Professional Documents

Culture Documents

ESKIMO PIE Case Study

Uploaded by

Pablo Vera100%(1)100% found this document useful (1 vote)

5K views13 pagesEskimo pie earns revenues primarily through licensing, not a big manufacturer. Net income $4,000,000 Plus current interest expense less taxes (. X 67,000) 40,200 Plus: depreciation $1,352,000 Less: interest income from $13 mil.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEskimo pie earns revenues primarily through licensing, not a big manufacturer. Net income $4,000,000 Plus current interest expense less taxes (. X 67,000) 40,200 Plus: depreciation $1,352,000 Less: interest income from $13 mil.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

5K views13 pagesESKIMO PIE Case Study

Uploaded by

Pablo VeraEskimo pie earns revenues primarily through licensing, not a big manufacturer. Net income $4,000,000 Plus current interest expense less taxes (. X 67,000) 40,200 Plus: depreciation $1,352,000 Less: interest income from $13 mil.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 13

Eskimo Pie Corporation

Background and I ssues

Eskimo pie sells ice-cream and related food products

--earns revenues primarily through licensing, not a big manufacturer

--key assets are brand name recognition

--fragmented industry is consolidating, recent entry by large food cos.

Why was Reynolds selling Eskimo?

Why did Eskimo management prefer the IPO to the Nestle offer?

What criteria should Reynolds use in deciding between selling Eskimo to another

firm versus taking Eskimo public in an IPO?

Valuing Eskimo Pie

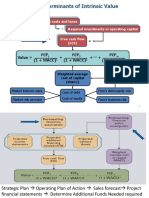

To value Eskimo we need the following:

(1) An estimate of r

WACC

(2) An estimate of expected cash flows in 1991

(3) An estimate of the growth rate of future cash flows

Step 1: Estimating WACC

(A) Estimate

unlevered

: Use equity betas of stock in table 8, unlever them using the

formula from chapter 12:

equity

= [1 + (1-T

C

)Debt/Equity]

unlevered

equity

unlevered

Ben & Jerrys 1.2 1.18

Dreyers 1.4 1.33

Empire of Carolina .3 0.14

Steves Ice Cream 2.5 2.37

Hershey Foods 1.0 0.96

Tootsie Roll 1.0 1.00

Average

unlevered

= 1.162, use this as our estimate.

Estimating WACC (continued)

(B) Estimate

equity

at the target D/E ratio

What would Eskimos target capital structure be after IPO?

equity

=

unlevered

= 1.162

(C) Identify r

f

Use 10 year bond yield from exhibit 9: 7.42%

(D) Identify the market risk premium r

M

-r

f

Use 7.43% given in the problem.

(E) Use the CAPM to estimate r

equity

r

equity

= 7.42 + (1.162) x (7.43) = 16.05%

Under the unlevered target capital structure, r

WACC

= r

equity

= 16.05%

Step 2. Expected cash flows

Lets estimate year-end 1991 after-tax cash flows since the Exhibit 6 forecasts

seem too low.

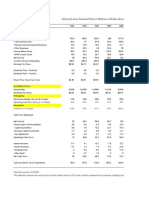

Net income $4,000,000

Plus current interest expense less taxes (.6 x 67,000) 40,200

Plus: depreciation $1,352,000

Less: interest income from $13 mil. Cash -$355,680

[$13 mil. paid out in the transaction

Lost interest: $13mil. x (1-.4) x 4.56%]

Less: capital expenditures -$1,000,000

change in working capital 0

Total Expected Cash Flow at end of 1991 $4,036,520

Working capital changes

Working capital excluding cash has decreased over the period 1987 to 1991, even

though sales have increased.

Eskimo Pie is a marketing and licensing firm, not a manufacturer.

Would be reasonable to exclude working capital changes from cash flow

estimation.

1987 1988 1989 1990

Working capital 9,342 11,107 10,830 11,735

Cash 5,550 8,109 10,723 13,191

Working capital less cash 3,792 2,998 107 -1,456

Step 2. Expected cash flows

Lets estimate year-end 1991 after-tax cash flows since the Exhibit 6 forecasts

seem too low.

Net income $4,000,000

Plus current interest expense less taxes (.6 x 67,000) 40,200

Plus: depreciation $1,352,000

Less: interest income from $13 mil. Cash -$355,680

[$13 mil. paid out in the transaction

Lost interest: $13mil. x (1-.4) x 4.56%]

Less: capital expenditures -$1,000,000

change in working capital 0

Total Expected Cash Flow at end of 1991 $4,036,520

Step 3. Estimating a growth rate in future cash flows

Eskimo Pie grows substantially in 1991, which made IPO a potential alternative.

One approach: Estimate average annual growth in sales

1988 (36,695-30,769)/(30,769) = 19.25%

1989 (46,709-36,695)/(36,695) = 27.29%

1990 (47,198-46,709)/(46,709) = 1.05%

1991 (61,000-47,198)/(47,198) = 29.24%

Average sales growth 19.21%

Question: Is this a reasonable estimate of expected cash flow growth?

Has past 4-year period been special will growth slow down?

Other approaches to estimate growth

1. Past growth in net income

2. Past growth in operating income

3. Past growth in cash flows

Problem: These numbers are more variable, particularly for years with income or

cash flows close to zero.

Bringing in more information

What are analysts saying about future industry prospects?

What does Goldman-Sachs project? (forward looking estimates)

Expected 1992 growth in sales 4.54%

Expected 1993 growth in sales 1.24%

Average 2.89%

Expected 1992 growth in net income 10.44%

Expected 1993 growth in net income 6.23%

Average 8.34%

Net income more closely tracks changes in cash flow

Since growth is slowing down, lets use 6.23% for a constant growth rate.

4. Putting it all together

V = [Expected 1991 cash flow x (1+growth rate)] / [r growth rate]

V = [($4,036,520) x (1 + .0623)] / [.1605 - .0623]

V (or E) = 43,665,939

Should Reynolds sell to Nestle or do the IPO?

Nestle offer - $61 million cash

IPO proceeds Cash from stock sale $43,665,939

Special dividend payment of $15,000,000

Total $58,665,939

Looks like Nestle offer is slightly better.

Some Issues:

Results very sensitive to assumptions about growth rates - If more optimistic

since Goldman Sachs projection does not reflect the recent development.

Use 8.34% (the average growth rate) Total proceeds would be $71,720,697.

Other methods of valuing stocks? How about other firms in the same industry?

Comparable public firm multiples

There would be some multiples that could be used to check our estimates.

The value of Eskimo Pie would range from about $84 to $98 million (excluding

the excess cash) our estimate seems to be undervalued.

Additional issues: Need to convince that IPO is feasible.

Equity-to-net income Total value-to-sales

Average of other firms 22.8 1.6

Estimate for Eskimo Pie 3.7 61

Implied value 84.4 97.6

You might also like

- Eskimo PieDocument2 pagesEskimo Piechch91750% (2)

- FINA 5470 - Case 3 - Eskimo PieDocument7 pagesFINA 5470 - Case 3 - Eskimo PieYifan ChenNo ratings yet

- Case 2 Eskimo Pie Corporation (Abridged)Document7 pagesCase 2 Eskimo Pie Corporation (Abridged)Irakli Salia100% (1)

- Eskimo PieDocument30 pagesEskimo PieMing Yang100% (1)

- Eskimo PieDocument7 pagesEskimo PieHeather KellerNo ratings yet

- Investment Banking Case AnalysisDocument3 pagesInvestment Banking Case AnalysisSunil VadhvaNo ratings yet

- What Is Your Estimate of The Value of Eskimo Pie Corporation As A Stand-Alone Company?Document7 pagesWhat Is Your Estimate of The Value of Eskimo Pie Corporation As A Stand-Alone Company?Ya-ting YangNo ratings yet

- Eskimo Pie CaseDocument19 pagesEskimo Pie Casedese88No ratings yet

- Eskimo Pie FileDocument15 pagesEskimo Pie FilesuwimolJNo ratings yet

- Popsicle Unilever 7.6% Klondike Empire of Carolin 5.4% Eskimo Pie Eskimo Pie 5.3% Snickers Mars 4.8% Weight Watchers H.J. Heinz 4.3%Document18 pagesPopsicle Unilever 7.6% Klondike Empire of Carolin 5.4% Eskimo Pie Eskimo Pie 5.3% Snickers Mars 4.8% Weight Watchers H.J. Heinz 4.3%Irakli SaliaNo ratings yet

- Hbs Case - Ust Inc.Document4 pagesHbs Case - Ust Inc.Lau See YangNo ratings yet

- case-UST IncDocument10 pagescase-UST Incnipun9143No ratings yet

- Assignment 7 - Clarkson LumberDocument5 pagesAssignment 7 - Clarkson Lumbertesttest1No ratings yet

- Case IDocument20 pagesCase ICherry KanjanapornsinNo ratings yet

- Case Study Debt Policy Ust IncDocument10 pagesCase Study Debt Policy Ust IncWill Tan80% (5)

- MCI Communications CorporationDocument6 pagesMCI Communications Corporationnipun9143No ratings yet

- Debt Policy at UST IncDocument5 pagesDebt Policy at UST Incggrillo73No ratings yet

- UST Final CaseDocument4 pagesUST Final Casestrongchong0050% (2)

- American Chemical CorporationDocument8 pagesAmerican Chemical CorporationAnastasiaNo ratings yet

- UST Debt Policy SpreadsheetDocument9 pagesUST Debt Policy Spreadsheetjchodgson0% (2)

- Debt Policy at Ust IncDocument18 pagesDebt Policy at Ust InctutenkhamenNo ratings yet

- Case Study Debt Policy Ust IncDocument10 pagesCase Study Debt Policy Ust IncIrfan MohdNo ratings yet

- American Chemical Corporation: Financial Analysis: June 2010Document9 pagesAmerican Chemical Corporation: Financial Analysis: June 2010BenNo ratings yet

- Corp Finance HBS Case Study: Debt Policy at UST IncDocument4 pagesCorp Finance HBS Case Study: Debt Policy at UST IncTang LeiNo ratings yet

- UST IncDocument16 pagesUST IncNur 'AtiqahNo ratings yet

- Blain Kitchenware Inc.: Capital StructureDocument7 pagesBlain Kitchenware Inc.: Capital StructureRoy Lambert100% (4)

- Debt Policy at Ust Case SolutionDocument2 pagesDebt Policy at Ust Case Solutiontamur_ahan50% (2)

- Case Study - Linear Tech - Christopher Taylor - SampleDocument9 pagesCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193No ratings yet

- Friendly CS SolutionDocument8 pagesFriendly CS SolutionEfendiNo ratings yet

- CMF USTCase ReportDocument6 pagesCMF USTCase ReportAmal Daher100% (1)

- Linear Tech Dividend PolicyDocument25 pagesLinear Tech Dividend PolicyAdarsh Chhajed0% (2)

- Netscape's Initial Public OfferingDocument9 pagesNetscape's Initial Public OfferingRasheeq Rayhan100% (1)

- Debt Policy at UST Inc.Document47 pagesDebt Policy at UST Inc.karthikk1990100% (2)

- Cooper Industries - Group 5Document11 pagesCooper Industries - Group 5Rudro MukherjeeNo ratings yet

- 13 American Chemical Corporation - Group 13Document5 pages13 American Chemical Corporation - Group 13Anonymous MpSSPQi0% (1)

- Deluxe CorpDocument7 pagesDeluxe CorpUdit UpretiNo ratings yet

- Cooper Industries Case QuestionsDocument3 pagesCooper Industries Case QuestionsChip choiNo ratings yet

- Continental CarriersDocument10 pagesContinental Carriersnipun9143No ratings yet

- Friendly Cards CaseDocument3 pagesFriendly Cards CaseJeff Farley50% (2)

- Ust Inc Case SolutionDocument16 pagesUst Inc Case SolutionJamshaid Mannan100% (2)

- Linear Technology Payout Policy Case 3Document4 pagesLinear Technology Payout Policy Case 3Amrinder SinghNo ratings yet

- Energy GelDocument4 pagesEnergy Gelchetan DuaNo ratings yet

- Deluxe Corporation CaseDocument7 pagesDeluxe Corporation Caseankur.mastNo ratings yet

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Dividend Policy at Linear TechnologyDocument9 pagesDividend Policy at Linear TechnologySAHILNo ratings yet

- Year 1979 1980 1981 1982 1983 1984 Period 0 1 2 3 4 5Document30 pagesYear 1979 1980 1981 1982 1983 1984 Period 0 1 2 3 4 5shardullavande33% (3)

- Uttam Kumar Sec-A Dividend Policy Linear TechnologyDocument11 pagesUttam Kumar Sec-A Dividend Policy Linear TechnologyUttam Kumar100% (1)

- Teletech Corporation 2005 Case SolutionDocument5 pagesTeletech Corporation 2005 Case SolutionAmrita Sharma100% (1)

- Chapter 19: Financial Statement AnalysisDocument11 pagesChapter 19: Financial Statement AnalysisSilviu TrebuianNo ratings yet

- Lecture 28Document34 pagesLecture 28Riaz Baloch NotezaiNo ratings yet

- CH 4Document20 pagesCH 4Waheed Zafar100% (1)

- Value + + + FCF FCF FCF (1 + WACC) (1 + WACC) (1 + WACC) ..Document33 pagesValue + + + FCF FCF FCF (1 + WACC) (1 + WACC) (1 + WACC) ..Manabendra DasNo ratings yet

- 2-4 2006 Dec ADocument13 pages2-4 2006 Dec AAjay Takiar50% (2)

- Chapter Fifteen Full-Information Forecasting, Valuation, and Business Strategy AnalysisDocument56 pagesChapter Fifteen Full-Information Forecasting, Valuation, and Business Strategy AnalysisRitesh Batra100% (4)

- Ros69749 ch10Document9 pagesRos69749 ch10iteddyzNo ratings yet

- M09 Berk0821 04 Ism C091Document15 pagesM09 Berk0821 04 Ism C091Linda VoNo ratings yet

- The Home DepotDocument30 pagesThe Home DepotAnoop SrivastavaNo ratings yet

- Evaluating Financial Performance: Finance Jaime F. ZenderDocument33 pagesEvaluating Financial Performance: Finance Jaime F. ZenderRenjul ParavurNo ratings yet

- CH 10Document29 pagesCH 10Ratalos HunterzNo ratings yet

- Dividend Assessment: The Cash - Trust NexusDocument13 pagesDividend Assessment: The Cash - Trust NexusAnshik BansalNo ratings yet

- Even in Ancient TimesDocument3 pagesEven in Ancient TimesPablo VeraNo ratings yet

- Why The Rich Are So Much RicherDocument9 pagesWhy The Rich Are So Much RicherPablo VeraNo ratings yet

- Operations Hw1 q1 Q2aDocument1 pageOperations Hw1 q1 Q2aPablo VeraNo ratings yet

- Climate Change EssayDocument3 pagesClimate Change EssayPablo VeraNo ratings yet

- Essentials of Treasury Management - Working Capital Class Final OutlineDocument32 pagesEssentials of Treasury Management - Working Capital Class Final OutlinePablo VeraNo ratings yet

- Timothy Morge - Market MapsDocument40 pagesTimothy Morge - Market MapsRaghav Sampath100% (11)

- Order Execution Only GRSP Statement (CDN$) APR. 30 2020: Local CallsDocument4 pagesOrder Execution Only GRSP Statement (CDN$) APR. 30 2020: Local CallsAndy HuffNo ratings yet

- Chapter 1 - The Foundations of EconomicsDocument7 pagesChapter 1 - The Foundations of EconomicsFana HiranandaniNo ratings yet

- Entrepreneurship Business Plan DR John ProductDocument11 pagesEntrepreneurship Business Plan DR John ProductsuccessseakerNo ratings yet

- TERM PAPER On PRANDocument21 pagesTERM PAPER On PRANSmookers Heaven0% (1)

- Harsad Mehta ScamDocument12 pagesHarsad Mehta ScamGayatri SethNo ratings yet

- Global Supply Chain Business ProcessDocument5 pagesGlobal Supply Chain Business ProcessDeepthi PakalapatiNo ratings yet

- 5a. Tutorial 5Document7 pages5a. Tutorial 5Siew Hui En A20A1947No ratings yet

- Asset Valuation Derivative . Guide For New InvestorsDocument2 pagesAsset Valuation Derivative . Guide For New InvestorsShashank PalNo ratings yet

- Rostow Stages of Economic DevelopmentDocument2 pagesRostow Stages of Economic DevelopmentJhay Shadow100% (1)

- M&a Twitter and Elon MuskDocument18 pagesM&a Twitter and Elon MuskKosHanNo ratings yet

- Submitted By: Vivek SharmaDocument18 pagesSubmitted By: Vivek SharmaVe1kNo ratings yet

- A Study On Social Media As A Marketing-1Document14 pagesA Study On Social Media As A Marketing-1barbie gogoiNo ratings yet

- Economic System: Planned EconomyDocument8 pagesEconomic System: Planned EconomyHossain Mohammad Abin100% (2)

- Mark Plan and Examiner'S Commentary: General CommentsDocument19 pagesMark Plan and Examiner'S Commentary: General CommentsvikkyNo ratings yet

- Market StructureDocument37 pagesMarket StructureJëssiçä R. ArëllanöNo ratings yet

- A Study On Customer Satisfaction Towards ROYAL ENFIELD BIKES, TrichyDocument6 pagesA Study On Customer Satisfaction Towards ROYAL ENFIELD BIKES, TrichyLarance GNo ratings yet

- FN3092 Corporate FinanceDocument2 pagesFN3092 Corporate Financemrudder1999No ratings yet

- Palawan State UnversityDocument3 pagesPalawan State UnversityJoel PangisbanNo ratings yet

- SoftwareAG 2010 Annual Report Tcm16-84432Document162 pagesSoftwareAG 2010 Annual Report Tcm16-84432Rodrigo LuisNo ratings yet

- Case Study ExampleDocument6 pagesCase Study ExampleNurhafizah RamliNo ratings yet

- DEEPAKDocument1 pageDEEPAKShivangi SaxenaNo ratings yet

- MBA 644 2019 Individual Assignment 1 - Gautam SaseedharanDocument6 pagesMBA 644 2019 Individual Assignment 1 - Gautam SaseedharanGautamNo ratings yet

- Pestle, Porters 5 Forces and Cultural Web For Strategy of Marks and SpencerDocument1 pagePestle, Porters 5 Forces and Cultural Web For Strategy of Marks and SpencerMac Corleone0% (1)

- Notice: Order Exempting Non-Convertible Preferred Securities From Rule 611 (A), Etc.Document2 pagesNotice: Order Exempting Non-Convertible Preferred Securities From Rule 611 (A), Etc.Justia.comNo ratings yet

- SLIM - DDM - Module 2 - Class 2 - Nov 2019Document62 pagesSLIM - DDM - Module 2 - Class 2 - Nov 2019Nisal WickramasingheNo ratings yet

- Study On Consumer Sales Promotion of Apparel Retail StoresDocument53 pagesStudy On Consumer Sales Promotion of Apparel Retail Storesparinaym143100% (5)

- Impossible TrinityDocument43 pagesImpossible TrinityArnab Kumar SahaNo ratings yet

- A Comprehensive Study On Forward Integration Supply Chain Management in Pharma IndustryDocument10 pagesA Comprehensive Study On Forward Integration Supply Chain Management in Pharma Industrynandini vyasNo ratings yet

- Pricing Construction Work: A Marketing Viewpoint: Martin Skitmore, Hedley SmythDocument49 pagesPricing Construction Work: A Marketing Viewpoint: Martin Skitmore, Hedley SmythAmith SoyzaNo ratings yet