Professional Documents

Culture Documents

Ericsson Telecommunications vs. City of Pasig

Uploaded by

xx_stripped52Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ericsson Telecommunications vs. City of Pasig

Uploaded by

xx_stripped52Copyright:

Available Formats

ERICSSON TELECOMMUNICATIONS, INC., vs. CITY OF PASIG, represented by its City Mayor, Hon. Vicente P. Eusebio, et al (G.R. No.

176667; November 22, 2007) Facts: 1. Ericsson Telecommunications, Inc. is a corporation engaged in the design, engineering, and marketing of telecommunication facilities/system with principal address at Pasig City 2. It was assessed by the City Treasurer of Pasig City of business tax deficiency for the years 1998 and 1999 and also for 2000 and 2001 based on its gross revenues. 3. Petitioner filed a Protest arguing that that the local business tax on contractors should be based on gross receipts and not gross revenue. Issue: What should be the basis of the local business tax? gross receipts or gross revenue? Held: The basis should be gross receipts Paragraph e, Section 143 of the Local Government Code provides that The municipality may impose taxes on the following businesses: (e) On contractors and other independent contractors, in accordance with the following schedule: With gross receipts for the preceding calendar year in the amount of: The above provision specifically refers to gross receipts. Section 131 of the Local Government Code defines gross sales or receipts as follows: "Gross Sales or Receipts" - include the total amount of money or its equivalent representing the contract price, compensation or service fee, including the amount charged or materials supplied with the services and the deposits or advance payments actually or constructively received during the taxable quarter for the services performed or to be performed for another person excluding discounts if determinable at the time of sales, sales return, excise tax, and value-added tax (VAT); The law is clear. Gross receipts include money or its equivalent actually or constructively received in consideration of services rendered or articles sold, exchanged or leased, whether actual or constructive. Gross Revenue - covers money or its equivalent actually or constructively received, including the value of services rendered or articles sold, exchanged or leased, the payment of which is yet to be received. This is in consonance with the International Financial Reporting Standards, which defines revenue as the gross inflow of economic benefits (cash, receivables, and other assets) arising from the ordinary operating activities of an enterprise (such as sales of goods, sales of services, interest, royalties, and dividends), which is measured at the fair value of the consideration received or receivable In petitioner's case, its audited financial statements reflect income or revenue which accrued to it during the taxable period although not yet actually or constructively received or paid. This is because petitioner uses the accrual method of accounting, where income is reportable when all the events have occurred that fix the taxpayer's right to receive the income, and the amount can be determined with reasonable accuracy; the right to receive income, and not the actual receipt, determines when to include the amount in gross income. The imposition of local business tax based on petitioner's gross revenue will inevitably result in the constitutionally proscribed double taxation taxing of the same person twice by the same jurisdiction for the same thing inasmuch as petitioner's revenue or income for a taxable year will definitely include its gross receipts already reported during the previous year and for which local business tax has already been paid. Amount of Tax Per Annum

You might also like

- Tax Rev Digest Mindanao II Geothermal Partnership V CirDocument4 pagesTax Rev Digest Mindanao II Geothermal Partnership V CirCalypso75% (4)

- Atlas Consolidated Mining V CIR (Case Digest)Document2 pagesAtlas Consolidated Mining V CIR (Case Digest)Jeng Pion100% (1)

- 3M PhilippinesDocument2 pages3M PhilippinesKarl Vincent Raso100% (1)

- Digest CIR Vs PinedaDocument2 pagesDigest CIR Vs PinedaLoraine Ferrer100% (1)

- Jaka Investment Vs CIR - CDDocument2 pagesJaka Investment Vs CIR - CDNolas Jay100% (1)

- 46-Quezon City Vs BayantelDocument3 pages46-Quezon City Vs BayantelIshNo ratings yet

- Condominium dues not subject to income tax, VATDocument3 pagesCondominium dues not subject to income tax, VATHaniya Solaiman Guro50% (2)

- CIR vs. Isabela Cultural Corporation 135210Document1 pageCIR vs. Isabela Cultural Corporation 135210magenNo ratings yet

- CIR Vs Smart CommunicationsDocument1 pageCIR Vs Smart CommunicationsHoreb FelixNo ratings yet

- Tax Refund Denied for Lack of Official ReceiptsDocument2 pagesTax Refund Denied for Lack of Official ReceiptsDianne Bernadeth Cos-agon100% (1)

- CIR vs. Filinvest Development Corp.Document2 pagesCIR vs. Filinvest Development Corp.Cheng Aya50% (2)

- CIR vs. CA - G.R. No. 125355 (Digest)Document7 pagesCIR vs. CA - G.R. No. 125355 (Digest)Karen Gina DupraNo ratings yet

- CIR vs. BENGUET CORPORATIONDocument3 pagesCIR vs. BENGUET CORPORATIONakosiemNo ratings yet

- Taxation Law CIR v. SM Prime Holdings IncDocument2 pagesTaxation Law CIR v. SM Prime Holdings IncgailacdNo ratings yet

- Taganito Mining Corp. vs. CIR CTA 04702 (Full Text)Document14 pagesTaganito Mining Corp. vs. CIR CTA 04702 (Full Text)Ritzchalle Garcia-Oalin100% (1)

- Saint Wealth LTD., Et Al. v. Bureau of Internal RevenueDocument3 pagesSaint Wealth LTD., Et Al. v. Bureau of Internal RevenueRizchelle Sampang-Manaog67% (3)

- CIR vs. Burroghs, G.R. No. 66653, June 19, 1986Document1 pageCIR vs. Burroghs, G.R. No. 66653, June 19, 1986Oro ChamberNo ratings yet

- CIR Vs CTA DigestDocument2 pagesCIR Vs CTA DigestAbilene Joy Dela Cruz83% (6)

- Sony Phils. vs. Cir DigestDocument3 pagesSony Phils. vs. Cir DigestClavel TuasonNo ratings yet

- GR No. 157594 Toshiba vs. CIRDocument2 pagesGR No. 157594 Toshiba vs. CIRMaryanJunko100% (1)

- Supreme Court Rules 20% FWT Forms Part of Gross Receipts for GRT CalculationDocument2 pagesSupreme Court Rules 20% FWT Forms Part of Gross Receipts for GRT CalculationMarj CenNo ratings yet

- Cir v. MeralcoDocument2 pagesCir v. MeralcoKhaiye De Asis AggabaoNo ratings yet

- Lascona Land Vs CIRDocument2 pagesLascona Land Vs CIRJOHN SPARKSNo ratings yet

- Adamson vs. Court of Appeals 2009Document3 pagesAdamson vs. Court of Appeals 2009joyceNo ratings yet

- Petron vs. Tiangco | LGUs cannot impose taxes on petroleumDocument1 pagePetron vs. Tiangco | LGUs cannot impose taxes on petroleumAleli Joyce Bucu100% (1)

- Estate Not Liable for Property Taxes Before RepurchaseDocument1 pageEstate Not Liable for Property Taxes Before RepurchaseMACNo ratings yet

- Collector v. LaraDocument2 pagesCollector v. LaraJaypoll DiazNo ratings yet

- CIR vs Magsaysay Lines on VAT on sale of vesselsDocument2 pagesCIR vs Magsaysay Lines on VAT on sale of vesselsmisscyu100% (1)

- Spouses Tan Vs BanteguiDocument2 pagesSpouses Tan Vs BanteguiPaul EsparagozaNo ratings yet

- Nippon Express V Cir Case No. 5Document2 pagesNippon Express V Cir Case No. 5Brian Jonathan Paraan100% (3)

- Mindanao Shopping V DuterteDocument2 pagesMindanao Shopping V DutertefcnrrsNo ratings yet

- ANPC v. BIR rules membership fees non-taxableDocument2 pagesANPC v. BIR rules membership fees non-taxableDerek C. Egalla100% (1)

- Calasanz V CirDocument2 pagesCalasanz V CirLatjing Soliman100% (3)

- Domingo v. GarlitosDocument1 pageDomingo v. GarlitosJazz TraceyNo ratings yet

- 16 Roxas V CTA 23 SCRA 276 (1968) - DigestDocument8 pages16 Roxas V CTA 23 SCRA 276 (1968) - DigestKeith Balbin0% (1)

- CIR V BurmeisterDocument1 pageCIR V BurmeisterMark Wong delos ReyesNo ratings yet

- CBC vs Court of Appeals Tax RulingDocument1 pageCBC vs Court of Appeals Tax RulingArmstrong BosantogNo ratings yet

- CTA upholds disallowance of Tambunting Pawnshop's tax deductionsDocument3 pagesCTA upholds disallowance of Tambunting Pawnshop's tax deductionsLouis Belarma100% (2)

- CIR Vs Seagate, GR 153866Document3 pagesCIR Vs Seagate, GR 153866Mar Develos100% (1)

- 08 City of Iriga v. Camarines Sur III Electric Cooperative, Inc.Document2 pages08 City of Iriga v. Camarines Sur III Electric Cooperative, Inc.Rem SerranoNo ratings yet

- Roxas v. CTA upholds capital gains tax treatment for sale of farmland to tenantsDocument3 pagesRoxas v. CTA upholds capital gains tax treatment for sale of farmland to tenantsKeith Balbin100% (2)

- CIR Vs Team Energy CorporationDocument5 pagesCIR Vs Team Energy CorporationDNAANo ratings yet

- Cir v. Febtc DigestDocument2 pagesCir v. Febtc DigestNelly HerreraNo ratings yet

- DIAZ AND TIMBOL v. SECRETARY OF FINANCE AND THE COMMISSIONER OF INTERNAL REVENUEDocument2 pagesDIAZ AND TIMBOL v. SECRETARY OF FINANCE AND THE COMMISSIONER OF INTERNAL REVENUERose De JesusNo ratings yet

- Forms of escape from taxation through VAT exemptionsDocument3 pagesForms of escape from taxation through VAT exemptionsKath Leen100% (1)

- American Express Philippine branch zero-rated transactions tax caseDocument2 pagesAmerican Express Philippine branch zero-rated transactions tax caseFrancis Xavier Sinon100% (1)

- City of Iriga vs. CamSurDocument1 pageCity of Iriga vs. CamSurxx_stripped52No ratings yet

- Marcos Ii VS CaDocument2 pagesMarcos Ii VS CaEJ LomocsoNo ratings yet

- Republic V GonzalesDocument1 pageRepublic V GonzalesmenforeverNo ratings yet

- CIR v. CADocument2 pagesCIR v. CAKristina Karen100% (1)

- National Development Company Vs CIRDocument7 pagesNational Development Company Vs CIRIvy ZaldarriagaNo ratings yet

- Petron v. TiangcoDocument1 pagePetron v. TiangcoArahbells100% (1)

- Manila Theater Tax UpheldDocument1 pageManila Theater Tax UpheldJSMendozaNo ratings yet

- Commissioner vs Isabela CulturalDocument2 pagesCommissioner vs Isabela CulturalKim Lorenzo Calatrava100% (2)

- Cir v. Phoenix DigestDocument3 pagesCir v. Phoenix DigestkathrynmaydevezaNo ratings yet

- Alcantara vs. Republic (Digest)Document1 pageAlcantara vs. Republic (Digest)Kristofer AralarNo ratings yet

- Ericsson Tax Ruling on Gross Receipts vs RevenueDocument2 pagesEricsson Tax Ruling on Gross Receipts vs RevenueAgee Romero-ValdesNo ratings yet

- Ericsson V PasigDocument2 pagesEricsson V PasigAgee Romero-ValdesNo ratings yet

- 13 (D) Ericsson Telecommunications, Inc. vs. City of PasigDocument2 pages13 (D) Ericsson Telecommunications, Inc. vs. City of PasigGoodyNo ratings yet

- Real Estate Tax ChallengeDocument24 pagesReal Estate Tax ChallengeChristine Rose Bonilla LikiganNo ratings yet

- Digest 6Document5 pagesDigest 6xx_stripped52No ratings yet

- RTC Noted The Above-Stated Entry of Special Appearance of AttyDocument10 pagesRTC Noted The Above-Stated Entry of Special Appearance of Attyxx_stripped52No ratings yet

- Legal EthicsDocument13 pagesLegal Ethicsxx_stripped52No ratings yet

- Far East Bank vs. TentmakersDocument2 pagesFar East Bank vs. Tentmakersxx_stripped52No ratings yet

- Digest 2Document3 pagesDigest 2xx_stripped52No ratings yet

- Digest 3Document3 pagesDigest 3xx_stripped52No ratings yet

- Digest 4Document2 pagesDigest 4xx_stripped52No ratings yet

- Banking LCDocument5 pagesBanking LCxx_stripped52No ratings yet

- Valid Tender of Payment Stops Interest AccrualDocument1 pageValid Tender of Payment Stops Interest Accrualxx_stripped52100% (1)

- Central Bank vs. CADocument2 pagesCentral Bank vs. CAxx_stripped52No ratings yet

- Simex vs. CADocument1 pageSimex vs. CAxx_stripped52No ratings yet

- Central Bank vs. CADocument2 pagesCentral Bank vs. CAxx_stripped52No ratings yet

- Bank of America vs. CADocument2 pagesBank of America vs. CAxx_stripped52No ratings yet

- Simex vs. CADocument1 pageSimex vs. CAxx_stripped52No ratings yet

- Far East Bank vs. TentmakersDocument2 pagesFar East Bank vs. Tentmakersxx_stripped52No ratings yet

- Central Bank vs. CADocument2 pagesCentral Bank vs. CAxx_stripped52No ratings yet

- MacDonald v. National City Bank of New York - DigestDocument2 pagesMacDonald v. National City Bank of New York - Digestxx_stripped52No ratings yet

- DigestsDocument5 pagesDigestsxx_stripped52No ratings yet

- Case Digest (My Part) 1.21.2012Document4 pagesCase Digest (My Part) 1.21.2012xx_stripped52No ratings yet

- Isabela Sawmill Partnership Dissolution and Creditor ClaimsDocument1 pageIsabela Sawmill Partnership Dissolution and Creditor Claimsxx_stripped52No ratings yet

- Lindberg Phil. vs. City of MakatiDocument15 pagesLindberg Phil. vs. City of Makatixx_stripped52No ratings yet

- SPECPRO Corpus v. Amparo v. DataDocument11 pagesSPECPRO Corpus v. Amparo v. Dataxx_stripped52No ratings yet

- Case Digest (My Part) 2.5.2012Document3 pagesCase Digest (My Part) 2.5.2012xx_stripped52No ratings yet

- Rural Bank of LucenaDocument2 pagesRural Bank of Lucenaxx_stripped52No ratings yet

- Bearneza v. DequillaDocument2 pagesBearneza v. DequillaJerome Azarcon100% (1)

- MU - ÑASQUE Vs CADocument2 pagesMU - ÑASQUE Vs CAxx_stripped52No ratings yet

- City of Iriga vs. CamSurDocument1 pageCity of Iriga vs. CamSurxx_stripped52No ratings yet

- Complete Discussion Guide-28 Jan 2013Document3 pagesComplete Discussion Guide-28 Jan 2013xx_stripped52No ratings yet

- MacDonald v. National City Bank of New York - DigestDocument2 pagesMacDonald v. National City Bank of New York - Digestxx_stripped52No ratings yet

- CH 19Document56 pagesCH 19Ahmed El KhateebNo ratings yet

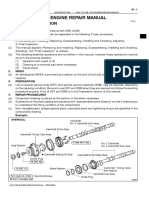

- How To Use This Engine Repair Manual: General InformationDocument3 pagesHow To Use This Engine Repair Manual: General InformationHenry SilvaNo ratings yet

- Prac Research Module 2Document12 pagesPrac Research Module 2Dennis Jade Gascon NumeronNo ratings yet

- Business Law Module No. 2Document10 pagesBusiness Law Module No. 2Yolly DiazNo ratings yet

- Arx Occasional Papers - Hospitaller Gunpowder MagazinesDocument76 pagesArx Occasional Papers - Hospitaller Gunpowder MagazinesJohn Spiteri GingellNo ratings yet

- Battery Genset Usage 06-08pelj0910Document4 pagesBattery Genset Usage 06-08pelj0910b400013No ratings yet

- CSR of Cadbury LTDDocument10 pagesCSR of Cadbury LTDKinjal BhanushaliNo ratings yet

- York Product Listing 2011Document49 pagesYork Product Listing 2011designsolutionsallNo ratings yet

- February / March 2010Document16 pagesFebruary / March 2010Instrulife OostkampNo ratings yet

- Joint School Safety Report - Final ReportDocument8 pagesJoint School Safety Report - Final ReportUSA TODAY NetworkNo ratings yet

- Ethiopian Civil Service University UmmpDocument76 pagesEthiopian Civil Service University UmmpsemabayNo ratings yet

- The Relationship Between Family Background and Academic Performance of Secondary School StudentsDocument57 pagesThe Relationship Between Family Background and Academic Performance of Secondary School StudentsMAKE MUSOLININo ratings yet

- Meta Trader 4Document2 pagesMeta Trader 4Alexis Chinchay AtaoNo ratings yet

- Bandwidth and File Size - Year 8Document2 pagesBandwidth and File Size - Year 8Orlan LumanogNo ratings yet

- Labov-DIFUSÃO - Resolving The Neogrammarian ControversyDocument43 pagesLabov-DIFUSÃO - Resolving The Neogrammarian ControversyGermana RodriguesNo ratings yet

- Digital Movement Guide CodesDocument18 pagesDigital Movement Guide Codescgeorgiou80No ratings yet

- Device Exp 2 Student ManualDocument4 pagesDevice Exp 2 Student Manualgg ezNo ratings yet

- Weekly Home Learning Plan Math 10 Module 2Document1 pageWeekly Home Learning Plan Math 10 Module 2Yhani RomeroNo ratings yet

- Lesson 2 Globalization of World EconomicsDocument17 pagesLesson 2 Globalization of World EconomicsKent Aron Lazona Doromal57% (7)

- Earth Drill FlightsDocument2 pagesEarth Drill FlightsMMM-MMMNo ratings yet

- Environmental Science PDFDocument118 pagesEnvironmental Science PDFJieyan OliverosNo ratings yet

- Final Key 2519Document2 pagesFinal Key 2519DanielchrsNo ratings yet

- Product Packaging, Labelling and Shipping Plans: What's NextDocument17 pagesProduct Packaging, Labelling and Shipping Plans: What's NextShameer ShahNo ratings yet

- Golin Grammar-Texts-Dictionary (New Guinean Language)Document225 pagesGolin Grammar-Texts-Dictionary (New Guinean Language)amoyil422No ratings yet

- Toolkit:ALLCLEAR - SKYbrary Aviation SafetyDocument3 pagesToolkit:ALLCLEAR - SKYbrary Aviation Safetybhartisingh0812No ratings yet

- ROCKET STOVE DESIGN GUIDEDocument9 pagesROCKET STOVE DESIGN GUIDEfrola5100% (2)

- Ten - Doc. TR 20 01 (Vol. II)Document309 pagesTen - Doc. TR 20 01 (Vol. II)Manoj OjhaNo ratings yet

- Virtue Ethics: Aristotle and St. Thomas Aquinas: DiscussionDocument16 pagesVirtue Ethics: Aristotle and St. Thomas Aquinas: DiscussionCarlisle ParkerNo ratings yet

- Marlissa - After School SpecialDocument28 pagesMarlissa - After School SpecialDeepak Ratha50% (2)

- Will You Be There? Song ActivitiesDocument3 pagesWill You Be There? Song ActivitieszelindaaNo ratings yet