Professional Documents

Culture Documents

Case 5 - 32

Uploaded by

ashu1403Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case 5 - 32

Uploaded by

ashu1403Copyright:

Available Formats

Q1.

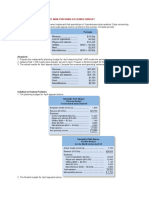

Assuming sales of $30,000,000, construct a budgeted contribution format income statement for the upcoming year for each of the following alternatives: a. The independent sales agents' commission rate remains unchanged at 18%. Commission Rates Sales Cost of Goods Sold: Variable Expenses Commissions Contribution Margin Fixed Expenses: Cost of Goods Sold Travel & Entertainment Expense Sales Manager & Support Staff Annual Payroll Cost Fixed advertising expense Fixed administrative expense Net Operating Income b. The independent sales agents' commission rate increases to 20% Commission Rates Sales Cost of Goods Sold: Variable Expenses Commissions Contribution Margin Fixed Expenses: Cost of Goods Sold Travel & Entertainment Expense Sales Manager & Support Staff Annual Payroll Cost Fixed advertising expense Fixed administrative expense Net Operating Income 2,800,000 0 0 0 800,000 3,200,000 6,800,000 (200,000) 17,400,000 6,000,000 23,400,000 6,600,000 78% 22% 20% 30,000,000 Ratio 100% 2,800,000 0 0 0 800,000 3,200,000 6,800,000 400,000 17,400,000 5,400,000 22,800,000 7,200,000 76% 24% 18% 30,000,000 Ratio 100%

c. The company employs its own sales force Commission Rates Sales Cost of Goods Sold: Variable Expenses Commissions Contribution Margin Fixed Expenses: Cost of Goods Sold Travel & Entertainment Expense Sales Manager & Support Staff Annual Payroll Cost Fixed advertising expense Fixed administrative expense Net Operating Income 2,800,000 400,000 200,000 700,000 1,300,000 3,200,000 8,600,000 1,000,000 17,400,000 3,000,000 20,400,000 9,600,000 68% 2632%

10%

30,000,000

Ratio 100%

Q2. Calculate Marston Corporation's break-even point in sales dollars for the upcoming year assuming the following: a. The independent sales agents' commission rate remains unchanged at 18%. b. The independent sales agents' commission rate increases to 20%. c. The company employs its own sales force. Break even sales dollars for three alternatives is given by the formula Total fixed expenses / contribution margin ratio of sales For independent sales agents' commission rate at 18%. Breakeven = 6,800,000 / 0.24 = $ 28,333,333 For independent sales agents' commission rate at 20%. Breakeven = 6,800,000 / 0.22 = $ 30,909,091 Company employs its own sales force @10% commission Breakeven = 8,600,000 / 0.32 = $ 26,875,000

Q3. Refer to your answer to (1b) above. If the company employs its own sales force, what volume of sales would be necessary to generate the net operating income the company would realize if sales are $30,000,000 and the company continues to sell through agents (at a 20% commission rate)? Volume of sales would be necessary to generate the net operating income the company would realize if sales are $30,000,000 and the company continues to sell through agents (at a 20% commission rate) = [(200,000) + 8,600,000]/ 0.32 = $ 26,250,000

Q4. Determine the volume of sales at which net operating income would be equal regardless of whether Marston Corporation sells through agents (at a 20% commission rate) or employs its own sales force. Say the net income = X X* 22% - 6,800,000 = X* 32% - 8,600,000 Solving the equation for X We get 18,000,000 Therefore, the volume of sales at which net operating income would be equal regardless of whether Marston Corporation sells through agents (at a 20% commission rate) or employs its own sales force is 18,000,000. Own sales force @ 10% 18,000,000 12,240,000 5,760,000 8,600,000 $ (2,840,000) 18,000,000 20% Commission 18,000,000 14,040,000 3,960,000 6,800,000 $ (2,840,000)

Sales Total variable expense Contribution margin Total fixed expenses Net operating income

100% 68% 32%

Sales Total variable expense Contribution margin Total fixed expenses Net operating income

100% 78% 22%

Q5. Prepare a graph on which you plot the profits for both of the following alternatives. a. The independent sales agents' commission rate increases to 20%. b. The company employs its own sales force. On the graph, use total sales revenue as the measure of activity.

20,000,000

15,000,000

10,000,000

5,000,000

0 15,000,000 -5,000,000 20,000,000 25,000,000 30,000,000 35,000,000 40,000,000 45,000,000

-10,000,000

-15,000,000 Profits for commission @ 20% Profits for commission @ 10%

Q6. Write a memo to the president of Marston Corporation in which you make a recommendation as to whether the company should continue to use independent sales agents (at a 20% commission rate) or employ its own sales force. Fully explain the reasons for your recommendation in the memo.

To: From:

President of Marston Corporation XYZ

On the presumption that a new sales force can be hired quickly and be effectively trained well, the option of doing so reaps the maximum profit to the company. On the basis of the data provided, it was analysed that hiring its own sales force gives the company a higher net operating income till the sales fall below a threshold level of $18,000,000. Current sales numbers do not indicate the likelihood of this happening in normal situation. The only issue that can be linked to choosing this option is the assumption of the effectiveness of the sales staff. The new staff are more likely to have less expertise because the current agents have an experience of many years. They have been on the job for a longer time, selling a variety of products, which gives them a bit of an edge over nay newcomer. The positive side that we can take for this is that our own staff will be trained to be more specialized and will have a focused effort directed only to our products. The challenge will be to get to hospital purchasing agents attention, who in many cased would prefer to deal with lesser number of agents for more number of products than vice versa. . As per the current estimates, we can afford a slight drop in sales for it will be compensated by the lower costs of managing our own sales force. Breakeven analyses show that as long as we are able to maintain a sales

level of $26,250,000, we will not incur any losses. Therefore, if we can be confident, that our own staff can generate sales of at least this amount, we can safely switch to this alternative.

You might also like

- CVP Exercise Ref. Bautista, Cancino, Rada, SarmientoDocument5 pagesCVP Exercise Ref. Bautista, Cancino, Rada, SarmientoRodolfo ManalacNo ratings yet

- HW 6-19Document9 pagesHW 6-19tgawri100% (2)

- Calculating unrealized intercompany inventory profit adjustmentDocument22 pagesCalculating unrealized intercompany inventory profit adjustmentxxxxxxxxx100% (3)

- Chapter 10Document63 pagesChapter 10Maryane AngelaNo ratings yet

- CVP Analysis of Shirt StoreDocument16 pagesCVP Analysis of Shirt StoreChamrith SophearaNo ratings yet

- HO RelevantCostingDocument3 pagesHO RelevantCostingJustine CruzNo ratings yet

- Dari GoogleDocument6 pagesDari Googleabc defNo ratings yet

- Problem 18 - 18 18 - 31 and 18 - 32Document5 pagesProblem 18 - 18 18 - 31 and 18 - 32anon_459698449No ratings yet

- Cost AccountingDocument9 pagesCost AccountingCyndy VillapandoNo ratings yet

- Cost-plus target return pricing and activity-based costing analysisDocument7 pagesCost-plus target return pricing and activity-based costing analysisAryan LeeNo ratings yet

- Audit of Other Income Statement ComponentsDocument7 pagesAudit of Other Income Statement ComponentsIbratama Sukses PratamaNo ratings yet

- 12-2 Cost AccountingDocument3 pages12-2 Cost AccountingRichKing100% (1)

- CH 5 - 1Document25 pagesCH 5 - 1api-251535767No ratings yet

- 02 CVP Analysis PDFDocument5 pages02 CVP Analysis PDFJunZon VelascoNo ratings yet

- Class Participation 9 E7-18: Last Name - First Name - IDDocument2 pagesClass Participation 9 E7-18: Last Name - First Name - IDaj singhNo ratings yet

- Mahusay-Bsa-315-Module 3-CaseletsDocument15 pagesMahusay-Bsa-315-Module 3-CaseletsJeth MahusayNo ratings yet

- Case 7-20 Contact Global Our Analysis-FinalsDocument11 pagesCase 7-20 Contact Global Our Analysis-FinalsJenny Malabrigo, MBANo ratings yet

- 202E03Document29 pages202E03Ariz Joelee ArthaNo ratings yet

- Chap 4Document52 pagesChap 4Ella Mae LayarNo ratings yet

- Intercompany Profit Transactions - Inventories: Transactions Within The Affiliated GroupDocument60 pagesIntercompany Profit Transactions - Inventories: Transactions Within The Affiliated GroupPhil MO JoeNo ratings yet

- Segmented Reporting, Investment Center Evaluation, and Transfer PricingDocument80 pagesSegmented Reporting, Investment Center Evaluation, and Transfer PricingHanabusa Kawaii Idou0% (1)

- 12-9 AkmanDocument1 page12-9 AkmanErditama GeryNo ratings yet

- KidsTravel Produces Car Seats For Children From Newborn To 2 Years OldDocument2 pagesKidsTravel Produces Car Seats For Children From Newborn To 2 Years OldElliot Richard0% (1)

- FS Analysis PDFDocument475 pagesFS Analysis PDFStephanie Espalabra100% (1)

- Homework CH 5 1Document46 pagesHomework CH 5 1LNo ratings yet

- Accounting Management - Transfer Pricing ExerciseDocument8 pagesAccounting Management - Transfer Pricing ExerciseQueenielyn TagraNo ratings yet

- Cost-Volume-Profit AnalysisDocument6 pagesCost-Volume-Profit AnalysisCher NaNo ratings yet

- Managerial Accounting: Osama KhaderDocument37 pagesManagerial Accounting: Osama Khaderroaa ghanimNo ratings yet

- Master Budget-WPS OfficeDocument12 pagesMaster Budget-WPS OfficeRean Jane EscabarteNo ratings yet

- Review Problem 1: Variance Analysis Using A Flexible Budget: RequiredDocument12 pagesReview Problem 1: Variance Analysis Using A Flexible Budget: RequiredGraieszian LyraNo ratings yet

- Chap6 PDFDocument46 pagesChap6 PDFعبدالله ماجد المطارنهNo ratings yet

- Management Accounting AnswerDocument3 pagesManagement Accounting AnswerRama fauziNo ratings yet

- ACC-350 Student Armando Saenz Problem 5-29 Break-Even AnalysisDocument11 pagesACC-350 Student Armando Saenz Problem 5-29 Break-Even AnalysisiinNo ratings yet

- Ac2102 TPDocument6 pagesAc2102 TPNors PataytayNo ratings yet

- 2010-09-27 104244 AdvancedDocument11 pages2010-09-27 104244 Advancedhetalcar100% (1)

- Proposal A Proposal B Proposal CDocument6 pagesProposal A Proposal B Proposal CMaha HamdyNo ratings yet

- Acct 2302 Quiz 3 KeyDocument11 pagesAcct 2302 Quiz 3 KeyRachel YangNo ratings yet

- CVP Relationships and Break-Even AnalysisDocument3 pagesCVP Relationships and Break-Even AnalysisExequiel AdradaNo ratings yet

- Variable Costing Lecture NotesDocument2 pagesVariable Costing Lecture NotesCrestu JinNo ratings yet

- Pricing Decisions and Cost Management QuestionsDocument14 pagesPricing Decisions and Cost Management QuestionsZaid Al-rakhesNo ratings yet

- 02 Exercises - Accounting For NPOs v2Document3 pages02 Exercises - Accounting For NPOs v2Peter Andre GuintoNo ratings yet

- 1-3-Ulo D ExerciseDocument5 pages1-3-Ulo D ExerciseJames Darwin TehNo ratings yet

- Advanced Accounting Chapter 6Document17 pagesAdvanced Accounting Chapter 6Ya Lun67% (6)

- At The Beginning of The Last Quarter of 2013 YoungstonDocument3 pagesAt The Beginning of The Last Quarter of 2013 YoungstonAmit PandeyNo ratings yet

- Managerial AccountingMid Term Examination (1) - CONSULTADocument7 pagesManagerial AccountingMid Term Examination (1) - CONSULTAMay Ramos100% (1)

- Home Office and Bracnch - Special ProblemsDocument22 pagesHome Office and Bracnch - Special ProblemsYeshi Soo YahNo ratings yet

- Practice Problem Absorptionvariable Costing With Solutions PDFDocument5 pagesPractice Problem Absorptionvariable Costing With Solutions PDFOne DozenNo ratings yet

- Cost Accounting Hilton 14Document13 pagesCost Accounting Hilton 14Vin TenNo ratings yet

- ELIMINATE UNREALIZED GAINS ON INTERCOMPANY SALESDocument33 pagesELIMINATE UNREALIZED GAINS ON INTERCOMPANY SALESJulliena BakersNo ratings yet

- QS12 - Midterm 2 Review SolutionDocument7 pagesQS12 - Midterm 2 Review Solutionlyk0tex0% (1)

- AnswerDocument1 pageAnswerEevan SalazarNo ratings yet

- Artistic Woodcrafting Inc.Document10 pagesArtistic Woodcrafting Inc.Irish June Tayag0% (1)

- RWD 05 CVP AnalysisDocument58 pagesRWD 05 CVP Analysishamba allahNo ratings yet

- Budgeting and Cash Flow ManagementDocument4 pagesBudgeting and Cash Flow ManagementYaj Cruzada100% (1)

- Chapter EightDocument38 pagesChapter EightLauren Campbell100% (4)

- Maximize jewelry store revenue with integer programmingDocument3 pagesMaximize jewelry store revenue with integer programmingohmyme sungjaeNo ratings yet

- Feather Friends CM Ratio and Break-Even AnalysisDocument2 pagesFeather Friends CM Ratio and Break-Even AnalysisTinku SNo ratings yet

- Expenses Contribution MarginratioDocument3 pagesExpenses Contribution MarginratioMike Oshaunessy BaconNo ratings yet

- 6e Brewer CH05 B EOCDocument18 pages6e Brewer CH05 B EOCLiyanCenNo ratings yet

- PR Week 5 CVPDocument3 pagesPR Week 5 CVPAyhuNo ratings yet

- Finance EQTDocument4 pagesFinance EQTashu1403No ratings yet

- Toyota RecallsDocument7 pagesToyota Recallsashu1403No ratings yet

- Doing Business in China - 1Document7 pagesDoing Business in China - 1ashu1403No ratings yet

- STPDDocument37 pagesSTPDDipesh KotechaNo ratings yet

- Karnataka Clears Investment Proposals Worth RsDocument1 pageKarnataka Clears Investment Proposals Worth Rsashu1403No ratings yet

- Aus Econ2Document11 pagesAus Econ2ashu1403No ratings yet

- FSA2Document9 pagesFSA2ashu1403No ratings yet

- Walmart CrisisDocument2 pagesWalmart Crisisashu1403No ratings yet

- Swedish Financial SystemDocument5 pagesSwedish Financial Systemashu1403No ratings yet

- Economics EssayDocument2 pagesEconomics Essayashu1403No ratings yet

- Australia Sustainability ReportingDocument4 pagesAustralia Sustainability Reportingashu1403No ratings yet

- Toyota RecallsDocument7 pagesToyota Recallsashu1403No ratings yet

- Manufacturing - A Sector Study: The Performance of Manufacturing Companies Within Benchmark IndexDocument16 pagesManufacturing - A Sector Study: The Performance of Manufacturing Companies Within Benchmark Indexashu1403No ratings yet

- Major Themes of The Earnings Call: RD RDDocument1 pageMajor Themes of The Earnings Call: RD RDashu1403No ratings yet

- ArticleDocument13 pagesArticleashu1403No ratings yet

- FM TestDocument4 pagesFM Testashu1403No ratings yet

- Snapshot of Costs Associated With Organic Foods (The Daily Meal, March 2012)Document5 pagesSnapshot of Costs Associated With Organic Foods (The Daily Meal, March 2012)ashu1403No ratings yet

- The UK's Code of Practice Regulator Has Issued Guidance On Social Media and Other Digital Communications ToolsDocument5 pagesThe UK's Code of Practice Regulator Has Issued Guidance On Social Media and Other Digital Communications Toolsashu1403No ratings yet

- IFM Strategic Financial ManagementDocument1 pageIFM Strategic Financial Managementashu1403No ratings yet

- 01 - Time Value of MoneyDocument3 pages01 - Time Value of Moneyashu1403No ratings yet

- Drivers of Option LiquidityDocument19 pagesDrivers of Option Liquidityashu1403No ratings yet

- As 11 - Some ImplicationsDocument5 pagesAs 11 - Some Implicationsashu1403No ratings yet

- LPP JuliaDocument8 pagesLPP Juliaashu1403No ratings yet

- BiodieselDocument7 pagesBiodieselashu1403No ratings yet

- Gaius Julius Caesar (July 13, 100 BC - March 15, 44 BC) Was A Roman Military and Political LeaderDocument2 pagesGaius Julius Caesar (July 13, 100 BC - March 15, 44 BC) Was A Roman Military and Political Leaderashu1403No ratings yet

- Continuing Certification Requirements: (CCR) HandbookDocument19 pagesContinuing Certification Requirements: (CCR) HandbookLip Min KhorNo ratings yet

- DL-6104 - Business LawDocument358 pagesDL-6104 - Business LawTiki TakaNo ratings yet

- Defacto Veritas Certification PVT LTD - Company ProfileDocument6 pagesDefacto Veritas Certification PVT LTD - Company Profileadnan hakimNo ratings yet

- Technical Delivery Manager IT EDM 040813Document2 pagesTechnical Delivery Manager IT EDM 040813Jagadish GaglaniNo ratings yet

- Diagnostic Level 3 AccountingDocument17 pagesDiagnostic Level 3 AccountingRobert CastilloNo ratings yet

- CPA licensure exam syllabus management accountingDocument3 pagesCPA licensure exam syllabus management accountingLouie de la TorreNo ratings yet

- Economic ServicesDocument34 pagesEconomic ServicesTUMAUINI TOURISMNo ratings yet

- CH 02Document37 pagesCH 02Tosuki HarisNo ratings yet

- SCDL Solved International Finance AssignmentsDocument19 pagesSCDL Solved International Finance AssignmentsShipra GoyalNo ratings yet

- "A Study of Financial Performance Analysis of IT Company": Project ReportDocument48 pages"A Study of Financial Performance Analysis of IT Company": Project ReportRohit MishraNo ratings yet

- Siebel Systems Case Analysis SummaryDocument6 pagesSiebel Systems Case Analysis SummaryAyush MittalNo ratings yet

- Terminologies: DEMAT AccountDocument5 pagesTerminologies: DEMAT Accountdinesh kumarNo ratings yet

- WI-1231373 QEL03 Audit Plan Letter CobrandDocument4 pagesWI-1231373 QEL03 Audit Plan Letter Cobrandjohn jNo ratings yet

- Csa z1600 Emergency and Continuity Management Program - Ron MeyersDocument23 pagesCsa z1600 Emergency and Continuity Management Program - Ron MeyersDidu DaduNo ratings yet

- Materials Management Ec IVDocument92 pagesMaterials Management Ec IVshivashankaracharNo ratings yet

- F8 (AA) Kit - Que 81 Prancer ConstructionDocument2 pagesF8 (AA) Kit - Que 81 Prancer ConstructionChrisNo ratings yet

- Stratman NotesDocument2 pagesStratman NotesWakin PoloNo ratings yet

- How To Build A Double Calendar SpreadDocument26 pagesHow To Build A Double Calendar SpreadscriberoneNo ratings yet

- How To Think Like A Marketing Genius - Table of ContentsDocument10 pagesHow To Think Like A Marketing Genius - Table of Contentsbuymenow2005No ratings yet

- OpenText Vendor Invoice Management For SAP Solutions 7.5 SP7 - Configuration Guide English (VIM070500-07-CGD-EN-02)Document922 pagesOpenText Vendor Invoice Management For SAP Solutions 7.5 SP7 - Configuration Guide English (VIM070500-07-CGD-EN-02)Varsha Pawaskar100% (4)

- Cash PoolingDocument10 pagesCash PoolingsavepageNo ratings yet

- Bank Panin Dubai Syariah GCG Report 2018Document117 pagesBank Panin Dubai Syariah GCG Report 2018kwon jielNo ratings yet

- Hallahan Et Al. 2011, "Defining Strategic Communication" in International Journal of Strategic CommunicationDocument34 pagesHallahan Et Al. 2011, "Defining Strategic Communication" in International Journal of Strategic Communicationlivros_bihNo ratings yet

- Done OJTjvvvvvDocument30 pagesDone OJTjvvvvvMike Lawrence CadizNo ratings yet

- SM AssignmentDocument17 pagesSM AssignmentElvinNo ratings yet

- Hippo Case StudyDocument3 pagesHippo Case StudyAditya Pawar 100100% (1)

- BMW CaseDocument16 pagesBMW CaseAfsheen Danish NaqviNo ratings yet

- Slide 1: Your Coffee ShopDocument15 pagesSlide 1: Your Coffee ShopMahardika Agil Bima IINo ratings yet

- Value Chain Analysis Guide for Strategic ManagementDocument16 pagesValue Chain Analysis Guide for Strategic ManagementJazelle Mae DimaanoNo ratings yet

- Dissolution QuestionsDocument5 pagesDissolution Questionsstudyystuff7No ratings yet