Professional Documents

Culture Documents

Aloha Products Case Study Analysus

Uploaded by

Jeff RudzinskiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aloha Products Case Study Analysus

Uploaded by

Jeff RudzinskiCopyright:

Available Formats

Description of the Current Situation Aloha Products is a privately held regional processor of specialty coffees.

Headquartered in Columbus, Ohio, hey operate three processing and packaging plants and sell coffee blends in the mid-west and Atlantic states. The company generates annual revenues of $150 million through sales of their branded coffee blends in addition to normal profits earned on spot exchanges resulting from excess inventory. The company consists of the three processing plants operated by plant managers, corporate headquarters, and a special purchasing division which is responsible for obtaining coffee beams on the coffee, sugar, and coco exchange located in New York. Corporate headquarters is responsible for all marketing and sales operations, and is headed by the President and Vice-President for Advertising and Promotion. The plant managers were each responsible for their plant operations which consisted of processing and packaging. Plant manage compensation is tied to gross margin. Production output is dictated to plant managers from the corporate Vice-President of Manufacturing. The purchasing unit located in New York is nearly autonomous in their operation. Purchasing of coffee beans is done 3-12 months in advance of the delivery of the beans. The company obtains its input beans through a series of contracts, each of which is handled and treated separately. Because the inputs are purchased months in advance, sometimes consumer demands do not meet the inventory on hand at any given time. In either the case of a surplus or shortage, the company either buys or sells coffee in spot exchanges. The purchasing unit was able to sell beans purchased on the exchange to outside entities for a normal profit, or to transfer the beans at the cost of acquisition to the three plants, with no profit or loss recorded on the transfer. The overall cost of running the purchasing unit is charged to the central office, and then incorporated as part of general overhead. Recently, the plant managers have expressed discontent with the way in which their gross margin is calculated. Their grievance boils down to the fact that they cannot control the price of their inputs nor the volume, price, or mix of their outputs. In their view, this prevents them from operating efficiently and generating a better gross margin. Identifiable Problem Areas Alohas issues boil down to deficiencies in communications, unit responsibilities, and organizational structure. For starters, the production unit (three plants) managers have little to no voice regarding input purchasing, which is handled by the automatous purchasing unit in New York. The link between the two is essential, as processing managers will have much better knowledge regarding production capabilities and cost minimization than will the purchasing unit, or even the corporate office for that matter. Labor efficiency, mechanical breakdowns, wages rates, overhead expenses, etc. will all be different at each plant, and therefore the decisions made by the managers at those plants will differ as well. Logically then, if managers cannot make decisions regarding input acquisition, price, volume, and output, their hands are tied in terms of generating profit. For example, it could be possible in some

cases to increase total profit while reducing gross margin (the Wal-Mart model). However, with plant managers unable to determine output, this decision would not be an available option to them. Additionally, because most aspects of production are dictated by headquarters, it makes it nearly impossible for the central office to accurately gauge the performance of the plant managers and by extension, the plant itself. What may look to be a low gross margin may in fact be the highest margin attainable given the predetermined conditions regarding production at those plants. Or, what looked to be a high gross margin may have been sub-par compared with a situation where the plant manager could control all aspects of production. In essence, the company is attempting to operate on both a centralized model, with sales, purchasing, marketing, and output decisions being made at headquarters, but also with a decentralized structure, with production and purchasing being done by separate units. They also have inaccurate information regarding operations, with units incorrectly labeled. The three plants are evaluated as profit centers, while they actually operate as cost centers. Finally, the companys process for purchasing beans results in unnecessary shortages and overstocks. While central purchasing results in favorable pricing for the company, spot exchanges needed to meet output demand can have the opposite effect. The communication disconnect between the purchasing unit and the sales and marketing unit also means that some purchases will be made that do not align with customer needed, and unnecessary sales through spot exchanges will be required.

Possible Solutions for Problems Corporate management needs to align its performance standards with the unit objectives. This either means evaluating the three plants as cost centers, where minimizing cost is used as a metric, or it must be evaluated as a profit center and given the ability to determine input and output pricing volume, and mix. The conditions of the market are such that designating the plants as a cost center makes more sense. If the plants were a true profit center, each plant would need to purchase its own inputs either through the purchasing unit in New York or through a third party external to Aloha. Because most coffee is purchased through exchanges, any purchase of beans through a third party would most often come at a marked up price over the exchange price. Therefore, it makes more sense to have a team remain in New York for the purpose of acquiring beans at lower rates, and to have the plants function strictly as cost centers. This would also maintain efficiencies without the need for redundancy. However, the purchasing team cannot be independent of the plants or the sales and marketing unit. Instead, the purchasing unit would comprise of representatives from each plant and from the sales and marketing units. By integrating other areas of the business into purchasing the need for future spot transactions will be reduced. Also, by establishing the plants as a cost center, plant managers can more closely attend to relevant matters involving processing costs and headquartered management can accurately determine the effectiveness of the managers and the plants.

You might also like

- P V: The Case Will Be Analyzed From The Standpoint of TheDocument3 pagesP V: The Case Will Be Analyzed From The Standpoint of ThecesarvirataNo ratings yet

- Measuring and Controlling Assets at Aloha ProductsDocument2 pagesMeasuring and Controlling Assets at Aloha ProductsDenisse MontesNo ratings yet

- Aloha Products Assignment-MCS AjayDocument5 pagesAloha Products Assignment-MCS Ajayshalinpshah100% (1)

- Case 4-1. Vershire CompanyDocument3 pagesCase 4-1. Vershire CompanyMuhammad Kamil100% (1)

- Case Analysis of Abrams CompanyDocument4 pagesCase Analysis of Abrams CompanyMilanPadariyaNo ratings yet

- Case Study - Management Control - Rendell CompanyDocument17 pagesCase Study - Management Control - Rendell CompanyJed Estanislao60% (5)

- Westport Electric Corporation EditDocument6 pagesWestport Electric Corporation EditMichele GranadaNo ratings yet

- Westport Electric CorporationDocument3 pagesWestport Electric CorporationPraful PatilNo ratings yet

- Westport Electrical Corporation Case Study AnlysisDocument4 pagesWestport Electrical Corporation Case Study AnlysisMilanPadariyaNo ratings yet

- North Country Auto decentralization improves performanceDocument2 pagesNorth Country Auto decentralization improves performanceHafsyah MahmudahNo ratings yet

- Quality Metal Service CentreDocument4 pagesQuality Metal Service CentreManali MangaonkarNo ratings yet

- Abrams Company (Case 5-4)Document12 pagesAbrams Company (Case 5-4)Mhd HeickalNo ratings yet

- Case North Country AutoDocument3 pagesCase North Country AutoAnanda Agustin Fitriana100% (2)

- Grand Jean CompanyDocument6 pagesGrand Jean CompanyAdi AdiadiNo ratings yet

- Grand Jean CompanyDocument6 pagesGrand Jean Companyrajat_singla100% (8)

- Jane Belinda Saranga - CASE 1-3 Xerox CorporationDocument2 pagesJane Belinda Saranga - CASE 1-3 Xerox CorporationJane Belinda SarangaNo ratings yet

- Case 6 - University Day Care CentreDocument3 pagesCase 6 - University Day Care CentreAnirudh Gulur100% (3)

- Case 3-1 Southwest AirlinesDocument2 pagesCase 3-1 Southwest AirlinesDebby Febriany86% (7)

- Use EVA Instead of ROA to Measure Performance at Quality MetalDocument2 pagesUse EVA Instead of ROA to Measure Performance at Quality Metalcesarvirata100% (2)

- Enager Industries, Inc.Document6 pagesEnager Industries, Inc.luckyladdy100% (11)

- Case 9 1Document2 pagesCase 9 1Jessica Tjan80% (5)

- Xerox Corp Case SolutionsDocument4 pagesXerox Corp Case SolutionsSwastik Karnatki100% (1)

- Xerox's Management Control EvolutionDocument4 pagesXerox's Management Control Evolutionalanz123No ratings yet

- Case Analysis New York Times - Gabungan Semua - FixxxxxxxxxDocument18 pagesCase Analysis New York Times - Gabungan Semua - FixxxxxxxxxGlenius Budiman100% (3)

- BIRCH Paper Company SolutionDocument4 pagesBIRCH Paper Company Solutionhssh8No ratings yet

- New Jersey InsuranceDocument2 pagesNew Jersey Insurancerksp9999950% (2)

- Decentralized vs Centralized Strategy Pros and ConsDocument3 pagesDecentralized vs Centralized Strategy Pros and ConsAnkit Kumar SinghNo ratings yet

- Birch Paper Company Transfer Pricing CaseDocument11 pagesBirch Paper Company Transfer Pricing CaseMadhuri Sangare100% (1)

- Summary & Questions Quality Metal Service CenterDocument2 pagesSummary & Questions Quality Metal Service CenterRahul RathoreNo ratings yet

- Birch Paper Company Case Analysis MCSDocument3 pagesBirch Paper Company Case Analysis MCSMegaAppleNo ratings yet

- Bergerac Systems: The Challenge of Backward IntegrationDocument5 pagesBergerac Systems: The Challenge of Backward IntegrationSanthosh Selvam100% (2)

- 17-1 Delaney MotorsDocument2 pages17-1 Delaney MotorsYJ26126100% (6)

- Case Study On Scientific Glass Inc Inventory ManagementDocument45 pagesCase Study On Scientific Glass Inc Inventory ManagementMuhammad Ali SheikhNo ratings yet

- Codman & Shurtleff CaseDocument3 pagesCodman & Shurtleff CaseElom Katako33% (3)

- Barilla SpaDocument11 pagesBarilla Spavariapratik100% (1)

- Accept Thomson Division Bid to Support Internal Development CostsDocument2 pagesAccept Thomson Division Bid to Support Internal Development Costsutrao100% (2)

- Quality Metal Service Center - FinalDocument5 pagesQuality Metal Service Center - FinalJerelleen Rodriguez100% (1)

- Birch Paper Company CaseDocument2 pagesBirch Paper Company Casedlrjames100% (4)

- Comparing Planning and Control Systems of Texas Instruments and Hewlett-PackardDocument20 pagesComparing Planning and Control Systems of Texas Instruments and Hewlett-PackardNaveen SinghNo ratings yet

- Organizing and Controlling Profit CentersDocument3 pagesOrganizing and Controlling Profit CentersTiffany SmithNo ratings yet

- Scientific Glass Inc - Inventory ManagementDocument11 pagesScientific Glass Inc - Inventory ManagementdathanNo ratings yet

- North Country Auto Profit CentersDocument9 pagesNorth Country Auto Profit CentersSamu BorgesNo ratings yet

- Case 2Document5 pagesCase 2giscapindy100% (4)

- HomeWork MCS-Nurul Sari (1101002048) - Case 5.1 5.4Document5 pagesHomeWork MCS-Nurul Sari (1101002048) - Case 5.1 5.4Nurul SariNo ratings yet

- Case14-62 Vonderweidt Sportway CorpDocument5 pagesCase14-62 Vonderweidt Sportway CorpRdj JaureguiNo ratings yet

- GBA 645 Case7 Real Estate and Capital Structure DecisionsDocument6 pagesGBA 645 Case7 Real Estate and Capital Structure DecisionssimplyabeerNo ratings yet

- Case Study - Grand Jean CompanyDocument16 pagesCase Study - Grand Jean Companyyadavmihir63100% (1)

- Case 2-1 - 2-3 - Mardiyah Isma Hidayati - 1101002026Document5 pagesCase 2-1 - 2-3 - Mardiyah Isma Hidayati - 1101002026Mardiyah Isma HidayatiNo ratings yet

- Aries Agro Limited Case StudyDocument10 pagesAries Agro Limited Case StudySelwin DsouzaNo ratings yet

- This Study Resource Was: ZumwaldDocument2 pagesThis Study Resource Was: ZumwaldVevo PNo ratings yet

- Landau CompanyDocument4 pagesLandau Companyrond_2728No ratings yet

- Description of Current SituationDocument10 pagesDescription of Current SituationNAYANNo ratings yet

- Overview of Aloha ProductsDocument5 pagesOverview of Aloha ProductssajjanmishraNo ratings yet

- Caso 7.4 Aloha Control de GestiónDocument23 pagesCaso 7.4 Aloha Control de GestiónWilfredorhNo ratings yet

- Management Control System: Issues with Profit CalculationDocument2 pagesManagement Control System: Issues with Profit CalculationAbby HactherNo ratings yet

- Case 2 - Vershire Company (Version 2.1)Document3 pagesCase 2 - Vershire Company (Version 2.1)shielamaeNo ratings yet

- Team Cactus Document AnalysisDocument7 pagesTeam Cactus Document AnalysisUyen TranNo ratings yet

- Staple Yourself To Order - CritqueDocument4 pagesStaple Yourself To Order - Critquexebra100% (2)

- Financial Analysis of Inventory Management in Pharmacy PracticeDocument24 pagesFinancial Analysis of Inventory Management in Pharmacy PracticecherokeeNo ratings yet

- Accounting 52 Project Harry's HamburgerDocument3 pagesAccounting 52 Project Harry's HamburgerGeoffrey GreeneNo ratings yet

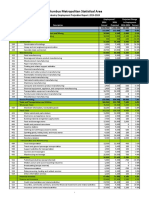

- Columbus Job Projections 2014-2024Document16 pagesColumbus Job Projections 2014-2024Jeff RudzinskiNo ratings yet

- Analysis of The American Automotive Industry Including Breakdowns of SalesDocument5 pagesAnalysis of The American Automotive Industry Including Breakdowns of SalesJeff RudzinskiNo ratings yet

- The Worst Things ImaginableDocument9 pagesThe Worst Things ImaginableJeff RudzinskiNo ratings yet

- As A General StatementDocument2 pagesAs A General StatementJeff RudzinskiNo ratings yet

- Project Report On SIP in Mutual FundsDocument76 pagesProject Report On SIP in Mutual FundsAnubhav Sood100% (5)

- BCG Global Payments 2020Document34 pagesBCG Global Payments 2020ForkLog100% (1)

- Gucci Strategic MGTDocument18 pagesGucci Strategic MGTd342784rppkncom0% (1)

- 500 Empresas para El Futuro (Peyber, Etc... )Document51 pages500 Empresas para El Futuro (Peyber, Etc... )Peyber Hispania100% (1)

- Brannigan FoodsDocument3 pagesBrannigan FoodsRahul SharanNo ratings yet

- Questions On Competition Act 2002Document2 pagesQuestions On Competition Act 2002Harsh Gupta50% (2)

- Catalyst Instruction and Applied in IndustryDocument269 pagesCatalyst Instruction and Applied in IndustryhamedNo ratings yet

- 09 ArDocument104 pages09 ArDaniel KwanNo ratings yet

- II Semester 2016-17 Course Handout BAV ECON F355Document19 pagesII Semester 2016-17 Course Handout BAV ECON F355Tushit ThakkarNo ratings yet

- Corporate M&A - Indonesia 2022Document13 pagesCorporate M&A - Indonesia 2022Andhika Hananta RNo ratings yet

- Cross-Border Mergers and AcquisitionDocument34 pagesCross-Border Mergers and Acquisitionvarinder kumar KumarNo ratings yet

- Zara CaseDocument2 pagesZara CaseE100% (1)

- The Knowledge Company - Strategy Formulation in Knowledge-Intensive IndustriesDocument17 pagesThe Knowledge Company - Strategy Formulation in Knowledge-Intensive Industriesrmdeca0% (1)

- Mergers and Aquisition: University of Economics - Ho Chi Minh CityDocument7 pagesMergers and Aquisition: University of Economics - Ho Chi Minh CityNhân TrịnhNo ratings yet

- CiplaDocument19 pagesCiplaTulika AggarwalNo ratings yet

- Venture Capital Term Sheet for Series A FinancingDocument28 pagesVenture Capital Term Sheet for Series A Financingcah2009aNo ratings yet

- A Primer On Reading Annual ReportsDocument229 pagesA Primer On Reading Annual ReportsTomas AriasNo ratings yet

- Creating Value from Mergers and AcquisitionsDocument7 pagesCreating Value from Mergers and Acquisitionsredaek0% (1)

- Strategic Management ProjectDocument84 pagesStrategic Management ProjectTalha Abdul Rauf57% (7)

- Unit 21 Organisational Culture: ObjectivesDocument11 pagesUnit 21 Organisational Culture: ObjectivesVarun GuptaNo ratings yet

- HRSG Dictionary Overview ListDocument18 pagesHRSG Dictionary Overview ListWilliam AndersonNo ratings yet

- Andrei Dvornic v. Cloudera, Tom Reilly, Jim Frankola, Mike Olson Class Action US District Court Northern District of CaliforniaDocument34 pagesAndrei Dvornic v. Cloudera, Tom Reilly, Jim Frankola, Mike Olson Class Action US District Court Northern District of CaliforniaJordan NovetNo ratings yet

- BCE: INC Case AnalysisDocument6 pagesBCE: INC Case AnalysisShuja Ur RahmanNo ratings yet

- NO. Chapter Name Page No.: Content of TableDocument58 pagesNO. Chapter Name Page No.: Content of TableSuraj JadhavNo ratings yet

- Vietnam medical device market poised for growthDocument11 pagesVietnam medical device market poised for growthÂn THiênNo ratings yet

- 2017 Global M A Retention Report PDFDocument12 pages2017 Global M A Retention Report PDFSankaty LightNo ratings yet

- Structure Conduct Performance ParadigmDocument16 pagesStructure Conduct Performance ParadigmAnonymous OP6R1ZSNo ratings yet

- Task 1 - Email JP MorganDocument2 pagesTask 1 - Email JP MorganWilliam100% (1)

- Carlsberg Emerging Markets StrategyDocument8 pagesCarlsberg Emerging Markets StrategyAnn Margarette Sambilay100% (1)