Professional Documents

Culture Documents

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright:

Available Formats

Mizuho Corporate Bank

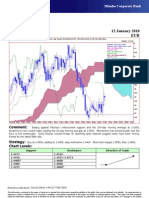

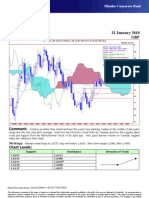

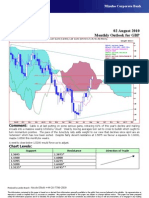

Technical Analysis 13 January 2010

EUR

EUR=EBS, Last Quote [Candle] EUR=, Bid [Ichimoku 9, 26, 52, 26] Daily

15Sep09 - 18Feb10

Pr

EUR=EBS , Last Quote, Candle 1.515

13Jan10 1.4485 1.4506 1.4456 1.4500

EUR= , Bid, Tenkan Sen 9 1.51

13Jan10 1.4406

EUR= , Bid, Kijun Sen 26

1.505

13Jan10 1.4499

EUR= , Bid, Senkou Span(a) 52

17Feb10 1.4453 1.5

EUR= , Bid, Senkou Span(b) 52

17Feb10 1.4680 1.495

EUR= , Bid, Chikou Span 26

09Dec09 1.4498 1.49

1.485

1.48

1.475

1.47

1.465

1.46

1.455

1.45

1.445

1.44

1.435

1.43

1.425

1.42

21Sep09 28Sep 05Oct 12Oct 19Oct 26Oct 02Nov 09Nov 16Nov 23Nov 30Nov 07Dec 14Dec 21Dec 28Dec 04Jan 11Jan 18Jan 25Jan 01Feb 08Feb 15Feb

Comment: Consolidating neatly just above new recent highs, the upside currently limited by the 26-day

moving average. Momentum is bullish and the Euro is not overbought. Price action over the last four days can be

seen as a ‘pennant’ suggesting another burst higher this week with a measured target of at least 1.4720, maybe

1.4825.

Strategy: Buy at 1.4500, adding to 1.4455; stop well below 1.4400. Short term target 1.4550, then 1.4800.

Chart Levels:

Support Resistance Direction of Trade

1.4480 1.4546

1.4453 1.4557/1.4573*

1.4400* 1.4600

1.4300 1.4680

1.4255 1.4800*

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- Volume Spread Analysis Improved With Wyckoff 2Document3 pagesVolume Spread Analysis Improved With Wyckoff 2ngocleasing86% (7)

- Strama Paper FinalDocument31 pagesStrama Paper FinalLauren Refugio50% (4)

- PARTNERSHIP ACCOUNTING EXAM REVIEWDocument26 pagesPARTNERSHIP ACCOUNTING EXAM REVIEWIts meh Sushi50% (2)

- How Competitive Forces Shape StrategyDocument11 pagesHow Competitive Forces Shape StrategyErwinsyah RusliNo ratings yet

- Mobile AccessoriesDocument27 pagesMobile AccessoriesDiya BoppandaNo ratings yet

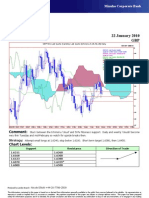

- Technical Analysis 14 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 14 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- Technical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- Technical Analysis 19 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 19 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 27 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 27 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Eur-Usd-04 January 2010 DailyDocument1 pageEur-Usd-04 January 2010 DailyMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- GBP Usd 01 19 2010Document1 pageGBP Usd 01 19 2010Miir ViirNo ratings yet

- Gbp-Usd-05 January 2010 DailyDocument1 pageGbp-Usd-05 January 2010 DailyMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- AUG-05 Mizuho Technical Analysis EUR USDDocument1 pageAUG-05 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Gbp-Usd-04 January 2010 DailyDocument1 pageGbp-Usd-04 January 2010 DailyMiir ViirNo ratings yet

- MyFXForecastsforTHURSDAY July29thDocument2 pagesMyFXForecastsforTHURSDAY July29thapi-26441337No ratings yet

- EUR USDUPDATEApril23Document2 pagesEUR USDUPDATEApril23api-26441337No ratings yet

- MyFXForecastsforMONDAY August2ndDocument2 pagesMyFXForecastsforMONDAY August2ndapi-26441337No ratings yet

- BM 09 - Jalan Revolusi Kiri - Long & Cross (Iik)Document7 pagesBM 09 - Jalan Revolusi Kiri - Long & Cross (Iik)Rizky Wahyu SyaputraNo ratings yet

- MyFXForecastsforWEDNESDAY August18thDocument2 pagesMyFXForecastsforWEDNESDAY August18thapi-26441337No ratings yet

- ATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewDocument1 pageATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewKAR WEI LEENo ratings yet

- ATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewDocument1 pageATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewKAR WEI LEENo ratings yet

- Bupropion - Louis 3 1 "C:/Users/Nmr/Dropbox (Lims) /NMR 500Mhz/2019 Medical Capstone"Document1 pageBupropion - Louis 3 1 "C:/Users/Nmr/Dropbox (Lims) /NMR 500Mhz/2019 Medical Capstone"lorenzoNo ratings yet

- Area-250 SQ.M Kitchen Area - 510 SQ.M Restaurant: SLOPE - 1:10Document1 pageArea-250 SQ.M Kitchen Area - 510 SQ.M Restaurant: SLOPE - 1:10mathivananNo ratings yet

- My Latest FXForecastsfor JULY5Document2 pagesMy Latest FXForecastsfor JULY5api-26441337No ratings yet

- Presentation Schedule2010BWFLYER FinalDocument1 pagePresentation Schedule2010BWFLYER FinalRamon Salsas EscatNo ratings yet

- Bucatarie Living+ Loc de Luat Masa Dormitor: P P P PDocument1 pageBucatarie Living+ Loc de Luat Masa Dormitor: P P P PRoxana CiobanuNo ratings yet

- My LATESTFXForecastsfor MAY13Document2 pagesMy LATESTFXForecastsfor MAY13api-26441337No ratings yet

- AUDITORIO CASA DE LA CULTURA HUANCAYO-ModelDocument1 pageAUDITORIO CASA DE LA CULTURA HUANCAYO-ModelBrandon RiveraNo ratings yet

- My FX Forecasts For MAY 14th: Euro/Us Dollar - Medium Term ViewDocument3 pagesMy FX Forecasts For MAY 14th: Euro/Us Dollar - Medium Term Viewapi-26441337No ratings yet

- MyFXForecastsforTHURSDAY August12thDocument2 pagesMyFXForecastsforTHURSDAY August12thapi-26441337No ratings yet

- Esquema Prueba Viga Vpt-1aDocument1 pageEsquema Prueba Viga Vpt-1aVictor HerreraNo ratings yet

- MyFXForecastsforMONDAY August23rdDocument2 pagesMyFXForecastsforMONDAY August23rdapi-26441337No ratings yet

- My LATESTFXForecastsfor APRIL23Document2 pagesMy LATESTFXForecastsfor APRIL23api-26441337No ratings yet

- Tugas Akhir Steel Pipe Rack MSIBDocument3 pagesTugas Akhir Steel Pipe Rack MSIBf a chaidirNo ratings yet

- Arkananta: Denah Kolom Lt. 1 Denah Kolom Lt. 2Document1 pageArkananta: Denah Kolom Lt. 1 Denah Kolom Lt. 2Wahyu UNo ratings yet

- Arquitectonico PBDocument1 pageArquitectonico PBPedro MárquezNo ratings yet

- Balcon B equipment layout and dimensionsDocument1 pageBalcon B equipment layout and dimensionsOana RusuNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- Comuna Calui: Clasa de Calitate A Lemnului: I Clasa de Exploatare: 2 Modul de Tratare A Lemnului: IgnifugatDocument1 pageComuna Calui: Clasa de Calitate A Lemnului: I Clasa de Exploatare: 2 Modul de Tratare A Lemnului: Ignifugatdarhim2017No ratings yet

- AUG-04 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-04 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- DWG'S Site Office EngDocument26 pagesDWG'S Site Office Engpenyuka tembalangNo ratings yet

- Kementerian Pekerjaan Umum Dan Perumahan Rakyat: PropinsiDocument1 pageKementerian Pekerjaan Umum Dan Perumahan Rakyat: Propinsirachmat hidayatNo ratings yet

- Workshop # 6Document4 pagesWorkshop # 6Charlene Camille GanaNo ratings yet

- G' E' F G: InvestitorDocument1 pageG' E' F G: InvestitorJetjonNo ratings yet

- Webcast 4T19 - Ingles - Vfinal3Document17 pagesWebcast 4T19 - Ingles - Vfinal3Faheem RajaNo ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR USDDocument1 pageAUG-10 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirNo ratings yet

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirNo ratings yet

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocument1 pageAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirNo ratings yet

- NoitesDocument4 pagesNoitesEdwinJugadoNo ratings yet

- Concentrate Business Vs Bottling BusinessDocument3 pagesConcentrate Business Vs Bottling BusinessShivani BansalNo ratings yet

- Fire in A Bangladesh Garment FactoryDocument6 pagesFire in A Bangladesh Garment FactoryRaquelNo ratings yet

- T10.10 Example: Fairways Equipment and Operating Costs: Irwin/Mcgraw-HillDocument31 pagesT10.10 Example: Fairways Equipment and Operating Costs: Irwin/Mcgraw-HillcgrkrcglnNo ratings yet

- Dan Loeb Sony LetterDocument4 pagesDan Loeb Sony LetterZerohedge100% (1)

- K21u 1229Document4 pagesK21u 1229muneermkd1234No ratings yet

- Auditing and The Public Accounting ProfessionDocument12 pagesAuditing and The Public Accounting ProfessionYebegashet AlemayehuNo ratings yet

- Summer Training Report On Talent AcquisitionDocument56 pagesSummer Training Report On Talent AcquisitionFun2ushhNo ratings yet

- Photographed Baby Pay To Alipay Confirm The Receipt of GoodsDocument2 pagesPhotographed Baby Pay To Alipay Confirm The Receipt of Goodsroma kononovNo ratings yet

- Iifl Focused Equity Fund: Investment ObjectiveDocument2 pagesIifl Focused Equity Fund: Investment ObjectiveGrishma JainNo ratings yet

- Aadfi Rates BDC Amongst The Best Performing African Development Finance Institutions in AfricaDocument1 pageAadfi Rates BDC Amongst The Best Performing African Development Finance Institutions in AfricaLesego MoabiNo ratings yet

- 420jjpb2wmtfx0 PDFDocument19 pages420jjpb2wmtfx0 PDFDaudSutrisnoNo ratings yet

- Ambiente Marketing Plan Mid-Term FinalDocument10 pagesAmbiente Marketing Plan Mid-Term Finalapi-550044935No ratings yet

- Costing Theory & Formulas & ShortcutsDocument58 pagesCosting Theory & Formulas & ShortcutsSaibhumi100% (1)

- Lecture: Statement of Cash Flow Ii Lecture ADocument27 pagesLecture: Statement of Cash Flow Ii Lecture ATinashe ChikwenhereNo ratings yet

- Market IndicatorsDocument7 pagesMarket Indicatorssantosh kumar mauryaNo ratings yet

- Principlesofmarketing Chapter2 170810162334Document67 pagesPrinciplesofmarketing Chapter2 170810162334PanpanpanNo ratings yet

- NMIMS TRIMESTER VI - BRAND MANAGEMENT HISTORYDocument46 pagesNMIMS TRIMESTER VI - BRAND MANAGEMENT HISTORYPayal AroraNo ratings yet

- MKT Definitions VaranyDocument15 pagesMKT Definitions VaranyVarany manzanoNo ratings yet

- Introduction and Company Profile: Retail in IndiaDocument60 pagesIntroduction and Company Profile: Retail in IndiaAbhinav Bansal0% (1)

- MOA BlankDocument4 pagesMOA Blankclarisa mangwagNo ratings yet

- Medanit Sisay Tesfaye PDF Th...Document71 pagesMedanit Sisay Tesfaye PDF Th...Tesfahun GetachewNo ratings yet

- Sop Finaldraft RaghavbangadDocument3 pagesSop Finaldraft RaghavbangadraghavNo ratings yet

- Ia-Carp Q1 W2 PDFDocument16 pagesIa-Carp Q1 W2 PDFLaurenceFabialaNo ratings yet

- Production Planning and ControlDocument16 pagesProduction Planning and Controlnitish kumar twariNo ratings yet