Professional Documents

Culture Documents

Financial Report On State Bank of India

Uploaded by

Ashish YadavOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Report On State Bank of India

Uploaded by

Ashish YadavCopyright:

Available Formats

1

PROJECT REPORT

ON

COMPARATIVE STUDY OF FINANCIAL PERFORMANCE OF STATE BANK OF

INDIA AND BANK OF BARODA

Dr. Gaur Hari Singhania Institute of Management and Research

Dr. Gaur Hari Singhania Institute Of Management And Research

Submitted to:

Institute mentor

Director Sir

Submitted by:

Jayati Poddar

Roll No. 1340

Sec- A

2

DECLARATION

I, Jayati Poddar studying in Dr. Gaur Hari Singhania Institute Of Management and Research do

hereby declare that this project relating to the study of ratio analysis and the title Comparative

Study Of Financial Performance Of State Bank Of India And Bank Of Baroda has been

prepared by me after undergoing the study as part of the PGDM program of GHS-IMR.

I, express a thanks to my Institute mentor- Prof. Prithvi Yadav Sir, Director of GHS-IMR for his

support in the project.

I, further declare that this project work is the outcome of my efforts and not a replica of any other

report/work submitted to any University/ Boards.

Name of Student: Jayati Poddar

Place: Kanpur

3

ACKNOWLEDGEMENT

I express my gratitude to Prof. Prithvi Yadav sir, Director

Of GHS-IMR for providing me an opportunity to undergo summer training. And also for those

who have guided and inspired me in completing this study. I would like to express my deep

sense of gratitude to our Institute mentor Prof. Prithvi Yadav Sir for giving me support and

helping me during my project study.

I would like to express my gratitude to my institute guide Prof. Prithvi Yadav sir for his

constant encouragement and guidance without the task would not have been completed.

Last but not the least I would like to thank my parent and friends for their support.

THANKYOU ALL

Jayati Poddar

4

PREFACE

In any organization, the two important financial statements are the Balance Sheet and Profit &

Loss Account of the business. Balance Sheet is a statement of financial position of an enterprise

at a particular point of time. Profit & Loss account shows the net profit or net loss of a company

for a specified period of time. When these statements of the last few year of any organization are

studied and analyzed, significant conclusions may be arrived regarding the changes in the

financial position, the important policies followed and trends in profit and loss etc. Analysis and

interpretation of financial statement has now become an important technique of credit appraisal.

The investors, financial experts, management executives and the bankers all analyze these

statements. Though the basic technique of appraisal remains the same in all the cases but the

approach and the emphasis in the analysis vary. A banker interprets the financial statement so as

to evaluate the financial soundness and stability, the liquidity position and the profitability or the

earning capacity of borrowing concern. Analysis of financial statements is necessary because it

helps in depicting the financial position on the basis of past and current records. Analysis of

financial statements helps in making the future decisions and strategies. Therefore it is very

necessary for every organization whether it is a financial or manufacturing, to make financial

statement and to analyze it.

5

Table of content

Chapter No. Particulars Page no.

Acknowledgement 3

Preface 4

1 Introduction of banking 6-18

2 Company Profile 19-61

State bank of India

Bank of Baroda

3 Research methodology 83-85

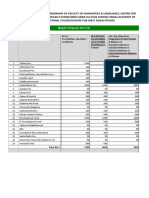

4 Financial Analysis 86-96

Ratio analysis

5 Financial comparative

analysis

97-104

6 Findings, suggestions and conclusions 105-112

7 References 113

6

INTRODUCTION OF BANKING

7

DEFINITION OF BANK

Banking Means "Accepting Deposits for the purpose of lending or Investment of deposits of

money from the public, repayable on demand or otherwise and withdraw by cheque, draft or

otherwise."

- Banking Companies (Regulation) Act,1949

ORIGIN OF THE WORD BANK:-

The origin of the word bank is shrouded in mystery. According to one view point the Italian

business house carrying on crude from of banking were called banchi bancheri" According to

another viewpoint banking is derived from German word "Branck" which mean heap or mound.

In England, the issue of paper money by the government was referred to as a raising a bank.

ORIGIN OF BANKING :

Its origin in the simplest form can be traced to the origin of authentic history. After recognizing

the benefit of money as a medium of exchange, the importance of banking was developed as it

provides the safer place to store the money. This safe place ultimately evolved in to financial

institutions that accepts deposits and make loans i.e., modern commercial banks.

Banking system in India

Without a sound and effective banking system in India it cannot have a healthy economy.The

banking system of India should not only be hassle free but it should be able to meet new

challenges posed by the technology and any other external and internal factors.

For the past three decades India's banking system has several outstanding achievements to its

credit. The most striking is its extensive reach. It is no longer confined to only metropolitans or

INTRODUCTION OF BANKING

8

cosmopolitans in India. In fact, Indian banking system has reached even to the remote corners of

the country. This is one of the main reasons of India's growth process.

HISTORY OF BANKING IN INDIA

Banking in India has its origin as early or Vedic period. It is believed that the transitions from

many lending to banking must have occurred even before Manu, the great Hindu furriest, who

has devoted a section of his work to deposit and advances and laid down rules relating to the rate

of interest. During the mogul period, the indigenous banker played a very important role in

lending money and financing foreign trade and commerce.

During the days of the East India Company it was the turn of agency house to carry on the

banking business. The General Bank of India was the first joint stock bank to be established in

the year 1786. The other which followed was the Bank of Hindustan and Bengal Bank. The Bank

of Hindustan is reported to have continued till 1906. While other two failed in the meantime. In

the first half of the 19th century the East India Company established there banks, The bank of

Bengal in 1809, the Bank of Bombay in 1840 and the Bank of Bombay in1843. These three

banks also known as the Presidency banks were the independent units and functioned well.

These three banks were amalgamated in 1920 and new bank, the Imperial Bank of India was

established on 27th January, 1921.

With the passing of the State Bank of India Act in 1955 the undertaking of the Imperial Bank of

India was taken over by the newly constituted SBI. The Reserve Bank of India (RBI) which is

the Central bank was established in April, 1935 by passing Reserve bank of India act 1935. The

Central office of RBI is in Mumbai and it controls all the other banks in the country.

In the wake of Swadeshi Movement, number of banks with the Indian management were

established in the country namely, Punjab National Bank Ltd., Bank of India Ltd., Bank of

Baroda Ltd., Canara Bank. Ltd. on 19

th

July 1969, 14 major banks of the country were

nationalized and on 15

th

April 1980, 6 more commercial private sector banks were taken over by

the government.

The first bank in India, though conservative, was established in 1786. From 1786 till today,the

journey of Indian Banking System can be segregated into three distinct phases. They areas

mentioned below:

Early phase from 1786 to 1969 of Indian Banks

Nationalization of Indian Banks and up to 1991 prior to Indian banking sector Reforms.

9

New phase of Indian Banking System with the advent of Indian Financial & Banking

Sector Reforms after 1991.

Phase I

The General Bank of India was set up in the year 1786. Next came Bank of Hindustan and

Bengal Bank. The East India Company established Bank of Bengal (1809), Bank of Bombay

(1840) and Bank of Madras (1843) as independent units and called it Presidency Banks.

These three banks were amalgamated in 1920 and Imperial Bank of India was established which

started as private shareholders banks, mostly Europeans shareholders.

In 1865 Allahabad Bank was established and first time exclusively by Indians, Punjab National

Bank Ltd. was set up in 1894 with headquarters at Lahore. Between 1906 and 1913, Bank of

India, Central Bank of India, Bank of Baroda, Canara Bank, Indian Bank, and Bank of Mysore

were set up. Reserve Bank of India came in 1935.

During the first phase the growth was very slow and banks also experienced periodic failures

between 1913 and 1948. There were approximately 1100 banks, mostly small. To streamline the

functioning and activities of commercial banks, the Government of India came up with The

Banking Companies Act, 1949 which was later changed to Banking Regulation Act 1949 as per

amending Act of 1965 (Act No. 23 of 1965). Reserve Bank of India was vested with extensive

powers for the supervision of banking in India as the Central Banking Authority.

During those days public has lesser confidence in the banks. As an aftermath deposit

mobilization was slow. Abreast of it the savings bank facility provided by the Postal department

was comparatively safer. Moreover, funds were largely given to traders.

Phase II

Government took major steps in this Indian Banking Sector Reform after independence. In1955,

it nationalized Imperial Bank of India with extensive banking facilities on a large scale especially

in rural and semi-urban areas. It formed State Bank of India to act as the principal agent of RBI

and to handle banking transactions of the Union and State Governments all over the country.

Seven banks forming subsidiary of State Bank of India was nationalized in 1960 on 19th

July,1969, major process of nationalization was carried out. It was the effort of the then Prime

Minister of India, Mrs. Indira Gandhi. 14 major commercial banks in the country was

nationalized.

Second phase of nationalization Indian Banking Sector Reform was carried out in 1980 with

seven more banks. This step brought 80% of the banking segment in India under Government

ownership.

10

The following are the steps taken by the Government of India to Regulate Banking

Institutions in the Country: 1949: Enactment of Banking Regulation Act.

1955: Nationalization of State Bank of India.

1959: Nationalization of SBI subsidiaries.

1961: Insurance cover extended to deposits.

1969: Nationalization of 14 major banks.

1971: Creation of credit guarantee corporation.

1975: Creation of regional rural banks.

1980: Nationalization of seven banks with deposits over 200 crore.

After the nationalization of banks, the branches of the public sector bank India rose to

approximately 800% in deposits and advances took a huge jump by 11,000%.

Banking in the sunshine of Government ownership gave the public implicit faith and immense

confidence about the sustainability of these institutions.

Phase III

This phase has introduced many more products and facilities in the banking sector in its reforms

measure. In 1991, under the chairmanship of M Narasimhama, a committee was set up by his

name which worked for the liberalization of banking practices. The country is flooded with

foreign banks and their ATM stations. Efforts are being put to give a satisfactory service to

customers. Phone banking and net banking is introduced. The entire system became more

convenient and swift. Time is given more importance than money. The financial system of India

has shown a great deal of resilience. It is sheltered from any crisis triggered by any external

macroeconomics shock as other East Asian Countries suffered. This is all due to a flexible

exchange rate regime, the foreign reserves are high, the capital account is not yet fully

convertible, and banks and their customers have limited foreign exchange exposure.

BANKS IN INDIA

In India the banks are being segregated in different groups. Each group has their own benefits

and limitations in operating in India. Each has their own dedicated target market. Few of them

only work in rural sector while others in both rural as well as urban. Many even are only catering

in cities. Some are of Indian origin and some are foreign players.

All these details and many more is discussed over here. The banks and its relation with the

customers, their mode of operation, the names of banks under different groups and other such

useful informations are talked about.

11

One more section has been taken note of is the upcoming foreign banks in India. The RBI has

shown certain interest to involve more of foreign banks than the existing one recently. This step

has paved a way for few more foreign banks to start business in India.

BANKING STRUCTURE IN INDIA

SCHEDULED BANKS IN INDIA

(1) Scheduled Commercial Banks

Public Sector Banks

Private Sector

Banks

Foreign Banks In

India

Regional Rural

Banks

(26) (25) (29) (95)

Nationalized

Bank

Other Public

Sector Banks

(IDBI)

SBI And Its

Associates

Old Private

Banks

New Private

Banks

(2) Scheduled Cooperative Banks

Scheduled Urban Cooperative Banks

Scheduled State Cooperative Banks

Public Sector Banks

12

Public sector banks are those banks which are owned by the Government. The Govt. runs these

Banks. In India 14 banks were nationalized in 1969 & in 1980 another 6 banks were also

nationalized. Therefore in 1980 the number of nationalized bank 20. At present there are total 26

Public Sector Banks in India (As on 26-09-2009). Of these 19 are nationalised banks, 6(STATE

BANK OF INDORE ALSO MERGED RECENTLY) belong to SBI & associates group and 1

bank (IDBI Bank) is classified as other public sector bank. Welfare is their primary objective.

Nationalized banks

Allahabad Bank

Andhra Bank

Bank Of Baroda

Bank Of India

Bank Of Maharastra

Canara Bank

Central Bank Of India

Corporation Bank

Dena Bank

Indian Bank

Indian Overseas Bank

Oriental Bank Of

Commerce

Punjab & Sind Bank

Punjab National Bank

Syndicate Bank

UCO Bank

Union Bank Of India

United Bank Of India

Vijaya Bank

Other

Public

Sector

Banks

IDBI

(Industrial

Development

Bank Of

India)Ltd.

SBI & its Associates

State Bank of India

State Bank of Hyderabad

State Bank of Mysore

State Bank of Patiala

State Bank of Travancore

State Bank of Bikaner And Jaipur

(State Bank of Saurastra merged with

SBI in the year 2008 and State Bank of

Indore In 2010)

Private Sector Banks

13

These banks are owned and run by the private sector. Various banks in the country such as ICICI

Bank, HDFC Bank etc. An individual has control over there banks in preparation to the share of

the banks held by him.

Private banking in India was practiced since the beginning of banking system in India. The first

private bank in India to be set up in Private Sector Banks in India was IndusInd Bank. It is one of

the fastest growing Bank Private Sector Banks in India. IDBI ranks the tenth largest development

bank in the world as Private Banks in India and has promoted world class institutions in India.

The first Private Bank in India to receive an in principle approval from the Reserve Bank of

India was Housing Development Finance Corporation Limited, to set up a bank in the private

sector banks in India as part of the RBI's liberalization of the Indian Banking Industry. It was

incorporated in August 1994 as HDFC Bank Limited with registered office in Mumbai and

commenced operations as Scheduled Commercial Bank in January 1995. ING Vysya, yet another

Private Bank of India was incorporated in the year 1930

Private sector banks have been subdivided into following 2 categories:-

Old Private Sector Banks

Bank of Rajasthan Ltd.

Catholic Syrian Bank Ltd.

City Union Bank Ltd.

Dhanalakshmi Bank Ltd.

Federal Bank Ltd.

ING Vysya Bank Ltd.

Jammu and Kashmir Bank Ltd.

Karnataka Bank Ltd.

Karur Vysya Bank Ltd.

Lakshmi Vilas Bank Ltd.

Nainital Bank Ltd.

Ratnakar Bank Ltd.

SBI Commercial and International

Bank Ltd.

South Indian Bank Ltd.

Tamilnad Mercantile Bank Ltd.

United Western Bank Ltd.

New Private Sector Banks

Bank of Punjab Ltd. (since merged

with Centurian Bank)

Centurian Bank of Punjab (since

merged with HDFC Bank)

Development Credit Bank Ltd.

HDFC Bank Ltd.

ICICI Bank Ltd.

IndusInd Bank Ltd.

Kotak Mahindra Bank Ltd.

Axis Bank (earlier UTI Bank)

Yes Bank Ltd.

14

Foreign Banks In India

ABN AMRO Bank N.V.

Abu Dhabi Commercial

Bank Ltd

American Express Bank

Antwerp Diamond Bank

Arab Bangladesh Bank

Bank International

Indonesia

Bank of America

Bank of Bahrain & Kuwait

Bank of Ceylon

Bank of Nova Scotia

Bank of Tokyo Mitsubishi

UFJ

Barclays Bank

BNP Paribas

Calyon Bank

ChinaTrust Commercial

Bank

Citibank

DBS Bank

Deutsche Bank

HSBC (Hongkong &

Shanghai Banking

Corporation)

JPMorgan Chase Bank

Krung Thai Bank

Mashreq Bank

Mizuho Corporate Bank

Oman International Bank

Shinhan Bank

Socit Gnrale

Sonali Bank

Standard Chartered Bank

State Bank of Mauritius

Cooperative banks in India

15

The Cooperative bank is an important constituent of the Indian Financial System, judging by the

role assigned to co operative, the expectations the co operative is supposed to fulfil, their

number, and the number of offices the cooperative bank operate. Though the co operative

movement originated in the West, but the importance of such banks have assumed in India is

rarely paralleled anywhere else in the world. The cooperative banks in India plays an important

role even today in rural financing. The businesses of cooperative bank in the urban areas also has

increased phenomenally in recent years due to the sharp increase in the number of primary co-

operative banks.

Co operative Banks in India are registered under the Co-operative Societies Act. The cooperative

bank is also regulated by the RBI. They are governed by the Banking Regulations Act 1949 and

Banking Laws (Co-operative Societies) Act, 1965.

Rural banks in India

Rural banking in I ndia started since the establishment of banking sector in India. Rural Banks

in those days mainly focussed upon the agro sector. Regional rural banks in India penetrated

every corner of the country and extended a helping hand in the growth process of the country.

SBI has 30 Regional Rural Banks in India known as RRBs. The rural banks of SBI is spread in

13 states extending from Kashmir to Karnataka and Himachal Pradesh to North East. The total

number of SBIs Regional Rural Banks in India branches is 2349 (16%). Till date in rural banking

in India, there are 14,475 rural banks in the country of which 2126 (91%) are located in remote

rural areas.

Apart from SBI, there are other few banks which functions for the development of the rural areas

in India.

Few of them are as follows.

Haryana State Cooperative Apex Bank Limited

The Haryana State Cooperative Apex Bank Ltd. commonly called as HARCOBANK plays a

vital role in rural banking in the economy of Haryana State and has been providing aids and

financing farmers, rural artisans, agricultural labourers, entrepreneurs, etc. in the state and giving

service to its depositors.

NABARD

National Bank for Agriculture and Rural Development (NABARD) is a development bank in the

16

sector of Regional Rural Banks in India. It provides and regulates credit and gives service for the

promotion and development of rural sectors mainly agriculture, small scale industries, cottage

and village industries, handicrafts. It also finance rural crafts and other allied rural economic

activities to promote integrated rural development. It helps in securing rural prosperity and its

connected matters.

Sindhanur Urban Souharda Co-operative Bank

Sindhanur Urban Souharda Co-operative Bank, popularly known as SUCO BANK is the first of

its kind in rural banks of India. The impressive story of its inception is interesting and inspiring

for all the youth of this country.

United Bank of India

United Bank of India (UBI) also plays an important role in regional rural banks. It has expanded

its branch network in a big way to actively participate in the developmental of the rural and

semi-urban areas in conformity with the objectives of nationalisation.

Syndicate Bank

Syndicate Bank was firmly rooted in rural India as rural banking and have a clear vision of future

India by understanding the grassroot realities. Its progress has been abreast of the phase of

progressive banking in India especially in rural banks.

Fact Files of Banks in India

The first Bank in India to be given an ISO certification.

Canara Bank

The first Bank in Northern India to get ISO 9002 certification

for their selected branches.

Punjab and Sind

Bank

17

The first Indian Bank to have been started solely with Indian capital.

Punjab National

Bank

The first among the Private Sector Banks in Kerala to become Scheduled

Bank in 1946 under the RBI act.

South Indian Bank

Indias oldest,largest and the most successful commercial bank offering the

widest possible rang of domestic,international and NRI products and

services,through its vast network in India and overseas.

State Bank of India

Indias second largest Private Sector Bank and is now the largest scheduled

commercial bank in India.

The Federal Bank

Limited

Bank which started as Private Shareholders Banks,mostly European

shareholders.

Imperial Bank of

India

The first Indian Bank to open a branch outside India in London in 1946 and

the first to open a branch in continental Europe at Paris in 1974

Bank of India,

founded in 1906 in

Mumbai.

The oldest Public Sector Bank in India having branches all over India and

serving the customers for the last 132 years.

Allahabad Bank

18

The first Indian Commercial Bank which was wholly owned and managed by

Indians.

Central Bank of

India

INDIAN BANKING INDUSTRY

The Indian banking market is growing at an astonishing rate, with Assets expected to reach

US$1 trillion by 2010. An expanding economy, middleclass, and technological innovations are

all contributing to this growth.

The countrys middle class accounts for over 320 million People. In correlation with the growth

of the economy, rising income levels, increased standard of living, and affordability of banking

products are promising factors for continued expansion.

The Indian banking Industry is in the middle of an IT revolution, Focusing on the expansion of

retail and rural banking. Players are becoming increasingly customer -centric in their approach,

which has resulted in innovative methods of offering new banking products and services. Banks

are now realizing the importance of being a big playerand are beginning to focus their attention

on mergers and acquisitions to take advantage of economies of scale and/or comply with Basel II

regulation.Indian banking industry assets are expected to reach US$1 trillion by 2010 and are

poised to receive a greater infusion of foreign capital, says Prathima Rajan, analyst in Celent's

banking group and author of the report. The banking industry should focus on having a small

number of large players that can compete globally rather than having a large number of

fragmented players.

19

STATE BANK OF INDIA

20

STATE BANK OF INDIA

State Bank of India

Industry :Banks - Public Sector

Incorporation Year 1955

Chairman Pratip Chaudhuri

Managing Director Hemant G Contractor

Company Secretary -

Auditor B M Chatrath & Co/ Kalyaniwala & Mistry

Registered Office

State Bank Bhavan 8th Floor,

Madame Cama Road Nariman Point,

Mumbai, 400021, Maharashtra

Telephone 91-22-22883888/22022678

Fax 91-22-22855348

E-mail gm.snb@sbi.co.in

Website http://www.sbi.co.in

Face Value (Rs) 10

BSE Code 500112

BSE Group A

NSE Code SBIN

Bloomberg SBIN IN

Reuters SBI.BO

ISIN Demat INE062A01012

Market Lot 1

Listing

Ahmedabad,Chennai,Delhi,Kolkata,London,Mumbai,

NSE

Financial Year End 03

Book Closure Month May

AGM Month Jun

Registrar's Name & Address

Datamatics Financial Services, PlotNo-A-16-17 PartB, Cross

Lane MIDC, Marol Andheri (East), Mumbai - 400 093.

91-22-28213383/90/66

91-22-28369408

21

It is the largest Indian banking and financial services company (by turnover and total assets) with

its headquarters in Mumbai, India. It is state-owned. The bank traces its ancestry to British India,

through the Imperial Bank of India, to the founding in 1806 of the Bank of Calcutta, making it

the oldest commercial bank in the Indian Subcontinent. Bank of Madras merged into the other

two presidency banks, Bank of Calcutta and Bank of Bombay to form Imperial Bank of India,

which in turn became State Bank of India. The government of India nationalized the Imperial

Bank of India in 1955, with the Reserve Bank of India taking a 60% stake, and renamed it the

State Bank of India. In 2008, the government took over the stake held by the Reserve Bank of

India.

SBI provides a range of banking products through its vast network of branches in India and

overseas, including products aimed at non-resident Indians (NRIs). The State Bank Group, with

over 16,000 branches, has the largest banking branch network in India. SBI has 14 Local Head

Offices and 57 Zonal Offices that are located at important cities throughout the country. It also

has around 130 branches overseas.

With an asset base of $352 billion and $285 billion in deposits, SBI is a regional banking

behemoth and is one of the largest financial institutions in the world. It has a market share among

Indian commercial banks of about 20% in deposits and loans. T The State Bank of India is the

29th most reputed company in the world according to Forbes. Also SBI is the only bank featured

in the coveted "top 10 brands of India" list in an annual survey conducted by Brand Finance and

The Economic Times in 2010. The State Bank of India is the largest of the Big Four banks of

India, along with ICICI Bank, Punjab National Bank and HDFC Bankits main competitors.

History of state bank of India:

State Bank of India is the largest state-owned banking and financial services company in India.

The Bank provides banking services to the customer. In addition to the banking services, the

Bank through their subsidiaries, provides a range of financial services, which include life

insurance, merchant banking, mutual funds, credit card, factoring, security trading, pension fund

management and primary dealership in the money market.

The Bank operates in four business segments, namely Treasury, Corporate/ Wholesale Banking,

Retail Banking and Other Banking Business. The Treasury segment includes the investment

portfolio and trading in foreign exchange contracts and derivative contracts. The Corporate/

Wholesale Banking segment comprises the lending activities of Corporate Accounts Group, Mid

Corporate Accounts Group and Stressed Assets Management Group. The Retail Banking

segment consists of branches in National Banking Group, which primarily includes personal

banking activities, including lending activities to corporate customers having banking relations

with branches in the National Banking Group.

SBI provides a range of banking products through their vast network of branches in India and

overseas, including products aimed at NRIs. The State Bank Group, with over 16,000 branches,

has the largest banking branch network in India. The State bank of India is the 10th most reputed

company in the world according to Forbes. The bank has 156 overseas offices spread over 32

countries. They have branches of the parent in Colombo, Dhaka, Frankfurt, Hong Kong,

22

Johannesburg, London and environs, Los Angeles, Male in the Maldives, Muscat, New York,

Osaka, Sydney, and Tokyo. They have offshore banking units in the Bahamas, Bahrain, and

Singapore, and representative offices in Bhutan and Cape Town.

State Bank of India was incorporated in the year 1955. The Bank traces their ancestry to British

India, through the Imperial Bank of India, to the founding in 1806 of the Bank of Calcutta,

making them the oldest commercial bank in the Indian Sub-continent. The Government of India

nationalized the Imperial Bank of India in the year 1955, with the Reserve Bank of India taking a

60% stake, and name was changed to State Bank of India.

In the year 2001, the SBI Life Insurance Company was started by the Bank. They are the only

Bank that have been permitted 74% stake in the insurance business. The Bank's insurance

subsidiary 'SBI Life Insurance Company' is a joint venture with Cardif S.A in which Cardif holds

26% of the stake.

During the year 2005-06, the bank introduced 'SBI e-tax' an online tax payments facility for

direct and indirect tax payment. They also launched the centralized pension processing. The

Bank made a partnership with Tata Consultancy Services for setup C-Edg Technologies and

consulting services to the banking, financial services and insurance industry. The bank was noted

as 'The most preferred bank' in a survey by TV 18 in association with AC Nielsen-ORG Marg.

Also, the Bank was voted as 'The most preferred housing loan provider' in AWAAZ consumer

awards for the year 2006.

In the customer loyalty survey 2006-07 conducted by 'Business World', the Bank was ranked

number one in all parameters of customer satisfaction, service orientation, customer care/ call

center, customer loyalty and home loans. SBI Funds was judged 'Mutual fund of the year' by

CNBC/TV-18/CRISL. The Bank introduced new products and services such as web-based

remittance, instant fund transfer, online-trading and comprehensive cash management.

During the year 2007-08, the Bank launched 965 branches all over the country. They

inaugurated a new state-of-the art Dealing Room with online connectivity to all active forex

intensive Branches at Corporate Centre in Mumbai. They launched a new product, Construction

Equipment Loan to cater to construction Companies. Also, they introduced new products such as

SBI Reverse Mortgage Loan and SBI Home Plus in the areas of Home Loans.

During the year, the RBI transferred their entire shareholding in the Bank representing 59.73%

of the issued capital of the Bank to the Government of India. The Bank acquired 92.03% of

equity of Global Trade Finance Ltd. Consequently, GTFL became a subsidiary of the Bank.

They signed an MoU with the Indian railways for installing ATMs at 682 railway stations. In

March 2008, the Bank opened their 10,000th branch and became only the second bank in the

world to have more than 10,000 branches after China's ICBC. During the year 2008-09, the

company launched Import factoring, a new product in association with SBI Factors &

Commercial Services Ltd. They increased the number of branches for retail sale of gold coins

from 250 to 518. Also, they re-launched Gold Deposit Scheme at 50 branches to mobilize gold

from domestic market for deployment as metal loans to jewellers.

During the year, the Bank opened their 11,111th Branch at Sonapur (Kamrup District) in Assam.

They introduced three new products viz., SBI Special Home Loan, SBI Happy Home Loan and

SBI Lifestyle in response to the stimulus package announced by the Government of India. Also,

they entered into an exclusive arrangement with TATA Motors for handling the booking process

of TATA 'Nano' cars. During the year, the Bank launched on their web-site an on-line

application form for registering Auto Loan enquiries and expeditiously monitoring and

23

converting these leads into Auto Loans. Also, they launched 'e-invest' for the ASBA

(applications supported by blocked accounts) to aid investors for their equity subscriptions, IPO

and Rights applications.

During the year, the Bank set up a custodial services company namely SBI Custodial Services

Pvt. Ltd., in joint venture with Societe Generale, France. They signed letter of intent for setting

up of joint venture company for undertaking General Insurance Business. Also, they divested

10% equity stake in its wholly owned subsidiary SBI Pension Fund Pvt. Ltd at cost in favour of

its subsidiaries. In October 2008, the Bank signed an MoU with State General Reserve Fund

(SGRF) of Oman, for a general purpose private equity fund.

During the year, State Bank of Saurashtra (SBS), a wholly owned subsidiary of the Bank,

amalgamated with the Bank with effect from August 13, 2008. They signed a joint venture

agreement with Insurance Australia Group for undertaking General Insurance business. Also,

they signed a joint venture agreement with Macquarie Capital Group, Australia and IFC,

Washington for setting up an Infrastructure fund of USD 3 billion for investing in various

infrastructure projects in India.

During the year 2009-10, the Bank opened 1,049 branches, out of which branches were opened

in metro and urban areas with a view to increase the Bank's reach and be more accessible to

customers. In July 2009, SBI introduced 'SBI Loan to Affluent Pensioners' enabling the

government pensioners to avail personal loans upto Rs 3 lakh.

During the year, the Bank designed a special package, the Defence Salary Package, for

personnel of the three Armed Forces i.e. the Army, Navy and Air Force who maintain their

Salary accounts with them. As of March 2010, the Bank had 12,496 branches and 21,485 Group

ATMs. In June 2009, the company increased their shareholding in Nepal SBI Bank Ltd to

55.02% and thus Nepal SBI Bank Ltd became a subsidiary of the Bank with effect from June 14,

2009.

In May

2010, the Bank selected consortium of Elavon Incorporation, USA and Visa International, USA

as their joint venture (JV) partner for Merchant Acquiring Business. They set up a wholly owned

subsidiary, namely SBI Payment Services Pvt Ltd for conducting Merchant Acquiring Business.

In August 2010, State Bank of Indore was amalgamated with the Bank as per the scheme of

amalgamation approved by the Central Board.

During the year 2010-11, the Bank introduced 2 new products, namely 'Pushpa Ullas' and

'Arthias Plus' on pilot basis. They made substantial progress in establishing itself as a leading PE

fund player of the country. Also, they also signed a Joint Venture agreement with State General

Reserve Fund (SGRF) of Sultanate of Oman, a sovereign entity, to set up a general purpose

private equity fund with an initial corpus of USD 100 mn, expandable further to USD 1.5 bn.

During the year, the Bank opened 576 new branches besides merger of 470 branches of

erstwhile State Bank of Indore. Also, they opened 14 foreign offices during the year, taking the

total to 156. In July 1, 2010, the Bank launched their 'Green Channel Counter' at select branches

across the country.

In General Insurance business, the Bank launched limited operations in April 2010 for the

Corporate and Mid Corporate customers based at Mumbai, and it was expanded to six other

major locations in July 2010. In the Retail segment, the Bank launched their Long Term Home

Insurance business at Mumbai in October 2010, which was gradually extended to cover 56

24

RACPCs and RASMECCs. General Insurance SME business was launched on a pilot basis in

Mumbai and Chennai in February 2011. During the first quarter of the financial year 2011-12,

the Government of India issued the 'Acquisition of State Bank of India Commercial &

International Bank Ltd. vide notification dated July 29, 2011. Consequent to the said notification,

the undertaking of State Bank of India Commercial & International stands transferred to and vest

in State Bank of India with effect from July 29, 2011.

MILESTONE OF STATE BANK OF INDIA

1955 -

On 1st July State Bank of India was constituted under the State Bank

Of India Act 1955, for the purpose of taking over the undertaking and

business of the Imperial Bank of India. The Imperial Bank of India

was founded in 1921 under the Imperial Bank of India Act 1920. The Bank

transacts general banking business of every description including,

foreign exchange, merchant banking and mutual funds

1959 -

On September State Bank of India (Subsidiary Bank) Act was passed.

On October State Bank of Hyderabad become the first subsidiary of SBI.

1960 -

During this period, State Bank of Jaipur, State Bank of Bikaner,

State Bank of Indore, State Bank of Travancore, State Bank of Mysore,

State Bank Patiala and State Bank of Saurashtra became subsidiaries of the

bank.

1962 -

The Bhor State Bank Ltd was Amalgamated with the Bank bring the

Total number of minor State associated banks so amalgamated to five. A scheme for amalgamation of the

Bank of Aundh Ltd., was also approved.

On 20th August, the Unit Bank Ltd. Chennai was taken over by the Bank.

1963 -

In october Branch in London become bankers to the Indian High Commission, thereby

taking over a function till then performed by the office of RBI. Of the other business

transacted by the Branch, an important aspect was medium term loans mostly to Indian

shipping companies.

1969 -

On November 8th the Bank of Behar Ltd was amalgamated.

1972 -

A merchant banking division was set up in the central office to cater to promotional needs

of the corporate sector.

1977

During the year bank introduced the Perennial Pension Plan Scheme

Under which if the depositors make a regular monthly payment of a fixed

25

amount for a period of 84 to 132 months, they become eligible from

the 86th and 134th months respectively for getting a monthly pension of predetermined

amount forever.

In order to meet all the developmental needs of the villages

Including their social and cultural needs, the bank launched an integrated

Rural development programme, aimed at not only covering the credit needs

of agriculture and agricultural activities and village industries, but

also housing and social activities.

1980 -

Bank introduced the cash Certificate Scheme under which deposit

certificate are issued for a fixed period on payment of the issue price

specified for the respective maturity period and the face value

corresponding to the issue price plus interest compounded at

quarterly intervals is paid on maturity. The certificates are issued for the

face value of Rs 100, Rs 1000, Rs 10,000 and Rs 50,000 maturing

after 29,65,84 and 120 months.

1982 -

The Non-Resident Investment Cell was set up, which had streamlined

The working operations of the non-resident investment sections at

Important centers.

1983 -

SBI launched self employment scheme, for providing self-employment

To educated unemployed youth. Educated unemployed youths are

Encouraged to undertake self-employment ventures in industry, services and

business.

1984 -

The bank provide need-based rehabitation assistance to large and

medium sick industrial units.

1985 -

During the year, company set up a data bank of sick units available

for taken over by healthy units.With effect from 26th August, the Bank of Cochin Ltd

with 108 branches was also amalgamated with the Bank.

(i) All shares in the Capital of the Imperial Bank of India was

vested in the RBI. The SBI was registered with an Authorised capital of

Rs.20 crores, and an issued and paid up capital of Rs.562,50,000 divided

into 562,500 shares of Rs.100 each.

(ii) Every person who on the 30th June, 1955, was registered as a

holder of shares in the Imperial Bank of India was paid by the

Reserve Bank of India.

44,37,500 No. of shares issued at a premium of Rs 160 per share.

1986 -

At the end of the year 324 sick units with an outstanding of Rs 1069

crores were assisted. Of these, 107 units were considered viable and

60 from them were placed under regular nursing programme.

On 1st August a new subsidiary named SBI Capital Market was

functioning independently, took up leasing business and certain other new

26

services.

100,00,00 No. of shares issued at a prem. of Rs 160 per share.

1987 -

Up to the end of the year the bank had sponsored 30 Regional Rural

Banks covering 66 backward and underbanked districts in the country.

In terms of deployment, the advances portfolio of overseas offices

rose to Rs 5,767 crores. Investments in inter-bank money markets and

also in prime securities amounted to Rs 2,670 crores by the end of the

year.

1988 -

During the year bank initiated UPTECH an Industrial Technology Group

to direct and guide programmes aimed at facilitating technology

upgradation.

Also a scheme to develop enterpreneurship among woman under the name

Stree Shakti was launched. Several concessions in respect of margin

and and rate of interest have been built into the package. Three

pilot programmes were launched at Chennai, Calcutta, and Hyderabad.

On 20th September, the bank inaugurated `SBINET,' an integrated

communication project aimed at improving customer service,

operational efficiency and administrative convenience. The network has been

designed to handle voice, fax data and manages through the trunk

routes and exchanges in important centres.

The bank sponsored 30 RRB's covering 66 divisions in the country.

branches were opened raising the branch network to 2,306.

1989 -

SBICAP, in their capacity as Trustee and Manager of Mutual Fund,

launched two scheme viz., Mangnum Monthly Income Scheme 1989 and

Magnum Tax Service Scheme 1990.

During the same period SBI in association with Morgan Stanley Asset

Management Inc. of USA, launched the India Magnum Fund.

1990 -

New products launched during the year included a Regular Income

Scheme, offering an assured return in excess of 12% and the first Pure

Growth Scheme aimed at capital appreciation. A Second offshore fund of US

$ 12 million called Asian Convertible and Indian Fund was launched in

association with Asian Development Bank, Manila.

During Kharif 1990, the bank introduced an agricultural credit card,

known as SBI Green Card to give greater liquidity and flexibility to

farmers in procuring agricultural inputs. The scheme was introduced

on a pilot basis in 125 intensive centre branches.

As at on 31st March, SBIMF had over 3,40,000 Indian investors and

about Rs 475 crores by way of investible domestic funds.

50,00,000 No. of shares issued at a prem. of Rs 160 per share.

1991 -

During February the bank set up a new subsidiary called the SBI

Factors and Commercial Serviced Pvt. Ltd. for rendering factoring services

27

to the industrial and commercial units in Western India.

1992 -

The bank sponsored 30 RRBs with a network of 3189 offices covering

102 backward and under banked districts of the country. A sum of Rs

15.25 crores was contributed towards the share capital of the RRBs.

During the period bank intoduced `Stockinvest' scheme. Also

introduced a `Gyan Jyoti' that replaced earlier education loan schemes and

offers substantial augmented assistance to students pursuing higher

studies.

Moreover dedicated NRI branches equipped with State-of-the-art

technology was set up at Mumbai and Delhi to cater to the special

needs of NRI residents.

1993 -

During the year as a part of its overseas expansion the bank

established representative office in Tashkent.

During December, the bank issued 124,000,000 equity shares of Rs.10

each for cash at a premium of 90 per share of which 245,00,000

shareseach were reserved for allotment on a preferential basis to Indian

Financial Institutions and Indian Mutual Funds. Balance issued to

thepublic.

Simultaneously it came out with another issue of 50,00,000 12%

unsecured redeemable floating rate bonds in the nature of promisory

notes of the face value of 1000 each. Oversubscription upon a

furtheramount of Rs 500 crores (in all Rs 1000 crores) was to be allowed.

Theface value of each bond would be redeemed at par at the expiry of 10

years from the date of allotment. In the event that the State Bank

decides to exercise its option to call up the bonds they would be

redeemed at the rate of 5% at the end of 5th year, at 3% at the end

of7th year and 1% at the end of 9th year.

It was proposed to issue 1200,00,000 right equity shares of Rs.10

eachat a premium of Rs.50 per share in the proportion of 3:5. Also

another120,00,000 equity shares of Rs.10 each were to be issued at a

premiumof Rs.50 per share to employees on an equitable basis.

250 sick units with the bank were referred to the BIFR including 31

public sector units. Approved rehabilitation packages being

implemented in 85 units and 41 have been recommended to be wound up.

The bank continued to be appointed as the operating agency and

rehabilitation packages were submitted to BIFR in 48 cases.

Equity shares subdivided. 1418,50,000 No. of Equity Shares of Rs.

10each issued at a prem. of Rs 90 per share to the public. Another

1319,78,726 shares of Rs 10 each offered at a prem. of Rs 90 per

shareon Rights basis and to employees.

1994 -

358 sick units with the bank were referred to the BIFR including 55

public sector units. Approved rehabilitation packages implemented

in87 units.

28

1,80,463 No. of Shares kept in abeyance were issued.

1995 -

351 sick units with the bank were referred to the BIFR including 66

public sector units. Approved rehabilitation packages implemented

in112 units.

683 No. of shares kept in abeyance were allotted.

1996 -

On 3rd October the Bank Issued 261,45,000 GDRs amounting to

5,22,90,000equity shares. 1 GDR is issued to 2 equity shares. The issue price

ofGDR was US $ 14.15 per GDR.

1997 -

Shares issued to employees of the bank bearing distinctive numbers

46,26,00,001 to 47,46,00,000 will not be good delivery. The rights

issue was for 12 crore equity shares at a premium of Rs.50

aggregatingRs.720 crore in addition to a further issue of 1.2 crore equity

sharesof Rs.10 at a premium of Rs.50 aggregating Rs.72 crore for State

Bankemployees. The price of the rights had been Rs.60 per share.

After SBI Capital Markets, Manila-based Asian Development bank will

pick up 15 per cent equity stake in the new stock broking subsidiary

ofState Bank of India to be made operational by mid-1997. The balance

85per cent will be subscribed to by SBI.

SBI Securities Ltd the 100 per cent stockbroking subsidiary of SBI,

hasrecently received the much-awaited letter of incorporation from the

Registrar of Companies. Following this, both SBI and ADB will pick

up their respective shares in the new stockbroking firm. SSL will have

anequity base of Rs.50 crore.

The State Bank of India has tied up with GE Capital to float a

venturein Mumbai. State Bank signed the memorandum of understanding with

GE Caps in March.

State Bank will tie up with either VISA or Mastercard or even both

forthe franchise network. GE Caps through this joint venture will be

imparting technology, credit card expertise and payment card

mechanism.

The Reserve bank of India has directed the SBI to set up a 0

million stand-by facility for the Indian oil corporation.

State Bank of India (SBI) signed an agreement with the National

Securities Depository Ltd (NSDL) for dematerialisation of its

shares.

Besides, SBI has also become an equity stake holder in NSDL to the

extent of 4.76%.

SBI Commercial and International Bank, has become the country's

firstpublic sector bank to introduce optical disk (OD) facilities for

datastorage.

1998 -

State Bank of India will kick-start its credit card business on July

1by floating two joint ventures with GE Capital. The largest

29

financial intermediary in the country will sign the joint venture agreement

withGE Caps in the last week of January.

The State Bank of India on Jan 27 kicked off its foray into the

payment cards business with a joint venture agreement with US-based

Financial services giant, General Electric Capital Corporation (GE Capital).

State Bank of India (SBI) on June 24 signed an exclusive agreement

with the world's largest payment system - Visa International - for

Payment cards in India. The agreement was signed in Mumbai between the SBI

managing director, Mr. O P Sethia, and the general manager and

executivevice president (South East Asia) of Visa, Mr James G Murray.

1999 -

State Bank of India (SBI) has bagged the mandate to syndicate the $

120million loan for the National Thermal Power Corporation (NTPC).

The State Bank of India (SBI) proposes to take up the life insurance

and general insurance business once the sector is opened up.

State Bank of India has tied up with its associate banks to market

theSBI Card. The SBI has tied up with State Bank of Patiala in

Chandigarhand State Bank of Mysore in Bangalore to help market its credit

card.

SBI proposes to introduce a value-added service for cardholders

wherebythe credit card can also be used as an ATM card.

The State Bank of India will tie up with international investment

banker Credit SuisseFirst Boston and three domestic public sector

banksto form a gold assaying venture.

The State Bank of India (SBI) has decided to take over SBI Home

Finance(SBIHF), with its assets and liabilities. Having the largest stake,

SBI has been weighing various options for bailing out the joint

venturecompany which has slipped into huge losses.

The State Bank of India (SBI) has signed up with Central Depository

Services (I) (CDSIL) for the dematerialisation of its shares.

SBI shares have already been admitted as security with National

Securities Depository (NSDL). Besides, SBI also has a stake (Rs 10

cr)in the equity of CSDL.

According to an agreement entered into with the development bank,

StateBank of India (SBI) was to reduce its stake in its investment

bankingsubsidiary to below 50 per cent by March 31.

The State Bank of India (SBI) has entered into an agreement with

Moody's Investor Service and Icra, under which SBI will pick up

Moody's11 per cent stake in Icra in case the global rating firm wants to

getout of its investment in India.

State Bank of India (SBI) has taken the lead in `convenience

banking'by becoming the first public sector bank to offer its `savings bank'

account holders the benefits of fixed deposits (higher interest

rates)and current accounts (overdraft facility).

2000 -

The Bank has embarked upon the expansion of its ATM network in the

30

twincities of Hyderabad and Secunderfabad.

The Bank has become the first government owned financial institution

tojoin the rank of companies declaring interim dividend.

The Bank has proposed to come out with an issue under private

placementof unsecured, non-convertible, subordinated bonds in the nature of

promissory notes of Rs 1 lakh each aggregating Rs 600 crores with an

option to retain oversubscription of up to Rs 40 crores.

The Bank launched the Metal (Gold) Loan Scheme in Coimbatore. This

is the third scheme to be introduced by SBI.

SBI is also forming a subsidiary - SBI Gold and Precious Metals Pvt.

Ltd. with 50 per cent equity participation.

Mr. Vepa Kamesam, Deputy Managing Director, has been appointed as

Managing Director with effect from 1st June.

SBI board cleared the setting up of a separate subsidiary forinformation technology.

KC Raut has recently taken charge as general manager at State Bank

ofIndia, Chennai.

The Bank has become the first public sector bank to offer fixed-ratehome loans.

The State Bank of India has tied up with State Bank of Mysore tolaunch

co-branded credit cards as part its strategy to collaborate withassociate banks to expand its cardholder base.

Central Depository Services (India) Ltd has signed an agreement with

State Bank of India as its Depository participant.

State Bank of India and the Exim Bank of the US have signedamemorandum

of understanding, involving 0 million, to support the small and

medium-sized ndian companies to purchase US goods and services.

Mr. Suresh Kumar Mehra, Workmen Directors, ceased to be a member of

theCentral Board of the bank effect from October 1, due to his

retirementat the close of the business on September 30.

The Bank has launched an international credit cards for doctors, the frist of its kind in the country, offering

facilities including specialdiscounts on medical equipment and personal

loans from GE countrywide.

The State Bank of India has introduced a new scheme to boostexports.

The CRISIL has assigned a triple-A (AAA) rating to the State Bank of

India's Rs 3,000 crore bonds programme.

The Bank have decided to close down its fully-owned foreignsubsidiary

- SBI European Bank Ltd., in London.

Mr. S. Mukerji, Managing Director, of the bank retired from the bankon 30th of November.

State Bank of India Mutual Fund has launched the Magnum Gilt Fund,dedicated to

investing in government securities.

2001 -

The Bank has signed an MoU with Cardif S.A. for the bank's lifeinsurance business.

The Bank has introduced Voluntary Retirement Scheme for eligible

employees, open from the 15th January 2001 to the 31st January 2001.

The Bank has incorporated a subsidiary `SBI Life Insurance CompanyLtd.,' for doing life insurance

business. The Bank will install 10 more Automated Teller Machines in the

north-eastern region in addition to the one already commissioned at Guwahati.

State Bank of India launched three more ATMs i n Bangalore.

31

Mr Y Radhakrishnan has been promoted to the post of managingdirector

of State Bank of India. SBI Cards has set up a special insurance cell in Ahmedabad for

facilitating the claims of SBI cardholders affected by the tragic earthquake in Gujarat.

SBI has assigned the Delhi-based HCL Com Net to provide it ATMteller

inter-connectivity which could involve investments running into

several hundred crores.

SBI chief general manager Madhav M Mehta, who is currently theoperational head in

Gujarat, has been transferred to its corporate office in Mumbai as chief general manager

(CGM).

July 3- Announces the launch of the SBI International card and theSBI

Global Card for global travelers in India. SBI International cards and

SBI Gold Cards would be accepted at over 20 million Visa outletsworldwide and one lakh

outlets in India. State Bank of India has embarked upon an ambitious Rs 800-crore

technology upgradation programme. The bank has appointed KPMG, aconsultant in

computer technology, to provide inter connectivitynetworking to the computerised branches

and also to the ATMs acrossthecountry enabling its customers to transact any kind of

business from anywhere.

State Bank of India was presented the award for JD Power AsiaPacifics2001 India Sales Satisfaction Index

(SSI) and Consumer FinancingSatisfaction (CFS)

State Bank of India has added three more ATMs to its network. ThenewATMs were

installed at SBI's Andheri (west),Goregaon (east),and Borivili (east) branches on September

22. State Bank Of India (SBI) has informed BSE that Shri K.J.Udeshi, ED,RBI has been

nominated on the Central Board of the Bank as nomineeofRBI in place of Dr.Y.V.Reddy,

w.e.f. September 22, 2001 under Sec.19(f)of SBI Act.

State Bank of India has slashed the interest rate on home loans by 0.5per cent to 12 per cent, effective from

September 15.

IN A significant move, the State Bank of India has decided todistance itself from its

subsidiaries - SBI Capital Markets, SBI Gilts, SBIAMCand State Bank of Credit and

Commerce International. They will havethe autonomy, independent chairmen and external executives at thesenior

management level at market-related salaries. At present, the

SBI chairman is the ex-officio chairperson of all the subsidiaries,including the associate

banks.

The new scheme will be aimed only at the award staff, a categorythatwas included with

officers in the January 2001 voluntary retirementscheme.

SBI Cards on July 3, announced the launch of the SBI Internationalcardand the SBI Global

Card for global travelers in India.

- VRS implemented in which around 21,000 employees, includingofficers, were permitted

to retire

- The Bank has crossed another milestone by making a successfulforay

into insurance. SBI is the only Bank to have been permitted a 74%

stake

in the insurance business. The Bank's insurance subsidiary, SBI Life

Insurance Company, a joint venture with the Bank holding 74% and

Cardif S.A., the Joint venture partner, the balance 26%, was incorporated to

undertake life insurance and pension business. Cardif S.A. is a

wholly-owned subsidiary of BNP-Paribas, which is the largest bank in

32

France and one of the top ten banks in the world. Cardif S.A. is the

largest bancassurance company in France.

- The bank's efforts to establish a world -class credit information

bureau in India culminated in the successful setting up of the

Credit

Information Bureau (India) Ltd., a joint venture of the Bank with

HDFC

Ltd., Dun and Bradstreet Information Services India Pvt. Ltd. and

Trans Union International Inc.

2002

- In order to reduce risk and develop a transparent and active debt

market in general and government securities market in particular,

the Clearing Corporation of India Ltd. has been set up in Mumbai with the Bank as the chief promoter.

-E K Thakur resigns from Directorship of SBI.

-TCS bags order of Rs 500 crore from SBI.

-SBI has informed that the following change in Directors. 1. Shri A C Kalita, Director on the Bank's

Central Board ceased to be a Director on the Board wef May 13, 2002 on expiry of his term on May 12,

2002.2. Shri Y Radhakrishnan Managing Director & GE (CB) has relinquished office of the Managing

Director as on June 30, 2002 and ceased to be Director on the Board wef July 01, 2002.

-State Bank of India has informed BSE that Mr D C Gupta IAS Secretary

(Financial Sector), Ministry of Finance, Department of Economic

Affairs, New Delhi has been nominated as Director on the Board of

State Bank of India with effect from July 17, 2002 vice Mr S K Purkayastha.

-State Bank of India has informed BSE that Mr S Govindarajan,

Managing Director & GE (NB) has relinquished office of the Managing

Director as on July 31, 2002 and ceased to be Director on the Board w

e f August 01, 2002.Further Mr P R Khanna, Director on the Bank's

Central Board ceased to be a Director on the Board w e f August 20, 2002 consequent upon his resignation.

-State Bank of India has informed BSE that the Bank has decided to

close SBI Securities Ltd (SBISL), a subsidiary of the Bank, following

a Directive in this regard from the RBI.

-State Bank of India has informed that the Central Government

appointed Mr A K Batra, Deputy Managing Director, State Bank of India

as Managing Director, State Bank of India for the period from the date

of his taking charge and upto August 31, 2003. Also, Mr P N

Venkatachalam, Deputy Managing Director, State Bank of India, has

been appointed as Managing Director, State Bank of India for the

period from the date of his taking charge and upto March 31, 2004.

33

-State Bank Of India has informed that Shri Prithvi Raj Khanna and

Shri Kumar Bery have been duly elected as Directors under Section

19(c) of SBI Act at the General Meeting of the -State Bank of India

has informed that it has appointed Mr Ananta Chandra Kalita, as a

Director on the Central Board of the Bank from amongst the employees

of the Bank, who are workmen, for a period not exceeding six months

commencing from October 03, 2002 or until his successor is appointed

or till he ceases to be workmen employee of State Bank of India, or

until further orders, whichever event occurs earlier.shareholders of

the bank held on September 09, 2002.

-State Bank of India has informed BSE that Shri Janki Ballabh,

Chairman has relinquished office of Chairman at the close of business

hours on his attaining superannuation on October 31, 2002.

-State Bank of India has informed that Smt Vineeta Rai, Secretary

(Banking & Insurance), Ministry of Finance and Company Affairs,

Department of Economic Affairs (Banking Division), New Delhi has been

nominated as Director of the Board with effect from October 30, 2002.

-State Bank of India has informed that the Central Government, after

consultation with the Reserve Bank of India, appointed Shri A K

Purwar, Deputy Managing Director, State Bank as Chairman, State Bank

of India from the date of his taking charge of the post and upto May

31, 2003 i.e. date of his superannuation or until further orders

whichever is earlier. Shri A K Purwar assumed the charge of Chairman,

State Bank of India, on November 13, 2002.

2003

- State Bank of India (SBI) and Maruti Udyog Ltd have announced a

joint initiative aimed at making car finance affordable to middle and

lower middle class customers. Customers will now have transparent car

finance involving no hidden charges and pre-closure penalties, and

also get the dealers' margins, Mr S.K. Bhattacharya, Chief General

Manager, SBI, told newspersons. It will help both the bank and Maruti

to aggressively tap the Andhra Pradesh market, he said. SBI offers

finance facility even for lifetime tax, insurance and accessories of

the vehicle.

- State Bank of India has informed that the Bank has appointed Shri

Ananta Chandra Kalita, Head Assistant, State Bank of India as a

Director on the Central Board of the Bank amongst the employees of

the Bank, who are workmen for a period of 3 years commencing from

July 15, 2003 or until he ceases to be a workmen employee of the Bank

or until further orders, whichever is earlier provided that he shall

not hold the office continously for a period exceeding six year.

34

- SBI group's total profit identified at Rs 3,354 cr in '02

- Mr. D C Gupta nominated as Director on the Board of SBI

- SBI introduces IT upgradation plan with KPMG help

- SBI Cards and Payment Services Private Ltd, the credit card

subsidiary of the State Bank of India, introduces two new schemes

recently- SBI Advantage Card to the bank's fixed deposit customers

and SBI International Card for its home loan borrowers

- Launches a new credit appraisal system targeting the small and

medium enterprises (SME) for loans up to Rs 25 lakh

- SBI selects TCS to execute trade finance solution

- SBI and ICICI Bank among the top 100 banks in Asia in 2001 as per

the study by Asian Banker Journal

- Introduces SBI Cash Plus, its Maestro Debit Card that allows

customers to access their deposit accounts from ATMs and merchant

establishments

2003

- Promotes three Chief General Managers (CGM) to the posts of Deputy

Managing Directors (DMDs). They are: A D Kalmankar, CGM in charge of

Staff College of Hyderabad, A K Das, CGM, Hyderabad; and R K Sinha,

CGM, Chandigarh

- SBI appoints Mr. S K Bhattacharya as the new Chief General Manager

for Hyderabad circle

- Increases its equity stake in Discount and Finance House of India

Ltd (DFHIL) to 51%

- Ties up with Maruti Udyog Ltd. (MUL) for car finance

- Receives permission from Insurance Regulatory and Development

Authority (IRDA) to sell healthcare products to individuals

- Increases its Equity Stake in DFHIL to 55.30%

- Starts new 'Plus schemes' loans such as Justice Plus intended for

the judges and court employees, Police Plus for the police personnel,

35

Teacher Plus for the teaching community and Doctor Plus for the

medical practitioners

- Receives RBI licence to set up offshore banking units (OBUs) in special economic zones (SEZs)

- Launches SBI Bangalore card meant for a broad-based target audience

in the 25 plus age group ranging from upwardly mobile professionals

and middle class segments

- SBI unveils Hyderabad card, an exclusive initiative for the

citizens of Hyderabad

- Ananta Chandra Kalita ceases to be a Director of SBI

- Christens the tieup with Maruti Udyog Ltd. as SBI-Maruti Finance

- Orders For 1,500 ATMs With NCR Corporation

- Orange, the cellular service operator of the Hutch group for the

Mumbai circle, ties up with State Bank of India for prepaid card

refill options

- Ropes in US-based consultant McKinsey & Co to undertake Business

Process Re-engineering (BPR) exercise for the bank

- Launches charter for Small Scale Industries (SSIs)

- NPA (Non Performing Assets) slashed to 4.5 pc, writes off Rs 4,000

crore worth of assets

- Forays into stock market

- Stock price crosses the Rs 400 mark for the first time since

listing on BSE

- Mr. A K Batra, Managing Director & Group Executive (Corporate

Banking) of the Bank ceases to be a Director on the Board with effect

from July 8, 2003

- Plans a new scheme to attract Resurgent India Bonds (RIB)

- N S Sisodia, Secretary (Banking & Insurance), Ministry of Finance

and Company Affairs, Department of Economic Affairs (Banking

Division), has been nominated as a Director on the Board of State

Bank of India w.e.f. July 11, 2003

36

- Mr. Ananta Chandra Kalita, Head Assistant, State Bank of India,

appointed as a Director on the Central Board of the Bank amongst the

employees of the Bank

- Inks two important agreements with its employees' unions and

officers' associations. According to the contract SBI's staff will

be having no rights to interfere in bank's computerisation plans

- SBI, AirTel launch mobility service at Rs 299

- Central government nominates Mr. Arun Singh as a director on the

board of the bank wef July 25, 2003 for a period of three years.

- State Bank of India along with ANZ Investment Bank have consummated

5 year syndicate loan facility of 0 million to Indian

Petrochemicals Corporation (IPCL)

- Opens cheque clearing cente at Kolkata

- Inks pact with Mahindra & Mahindra (M&M) for co-branded tractor

scheme SBI-Mahindra Tractor Plus

- Joins hands with Tractors and Farm Equipment Ltd (TAFE) for tractor

loans

- Launches insurance scheme in Kerala

- Unveils new retail bank loan product Credit Khazana, which targets

the bank's housing loan account holders

- Unveils online ticket reservation system 'e-Rail'

- Reserve Bank of India nominates Dr Rakesh Mohan, Deputy Governor,

RBI, on the Central Board of the bank

- Appoints Mr C. Narasimhan as the Chief General Manager of the SBI's Kerala Circle

-Unveils Credit Khazana, retail bank loan product, to target the bank's housing loan account holders

- MRO-TEK Ltd has secured State Bank of India's order of Rs 15-crore

to provide networking solutions of 2Mbps and 64 Kbps high-end leased

line modems for SBI to connect more than 800 branches across the country.

-SBI joins hands with LIC to dentify long-term investment proposals

for LIC

37

-Tied with bajaj Auto to finance its two wheelers.

-SBI granted Rs 125-cr loan to Nethaji Apparel park to set up units

and buy machinery for the first batch of 54 garment plants in the

65-acre special apparel park.

-The bank has tied up with TVS motor company to finance two wheeler

loans

-Tied up with apollo hospital enterprise to finance for the hospital

treatement.

-The company launched mobile pre-paid cards recharge facility at its

ATM's

-Tied up with ICICI Bank and HDFC for sharing ATM networks

2003-Bank has entered into MOU with both ICICI Bank and HDFC Bank for

sharing Bank's ATM Network with them on bilateral terms.

-The Central Government after consultation with the Reserve Bank of

India, appointed Shri Chandan Bhattacharya, Deputy Managing Director

State Bank Of India as Managing Director State Bank Of India for the

period from December 17, 2003 to January 31, 2005.

-The State Bank of India has announced a special package to BSNL

employees by allowing concessional interest rates for different types

of loans to be availed by the BSNL staff.

2004

-Former KCCI President nominated to SBI Bangalore Local Board

-State Bank Of India has informed that Reserve Bank of India has

nominated Shri A V Sardesai, Executive Director, Reserve Bank of

India on the Central Board of State Bank of India vice Dr. Rakesh

Mohan.

-SBI sets up ATM counter in Ernakulam

-Bahrain Monetary Agency (BMA) grants in-principle licence to Statte

Bank of India (SBI)

-SBI sets up India's first drive-in ATM in Hyderabad

38

-State Bank of India has entered into an alliance with HDFC Bank for

sharing ATM networks to be operationalised from February 3, this

year.

2004

-SBI unveils new branch in Manjeri

-Bank awarded special prize for lending to self help group run by

women

-SBI unveils floating ATM

-State Bank of India appointed six new Deputy Managing Directors on

February 11, 2004. The new DMDs are: Mr T.S. Bhattacharya, CGM,

Product Development and Marketing, Mr M.M.Lateef, Managing Director,

SBI Gilts, Mr Yogesh Agarwal, CGM, Chandigarh, Mr Krishnamurthy, CGM,

Madras LHO and Mr R.Ramanathan, CGM, Technology and Mr Vijay Anand,

CGM, Corporate Account group. These top level appointments follow the

appointment of the new Managing Director for the bank, Mr Chandan

Bhattacharya, in December.

-GAIL ties up SBI for e-banking system

-SBI join hands with Visa for travel card

-SBI enters into ATM sharing agreements with UTI Bank & HDFC Bank

-Signs a Memorandum of Understanding (MoU) under which the bank will

provide term loans to farmers for purchasing capital inputs from Jain

Irrigation Systems Ltd (JISL)

-Join hands with Siemens for financing the medical equipments sold by

Siemens

-Joins hands with VST Tillers to launch SBI-VST Shakti, a new loan

scheme for farm mechanisation programme

-Unveils Vishwa Yatra foreign travel card, a prepaid card which

offers the traveller a convenient and secure way to carry cash

-Ties up with Same Deutz-Fahr India for tractor financing

-In ally with Sikkim govt to beef up SMEs

39

-The government has chosen State Bank of India (SBI) for channelising

government credit to other countries which runs into billions of

dollar

-SBI opens MICR cheque processing center

-Signs MoU with HMT Ltd. for financing their tractors

-State Bank of India deploys Flexcube as core banking solution at

Frankfurt

-Mr Ashok K. Kini appointed as new Managing Director of State Bank of

India with effect from April 1, 2004 to December 31, 2005

-SBI unveils Foreign Travel card in Orissa

-ICICI Bank, SBI, LIC in pact for Rs 20,000-cr projects

-Reliance Info in ATM pact with SBI

-State Bank of India, Bangalore Circle, has announced its tie-up with

New India Assurance Company Ltd (NIAC), for distribution of NIAC's

general insurance products in Karnataka

- SBI unveils new credit card in Ahmedabad

-State Bank of India joined the billion dollar club

-THE State Bank of India opened its 236th branch in the State at

Tripunithura on June 16

-SBI inaugurates first Internet shoppe in Kochi

-State Bank of India has opened a fully computerised branch at

Karunagappally in Kollam district

-L&T-John Deere Private Ltd has signed a memorandum of understanding

(MoU) with State Bank of India for tractor finance

-Buys 10% stake in Multi Commodity Exchange of India Ltd. (MCDEX)

for Rs 2.1 crore

-SBI join hands with Hero Honda to unveil co-branded credit card

-State Bank of India launched its first mobile ATM for increasing the

banking convenience of its customers

40

-State Bank of India has signed a Memorandum Of Understanding (MOU)

with the Societe Generale Asset Management of France (SGAM) for

inducting Societe Generale Asset Management as a stake holding

partner for SBI's mutual fund arm, SBI Fund Management Private Ltd

(SBIFMPL)

-State Bank of India, (SBI) with a view to expand the ambit of its

educational loan schemes, has unveiled a unique educational loan

scheme, christened Nursing Plus, for the nursing students of the

country

-SBI forges alliance with Hero Honda

-SBI offers new scheme`School Plus' for schools

-SBI Card has launched 'Instant Card' offering customers in need of

instant credit opportunity. With this, the customers will get an

opportunity to get ready to use credit card within a few hours of

filing in their application form

-SBI selects Finacle for international ops

-SBI enters ATM tie up with Andhra Bank

-SBI join hands with LIC for funding infrastructure projects

-Tata Motors on December 7, 2004, signs an MoU with State Bank of

India (SBI)

-SBI partners with Eicher Motors on December 27, 2004

2005

-Raj Travels joins hands with SBI for travel loans

-SBI opens branch at Vadakara

-SBI join hands with Apollo Health to offer loans

-SBI rolls out new loan scheme

-SBI opens first branch in Lakshadweep island of Kavaratti

-SBI enters into agreement for bilateral sharing of ATMs with PNB on

May 10, 2005

41

-SBI signs MOU with Corporation Bank for ATM sharing

-State Bank of India and 8 associate banks have entered into an

agreement with Bharat Petroleum Corporation Ltd (BPCL) for enhancing

card usage at fuel stations