Professional Documents

Culture Documents

Option Note

Uploaded by

etravoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Option Note

Uploaded by

etravoCopyright:

Available Formats

volatility is expressed as an annual rate

when prices change are assumed to be normally distributed, the continuous

compounding of these price changes will cause the prices at maturity to be log

normally distributed. (skewed to the upside because of greater rate of return in term

of absolute terms.

2 assumptions dans le model BS

1. continuous time model, assume vol constant over life of the option and

continuously compounded.

theses two assumption mean that the possible price of S at expiration of the opion

are log normally distributed

it also explain why option with higher strike carry more value than the other one,

in absolute term lognormal distribution assumption allows for greater upside price

movement than downside.

lognormal solve problem of pricing with log +infinite = +infinite instead of log -infinite

=0

correspond to real option payof

p64

contract = x100

for a weekly : divide by 7.2 such as ; 28% (vol) / 7.2 x $45 = 1.75price

change weekly

in the same way for daily instead of divide by 7.2 use 16 (because

square root of 256 trading days is 16)

for eurodollar contract . for calculate volatility, use 100- price of contract

(100-93=7 where 7 is input as price for forecasting a correct volatility

note . 100 is representing a barrier such as 0 for normal underlying and

commodities. can't price above

Volatility ; we want a volatility expressed in days or weeks or months

such as expiration of options instead of a annual volatility.

solution : volatility is proportionate to the square root of the time

Gamma ; gamma is long for long options and shorts for shorts options,

such as

long put : short delta (-) and positive gamma

theta is the value of loss to the option such as 0.57 =

vega ; sensitivity on changes in volatility

video tasty sell iron condor : only when implied volatility >50% with a

managing win profit prob >80% instead of 67% for

You might also like

- Ratings CriteriaDocument1 pageRatings CriteriaAakash KhandelwalNo ratings yet

- Consent Form FCC ParagonDocument1 pageConsent Form FCC ParagonetravoNo ratings yet

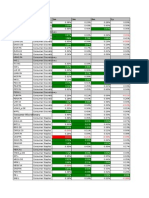

- Symbol Sectors 1m 3m 6m 1yDocument13 pagesSymbol Sectors 1m 3m 6m 1yetravoNo ratings yet

- Ntro To-Options 2012Document53 pagesNtro To-Options 2012etravoNo ratings yet

- Was Senior Management at Barings Aware That There Was A Problem at BFS? ExplainDocument4 pagesWas Senior Management at Barings Aware That There Was A Problem at BFS? ExplainetravoNo ratings yet

- Credit Default Swap Valuation IDocument35 pagesCredit Default Swap Valuation ISharad Dutta0% (1)

- Chart Implied Volatility Data in Real-TimeDocument2 pagesChart Implied Volatility Data in Real-TimeetravoNo ratings yet

- L 1-R Credit Spread D (0, T - Years) SP Cumul: PDF CumDocument5 pagesL 1-R Credit Spread D (0, T - Years) SP Cumul: PDF CumetravoNo ratings yet

- Symbol Sectors 1m 3m 6m 1yDocument13 pagesSymbol Sectors 1m 3m 6m 1yetravoNo ratings yet

- Capital Guaranteed Notes Ba Rrier Reverse Convertibles: Example: Autocallable NoteDocument4 pagesCapital Guaranteed Notes Ba Rrier Reverse Convertibles: Example: Autocallable NoteetravoNo ratings yet

- Tudor Capital Europe LLP Pillar 3 Disclosure PDFDocument7 pagesTudor Capital Europe LLP Pillar 3 Disclosure PDFetravoNo ratings yet

- Business ValuationDocument7 pagesBusiness ValuationetravoNo ratings yet

- XRTrading Cover LetterDocument1 pageXRTrading Cover LetteretravoNo ratings yet

- Equity Index Fair Value MonitorDocument2 pagesEquity Index Fair Value MonitoretravoNo ratings yet

- FT WordDocument1 pageFT WordetravoNo ratings yet

- Assignement DerivativesDocument4 pagesAssignement DerivativesetravoNo ratings yet

- 42728711ACST828ASS1Document17 pages42728711ACST828ASS1etravoNo ratings yet

- Finacial TimesDocument2 pagesFinacial TimesetravoNo ratings yet

- Finacial TimesDocument2 pagesFinacial TimesetravoNo ratings yet

- Dispersion Trading Reference For StartingDocument1 pageDispersion Trading Reference For StartingetravoNo ratings yet

- Group Assignment Strategic ManagementDocument2 pagesGroup Assignment Strategic ManagementetravoNo ratings yet

- Bain and Company Global Private Equity Report 2012 PDFDocument72 pagesBain and Company Global Private Equity Report 2012 PDFLinus Vallman JohanssonNo ratings yet

- Gem Global Report 2010revDocument85 pagesGem Global Report 2010revRafael Martins VieiraNo ratings yet

- Finacial TimesDocument2 pagesFinacial TimesetravoNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)