Professional Documents

Culture Documents

Strategy

Uploaded by

Elango25489Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Strategy

Uploaded by

Elango25489Copyright:

Available Formats

Strategy:1 Trading systems based on fast moving averages are quite easy to follow.

Let's take a look at this simple system. Currency pairs: ANY Time frame chart: 1 hour or 15 minute chart. Indicators: 10 EMA, 25 EMA, 50 EMA. Entry rules: When 10 EMA goes through 25 EMA and continues through 50 EMA, BUY/SELL in the direction of 10 EMA once it clearly makes it through 50 EMA. (Just wait for the current price bar to close on the opposite site of 50 EMA. This waiting helps to avoid false signals). Exit rules: option1: exit when 10 EMA crosses 25 EMA again. option2: exit when 10 EMA returns and touches 50 EMA (again it is suggested to wait until the current price bar after so called touch has been closed on the opposite side of 50 EMA).

Advantages: it is easy to use, and it gives very good results when the market is trending, during big price break-outs and big price moves. Disadvantages: Fast moving average indicator is a follow-up indicator or it is also called a lagging indicator, which means it does not predict future market directions, but rather reflects current situation on the market. This characteristic makes it vulnerable: firstly, because it can change its signals any time, secondly

because need to watch it all the time; and finally, when market trades sideways (no trend) with very little fluctuation in price it can give many false signals, so it is not suggested to use it during such periods.

Strategy2: Current strategy applies the same principles as Strategy #1. Use time frame and currency which respond the best (1 hour, 1 day or any other). Indicators: (multiple of 7) 7 SMA, 14 SMA, 21 SMA. Entry rules: When 7 SMA goes through 14 and continues through 21, BUY/SELL in the direction of 7 SMA once price gets through 21 SMA. Exit rules: exit when 7 SMA goes back and touches 21 SMA.

Advantages: again it is an easy set up and does not require any calculations or other studies. Can produce very good results during strong market moves, the system also can be easily programmed and traded automatically. Disadvantages: System requires periodical monitoring according to a chosen time frame. SMA indicator signal can be confirmed after the current price bar has been

fully formed and closed. In other words, when SMA stops changing and the signal is fixed, traders may rely on such information to open a trade.

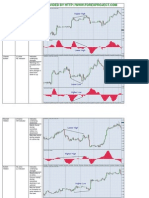

Strategies : 3 Currency: GBP/USD (preferred) or any other. Time frame: 3 hours (preferred) or 4 hours. Indicators: SMA 200, SMA 100 these are two influential SMAs; you will find price obeying their boundaries. SMA 15 EMA 5 MACD (12, 26, 9) Trading Rules: Since we are dealing with unpredictable until settled indicators (EMA, SMA, MACD) we will always be using signals AFTER the current signaling candle is closed. 1. Never open a trade if price is less than 25 pips away from 100 SMA or 200 SMA. 2. Do enter the market when price has crossed either 100 SMA (expect large move) or 200 SMA (expect very large move) and only after the current candle has closed on the opposite side of the SMA. SMAs this big do not get crossed very often. 3. Set stop loss initially at 50 pips. Look for nearest support/resistance level and adjust it accordingly it could grow up to 70-90 pips but it should not be less than 40 pips. Anyway this measure is taken only to save us from a sudden exploding market, in all other cases it will not be hit as our system will take you out from the trade earlier.

4. Enter in the direction of 5 EMA once two conditions are met: 1) 5 EMA crosses 15 SMA permanently which means the current candle is closed and lines are locked and will not move while we make a decision to open a trade. 2) MACD lines are crossed, and the current candle is closed. The 2 crosses do not have to happen simultaneously. MACD lines can cross earlier than EMA and SMA or shortly after, but there should be no more than 5 candles in between 2 crosses. If 2-cross condition is not met no entry. Exit rules: exit with the same rules as for entry: when two crosses are in place. If we have only one cross we are still in trade. Profit target: a) can be set to a desired amount of pips and followed with trailing stop further once the target is reached. b) or use 50 pips profit target do start chasing the price with trailing stop after gaining 50 pips. c) or you may not use trailing stop and set no profit targets, then exit according to Exit rules on the next 2-cross.

Lets walk through the numbers: #1 EMA 5 crosses 15 SMA, MACD lines also crossed, price is not close to SMA 100 we place Long order. #2 again we have 2 crosses: moving averages cross and MACD we exit Long and immediately place Short order. # 3 2 crosses are in place, by the time our current signaling candle is closed we are already far enough from 100 SMA, so we close Short and open Long position. Yes, till this point we were trading in sideways moving market so no profits here, may be some small negative results. Solution trading only during active hours, for GBP/USD it is London and New York sessions. #4 As we were Long this point is our exit (2-cross condition is met again) and immediately place Sell order. #5 moving averages on the chart have crossed, however MACD does not, we stay in trade.

We watch price passing 100 SMA and closing below it it is a good sell signal, but we are already trading it. #6 first appears MACD crossover, followed by moving averages crossover at this point we close our Short position. Do we open Long position immediately? No, because we are very close to 100 SMA. We need to wait until candle passes and closes above 100 SMA to open a Long trade. Once it happens we are in trading Long. #7 MACD lines has attempted to cross, but nothing to worry as there is no second cross from moving averages. #8 same as #7. #9 time to finally close Long position and go Short

You might also like

- Forex Trading The Simplest Way To Beat Any Financial Market: Volume 2, #2From EverandForex Trading The Simplest Way To Beat Any Financial Market: Volume 2, #2No ratings yet

- Easy 15min forex trading system with SMI indicatorDocument7 pagesEasy 15min forex trading system with SMI indicatorAnonymous H3kGwRFiE100% (1)

- 1 Hour Tunnel Method Forex StrategyDocument7 pages1 Hour Tunnel Method Forex StrategyTradiyo ForexNo ratings yet

- Schaff Trend Cycle Indicator - Forex Indicators GuideDocument3 pagesSchaff Trend Cycle Indicator - Forex Indicators Guideenghoss77100% (1)

- Forex Earthquake: by Raoul WayneDocument21 pagesForex Earthquake: by Raoul WayneDavid100% (1)

- Pip Revelation ManualDocument18 pagesPip Revelation ManualCapitanu IulianNo ratings yet

- USDJPY - 100 Pips Set and Forget Strategy - Apiary FundDocument32 pagesUSDJPY - 100 Pips Set and Forget Strategy - Apiary FundEko WaluyoNo ratings yet

- Price Trapping StrategyDocument5 pagesPrice Trapping StrategyscriberoneNo ratings yet

- Abonacci Trading v11-11Document12 pagesAbonacci Trading v11-11ghcardenas100% (1)

- SupersistemaDocument15 pagesSupersistemaLoco LocatisNo ratings yet

- The Lindencourt Daily Forex System ManualDocument19 pagesThe Lindencourt Daily Forex System Manualanonim150No ratings yet

- NNFX Trade AssistantDocument7 pagesNNFX Trade AssistantSang PengelanaNo ratings yet

- The Complete Newbies Guide To Online Forex TradingDocument23 pagesThe Complete Newbies Guide To Online Forex TradingTeresa CarterNo ratings yet

- 5emas Forex System - Forex Scalping, Day-Trading and Short-Term Trading SystemDocument16 pages5emas Forex System - Forex Scalping, Day-Trading and Short-Term Trading SystemWakhid Nurdin0% (1)

- Chicago GSB EXP11 - Introduction To ConsultingDocument51 pagesChicago GSB EXP11 - Introduction To ConsultingRafael CunhaNo ratings yet

- Easy 1 Minute Forex Scalping StrategyDocument7 pagesEasy 1 Minute Forex Scalping StrategyVLADIMIR ANDREI MUNTEANU100% (1)

- MTF TRIX v1.4Document28 pagesMTF TRIX v1.4sabareNo ratings yet

- How To Trade A News BreakoutDocument4 pagesHow To Trade A News BreakoutJason2Kool100% (2)

- LUMAScape List SearchableDocument11 pagesLUMAScape List SearchableDianne RobbNo ratings yet

- CFA 1 Financial Reporting & AccountingDocument92 pagesCFA 1 Financial Reporting & AccountingAspanwz Spanwz100% (1)

- Advanced Midnight Forex StrategyDocument14 pagesAdvanced Midnight Forex StrategyMedhat Ramses Kamil100% (2)

- FSM Early EntryDocument14 pagesFSM Early EntryAjith Moses100% (1)

- Chap 1 Basis of Malaysian Income Tax 2022Document7 pagesChap 1 Basis of Malaysian Income Tax 2022Jasne OczyNo ratings yet

- FOREX Perfection In Manual, Automated And Predictive TradingFrom EverandFOREX Perfection In Manual, Automated And Predictive TradingNo ratings yet

- GBPJPY Daily Trend MethodDocument3 pagesGBPJPY Daily Trend MethodghcardenasNo ratings yet

- 001 SAP Collection Management Config PreviewDocument31 pages001 SAP Collection Management Config PreviewKarina NunesNo ratings yet

- ScalpingDocument6 pagesScalpingzooor100% (1)

- Capt Rahul - Secret Profit LevelDocument17 pagesCapt Rahul - Secret Profit LevelAlpha TraderNo ratings yet

- MT5 IndicatorsV3Document100 pagesMT5 IndicatorsV3golgongroup100% (1)

- Binary Trading Strategy That's Makes You Millionaire in 2022Document2 pagesBinary Trading Strategy That's Makes You Millionaire in 2022Tieba issouf OuattaraNo ratings yet

- BLACK-BφX.COM Scalping System GuideDocument12 pagesBLACK-BφX.COM Scalping System GuideeddieNo ratings yet

- Forex Trading Book: Learn Forex FundamentalsDocument66 pagesForex Trading Book: Learn Forex FundamentalsFahrur RoziNo ratings yet

- ForexRealProfitEA v5.11 Manual 12.21.2010Document29 pagesForexRealProfitEA v5.11 Manual 12.21.2010RODRIGO TROCONIS100% (1)

- A Simple D1 Trading StrategyDocument2 pagesA Simple D1 Trading StrategyRayzwanRayzmanNo ratings yet

- Power Pin Reversal Stochastic Forex Trading StrategyDocument7 pagesPower Pin Reversal Stochastic Forex Trading StrategyjoseluisvazquezNo ratings yet

- Stop LossDocument3 pagesStop LosssalmanscribdNo ratings yet

- The 15-step guide to profitable Forex trading with PAFX signalsDocument67 pagesThe 15-step guide to profitable Forex trading with PAFX signalsShovo Mazumder Pial100% (1)

- Rules For Forex TradingDocument22 pagesRules For Forex Tradinglever70No ratings yet

- The "Sure-Fire" Forex Hedging StrategyDocument6 pagesThe "Sure-Fire" Forex Hedging StrategyRichardNo ratings yet

- Big Secret of Intermarket TradingDocument7 pagesBig Secret of Intermarket TradingadolfinoNo ratings yet

- Implant OcclusionDocument52 pagesImplant OcclusionElango25489100% (3)

- Simple Forex StrategiesDocument4 pagesSimple Forex Strategieszeina32No ratings yet

- Hi LoDocument3 pagesHi LoPhillipe S. ScofieldNo ratings yet

- IMPLANT OCCLUSION GUIDEDocument57 pagesIMPLANT OCCLUSION GUIDEElango2548994% (16)

- Entry Rules 30 Pip MethodDocument9 pagesEntry Rules 30 Pip MethodJuan DavidNo ratings yet

- Daily High Low Forex Trading StrategyDocument2 pagesDaily High Low Forex Trading StrategyzooorNo ratings yet

- NexusFX - System ManualDocument30 pagesNexusFX - System ManualJulius IguguNo ratings yet

- Forex: Strategies on How to Excel at FOREX Trading: Strategies On How To Excel At Trading, #3From EverandForex: Strategies on How to Excel at FOREX Trading: Strategies On How To Excel At Trading, #3No ratings yet

- Technical Analysis in Forex TradingDocument7 pagesTechnical Analysis in Forex TradingIFCMarketsNo ratings yet

- Trading Non-Farm Payroll" Forex StrategyDocument12 pagesTrading Non-Farm Payroll" Forex StrategySharizal ShafeiNo ratings yet

- Trade Forex Using Support and ResistanceDocument48 pagesTrade Forex Using Support and ResistancemzfarhanNo ratings yet

- Entry Rules 30 Pip MethodDocument9 pagesEntry Rules 30 Pip MethodAgus Cucuk100% (1)

- 3EMA Forex Scalping System PDFDocument13 pages3EMA Forex Scalping System PDFSai SumanaNo ratings yet

- ESG Risk FrameworkDocument15 pagesESG Risk Frameworkamoghkanade100% (1)

- Dubai StrategyDocument76 pagesDubai Strategyherbak100% (2)

- 20 Pips Daily Price Action Forex Breakout StrategyDocument4 pages20 Pips Daily Price Action Forex Breakout StrategyJoseph KachereNo ratings yet

- 4x4 Forex Trading StrategyDocument4 pages4x4 Forex Trading StrategySubbuPadalaNo ratings yet

- 3 EuroLondonScalpDocument20 pages3 EuroLondonScalpUnix 01No ratings yet

- Office Fit-Out GuideDocument4 pagesOffice Fit-Out Guidebulsemberutu100% (1)

- Scalping M5 Abc StrategyDocument13 pagesScalping M5 Abc StrategyIrNo ratings yet

- Kotler Pom17e PPT 01Document33 pagesKotler Pom17e PPT 01solehah sapie100% (1)

- How To Trade Ranging Markets: 1. General InformationDocument7 pagesHow To Trade Ranging Markets: 1. General InformationZayminhtet McNo ratings yet

- Fxgoat Nas100 Strategy PDFDocument29 pagesFxgoat Nas100 Strategy PDFDinesh CNo ratings yet

- High Probability Ranging Market Reversal StrategyDocument9 pagesHigh Probability Ranging Market Reversal StrategyNikos Karpathakis100% (1)

- Super BUY SELL Profit - Bes..Document17 pagesSuper BUY SELL Profit - Bes..Muhammad Muntasir AlwyNo ratings yet

- Rejection Spike: Forex Income BossDocument19 pagesRejection Spike: Forex Income BosskrisnaNo ratings yet

- Volatility Index75 RISK AND MONEY MANAGEMENT-UPDATEDDocument12 pagesVolatility Index75 RISK AND MONEY MANAGEMENT-UPDATEDJoseph Chukwu100% (1)

- DivergenceDocument2 pagesDivergenceBoris BorisavljevicNo ratings yet

- 26Document3 pages26Elango25489No ratings yet

- How To Use Variolink VeneerDocument5 pagesHow To Use Variolink VeneerElango25489No ratings yet

- Shasun Company ProfileDocument16 pagesShasun Company ProfileElango25489No ratings yet

- Journal Club: Presented by Dr.R.Venkatesh 2 Year PGDocument12 pagesJournal Club: Presented by Dr.R.Venkatesh 2 Year PGElango25489No ratings yet

- Objectives of The StudyDocument9 pagesObjectives of The StudyElango25489No ratings yet

- Journal Club: Presented by Dr.R.Venkatesh 2 Year PGDocument12 pagesJournal Club: Presented by Dr.R.Venkatesh 2 Year PGElango25489No ratings yet

- Ratio Analysis Formulas + TheoriesDocument8 pagesRatio Analysis Formulas + TheoriesmahenckppNo ratings yet

- Bright BrothersDocument2 pagesBright BrothersElango25489No ratings yet

- 8K Miles: Keep Yourself Away 8K Miles'Document4 pages8K Miles: Keep Yourself Away 8K Miles'Suneel KotteNo ratings yet

- Emily A. Moore: Audit Test - October 9 PayrollDocument3 pagesEmily A. Moore: Audit Test - October 9 PayrollJoel Christian MascariñaNo ratings yet

- Aec 001-Bacc 001 (Econ) - Week 9 Module-1Document5 pagesAec 001-Bacc 001 (Econ) - Week 9 Module-1Nicole ValentinoNo ratings yet

- Sales: Chapter 1 - Nature and Form of The ContractDocument22 pagesSales: Chapter 1 - Nature and Form of The ContractGeanelleRicanorEsperonNo ratings yet

- Teaching Innovation Currency in DisciplineDocument5 pagesTeaching Innovation Currency in Disciplineapi-393438096No ratings yet

- Financial Accounting and Reporting: Exercise 1Document6 pagesFinancial Accounting and Reporting: Exercise 1Lenneth MonesNo ratings yet

- Ias 16 Property Plant Equipment v1 080713Document7 pagesIas 16 Property Plant Equipment v1 080713Phebieon MukwenhaNo ratings yet

- Simulacro Ititl 2Document18 pagesSimulacro Ititl 2Yoshieki Daniel Tanamachic ChavezNo ratings yet

- Banks Customer Satisfaction in Kuwait PDFDocument77 pagesBanks Customer Satisfaction in Kuwait PDFpavlov2No ratings yet

- ACC 604 Chapter 4 Systems DesignDocument59 pagesACC 604 Chapter 4 Systems DesignMedalla NikkoNo ratings yet

- Store Environment Objectives and Layout ManagementDocument6 pagesStore Environment Objectives and Layout ManagementPearl OgayonNo ratings yet

- Replenishment Planning - Process StepsDocument1 pageReplenishment Planning - Process StepsNishu NishuNo ratings yet

- Harambee University Holeta Campus Official and Final Grade ReportDocument9 pagesHarambee University Holeta Campus Official and Final Grade ReportlulumokeninNo ratings yet

- Lesson #02 - CUSTOMER NEEDS AND EXPECTATIONSDocument3 pagesLesson #02 - CUSTOMER NEEDS AND EXPECTATIONSThomasaquinos msigala JrNo ratings yet

- Documents To Check While Buying A Property in BengaluruDocument2 pagesDocuments To Check While Buying A Property in BengaluruSujeshNo ratings yet

- PEST ANALYSIS OF PAKISTAN TOBACCODocument5 pagesPEST ANALYSIS OF PAKISTAN TOBACCOali_sattar150% (1)

- BondsDocument12 pagesBondsGelyn Cruz100% (1)

- Organizational Culture and EnvironmentDocument5 pagesOrganizational Culture and EnvironmentJanette CortezNo ratings yet

- LAS w7Document7 pagesLAS w7Pats MinaoNo ratings yet

- Kraus 2021 Digital Transformation An OverviewDocument15 pagesKraus 2021 Digital Transformation An OverviewPatrick O MahonyNo ratings yet

- Finacle X Pnbrep & PNBRPT Menus: List of PNBREP Reports - PNBREP - 1Document17 pagesFinacle X Pnbrep & PNBRPT Menus: List of PNBREP Reports - PNBREP - 1Amit67% (3)

- Stratma 1.1Document4 pagesStratma 1.1Patrick AlvinNo ratings yet