Professional Documents

Culture Documents

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright:

Available Formats

Mizuho Corporate Bank

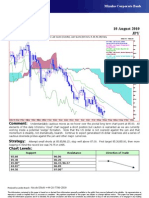

Technical Analysis 21 January 2010

EUR

EUR=EBS, Last Quote [Candle] EUR=, Bid [Ichimoku 9, 26, 52, 26] Weekly

04Oct08 - 29Jul10

Pr

1.5

1.48

1.46

1.44

1.42

1.4

1.38

1.36

1.34

EUR=EBS , Last Quote, Candle

24Jan10 1.4375 1.4415 1.4067 1.4116 1.32

EUR= , Bid, Tenkan Sen 9

24Jan10 1.4604

EUR= , Bid, Kijun Sen 26 1.3

24Jan10 1.4575

EUR= , Bid, Senkou Span(a) 52

18Jul10 1.4589 1.28

EUR= , Bid, Senkou Span(b) 52

18Jul10 1.3800

EUR= , Bid, Chikou Span 26 1.26

02Aug09 1.4114

1.24

Nov08 Dec Jan09 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan10 Feb Mar Apr May Jun Jul

Comment: Dropping below the flat-topped Ichimoku ‘cloud’ because it drops suddenly to a trough next week.

Approaching the 50% long term Fibonacci retracement support so watch how it might react here. The Euro is as

oversold as it was in thin markets at Christmas and good futures volume suggests an element of panic.

Strategy: Stand aside if possibly. If not, attempt small longs at 1.4115; stop below 1.4000. Short term target

1.4200, then 1.4300.

Chart Levels:

Support Resistance Direction of Trade

1.4085 1.4138

1.4067 1.4200

1.4045 1.4220

1.4000** 1.4311

1.3900 1.4415

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR USDDocument1 pageAUG-10 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirNo ratings yet

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirNo ratings yet

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocument1 pageAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirNo ratings yet

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Nursing ManagementDocument14 pagesNursing ManagementNolan Ivan EudinNo ratings yet

- OPGWDocument18 pagesOPGWGuilhermeNo ratings yet

- June 3rd 1947 Partition PlanDocument2 pagesJune 3rd 1947 Partition PlanZ_Jahangeer88% (16)

- Pinto Pm2 Ch01Document21 pagesPinto Pm2 Ch01Mia KulalNo ratings yet

- Ar 318Document88 pagesAr 318Jerime vidadNo ratings yet

- Facebook Use Case Diagram Activity Diagram Sequence DiagramDocument21 pagesFacebook Use Case Diagram Activity Diagram Sequence DiagramSaiNo ratings yet

- Choosing the Right Organizational Pattern for Your SpeechDocument19 pagesChoosing the Right Organizational Pattern for Your SpeechKyle RicardoNo ratings yet

- Ariston Oven ManualDocument16 pagesAriston Oven ManualJoanne JoanneNo ratings yet

- Leases 2Document3 pagesLeases 2John Patrick Lazaro Andres100% (1)

- Multiple Choice Questions Class Viii: GeometryDocument29 pagesMultiple Choice Questions Class Viii: GeometrySoumitraBagNo ratings yet

- Brother LS2300 Sewing Machine Instruction ManualDocument96 pagesBrother LS2300 Sewing Machine Instruction ManualiliiexpugnansNo ratings yet

- CAE-NUST College Aeronautical Engineering AssignmentDocument3 pagesCAE-NUST College Aeronautical Engineering AssignmentBahram TahirNo ratings yet

- Labor DoctrinesDocument22 pagesLabor DoctrinesAngemeir Chloe FranciscoNo ratings yet

- 41720105Document4 pages41720105renu tomarNo ratings yet

- Southern Railway, Tiruchchirappalli: RC Guards Batch No: 1819045 Paper PresentationDocument12 pagesSouthern Railway, Tiruchchirappalli: RC Guards Batch No: 1819045 Paper PresentationSathya VNo ratings yet

- Shah Wali Ullah Syed Haji Shariat Ullah Ahmad Barelvi (Notes)Document2 pagesShah Wali Ullah Syed Haji Shariat Ullah Ahmad Barelvi (Notes)Samreen KapasiNo ratings yet

- Project Notes PackagingDocument4 pagesProject Notes PackagingAngrej Singh SohalNo ratings yet

- Valmet - S Waste To Energy SolutionsDocument14 pagesValmet - S Waste To Energy SolutionsNardo LlanosNo ratings yet

- Capetown Halal RestaurantsDocument1 pageCapetown Halal RestaurantsKhawaja UsmanNo ratings yet

- Rizal's First Return Home to the PhilippinesDocument52 pagesRizal's First Return Home to the PhilippinesMaria Mikaela MarcelinoNo ratings yet

- The Cult of Demeter On Andros and The HDocument14 pagesThe Cult of Demeter On Andros and The HSanNo ratings yet

- Pines City Colleges: College of NursingDocument2 pagesPines City Colleges: College of NursingmagisasamundoNo ratings yet

- ĐỀ MINH HỌA 15-19Document25 pagesĐỀ MINH HỌA 15-19Trung Vũ ThànhNo ratings yet

- Khilafat Movement Pakistan Studies (2059)Document5 pagesKhilafat Movement Pakistan Studies (2059)emaz kareem Student0% (1)

- Yoga For The Primary Prevention of Cardiovascular Disease (Hartley 2014)Document52 pagesYoga For The Primary Prevention of Cardiovascular Disease (Hartley 2014)Marcelo NorisNo ratings yet

- Unit 20: Where Is Sapa: 2.look, Read and CompleteDocument4 pagesUnit 20: Where Is Sapa: 2.look, Read and CompleteNguyenThuyDungNo ratings yet

- Specification For Corrugated Bitumen Roofing Sheets: Indian StandardDocument10 pagesSpecification For Corrugated Bitumen Roofing Sheets: Indian StandardAmanulla KhanNo ratings yet

- Council Of Architecture Scale Of ChargesDocument4 pagesCouncil Of Architecture Scale Of ChargesAshwin RajendranNo ratings yet