Professional Documents

Culture Documents

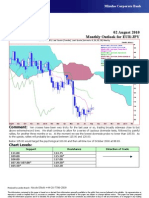

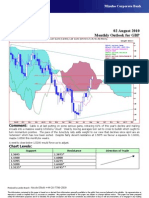

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright:

Available Formats

Mizuho Corporate Bank

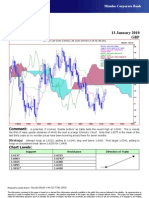

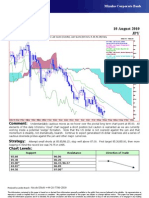

Technical Analysis 12 January 2010

EUR

EUR=EBS, Last Quote [Candle] EUR=, Bid [Ichimoku 9, 26, 52, 26] Daily

10Sep09 - 17Feb10

Pr

EUR=EBS , Last Quote, Candle

12Jan10 1.4512 1.4520 1.4453 1.4498

EUR= , Bid, Tenkan Sen 9 1.51

12Jan10 1.4406

EUR= , Bid, Kijun Sen 26

1.505

12Jan10 1.4541

EUR= , Bid, Senkou Span(a) 52

16Feb10 1.4474 1.5

EUR= , Bid, Senkou Span(b) 52

16Feb10 1.4680 1.495

EUR= , Bid, Chikou Span 26

08Dec09 1.4498 1.49

1.485

1.48

1.475

1.47

1.465

1.46

1.455

1.45

1.445

1.44

1.435

1.43

1.425

15Sep09 22Sep 29Sep 06Oct 13Oct 20Oct 27Oct 03Nov 10Nov 17Nov 24Nov 01Dec 08Dec 15Dec 22Dec 29Dec 05Jan 12Jan 19Jan 26Jan 02Feb 09Feb 16Feb

Comment: Basing against Fibonacci retracement support and the 200-day moving average at 1.4250,

breaking to new recent highs, testing the 26-day moving average at 1.4541. Momentum has turned bullish and the

Euro is not overbought. Good futures volume Friday on declining open interest suggest many have been wrong-

footed by the latest little rally.

Strategy: Buy at 1.4500, adding to 1.4455; stop well below 1.4400. Short term target 1.4550, then 1.4800.

Chart Levels:

Support Resistance Direction of Trade

1.4473 1.4534

1.4450 1.4557/1.4573

1.4400* 1.4600

1.4300 1.4680

1.4255 1.4800*

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- Technical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- Technical Analysis 14 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 14 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 19 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 19 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- Technical Analysis 27 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 27 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Eur-Usd-04 January 2010 DailyDocument1 pageEur-Usd-04 January 2010 DailyMiir ViirNo ratings yet

- Technical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Gbp-Usd-05 January 2010 DailyDocument1 pageGbp-Usd-05 January 2010 DailyMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- GBP Usd 01 19 2010Document1 pageGBP Usd 01 19 2010Miir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Gbp-Usd-04 January 2010 DailyDocument1 pageGbp-Usd-04 January 2010 DailyMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- AUG-05 Mizuho Technical Analysis EUR USDDocument1 pageAUG-05 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- BM 09 - Jalan Revolusi Kiri - Long & Cross (Iik)Document7 pagesBM 09 - Jalan Revolusi Kiri - Long & Cross (Iik)Rizky Wahyu SyaputraNo ratings yet

- Esquema Prueba Viga Vpt-1aDocument1 pageEsquema Prueba Viga Vpt-1aVictor HerreraNo ratings yet

- Area-250 SQ.M Kitchen Area - 510 SQ.M Restaurant: SLOPE - 1:10Document1 pageArea-250 SQ.M Kitchen Area - 510 SQ.M Restaurant: SLOPE - 1:10mathivananNo ratings yet

- MyFXForecastsforTHURSDAY July29thDocument2 pagesMyFXForecastsforTHURSDAY July29thapi-26441337No ratings yet

- Bucatarie Living+ Loc de Luat Masa Dormitor: P P P PDocument1 pageBucatarie Living+ Loc de Luat Masa Dormitor: P P P PRoxana CiobanuNo ratings yet

- MyFXForecastsforMONDAY August2ndDocument2 pagesMyFXForecastsforMONDAY August2ndapi-26441337No ratings yet

- Arkananta: Denah Kolom Lt. 1 Denah Kolom Lt. 2Document1 pageArkananta: Denah Kolom Lt. 1 Denah Kolom Lt. 2Wahyu UNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- AUDITORIO CASA DE LA CULTURA HUANCAYO-ModelDocument1 pageAUDITORIO CASA DE LA CULTURA HUANCAYO-ModelBrandon RiveraNo ratings yet

- Estimated pump mass and dimensions for base model numbersDocument1 pageEstimated pump mass and dimensions for base model numbersIta BarreraNo ratings yet

- MyFXForecastsforWEDNESDAY August18thDocument2 pagesMyFXForecastsforWEDNESDAY August18thapi-26441337No ratings yet

- Bank Protection of River at KM 00 To 400 Mymensingh-Cross Section DetailDocument1 pageBank Protection of River at KM 00 To 400 Mymensingh-Cross Section DetailramesNo ratings yet

- My Latest FXForecastsfor JULY5Document2 pagesMy Latest FXForecastsfor JULY5api-26441337No ratings yet

- My LATESTFXForecastsfor MAY13Document2 pagesMy LATESTFXForecastsfor MAY13api-26441337No ratings yet

- My FX Forecasts For MAY 14th: Euro/Us Dollar - Medium Term ViewDocument3 pagesMy FX Forecasts For MAY 14th: Euro/Us Dollar - Medium Term Viewapi-26441337No ratings yet

- Balcon B equipment layout and dimensionsDocument1 pageBalcon B equipment layout and dimensionsOana RusuNo ratings yet

- My LATESTFXForecastsfor APRIL23Document2 pagesMy LATESTFXForecastsfor APRIL23api-26441337No ratings yet

- Presentation Schedule2010BWFLYER FinalDocument1 pagePresentation Schedule2010BWFLYER FinalRamon Salsas EscatNo ratings yet

- Comuna Calui: Clasa de Calitate A Lemnului: I Clasa de Exploatare: 2 Modul de Tratare A Lemnului: IgnifugatDocument1 pageComuna Calui: Clasa de Calitate A Lemnului: I Clasa de Exploatare: 2 Modul de Tratare A Lemnului: Ignifugatdarhim2017No ratings yet

- ATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewDocument1 pageATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewKAR WEI LEENo ratings yet

- ATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewDocument1 pageATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewKAR WEI LEENo ratings yet

- well, Retaining Wall, Cut & Fill DrawingDocument4 pageswell, Retaining Wall, Cut & Fill DrawingNgurah TeguhNo ratings yet

- Bupropion - Louis 3 1 "C:/Users/Nmr/Dropbox (Lims) /NMR 500Mhz/2019 Medical Capstone"Document1 pageBupropion - Louis 3 1 "C:/Users/Nmr/Dropbox (Lims) /NMR 500Mhz/2019 Medical Capstone"lorenzoNo ratings yet

- Kantor & Minimarket - Rencana DenahDocument1 pageKantor & Minimarket - Rencana DenahCelebest Parnert CounsultantNo ratings yet

- MyFXForecastsforTHURSDAY August12thDocument2 pagesMyFXForecastsforTHURSDAY August12thapi-26441337No ratings yet

- 01 PlanDocument1 page01 Plan22 B prerna KshirsagarNo ratings yet

- Arquitectonico PBDocument1 pageArquitectonico PBPedro MárquezNo ratings yet

- Tugas Akhir Steel Pipe Rack MSIBDocument3 pagesTugas Akhir Steel Pipe Rack MSIBf a chaidirNo ratings yet

- AUG-04 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-04 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- Second Floor Power LayoutDocument1 pageSecond Floor Power Layoutsharmyne tawataoNo ratings yet

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR USDDocument1 pageAUG-10 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirNo ratings yet

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocument1 pageAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirNo ratings yet

- Contract Close-OutDocument3 pagesContract Close-OutParents' Coalition of Montgomery County, MarylandNo ratings yet

- MC - Assign Q - 1-2014 - Marketing CommunicationsDocument6 pagesMC - Assign Q - 1-2014 - Marketing CommunicationsBilal SaeedNo ratings yet

- Cenovnik Vodovod LiveniDocument160 pagesCenovnik Vodovod LiveniMirko GusicNo ratings yet

- 06 Guide To Tender EvaluationDocument9 pages06 Guide To Tender Evaluationromelramarack1858No ratings yet

- Case StudyDocument7 pagesCase StudynarenderNo ratings yet

- Monografia Edificios VerdesDocument56 pagesMonografia Edificios VerdesKa VaNo ratings yet

- PMC BANK AR 2019 Website FinalDocument88 pagesPMC BANK AR 2019 Website FinalnewsofthemarketNo ratings yet

- India's Central Bank Reserve Bank of India Regional Office, Delhi, Foreign Remittance Department. New Delhi: 110 001, India, 6, Sansad MargDocument2 pagesIndia's Central Bank Reserve Bank of India Regional Office, Delhi, Foreign Remittance Department. New Delhi: 110 001, India, 6, Sansad MargvnkatNo ratings yet

- API KHM DS2 en Excel v2Document436 pagesAPI KHM DS2 en Excel v2Indra ZulhijayantoNo ratings yet

- Chapter 3 - Managing System Project PDFDocument44 pagesChapter 3 - Managing System Project PDFJoshua Ocampo SenetaNo ratings yet

- Edmonton Commerce News June-July 2010Document28 pagesEdmonton Commerce News June-July 2010Venture PublishingNo ratings yet

- HAZOP ReportDocument27 pagesHAZOP ReportMuhammad.Saim100% (3)

- Tiong, Gilbert Charles - Financial Planning and ManagementDocument10 pagesTiong, Gilbert Charles - Financial Planning and ManagementGilbert TiongNo ratings yet

- JKGKJDocument2 pagesJKGKJYing LiuNo ratings yet

- Astro and CosmoDocument5 pagesAstro and CosmoGerson SchafferNo ratings yet

- ACI LimitedDocument2 pagesACI LimitedAshique IqbalNo ratings yet

- Management Accounting Tutorial QuestionsDocument2 pagesManagement Accounting Tutorial Questionskanasai1992No ratings yet

- Account Payable Tables in R12Document8 pagesAccount Payable Tables in R12anchauhanNo ratings yet

- Marketing Research and MISDocument20 pagesMarketing Research and MISMithun KanojiaNo ratings yet

- Construction Kickoff Meeting AgendaDocument3 pagesConstruction Kickoff Meeting AgendaBernardus Epintanta GintingNo ratings yet

- Group 6 - Mid-Term - PNJ PosterDocument1 pageGroup 6 - Mid-Term - PNJ PosterMai SươngNo ratings yet

- 0 - 265454387 The Bank of Punjab Internship ReportDocument51 pages0 - 265454387 The Bank of Punjab Internship Reportفیضان علیNo ratings yet

- H2 EconomicsDocument6 pagesH2 EconomicsDeclan Raj0% (1)

- KFC Case Study by MR OtakuDocument36 pagesKFC Case Study by MR OtakuSajan Razzak Akon100% (1)

- Project On Logistics Management: Name: Suresh Marimuthu Roll No.: 520964937 LC Code: 3078Document147 pagesProject On Logistics Management: Name: Suresh Marimuthu Roll No.: 520964937 LC Code: 3078awaisjinnahNo ratings yet

- EMBMDocument14 pagesEMBMapi-19882665No ratings yet

- LA Chief Procurement OfficerDocument3 pagesLA Chief Procurement OfficerJason ShuehNo ratings yet

- Program Management StudyDocument19 pagesProgram Management Studynavinchopra1986No ratings yet

- Estimate Cost of Building Fifty PensDocument4 pagesEstimate Cost of Building Fifty PensHelloLagbajaHelloLagbajaNo ratings yet

- CRM AssignmentDocument3 pagesCRM AssignmentDiksha VashishthNo ratings yet