Professional Documents

Culture Documents

2013 Snohomish County School District Levy Tax

Uploaded by

Debra Kolrud0 ratings0% found this document useful (0 votes)

136 views2 pages2013 Snohomish County School District Levy Tax

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document2013 Snohomish County School District Levy Tax

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

136 views2 pages2013 Snohomish County School District Levy Tax

Uploaded by

Debra Kolrud2013 Snohomish County School District Levy Tax

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

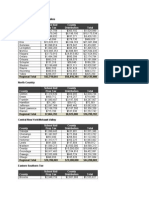

2013 Snohomish County

M&O Levy tax

(Excludes school tax on school bond)

District

1 Snohomish

2 Monroe

3 Everett

4 Lake Stevens

5 Lakewood

6 Marysville

7 Mukilteo

8 Edmonds

9 Arlington

10 Northshore

11 Granite Falls

12 Sultan

13 Stanwood

14 Darrington

Tax

Rate*

Average Assessed

Average District

Residential Value**

Levy Tax

$3.78

$3.99

$3.61

$3.83

$3.53

$4.40

$3.13

$2.80

$3.43

$2.51

$4.31

$4.65

$2.37

$4.27

$257,500

$237,900

$219,600

$200,300

$213,800

$167,200

$233,000

$251,500

$201,100

$270,000

$154,600

$132,500

$220,700

$108,500

$973

$950

$793

$767

$754

$736

$729

$704

$690

$678

$666

$616

$523

$463

2013 Snohomish County average residential (excluding Monroe)

M&O school levy tax was $699.

Monroe School District Taxpayers average was $950.00 or $251.00 more

than the average of other Snohomish county districts - 36% higher

* Tax rate per $1,000 of assessed property value

** Snohomish County Assessor average residential value per school district

School

Prepared by:

Debra Kolrud

Former Monroe School Director 2007-2011

You might also like

- M&O Levy Proposal October 10, 2011Document1 pageM&O Levy Proposal October 10, 2011Debra KolrudNo ratings yet

- Are Expenses Per Student, 2010-11Document3 pagesAre Expenses Per Student, 2010-11efaustNo ratings yet

- County School Aid/ Prop Tax County Distribution TotalDocument2 pagesCounty School Aid/ Prop Tax County Distribution TotalJon CampbellNo ratings yet

- Proptax10 Home ValueDocument28 pagesProptax10 Home ValueTax FoundationNo ratings yet

- City of Toronto: Where Your Property Tax Dollars GoDocument1 pageCity of Toronto: Where Your Property Tax Dollars GoCityNewsToronto0% (1)

- Utah Proposed Property Tax Increases For 2014Document1 pageUtah Proposed Property Tax Increases For 2014The Salt Lake TribuneNo ratings yet

- Tax Increase For Gov 09-10 Budget - 7-23Document1 pageTax Increase For Gov 09-10 Budget - 7-23jmicek100% (2)

- Pennsylvania Pension IncreasesDocument14 pagesPennsylvania Pension IncreasesNathan BenefieldNo ratings yet

- Florida StatewideMSAsSummaryDocument1 pageFlorida StatewideMSAsSummarykschofieldNo ratings yet

- DistrictscertifiedDocument3 pagesDistrictscertifiedcara12345No ratings yet

- Legal Fees Fy2001 - Fy2010 - RPTDocument37 pagesLegal Fees Fy2001 - Fy2010 - RPTCarol Pearse SnowNo ratings yet

- Minnesota Foster Care Rates 2009Document6 pagesMinnesota Foster Care Rates 2009Beverly TranNo ratings yet

- Serrano Daycare: Name Pay Rate Gross Pay Fica Net Pay Total Hours Federal Taxes States Taxes Workman'S CompDocument1 pageSerrano Daycare: Name Pay Rate Gross Pay Fica Net Pay Total Hours Federal Taxes States Taxes Workman'S Compg1r1jones1No ratings yet

- VISD Bond Summary 2017Document58 pagesVISD Bond Summary 2017Victoria Advocate100% (1)

- County and City Pay SpreadsheetDocument1 pageCounty and City Pay SpreadsheetLakeCoNewsNo ratings yet

- Alabama K-12 Allocation Amounts For Digital Devices and Health GrantsDocument8 pagesAlabama K-12 Allocation Amounts For Digital Devices and Health GrantsTrisha Powell CrainNo ratings yet

- Cupp-Patterson School Funding Formula Estimated AidDocument17 pagesCupp-Patterson School Funding Formula Estimated AidAndy ChowNo ratings yet

- Circuit BreakerDocument1 pageCircuit Breakerhungrymarshall1No ratings yet

- ASD BudgetDocument4 pagesASD BudgetHERCasdNo ratings yet

- Microsoft Excel Sheet For Calculating Various Financial Formula by Jack KarnesDocument42 pagesMicrosoft Excel Sheet For Calculating Various Financial Formula by Jack KarnesVikas AcharyaNo ratings yet

- Northwestern Vermont Towns Ranked by Median IncomeDocument1 pageNorthwestern Vermont Towns Ranked by Median IncomeCloverWhithamNo ratings yet

- Property Taxes On Owner-Occupied HousingDocument28 pagesProperty Taxes On Owner-Occupied HousingTax FoundationNo ratings yet

- Proptax 06 10 IncomeDocument102 pagesProptax 06 10 IncomeTax FoundationNo ratings yet

- LFB State Aid and Levy Information For Technical College DistrictsDocument4 pagesLFB State Aid and Levy Information For Technical College Districtskfoody5436No ratings yet

- ChesterCounty State Education Spending 2011-12Document2 pagesChesterCounty State Education Spending 2011-12bobguzzardiNo ratings yet

- SD HB110H1 With HC2083-1 4.20.21 FinalDocument18 pagesSD HB110H1 With HC2083-1 4.20.21 FinalKaren KaslerNo ratings yet

- Teacher SalariesDocument1 pageTeacher SalariesThe News-HeraldNo ratings yet

- Longmont Recreation Fall 2013 BrochureDocument60 pagesLongmont Recreation Fall 2013 BrochureCity of Longmont, ColoradoNo ratings yet

- Single Family HomesDocument1 pageSingle Family Homesapi-26358990No ratings yet

- Metro Atlanta Schools CARES ACT Funding BreakdownDocument12 pagesMetro Atlanta Schools CARES ACT Funding BreakdownJulie Wolfe100% (1)

- Budget - Nicole Smith 1Document6 pagesBudget - Nicole Smith 1api-307193564No ratings yet

- Gov Corbett Education Budget 2011-2012 Proposed BEF March2011-1Document22 pagesGov Corbett Education Budget 2011-2012 Proposed BEF March2011-1bobguzzardiNo ratings yet

- Report From NC Board of Education and DPI To GA On Supplemental FundingDocument8 pagesReport From NC Board of Education and DPI To GA On Supplemental FundingJamie BouletNo ratings yet

- Pay Rise ComparisonsDocument97 pagesPay Rise ComparisonspbeekmanNo ratings yet

- San Juan CountylevyincreasesDocument3 pagesSan Juan Countylevyincreasescarmstrong1456No ratings yet

- Seward: Minneapolis Neighborhood ProfileDocument8 pagesSeward: Minneapolis Neighborhood ProfilesewardpNo ratings yet

- District Heat Pro FormaDocument8 pagesDistrict Heat Pro FormakeithmontpvtNo ratings yet

- 19W IMI: ESSER 1.0 AllocationsDocument4 pages19W IMI: ESSER 1.0 AllocationsWJHL News Channel ElevenNo ratings yet

- Lake County Single Family Sales Summary 2006-2013Document91 pagesLake County Single Family Sales Summary 2006-2013The News-HeraldNo ratings yet

- Truth in Taxation Park Rapids Schools 2023-24Document23 pagesTruth in Taxation Park Rapids Schools 2023-24inforumdocsNo ratings yet

- Housing and TransportationDocument15 pagesHousing and Transportationapi-304328787No ratings yet

- Oak Grove k-8Document15 pagesOak Grove k-8ezexitteamNo ratings yet

- Three Years of No Tax Increase?: Ss U E!Document20 pagesThree Years of No Tax Increase?: Ss U E!elauwitNo ratings yet

- RPSD 2009-2010 Budget PresentationDocument15 pagesRPSD 2009-2010 Budget PresentationThe Concerned Citizens Of Roselle ParkNo ratings yet

- Workbook by IncomeDocument74 pagesWorkbook by IncomeRick KarlinNo ratings yet

- Saipe Released Nov 09Document10 pagesSaipe Released Nov 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- Mohsen Saadi Mohsen Saadi 4 Burnham Avenue Glenwood NSW 2768Document9 pagesMohsen Saadi Mohsen Saadi 4 Burnham Avenue Glenwood NSW 2768Cincin TiaNo ratings yet

- 2010 Remuneration ScheduleDocument4 pages2010 Remuneration ScheduleeltonmkwNo ratings yet

- Excell Formualae For BegginerDocument13 pagesExcell Formualae For BegginerWendy MckayNo ratings yet

- 2009 Major NYC AgenciesDocument1 page2009 Major NYC AgenciesElizabeth BenjaminNo ratings yet

- FEMA Announces Emergency Food and Shelter Programs Funding For AlabamaDocument6 pagesFEMA Announces Emergency Food and Shelter Programs Funding For AlabamarecyfoxNo ratings yet

- Prop Tax RankingsDocument144 pagesProp Tax RankingsRick KarlinNo ratings yet

- Qa Task 6 Workings Final-1Document49 pagesQa Task 6 Workings Final-1api-238672955No ratings yet

- Montreal Municipal Taxes 2010Document1 pageMontreal Municipal Taxes 2010Montreal GazetteNo ratings yet

- Weston Home Sales Report February 2013Document1 pageWeston Home Sales Report February 2013HigginsGroupRENo ratings yet

- Sam 08Document45 pagesSam 08GothamSchools.orgNo ratings yet

- Loan Calculation Scenario: Calculation Inputs Calculation ResultsDocument3 pagesLoan Calculation Scenario: Calculation Inputs Calculation ResultsGonzalo FrancoNo ratings yet

- Fact Sheet: Which Counties Spend The Most of Your Tax Dollars?Document7 pagesFact Sheet: Which Counties Spend The Most of Your Tax Dollars?Steve CouncilNo ratings yet

- Supplement To 2010 Annual Report: Bonus Payments To Public Authority StaffDocument4 pagesSupplement To 2010 Annual Report: Bonus Payments To Public Authority StaffrkarlinNo ratings yet

- Miller V Monroe School District Federal ComplaintDocument46 pagesMiller V Monroe School District Federal ComplaintDebra KolrudNo ratings yet

- Seattle Police Report During BLM RiotDocument5 pagesSeattle Police Report During BLM RiotDebra KolrudNo ratings yet

- Monroe School District FundingDocument2 pagesMonroe School District FundingDebra KolrudNo ratings yet

- Monroe School District Facebook GroupDocument22 pagesMonroe School District Facebook GroupDebra KolrudNo ratings yet

- Special Education Citizen Complaint (Secc) No. 13-72 Procedural HistoryDocument21 pagesSpecial Education Citizen Complaint (Secc) No. 13-72 Procedural HistoryDebra KolrudNo ratings yet

- Washington State Report CardDocument1 pageWashington State Report CardDebra KolrudNo ratings yet

- Neighborhood Watch From Snohomish County SheriffDocument24 pagesNeighborhood Watch From Snohomish County SheriffDebra Kolrud100% (1)

- Washington Risk PoolDocument87 pagesWashington Risk PoolDebra KolrudNo ratings yet

- It's Perfectly NormalDocument2 pagesIt's Perfectly NormalDebra KolrudNo ratings yet

- Public School Directors Denied The Ability To Communicate With Their Own District Attorney!!Document4 pagesPublic School Directors Denied The Ability To Communicate With Their Own District Attorney!!Debra KolrudNo ratings yet

- Monroe School District Superintendent ContractDocument5 pagesMonroe School District Superintendent ContractDebra KolrudNo ratings yet

- It's Perfectly NormalDocument1 pageIt's Perfectly NormalDebra KolrudNo ratings yet

- Monroe School District End of Course Washington State Report Card For Algebra 1 2012:13Document2 pagesMonroe School District End of Course Washington State Report Card For Algebra 1 2012:13Debra KolrudNo ratings yet

- Monroe School District Capital Facilities Plan 2010Document1 pageMonroe School District Capital Facilities Plan 2010Debra KolrudNo ratings yet

- Snohomish County Superform Carlos MartinezDocument3 pagesSnohomish County Superform Carlos MartinezDebra KolrudNo ratings yet

- Office of Superintendent of Public Instruction 2012-13 Table15 Personnel Report On Superintendent SalariesDocument6 pagesOffice of Superintendent of Public Instruction 2012-13 Table15 Personnel Report On Superintendent SalariesDebra KolrudNo ratings yet