Professional Documents

Culture Documents

Answer - Practice Question 1 - Statement of Changes in Equity.

Uploaded by

Rizzy Ice-cream MiloCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answer - Practice Question 1 - Statement of Changes in Equity.

Uploaded by

Rizzy Ice-cream MiloCopyright:

Available Formats

a) The additional 20% purchase by RBE results in an increase in the controlling interest held in the subsidiary, DCA.

No further goodwill is calculated on the additional purchase as goodwill is only calculated at the date control was gain in accordance with IFRS 3. However, at the date of additional purchase (1 October 2010) the value of the NCI needs to be established. The proportion sold will be transferred from NCI to parents equity within the SOCIE. The difference between that value and the consideration transferred is included in parents equity as an adjustment to parent equity on acquisition. b) Statement of charges in equity for the year ended 31 December 2010 Attributable to Equity holders of parent $000 Opening balance 3,350 TCI for the year (W1) 1,350 Share issue (2m x $1.30) 2,600 Dividends (200) Adjustment to NCI for 503 Add. Purchase of DCA Shares (W3) Adjustment to parents equity (37) (W3) Balance at the end of the year 7,566 NCI $000 650 150 0 (30) (W2) (503) Total equity $000 4,000 1,500 2,600 (230)

0 267

(37) 7,833

Working 1 NCI share of total comprehensive income of DCA $600,000: NCI at 30% x $600,000 x 9/12 months NCI at 10% x $600,000 x 3/12 months NCI share of TCI

$000

135 15 150

Therefore parent share of TCI of DCA is $600,000 - $150,000 = $450,000 Total TCI attributable to equity holders of Parent is $900,000 + $450,000 = $1,350,000. Working 2 NCI share of dividend paid April 2010 by DCA = 30% x $100,000 = $30,000 Working 3 Value of NCI at 1 October 2010 is $650,000 + $135,000 (W1) - $30,000 (W2) = $755,000.

Therefore the value transferred is $755,000 x 2/3 = $503,333 Adjustment to parents equity Consideration transferred Value on non-controlling interest transferred Adjustment to parent equity $000 540 (503) 37

You might also like

- UCC 1 Security AgreementDocument1 pageUCC 1 Security Agreementtlh78great100% (7)

- 2018 03 10.accounting 3b.activityDocument2 pages2018 03 10.accounting 3b.activityPatOcampo100% (2)

- Problem Set Time Value of MoneyDocument5 pagesProblem Set Time Value of MoneyRohit SharmaNo ratings yet

- Tax1 Q Chapter-11 12 13 With-AnswerDocument2 pagesTax1 Q Chapter-11 12 13 With-AnswerPrincess Edelyn CastorNo ratings yet

- HKICPA QP Exam (Module A) Feb2008 AnswerDocument10 pagesHKICPA QP Exam (Module A) Feb2008 Answercynthia tsui100% (1)

- Rental AgreementDocument3 pagesRental AgreementSuman Roy100% (1)

- Acc117 Group AssignmentDocument15 pagesAcc117 Group AssignmentMUHAMMAD HIFZHANI AZMANNo ratings yet

- Quiz - Act 07A: I. Theories: ProblemsDocument2 pagesQuiz - Act 07A: I. Theories: ProblemsShawn Organo0% (1)

- Jamolod - Unit 1 - General Features of Financial StatementDocument8 pagesJamolod - Unit 1 - General Features of Financial StatementJatha JamolodNo ratings yet

- Events After The Reporting Period NCA Held For Disposal Discontinued OperationsDocument2 pagesEvents After The Reporting Period NCA Held For Disposal Discontinued OperationsJeremiah DavidNo ratings yet

- Audit of Receivable Wit Ans KeyDocument19 pagesAudit of Receivable Wit Ans Keyalexis pradaNo ratings yet

- Solution-Dissolution and LiquidationDocument8 pagesSolution-Dissolution and LiquidationRejay VillamorNo ratings yet

- Activity 2Document3 pagesActivity 2LFGS Finals0% (1)

- Quiz - SFP With AnswersDocument4 pagesQuiz - SFP With Answersjanus lopezNo ratings yet

- Assignment Problem - Maranan, A2ADocument2 pagesAssignment Problem - Maranan, A2AJere Mae MarananNo ratings yet

- Atlas Retail Company Analysis of Prepaid Expense AccountDocument5 pagesAtlas Retail Company Analysis of Prepaid Expense AccountEizzel SamsonNo ratings yet

- Fundamentals of Abm 2.2Document6 pagesFundamentals of Abm 2.2Jasmine ActaNo ratings yet

- Activities/Assessments:: Origin / Rating Poor Needs Improvement Satisfactory V Good Excellent TotalDocument13 pagesActivities/Assessments:: Origin / Rating Poor Needs Improvement Satisfactory V Good Excellent TotalAmethyst LeeNo ratings yet

- This Study Resource Was: Saint Paul School of Business and LawDocument4 pagesThis Study Resource Was: Saint Paul School of Business and LawKim FloresNo ratings yet

- Auditing ProblemsDocument5 pagesAuditing ProblemsJayr BVNo ratings yet

- 5share OptionsDocument21 pages5share OptionsnengNo ratings yet

- Strategic Management ModelDocument5 pagesStrategic Management ModelJezrel May Sarvida100% (1)

- Ia3 IsDocument3 pagesIa3 IsMary Joy CabilNo ratings yet

- Statement of Comprehensive Income Part 2 StudentDocument7 pagesStatement of Comprehensive Income Part 2 StudentAG VenturesNo ratings yet

- 2019 11 30 Acc222 Exercises01Document1 page2019 11 30 Acc222 Exercises01Primitivo Suasin Bangahon Jr.No ratings yet

- Homework On Statement of Cash FlowsDocument2 pagesHomework On Statement of Cash FlowsAmy SpencerNo ratings yet

- Quiz 5 Acc 401Document10 pagesQuiz 5 Acc 401EML0% (1)

- ASSET 2019 Mock Boards - FARDocument7 pagesASSET 2019 Mock Boards - FARKenneth Christian WilburNo ratings yet

- Assets Liabilities and EquityDocument2 pagesAssets Liabilities and EquityArian Amurao50% (2)

- Partnership Problem SetDocument8 pagesPartnership Problem SetMary Rose ArguellesNo ratings yet

- Use The Following Information For The Next Seven Questions:: Activity 2.4Document2 pagesUse The Following Information For The Next Seven Questions:: Activity 2.4Tine Vasiana Duerme0% (1)

- Ryan Capistrano AC181 Mid-Term Examination RelebusDocument3 pagesRyan Capistrano AC181 Mid-Term Examination RelebusRyan CapistranoNo ratings yet

- 07 Interim Reporting FinalDocument3 pages07 Interim Reporting FinalMakoy BixenmanNo ratings yet

- TB21 PDFDocument33 pagesTB21 PDFJi WonNo ratings yet

- Chapter 12 - Practice SetDocument2 pagesChapter 12 - Practice SetKrystal shaneNo ratings yet

- Module 5 Management Science CBLDocument13 pagesModule 5 Management Science CBLGenesis RoldanNo ratings yet

- ACTIVITY 4 - NCA Held For SaleDocument3 pagesACTIVITY 4 - NCA Held For SaleEstiloNo ratings yet

- Chapter 15 Test Bank Partnerships - Formation, Operations, and Changes in Ownership InterestsDocument22 pagesChapter 15 Test Bank Partnerships - Formation, Operations, and Changes in Ownership InterestsOBC LingayenNo ratings yet

- Section 1-4 EncodedDocument570 pagesSection 1-4 EncodedPremiu rayaNo ratings yet

- Decentralized and Segment ReportingDocument44 pagesDecentralized and Segment ReportingShaina Santiago AlejoNo ratings yet

- Assets Book Value Estimated Realizable ValuesDocument3 pagesAssets Book Value Estimated Realizable ValuesEllyza SerranoNo ratings yet

- RFBT Quiz 1: Forgery. After Giving A Notice of Dishonor, Which of The Following Is Not Correct?Document7 pagesRFBT Quiz 1: Forgery. After Giving A Notice of Dishonor, Which of The Following Is Not Correct?cheni magsaelNo ratings yet

- Accounting For Branches and Combined FSDocument112 pagesAccounting For Branches and Combined FSyuaningtyasnvNo ratings yet

- QUizzer 4 - Overall With AnswerDocument20 pagesQUizzer 4 - Overall With AnswerJan Elaine CalderonNo ratings yet

- Practical Accounting 1 ReviewerDocument13 pagesPractical Accounting 1 ReviewerKimberly RamosNo ratings yet

- 05 Activity 1 BALADocument3 pages05 Activity 1 BALAPola PolzNo ratings yet

- GovernanceDocument3 pagesGovernanceAndrea Marie CalmaNo ratings yet

- Quiz InventoriesDocument2 pagesQuiz InventoriesKimboy Elizalde PanaguitonNo ratings yet

- Q Manacc1 Bep 2019Document5 pagesQ Manacc1 Bep 2019Deniece RonquilloNo ratings yet

- Chapter 3 MultiDocument3 pagesChapter 3 MultiJose Mari M. NavaseroNo ratings yet

- Current Liabilities and ProvisionsDocument12 pagesCurrent Liabilities and ProvisionsRinkashizu TokimimotakuNo ratings yet

- CVP Analysis and Break Even Point AnalysisDocument16 pagesCVP Analysis and Break Even Point AnalysisKirito Uzumaki100% (1)

- Cengage - The Management of Accounts Receivable and Inventories CalculationsDocument14 pagesCengage - The Management of Accounts Receivable and Inventories CalculationsMarcos Jose AveNo ratings yet

- Unit Iii Assessment ProblemsDocument8 pagesUnit Iii Assessment ProblemsChin Figura100% (1)

- #6 PFRS 8Document2 pages#6 PFRS 8Shara Joy B. ParaynoNo ratings yet

- Pure ProblemsDocument7 pagesPure Problemschristine anglaNo ratings yet

- Management Science - Final ExamDocument5 pagesManagement Science - Final ExamRHEA VANESSA FIGUEROA ARDIENTENo ratings yet

- CST MelcaDocument6 pagesCST MelcaMelca Rojo MelendresNo ratings yet

- AIS Tut 1Document3 pagesAIS Tut 1HagarMahmoud0% (1)

- MS11 Decentralization Segment Reporting Responsibility Accounting Performance Evaluation and Transfer PricingDocument4 pagesMS11 Decentralization Segment Reporting Responsibility Accounting Performance Evaluation and Transfer PricingMarchelle CaelNo ratings yet

- Assignment 7 1Document1 pageAssignment 7 1Eilen Joyce BisnarNo ratings yet

- Dagohoy Q1Document4 pagesDagohoy Q1belinda dagohoyNo ratings yet

- Financial Liabilities ProblemsDocument20 pagesFinancial Liabilities ProblemsEvelyn LabhananNo ratings yet

- Entrepreneurial Finance: Week 5 Family Business and Financing Family FirmsDocument35 pagesEntrepreneurial Finance: Week 5 Family Business and Financing Family FirmsRizzy Ice-cream MiloNo ratings yet

- Entrepreneurial Finance: Ethnic Minority Entrepreneurship and Financing Ethnic Minority BusinessesDocument38 pagesEntrepreneurial Finance: Ethnic Minority Entrepreneurship and Financing Ethnic Minority BusinessesRizzy Ice-cream MiloNo ratings yet

- Session 9 Financial Female EntrepreneursDocument31 pagesSession 9 Financial Female EntrepreneursRizzy Ice-cream MiloNo ratings yet

- Journal ArticlesDocument1 pageJournal ArticlesRizzy Ice-cream MiloNo ratings yet

- GlobalisationDocument10 pagesGlobalisationRizzy Ice-cream MiloNo ratings yet

- FDI Investment Flows - Theory and Evidence: 7IB003 International Business EnvironmentDocument17 pagesFDI Investment Flows - Theory and Evidence: 7IB003 International Business EnvironmentRizzy Ice-cream MiloNo ratings yet

- Preventing Sickkness and Rehabilitation of Business UnitsDocument46 pagesPreventing Sickkness and Rehabilitation of Business Unitsmurugesh_mbahit100% (13)

- Business PlanDocument5 pagesBusiness PlanColegiul de Constructii din HincestiNo ratings yet

- 12 Asian Cathay Finance V Sps Gravador and de VeraDocument9 pages12 Asian Cathay Finance V Sps Gravador and de VeraAnne VallaritNo ratings yet

- AFE3691 Tutorial QuestionsDocument29 pagesAFE3691 Tutorial QuestionsPetrinaNo ratings yet

- Borang CIMB Jan 2023Document15 pagesBorang CIMB Jan 2023anuaraqNo ratings yet

- The Accounting Process: Name: Date: Professor: Section: Score: QuizDocument6 pagesThe Accounting Process: Name: Date: Professor: Section: Score: QuizAllyna Jane Enriquez100% (1)

- Presentation On Business Icon: by Ankita Sthapak Roll No.57Document9 pagesPresentation On Business Icon: by Ankita Sthapak Roll No.57Ankita SthapakNo ratings yet

- Principles of Macro Economics Part 4Document6 pagesPrinciples of Macro Economics Part 4Duaa WajidNo ratings yet

- Complaint - Colorado Fire & Police Pension Vs CDN Banks CDOR ManipulationDocument100 pagesComplaint - Colorado Fire & Police Pension Vs CDN Banks CDOR ManipulationNationalObserverNo ratings yet

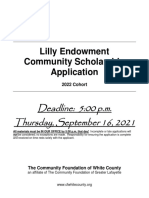

- White County Lilly Endowment Scholarship ApplicationDocument11 pagesWhite County Lilly Endowment Scholarship ApplicationVoodooPandasNo ratings yet

- Funds Flow AnalysisDocument105 pagesFunds Flow AnalysisAmjad Khan100% (2)

- Management SOPDocument12 pagesManagement SOPsparkle shresthaNo ratings yet

- 2016 ObliconDocument2 pages2016 ObliconKarla KatNo ratings yet

- Topic2 Part1Document16 pagesTopic2 Part1Abdul MoezNo ratings yet

- Dokumen - Tips r12 Overview of Oracle Asset ManagementDocument36 pagesDokumen - Tips r12 Overview of Oracle Asset ManagementCuong Thai HuyNo ratings yet

- Common Size Financial StatementsDocument3 pagesCommon Size Financial Statementsirfanabid828No ratings yet

- Masaniello ProgressivoDocument24 pagesMasaniello ProgressivoPavanNo ratings yet

- Oracle ERP, EBS: M Mursaleen BhuiyanDocument68 pagesOracle ERP, EBS: M Mursaleen BhuiyanMohammad Shaniaz IslamNo ratings yet

- Valuasi Saham MppaDocument29 pagesValuasi Saham MppaGaos FakhryNo ratings yet

- Nestle India Valuation ReportDocument10 pagesNestle India Valuation ReportSIDDHANT MOHAPATRANo ratings yet

- YatharthDocument8 pagesYatharthCp918315No ratings yet

- SamCERA PE Perf Report Q1 20 SolovisDocument1 pageSamCERA PE Perf Report Q1 20 SolovisdavidtollNo ratings yet

- Capital Structure of Banking Companies in IndiaDocument21 pagesCapital Structure of Banking Companies in IndiaAbhishek Soni43% (7)

- SIP Report OldDocument27 pagesSIP Report OldAbhishek rajNo ratings yet

- Treasury Bond Claim Form Sav1048Document7 pagesTreasury Bond Claim Form Sav1048aplaw100% (1)

- 21 VBHN-BTC 512873Document78 pages21 VBHN-BTC 512873LET LEARN ABCNo ratings yet

- Summer Internship Report On Indian Stock MarketsDocument18 pagesSummer Internship Report On Indian Stock Marketssujayphatak070% (1)