Professional Documents

Culture Documents

Sell Up Pack Up and Take Off - Stephen Watt and Colleen Ryan

Uploaded by

Allen & Unwin0%(4)0% found this document useful (4 votes)

5K views15 pagesBali? Thailand? Spain? France? Is living in a beautiful, exotic location a completely impossible dream? Not with this sensible and practical guide to the how, why and when of establishing a new life overseas.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBali? Thailand? Spain? France? Is living in a beautiful, exotic location a completely impossible dream? Not with this sensible and practical guide to the how, why and when of establishing a new life overseas.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0%(4)0% found this document useful (4 votes)

5K views15 pagesSell Up Pack Up and Take Off - Stephen Watt and Colleen Ryan

Uploaded by

Allen & UnwinBali? Thailand? Spain? France? Is living in a beautiful, exotic location a completely impossible dream? Not with this sensible and practical guide to the how, why and when of establishing a new life overseas.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 15

Whether youre 40-plus and feeling burnt out, or 50-plus and

approaching retirement, this is the perfect book for you. Find

out how to live an exciting and comfortable but cheaper life

overseason a long term or trial basis.

Sell Up, Pack Up and Take Of tells you about people who are

living the dream in Asia and Europe, making their dollar go

furtherwith better houses, a better social life, more luxury

and more adventure.

And you can do it too. In this book youll discover the pros

and cons of the great countries you can live in at a quarter of

the cost of Australia; the tricks of buying or renting a house;

how to get a visa; and how to manage your health insurance,

pension, super and tax.

Now that 60 is the new 40, its time to get positive and go

for it. A better life is yours for the taking.

Want to have a more luxurious lifestyle and

better house at a fraction of the cost?

Everything you need to know about

visas buying or renting property living costs

health care tax insurance and the cost of living

for Bali, Thailand, Malaysia, Spain and more

Cover design: Alissa Dinallo

Cover image: Thomas Flgge/Getty Images

L I F E S T Y L E

GLOSS L AMI NAT I ON

Stephen Wyatt and Colleen Ryan are both economists with majors in

accounting. Colleen worked as a tax accountant for an international

accounting rm in her early career and Stephen was a banker with

Merrill Lynch. They have lived overseas several times, most recently

in Shanghai, where they were the joint China correspondents for

the Australian Financial Review from 2004 to 2010.

Every effort has been made to provide accurate and authoritative information in this book.

Neither the publisher nor the author accepts any liability for injury, loss or damage caused

to any person acting as a result of information in this book nor for any errors or omissions.

Readers are advised to obtain advice from a licensed financial planner before acting on the

information contained in this book.

Extracts on pages 112 and 113 from Jon Swains River of Time (1997) are reproduced by

permission of the author.

First published in 2014

Copyright Stephen Wyatt and Colleen Ryan 2014

All rights reserved. No part of this book may be reproduced or transmitted in

any form or by any means, electronic or mechanical, including photocopying,

recording or by any information storage and retrieval system, without prior

permission in writing from the publisher. The Australian Copyright Act 1968

(the Act) allows a maximum of one chapter or 10 per cent of this book, whichever

is the greater, to be photocopied by any educational institution for its educational

purposes provided that the educational institution (or body that administers it) has

given a remuneration notice to Copyright Agency (Australia) under the Act.

Allen & Unwin

Sydney, Melbourne, Auckland, London

83 Alexander Street

Crows Nest NSW 2065

Australia

Phone: (61 2) 8425 0100

Email: info@allenandunwin.com

Web: www.allenandunwin.com

Cataloguing-in-Publication details are available

from the National Library of Australia

trove.nla.gov.au

ISBN 978 1 74331 785 3

Set in 11.75/14.75 pt Minion Pro by Bookhouse, Sydney

Printed and bound in Australia by Griffin Press

10 9 8 7 6 5 4 3 2 1

The paper in this book is FSC

certified.

FSC

promotes environmentally responsible,

socially beneficial and economically viable

management of the worlds forests.

C009448

Contents

Introduction vii

Chapter 1 Bali 1

Chapter 2 Thailand 20

Chapter 3 Malaysia 50

Chapter 4 Vietnam 76

Chapter 5 Cambodia 106

Chapter 6 Europe 128

Chapter 7 Superannuation 158

Chapter 8 Pensions 167

Chapter 9 Taxation 175

Chapter 10 Health insurance 188

Conclusion Thoughts in the bath 197

Appendices

Property 207

Visas 213

Acknowledgements 235

About the authors 237

vii

Introduction

It is a time to be free.

There are not many periods in life when you experience freedom.

Most of us enjoyed freedom in our late teens, twenties and even our

early 30s; pre-marriage and before the kids arrived; before mortgage

and debt and work took on a great seriousness.

But once the kids mature and become self-sufficient, and once

debts are paid and your working life ends, suddenly you enter another

period of immense freedom. It is back to your twenties again.

And you can enjoy it now just as you did when you were young

and free.

All you need to do is be clever and brave enough to change your

lifestyle and leverage the benefits of freedom.

It doesnt matter if you are 40 or 70. If you have reached a turning

point in your life then clean the slate, look at all the options, be brave.

And if you are facing retirement then remember that it is an

opportunity, not a death sentence. It is an extraordinary opportunity

to grasp afresh at life; to live life to the full. After all, at 60 there

really isnt a lot of it left. We need to make the most of it.

This book gives you an alternative. It offers up the chance for

another life. A new life in another country for a year, a few years or

forever and a cheaper life that will make those dollars go a lot further.

viii Sell Up, Pack Up and Take Off

Another time for big decisions

There are a few critical decision-making times in life. One such time

was back in your youth when you were deciding on which career to

follow, who to marry, where to live, whether to have children.

Now is another critical time when you need to make decisions

about how to live a new phase of your life. Do you stay put, and live

as you have lived for the past thirty or so years, or do you sell up,

pack up and take off ?

Whether you are 40 and burnt-out or 60 and facing an entirely

new landscape, decision time can be daunting.

If you are a baby boomer the chances are the kids have grown up.

The dog is dead. The job has ended or its just too intolerable to put

up with any more. The house where you have lived for decades is now

too big. And youve still got maybe twenty good years ahead of you.

What the hell are you going to do?

Stay in that family home? Get another dog to make you feel like

you have kids again? Hang about to look after the grandchildren?

Count your pennies and scrimp because those retirement savings

do not go nearly as far as you thought they would? Go to the same

club, pub, restaurant or golf course that you have gone to for the

past ten years? Watch your friends die? Watch a lot more TV?

Do the lawns a little more than you need to and get those edges

really sharp?

Well, you could. But why would you? It sounds pretty mind-

numbingly boring. There is a terrible sameness to it.

Sadly, that is the box that most retirees and indeed most people

decide to confine themselves to. This is the conventional mindset,

but it shouldnt be. There is no need to raise the white flag on life.

These days, the old 60 is the new 40. Get positive. Go for it.

There is a lot more living to do.

This book speaks to those who see retirement not as the sunset

years, but as the dawn to a new and exciting freedom. However, it

also speaks to those, of any age, who want the adventure of living

in another country, even if its only for a few years. It aims to help

people climb out of a dreary box and start living again.

ix Introduction

Once the kids mature and become self-sufficient,

and once debts are paid and your working life ends,

suddenly you enter another period of immense freedom.

It is back to your twenties again.

Life has changedwe live longer, healthier lives

Many Australians found themselves by travelling overseas when

they were young. And they havent stopped.

A very popular travel book, first published in 1975, was South

East Asia on a Shoestring. It was the bible to youth travel in Asia back

then. Today, its more likely to be called something like Retirement

in Asia on a Shoestring.

Since the baby boomer generation came of age, trips with the

kids to Bali and Thailand and Malaysia have been the norm. Many

Australians have worked and found partners overseas. And theyve

embraced medical tourism, whether it is a facelift in Thailand, a new

set of choppers in Bangkok or a full medical service in Singapore.

Life for Australians today is much more global than for previous

generationsand retirement will be too.

It is no longer a radical step to go and live overseas. Look at the

fly-in-fly-out workers in the mines of Western Australia. Many base

themselves in Bali today. It is not a big step to retire there.

And for the first time ever, technology allows us to live interna-

tionally but also stay close to loved ones. Technology has destroyed

the barriers historically confronted by those living in another country.

Jet travel allows you to be home in less than half a day from most

places in Asia. Email, Skype, smart-phones, iPads and computers

allow constant contact from anywhere.

When it comes to keeping in touch, living in Chiang Mai today

is not that different from living in Byron Bay and remaining close

to friends and family in Sydney.

So here is an alternative. Here is a new approach to life.

x Sell Up, Pack Up and Take Off

Sell up, pack up and take off

Sell that suburban house. Tell the kids and grandkids you love em

to death. Tell them that you are about to embark on an adventure,

but so, too, are they.

You want them to share in your new life and this will offer them

excitement and an adventure as well.

Add all or some of the funds from the sale of your house to the

superannuation fund. Call a taxi. Go to the airport. Get on a plane.

Go and live in splendour. Get a house on the beach in Malaysia, Bali,

Thailand, Cambodia or Vietnam.

Get some house help and really enjoy a G&T at sunset. Go for

a swim each morning. Forget watching the nightly TV news. Enjoy

the exotic life. Have the family over to visittheyll love it.

And guess what? It can be done at a fraction of the cost of living

in Australia. Sure, there are a few financial constraints and visa issues,

but these can be easily handledand you can still receive income

from your superannuation or receive your Australian pension.

Radical or sabbatical?

Of course, selling up, packing up and taking off is the radical

approach to change. Any move overseas needs a lot more research,

and this is what this book is about.

Change can be modest or aggressive.

For example, instead of selling up and taking off forever, some

may prefer renting out the family house in Australia rather than

selling it, then renting a home for themselves in Thailand or Bali or

wherever, rather than buying there.

Also, the move may be just for a few yearsa type of sabbatical

or extended holiday from your Australian life.

And you neednt have reached those mature years of life, either.

You may be 40 or 50 and just burnt out and sick of the life youre

leading. You might be feeling like you want to stop the world, get off,

run away from that daily grind and try a different life for a while.

Or you might just want the adventure. Escape is for all.

xi Introduction

The escape spectrum

There is a spectrum of escape: from running away forever, to escaping

for just a few months at a time. To put it simply, your options are:

Sell up, pack up and take off: the plan would be to live somewhere

else, perhaps forever.

Pack up and take off: keep the family home in Australia, rent it

out, then go and live for an extended period in a country you

have always wanted to live in.

Take off for the lifestyle change: refresh and recharge. This may

mean living for six months in Australia and six months in another

country, or three months here and nine months elsewhere, or

nine months in Australia and three months overseas, and so on.

The beauty is that no matter who you are, how rich or poor you

are, or how old you are, there is an escape route that will suit you.

Often, the need to escape, or the need to embrace change, is

triggered by external factorslike a financial crisis, an illness or

death in the family, an inheritance or the end of ones working life.

We need to adapt. Many new retirees have dropped a bundle

in the latest global financial crisis when the stock market halved in

2009. And who knows what Australian house prices might do over

the next decade?

If your nest egg has been crushed or if, in fact, you never had

much of a nest egg at all, then life in Australia can become cripplingly

expensive. One solution is to move to a cheaper country and make

that nest egg go a lot further.

Add all or some of the funds from the sale of your

house to the superannuation fund. Call a taxi. Go to

the airport. Get on a plane. Go and live in splendour.

Get a house on the beach in Malaysia, Bali, Thailand,

Cambodia or Vietnam.

And its doable. There are few financial constraints

and visa issues can be easily handled.

xii Sell Up, Pack Up and Take Off

We have escaped several times over our lives. We lived in Papua

New Guinea in the mid-1970s, moved to London for two years, then

returned to Australia for our child-raising years.

We had two gorgeous kids and waited as long as we could before

packing up and taking off again.

Our first move with children was to Washington DC in the

mid-1990s where we worked as journalists. Our son Hamish was

eleven and our daughter Georgia was fifteen. We stayed for two

years. It was politically fascinating but socially stultifying. And

we realised that eleven and fifteen were not the right ages to shift

children about.

So we came back to Australia and stayed for five years as the kids

finished school. But the call to adventure returned and as soon as

Hamish completed year 12 and began university, we were off again:

this time to Shanghai, both working as journalists for an Australian

newspaper.

It was wonderful and enriched our lives and the childrens lives.

Hamish had a year or so off university and wrote for the Shanghai

Daily, the English language newspaper in Shanghai. Georgia also had

a year off from university and travelled widely with her brother, and

with us when we were on assignment to the backwaters of China.

Such trips enabled Georgia to witness terrible poverty and illness

and corruption. It had a profound impact on her and brought to her

a greater understanding of social injustice.

We were in China for six great years through to 2010, when

we returned to Australia. Not only did we witness the economic

renaissance of the most populous nation in the world, but we were

immersed in a new culture, new language, new politics and a total-

itarian system to boot, in a dynamic new city and country.

And it was wonderful for the dynamics of the family. There was

space created between our children and us. This, we believe, explains

a lot about the great relationship we have with our children today.

Eighteen and 21-year-olds are not easy to live with. They want their

independence and parents find this transition very difficult. Parents

want to keep control. Georgia and Hamish are now 28 and 31, well

adjusted, successful and happy.

xiii Introduction

We are telling you this because our experiences overseas enriched

our lives and our childrens lives. And also, because we have done

it, we feel that we have some justification to write about it; to talk

about selling up, packing up and taking off, particularly as it becomes

such a popular idea for so many people.

A new mega trend: life goes international

The trend of moving offshore for a new life is accelerating. You are

not going to be lonely.

Governments in the developed Western world are increasingly

unable to look after their aging populations. At the same time,

investors are targeting the growing global retirement market. It

represents a big new band of consumers.

Today, there are more than 3 million people, or 14 per cent of

Australias total population, over the age of 65.

This will more than double over the next 35 years to hit more

than 8 million people, about 23 per cent of the population, according

to the Australian Governments Intergenerational Report of 2010.

Australia is on the brink of a retirement savings disaster and the

government may not be able to fund the shortfalls. It is the same story

in the US and other developed economies. Over the next 40 years

in the US, the number of people over the age of 60 will more than

double to a staggering 80 million.

The implications are clear. The cost of health care will soar.

Medical services in the West will be stretched to the limit and

certainly become increasingly expensive. Demands on governments

to service an aging population will increase exponentially.

In Australia today about 25 per cent of total government spending

goes to health, age related pensions and aged care. The Australian

Treasury expects this to increase to 50 per cent of total government

spending by 2050.

Governments in the West will struggle to deliver services or

financial assistance. Government budgets are already stretched. Debt

levels in most developed countries are crippling even now.

Governments in the East, however, see this demographic change

as a new trigger of growth and employment creation.

xiv Sell Up, Pack Up and Take Off

There is going to be a new diasporaan international diaspora

of people aged over 50 moving from the developed world to the

cheaper developing world.

Consider the example of Geoffrey and Michael, who we met and

interviewed in Ubud, Bali. They moved there mainly for financial

reasons. They built and live in a Balinese-style home that flows out

onto tropical gardens. Heliconias with their striking orange claw-like

flowers, gingers with leaves the size of elephant ears and lush green

cordylines surround us as we chat on the verandah that overlooks

a pool.

When Geoffrey and Michael retired they realised that they

faced a life of poverty in expensive Australia. Now they live a life

of plenty in Ubud with staff to cater for their every need. And they

have money to spare.

The really great news is that they can do this on an Australian

pension.

Geoffrey and Michael are at the forefront of a new wave of emig-

ration. Migration will begin to reverse. Rather than from developing

economies to the developed, the trend will be an increasing drift

from the developed to the developing.

Life goes international

Once, the end of a working life meant greater freedom to travel

around Australia. This gave rise to the grey nomads roaming

Australia in campervans.

Or it meant a sea-change or a tree-change from the city to the

coast or the country.

Thats what Stephens parents did. They sold their city home and

business and bought a little farm near Orange, New South Wales.

They found a new life and celebrated the learning that goes with a

whole new experience. Their years from 55 to 80 were wonderful.

But the domestic sea- or tree-change does not give you any

great cultural diversity. Nor does it allow you to spin those limited

funds out for many more years, nor live in a much grander style in

a different environment.

xv Introduction

Staying within Australia was understandable 30 years ago. That

was really the only choice. Moving to another country was extreme

and dramatic. You virtually said goodbye to family and friends.

That was before the computer, before email and Skype, and before

cheap air travel.

These days, those looking for a change of environment are

moving from Sydney to Bali, or Melbourne to Bangkok, or Adelaide

to Phnom Penh; not from Sydney to Orange.

And the financial motivation is going to be prime.

There is going to be a new diasporaan international

diaspora of people aged over 50 moving from the

developed world to the cheaper developing world.

The domestically roaming grey nomads will soon be moving

internationally, too. They will become international grey nomads.

And itll be cheaper than roaming expensive Australia.

Governments in Southeast Asia know that a whole new industry is

about to expand. They have seen the surge in medical tourism. Now

it is going to be the international sea-changeretirement tourism.

This book takes a look at what sort of life you can have in an Asian

country, how much it costs to live there, and how you can fund it. It

addresses the financial, medical and visa issues of getting a new life.

And it looks at the different places where you can livethe variety

of cheap and safe but exotic countriesand the tricks you need to

know when it comes to buying or renting a house. It also addresses

the problems posed by illness and the financial aspects of managing

your superannuation and tax.

We spoke to many Australians who have packed up and taken

off, and they share their stories and experiencesthe good, the bad,

the ugly and the brilliant. They tell us what its like to actually live

the overseas dream.

This book, we hope, will offer up the possibility of a whole new

existence for those who are ready for the adventure.

xvi Sell Up, Pack Up and Take Off

Ti ps and traps

Once you have made the decision to sell up, pack up and take

off, just remember that the secret to every good trip is in the

planning.

We include plenty of details throughout the book to help

you plan your overseas adventure, but just to get you started

heres a quick checklist of questions you need to address before

you leave Australia:

Visas: How do I get a long-stay visa in my chosen country?

Taxation: Am I better off being a resident or non-resident

of Australia for tax purposes (even though I might be living

in another country)?

Superannuation: Can I keep Australias generous tax conces-

sions for my superannuation?

My house: Will my family home in Australia still be capital

gains tax-free if I rent it out when I leave these shores?

Pension: Can I still get the age pension when I am living

overseas?

Health insurance: Do I need private health insurance in

Australia, can I get Medicare benefits when I return to

Australia on visits, and do I need health insurance overseas?

237

About the authors

After more than 20 years in financial journalism, Stephen Wyatt and

Colleen Ryan now live near Byron Bay, where they have planted a

rainforest, surf, write and run www.planet-boomer.com.

Married with two adult kids, they have packed up and taken

off overseas to live several timesin Papua New Guinea, London,

Washington DC and, most recently, in Shanghai, where they were

the joint China correspondents for the Australian Financial Review

from 2004 to 2010.

Both are economists with majors in accounting: Colleen worked

as a tax accountant for an international accounting firm in her

early career and was later editor of the Australian Financial Review;

Stephen was a banker with Merrill Lynch for 15 years, before turning

to journalism.

Stephen and Colleen believe their experiences living abroad have

enriched both their own lives and those of their children. They are

passionate about the benefits of selling up, packing up and taking

off at various stages of life, especially retirement.

You might also like

- The Ten Best Countries in The World To Retire On Your Pension. Thailand, Malaysia, Vietnam, Cambodia, Bali, Spain, Portugal, Costa Rica, Belize and Panama: The Retirees Travel Guide Series, #5From EverandThe Ten Best Countries in The World To Retire On Your Pension. Thailand, Malaysia, Vietnam, Cambodia, Bali, Spain, Portugal, Costa Rica, Belize and Panama: The Retirees Travel Guide Series, #5No ratings yet

- The Ageless Secrets - VDocument50 pagesThe Ageless Secrets - VmartinsNo ratings yet

- How to Survive Retirement: Reinventing Yourself for the Life You?ve Always WantedFrom EverandHow to Survive Retirement: Reinventing Yourself for the Life You?ve Always WantedNo ratings yet

- No One Ever Told Us That: Money and Life Lessons for Young AdultsFrom EverandNo One Ever Told Us That: Money and Life Lessons for Young AdultsRating: 5 out of 5 stars5/5 (1)

- Dreaming Down Under: Your practical guide to creating a new life in AustraliaFrom EverandDreaming Down Under: Your practical guide to creating a new life in AustraliaNo ratings yet

- Experiential Billionaire: Build a Life Rich in Experiences and Die With No RegretsFrom EverandExperiential Billionaire: Build a Life Rich in Experiences and Die With No RegretsNo ratings yet

- The Ageless SecretsDocument95 pagesThe Ageless SecretsGabriel Gonzales100% (1)

- The No-Regrets Guide to Retirement: How to Live Well, Invest Wisely and Make Your Money LastFrom EverandThe No-Regrets Guide to Retirement: How to Live Well, Invest Wisely and Make Your Money LastNo ratings yet

- Generation Cherry: Retired? Redundant? Rethink! Powerful strategies to give you a second bite of the cherryFrom EverandGeneration Cherry: Retired? Redundant? Rethink! Powerful strategies to give you a second bite of the cherryNo ratings yet

- Your Best Days are ahead of you: Reverse the rut and unleash the best version of youFrom EverandYour Best Days are ahead of you: Reverse the rut and unleash the best version of youNo ratings yet

- Mastering Your IncomeDocument19 pagesMastering Your IncomeDarryl470% (1)

- Celebrating Life On Our Own Terms: Older and Bolder, #2From EverandCelebrating Life On Our Own Terms: Older and Bolder, #2No ratings yet

- 101 Ways to Enjoy Retirement: Discover Unique Hobbies from Around the World to Start TodayFrom Everand101 Ways to Enjoy Retirement: Discover Unique Hobbies from Around the World to Start TodayNo ratings yet

- The Motley Fool Investment Guide for Teens: 8 Steps to Having More Money Than Your Parents Ever Dreamed OfFrom EverandThe Motley Fool Investment Guide for Teens: 8 Steps to Having More Money Than Your Parents Ever Dreamed OfRating: 4 out of 5 stars4/5 (10)

- The Laughing Boomer: Retire from Work - Gear Up for Living!From EverandThe Laughing Boomer: Retire from Work - Gear Up for Living!No ratings yet

- Breaking Ranks: To Help Society Sometimes You Must Break Its RulesFrom EverandBreaking Ranks: To Help Society Sometimes You Must Break Its RulesNo ratings yet

- Live Happier, Live Longer: Your guide to positive ageing and making the most of lifeFrom EverandLive Happier, Live Longer: Your guide to positive ageing and making the most of lifeNo ratings yet

- Expat Intelligence: Relax & Make Yourself at Home Abroad Hilarious Curiosities, Etiquette and Serious Resources for Long-Term Travel in Europe, Asia and South AmericaFrom EverandExpat Intelligence: Relax & Make Yourself at Home Abroad Hilarious Curiosities, Etiquette and Serious Resources for Long-Term Travel in Europe, Asia and South AmericaNo ratings yet

- Learn To Get Better at TransitionsDocument5 pagesLearn To Get Better at Transitionsmeghraj gurjarNo ratings yet

- How to Pay Your Mortgage Off in 10 Years: (Even when interest rates are going up)From EverandHow to Pay Your Mortgage Off in 10 Years: (Even when interest rates are going up)No ratings yet

- Life Skills for Young Adults: How to Survive Each Day and the Rest of Your Life.From EverandLife Skills for Young Adults: How to Survive Each Day and the Rest of Your Life.No ratings yet

- Tenacious Abundance: Simple Habits & Hacks for Being Happy, Healthy, Wealthy & WiseFrom EverandTenacious Abundance: Simple Habits & Hacks for Being Happy, Healthy, Wealthy & WiseNo ratings yet

- Debt-Free at Forty-Three: How I Achieved Financial Freedom in My 40s Through Smart Saving, Spending, and InvestingFrom EverandDebt-Free at Forty-Three: How I Achieved Financial Freedom in My 40s Through Smart Saving, Spending, and InvestingNo ratings yet

- 50 Years – 50 Lessons!: A Middle-Aged Man's Suggestions for Not Fecking Things Up - Now and in Later Life!From Everand50 Years – 50 Lessons!: A Middle-Aged Man's Suggestions for Not Fecking Things Up - Now and in Later Life!No ratings yet

- What If You Live?: The Truth About Retiring in the Early Twenty-First CenturyFrom EverandWhat If You Live?: The Truth About Retiring in the Early Twenty-First CenturyNo ratings yet

- HAPPY NEW YEAR! The 7 Acts of Happiness that’ll Make Your New Year the Best Year Ever!: Daily Happiness Habits for the New Year, 2019!From EverandHAPPY NEW YEAR! The 7 Acts of Happiness that’ll Make Your New Year the Best Year Ever!: Daily Happiness Habits for the New Year, 2019!No ratings yet

- Race to the Finish Line: Social Dynamics in Retirement CommunitiesFrom EverandRace to the Finish Line: Social Dynamics in Retirement CommunitiesNo ratings yet

- The Runway Decade: Building a Pre-Retirement Flight Plan in Your FiftiesFrom EverandThe Runway Decade: Building a Pre-Retirement Flight Plan in Your FiftiesNo ratings yet

- How to Live to Be 100—And Like It!: A Handbook for the Newly RetiredFrom EverandHow to Live to Be 100—And Like It!: A Handbook for the Newly RetiredNo ratings yet

- New Normal - Working From Home & Loving It! by S. CharleboisDocument112 pagesNew Normal - Working From Home & Loving It! by S. CharleboisSuzanne CharleboisNo ratings yet

- Older and Wiser: Inspiration and Advice for Retiring Baby BoomersFrom EverandOlder and Wiser: Inspiration and Advice for Retiring Baby BoomersNo ratings yet

- How to be Good and Rich: Strategic Honesty | 40 Personal Branding Principles Based on Integrity and TrustFrom EverandHow to be Good and Rich: Strategic Honesty | 40 Personal Branding Principles Based on Integrity and TrustNo ratings yet

- The Self-Sufficient Global Citizen: A Guide for Responsible Families and CommunitiesFrom EverandThe Self-Sufficient Global Citizen: A Guide for Responsible Families and CommunitiesNo ratings yet

- Learn to Earn: A Beginner's Guide to the Basics of Investing andFrom EverandLearn to Earn: A Beginner's Guide to the Basics of Investing andRating: 4 out of 5 stars4/5 (57)

- Never Worry About Retirement Again: A Financial Guide to a More Stress-Free, Happy RetirementFrom EverandNever Worry About Retirement Again: A Financial Guide to a More Stress-Free, Happy RetirementNo ratings yet

- Keys To Ageless LivingDocument38 pagesKeys To Ageless LivingdjoleNo ratings yet

- The One That Got Away ExtractDocument37 pagesThe One That Got Away ExtractAllen & UnwinNo ratings yet

- Sidelines Chapter SamplerDocument19 pagesSidelines Chapter SamplerAllen & UnwinNo ratings yet

- Dame Suzy D - Dame Susan DevoyDocument31 pagesDame Suzy D - Dame Susan DevoyAllen & UnwinNo ratings yet

- The Grimmelings - Rachael KingDocument17 pagesThe Grimmelings - Rachael KingAllen & UnwinNo ratings yet

- Menopause Brain by DR Lisa Mosconi ExtractDocument51 pagesMenopause Brain by DR Lisa Mosconi ExtractAllen & Unwin50% (2)

- Bookshop Dogs - Ruth ShawDocument21 pagesBookshop Dogs - Ruth ShawAllen & UnwinNo ratings yet

- Dark Arena Chapter SamplerDocument27 pagesDark Arena Chapter SamplerAllen & UnwinNo ratings yet

- The Blue Gum Camp Chapter SamplerDocument45 pagesThe Blue Gum Camp Chapter SamplerAllen & UnwinNo ratings yet

- Whenever You're Ready ExtractDocument10 pagesWhenever You're Ready ExtractAllen & UnwinNo ratings yet

- The In-Between Chapter SamplerDocument18 pagesThe In-Between Chapter SamplerAllen & Unwin100% (1)

- Body of Lies Chapter SamplerDocument19 pagesBody of Lies Chapter SamplerAllen & UnwinNo ratings yet

- Glenrock Chapter SamplerDocument40 pagesGlenrock Chapter SamplerAllen & UnwinNo ratings yet

- Stone Yard Devotional ExcerptDocument32 pagesStone Yard Devotional ExcerptAllen & UnwinNo ratings yet

- Dressmaker & The Hidden SoldierDocument15 pagesDressmaker & The Hidden SoldierAllen & Unwin100% (1)

- And Then She Fell Chapter SamplerDocument23 pagesAnd Then She Fell Chapter SamplerAllen & UnwinNo ratings yet

- On The Record by Steven Joyce ExcerptDocument18 pagesOn The Record by Steven Joyce ExcerptAllen & UnwinNo ratings yet

- Resurrection Walk by Michael Connelly ExcerptDocument29 pagesResurrection Walk by Michael Connelly ExcerptAllen & UnwinNo ratings yet

- Alex: Through My Eyes - Australian Disaster Zones by Rosanne Hawke, Edited by Lyn WhiteDocument22 pagesAlex: Through My Eyes - Australian Disaster Zones by Rosanne Hawke, Edited by Lyn WhiteAllen & UnwinNo ratings yet

- Green Dot ExtractDocument25 pagesGreen Dot ExtractAllen & UnwinNo ratings yet

- The Seven Chapter SamplerDocument24 pagesThe Seven Chapter SamplerAllen & UnwinNo ratings yet

- The Dressmaker & The Hidden SoldierDocument22 pagesThe Dressmaker & The Hidden SoldierAllen & UnwinNo ratings yet

- Resilient Grieving - DR Lucy HoneDocument11 pagesResilient Grieving - DR Lucy HoneAllen & UnwinNo ratings yet

- The House With The Lights On Chapter SamplerDocument35 pagesThe House With The Lights On Chapter SamplerAllen & UnwinNo ratings yet

- The Unearthed Chapter SamplerDocument23 pagesThe Unearthed Chapter SamplerAllen & UnwinNo ratings yet

- This Is ADHD - Chanelle MoriahDocument12 pagesThis Is ADHD - Chanelle MoriahAllen & Unwin0% (2)

- The Watchful Wife Chapter SamplerDocument23 pagesThe Watchful Wife Chapter SamplerAllen & UnwinNo ratings yet

- Dice Chapter SamplerDocument28 pagesDice Chapter SamplerAllen & UnwinNo ratings yet

- Resurrection Walk Chapter SamplerDocument18 pagesResurrection Walk Chapter SamplerAllen & UnwinNo ratings yet

- Immaculate Chapter SamplerDocument24 pagesImmaculate Chapter SamplerAllen & UnwinNo ratings yet

- Things That Matter Most Chapter SamplerDocument43 pagesThings That Matter Most Chapter SamplerAllen & UnwinNo ratings yet

- South Africa 2014/15 Potato Industry ReportDocument122 pagesSouth Africa 2014/15 Potato Industry ReportGRAMYA Pvt Ltd.No ratings yet

- Item Name HSN Code GST Rate QTY Taxable Rate Taxable ValueDocument4 pagesItem Name HSN Code GST Rate QTY Taxable Rate Taxable ValueAnup gurung100% (3)

- UDA Consultant RFPDocument31 pagesUDA Consultant RFPASHUTOSHNo ratings yet

- ECO211 Group Assignment InfographicDocument6 pagesECO211 Group Assignment InfographicAmaninaYusriNo ratings yet

- p5 2007 Dec QDocument12 pagesp5 2007 Dec QJacqueline NashNo ratings yet

- Gepco Online BillDocument2 pagesGepco Online BillHafiz RizwanNo ratings yet

- Uganda's National 4IR StrategyDocument15 pagesUganda's National 4IR StrategyThe Independent Magazine100% (1)

- New Board Format - Om GangaDocument32 pagesNew Board Format - Om Gangakalra31No ratings yet

- Observatory On The Protection of Taxpayers' RightsDocument284 pagesObservatory On The Protection of Taxpayers' RightsRoberto RamosNo ratings yet

- 3520437Document31 pages3520437ABNo ratings yet

- C Dobbyn PayslipsDocument2 pagesC Dobbyn PayslipsTanya CherryNo ratings yet

- Chapter 3 - Accumulating Costs For Products and Services (1-20)Document24 pagesChapter 3 - Accumulating Costs For Products and Services (1-20)JAY AUBREY PINEDA100% (1)

- Kotz, McDonough, Reich, Boyer Etc Estrutura Social de Acumulação, ConferênciaDocument538 pagesKotz, McDonough, Reich, Boyer Etc Estrutura Social de Acumulação, ConferênciaaflagsonNo ratings yet

- The Theory of InflationDocument16 pagesThe Theory of InflationJoseph OkpaNo ratings yet

- Wasiq ShaheenDocument2 pagesWasiq ShaheenWsi ChohanNo ratings yet

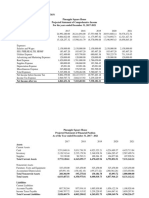

- Five-Year Financial Projection Pineapple Square House Projected Statement of Comprehensive Income For The Years Ended December 31, 2017-2021Document4 pagesFive-Year Financial Projection Pineapple Square House Projected Statement of Comprehensive Income For The Years Ended December 31, 2017-2021Rey PordalizaNo ratings yet

- The Political Environment: A Critical Concern: True / False QuestionsDocument82 pagesThe Political Environment: A Critical Concern: True / False QuestionsManal MansourNo ratings yet

- Inheritance Tax Case AnalyzedDocument3 pagesInheritance Tax Case AnalyzedBenedick LedesmaNo ratings yet

- The Informal Economy: Social Forces and Economic TransactionsDocument23 pagesThe Informal Economy: Social Forces and Economic TransactionsMartin RiveroNo ratings yet

- UNAM Pharma PayslipDocument2 pagesUNAM Pharma PayslipFake PopcornNo ratings yet

- Interplay Between CSR and GST: ITC AvailabilityDocument8 pagesInterplay Between CSR and GST: ITC AvailabilityAkanksha BohraNo ratings yet

- Charese Johnson Complaint - Sovereign Citizens Trust Funds IRS ScamDocument21 pagesCharese Johnson Complaint - Sovereign Citizens Trust Funds IRS ScamBeverly TranNo ratings yet

- Summary of Fund Perf - Sept 2012 LIFE ACCOUNTDocument4 pagesSummary of Fund Perf - Sept 2012 LIFE ACCOUNTJohn SmithNo ratings yet

- Commissioner vs Isabela CulturalDocument2 pagesCommissioner vs Isabela CulturalKim Lorenzo Calatrava100% (2)

- Labor Rights of Cooperative EmployeesDocument4 pagesLabor Rights of Cooperative EmployeesAndrei Da JoseNo ratings yet

- DTC Revised SummaryDocument1 pageDTC Revised SummaryChirag GanjawallaNo ratings yet

- Marketing Management - Group Project ReportDocument32 pagesMarketing Management - Group Project ReportChandan BhartiNo ratings yet

- Ashirbad Production HomeDocument4 pagesAshirbad Production Homeanon_913070355No ratings yet

- Economics, Identified Competencies and CoursesDocument13 pagesEconomics, Identified Competencies and CoursesBekeleNo ratings yet

- Hsslive-XII-CA-8.Practical 8-Payroll AccountingDocument3 pagesHsslive-XII-CA-8.Practical 8-Payroll AccountingAashyNo ratings yet