Professional Documents

Culture Documents

Technical Analysis 15 January 2010 JPY: Comment: Strategy: Chart Levels

Uploaded by

Miir ViirOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Technical Analysis 15 January 2010 JPY: Comment: Strategy: Chart Levels

Uploaded by

Miir ViirCopyright:

Available Formats

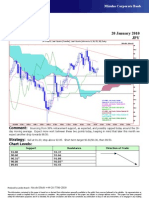

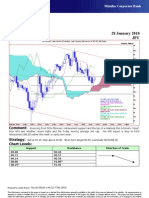

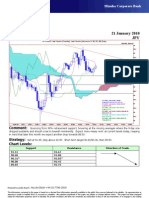

Mizuho Corporate Bank

Technical Analysis 15 January 2010

JPY

JPY=EBS, Last Quote [Candle], Last Quote [Ichimoku 9, 26, 52, 26] Daily

15Oct09 - 23Feb10

Pr

94

93.5

93

92.5

92

91.5

91

90.5

90

89.5

89

88.5

88

87.5

JPY=EBS , Last Quote, Candle

15Jan10 91.20 91.33 90.92 91.03

JPY=EBS , Last Quote, Tenkan Sen 9 87

15Jan10 92.26

JPY=EBS , Last Quote, Kijun Sen 26 86.5

15Jan10 90.98

JPY=EBS , Last Quote, Senkou Span(a) 52 86

19Feb10 91.62

JPY=EBS , Last Quote, Senkou Span(b) 52 85.5

19Feb10 89.30

JPY=EBS , Last Quote, Chikou Span 26

11Dec09 91.03 85

20Oct09 27Oct 03Nov 10Nov 17Nov 24Nov 01Dec 08Dec 15Dec 22Dec 29Dec 05Jan 12Jan 19Jan 26Jan 02Feb 09Feb 16Feb

Comment: Consolidating around the lower levels of the last three weeks, testing the 26-day moving average

at 90.98 today, and below the 9-day one. Expect more of the same this morning prior to another drop late today. A

weekly close clearly below 91.00 should turn momentum bearish.

Strategy: Sell at 91.05, adding to 91.50; stop above 92.05. Short term target 90.90, then 90.00.

Chart Levels:

Support Resistance Direction of Trade

90.90 91.33

90.73* 91.56

90.35 92.05*

90.00 92.65

89.50 93.78**

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 11 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 11 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 19 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 19 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 20 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 20 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 28 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 28 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 21 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 21 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 27 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 27 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 12 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 12 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 29 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 29 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Kontur FixDocument1 pageKontur FixIpan YopaniNo ratings yet

- A B C E F G H C D D: AzoteaDocument1 pageA B C E F G H C D D: AzoteaGustavo Róssiter VargasNo ratings yet

- My LATESTFXForecastsfor JUNE30Document3 pagesMy LATESTFXForecastsfor JUNE30api-26441337No ratings yet

- Technical Analysis 05 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 05 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Site Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatanDocument1 pageSite Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatandejomarlubNo ratings yet

- Residential Area: 10 M Wide RoadDocument1 pageResidential Area: 10 M Wide RoadharishNo ratings yet

- F&O ROLLOVER Jun - 2019 PDFDocument7 pagesF&O ROLLOVER Jun - 2019 PDFcdranuragNo ratings yet

- Technical Analysis 15 September 2010 JPY: CommentDocument1 pageTechnical Analysis 15 September 2010 JPY: CommentPlan B EconomicsNo ratings yet

- Cake - I Will SurviveDocument6 pagesCake - I Will SurviveJazz QuevedoNo ratings yet

- Group Leader Development 14-7-2022Document10 pagesGroup Leader Development 14-7-2022Lancar Jaya PrintingNo ratings yet

- Site Plan S6 - 4-1-2020Document1 pageSite Plan S6 - 4-1-2020harishNo ratings yet

- Power Point Cakupan PHBSDocument3 pagesPower Point Cakupan PHBSnovita sariNo ratings yet

- PCPL: Lito Pumicpic: Effectivity Date: February 2020Document1 pagePCPL: Lito Pumicpic: Effectivity Date: February 2020Jieza May MarquezNo ratings yet

- PP-001 Universal2 Pump Seal Reference ChartDocument1 pagePP-001 Universal2 Pump Seal Reference Chartandres roblezNo ratings yet

- Worton Creek Marina: Slip DiagramDocument1 pageWorton Creek Marina: Slip DiagramjacoNo ratings yet

- 1/7 (Row1 Col1)Document7 pages1/7 (Row1 Col1)renato_aleman_1No ratings yet

- Indian Railways: Trends, Issues, Opportunities and Outlook: G Raghuram Indian Institute of Management, AhmedabadDocument33 pagesIndian Railways: Trends, Issues, Opportunities and Outlook: G Raghuram Indian Institute of Management, AhmedabadmakbimhrdNo ratings yet

- 1-Cluster 03 Sewer Drawings 11-04-2018Document1 page1-Cluster 03 Sewer Drawings 11-04-2018Bernie QuepNo ratings yet

- Eis Me Aqui TromboneDocument2 pagesEis Me Aqui TromboneIury AugustoNo ratings yet

- Leg Profile-AP-63-AP-63Document1 pageLeg Profile-AP-63-AP-63Hikmat B. Ayer - हिक्मत ब. ऐरNo ratings yet

- Merry Christmas Mr. LawrenceDocument1 pageMerry Christmas Mr. Lawrenceckun kit yipNo ratings yet

- Rhino HeadDocument8 pagesRhino HeadALEJANDRONo ratings yet

- Rhino HeadDocument8 pagesRhino HeadSARABIA papeleria y regalosNo ratings yet

- Diseño de Alcantarillado Sanitario Municipio de Los CordobasDocument1 pageDiseño de Alcantarillado Sanitario Municipio de Los CordobasJose Alfredo Petro NavarroNo ratings yet

- UntitledDocument18 pagesUntitledImri TalgamNo ratings yet

- 2008 4GGSM 4G#RO MDO294 0164 - eSQAC - Clear - AlarmDocument23 pages2008 4GGSM 4G#RO MDO294 0164 - eSQAC - Clear - Alarmkhina luthfiNo ratings yet

- Kurva S PT - Etsa Hari Ke 30Document5 pagesKurva S PT - Etsa Hari Ke 30Ariwibowo SuparnadiNo ratings yet

- ZIVAN Lead-Acid Battery Charger, Model NG3, With ST62T25C6 Microcontroller Chip Labeled "V8"Document1 pageZIVAN Lead-Acid Battery Charger, Model NG3, With ST62T25C6 Microcontroller Chip Labeled "V8"Matias C100% (3)

- 5 Deck The Halls 02 Violin 2Document1 page5 Deck The Halls 02 Violin 2Nicanor MusNo ratings yet

- Site Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatanDocument1 pageSite Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatandejomarlubNo ratings yet

- Leg Profile-AP-64-AP-64Document1 pageLeg Profile-AP-64-AP-64Hikmat B. Ayer - हिक्मत ब. ऐरNo ratings yet

- Vals Sentimental - 4cDocument2 pagesVals Sentimental - 4cLolo LopezNo ratings yet

- Board SchematicDocument1 pageBoard SchematicJOSE LENIN RIVERA VILLALOBOS0% (1)

- 5 Deck The Halls 01 Violin 1Document1 page5 Deck The Halls 01 Violin 1Nicanor MusNo ratings yet

- Adc SchematicDocument1 pageAdc SchematicFernando FamaniaNo ratings yet

- Sewer Line Profile - Line Mh7-Mh19: RevisionsDocument1 pageSewer Line Profile - Line Mh7-Mh19: RevisionsBernie QuepNo ratings yet

- Weight and Length - Boys - 0 2 YearsDocument1 pageWeight and Length - Boys - 0 2 YearsSirawit KaewchaiyaNo ratings yet

- Housing TI085-052-070 136268Document1 pageHousing TI085-052-070 136268ZEUS ARMYNo ratings yet

- Forecasting Stationary ModelsDocument22 pagesForecasting Stationary ModelsVINAY GUPTANo ratings yet

- Aerodrome Chart MANAUS / Ponta Pelada, MIL (SBMN) : ARP S03 08 45 W059 59 06 Am-BrasilDocument2 pagesAerodrome Chart MANAUS / Ponta Pelada, MIL (SBMN) : ARP S03 08 45 W059 59 06 Am-BrasilJoão MazzaropiNo ratings yet

- Electrical Motor Efficiency Ratings PDFDocument3 pagesElectrical Motor Efficiency Ratings PDFGustavo CuatzoNo ratings yet

- Laboratorio-Primera Pla3ntaDocument1 pageLaboratorio-Primera Pla3ntaValeria VicenteNo ratings yet

- Turn Up The Radio - Autograph PDFDocument3 pagesTurn Up The Radio - Autograph PDFAlexandre Palacios de AlbuquerqueNo ratings yet

- Turn Up The Radio - Autograph PDFDocument3 pagesTurn Up The Radio - Autograph PDFAlexandre Palacios de AlbuquerqueNo ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR USDDocument1 pageAUG-10 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirNo ratings yet

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirNo ratings yet

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocument1 pageAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirNo ratings yet

- Chapter 6 Pricing StrategiesDocument51 pagesChapter 6 Pricing StrategiesSHS LEI COLLEEN P. QUINDOZANo ratings yet

- A Study On Impact of CRM On Customer Retention by Bharti Airtel LTDDocument4 pagesA Study On Impact of CRM On Customer Retention by Bharti Airtel LTDNeha AgarwalNo ratings yet

- OTC Trading - Impact of CCP Cognizant White PaperDocument12 pagesOTC Trading - Impact of CCP Cognizant White PaperGest DavidNo ratings yet

- Review in General Mathematics (Quiz Bee)Document26 pagesReview in General Mathematics (Quiz Bee)cherrie annNo ratings yet

- Walmart in JapanDocument13 pagesWalmart in JapanAbu Bakar ManafNo ratings yet

- Mekidelawit Tamrat MBAO9550.14BDocument4 pagesMekidelawit Tamrat MBAO9550.14BHiwot GebreEgziabherNo ratings yet

- Rose PetalDocument47 pagesRose Petalzee93% (15)

- The Expenditure Cycle (Latest)Document4 pagesThe Expenditure Cycle (Latest)Ashiqur Ansary100% (1)

- ToR Rental Markets in TanzaniaDocument11 pagesToR Rental Markets in TanzaniaAnonymous FnM14a0No ratings yet

- Dcomprehensiveexam DDocument12 pagesDcomprehensiveexam DDominic SociaNo ratings yet

- Joint Arrangements: Use The Following Information For Questions 1 and 2Document1 pageJoint Arrangements: Use The Following Information For Questions 1 and 2Mary Jescho Vidal AmpilNo ratings yet

- Master-TSP-ListSBDG TSPslist V11.2 LatestDocument358 pagesMaster-TSP-ListSBDG TSPslist V11.2 LatestIsmed Ulam Raja100% (1)

- By Satish Kumar MDocument16 pagesBy Satish Kumar Msumathi psgcasNo ratings yet

- The Ethics of International Transfer Pricing: Messaoud MehafdiDocument17 pagesThe Ethics of International Transfer Pricing: Messaoud MehafdiFir BhiNo ratings yet

- Chap 022Document23 pagesChap 022Muh BilalNo ratings yet

- Money MKT OperationDocument9 pagesMoney MKT OperationRohan PatilNo ratings yet

- 1.0 MCMC Licensing - Guidelines - 2019Document77 pages1.0 MCMC Licensing - Guidelines - 2019Carl LiNo ratings yet

- Business Model Canvas TemplateDocument1 pageBusiness Model Canvas TemplateNicholas Andrian WirajaNo ratings yet

- 'Spot Rate': Nvestopedia Explains 'Forward Exchange Contract'Document2 pages'Spot Rate': Nvestopedia Explains 'Forward Exchange Contract'Smriti KhannaNo ratings yet

- ComprehensiveDocument9 pagesComprehensiveChristopher RogersNo ratings yet

- CATC DL Ch06 E Commerce FundamentalsDocument16 pagesCATC DL Ch06 E Commerce Fundamentals01-11-09 ธีรายุ ฟื้นหัวสระNo ratings yet

- Redefining A BrandDocument16 pagesRedefining A BrandRd Indra AdikaNo ratings yet

- OYODocument16 pagesOYOAkshaySaxenaNo ratings yet

- Ikea Retail ManagementDocument28 pagesIkea Retail ManagementLokendra NaikNo ratings yet

- 6 - Yueh-Hua Lee, Hui-Chiung Lo & Enkhgerel EnkhtuvshinDocument13 pages6 - Yueh-Hua Lee, Hui-Chiung Lo & Enkhgerel EnkhtuvshinBige UrbaNo ratings yet

- IMC - TanishqDocument16 pagesIMC - Tanishqsriram_balNo ratings yet

- Franchise AccountingDocument4 pagesFranchise AccountingJBNo ratings yet

- Shapiro CHAPTER 6 SolutionsDocument10 pagesShapiro CHAPTER 6 SolutionsjzdoogNo ratings yet

- 18.marginal Absorption NewDocument17 pages18.marginal Absorption NewMuhammad EjazNo ratings yet

- Demand, Supply, and Market EquilibriumDocument20 pagesDemand, Supply, and Market Equilibriumchittran313100% (1)