Professional Documents

Culture Documents

Mizuho Corporate Bank

Uploaded by

Miir ViirOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright:

Available Formats

Mizuho Corporate Bank

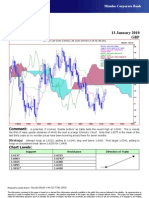

Technical Analysis 18 January 2010

GBP

GBP=D3, Last Quote [Candle], Last Quote [Ichimoku 9, 26, 52, 26] Daily

15Sep09 - 23Feb10

Pr

GBP=D3 , Last Quote, Candle

18Jan10 1.6253 1.6320 1.6250 1.6300

GBP=D3 , Last Quote, Tenkan Sen 9

18Jan10 1.6127 1.68

GBP=D3 , Last Quote, Kijun Sen 26

18Jan10 1.6122

GBP=D3 , Last Quote, Senkou Span(a) 52

1.67

22Feb10 1.6124

GBP=D3 , Last Quote, Senkou Span(b) 52

22Feb10 1.6356

GBP=D3 , Last Quote, Chikou Span 26 1.66

14Dec09 1.6300

1.65

1.64

1.63

1.62

1.61

1.6

1.59

1.58

1.57

28Sep09 12Oct 26Oct 09Nov 23Nov 07Dec 21Dec 04Jan 18Jan 01Feb 15Feb

Comment: Now that consensus opinion is firmly against sterling and the yen, these were last week’s best

performers, reversing their position in December. Cable is struggling with a large Ichimoku ‘cloud’ and moving

averages have crossed to bullish. Note the daily ‘cloud’ narrows sharply by the 26th of this month so prices should be

able to break through it eventually.

Strategy: Attempt longs at 1.6300, adding to 1.6255; stop well below 1.6200. Add to longs on a sustained break

above 1.6415 for 1.6555 short term.

Chart Levels:

Support Resistance Direction of Trade

1.6250 1.6320

1.6211 1.6357

1.6150 1.6415

1.6063 1.6500

1.6000 1.6600

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- December Study Notes PDFDocument105 pagesDecember Study Notes PDFKatlego Mushi100% (7)

- Quasidb - Live Data APIDocument428 pagesQuasidb - Live Data APIOndrášek ChaloudupkaNo ratings yet

- Acetrades EbookDocument20 pagesAcetrades Ebookallegre50% (2)

- Price Action Tips and TricksDocument29 pagesPrice Action Tips and TricksChris Rodriguez Solo100% (1)

- Bill Poulos - Power Forex Profit Principles PDFDocument98 pagesBill Poulos - Power Forex Profit Principles PDFNasko R100% (2)

- Q4 ABM Business Finance 12 Week 1 2Document3 pagesQ4 ABM Business Finance 12 Week 1 2Kinn Jay0% (1)

- Galaxy Dividend Income Growth FundDocument8 pagesGalaxy Dividend Income Growth FundLearning Engineer100% (1)

- Articles of Corporation FINALDocument11 pagesArticles of Corporation FINALMichelle Ann Domagtoy100% (1)

- CoplDocument8 pagesCoplAdil HassanNo ratings yet

- 1 Pivots-1 PDFDocument5 pages1 Pivots-1 PDFKalpesh Shah100% (1)

- Cryptocurrency - Tips & Strategies For Your Investing Success by Dexter SanchezDocument75 pagesCryptocurrency - Tips & Strategies For Your Investing Success by Dexter SanchezgfgfgfgNo ratings yet

- Buy Low Sell HighDocument20 pagesBuy Low Sell HighDamon BankheadNo ratings yet

- Buddhist TraderDocument54 pagesBuddhist Tradersid100% (3)

- 142FFTDocument4 pages142FFTEduardo FerreiraNo ratings yet

- Trading Strategies From Technical Analysis - 6Document19 pagesTrading Strategies From Technical Analysis - 6GEorge StassanNo ratings yet

- DeCycler by EHLERSDocument5 pagesDeCycler by EHLERSbulut33No ratings yet

- Ichimoku Kinko HyoDocument33 pagesIchimoku Kinko HyoAhmed NabilNo ratings yet

- Linear Regression Slope: Sensitivity Test: Oxford Capital Strategies LTD: Trading Strategy: Commission & Slippage: $0Document8 pagesLinear Regression Slope: Sensitivity Test: Oxford Capital Strategies LTD: Trading Strategy: Commission & Slippage: $0Oxford Capital Strategies LtdNo ratings yet

- 5 Min Hein Ken AshiDocument3 pages5 Min Hein Ken AshiDisha ParabNo ratings yet

- 496 Schaff Trend CycleDocument2 pages496 Schaff Trend Cyclemodis777No ratings yet

- SMART Installation 47 2 PDFDocument37 pagesSMART Installation 47 2 PDFletuanNo ratings yet

- Index of Zhengtong DaozangDocument56 pagesIndex of Zhengtong Daozangiftsm100% (1)

- Ehlers. The CG OscillatorDocument4 pagesEhlers. The CG OscillatorPapy RysNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Corey Hoffstein - Two Centuries of Momentum (2018)Document27 pagesCorey Hoffstein - Two Centuries of Momentum (2018)Kenneth AndersonNo ratings yet

- Getting Your Charts Ready Printer FriendlyDocument13 pagesGetting Your Charts Ready Printer FriendlyHobbes556No ratings yet

- The Kumo - IchiWiki - The Definitive Reference To The Ichimoku Kinko Hyo Charting SystemDocument7 pagesThe Kumo - IchiWiki - The Definitive Reference To The Ichimoku Kinko Hyo Charting SystemMiner cand100% (2)

- PivotPointPresentation P1MarketAuctionTheoryDocument28 pagesPivotPointPresentation P1MarketAuctionTheoryManik AroraNo ratings yet

- Management Accounting Autumn 2009Document18 pagesManagement Accounting Autumn 2009MahmozNo ratings yet

- 一目均衡表 (Ichimoku云图) PDFDocument19 pages一目均衡表 (Ichimoku云图) PDF郑登宇No ratings yet

- KTS Free Ver 2Document16 pagesKTS Free Ver 2Nam NguyenNo ratings yet

- Ichimoku Marketwatch V3Document4 pagesIchimoku Marketwatch V3Tamas DemeterNo ratings yet

- Hertz DT StrategryDocument13 pagesHertz DT Strategrysandra akinseteNo ratings yet

- Short Term Trading Strategy Based On Chart Pattern Recognition and Trend Trading in Nasdaq Biotechnology Stock MarketDocument7 pagesShort Term Trading Strategy Based On Chart Pattern Recognition and Trend Trading in Nasdaq Biotechnology Stock MarketAman KNo ratings yet

- 2.3 - Average Directional Movement Index Rating (ADXR) - Forex Indicators GuideDocument2 pages2.3 - Average Directional Movement Index Rating (ADXR) - Forex Indicators Guideenghoss77No ratings yet

- Adaptive CciDocument38 pagesAdaptive CciFábio Trevisan100% (1)

- The Joy of Detrending IiiDocument7 pagesThe Joy of Detrending IiiAnonymous X0iytQQYJ6No ratings yet

- Gold (2003) - FX Trading Via Recurrent Reinforcement Learning PDFDocument8 pagesGold (2003) - FX Trading Via Recurrent Reinforcement Learning PDFMarcelo SepulvedaNo ratings yet

- Makroanalisa PDFDocument101 pagesMakroanalisa PDFsutrisno suparNo ratings yet

- Dynamic Trading ToolsDocument24 pagesDynamic Trading Toolsmr12323100% (1)

- Bundle of SkillsDocument6 pagesBundle of SkillsVan Der Spuy Brink100% (1)

- Trading TimeDocument35 pagesTrading TimeHari H100% (1)

- Forex Profit Heaper ManualDocument12 pagesForex Profit Heaper Manualluisk94No ratings yet

- SharpShooterScalpingwdStrategy FuturesDocument24 pagesSharpShooterScalpingwdStrategy FuturesGARO OHANOGLUNo ratings yet

- ADX FilterDocument8 pagesADX FilterOxford Capital Strategies LtdNo ratings yet

- Sentiment: IndicatorsDocument15 pagesSentiment: IndicatorsKaneNo ratings yet

- The Relative Volatility IndexDocument4 pagesThe Relative Volatility IndexmjmariaantonyrajNo ratings yet

- WR SupplementDocument9 pagesWR Supplementtrb301No ratings yet

- My Trading Diary 2010Document10 pagesMy Trading Diary 2010bokugrahamNo ratings yet

- Wayne A. Thorp - Technical Analysis PDFDocument33 pagesWayne A. Thorp - Technical Analysis PDFSrinivasNo ratings yet

- S C Volume The Forgotten Oscillator PDFDocument6 pagesS C Volume The Forgotten Oscillator PDFkosurugNo ratings yet

- Average True Range (ATR) Formula, What It Means, and How To Use ItDocument10 pagesAverage True Range (ATR) Formula, What It Means, and How To Use ItAbdulaziz AlshakraNo ratings yet

- Swami ChartsDocument5 pagesSwami Chartscyrus68No ratings yet

- Momentum Turning PointsDocument68 pagesMomentum Turning PointsswarkamalNo ratings yet

- Synergy Basic Trading MethodDocument16 pagesSynergy Basic Trading Methodkazabian kazabian100% (1)

- ATAA ConferenceDocument6 pagesATAA ConferenceKayan3No ratings yet

- Enki Expert Advisor: Prime Trend (Look at Daily Chart)Document4 pagesEnki Expert Advisor: Prime Trend (Look at Daily Chart)Dacio Lima Santos Jr.No ratings yet

- From WoodiesDocument12 pagesFrom WoodiesalexandremorenoasuarNo ratings yet

- How I Trade For A Living - Chapter 1Document7 pagesHow I Trade For A Living - Chapter 1William Lee0% (1)

- CME DataMine T&S Vs IQFeed's Millisecond Time Stamps - Brokers and Data Feeds - Big Mike TradingDocument16 pagesCME DataMine T&S Vs IQFeed's Millisecond Time Stamps - Brokers and Data Feeds - Big Mike TradingDraženSNo ratings yet

- Advances in HFTDocument39 pagesAdvances in HFTnerimarco38No ratings yet

- Forex5 INDICATOR AlligatorDocument11 pagesForex5 INDICATOR AlligatorKamoheloNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- GBP Usd 01 19 2010Document1 pageGBP Usd 01 19 2010Miir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- ScotiaBank AUG 09 Daily FX UpdateDocument3 pagesScotiaBank AUG 09 Daily FX UpdateMiir ViirNo ratings yet

- AUG-09-DJ European Forex TechnicalsDocument3 pagesAUG-09-DJ European Forex TechnicalsMiir ViirNo ratings yet

- AUG-09 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-09 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- JYSKE Bank AUG 09 Market Drivers CurrenciesDocument5 pagesJYSKE Bank AUG 09 Market Drivers CurrenciesMiir ViirNo ratings yet

- Jyske Bank Aug 09 em DailyDocument5 pagesJyske Bank Aug 09 em DailyMiir ViirNo ratings yet

- JYSKE Bank AUG 09 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 09 Corp Orates DailyMiir ViirNo ratings yet

- Stock Market IndicesDocument18 pagesStock Market IndicesJasmine JoseNo ratings yet

- PPT-10 REITs - InvITs PresentaionDocument24 pagesPPT-10 REITs - InvITs PresentaionVikas MaheshwariNo ratings yet

- Buy Entry Intraday, Technical Analysis ScannerDocument2 pagesBuy Entry Intraday, Technical Analysis ScannerVipul SolankiNo ratings yet

- 48 - Future of US FundingDocument24 pages48 - Future of US FundingRahmawan SetiajiNo ratings yet

- CIO Monthly Extended - en - 1599738Document46 pagesCIO Monthly Extended - en - 1599738mark.qianNo ratings yet

- JPM 2010 Annual ReviewDocument300 pagesJPM 2010 Annual ReviewMatt CareyNo ratings yet

- Chilton Flagship Strategies - Presentation - February 2012Document25 pagesChilton Flagship Strategies - Presentation - February 2012ChapersonNo ratings yet

- Daytrading 2 PDF FreeDocument214 pagesDaytrading 2 PDF FreeMirco NardiNo ratings yet

- Period Close Exception ReportDocument11 pagesPeriod Close Exception ReportKumarNo ratings yet

- Final Jason Bond Picks Momentum Hunter Ebook March 2020 2 PDFDocument83 pagesFinal Jason Bond Picks Momentum Hunter Ebook March 2020 2 PDFLean GalbuseraNo ratings yet

- Warranty Expense and Bonds PayableDocument3 pagesWarranty Expense and Bonds PayableAira Jaimee GonzalesNo ratings yet

- Indian Financial SystemDocument25 pagesIndian Financial SystemThe State AcademyNo ratings yet

- T&L BrochureDocument2 pagesT&L BrochuremottebossNo ratings yet

- Aberdeen Emerging Markets Telecom & Infrastructure Fund, Inc. (ETF)Document28 pagesAberdeen Emerging Markets Telecom & Infrastructure Fund, Inc. (ETF)ArvinLedesmaChiongNo ratings yet

- Resume Joana de S Saad 1688571509Document2 pagesResume Joana de S Saad 1688571509Hola HoolaNo ratings yet

- Project On Technical AnalysisDocument32 pagesProject On Technical AnalysisShubham BhatiaNo ratings yet

- FinQuiz - Smart Summary - Study Session 8 - Reading 28Document3 pagesFinQuiz - Smart Summary - Study Session 8 - Reading 28RafaelNo ratings yet

- Name: - ScoreDocument1 pageName: - ScoreIvy MercadoNo ratings yet

- Ebay PPDocument33 pagesEbay PPsinghsarabjeetNo ratings yet

- IFRS Metodo Del Derivado HipoteticoDocument12 pagesIFRS Metodo Del Derivado HipoteticoEdgar Ramon Guillen VallejoNo ratings yet

- AMAZON Insider TradingDocument9 pagesAMAZON Insider TradingZerohedgeNo ratings yet

- Sta Diploma Level 2 Examination - Question Paper April 2015Document15 pagesSta Diploma Level 2 Examination - Question Paper April 2015missmawarlinaNo ratings yet

- Venture CapitalDocument16 pagesVenture CapitalAditya100% (1)

- CLP COP PEN NDF Docs PDFDocument31 pagesCLP COP PEN NDF Docs PDFAlex RubioNo ratings yet