

Wisconsin Waukesha County

Pennsylvania Indiana County

Pennsylvania Dauphin County

New York Saratoga County

Kansas

Butler County

Michigan

Isabella County

Homes

$2,043 +/- 5

$1,685 +/- 54

$2,457 +/- 68

$2,329 +/- 137

$4,210 +/- 154

$3,939 +/- 191

$3,455 +/- 98

$2,262 +/- 58

$3,532 +/- 79

$3,553 +/- 97

$1,626 +/- 96

$2,348 +/- 246

$1,478 +/- 115

$1,527 +/- 153

$2,886 +/- 84

$1,626 +/- 180

$1,806 +/- 85

$1,949 +/- 105

$4,677 +/- 163

$2,309 +/- 165

$4,209 +/- 123

$3,600 +/- 61

$3,618 +/- 84

$2,414 +/- 135

$3,973 +/- 66

$1,647 +/- 88

$2,422 +/- 72

$3,562 +/- 155

$1,921 +/- 218

$1,761 +/- 150

Taxes as Percent

Rank

429

246

269

64

78

110

282

106

104

447

261

492

475

163

447

391

354

43

275

66

98

97

252

74

444

250

102

362

406

Median Home Value

$179,900 +/- 292

$104,200 +/- 5,496

$152,600 +/- 5,077

$145,000 +/- 13,452

$262,400 +/- 10,921

$245,900 +/- 7,974

$216,200 +/- 9,229

$141,700 +/- 3,175

$222,200 +/- 6,983

$224,800 +/- 5,498

$102,900 +/- 5,943

$148,700 +/- 9,189

$93,900 +/- 3,486

$97,600 +/- 11,307

$185,500 +/- 4,367

$104,600 +/- 9,276

$116,600 +/- 6,031

$126,000 +/- 6,107

$302,600 +/- 12,387

$149,500 +/- 9,566

$272,700 +/- 7,894

$233,600 +/- 3,774

$235,300 +/- 7,658

$158,000 +/- 6,475

$260,500 +/- 5,572

$108,000 +/- 6,910

$160,600 +/- 3,892

$236,200 +/- 8,338

$127,500 +/- 15,527

$117,100 +/- 7,881

of Home Value

1.14% +/- 0.00

1.62% +/- 0.10

1.61% +/- 0.07

1.61% +/- 0.18

1.60% +/- 0.09

1.60% +/- 0.09

1.60% +/- 0.08

1.60% +/- 0.05

1.59% +/- 0.06

1.58% +/- 0.06

1.58% +/- 0.13

1.58% +/- 0.19

1.57% +/- 0.14

1.56% +/- 0.24

1.56% +/- 0.06

1.55% +/- 0.22

1.55% +/- 0.11

1.55% +/- 0.11

1.55% +/- 0.08

1.54% +/- 0.15

1.54% +/- 0.06

1.54% +/- 0.04

1.54% +/- 0.06

1.53% +/- 0.11

1.53% +/- 0.04

1.53% +/- 0.13

1.51% +/- 0.06

1.51% +/- 0.08

1.51% +/- 0.25

1.50% +/- 0.16

Median Household

Rank

175

176

177

178

179

180

181

182

183

184

185

186

187

188

189

190

191

192

193

194

195

196

197

198

199

200

201

202

203

Income

$62,898 +/- 113

$50,645 +/- 1,782

$61,741 +/- 2,073

$56,717 +/- 3,637

$87,036 +/- 4,490

$98,818 +/- 5,015

$79,024 +/- 4,691

$60,177 +/- 1,603

$70,205 +/- 3,176

$68,346 +/- 3,638

$44,763 +/- 2,621

$63,861 +/- 5,134

$50,484 +/- 2,945

$51,548 +/- 6,626

$66,769 +/- 1,988

$52,226 +/- 5,863

$51,750 +/- 2,338

$43,006 +/- 2,732

$84,901 +/- 4,810

$66,305 +/- 3,160

$77,818 +/- 5,293

$69,782 +/- 2,578

$73,806 +/- 4,860

$64,273 +/- 4,423

$83,790 +/- 2,725

$52,420 +/- 5,499

$66,179 +/- 2,237

$79,105 +/- 4,362

$67,671 +/- 8,884

$53,129 +/- 5,264

Taxes as Percent

of Income

3.25% +/- 0.01

3.33% +/- 0.16

3.98% +/- 0.17

4.11% +/- 0.36

4.84% +/- 0.31

3.99% +/- 0.28

4.37% +/- 0.29

3.76% +/- 0.14

5.03% +/- 0.25

5.20% +/- 0.31

3.63% +/- 0.30

3.68% +/- 0.49

2.93% +/- 0.28

2.96% +/- 0.48

4.32% +/- 0.18

3.11% +/- 0.49

3.49% +/- 0.23

4.53% +/- 0.38

5.51% +/- 0.37

3.48% +/- 0.30

5.41% +/- 0.40

5.16% +/- 0.21

4.90% +/- 0.34

3.76% +/- 0.33

4.74% +/- 0.17

3.14% +/- 0.37

3.66% +/- 0.16

4.50% +/- 0.32

2.84% +/- 0.49

3.31% +/- 0.43

Rank

326

198

179

92

195

131

232

81

69

263

250

416

409

146

372

290

114

54

292

62

71

86

233

98

362

255

116

435

330

Property Taxes on Owner-Occupied Housing

Ranked by Taxes as a Percent of Home Value, 2010

Median Property

Taxes Paid on

State

County

United States

Michigan

Ottawa County

Pennsylvania Lehigh County

Iowa

Woodbury County

Pennsylvania Schuylkill County

Kansas

Shawnee County

Pennsylvania Mercer County

Ohio

Trumbull County

Connecticut Fairfield County

Iowa

Dallas County

Pennsylvania Lancaster County

Texas

Orange County

Texas

Taylor County

Maine

Androscoggin County

Illinois

Williamson County

Connecticut Windham County

Ohio

Wood County

Michigan

Livingston County

Tennessee Shelby County

Michigan

Allegan County

Pennsylvania Lawrence County

Ohio

Butler County

Pennsylvania Luzerne County

Michigan

Shiawassee County

Texas

Angelina County

Ohio

Mahoning County

Ohio

Warren County

Connecticut New London County

Iowa

Black Hawk County

MassachusettsHampden County

Homes

$2,043 +/- 5

$2,342 +/- 79

$3,134 +/- 139

$1,474 +/- 81

$1,446 +/- 76

$1,797 +/- 80

$1,462 +/- 83

$1,488 +/- 59

$6,503 +/- 99

$2,546 +/- 179

$2,754 +/- 56

$1,203 +/- 121

$1,440 +/- 125

$2,302 +/- 94

$1,311 +/- 135

$3,305 +/- 135

$2,167 +/- 128

$2,680 +/- 69

$1,975 +/- 46

$2,035 +/- 130

$1,430 +/- 67

$2,264 +/- 85

$1,704 +/- 69

$1,643 +/- 86

$1,213 +/- 123

$1,379 +/- 47

$2,665 +/- 91

$3,779 +/- 77

$1,724 +/- 88

$2,870 +/- 41

Taxes as Percent

Rank

262

138

495

504

393

500

487

18

226

187

586

507

277

546

119

301

198

351

337

511

281

422

445

582

523

199

90

414

167

Median Home Value

$179,900 +/- 292

$156,000 +/- 3,540

$208,900 +/- 7,018

$98,500 +/- 6,224

$96,700 +/- 6,224

$121,000 +/- 5,643

$98,700 +/- 6,592

$101,000 +/- 4,569

$441,400 +/- 9,430

$172,900 +/- 15,081

$187,400 +/- 4,292

$81,900 +/- 8,123

$98,100 +/- 5,433

$158,400 +/- 5,504

$90,300 +/- 8,430

$227,800 +/- 7,803

$149,500 +/- 7,924

$185,200 +/- 5,110

$136,800 +/- 3,447

$141,200 +/- 8,268

$99,500 +/- 5,535

$157,800 +/- 4,729

$118,800 +/- 4,408

$114,700 +/- 7,078

$84,800 +/- 7,437

$96,600 +/- 3,766

$186,800 +/- 5,536

$265,000 +/- 7,480

$120,900 +/- 4,303

$201,400 +/- 4,808

of Home Value

1.14% +/- 0.00

1.50% +/- 0.06

1.50% +/- 0.08

1.50% +/- 0.13

1.50% +/- 0.12

1.49% +/- 0.10

1.48% +/- 0.13

1.47% +/- 0.09

1.47% +/- 0.04

1.47% +/- 0.16

1.47% +/- 0.05

1.47% +/- 0.21

1.47% +/- 0.15

1.45% +/- 0.08

1.45% +/- 0.20

1.45% +/- 0.08

1.45% +/- 0.12

1.45% +/- 0.05

1.44% +/- 0.05

1.44% +/- 0.12

1.44% +/- 0.10

1.43% +/- 0.07

1.43% +/- 0.08

1.43% +/- 0.12

1.43% +/- 0.19

1.43% +/- 0.07

1.43% +/- 0.06

1.43% +/- 0.05

1.43% +/- 0.09

1.43% +/- 0.04

Median Household

Rank

204

205

206

207

208

209

210

211

212

213

214

215

216

217

218

219

220

221

222

223

224

225

226

227

228

229

230

231

232

Income

$62,898 +/- 113

$61,756 +/- 1,990

$67,375 +/- 2,950

$52,558 +/- 3,943

$48,328 +/- 3,177

$59,997 +/- 3,564

$47,568 +/- 2,953

$49,553 +/- 2,974

$98,336 +/- 3,817

$77,909 +/- 9,750

$63,273 +/- 1,860

$49,769 +/- 5,232

$56,759 +/- 5,339

$53,883 +/- 8,724

$55,891 +/- 4,542

$75,410 +/- 3,321

$62,478 +/- 4,976

$71,037 +/- 2,998

$63,470 +/- 2,139

$50,866 +/- 2,707

$47,410 +/- 3,426

$69,317 +/- 2,892

$53,706 +/- 3,309

$52,471 +/- 4,018

$48,520 +/- 6,172

$47,200 +/- 2,446

$78,067 +/- 3,424

$76,352 +/- 2,945

$58,027 +/- 3,525

$66,360 +/- 3,336

Taxes as Percent

of Income

3.25% +/- 0.01

3.79% +/- 0.18

4.65% +/- 0.29

2.80% +/- 0.26

2.99% +/- 0.25

3.00% +/- 0.22

3.07% +/- 0.26

3.00% +/- 0.22

6.61% +/- 0.28

3.27% +/- 0.47

4.35% +/- 0.16

2.42% +/- 0.35

2.54% +/- 0.32

4.27% +/- 0.71

2.35% +/- 0.31

4.38% +/- 0.26

3.47% +/- 0.34

3.77% +/- 0.19

3.11% +/- 0.13

4.00% +/- 0.33

3.02% +/- 0.26

3.27% +/- 0.18

3.17% +/- 0.23

3.13% +/- 0.29

2.50% +/- 0.41

2.92% +/- 0.18

3.41% +/- 0.19

4.95% +/- 0.22

2.97% +/- 0.24

4.32% +/- 0.23

Rank

226

103

441

404

403

384

402

35

339

137

524

500

156

543

129

298

230

375

189

400

340

358

366

508

420

312

83

408

143

Property Taxes on Owner-Occupied Housing

Ranked by Taxes as a Percent of Home Value, 2010

Median Property

Taxes Paid on

State

County

United States

Iowa

Johnson County

Ohio

Geauga County

Pennsylvania Bucks County

North DakotaBurleigh County

Ohio

Medina County

Iowa

Pottawattamie County

Texas

Midland County

Texas

Gregg County

Ohio

Lorain County

MassachusettsFranklin County

Pennsylvania Lycoming County

Florida

Broward County

Iowa

Linn County

Pennsylvania Westmoreland County

South Dakota Pennington County

Pennsylvania Lackawanna County

Texas

Comal County

South Dakota Minnehaha County

Pennsylvania Cambria County

Iowa

Story County

Ohio

Clermont County

Ohio

Clark County

Michigan

Monroe County

Pennsylvania Montgomery County

Ohio

Richland County

Alaska

Anchorage Municipality

Texas

Bowie County

Pennsylvania Clearfield County

Florida

Osceola County

Homes

$2,043 +/- 5

$2,702 +/- 96

$3,211 +/- 190

$4,376 +/- 68

$2,356 +/- 101

$2,622 +/- 85

$1,841 +/- 99

$2,121 +/- 228

$1,701 +/- 207

$2,018 +/- 87

$3,178 +/- 118

$1,762 +/- 83

$2,488 +/- 59

$1,921 +/- 62

$1,871 +/- 63

$2,095 +/- 148

$1,987 +/- 111

$2,809 +/- 203

$2,071 +/- 110

$1,179 +/- 63

$2,174 +/- 123

$2,078 +/- 113

$1,380 +/- 50

$1,992 +/- 104

$3,972 +/- 65

$1,429 +/- 79

$3,786 +/- 132

$1,255 +/- 152

$1,211 +/- 63

$1,727 +/- 93

Taxes as Percent

Rank

195

128

56

258

205

383

317

423

342

131

404

239

362

375

326

349

175

331

593

300

327

522

348

75

512

88

569

584

413

Median Home Value

$179,900 +/- 292

$190,200 +/- 7,792

$226,300 +/- 8,581

$308,500 +/- 5,961

$166,800 +/- 5,803

$185,900 +/- 4,645

$130,600 +/- 7,848

$151,000 +/- 11,204

$121,200 +/- 10,611

$144,000 +/- 3,634

$227,600 +/- 7,332

$127,000 +/- 7,988

$179,600 +/- 4,122

$138,800 +/- 3,275

$135,900 +/- 4,686

$152,200 +/- 6,396

$144,900 +/- 5,042

$205,300 +/- 17,906

$151,400 +/- 5,169

$86,200 +/- 2,552

$159,000 +/- 5,276

$153,000 +/- 5,926

$102,000 +/- 6,406

$147,400 +/- 8,147

$295,300 +/- 3,611

$106,300 +/- 5,832

$282,200 +/- 7,203

$93,900 +/- 5,071

$90,800 +/- 5,408

$129,900 +/- 9,478

of Home Value

1.14% +/- 0.00

1.42% +/- 0.08

1.42% +/- 0.10

1.42% +/- 0.04

1.41% +/- 0.08

1.41% +/- 0.06

1.41% +/- 0.11

1.40% +/- 0.18

1.40% +/- 0.21

1.40% +/- 0.07

1.40% +/- 0.07

1.39% +/- 0.11

1.39% +/- 0.05

1.38% +/- 0.06

1.38% +/- 0.07

1.38% +/- 0.11

1.37% +/- 0.09

1.37% +/- 0.15

1.37% +/- 0.09

1.37% +/- 0.08

1.37% +/- 0.09

1.36% +/- 0.09

1.35% +/- 0.10

1.35% +/- 0.10

1.35% +/- 0.03

1.34% +/- 0.10

1.34% +/- 0.06

1.34% +/- 0.18

1.33% +/- 0.11

1.33% +/- 0.12

Median Household

Rank

233

234

235

236

237

238

239

240

241

242

243

244

245

246

247

248

249

250

251

252

253

254

255

256

257

258

259

260

261

Income

$62,898 +/- 113

$74,842 +/- 4,862

$67,861 +/- 3,472

$82,490 +/- 2,703

$70,644 +/- 5,670

$72,910 +/- 3,074

$60,582 +/- 3,181

$64,268 +/- 3,614

$53,030 +/- 5,532

$60,952 +/- 1,982

$63,043 +/- 4,879

$48,520 +/- 3,126

$57,169 +/- 1,970

$66,724 +/- 3,466

$56,427 +/- 1,835

$59,205 +/- 6,160

$55,817 +/- 3,061

$74,819 +/- 5,333

$67,175 +/- 3,378

$48,126 +/- 2,468

$73,992 +/- 4,303

$66,599 +/- 3,251

$51,929 +/- 2,158

$60,067 +/- 4,122

$91,885 +/- 2,116

$49,601 +/- 4,081

$97,736 +/- 4,614

$57,074 +/- 6,116

$42,072 +/- 2,497

$50,789 +/- 2,830

Taxes as Percent

of Income

3.25% +/- 0.01

3.61% +/- 0.27

4.73% +/- 0.37

5.30% +/- 0.19

3.34% +/- 0.30

3.60% +/- 0.19

3.04% +/- 0.23

3.30% +/- 0.40

3.21% +/- 0.51

3.31% +/- 0.18

5.04% +/- 0.43

3.63% +/- 0.29

4.35% +/- 0.18

2.88% +/- 0.18

3.32% +/- 0.16

3.54% +/- 0.45

3.56% +/- 0.28

3.75% +/- 0.38

3.08% +/- 0.23

2.45% +/- 0.18

2.94% +/- 0.24

3.12% +/- 0.23

2.66% +/- 0.15

3.32% +/- 0.29

4.32% +/- 0.12

2.88% +/- 0.29

3.87% +/- 0.23

2.20% +/- 0.36

2.88% +/- 0.23

3.40% +/- 0.26

Rank

268

100

65

325

274

392

337

351

333

80

264

138

429

329

281

277

235

382

515

414

369

475

328

145

427

214

576

430

314

Property Taxes on Owner-Occupied Housing

Ranked by Taxes as a Percent of Home Value, 2010

Median Property

Taxes Paid on

State

County

United States

Kansas

Leavenworth County

Pennsylvania Lebanon County

Kansas

Riley County

Texas

Smith County

Alaska

Fairbanks North Star Borough

Iowa

Scott County

Georgia

Dougherty County

Pennsylvania Butler County

Ohio

Portage County

Pennsylvania Chester County

Missouri

Jackson County

Michigan

Berrien County

Kansas

Johnson County

Michigan

Grand Traverse County

Ohio

Stark County

Arizona

Apache County

Missouri

St. Louis County

Texas

Tom Green County

Florida

Palm Beach County

Pennsylvania Fayette County

Ohio

Ashtabula County

New York Warren County

Ohio

Marion County

MassachusettsHampshire County

Georgia

Gwinnett County

Kansas

Sedgwick County

Maine

Cumberland County

Ohio

Muskingum County

Missouri

Clay County

Homes

$2,043 +/- 5

$2,209 +/- 178

$2,191 +/- 108

$2,078 +/- 277

$1,564 +/- 128

$2,791 +/- 210

$1,869 +/- 42

$1,276 +/- 103

$2,133 +/- 118

$2,032 +/- 106

$4,302 +/- 102

$1,716 +/- 49

$1,697 +/- 66

$2,698 +/- 41

$2,220 +/- 168

$1,596 +/- 61

$722 +/- 121

$2,291 +/- 41

$1,202 +/- 91

$2,538 +/- 54

$1,070 +/- 64

$1,458 +/- 76

$2,608 +/- 228

$1,197 +/- 69

$3,364 +/- 110

$2,279 +/- 48

$1,538 +/- 61

$3,110 +/- 104

$1,299 +/- 73

$1,888 +/- 63

Taxes as Percent

Rank

294

296

327

465

179

376

558

310

338

60

416

426

196

291

454

742

278

587

228

628

502

208

588

115

279

469

142

549

371

Median Home Value

$179,900 +/- 292

$166,200 +/- 11,807

$165,300 +/- 5,018

$157,600 +/- 15,064

$118,800 +/- 5,328

$212,200 +/- 15,649

$142,600 +/- 4,555

$97,400 +/- 8,431

$163,600 +/- 4,870

$155,900 +/- 6,704

$330,500 +/- 5,544

$131,900 +/- 3,053

$130,500 +/- 5,752

$207,700 +/- 4,050

$171,100 +/- 7,088

$123,700 +/- 3,055

$56,100 +/- 2,487

$178,100 +/- 3,152

$94,400 +/- 8,129

$199,500 +/- 5,529

$84,200 +/- 4,187

$114,800 +/- 7,345

$205,600 +/- 11,075

$94,800 +/- 7,563

$266,500 +/- 8,343

$180,600 +/- 3,985

$122,000 +/- 3,377

$246,700 +/- 6,185

$103,100 +/- 6,081

$150,500 +/- 4,438

of Home Value

1.14% +/- 0.00

1.33% +/- 0.14

1.33% +/- 0.08

1.32% +/- 0.22

1.32% +/- 0.12

1.32% +/- 0.14

1.31% +/- 0.05

1.31% +/- 0.16

1.30% +/- 0.08

1.30% +/- 0.09

1.30% +/- 0.04

1.30% +/- 0.05

1.30% +/- 0.08

1.30% +/- 0.03

1.30% +/- 0.11

1.29% +/- 0.06

1.29% +/- 0.22

1.29% +/- 0.03

1.27% +/- 0.15

1.27% +/- 0.04

1.27% +/- 0.10

1.27% +/- 0.10

1.27% +/- 0.13

1.26% +/- 0.12

1.26% +/- 0.06

1.26% +/- 0.04

1.26% +/- 0.06

1.26% +/- 0.05

1.26% +/- 0.10

1.25% +/- 0.06

Median Household

Rank

262

263

264

265

266

267

268

269

270

271

272

273

274

275

276

277

278

279

280

281

282

283

284

285

286

287

288

289

290

Income

$62,898 +/- 113

$68,795 +/- 7,670

$64,039 +/- 4,056

$62,801 +/- 7,084

$58,206 +/- 4,654

$77,543 +/- 11,486

$62,151 +/- 4,016

$47,413 +/- 4,248

$65,424 +/- 3,091

$58,715 +/- 3,292

$99,928 +/- 2,476

$62,063 +/- 2,112

$51,356 +/- 2,463

$86,569 +/- 1,936

$59,256 +/- 6,609

$52,121 +/- 2,525

$30,818 +/- 4,499

$70,571 +/- 1,636

$49,283 +/- 5,795

$58,256 +/- 1,924

$41,829 +/- 3,338

$46,556 +/- 4,021

$67,507 +/- 7,764

$50,685 +/- 7,740

$76,854 +/- 6,099

$71,276 +/- 2,116

$60,786 +/- 1,594

$70,811 +/- 2,730

$47,025 +/- 3,002

$67,954 +/- 3,706

Taxes as Percent

of Income

3.25% +/- 0.01

3.21% +/- 0.44

3.42% +/- 0.27

3.31% +/- 0.58

2.69% +/- 0.31

3.60% +/- 0.60

3.01% +/- 0.21

2.69% +/- 0.32

3.26% +/- 0.24

3.46% +/- 0.27

4.31% +/- 0.15

2.76% +/- 0.12

3.30% +/- 0.20

3.12% +/- 0.08

3.75% +/- 0.50

3.06% +/- 0.19

2.34% +/- 0.52

3.25% +/- 0.10

2.44% +/- 0.34

4.36% +/- 0.17

2.56% +/- 0.26

3.13% +/- 0.32

3.86% +/- 0.56

2.36% +/- 0.39

4.38% +/- 0.38

3.20% +/- 0.12

2.53% +/- 0.12

4.39% +/- 0.22

2.76% +/- 0.23

2.78% +/- 0.18

Rank

350

311

334

468

272

401

465

342

301

152

451

335

370

238

385

545

343

516

135

494

365

217

538

130

352

501

126

453

448

Property Taxes on Owner-Occupied Housing

Ranked by Taxes as a Percent of Home Value, 2010

Median Property

Taxes Paid on

State

County

United States

Ohio

Erie County

Florida

Miami-Dade County

Ohio

Licking County

Maryland

Prince George's County

Kansas

Douglas County

Ohio

Allen County

Ohio

Tuscarawas County

Alaska

Matanuska-Susitna Borough

Maryland

Baltimore city

Rhode Island Washington County

Florida

Lee County

Minnesota

Hennepin County

Michigan

Lapeer County

Texas

Henderson County

Missouri

St. Charles County

Ohio

Wayne County

Pennsylvania Adams County

Ohio

Fairfield County

Pennsylvania Centre County

Texas

Ector County

Georgia

Henry County

MassachusettsWorcester County

New Jersey Cape May County

Maine

Penobscot County

Ohio

Columbiana County

Georgia

DeKalb County

Minnesota

Ramsey County

Arizona

Pinal County

Missouri

Platte County

Homes

$2,043 +/- 5

$1,678 +/- 130

$2,590 +/- 47

$1,935 +/- 105

$3,569 +/- 53

$2,336 +/- 119

$1,371 +/- 79

$1,388 +/- 78

$2,601 +/- 166

$2,059 +/- 94

$4,224 +/- 175

$1,844 +/- 71

$2,930 +/- 37

$1,762 +/- 79

$1,158 +/- 203

$2,413 +/- 39

$1,698 +/- 88

$2,476 +/- 130

$2,032 +/- 119

$2,329 +/- 141

$1,065 +/- 164

$1,917 +/- 99

$3,238 +/- 50

$3,951 +/- 150

$1,690 +/- 100

$1,107 +/- 72

$2,114 +/- 96

$2,491 +/- 43

$1,478 +/- 68

$2,158 +/- 195

Taxes as Percent

Rank

432

214

357

101

266

525

521

210

333

62

381

157

404

602

253

425

242

338

269

631

365

126

77

427

620

320

238

492

303

Median Home Value

$179,900 +/- 292

$134,100 +/- 11,352

$207,100 +/- 4,078

$155,100 +/- 4,736

$286,100 +/- 4,577

$187,600 +/- 8,686

$110,200 +/- 4,319

$111,600 +/- 6,023

$209,600 +/- 11,295

$166,100 +/- 4,308

$342,300 +/- 13,839

$149,500 +/- 7,375

$238,000 +/- 2,871

$143,200 +/- 8,267

$94,300 +/- 10,360

$196,900 +/- 3,939

$139,000 +/- 4,291

$203,100 +/- 8,016

$167,400 +/- 4,817

$192,100 +/- 11,906

$88,000 +/- 6,579

$158,500 +/- 5,554

$268,100 +/- 4,681

$327,300 +/- 16,939

$140,600 +/- 8,118

$92,100 +/- 5,376

$176,100 +/- 6,126

$207,700 +/- 4,428

$123,500 +/- 5,726

$180,700 +/- 10,361

of Home Value

1.14% +/- 0.00

1.25% +/- 0.14

1.25% +/- 0.03

1.25% +/- 0.08

1.25% +/- 0.03

1.25% +/- 0.09

1.24% +/- 0.09

1.24% +/- 0.10

1.24% +/- 0.10

1.24% +/- 0.07

1.23% +/- 0.07

1.23% +/- 0.08

1.23% +/- 0.02

1.23% +/- 0.09

1.23% +/- 0.25

1.23% +/- 0.03

1.22% +/- 0.07

1.22% +/- 0.08

1.21% +/- 0.08

1.21% +/- 0.11

1.21% +/- 0.21

1.21% +/- 0.08

1.21% +/- 0.03

1.21% +/- 0.08

1.20% +/- 0.10

1.20% +/- 0.11

1.20% +/- 0.07

1.20% +/- 0.03

1.20% +/- 0.08

1.19% +/- 0.13

Median Household

Rank

291

292

293

294

295

296

297

298

299

300

301

302

303

304

305

306

307

308

309

310

311

312

313

314

315

316

317

318

319

Income

$62,898 +/- 113

$53,909 +/- 3,430

$53,896 +/- 1,556

$62,841 +/- 1,997

$87,124 +/- 3,120

$73,145 +/- 6,143

$52,043 +/- 3,387

$46,857 +/- 2,853

$76,617 +/- 4,427

$59,519 +/- 2,894

$81,961 +/- 8,319

$52,643 +/- 1,860

$80,119 +/- 1,672

$53,017 +/- 2,572

$41,340 +/- 2,221

$74,969 +/- 3,510

$56,208 +/- 4,649

$62,701 +/- 3,312

$66,567 +/- 4,969

$66,497 +/- 6,440

$54,210 +/- 4,222

$66,951 +/- 3,794

$81,808 +/- 2,406

$67,950 +/- 6,338

$57,750 +/- 2,172

$45,594 +/- 3,903

$66,353 +/- 2,034

$71,576 +/- 2,285

$55,368 +/- 2,184

$78,585 +/- 8,472

Taxes as Percent

of Income

3.25% +/- 0.01

3.11% +/- 0.31

4.81% +/- 0.16

3.08% +/- 0.19

4.10% +/- 0.16

3.19% +/- 0.31

2.63% +/- 0.23

2.96% +/- 0.25

3.39% +/- 0.29

3.46% +/- 0.23

5.15% +/- 0.56

3.50% +/- 0.18

3.66% +/- 0.09

3.32% +/- 0.22

2.80% +/- 0.51

3.22% +/- 0.16

3.02% +/- 0.29

3.95% +/- 0.29

3.05% +/- 0.29

3.50% +/- 0.40

1.96% +/- 0.34

2.86% +/- 0.22

3.96% +/- 0.13

5.81% +/- 0.59

2.93% +/- 0.21

2.43% +/- 0.26

3.19% +/- 0.17

3.48% +/- 0.13

2.67% +/- 0.16

2.75% +/- 0.39

Rank

374

97

383

181

353

483

410

317

302

73

287

257

327

443

348

397

204

387

288

623

432

203

48

417

519

355

294

473

458

Property Taxes on Owner-Occupied Housing

Ranked by Taxes as a Percent of Home Value, 2010

Median Property

Taxes Paid on

State

County

United States

Pennsylvania Cumberland County

North Carolina

Durham County

Iowa

Dubuque County

Indiana

Lake County

Florida

Alachua County

Minnesota

Anoka County

Florida

Charlotte County

Maine

Aroostook County

Florida

Hillsborough County

Minnesota

Sherburne County

Texas

Walker County

MassachusettsBerkshire County

Florida

Orange County

Florida

Lake County

Georgia

Fulton County

Oregon

Linn County

Ohio

Hancock County

Virginia

Loudoun County

Kentucky

Kenton County

Minnesota

Olmsted County

North Carolina

Cumberland County

Maryland

Howard County

Maryland

Frederick County

Minnesota

Scott County

Oregon

Umatilla County

California

Riverside County

Georgia

Richmond County

Rhode Island Newport County

Minnesota

Carver County

Homes

$2,043 +/- 5

$2,104 +/- 80

$2,101 +/- 80

$1,777 +/- 85

$1,674 +/- 55

$2,073 +/- 143

$2,335 +/- 46

$1,742 +/- 86

$1,117 +/- 78

$1,935 +/- 50

$2,249 +/- 103

$1,528 +/- 409

$2,377 +/- 92

$2,018 +/- 59

$1,767 +/- 102

$2,807 +/- 92

$2,074 +/- 121

$1,506 +/- 116

$5,112 +/- 176

$1,654 +/- 78

$1,954 +/- 71

$1,442 +/- 48

$4,705 +/- 112

$3,557 +/- 106

$2,927 +/- 85

$1,686 +/- 131

$2,549 +/- 51

$1,068 +/- 69

$3,958 +/- 262

$3,069 +/- 161

Taxes as Percent

Rank

322

323

401

433

330

267

409

616

357

285

474

257

342

402

176

329

483

34

440

353

505

42

103

158

428

225

629

76

145

Median Home Value

$179,900 +/- 292

$177,200 +/- 5,876

$177,400 +/- 6,055

$150,100 +/- 6,262

$141,400 +/- 4,319

$175,500 +/- 6,189

$198,000 +/- 3,423

$147,800 +/- 11,606

$95,000 +/- 7,766

$165,100 +/- 2,606

$192,200 +/- 6,851

$131,100 +/- 21,695

$204,000 +/- 12,897

$174,200 +/- 2,815

$153,300 +/- 4,852

$244,300 +/- 7,932

$180,600 +/- 8,731

$131,600 +/- 10,532

$447,100 +/- 12,816

$145,400 +/- 6,030

$171,800 +/- 4,376

$126,900 +/- 7,856

$415,400 +/- 14,894

$314,300 +/- 9,739

$258,800 +/- 9,374

$150,700 +/- 9,621

$227,900 +/- 2,802

$95,500 +/- 4,758

$354,600 +/- 19,926

$275,100 +/- 13,142

of Home Value

1.14% +/- 0.00

1.19% +/- 0.06

1.18% +/- 0.06

1.18% +/- 0.08

1.18% +/- 0.05

1.18% +/- 0.09

1.18% +/- 0.03

1.18% +/- 0.11

1.18% +/- 0.13

1.17% +/- 0.04

1.17% +/- 0.07

1.17% +/- 0.37

1.17% +/- 0.09

1.16% +/- 0.04

1.15% +/- 0.08

1.15% +/- 0.05

1.15% +/- 0.09

1.14% +/- 0.13

1.14% +/- 0.05

1.14% +/- 0.07

1.14% +/- 0.05

1.14% +/- 0.08

1.13% +/- 0.05

1.13% +/- 0.05

1.13% +/- 0.05

1.12% +/- 0.11

1.12% +/- 0.03

1.12% +/- 0.09

1.12% +/- 0.10

1.12% +/- 0.08

Median Household

Rank

320

321

322

323

324

325

326

327

328

329

330

331

332

333

334

335

336

337

338

339

340

341

342

343

344

345

346

347

348

Income

$62,898 +/- 113

$67,176 +/- 2,414

$71,290 +/- 2,742

$60,779 +/- 3,778

$57,839 +/- 2,094

$61,740 +/- 3,160

$72,103 +/- 2,091

$45,753 +/- 3,731

$44,552 +/- 2,987

$59,846 +/- 1,683

$74,268 +/- 3,752

$52,483 +/- 7,763

$54,404 +/- 4,864

$59,731 +/- 1,838

$48,714 +/- 2,614

$80,905 +/- 1,948

$55,644 +/- 2,338

$58,897 +/- 3,607

$130,004 +/- 3,523

$61,252 +/- 2,096

$75,366 +/- 2,728

$54,218 +/- 4,358

$124,553 +/- 4,211

$96,262 +/- 4,496

$84,421 +/- 3,451

$61,228 +/- 3,859

$66,100 +/- 1,334

$49,884 +/- 3,054

$90,778 +/- 5,387

$88,144 +/- 3,257

Taxes as Percent

of Income

3.25% +/- 0.01

3.13% +/- 0.16

2.95% +/- 0.16

2.92% +/- 0.23

2.89% +/- 0.14

3.36% +/- 0.29

3.24% +/- 0.11

3.81% +/- 0.36

2.51% +/- 0.24

3.23% +/- 0.12

3.03% +/- 0.21

2.91% +/- 0.89

4.37% +/- 0.43

3.38% +/- 0.14

3.63% +/- 0.29

3.47% +/- 0.14

3.73% +/- 0.27

2.56% +/- 0.25

3.93% +/- 0.17

2.70% +/- 0.16

2.59% +/- 0.13

2.66% +/- 0.23

3.78% +/- 0.16

3.70% +/- 0.20

3.47% +/- 0.17

2.75% +/- 0.28

3.86% +/- 0.11

2.14% +/- 0.19

4.36% +/- 0.39

3.48% +/- 0.22

Rank

364

412

419

424

323

345

225

506

346

395

422

133

321

265

297

240

495

207

463

489

474

228

246

299

456

219

587

134

293

Property Taxes on Owner-Occupied Housing

Ranked by Taxes as a Percent of Home Value, 2010

Median Property

Taxes Paid on

State

County

United States

Georgia

Clayton County

Washington Clark County

Maine

Kennebec County

Washington Pierce County

North Carolina

Robeson County

MassachusettsMiddlesex County

MassachusettsNorfolk County

Maine

York County

MassachusettsPlymouth County

Texas

Harrison County

Georgia

Fayette County

Pennsylvania Northumberland County

Virginia

Portsmouth city

North Carolina

Orange County

Pennsylvania Somerset County

Minnesota

Dakota County

California

Kern County

Florida

Volusia County

Minnesota

Wright County

Florida

Manatee County

Ohio

Miami County

Florida

St. Johns County

Pennsylvania Washington County

MassachusettsEssex County

Georgia

Newton County

Virginia

Richmond city

Florida

Marion County

Georgia

Clarke County

Oregon

Multnomah County

Homes

$2,043 +/- 5

$1,218 +/- 47

$2,594 +/- 52

$1,711 +/- 61

$2,800 +/- 45

$705 +/- 50

$4,478 +/- 47

$4,349 +/- 86

$2,512 +/- 67

$3,763 +/- 73

$1,274 +/- 167

$2,593 +/- 136

$1,110 +/- 81

$2,047 +/- 177

$3,000 +/- 284

$1,028 +/- 80

$2,558 +/- 45

$1,796 +/- 54

$1,655 +/- 71

$2,185 +/- 101

$1,805 +/- 89

$1,473 +/- 51

$2,785 +/- 162

$1,529 +/- 79

$3,825 +/- 69

$1,457 +/- 89

$2,250 +/- 126

$1,267 +/- 52

$1,729 +/- 137

$2,949 +/- 52

Taxes as Percent

Rank

579

212

418

178

748

51

58

234

93

559

213

619

335

152

642

221

394

438

297

392

496

180

473

85

503

284

561

412

156

Median Home Value

$179,900 +/- 292

$109,400 +/- 4,241

$233,000 +/- 4,366

$153,800 +/- 5,971

$252,000 +/- 4,446

$63,500 +/- 6,025

$403,500 +/- 5,807

$392,000 +/- 5,569

$226,500 +/- 5,934

$339,400 +/- 5,176

$115,000 +/- 11,934

$234,300 +/- 11,029

$100,300 +/- 7,414

$185,000 +/- 9,088

$271,500 +/- 16,584

$93,300 +/- 3,922

$233,800 +/- 3,916

$164,200 +/- 3,666

$151,600 +/- 3,522

$200,200 +/- 6,929

$165,600 +/- 6,572

$135,200 +/- 6,019

$255,900 +/- 16,561

$140,600 +/- 7,592

$352,900 +/- 5,186

$134,500 +/- 5,822

$209,200 +/- 11,647

$118,100 +/- 3,784

$161,400 +/- 5,720

$275,300 +/- 4,865

of Home Value

1.14% +/- 0.00

1.11% +/- 0.06

1.11% +/- 0.03

1.11% +/- 0.06

1.11% +/- 0.03

1.11% +/- 0.13

1.11% +/- 0.02

1.11% +/- 0.03

1.11% +/- 0.04

1.11% +/- 0.03

1.11% +/- 0.19

1.11% +/- 0.08

1.11% +/- 0.11

1.11% +/- 0.11

1.10% +/- 0.12

1.10% +/- 0.10

1.09% +/- 0.03

1.09% +/- 0.04

1.09% +/- 0.05

1.09% +/- 0.06

1.09% +/- 0.07

1.09% +/- 0.06

1.09% +/- 0.09

1.09% +/- 0.08

1.08% +/- 0.03

1.08% +/- 0.08

1.08% +/- 0.08

1.07% +/- 0.06

1.07% +/- 0.09

1.07% +/- 0.03

Median Household

Rank

349

350

351

352

353

354

355

356

357

358

359

360

361

362

363

364

365

366

367

368

369

370

371

372

373

374

375

376

377

Income

$62,898 +/- 113

$46,087 +/- 2,477

$67,150 +/- 2,145

$53,910 +/- 2,547

$70,509 +/- 1,477

$34,923 +/- 3,784

$98,516 +/- 2,223

$99,190 +/- 3,439

$62,810 +/- 3,093

$86,097 +/- 2,477

$60,339 +/- 6,208

$88,023 +/- 6,602

$46,030 +/- 4,099

$54,526 +/- 6,515

$86,393 +/- 5,255

$44,266 +/- 2,780

$82,432 +/- 2,299

$61,561 +/- 2,051

$48,007 +/- 1,881

$75,670 +/- 3,626

$52,669 +/- 2,295

$57,235 +/- 4,272

$65,502 +/- 4,195

$58,335 +/- 3,688

$85,982 +/- 1,950

$54,954 +/- 3,348

$65,693 +/- 4,952

$40,591 +/- 1,791

$56,756 +/- 7,023

$68,202 +/- 2,253

Taxes as Percent

of Income

3.25% +/- 0.01

2.64% +/- 0.17

3.86% +/- 0.15

3.17% +/- 0.19

3.97% +/- 0.10

2.02% +/- 0.26

4.55% +/- 0.11

4.38% +/- 0.18

4.00% +/- 0.22

4.37% +/- 0.15

2.11% +/- 0.35

2.95% +/- 0.27

2.41% +/- 0.28

3.75% +/- 0.55

3.47% +/- 0.39

2.32% +/- 0.23

3.10% +/- 0.10

2.92% +/- 0.13

3.45% +/- 0.20

2.89% +/- 0.19

3.43% +/- 0.23

2.57% +/- 0.21

4.25% +/- 0.37

2.62% +/- 0.21

4.45% +/- 0.13

2.65% +/- 0.23

3.43% +/- 0.32

3.12% +/- 0.19

3.05% +/- 0.45

4.32% +/- 0.16

Rank

480

218

357

201

609

113

127

190

132

593

413

526

236

295

549

376

421

305

426

309

493

158

486

122

478

310

368

389

144

Property Taxes on Owner-Occupied Housing

Ranked by Taxes as a Percent of Home Value, 2010

Median Property

Taxes Paid on

State

County

United States

Indiana

Marion County

Georgia

Paulding County

Washington Franklin County

Oregon

Benton County

Maryland

Allegany County

Florida

Hernando County

Florida

Martin County

Missouri

Cass County

North Carolina

Mecklenburg County

Oregon

Washington County

Nevada

Clark County

Oregon

Marion County

Maryland

Harford County

Minnesota

Washington County

Florida

Flagler County

North Carolina

Gaston County

Oklahoma Tulsa County

Kentucky

Campbell County

Georgia

Douglas County

North Carolina

Guilford County

Michigan

Marquette County

Georgia

Walton County

Ohio

Ross County

Florida

Polk County

North Carolina

Wilson County

Virginia

Newport News city

Pennsylvania Franklin County

Virginia

Prince William County

Florida

Pasco County

Homes

$2,043 +/- 5

$1,266 +/- 29

$1,486 +/- 74

$1,655 +/- 122

$2,727 +/- 122

$1,326 +/- 71

$1,338 +/- 67

$1,998 +/- 182

$1,634 +/- 121

$1,977 +/- 34

$3,039 +/- 69

$1,793 +/- 37

$2,099 +/- 83

$3,016 +/- 116

$2,621 +/- 49

$1,818 +/- 93

$1,338 +/- 75

$1,417 +/- 31

$1,545 +/- 88

$1,526 +/- 136

$1,648 +/- 47

$1,314 +/- 63

$1,731 +/- 155

$1,219 +/- 112

$1,237 +/- 43

$1,173 +/- 103

$2,127 +/- 114

$1,883 +/- 87

$3,267 +/- 98

$1,278 +/- 63

Taxes as Percent

Rank

562

489

438

192

542

536

347

446

350

148

396

324

150

206

388

536

516

467

477

443

545

410

578

575

596

314

372

124

556

Median Home Value

$179,900 +/- 292

$118,200 +/- 2,028

$138,800 +/- 5,235

$155,100 +/- 5,231

$255,900 +/- 15,684

$124,500 +/- 10,948

$125,900 +/- 6,711

$188,400 +/- 16,895

$154,200 +/- 5,482

$187,400 +/- 4,037

$288,200 +/- 5,502

$170,100 +/- 2,231

$199,300 +/- 5,662

$286,400 +/- 9,189

$249,000 +/- 6,886

$172,800 +/- 9,363

$127,400 +/- 8,748

$135,000 +/- 3,023

$147,300 +/- 5,771

$145,900 +/- 9,569

$157,900 +/- 4,041

$126,000 +/- 10,776

$166,400 +/- 9,291

$117,300 +/- 9,876

$119,100 +/- 3,603

$113,100 +/- 9,201

$205,100 +/- 6,981

$182,400 +/- 5,957

$316,600 +/- 7,647

$123,900 +/- 4,792

of Home Value

1.14% +/- 0.00

1.07% +/- 0.03

1.07% +/- 0.07

1.07% +/- 0.09

1.07% +/- 0.08

1.07% +/- 0.11

1.06% +/- 0.08

1.06% +/- 0.14

1.06% +/- 0.09

1.05% +/- 0.03

1.05% +/- 0.03

1.05% +/- 0.03

1.05% +/- 0.05

1.05% +/- 0.05

1.05% +/- 0.04

1.05% +/- 0.08

1.05% +/- 0.09

1.05% +/- 0.03

1.05% +/- 0.07

1.05% +/- 0.12

1.04% +/- 0.04

1.04% +/- 0.10

1.04% +/- 0.11

1.04% +/- 0.13

1.04% +/- 0.05

1.04% +/- 0.12

1.04% +/- 0.07

1.03% +/- 0.06

1.03% +/- 0.04

1.03% +/- 0.06

Median Household

Rank

378

379

380

381

382

383

384

385

386

387

388

389

390

391

392

393

394

395

396

397

398

399

400

401

402

403

404

405

406

Income

$62,898 +/- 113

$55,384 +/- 1,528

$63,985 +/- 3,812

$60,169 +/- 5,192

$74,480 +/- 4,492

$45,313 +/- 4,212

$41,633 +/- 2,193

$54,230 +/- 6,263

$60,879 +/- 3,106

$69,427 +/- 2,150

$78,186 +/- 3,124

$66,243 +/- 1,154

$57,687 +/- 3,267

$83,857 +/- 3,325

$84,682 +/- 3,426

$48,832 +/- 4,948

$49,937 +/- 2,991