Professional Documents

Culture Documents

Technical Analysis 11 January 2010 JPY: Comment: Strategy: Chart Levels

Uploaded by

Miir ViirOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Technical Analysis 11 January 2010 JPY: Comment: Strategy: Chart Levels

Uploaded by

Miir ViirCopyright:

Available Formats

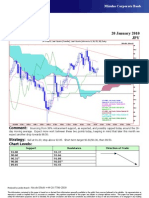

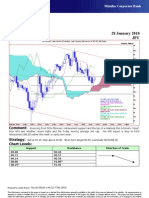

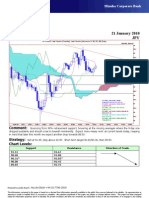

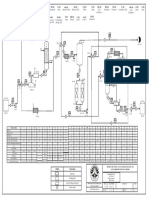

Mizuho Corporate Bank

Technical Analysis 11 January 2010

JPY

JPY=EBS, Last Quote [Candle], Last Quote [Ichimoku 9, 26, 52, 26] Daily

01Oct09 - 16Feb10

Pr

93.5

93

92.5

92

91.5

91

90.5

90

89.5

89

88.5

88

87.5

JPY=EBS , Last Quote, Candle

11Jan10 92.42 92.62 92.17 92.24 87

JPY=EBS , Last Quote, Tenkan Sen 9

11Jan10 92.52

86.5

JPY=EBS , Last Quote, Kijun Sen 26

11Jan10 90.57

JPY=EBS , Last Quote, Senkou Span(a) 52 86

15Feb10 91.54

JPY=EBS , Last Quote, Senkou Span(b) 52 85.5

15Feb10 89.30

JPY=EBS , Last Quote, Chikou Span 26

07Dec09 92.24 85

05Oct09 12Oct 19Oct 26Oct 02Nov 09Nov 16Nov 23Nov 30Nov 07Dec 14Dec 21Dec 28Dec 04Jan 11Jan 18Jan 25Jan 01Feb 08Feb 15Feb

Comment: A small ‘spike high’ reversal candle on Friday and a ‘doji’ on the weekly chart suggests the rally is

running out of steam. Now watch for more signs of topping, starting with a break below immediate trendline support

and then a drop below recent interim lows at 91.00.

Strategy: Sell at 92.25, adding to 93.00; stop above 94.00. Short term target 91.25/91.00, then 90.00.

Chart Levels:

Support Resistance Direction of Trade

92.17 92.52

91.50 92.75

91.25 93.00

91.00* 93.22

90.50 93.78*

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 27 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 27 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 20 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 20 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 28 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 28 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 15 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 15 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 12 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 12 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 21 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 21 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 29 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 29 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 19 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 19 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 05 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 05 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- My LATESTFXForecastsfor JUNE30Document3 pagesMy LATESTFXForecastsfor JUNE30api-26441337No ratings yet

- Residential area elevation and land use detailsDocument1 pageResidential area elevation and land use detailsharishNo ratings yet

- Technical Analysis 15 September 2010 JPY: CommentDocument1 pageTechnical Analysis 15 September 2010 JPY: CommentPlan B EconomicsNo ratings yet

- A B C E F G H C D D: AzoteaDocument1 pageA B C E F G H C D D: AzoteaGustavo Róssiter VargasNo ratings yet

- Residential area elevation and drainage planDocument1 pageResidential area elevation and drainage planharishNo ratings yet

- PCPL: Lito Pumicpic: Effectivity Date: February 2020Document1 pagePCPL: Lito Pumicpic: Effectivity Date: February 2020Jieza May MarquezNo ratings yet

- Kontur FixDocument1 pageKontur FixIpan YopaniNo ratings yet

- Site Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatanDocument1 pageSite Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatandejomarlubNo ratings yet

- Nifty Derivatives Report Shows Sector Wise Rollover TrendsDocument7 pagesNifty Derivatives Report Shows Sector Wise Rollover TrendscdranuragNo ratings yet

- Kurva S PT - Etsa Hari Ke 30Document5 pagesKurva S PT - Etsa Hari Ke 30Ariwibowo SuparnadiNo ratings yet

- Cake - I Will SurviveDocument6 pagesCake - I Will SurviveJazz QuevedoNo ratings yet

- Group Leader Development 14-7-2022Document10 pagesGroup Leader Development 14-7-2022Lancar Jaya PrintingNo ratings yet

- PP-001 Universal2 Pump Seal Reference ChartDocument1 pagePP-001 Universal2 Pump Seal Reference Chartandres roblezNo ratings yet

- Worton Creek Marina: Slip DiagramDocument1 pageWorton Creek Marina: Slip DiagramjacoNo ratings yet

- 1/7 (Row1 Col1)Document7 pages1/7 (Row1 Col1)renato_aleman_1No ratings yet

- CNN Features Off-The-shelf: An Astounding Baseline For RecognitionDocument8 pagesCNN Features Off-The-shelf: An Astounding Baseline For RecognitionAkash GuptaNo ratings yet

- Indian Railways: Trends, Issues, Opportunities and Outlook: G Raghuram Indian Institute of Management, AhmedabadDocument33 pagesIndian Railways: Trends, Issues, Opportunities and Outlook: G Raghuram Indian Institute of Management, AhmedabadmakbimhrdNo ratings yet

- Sewer Line Profile - Line Mh7-Mh19: RevisionsDocument1 pageSewer Line Profile - Line Mh7-Mh19: RevisionsBernie QuepNo ratings yet

- 1-Cluster 03 Sewer Drawings 11-04-2018Document1 page1-Cluster 03 Sewer Drawings 11-04-2018Bernie QuepNo ratings yet

- Rhino HeadDocument8 pagesRhino HeadALEJANDRONo ratings yet

- Rhino HeadDocument8 pagesRhino HeadSARABIA papeleria y regalosNo ratings yet

- Khadi Chowk To Bridge Part - 2Document1 pageKhadi Chowk To Bridge Part - 2naman jainNo ratings yet

- 5 Deck The Halls 02 Violin 2Document1 page5 Deck The Halls 02 Violin 2Nicanor MusNo ratings yet

- Deck Halls Violin Sheet MusicDocument1 pageDeck Halls Violin Sheet MusicNicanor MusNo ratings yet

- Design and analysis of sewer systemsDocument1 pageDesign and analysis of sewer systemsJose Alfredo Petro NavarroNo ratings yet

- Technical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- UntitledDocument18 pagesUntitledImri TalgamNo ratings yet

- Laporan Kerja Hari Ke-25 Perkuatan Struktur GedungDocument1 pageLaporan Kerja Hari Ke-25 Perkuatan Struktur GedungAriwibowo SuparnadiNo ratings yet

- Power Point Cakupan PHBSDocument3 pagesPower Point Cakupan PHBSnovita sariNo ratings yet

- Eis Me Aqui TromboneDocument2 pagesEis Me Aqui TromboneIury AugustoNo ratings yet

- Leg Profile-AP-63-AP-63Document1 pageLeg Profile-AP-63-AP-63Hikmat B. Ayer - हिक्मत ब. ऐरNo ratings yet

- mika c_aDocument2 pagesmika c_aJean-Claude BourletNo ratings yet

- 4DDocument1 page4DFitri WahyuniNo ratings yet

- Forecasting Basic Concepts And Stationary ModelsDocument22 pagesForecasting Basic Concepts And Stationary ModelsVINAY GUPTANo ratings yet

- OYE - Trumpet in BB 1 - 2011-08-19 1409Document1 pageOYE - Trumpet in BB 1 - 2011-08-19 1409Arley Samuel Jaimes GallardoNo ratings yet

- Project Performance TrackingDocument6 pagesProject Performance TrackingrannuNo ratings yet

- Board SchematicDocument1 pageBoard SchematicJOSE LENIN RIVERA VILLALOBOS0% (1)

- CNN Features Off-the-Shelf_ An Astounding Baseline for RecognitionDocument8 pagesCNN Features Off-the-Shelf_ An Astounding Baseline for RecognitionhiriNo ratings yet

- 2008 4GGSM 4G#RO MDO294 0164 - eSQAC - Clear - AlarmDocument23 pages2008 4GGSM 4G#RO MDO294 0164 - eSQAC - Clear - Alarmkhina luthfiNo ratings yet

- Merry Christmas Mr. LawrenceDocument1 pageMerry Christmas Mr. Lawrenceckun kit yipNo ratings yet

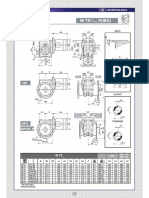

- W 75 ... P (IEC) : BonfiglioliDocument1 pageW 75 ... P (IEC) : BonfiglioliAtox BlackNo ratings yet

- 04-08-2017 Plano Indep.-Subd P 1-3Document1 page04-08-2017 Plano Indep.-Subd P 1-3jesusNo ratings yet

- Leg Profile-AP-64-AP-64Document1 pageLeg Profile-AP-64-AP-64Hikmat B. Ayer - हिक्मत ब. ऐरNo ratings yet

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR USDDocument1 pageAUG-10 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirNo ratings yet

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocument1 pageAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirNo ratings yet

- The Witch of Kings CrossDocument11 pagesThe Witch of Kings CrossMarguerite and Leni Johnson100% (1)

- Language Hub Student S Book Elementary Unit 1 1Document9 pagesLanguage Hub Student S Book Elementary Unit 1 1Paulo MalheiroNo ratings yet

- Fe en Accion - Morris VendenDocument734 pagesFe en Accion - Morris VendenNicolas BertoaNo ratings yet

- 25 Useful Brainstorming Techniques Personal Excellence EbookDocument8 pages25 Useful Brainstorming Techniques Personal Excellence EbookFikri HafiyaNo ratings yet

- (Part B) APPLICATION LETTER, COVER LETTER, CV, RESUME & JOB INTERVIEW - Google Forms-1Document10 pages(Part B) APPLICATION LETTER, COVER LETTER, CV, RESUME & JOB INTERVIEW - Google Forms-1adNo ratings yet

- Forest Economics: Question 1. What Are The Limitations of Applications of Economic Principles in Forestry?Document2 pagesForest Economics: Question 1. What Are The Limitations of Applications of Economic Principles in Forestry?Nikhil AgrawalNo ratings yet

- Mixed 14Document2 pagesMixed 14Rafi AzamNo ratings yet

- (PALE) PP vs. DE LUNA PDFDocument3 pages(PALE) PP vs. DE LUNA PDF8111 aaa 1118No ratings yet

- Language Teacher Educator IdentityDocument92 pagesLanguage Teacher Educator IdentityEricka RodriguesNo ratings yet

- Ford Investigative Judgment Free EbookDocument73 pagesFord Investigative Judgment Free EbookMICHAEL FAJARDO VARAS100% (1)

- GLORIADocument97 pagesGLORIAGovel EzraNo ratings yet

- Aikido NJKS PDFDocument105 pagesAikido NJKS PDFdimitaring100% (5)

- EAR Policy KhedaDocument40 pagesEAR Policy KhedaArvind SahaniNo ratings yet

- Penyebaran Fahaman Bertentangan Akidah Islam Di Media Sosial Dari Perspektif Undang-Undang Dan Syariah Di MalaysiaDocument12 pagesPenyebaran Fahaman Bertentangan Akidah Islam Di Media Sosial Dari Perspektif Undang-Undang Dan Syariah Di Malaysia2023225596No ratings yet

- Law, Rhetoric, and Irony in The Formation of Canadian Civil Culture (PDFDrive)Document374 pagesLaw, Rhetoric, and Irony in The Formation of Canadian Civil Culture (PDFDrive)Dávid KisNo ratings yet

- Monitoring of SLM Distribution in Sta. Maria ElementaryDocument3 pagesMonitoring of SLM Distribution in Sta. Maria ElementaryAnnalyn Gonzales ModeloNo ratings yet

- Dorfman v. UCSD Ruling - California Court of Appeal, Fourth Appellate DivisionDocument20 pagesDorfman v. UCSD Ruling - California Court of Appeal, Fourth Appellate DivisionThe College FixNo ratings yet

- I Am The One Who Would Awaken YouDocument5 pagesI Am The One Who Would Awaken Youtimsmith1081574No ratings yet

- 5 8 Pe Ola) CSL, E Quranic WondersDocument280 pages5 8 Pe Ola) CSL, E Quranic WondersMuhammad Faizan Raza Attari QadriNo ratings yet

- Ngo Burca Vs RP DigestDocument1 pageNgo Burca Vs RP DigestIvy Paz100% (1)

- CPAR and UCSP classes inspire passion for healthcareDocument2 pagesCPAR and UCSP classes inspire passion for healthcareMARIAPATRICIA MENDOZANo ratings yet

- 1170.2-2011 (+a5)Document7 pages1170.2-2011 (+a5)Adam0% (1)

- Doctrines On Persons and Family RelationsDocument69 pagesDoctrines On Persons and Family RelationsCarla VirtucioNo ratings yet

- Ricoh MP 4001 Users Manual 121110Document6 pagesRicoh MP 4001 Users Manual 121110liliana vargas alvarezNo ratings yet

- Censorship Is Always Self Defeating and Therefore FutileDocument2 pagesCensorship Is Always Self Defeating and Therefore Futileqwert2526No ratings yet

- Northern Nigeria Media History OverviewDocument7 pagesNorthern Nigeria Media History OverviewAdetutu AnnieNo ratings yet

- Ola Ride Receipt March 25Document3 pagesOla Ride Receipt March 25Nachiappan PlNo ratings yet

- Global BF Scorecard 2017Document7 pagesGlobal BF Scorecard 2017sofiabloemNo ratings yet

- Questionnaire For Online Banking SurveyDocument3 pagesQuestionnaire For Online Banking Surveycallyash91178% (32)

- Action Plan for Integrated Waste Management in SaharanpurDocument5 pagesAction Plan for Integrated Waste Management in SaharanpuramitNo ratings yet