Professional Documents

Culture Documents

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

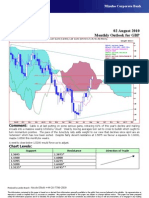

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright:

Available Formats

Mizuho Corporate Bank

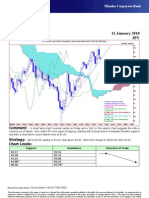

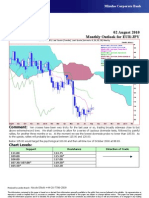

Technical Analysis 13 January 2010

JPY

JPY=EBS, Last Quote [Candle], Last Quote [Ichimoku 9, 26, 52, 26] Daily

01Oct09 - 18Feb10

Pr

93.5

93

92.5

92

91.5

91

90.5

90

89.5

89

88.5

88

87.5

JPY=EBS , Last Quote, Candle

13Jan10 90.99 91.36 90.91 91.11

JPY=EBS , Last Quote, Tenkan Sen 9 87

13Jan10 92.26

JPY=EBS , Last Quote, Kijun Sen 26 86.5

13Jan10 90.57

JPY=EBS , Last Quote, Senkou Span(a) 52

86

17Feb10 91.41

JPY=EBS , Last Quote, Senkou Span(b) 52

17Feb10 89.30 85.5

JPY=EBS , Last Quote, Chikou Span 26

09Dec09 91.11 85

05Oct09 12Oct 19Oct 26Oct 02Nov 09Nov 16Nov 23Nov 30Nov 07Dec 14Dec 21Dec 28Dec 04Jan 11Jan 18Jan 25Jan 01Feb 08Feb 15Feb

Comment: Going according to plan as prices retreat from ‘channel’ resistance and now closing below recent

interim lows at 91.00. While finding support from the 26-day moving average, yesterday’s close has turned

momentum bearish. The USD is not oversold so we favour another drop. Note that futures open interest is one third

of 2007’s peak showing just how many investors have given up on the ‘carry trade’. Ignore comments on this

subject.

Strategy: Sell at 91.15, adding to 91.80; stop above 92.35. Short term target 90.65, then 90.00.

Chart Levels:

Support Resistance Direction of Trade

90.91 91.36

90.73/90.57* 91.90

90.00 92.33

89.80 92.65

89.25 93.22* 93.78**

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- What Is MoneyDocument9 pagesWhat Is MoneyMira Andriani100% (1)

- CFA L1 3 Month ScheduleDocument9 pagesCFA L1 3 Month ScheduleSakura2709No ratings yet

- Pivot Point For Successful TradingDocument5 pagesPivot Point For Successful Tradingmaymam22521100% (1)

- Market Manipulation TacticsDocument4 pagesMarket Manipulation TacticsBv Rao0% (1)

- Morton Handley & CompanyDocument4 pagesMorton Handley & Companybusinessdoctor23No ratings yet

- Goldman SudokuDocument7 pagesGoldman SudokuPedro Emilio Garcia Molina100% (1)

- Retracements With TMV: Trade Breakouts andDocument7 pagesRetracements With TMV: Trade Breakouts andDevang Varma100% (1)

- 1/7 (Row1 Col1)Document7 pages1/7 (Row1 Col1)renato_aleman_1No ratings yet

- Investing and Compounding Interest Rates ExplainedDocument4 pagesInvesting and Compounding Interest Rates ExplainedJufel RamirezNo ratings yet

- Heather EvansDocument35 pagesHeather Evansmizhar7863173100% (1)

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 19 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 19 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 28 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 28 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 21 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 21 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 12 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 12 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 20 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 20 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 11 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 11 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

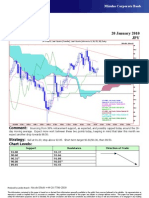

- Technical Analysis 29 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 29 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 15 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 15 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

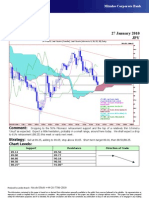

- Technical Analysis 27 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 27 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 05 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 05 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 15 September 2010 JPY: CommentDocument1 pageTechnical Analysis 15 September 2010 JPY: CommentPlan B EconomicsNo ratings yet

- Technical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- My LATESTFXForecastsfor JUNE30Document3 pagesMy LATESTFXForecastsfor JUNE30api-26441337No ratings yet

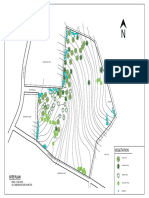

- Residential area elevation and land use detailsDocument1 pageResidential area elevation and land use detailsharishNo ratings yet

- A B C E F G H C D D: AzoteaDocument1 pageA B C E F G H C D D: AzoteaGustavo Róssiter VargasNo ratings yet

- PCPL: Lito Pumicpic: Effectivity Date: February 2020Document1 pagePCPL: Lito Pumicpic: Effectivity Date: February 2020Jieza May MarquezNo ratings yet

- Residential area elevation and drainage planDocument1 pageResidential area elevation and drainage planharishNo ratings yet

- Kontur FixDocument1 pageKontur FixIpan YopaniNo ratings yet

- CNN Features Off-The-shelf: An Astounding Baseline For RecognitionDocument8 pagesCNN Features Off-The-shelf: An Astounding Baseline For RecognitionAkash GuptaNo ratings yet

- Power Point Cakupan PHBSDocument3 pagesPower Point Cakupan PHBSnovita sariNo ratings yet

- Cake - I Will SurviveDocument6 pagesCake - I Will SurviveJazz QuevedoNo ratings yet

- Site Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatanDocument1 pageSite Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatandejomarlubNo ratings yet

- Khadi Chowk To Bridge Part - 2Document1 pageKhadi Chowk To Bridge Part - 2naman jainNo ratings yet

- Kurva S PT - Etsa Hari Ke 30Document5 pagesKurva S PT - Etsa Hari Ke 30Ariwibowo SuparnadiNo ratings yet

- Group Leader Development 14-7-2022Document10 pagesGroup Leader Development 14-7-2022Lancar Jaya PrintingNo ratings yet

- Nifty Derivatives Report Shows Sector Wise Rollover TrendsDocument7 pagesNifty Derivatives Report Shows Sector Wise Rollover TrendscdranuragNo ratings yet

- 4DDocument1 page4DFitri WahyuniNo ratings yet

- Merry Christmas Mr. LawrenceDocument1 pageMerry Christmas Mr. Lawrenceckun kit yipNo ratings yet

- Indian Railways: Trends, Issues, Opportunities and Outlook: G Raghuram Indian Institute of Management, AhmedabadDocument33 pagesIndian Railways: Trends, Issues, Opportunities and Outlook: G Raghuram Indian Institute of Management, AhmedabadmakbimhrdNo ratings yet

- W 75 ... P (IEC) : BonfiglioliDocument1 pageW 75 ... P (IEC) : BonfiglioliAtox BlackNo ratings yet

- PP-001 Universal2 Pump Seal Reference ChartDocument1 pagePP-001 Universal2 Pump Seal Reference Chartandres roblezNo ratings yet

- Design and analysis of sewer systemsDocument1 pageDesign and analysis of sewer systemsJose Alfredo Petro NavarroNo ratings yet

- 1-Cluster 03 Sewer Drawings 11-04-2018Document1 page1-Cluster 03 Sewer Drawings 11-04-2018Bernie QuepNo ratings yet

- mika c_aDocument2 pagesmika c_aJean-Claude BourletNo ratings yet

- Sewer Line Profile - Line Mh7-Mh19: RevisionsDocument1 pageSewer Line Profile - Line Mh7-Mh19: RevisionsBernie QuepNo ratings yet

- Project Performance TrackingDocument6 pagesProject Performance TrackingrannuNo ratings yet

- Board SchematicDocument1 pageBoard SchematicJOSE LENIN RIVERA VILLALOBOS0% (1)

- Tom 2.0 Copia-Version 2 PDFDocument1 pageTom 2.0 Copia-Version 2 PDFISLAS RAYMUNDO BRIGITTE MONTSERRAT ARQUITECTURANo ratings yet

- Trombone IIDocument8 pagesTrombone IIKirs YoshikageNo ratings yet

- Plan etaj 1 cladire cercetareDocument1 pagePlan etaj 1 cladire cercetareMarius MargineanNo ratings yet

- Worton Creek Marina: Slip DiagramDocument1 pageWorton Creek Marina: Slip DiagramjacoNo ratings yet

- Site:-Plot No. 192, Darbar Nagar at Unn at Choryashi at SuratDocument1 pageSite:-Plot No. 192, Darbar Nagar at Unn at Choryashi at SuratHRPANSURIYANo ratings yet

- fyjfjyDocument1 pagefyjfjymarianaalejandracuentasroblesNo ratings yet

- Eis Me Aqui TromboneDocument2 pagesEis Me Aqui TromboneIury AugustoNo ratings yet

- UntitledDocument18 pagesUntitledImri TalgamNo ratings yet

- Leg Profile-AP-63-AP-63Document1 pageLeg Profile-AP-63-AP-63Hikmat B. Ayer - हिक्मत ब. ऐरNo ratings yet

- Housing_TI085-052-070_136268Document1 pageHousing_TI085-052-070_136268ZEUS ARMYNo ratings yet

- Laporan Kerja Hari Ke-25 Perkuatan Struktur GedungDocument1 pageLaporan Kerja Hari Ke-25 Perkuatan Struktur GedungAriwibowo SuparnadiNo ratings yet

- Electrical Motor Efficiency Ratings PDFDocument3 pagesElectrical Motor Efficiency Ratings PDFGustavo CuatzoNo ratings yet

- RMW2.2G24D-EZ-SX Plunger Pump SpecsDocument1 pageRMW2.2G24D-EZ-SX Plunger Pump SpecsNitro anguianoNo ratings yet

- OYE - Trumpet in BB 1 - 2011-08-19 1409Document1 pageOYE - Trumpet in BB 1 - 2011-08-19 1409Arley Samuel Jaimes GallardoNo ratings yet

- Pemodelan EksitingDocument1 pagePemodelan EksitingAyah AlealanaNo ratings yet

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR USDDocument1 pageAUG-10 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirNo ratings yet

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocument1 pageAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirNo ratings yet

- Ijmra MT1321 PDFDocument26 pagesIjmra MT1321 PDFRenuka SharmaNo ratings yet

- What Is An AssetDocument6 pagesWhat Is An AssetrimpyNo ratings yet

- Ebook PDF Multinational Financial Management 11th EditionDocument61 pagesEbook PDF Multinational Financial Management 11th Editionjefferson.kleckner559100% (44)

- Crisis in Indonesia: Economy, Society and PoliticsDocument2 pagesCrisis in Indonesia: Economy, Society and PoliticslannyNo ratings yet

- 00syllabus - Fin501 - Asset Pricing and Derivatives SyllabusDocument4 pages00syllabus - Fin501 - Asset Pricing and Derivatives SyllabusVictor VillanoNo ratings yet

- Asma CapitalDocument10 pagesAsma CapitalAkhmad Audi HarvanNo ratings yet

- PT Oorja Indo KGSDocument27 pagesPT Oorja Indo KGSibadoyeokNo ratings yet

- Rubinstein (History of Modigliani-Miller Theorem)Document7 pagesRubinstein (History of Modigliani-Miller Theorem)as111320034667No ratings yet

- Net Present Value (NPV) vs. Internal Rate of Return (IRR)Document14 pagesNet Present Value (NPV) vs. Internal Rate of Return (IRR)Mahmoud MorsiNo ratings yet

- Customer Satisfaction Study at HDFC BankDocument104 pagesCustomer Satisfaction Study at HDFC Bankbb9780No ratings yet

- Fundamentals of International Financial Management by S Kevin B00k7yg378Document5 pagesFundamentals of International Financial Management by S Kevin B00k7yg378phani chowdaryNo ratings yet

- Ac102 ch6 PDFDocument16 pagesAc102 ch6 PDFGopi KrishnaNo ratings yet

- MDAXDocument3 pagesMDAXJesu JesuNo ratings yet

- Emily Tao Summary of Analysis of Premium Liabilities For Australian Lines of BusinessDocument11 pagesEmily Tao Summary of Analysis of Premium Liabilities For Australian Lines of Businesszafar1976No ratings yet

- Factor Influencing The Investment Decision Making of InvestorsDocument100 pagesFactor Influencing The Investment Decision Making of InvestorsajjuNo ratings yet

- Lesson 3: Financial System and Economic Development: Learning ObjectivesDocument4 pagesLesson 3: Financial System and Economic Development: Learning Objectivesnotes.mcpuNo ratings yet

- ISFIF Programme Schedule - 08 12 2017Document31 pagesISFIF Programme Schedule - 08 12 2017Saurav DashNo ratings yet

- ICICI Bank Relationship Manager Business Loans GroupDocument2 pagesICICI Bank Relationship Manager Business Loans GroupSuraj DoshiNo ratings yet

- Fakeout Candle MethodDocument5 pagesFakeout Candle MethodKabelo GaosupelweNo ratings yet

- Access Bank Products, Services and BusinessesDocument7 pagesAccess Bank Products, Services and BusinessesSeun -nuga DanielNo ratings yet

- Seminar Questions Set IVDocument4 pagesSeminar Questions Set IVfanuel kijojiNo ratings yet