Professional Documents

Culture Documents

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright:

Available Formats

Mizuho Corporate Bank

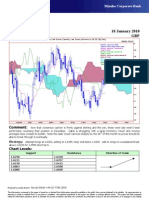

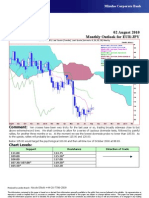

Technical Analysis 13 January 2010

GBP

GBP=D3, Last Quote [Candle], Last Quote [Ichimoku 9, 26, 52, 26] Daily

05Sep09 - 18Feb10

Pr

GBP=D3 , Last Quote, Candle 1.69

13Jan10 1.6159 1.6225 1.6137 1.6223

GBP=D3 , Last Quote, Tenkan Sen 9

13Jan10 1.6069

1.68

GBP=D3 , Last Quote, Kijun Sen 26

13Jan10 1.6122

GBP=D3 , Last Quote, Senkou Span(a) 52

17Feb10 1.6096 1.67

GBP=D3 , Last Quote, Senkou Span(b) 52

17Feb10 1.6356

GBP=D3 , Last Quote, Chikou Span 26

09Dec09 1.6223 1.66

1.65

1.64

1.63

1.62

1.61

1.6

1.59

1.58

1.57

17Sep09 01Oct 15Oct 29Oct 12Nov 26Nov 10Dec 24Dec 07Jan 21Jan 04Feb 18Feb

Comment: A potential, if crooked, ‘double bottom’ as Cable tests the recent high at 1.6242. This is merely

the first of many upside obstacles of which the next is a large Ichimoku ‘cloud’. Note that 1.6375 is the mean of the

last thirty years so no wonder prices have been hovering around here for seven months.

Strategy: Attempt longs at 1.6210, adding to 1.6140; stop well below 1.6000. First target 1.6240, adding to

longs on a sustained break above 1.6250 for 1.6400.

Chart Levels:

Support Resistance Direction of Trade

1.6137 1.6225

1.6063 1.6242*

1.5925 1.6300

1.5895 1.6355

1.5832* 1.6400

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Gbp-Usd-05 January 2010 DailyDocument1 pageGbp-Usd-05 January 2010 DailyMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- GBP Usd 01 19 2010Document1 pageGBP Usd 01 19 2010Miir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 14 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 14 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Gbp-Usd-04 January 2010 DailyDocument1 pageGbp-Usd-04 January 2010 DailyMiir ViirNo ratings yet

- Technical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- Technical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 27 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 27 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Eur-Usd-04 January 2010 DailyDocument1 pageEur-Usd-04 January 2010 DailyMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 19 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 19 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- AUG-09 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-09 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- 12 Reinforcement Learning FullDocument51 pages12 Reinforcement Learning Fullckcheun43No ratings yet

- Technical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Studying Group IDocument10 pagesStudying Group ICarmo AgostinhoNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- Eight (F) Compound: Mohamed Abd ElwahabDocument1 pageEight (F) Compound: Mohamed Abd Elwahabenggerges.raafat100No ratings yet

- Pervaze VorovestiDocument1 pagePervaze VorovestiCristian CoroamaNo ratings yet

- PHP 1 TP 5 JFDocument9 pagesPHP 1 TP 5 JFAKASH TIWARINo ratings yet

- Soal Latihan Praktik ExcelDocument7 pagesSoal Latihan Praktik ExcelDwita YpNo ratings yet

- Plate3 - Power Plan LayoutDocument1 pagePlate3 - Power Plan LayoutRitchie OstiaNo ratings yet

- AUG-05 Mizuho Technical Analysis EUR USDDocument1 pageAUG-05 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- 2024-01-15 - GK - 06 Kontrakan Jati KramatDocument1 page2024-01-15 - GK - 06 Kontrakan Jati Kramatnuke.rachmasariNo ratings yet

- Slip Gaji Karyawan Pt. Prakarsa PramanditaDocument1 pageSlip Gaji Karyawan Pt. Prakarsa PramanditaAlvindo SurveyorNo ratings yet

- Nilai Raport Kls Xi TKJ 2Document16 pagesNilai Raport Kls Xi TKJ 2artha wiriye negareNo ratings yet

- Weld Defects in RTDocument102 pagesWeld Defects in RTSaad Al Katrany100% (1)

- Technical Analysis 05 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 05 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- CT PLATEDocument1 pageCT PLATEbsndbh65wcNo ratings yet

- Nilai Raport KLS Xi Upw 3Document16 pagesNilai Raport KLS Xi Upw 3artha wiriye negareNo ratings yet

- PETE301-211-5.1 Gas COndensateDocument18 pagesPETE301-211-5.1 Gas COndensateMahdil aliNo ratings yet

- Survey Record For Existing Corbel - R01 - 20220817-A3Document1 pageSurvey Record For Existing Corbel - R01 - 20220817-A3YF NNo ratings yet

- 20 2 PDFDocument1 page20 2 PDFdwirelesNo ratings yet

- Lembar Kerja BK BesarDocument17 pagesLembar Kerja BK BesarCool ThryNo ratings yet

- Mechanics - Statics AnswerDocument17 pagesMechanics - Statics AnswerDaniel TilahunNo ratings yet

- Bearing Capacity 3Document2 pagesBearing Capacity 3Alfredo De FexNo ratings yet

- Bearing CapacityDocument2 pagesBearing CapacityAlfredo De FexNo ratings yet

- Bearing CapacityDocument2 pagesBearing CapacityAlfredo De FexNo ratings yet

- Meyerhof Results: Bearing Capacity of Shallow Foundations Meyerhof MethodDocument2 pagesMeyerhof Results: Bearing Capacity of Shallow Foundations Meyerhof MethodAlfredo De FexNo ratings yet

- Po 520Document1 pagePo 520felix manuelNo ratings yet

- Ksh 781.83 electricity bill detailsDocument1 pageKsh 781.83 electricity bill detailsIsaiah Kipyego0% (1)

- 4Document1 page4mkyc gameNo ratings yet

- CALIENTE Jul09 Friday Evening ProgramDocument10 pagesCALIENTE Jul09 Friday Evening ProgramDeivid JuniorNo ratings yet

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- AUG-10 Mizuho Technical Analysis EUR USDDocument1 pageAUG-10 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirNo ratings yet

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirNo ratings yet

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocument1 pageAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirNo ratings yet

- Art 1780280905 PDFDocument8 pagesArt 1780280905 PDFIesna NaNo ratings yet

- Inline check sieve removes foreign matterDocument2 pagesInline check sieve removes foreign matterGreere Oana-NicoletaNo ratings yet

- LTD Samplex - Serrano NotesDocument3 pagesLTD Samplex - Serrano NotesMariam BautistaNo ratings yet

- February / March 2010Document16 pagesFebruary / March 2010Instrulife OostkampNo ratings yet

- ILOILO STATE COLLEGE OF FISHERIES-DUMANGAS CAMPUS ON-THE JOB TRAINING NARRATIVE REPORTDocument54 pagesILOILO STATE COLLEGE OF FISHERIES-DUMANGAS CAMPUS ON-THE JOB TRAINING NARRATIVE REPORTCherry Lyn Belgira60% (5)

- University of Wisconsin Proposal TemplateDocument5 pagesUniversity of Wisconsin Proposal TemplateLuke TilleyNo ratings yet

- Sound! Euphonium (Light Novel)Document177 pagesSound! Euphonium (Light Novel)Uwam AnggoroNo ratings yet

- Examination of InvitationDocument3 pagesExamination of InvitationChoi Rinna62% (13)

- Search Inside Yourself PDFDocument20 pagesSearch Inside Yourself PDFzeni modjo02No ratings yet

- Research Proposal by Efe Onomake Updated.Document18 pagesResearch Proposal by Efe Onomake Updated.efe westNo ratings yet

- Explaining ADHD To TeachersDocument1 pageExplaining ADHD To TeachersChris100% (2)

- Weekly Home Learning Plan Math 10 Module 2Document1 pageWeekly Home Learning Plan Math 10 Module 2Yhani RomeroNo ratings yet

- Item Survey Harga Juli 2023Document16 pagesItem Survey Harga Juli 2023Haji Untung (Sukma)No ratings yet

- IndiGo flight booking from Ahmedabad to DurgaPurDocument2 pagesIndiGo flight booking from Ahmedabad to DurgaPurVikram RajpurohitNo ratings yet

- Neligence: Allows Standards of Acceptable Behavior To Be Set For SocietyDocument3 pagesNeligence: Allows Standards of Acceptable Behavior To Be Set For SocietyransomNo ratings yet

- TITLE 28 United States Code Sec. 3002Document77 pagesTITLE 28 United States Code Sec. 3002Vincent J. Cataldi91% (11)

- KT 1 Ky Nang Tong Hop 2-ThươngDocument4 pagesKT 1 Ky Nang Tong Hop 2-ThươngLệ ThứcNo ratings yet

- Lost Temple of Forgotten Evil - Adventure v3 PDFDocument36 pagesLost Temple of Forgotten Evil - Adventure v3 PDFВячеслав100% (2)

- 14 Jet Mykles - Heaven Sent 5 - GenesisDocument124 pages14 Jet Mykles - Heaven Sent 5 - Genesiskeikey2050% (2)

- 12 Preliminary Conference BriefDocument7 pages12 Preliminary Conference Briefkaizen shinichiNo ratings yet

- CSR of Cadbury LTDDocument10 pagesCSR of Cadbury LTDKinjal BhanushaliNo ratings yet

- P.E 4 Midterm Exam 2 9Document5 pagesP.E 4 Midterm Exam 2 9Xena IngalNo ratings yet

- Purposive Communication Module 1Document18 pagesPurposive Communication Module 1daphne pejo100% (4)

- Unit I. Phraseology As A Science 1. Main Terms of Phraseology 1. Study The Information About The Main Terms of PhraseologyDocument8 pagesUnit I. Phraseology As A Science 1. Main Terms of Phraseology 1. Study The Information About The Main Terms of PhraseologyIuliana IgnatNo ratings yet

- Battery Genset Usage 06-08pelj0910Document4 pagesBattery Genset Usage 06-08pelj0910b400013No ratings yet

- MinePlan Release NotesDocument14 pagesMinePlan Release NotesJuanJo RoblesNo ratings yet

- Supreme Court declares Pork Barrel System unconstitutionalDocument3 pagesSupreme Court declares Pork Barrel System unconstitutionalDom Robinson BaggayanNo ratings yet

- Structural Works - SharingDocument37 pagesStructural Works - SharingEsvimy Deliquena CauilanNo ratings yet

- CH 19Document56 pagesCH 19Ahmed El KhateebNo ratings yet

- 2Document5 pages2Frances CiaNo ratings yet