Professional Documents

Culture Documents

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright:

Available Formats

Mizuho Corporate Bank

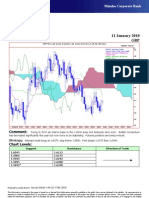

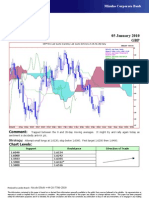

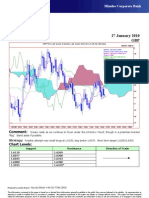

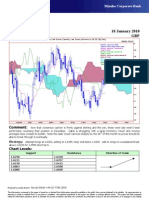

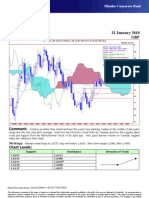

Technical Analysis 14 January 2010

GBP

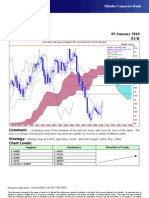

EUR=EBS, Last Quote [Candle] EUR=, Bid [Ichimoku 9, 26, 52, 26] Daily

28Sep09 - 19Feb10

Pr

EUR=EBS , Last Quote, Candle 1.515

14Jan10 1.4510 1.4556 1.4495 1.4540

EUR= , Bid, Tenkan Sen 9 1.51

14Jan10 1.4419

EUR= , Bid, Kijun Sen 26

14Jan10 1.4496 1.505

EUR= , Bid, Senkou Span(a) 52

18Feb10 1.4457 1.5

EUR= , Bid, Senkou Span(b) 52

18Feb10 1.4680 1.495

EUR= , Bid, Chikou Span 26

10Dec09 1.4537

1.49

1.485

1.48

1.475

1.47

1.465

1.46

1.455

1.45

1.445

1.44

1.435

1.43

1.425

05Oct09 12Oct 19Oct 26Oct 02Nov 09Nov 16Nov 23Nov 30Nov 07Dec 14Dec 21Dec 28Dec 04Jan 11Jan 18Jan 25Jan 01Feb 08Feb 15Feb

Comment: Rallying to new recent highs but stuck below a large Ichimoku ‘cloud’. Note this narrows sharply

th

by the 26 of this month so prices should be able to break through it eventually.

Strategy: Attempt longs at 1.6300, adding to 1.6235; stop well below 1.6100. Add to longs on a sustained break

above 1.6310 for 1.6400, then more.

Chart Levels:

Support Resistance Direction of Trade

1.6235 1.6309

1.6135 1.6340

1.6060 1.6415

1.5925 1.6500

1.5895* 1.6600

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- Technical Analysis 14 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 14 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- Technical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- Technical Analysis 19 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 19 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 27 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 27 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Eur-Usd-04 January 2010 DailyDocument1 pageEur-Usd-04 January 2010 DailyMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- GBP Usd 01 19 2010Document1 pageGBP Usd 01 19 2010Miir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Gbp-Usd-05 January 2010 DailyDocument1 pageGbp-Usd-05 January 2010 DailyMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- AUG-05 Mizuho Technical Analysis EUR USDDocument1 pageAUG-05 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- Gbp-Usd-04 January 2010 DailyDocument1 pageGbp-Usd-04 January 2010 DailyMiir ViirNo ratings yet

- Esquema Prueba Viga Vpt-1aDocument1 pageEsquema Prueba Viga Vpt-1aVictor HerreraNo ratings yet

- Bucatarie Living+ Loc de Luat Masa Dormitor: P P P PDocument1 pageBucatarie Living+ Loc de Luat Masa Dormitor: P P P PRoxana CiobanuNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- MyFXForecastsforTHURSDAY July29thDocument2 pagesMyFXForecastsforTHURSDAY July29thapi-26441337No ratings yet

- AUDITORIO CASA DE LA CULTURA HUANCAYO-ModelDocument1 pageAUDITORIO CASA DE LA CULTURA HUANCAYO-ModelBrandon RiveraNo ratings yet

- EUR USDUPDATEApril23Document2 pagesEUR USDUPDATEApril23api-26441337No ratings yet

- MyFXForecastsforMONDAY August2ndDocument2 pagesMyFXForecastsforMONDAY August2ndapi-26441337No ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- My Latest FXForecastsfor JULY5Document2 pagesMy Latest FXForecastsfor JULY5api-26441337No ratings yet

- BM 09 - Jalan Revolusi Kiri - Long & Cross (Iik)Document7 pagesBM 09 - Jalan Revolusi Kiri - Long & Cross (Iik)Rizky Wahyu SyaputraNo ratings yet

- AUG-04 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-04 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- Stair 1Document2 pagesStair 1Edan John HernandezNo ratings yet

- Technical Analysis 15 September 2010 JPY: CommentDocument1 pageTechnical Analysis 15 September 2010 JPY: CommentPlan B EconomicsNo ratings yet

- Area-250 SQ.M Kitchen Area - 510 SQ.M Restaurant: SLOPE - 1:10Document1 pageArea-250 SQ.M Kitchen Area - 510 SQ.M Restaurant: SLOPE - 1:10mathivananNo ratings yet

- Tugas Akhir Steel Pipe Rack MSIBDocument3 pagesTugas Akhir Steel Pipe Rack MSIBf a chaidirNo ratings yet

- MyFXForecastsforWEDNESDAY August18thDocument2 pagesMyFXForecastsforWEDNESDAY August18thapi-26441337No ratings yet

- Technical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Arquitectonico PBDocument1 pageArquitectonico PBPedro MárquezNo ratings yet

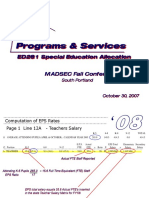

- Essential: Programs & ServicesDocument19 pagesEssential: Programs & ServicesLina LopesNo ratings yet

- Presentation Schedule2010BWFLYER FinalDocument1 pagePresentation Schedule2010BWFLYER FinalRamon Salsas EscatNo ratings yet

- Bupropion - Louis 3 1 "C:/Users/Nmr/Dropbox (Lims) /NMR 500Mhz/2019 Medical Capstone"Document1 pageBupropion - Louis 3 1 "C:/Users/Nmr/Dropbox (Lims) /NMR 500Mhz/2019 Medical Capstone"lorenzoNo ratings yet

- Instalatii EtajDocument1 pageInstalatii EtajOana RusuNo ratings yet

- ScienceDocument9 pagesScience심린No ratings yet

- ANEXA NR. 1.37 La Regulament Plan Etaj Releveu Imobil: RecapitulatieDocument1 pageANEXA NR. 1.37 La Regulament Plan Etaj Releveu Imobil: RecapitulatieSandu Denis-SorinNo ratings yet

- Arkananta: Denah Kolom Lt. 1 Denah Kolom Lt. 2Document1 pageArkananta: Denah Kolom Lt. 1 Denah Kolom Lt. 2Wahyu UNo ratings yet

- AUG-02 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-02 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- Ambr Rolla - MIDWEEEEK Deals 07, 08, 09 Aug-2023Document3 pagesAmbr Rolla - MIDWEEEEK Deals 07, 08, 09 Aug-2023Thendral IlankumaranNo ratings yet

- MyFXForecastsforTHURSDAY August12thDocument2 pagesMyFXForecastsforTHURSDAY August12thapi-26441337No ratings yet

- ATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewDocument1 pageATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewKAR WEI LEENo ratings yet

- ATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewDocument1 pageATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewKAR WEI LEENo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- JYSKE Bank AUG 09 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 09 Corp Orates DailyMiir ViirNo ratings yet

- AUG-09-DJ European Forex TechnicalsDocument3 pagesAUG-09-DJ European Forex TechnicalsMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- ScotiaBank AUG 09 Daily FX UpdateDocument3 pagesScotiaBank AUG 09 Daily FX UpdateMiir ViirNo ratings yet

- AUG-09 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-09 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- JYSKE Bank AUG 09 Market Drivers CurrenciesDocument5 pagesJYSKE Bank AUG 09 Market Drivers CurrenciesMiir ViirNo ratings yet

- Jyske Bank Aug 09 em DailyDocument5 pagesJyske Bank Aug 09 em DailyMiir ViirNo ratings yet

- Icici History of Industrial Credit and Investment Corporation of India (ICICI)Document4 pagesIcici History of Industrial Credit and Investment Corporation of India (ICICI)Saadhana MuthuNo ratings yet

- Does The Stereotypical Personality Reported For The Male Police Officer Fit That of The Female Police OfficerDocument2 pagesDoes The Stereotypical Personality Reported For The Male Police Officer Fit That of The Female Police OfficerIwant HotbabesNo ratings yet

- Group 5Document38 pagesGroup 5krizel rebualosNo ratings yet

- Uboot Rulebook v1.1 EN PDFDocument52 pagesUboot Rulebook v1.1 EN PDFUnai GomezNo ratings yet

- A Study On Mobilization of Deposit and Investment of Nabil Bank LTDDocument68 pagesA Study On Mobilization of Deposit and Investment of Nabil Bank LTDPadamNo ratings yet

- Art. 19 1993 P.CR - LJ 704Document10 pagesArt. 19 1993 P.CR - LJ 704Alisha khanNo ratings yet

- Dawah Course Syllabus - NDocument7 pagesDawah Course Syllabus - NMahmudul AminNo ratings yet

- Project Initiation Document (Pid) : PurposeDocument17 pagesProject Initiation Document (Pid) : PurposelucozzadeNo ratings yet

- 10 Types of Innovation (Updated)Document4 pages10 Types of Innovation (Updated)Nur AprinaNo ratings yet

- Bung Tomo InggrisDocument4 pagesBung Tomo Inggrissyahruladiansyah43No ratings yet

- Maharashtra Government Dilutes Gunthewari ActDocument2 pagesMaharashtra Government Dilutes Gunthewari ActUtkarsh SuranaNo ratings yet

- Odysseus JourneyDocument8 pagesOdysseus JourneyDrey MartinezNo ratings yet

- Information Security NotesDocument15 pagesInformation Security NotesSulaimanNo ratings yet

- Sharmila Ghuge V StateDocument20 pagesSharmila Ghuge V StateBar & BenchNo ratings yet

- Notice: Native American Human Remains, Funerary Objects Inventory, Repatriation, Etc.: Cosumnes River College, Sacramento, CADocument2 pagesNotice: Native American Human Remains, Funerary Objects Inventory, Repatriation, Etc.: Cosumnes River College, Sacramento, CAJustia.comNo ratings yet

- 21 ST CLQ1 W4 CADocument11 pages21 ST CLQ1 W4 CAPatrick LegaspiNo ratings yet

- Itinerary KigaliDocument2 pagesItinerary KigaliDaniel Kyeyune Muwanga100% (1)

- Worldpay Social Gaming and Gambling Whitepaper Chapter OneDocument11 pagesWorldpay Social Gaming and Gambling Whitepaper Chapter OneAnnivasNo ratings yet

- City of Cleveland Shaker Square Housing ComplaintDocument99 pagesCity of Cleveland Shaker Square Housing ComplaintWKYC.comNo ratings yet

- ACR Format Assisstant and ClerkDocument3 pagesACR Format Assisstant and ClerkJalil badnasebNo ratings yet

- Berkshire Hathaway Inc.: United States Securities and Exchange CommissionDocument48 pagesBerkshire Hathaway Inc.: United States Securities and Exchange CommissionTu Zhan LuoNo ratings yet

- Pronunciation SyllabusDocument5 pagesPronunciation Syllabusapi-255350959No ratings yet

- Senior High School: Rules of Debit and CreditDocument19 pagesSenior High School: Rules of Debit and CreditIva Milli Ayson50% (2)

- Persuasive Writing Exam - Muhamad Saiful Azhar Bin SabriDocument3 pagesPersuasive Writing Exam - Muhamad Saiful Azhar Bin SabriSaiful AzharNo ratings yet

- Ice Cream CaseDocument7 pagesIce Cream Casesardar hussainNo ratings yet

- Coding Decoding 1 - 5311366Document20 pagesCoding Decoding 1 - 5311366Sudarshan bhadaneNo ratings yet

- Superstore PROJECT 1Document3 pagesSuperstore PROJECT 1Tosin GeorgeNo ratings yet

- Aims of The Big Three'Document10 pagesAims of The Big Three'SafaNo ratings yet

- EDUC - 115 D - Fall2018 - Kathryn GauthierDocument7 pagesEDUC - 115 D - Fall2018 - Kathryn Gauthierdocs4me_nowNo ratings yet

- Technical AnalysisDocument4 pagesTechnical AnalysisShaira Ellyxa Mae VergaraNo ratings yet