Professional Documents

Culture Documents

Mizuho Corporate Bank

Uploaded by

Miir ViirOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright:

Available Formats

Mizuho Corporate Bank

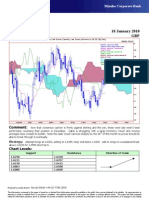

Technical Analysis 20 January 2010

GBP

GBP=D3, Last Quote [Candle], Last Quote [Ichimoku 9, 26, 52, 26] Daily

06Oct09 - 25Feb10

Pr

GBP=D3 , Last Quote, Candle

20Jan10 1.6365 1.6370 1.6281 1.6306

GBP=D3 , Last Quote, Tenkan Sen 9 1.68

20Jan10 1.6187

GBP=D3 , Last Quote, Kijun Sen 26

20Jan10 1.6146

GBP=D3 , Last Quote, Senkou Span(a) 52 1.67

24Feb10 1.6166

GBP=D3 , Last Quote, Senkou Span(b) 52

24Feb10 1.6356

1.66

GBP=D3 , Last Quote, Chikou Span 26

16Dec09 1.6306

1.65

1.64

1.63

1.62

1.61

1.6

1.59

1.58

1.57

12Oct09 19Oct 26Oct 02Nov 09Nov 16Nov 23Nov 30Nov 07Dec 14Dec 21Dec 28Dec 04Jan 11Jan 18Jan 25Jan 01Feb 08Feb 15Feb 22Feb

Comment: Holding up against the US dollar better than several other currencies, while struggling at the top of

the Ichimoku ‘cloud’, and moving averages suggest a long position. Note how this thins by Tuesday and how the

Lagging Span could get support from the flat-bottomed ‘cloud’ of 26 days ago. Cable is not overbought and

momentum is still not clearly bullish.

Strategy: Attempt small longs at 1.6295; stop well below 1.6200. Short term target 1.6385, then 1.6450.

Chart Levels:

Support Resistance Direction of Trade

1.6281 1.6370

1.6250 1.6400

1.6211 1.6459*

1.6150 1.6500

1.6137 1.6625

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- GBP Usd 01 19 2010Document1 pageGBP Usd 01 19 2010Miir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Gbp-Usd-05 January 2010 DailyDocument1 pageGbp-Usd-05 January 2010 DailyMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

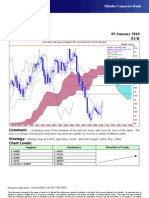

- Technical Analysis 27 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 27 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 14 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 14 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 19 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 19 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Eur-Usd-04 January 2010 DailyDocument1 pageEur-Usd-04 January 2010 DailyMiir ViirNo ratings yet

- Technical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Thesun 2009-08-05 Page15 Global Automakers Beat Forecasts Remain CautiousDocument1 pageThesun 2009-08-05 Page15 Global Automakers Beat Forecasts Remain CautiousImpulsive collectorNo ratings yet

- Technical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- CT PlateDocument1 pageCT Platebsndbh65wcNo ratings yet

- Studying Group IDocument10 pagesStudying Group ICarmo AgostinhoNo ratings yet

- Iris Triumph V-35 Ex Cigading PDFDocument1 pageIris Triumph V-35 Ex Cigading PDFAkmal HakimNo ratings yet

- Thesun 2009-04-07 Page12 Cimb To Close 60 Surplus BranchesDocument1 pageThesun 2009-04-07 Page12 Cimb To Close 60 Surplus BranchesImpulsive collectorNo ratings yet

- Circuit DiagramDocument1 pageCircuit DiagramAkif AzayevNo ratings yet

- (X1:632-637-642 Jumper) : Cable Assignment List D06-W02 D06-W02 D06-W02Document1 page(X1:632-637-642 Jumper) : Cable Assignment List D06-W02 D06-W02 D06-W02Akif AzayevNo ratings yet

- 2024-01-15 - GK - 06 Kontrakan Jati KramatDocument1 page2024-01-15 - GK - 06 Kontrakan Jati Kramatnuke.rachmasariNo ratings yet

- Soal Latihan Praktik ExcelDocument7 pagesSoal Latihan Praktik ExcelDwita YpNo ratings yet

- Dimensional LayoutDocument8 pagesDimensional LayoutnormalNo ratings yet

- Project: Client: Design By: Job No.: Date: Review byDocument2 pagesProject: Client: Design By: Job No.: Date: Review byjklo12No ratings yet

- Nicor Gass BillDocument2 pagesNicor Gass BillVictor VSNo ratings yet

- Book My Dearest DaughterDocument1 pageBook My Dearest Daughtermohammad faisalNo ratings yet

- Buku Besar - Zahra ArifianaDocument56 pagesBuku Besar - Zahra Arifianazahra arifianaNo ratings yet

- ST 934 20200521Document2 pagesST 934 20200521Creo ParametricNo ratings yet

- Kayseri burhan-BeamDesDocument173 pagesKayseri burhan-BeamDesbrkn8No ratings yet

- Denah Lt. 1 Alt. B - Rumah Pak Yunathan 2022Document1 pageDenah Lt. 1 Alt. B - Rumah Pak Yunathan 2022Rian SetiawanNo ratings yet

- List Contract Outsource 2021 1Document1 pageList Contract Outsource 2021 1Raditya DastanNo ratings yet

- Round Panen UmwnDocument10 pagesRound Panen Umwntaufik purnomoNo ratings yet

- QR June 2021Document1 pageQR June 2021Rachel Las MariasNo ratings yet

- 2024-01-15 - GK - 04 Kontrakan Jati KramatDocument1 page2024-01-15 - GK - 04 Kontrakan Jati Kramatnuke.rachmasariNo ratings yet

- SBSA Statement 2023-10-03Document14 pagesSBSA Statement 2023-10-03mthembux598No ratings yet

- Dead 90 CKN: LoadsDocument4 pagesDead 90 CKN: Loads張定墉No ratings yet

- MohammadDocument2 pagesMohammadxfzm99mr8rNo ratings yet

- ความร้อนและทฤษฎีจลน์แก๊สDocument44 pagesความร้อนและทฤษฎีจลน์แก๊สKanittha ChaiyasitNo ratings yet

- Alfalah Fund Super Market: Analysis of Open-End FundsDocument2 pagesAlfalah Fund Super Market: Analysis of Open-End FundsadeelngNo ratings yet

- MH MH: Drainage PlanDocument1 pageMH MH: Drainage PlanBong PerezNo ratings yet

- MH MH: Drainage PlanDocument1 pageMH MH: Drainage PlanBong PerezNo ratings yet

- Thesun 2009-03-03 Page13 Property Mart Likely To Be BearishDocument1 pageThesun 2009-03-03 Page13 Property Mart Likely To Be BearishImpulsive collectorNo ratings yet

- MH MH: Drainage PlanDocument1 pageMH MH: Drainage PlanBong PerezNo ratings yet

- MH MH: Drainage PlanDocument1 pageMH MH: Drainage PlanBong PerezNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR USDDocument1 pageAUG-10 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirNo ratings yet

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocument1 pageAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirNo ratings yet

- Omnibus Motion (Motion To Re-Open, Admit Answer and Delist: Republic of The PhilippinesDocument6 pagesOmnibus Motion (Motion To Re-Open, Admit Answer and Delist: Republic of The PhilippinesHIBA INTL. INC.No ratings yet

- DockerDocument35 pagesDocker2018pgicsankush10No ratings yet

- ICFR Presentation - Ernst and YoungDocument40 pagesICFR Presentation - Ernst and YoungUTIE ELISA RAMADHANI67% (3)

- ConjunctionDocument15 pagesConjunctionAlfian MilitanNo ratings yet

- Etsi en 300 019-2-2 V2.4.1 (2017-11)Document22 pagesEtsi en 300 019-2-2 V2.4.1 (2017-11)liuyx866No ratings yet

- Lesson PlansDocument9 pagesLesson Plansapi-238729751No ratings yet

- The Foundations of Ekistics PDFDocument15 pagesThe Foundations of Ekistics PDFMd Shahroz AlamNo ratings yet

- Morrison On Rarick (1966)Document4 pagesMorrison On Rarick (1966)alex7878No ratings yet

- Electronic Form Only: Part 1. Information About YouDocument7 pagesElectronic Form Only: Part 1. Information About YourileyNo ratings yet

- The Municipality of Santa BarbaraDocument10 pagesThe Municipality of Santa BarbaraEmel Grace Majaducon TevesNo ratings yet

- July 2006 Bar Exam Louisiana Code of Civil ProcedureDocument11 pagesJuly 2006 Bar Exam Louisiana Code of Civil ProcedureDinkle KingNo ratings yet

- Performance Appraisal System-Jelly BellyDocument13 pagesPerformance Appraisal System-Jelly BellyRaisul Pradhan100% (2)

- Types of Goods Under Sales of Goods ACTDocument22 pagesTypes of Goods Under Sales of Goods ACTAlka Singh100% (1)

- Evolut Pro Mini Product Brochure PDFDocument8 pagesEvolut Pro Mini Product Brochure PDFBalázs PalcsikNo ratings yet

- Soft Skills PresentationDocument11 pagesSoft Skills PresentationRishabh JainNo ratings yet

- Conflict Management and Negotiation - Team 5Document34 pagesConflict Management and Negotiation - Team 5Austin IsaacNo ratings yet

- Pau Inglés-7Document2 pagesPau Inglés-7AlfodNo ratings yet

- S1-TITAN Overview BrochureDocument8 pagesS1-TITAN Overview BrochureصصNo ratings yet

- Richard Steele: 2 in PoliticsDocument4 pagesRichard Steele: 2 in PoliticszunchoNo ratings yet

- Multigrade Lesson Plan MathDocument7 pagesMultigrade Lesson Plan MathArmie Yanga HernandezNo ratings yet

- Second and Third Round Table Conferences NCERT NotesDocument2 pagesSecond and Third Round Table Conferences NCERT NotesAanya AgrahariNo ratings yet

- Task 1: Choose The Present Simple, The Present Continuous, The PresentDocument5 pagesTask 1: Choose The Present Simple, The Present Continuous, The PresentAlexandra KupriyenkoNo ratings yet

- GE Money and BankingDocument110 pagesGE Money and BankingBabita DeviNo ratings yet

- The Craving Mind From Cigarettes To Smartphones To Love - Why We Get Hooked and How We Can Break Bad Habits PDFDocument257 pagesThe Craving Mind From Cigarettes To Smartphones To Love - Why We Get Hooked and How We Can Break Bad Habits PDFJacques Savariau92% (13)

- Computer Science Past Papers MCQS SolvedDocument24 pagesComputer Science Past Papers MCQS SolvedLEGAL AFFAIRS DIVISION100% (1)

- Learning-Module-in-Human-Resource-Management AY 22-23Document45 pagesLearning-Module-in-Human-Resource-Management AY 22-23Theresa Roque100% (2)

- AquaSorb PlantDocument2 pagesAquaSorb Plantark6of7No ratings yet

- SMM Live Project MICA (1) (1)Document8 pagesSMM Live Project MICA (1) (1)Raj SinghNo ratings yet

- Part 1Document14 pagesPart 1Jat SardanNo ratings yet

- Houses WorksheetDocument3 pagesHouses WorksheetYeferzon Clavijo GilNo ratings yet