Professional Documents

Culture Documents

Dispersion Trading Reference For Starting

Uploaded by

etravoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dispersion Trading Reference For Starting

Uploaded by

etravoCopyright:

Available Formats

Dispersion trading reference for starting

Goyal, A. and Saretto, A. Option returns and volatility mispricing. (February 2007). Working paper. Available at SSRN: http://ssrn. com/abstract=889947 Jiang, G. J., & Tian, Y. S. (2007). Extracting model-free volatility from option prices: An examination of the VIX index. Journal of Derivatives, 14(3), 3560. Law, A. M., & Kelton, W. D. (2000). Simulation modeling and analysis, Third edition. McGrawHill. Lehman Brothers (2002, July 11). On mean reversion in implied volatility time series. Global Foreign Exchange and Local Market Strategies. Markowitz, H. M. (1952). Portfolio selection. Journal of Finance, 7(1), 7791. Marshall, C. M. (2008). Isolating the systematic and unsystematic components of a single stock's (or portfolio's) standard deviation. Working paper, Queens College of the City University of New York. Marshall, C.M. (2008b). Volatility trading: Hedge funds and the search for alpha (new challenges to the efficient markets hypothesis), Doctoral Dissertation, Fordham University, September 2008. Mehta, N. B., Molisch, A. F., Wu, J., & Zhang, J. (2006, June). Approximating the sum of correlated lognormal or lognormal-rice random variablesIEEE International Conference on Communications (ICC), vol. 4. (pp. 16051610) 81649547. Mitchell, R. L. (1968, February). Permanence of the log-normal distribution. Defense Technical Information Center. Mougeot, N. (2007, May 14). Hidden assets' investing series: Dispersion trading. Technical report: Equity Derivatives Strategy Group. Deutsche Bank. Nelken, I. (2006). Variance swap volatility dispersion. Derivatives Use, Trading & Regulation, 11(4), 334. Ramsey, P. H. (1989). Critical values for Spearman's rank order correlation. Journal of Educational Statistics, 14(3), 245253. Simaan, Y. E., & Wu, L. (2007, Winter). Price discovery in the U.S. stock options market. Journal of Derivatives, 15(2), 2038. Whaley, R. (2000). The investor fear gauge. Journal of Portfolio Management, 26, 1217.

You might also like

- Daftar Pustaka: of Financial Economics 91 (1), 1-23Document2 pagesDaftar Pustaka: of Financial Economics 91 (1), 1-23Sindi AriskaNo ratings yet

- Macroeconomic Factors and Stock Market ReturnsDocument12 pagesMacroeconomic Factors and Stock Market ReturnsBilal RazzaqNo ratings yet

- 19 BibliographyDocument7 pages19 BibliographyHannan NadkarNo ratings yet

- 11 BibliographyDocument10 pages11 BibliographytouffiqNo ratings yet

- Final Ref ListDocument13 pagesFinal Ref ListyaarbaileeNo ratings yet

- Market Microstructure Syllabus for Short Course at Goethe UniversityDocument7 pagesMarket Microstructure Syllabus for Short Course at Goethe UniversityssdebNo ratings yet

- Asset Pricing PuzzlesDocument6 pagesAsset Pricing Puzzlesgr8fun5052No ratings yet

- Stats 242: Algorithmic Trading and Quantitative Strategies Summer 2011Document9 pagesStats 242: Algorithmic Trading and Quantitative Strategies Summer 2011Veeken ChaglassianNo ratings yet

- Relationship Between Inflation and Stock Prices in ThailandDocument6 pagesRelationship Between Inflation and Stock Prices in ThailandEzekiel WilliamNo ratings yet

- ReferencesDocument3 pagesReferencesRazzARazaNo ratings yet

- New Microsoft Word DocumentDocument22 pagesNew Microsoft Word DocumentBikashRanaNo ratings yet

- Mancini - Advanced Topics in Financial Econometrics (Swiss) PDFDocument5 pagesMancini - Advanced Topics in Financial Econometrics (Swiss) PDFInvestNo ratings yet

- 10710econ612100 PDFDocument5 pages10710econ612100 PDFJeffwei WeiNo ratings yet

- Rider College, Lawrenceville, NJ 08648, USADocument14 pagesRider College, Lawrenceville, NJ 08648, USAMakar FilchenkoNo ratings yet

- Asset Pricing 2021Document8 pagesAsset Pricing 2021lgcasais3No ratings yet

- Econometrics 3: Time Series Analysis and Forecasting TechniquesDocument4 pagesEconometrics 3: Time Series Analysis and Forecasting TechniqueskanirajNo ratings yet

- Econ275 (Stanford) PDFDocument4 pagesEcon275 (Stanford) PDFInvestNo ratings yet

- 经典文献阅读与讨论Document2 pages经典文献阅读与讨论elodie leeNo ratings yet

- The Microstructure of Financial MarketsDocument27 pagesThe Microstructure of Financial MarketsKofi Appiah-Danquah100% (1)

- 06 ReferencesDocument4 pages06 ReferencesarvindttNo ratings yet

- EC FinancialEconomics WS2023 Sylabus-1Document6 pagesEC FinancialEconomics WS2023 Sylabus-1himanshoo panwarNo ratings yet

- Course Outline and Reading ListDocument5 pagesCourse Outline and Reading ListjackNo ratings yet

- Investor Behavior FactorsDocument2 pagesInvestor Behavior FactorsRama ChandranNo ratings yet

- AG912 Tutorial 9Document1 pageAG912 Tutorial 9athirah binti shazaliNo ratings yet

- Labour EconomicsDocument6 pagesLabour EconomicsNitin Singh100% (1)

- Outline Dev EconDocument10 pagesOutline Dev EconAmara AshfaqNo ratings yet

- References Wps OfficeDocument3 pagesReferences Wps OfficeFrancis OtienoNo ratings yet

- 03 - Literature Review Technical AnalysisDocument9 pages03 - Literature Review Technical AnalysisABOOBAKKERNo ratings yet

- Econ 5301 Course OutlineDocument4 pagesEcon 5301 Course OutlineMisbahul IslamNo ratings yet

- ECON 30501 Topics in Economic TheoryDocument6 pagesECON 30501 Topics in Economic TheoryJune-sub ParkNo ratings yet

- 1 s2.0 S1059056021000861 MainDocument14 pages1 s2.0 S1059056021000861 MainAshwin KurupNo ratings yet

- 2 Structura Proiect StatisticaDocument3 pages2 Structura Proiect StatisticamariaNo ratings yet

- SSRN Id2924309Document2 pagesSSRN Id2924309yaar iduNo ratings yet

- Mean Reversion in Stock Prices - Evidence and Implications. James M. PoterbaDocument72 pagesMean Reversion in Stock Prices - Evidence and Implications. James M. PoterbaDryTvMusicNo ratings yet

- BA 991 Readings List SummaryDocument6 pagesBA 991 Readings List Summarymicro873No ratings yet

- Surveying Stock Market Forecasting Techniques Part II - Soft Computing Methods - 2009Document10 pagesSurveying Stock Market Forecasting Techniques Part II - Soft Computing Methods - 2009Guilherme FerreiraNo ratings yet

- MA Economics Entrance CourseDocument10 pagesMA Economics Entrance Courseabhishek thakur0% (1)

- Research Papers on Stock Market Overreaction and Investor BehaviorDocument3 pagesResearch Papers on Stock Market Overreaction and Investor BehaviorNavneet JaiswalNo ratings yet

- Does The Market Maker Stabilize The Market?Document32 pagesDoes The Market Maker Stabilize The Market?Tran Duc MinhNo ratings yet

- Advanced Macroeconomic AnalysisDocument17 pagesAdvanced Macroeconomic AnalysisAyat SalimNo ratings yet

- Statistics For Research: With A Guide To SPSSDocument20 pagesStatistics For Research: With A Guide To SPSSIgorNo ratings yet

- De Gasit La BibliotecaDocument1 pageDe Gasit La BibliotecalucidinbrNo ratings yet

- RBI Paper Examines Technical Trading and Exchange Rates in IndiaDocument22 pagesRBI Paper Examines Technical Trading and Exchange Rates in IndiastriveaceNo ratings yet

- Sa WZ03Document43 pagesSa WZ03Walid FithhNo ratings yet

- Market Dispersion and The Pro Tability of Hedge FundsDocument35 pagesMarket Dispersion and The Pro Tability of Hedge FundsJeremy CanlasNo ratings yet

- Daftar Pustaka CG PayungDocument13 pagesDaftar Pustaka CG Payungdian ramadhaniNo ratings yet

- Random Document, I Just Want My DocumentDocument5 pagesRandom Document, I Just Want My DocumentIqbal HaikalNo ratings yet

- Value and Momentum EverywhereDocument58 pagesValue and Momentum EverywhereDessy ParamitaNo ratings yet

- 17 ReferencesDocument13 pages17 ReferencesSujal MaharanaNo ratings yet

- 2 Long-Memory Modeling and Forecasting oDocument28 pages2 Long-Memory Modeling and Forecasting oАндрей РябовNo ratings yet

- Asset Pricing Topics at NYU Stern (Fall 2002Document8 pagesAsset Pricing Topics at NYU Stern (Fall 2002Anonymous v9zDTEcgsNo ratings yet

- Graduate International Trade Theory: Mjyu@ Ccer - Pku.edu - CN /mjyu - Ccer.edu - Cn/courses/phdtrade - HTMLDocument4 pagesGraduate International Trade Theory: Mjyu@ Ccer - Pku.edu - CN /mjyu - Ccer.edu - Cn/courses/phdtrade - HTMLReema LuciaNo ratings yet

- Macroeconomía I 2017Document3 pagesMacroeconomía I 2017mauro monterosNo ratings yet

- Volatility Arbitrage ReferencesDocument11 pagesVolatility Arbitrage ReferencesSrinivasaNo ratings yet

- Moving AverageDocument36 pagesMoving AverageFaisal KorothNo ratings yet

- Course Code/Title: FIN510M / Dev 'T of Financial Theories and Contemporary Issues Professor: Ms. Vivian Y. Eleazar Course DescriptionDocument2 pagesCourse Code/Title: FIN510M / Dev 'T of Financial Theories and Contemporary Issues Professor: Ms. Vivian Y. Eleazar Course DescriptionRush YuviencoNo ratings yet

- Wuthisatian 2014 JurnalDocument24 pagesWuthisatian 2014 JurnalAR Bonjer 2No ratings yet

- The Intraday Behavior of Bid-Ask Spreads For NYSE Stocks and CBOE OptionsDocument19 pagesThe Intraday Behavior of Bid-Ask Spreads For NYSE Stocks and CBOE OptionsSamNo ratings yet

- What Makes The VIX Tick PDFDocument59 pagesWhat Makes The VIX Tick PDFmititeiNo ratings yet

- Ntro To-Options 2012Document53 pagesNtro To-Options 2012etravoNo ratings yet

- Consent Form for Background and Financial ChecksDocument1 pageConsent Form for Background and Financial ChecksetravoNo ratings yet

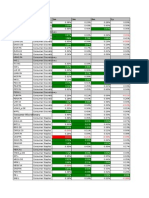

- Consumer Discretionary, Staples, Energy, Financials, Healthcare, Industrials Sector PerformanceDocument13 pagesConsumer Discretionary, Staples, Energy, Financials, Healthcare, Industrials Sector PerformanceetravoNo ratings yet

- Consumer Discretionary, Staples, Energy, Financials, Healthcare, Industrials Sector PerformanceDocument13 pagesConsumer Discretionary, Staples, Energy, Financials, Healthcare, Industrials Sector PerformanceetravoNo ratings yet

- Ratings CriteriaDocument1 pageRatings CriteriaAakash KhandelwalNo ratings yet

- Credit Default Swap Valuation IDocument35 pagesCredit Default Swap Valuation ISharad Dutta0% (1)

- Option NoteDocument2 pagesOption NoteetravoNo ratings yet

- Was Senior Management at Barings Aware That There Was A Problem at BFS? ExplainDocument4 pagesWas Senior Management at Barings Aware That There Was A Problem at BFS? ExplainetravoNo ratings yet

- Chart Implied Volatility Data in Real-TimeDocument2 pagesChart Implied Volatility Data in Real-TimeetravoNo ratings yet

- Autocallable Feature Explained: How This Structured Product Trait WorksDocument4 pagesAutocallable Feature Explained: How This Structured Product Trait WorksetravoNo ratings yet

- L 1-R Credit Spread D (0, T - Years) SP Cumul: PDF CumDocument5 pagesL 1-R Credit Spread D (0, T - Years) SP Cumul: PDF CumetravoNo ratings yet

- XRTrading Cover LetterDocument1 pageXRTrading Cover LetteretravoNo ratings yet

- Equity Index Fair Value MonitorDocument2 pagesEquity Index Fair Value MonitoretravoNo ratings yet

- Tudor Capital Europe Pillar 3 Policy SummaryDocument7 pagesTudor Capital Europe Pillar 3 Policy SummaryetravoNo ratings yet

- 42728711ACST828ASS1Document17 pages42728711ACST828ASS1etravoNo ratings yet

- Assignement DerivativesDocument4 pagesAssignement DerivativesetravoNo ratings yet

- Group Assignment Strategic ManagementDocument2 pagesGroup Assignment Strategic ManagementetravoNo ratings yet

- Business ValuationDocument7 pagesBusiness ValuationetravoNo ratings yet

- Finacial TimesDocument2 pagesFinacial TimesetravoNo ratings yet

- Finacial TimesDocument2 pagesFinacial TimesetravoNo ratings yet

- Gem Global Report 2010revDocument85 pagesGem Global Report 2010revRafael Martins VieiraNo ratings yet

- FT WordDocument1 pageFT WordetravoNo ratings yet

- Bain and Company Global Private Equity Report 2012 PDFDocument72 pagesBain and Company Global Private Equity Report 2012 PDFLinus Vallman JohanssonNo ratings yet

- Finacial TimesDocument2 pagesFinacial TimesetravoNo ratings yet