Professional Documents

Culture Documents

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright:

Available Formats

Mizuho Corporate Bank

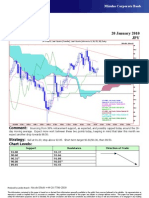

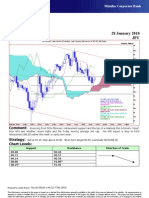

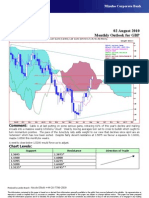

Technical Analysis 18 January 2010

JPY

JPY=EBS, Last Quote [Candle], Last Quote [Ichimoku 9, 26, 52, 26] Daily

22Oct09 - 23Feb10

Pr

93.5

93

92.5

92

91.5

91

90.5

90

89.5

89

88.5

88

JPY=EBS , Last Quote, Candle 87.5

18Jan10 90.81 91.07 90.71 90.94

JPY=EBS , Last Quote, Tenkan Sen 9 87

18Jan10 92.19

JPY=EBS , Last Quote, Kijun Sen 26

86.5

18Jan10 91.05

JPY=EBS , Last Quote, Senkou Span(a) 52

22Feb10 91.62 86

JPY=EBS , Last Quote, Senkou Span(b) 52

22Feb10 89.30 85.5

JPY=EBS , Last Quote, Chikou Span 26

14Dec09 90.94

85

26Oct09 02Nov 09Nov 16Nov 23Nov 30Nov 07Dec 14Dec 21Dec 28Dec 04Jan 11Jan 18Jan 25Jan 01Feb 08Feb 15Feb 22Feb

Comment: Hovering at the lower levels of the last three weeks, just under the 26-day moving average at

91.05 today, and below the 9-day one. Last week’s close just below 91.00 has turned momentum bearish, many yen

crosses having ‘bearish engulfing’ weekly candles. We also have a small potential ‘head-and-shoulders’ topping

pattern whose measured target is at least 89.00, probably just under 88.00.

Strategy: Sell at 90.95, adding to 91.30; stop above 92.05. Short term target 90.75, then 90.00.

Chart Levels:

Support Resistance Direction of Trade

90.70 91.07

90.60* 91.33

90.35 92.05*

90.00 92.65

89.50 93.78**

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 20 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 20 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 21 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 21 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 28 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 28 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 19 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 19 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 12 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 12 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 11 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 11 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 27 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 27 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 29 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 29 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 15 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 15 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 05 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 05 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 15 September 2010 JPY: CommentDocument1 pageTechnical Analysis 15 September 2010 JPY: CommentPlan B EconomicsNo ratings yet

- My LATESTFXForecastsfor JUNE30Document3 pagesMy LATESTFXForecastsfor JUNE30api-26441337No ratings yet

- Residential Area: 10 M Wide RoadDocument1 pageResidential Area: 10 M Wide RoadharishNo ratings yet

- PCPL: Lito Pumicpic: Effectivity Date: February 2020Document1 pagePCPL: Lito Pumicpic: Effectivity Date: February 2020Jieza May MarquezNo ratings yet

- Site Plan S6 - 4-1-2020Document1 pageSite Plan S6 - 4-1-2020harishNo ratings yet

- Power Point Cakupan PHBSDocument3 pagesPower Point Cakupan PHBSnovita sariNo ratings yet

- Technical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- A B C E F G H C D D: AzoteaDocument1 pageA B C E F G H C D D: AzoteaGustavo Róssiter VargasNo ratings yet

- Site Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatanDocument1 pageSite Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatandejomarlubNo ratings yet

- Kontur FixDocument1 pageKontur FixIpan YopaniNo ratings yet

- Group Leader Development 14-7-2022Document10 pagesGroup Leader Development 14-7-2022Lancar Jaya PrintingNo ratings yet

- F&O ROLLOVER Jun - 2019 PDFDocument7 pagesF&O ROLLOVER Jun - 2019 PDFcdranuragNo ratings yet

- CNN Features Off-The-shelf: An Astounding Baseline For RecognitionDocument8 pagesCNN Features Off-The-shelf: An Astounding Baseline For RecognitionAkash GuptaNo ratings yet

- Kurva S PT - Etsa Hari Ke 30Document5 pagesKurva S PT - Etsa Hari Ke 30Ariwibowo SuparnadiNo ratings yet

- Khadi Chowk To Bridge Part - 2Document1 pageKhadi Chowk To Bridge Part - 2naman jainNo ratings yet

- Indian Railways: Trends, Issues, Opportunities and Outlook: G Raghuram Indian Institute of Management, AhmedabadDocument33 pagesIndian Railways: Trends, Issues, Opportunities and Outlook: G Raghuram Indian Institute of Management, AhmedabadmakbimhrdNo ratings yet

- 1/7 (Row1 Col1)Document7 pages1/7 (Row1 Col1)renato_aleman_1No ratings yet

- Merry Christmas Mr. LawrenceDocument1 pageMerry Christmas Mr. Lawrenceckun kit yipNo ratings yet

- Forecasting Stationary ModelsDocument22 pagesForecasting Stationary ModelsVINAY GUPTANo ratings yet

- Cake - I Will SurviveDocument6 pagesCake - I Will SurviveJazz QuevedoNo ratings yet

- CNN Features Off-the-Shelf - An Astounding Baseline For RecognitionDocument8 pagesCNN Features Off-the-Shelf - An Astounding Baseline For RecognitionhiriNo ratings yet

- Trombone IIDocument8 pagesTrombone IIKirs YoshikageNo ratings yet

- Diseño de Alcantarillado Sanitario Municipio de Los CordobasDocument1 pageDiseño de Alcantarillado Sanitario Municipio de Los CordobasJose Alfredo Petro NavarroNo ratings yet

- Electrical Motor Efficiency Ratings PDFDocument3 pagesElectrical Motor Efficiency Ratings PDFGustavo CuatzoNo ratings yet

- UntitledDocument18 pagesUntitledImri TalgamNo ratings yet

- Worton Creek Marina: Slip DiagramDocument1 pageWorton Creek Marina: Slip DiagramjacoNo ratings yet

- PP-001 Universal2 Pump Seal Reference ChartDocument1 pagePP-001 Universal2 Pump Seal Reference Chartandres roblezNo ratings yet

- 4DDocument1 page4DFitri WahyuniNo ratings yet

- Sewer Line Profile - Line Mh7-Mh19: RevisionsDocument1 pageSewer Line Profile - Line Mh7-Mh19: RevisionsBernie QuepNo ratings yet

- Eis Me Aqui TromboneDocument2 pagesEis Me Aqui TromboneIury AugustoNo ratings yet

- Housing TI085-052-070 136268Document1 pageHousing TI085-052-070 136268ZEUS ARMYNo ratings yet

- Board SchematicDocument1 pageBoard SchematicJOSE LENIN RIVERA VILLALOBOS0% (1)

- Turn Up The Radio - Autograph: Drum ScoreDocument3 pagesTurn Up The Radio - Autograph: Drum ScoreAlexandre Palacios de AlbuquerqueNo ratings yet

- Turn Up The Radio - Autograph PDFDocument3 pagesTurn Up The Radio - Autograph PDFAlexandre Palacios de AlbuquerqueNo ratings yet

- Turn Up The Radio - Autograph PDFDocument3 pagesTurn Up The Radio - Autograph PDFAlexandre Palacios de AlbuquerqueNo ratings yet

- Turn Up The Radio - Autograph PDFDocument3 pagesTurn Up The Radio - Autograph PDFAlexandre Palacios de AlbuquerqueNo ratings yet

- Pemodelan EksitingDocument1 pagePemodelan EksitingAyah AlealanaNo ratings yet

- Site Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatanDocument1 pageSite Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatandejomarlubNo ratings yet

- W 75 ... P (IEC) : BonfiglioliDocument1 pageW 75 ... P (IEC) : BonfiglioliAtox BlackNo ratings yet

- El Triste: SebastianDocument1 pageEl Triste: SebastianAntonio Alexander CamposNo ratings yet

- A Classical Christmas - 1-2 Corno - in - MibDocument2 pagesA Classical Christmas - 1-2 Corno - in - MibsayesotNo ratings yet

- Mika C - ADocument2 pagesMika C - AJean-Claude BourletNo ratings yet

- 1-Cluster 03 Sewer Drawings 11-04-2018Document1 page1-Cluster 03 Sewer Drawings 11-04-2018Bernie QuepNo ratings yet

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR USDDocument1 pageAUG-10 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirNo ratings yet

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirNo ratings yet

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirNo ratings yet

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirNo ratings yet

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocument1 pageAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirNo ratings yet

- 280-Article Text-1201-1-10-20220426Document8 pages280-Article Text-1201-1-10-20220426Ayu Ratri PNo ratings yet

- Flexural Design of Fiber-Reinforced Concrete Soranakom Mobasher 106-m52Document10 pagesFlexural Design of Fiber-Reinforced Concrete Soranakom Mobasher 106-m52Premalatha JeyaramNo ratings yet

- Course Content: SAP Fiori Implementation (SAPX03)Document3 pagesCourse Content: SAP Fiori Implementation (SAPX03)Jathin Varma KanumuriNo ratings yet

- Final For Influence of OJTDocument39 pagesFinal For Influence of OJTAnthony B. AnocheNo ratings yet

- Shipping Operation Diagram: 120' (EVERY 30')Document10 pagesShipping Operation Diagram: 120' (EVERY 30')Hafid AriNo ratings yet

- Hussain Kapadawala 1Document56 pagesHussain Kapadawala 1hussainkapda7276No ratings yet

- Chapter 4 Nuc - PhyDocument11 pagesChapter 4 Nuc - PhyHaris ShahidNo ratings yet

- EntropyDocument38 pagesEntropyPreshanth_Jaga_2224No ratings yet

- Unit 6 Listening Practice OUT AND ABOUT 1Document1 pageUnit 6 Listening Practice OUT AND ABOUT 1Marta Sampedro GonzalezNo ratings yet

- Cardiovascular System Heart ReviewerDocument8 pagesCardiovascular System Heart ReviewerImmanuel Cris PalasigueNo ratings yet

- Universal Prayers IIDocument3 pagesUniversal Prayers IIJericho AguiatanNo ratings yet

- G.R. No. 201354 September 21, 2016Document11 pagesG.R. No. 201354 September 21, 2016Winston YutaNo ratings yet

- Decretals Gregory IXDocument572 pagesDecretals Gregory IXDesideriusBT100% (4)

- Noceda vs. Court of Appeals (Property Case)Document3 pagesNoceda vs. Court of Appeals (Property Case)jokuanNo ratings yet

- Public ParticipationDocument17 pagesPublic ParticipationAinul Jaria MaidinNo ratings yet

- Proofs in Indian Mathematics: M.D.SrinivasDocument40 pagesProofs in Indian Mathematics: M.D.SrinivasShashankNo ratings yet

- Emotions Influence Color Preference PDFDocument48 pagesEmotions Influence Color Preference PDFfllorinvNo ratings yet

- Urban Design ToolsDocument24 pagesUrban Design Toolstanie75% (8)

- Hapter 2: Theoretical FrameworkDocument18 pagesHapter 2: Theoretical FrameworkMohamed HamzaNo ratings yet

- DBS AR 2019 Final Final PDFDocument371 pagesDBS AR 2019 Final Final PDFDevi Nurusr100% (1)

- MIL Q3 Module 5 REVISEDDocument23 pagesMIL Q3 Module 5 REVISEDEustass Kidd68% (19)

- An Aging Game Simulation Activity For Al PDFDocument13 pagesAn Aging Game Simulation Activity For Al PDFramzan aliNo ratings yet

- Fouts Federal LawsuitDocument28 pagesFouts Federal LawsuitWXYZ-TV DetroitNo ratings yet

- 87844-Chapter 1. The Psychology of TourismDocument28 pages87844-Chapter 1. The Psychology of TourismVENA LANDERONo ratings yet

- 21st Century NotesDocument3 pages21st Century NotesCarmen De HittaNo ratings yet

- 5568 AssignmentDocument12 pages5568 AssignmentAtif AliNo ratings yet

- Chapter - 2: Project AdministrationDocument69 pagesChapter - 2: Project AdministrationRenish RanganiNo ratings yet

- Nicolopoulou-Stamati - Reproductive Health and The EnvironmentDocument409 pagesNicolopoulou-Stamati - Reproductive Health and The EnvironmentGiorgos PapasakelarisNo ratings yet

- Mindfulness: Presented by Joshua Green, M.S. Doctoral Intern at Umaine Counseling CenterDocument12 pagesMindfulness: Presented by Joshua Green, M.S. Doctoral Intern at Umaine Counseling CenterLawrence MbahNo ratings yet

- Noorul Islam Centre For Higher Education Noorul Islam University, Kumaracoil M.E. Biomedical Instrumentation Curriculum & Syllabus Semester IDocument26 pagesNoorul Islam Centre For Higher Education Noorul Islam University, Kumaracoil M.E. Biomedical Instrumentation Curriculum & Syllabus Semester Iisaac RNo ratings yet