Professional Documents

Culture Documents

Mizuho Corporate Bank

Uploaded by

Miir ViirOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright:

Available Formats

Mizuho Corporate Bank

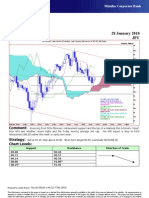

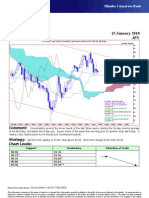

Technical Analysis 22 January 2010

JPY

JPY=EBS, Last Quote [Candle], Last Quote [Ichimoku 9, 26, 52, 26] Daily

31Oct09 - 02Mar10

Pr

94

93.5

93

92.5

92

91.5

91

90.5

90

89.5

89

88.5

88

JPY=EBS , Last Quote, Candle 87.5

22Jan10 90.41 90.50 89.78 90.26

JPY=EBS , Last Quote, Tenkan Sen 9 87

22Jan10 91.11

JPY=EBS , Last Quote, Kijun Sen 26

86.5

22Jan10 91.31

JPY=EBS , Last Quote, Senkou Span(a) 52

26Feb10 91.21 86

JPY=EBS , Last Quote, Senkou Span(b) 52

26Feb10 89.30 85.5

JPY=EBS , Last Quote, Chikou Span 26

18Dec09 90.26 85

04Nov09 11Nov 18Nov 25Nov 02Dec 09Dec 16Dec 23Dec 30Dec 06Jan 13Jan 20Jan 27Jan 03Feb 10Feb 17Feb 24Feb

Comment: Still hovering at 38% retracement support, moves increasingly erratic, so that we formed a very

strange candle yesterday (a mix of a ‘spike high’ with ‘bearish engulfing’ candle). The 9-day moving average has

dropped below the 26-day one now suggesting a bearish position (though we have yet to drop below the ‘cloud’).

Expect yet more messy work at current levels today, keeping in mind that later this month we expect another drop

towards 88.50.

Strategy: Sell at 90.15, adding to 91.00; stop above 92.05. Short term target 89.80/89.50, then 88.50.

Chart Levels:

Support Resistance Direction of Trade

90.00 90.50

89.78* 90.85

89.50 91.30

89.30 91.88*

88.80 92.05*

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 28 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 28 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

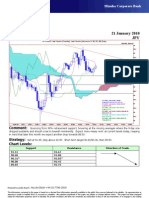

- Technical Analysis 21 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 21 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

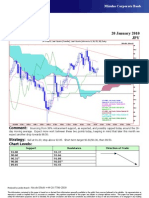

- Technical Analysis 29 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 29 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 12 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 12 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

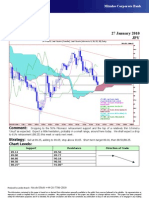

- Technical Analysis 27 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 27 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 20 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 20 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 15 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 15 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 11 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 11 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 19 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 19 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 05 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 05 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 15 September 2010 JPY: CommentDocument1 pageTechnical Analysis 15 September 2010 JPY: CommentPlan B EconomicsNo ratings yet

- My LATESTFXForecastsfor JUNE30Document3 pagesMy LATESTFXForecastsfor JUNE30api-26441337No ratings yet

- Technical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- A B C E F G H C D D: AzoteaDocument1 pageA B C E F G H C D D: AzoteaGustavo Róssiter VargasNo ratings yet

- Group Leader Development 14-7-2022Document10 pagesGroup Leader Development 14-7-2022Lancar Jaya PrintingNo ratings yet

- Residential Area: 10 M Wide RoadDocument1 pageResidential Area: 10 M Wide RoadharishNo ratings yet

- Site Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatanDocument1 pageSite Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatandejomarlubNo ratings yet

- F&O ROLLOVER Jun - 2019 PDFDocument7 pagesF&O ROLLOVER Jun - 2019 PDFcdranuragNo ratings yet

- PP-001 Universal2 Pump Seal Reference ChartDocument1 pagePP-001 Universal2 Pump Seal Reference Chartandres roblezNo ratings yet

- Kontur FixDocument1 pageKontur FixIpan YopaniNo ratings yet

- Power Point Cakupan PHBSDocument3 pagesPower Point Cakupan PHBSnovita sariNo ratings yet

- Site Plan S6 - 4-1-2020Document1 pageSite Plan S6 - 4-1-2020harishNo ratings yet

- PCPL: Lito Pumicpic: Effectivity Date: February 2020Document1 pagePCPL: Lito Pumicpic: Effectivity Date: February 2020Jieza May MarquezNo ratings yet

- 1-Cluster 03 Sewer Drawings 11-04-2018Document1 page1-Cluster 03 Sewer Drawings 11-04-2018Bernie QuepNo ratings yet

- 1/7 (Row1 Col1)Document7 pages1/7 (Row1 Col1)renato_aleman_1No ratings yet

- Indian Railways: Trends, Issues, Opportunities and Outlook: G Raghuram Indian Institute of Management, AhmedabadDocument33 pagesIndian Railways: Trends, Issues, Opportunities and Outlook: G Raghuram Indian Institute of Management, AhmedabadmakbimhrdNo ratings yet

- Sewer Line Profile - Line Mh7-Mh19: RevisionsDocument1 pageSewer Line Profile - Line Mh7-Mh19: RevisionsBernie QuepNo ratings yet

- Cake - I Will SurviveDocument6 pagesCake - I Will SurviveJazz QuevedoNo ratings yet

- Worton Creek Marina: Slip DiagramDocument1 pageWorton Creek Marina: Slip DiagramjacoNo ratings yet

- 2008 4GGSM 4G#RO MDO294 0164 - eSQAC - Clear - AlarmDocument23 pages2008 4GGSM 4G#RO MDO294 0164 - eSQAC - Clear - Alarmkhina luthfiNo ratings yet

- Merry Christmas Mr. LawrenceDocument1 pageMerry Christmas Mr. Lawrenceckun kit yipNo ratings yet

- Forecasting Stationary ModelsDocument22 pagesForecasting Stationary ModelsVINAY GUPTANo ratings yet

- Rhino HeadDocument8 pagesRhino HeadALEJANDRONo ratings yet

- Rhino HeadDocument8 pagesRhino HeadSARABIA papeleria y regalosNo ratings yet

- 5 Deck The Halls 02 Violin 2Document1 page5 Deck The Halls 02 Violin 2Nicanor MusNo ratings yet

- Eis Me Aqui TromboneDocument2 pagesEis Me Aqui TromboneIury AugustoNo ratings yet

- PolyFish Fox FreeDocument22 pagesPolyFish Fox FreeBayronMayguaCaballero50% (2)

- Trombone IIDocument8 pagesTrombone IIKirs YoshikageNo ratings yet

- Electrical Motor Efficiency Ratings PDFDocument3 pagesElectrical Motor Efficiency Ratings PDFGustavo CuatzoNo ratings yet

- Merry Christmas Mr. Lawrence-FluteDocument2 pagesMerry Christmas Mr. Lawrence-FluteBruno Del BenNo ratings yet

- Kurva S PT - Etsa Hari Ke 30Document5 pagesKurva S PT - Etsa Hari Ke 30Ariwibowo SuparnadiNo ratings yet

- CNN Features Off-The-shelf: An Astounding Baseline For RecognitionDocument8 pagesCNN Features Off-The-shelf: An Astounding Baseline For RecognitionAkash GuptaNo ratings yet

- Khadi Chowk To Bridge Part - 2Document1 pageKhadi Chowk To Bridge Part - 2naman jainNo ratings yet

- FIFA 22 Team of The Year FUT TOTY FifaRosters 6Document1 pageFIFA 22 Team of The Year FUT TOTY FifaRosters 6Alvaro CoqueNo ratings yet

- Leg Profile-AP-63-AP-63Document1 pageLeg Profile-AP-63-AP-63Hikmat B. Ayer - हिक्मत ब. ऐरNo ratings yet

- Cell Availability: Kpi InformationDocument23 pagesCell Availability: Kpi InformationHaryadi syamsuddinNo ratings yet

- Turn Up The Radio - Autograph PDFDocument3 pagesTurn Up The Radio - Autograph PDFAlexandre Palacios de AlbuquerqueNo ratings yet

- Turn Up The Radio - Autograph: Drum ScoreDocument3 pagesTurn Up The Radio - Autograph: Drum ScoreAlexandre Palacios de AlbuquerqueNo ratings yet

- Turn Up The Radio - Autograph PDFDocument3 pagesTurn Up The Radio - Autograph PDFAlexandre Palacios de AlbuquerqueNo ratings yet

- Turn Up The Radio - Autograph PDFDocument3 pagesTurn Up The Radio - Autograph PDFAlexandre Palacios de AlbuquerqueNo ratings yet

- Chart - Stitch FiddleDocument1 pageChart - Stitch FiddleCharlotte CrouchNo ratings yet

- Diseño de Alcantarillado Sanitario Municipio de Los CordobasDocument1 pageDiseño de Alcantarillado Sanitario Municipio de Los CordobasJose Alfredo Petro NavarroNo ratings yet

- Leg Profile-AP-64-AP-64Document1 pageLeg Profile-AP-64-AP-64Hikmat B. Ayer - हिक्मत ब. ऐरNo ratings yet

- 5 Deck The Halls 01 Violin 1Document1 page5 Deck The Halls 01 Violin 1Nicanor MusNo ratings yet

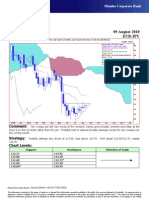

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- AUG-09 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-09 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- JYSKE Bank AUG 09 Market Drivers CurrenciesDocument5 pagesJYSKE Bank AUG 09 Market Drivers CurrenciesMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG-09-DJ European Forex TechnicalsDocument3 pagesAUG-09-DJ European Forex TechnicalsMiir ViirNo ratings yet

- Jyske Bank Aug 09 em DailyDocument5 pagesJyske Bank Aug 09 em DailyMiir ViirNo ratings yet

- ScotiaBank AUG 09 Daily FX UpdateDocument3 pagesScotiaBank AUG 09 Daily FX UpdateMiir ViirNo ratings yet

- JYSKE Bank AUG 09 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 09 Corp Orates DailyMiir ViirNo ratings yet

- Case Digest (Complete)Document7 pagesCase Digest (Complete)Shailah Leilene Arce Briones100% (1)

- Point Me HarryDocument135 pagesPoint Me HarryTinx LenaNo ratings yet

- The Impact of Culture On The Quality of Internal Audit An Empirical Study.Document22 pagesThe Impact of Culture On The Quality of Internal Audit An Empirical Study.Vaisal AmirNo ratings yet

- Daftar Nama Dosen Pembimbing Periode 2020-1 PagiDocument3 pagesDaftar Nama Dosen Pembimbing Periode 2020-1 PagiNufita Twandita DewiNo ratings yet

- Power To Regulate Practice of LawDocument27 pagesPower To Regulate Practice of LawSarah Jade LayugNo ratings yet

- Review MT2Document33 pagesReview MT2Vishwanath KrNo ratings yet

- ZoroastrianismDocument13 pagesZoroastrianismDave Sarmiento ArroyoNo ratings yet

- Arendt Between Past and Future PrefaceDocument13 pagesArendt Between Past and Future Prefacegolebdj100% (2)

- Assignment Topic: Under The Supervision of Mam SehrishDocument18 pagesAssignment Topic: Under The Supervision of Mam SehrishAttarehman QureshiNo ratings yet

- The Making of R.A. 1425Document3 pagesThe Making of R.A. 1425Reje CuaresmaNo ratings yet

- Functional DyspepsiaDocument19 pagesFunctional DyspepsiaMahmoud AliNo ratings yet

- The Patriarchial Idea of God Author(s) : Herbert Gordon May Source: Journal of Biblical Literature, Vol. 60, No. 2 (Jun., 1941), Pp. 113-128 Published By: Stable URL: Accessed: 19/06/2014 16:43Document17 pagesThe Patriarchial Idea of God Author(s) : Herbert Gordon May Source: Journal of Biblical Literature, Vol. 60, No. 2 (Jun., 1941), Pp. 113-128 Published By: Stable URL: Accessed: 19/06/2014 16:43Fernando FonsecaNo ratings yet

- Generation We - Eric Greenberg With Karl WeberDocument257 pagesGeneration We - Eric Greenberg With Karl WeberScarlettNyxNo ratings yet

- Scientology: Integrity and HonestyDocument41 pagesScientology: Integrity and HonestyOfficial Church of Scientology86% (7)

- Cawis vs. Cerilles - G.R. No. 170207 - April 19, 2010Document2 pagesCawis vs. Cerilles - G.R. No. 170207 - April 19, 2010Lordy Jessah AggabaoNo ratings yet

- Field Based Learning Assignment - Edl 273Document9 pagesField Based Learning Assignment - Edl 273api-324719969No ratings yet

- List of English Verbs in All TensesDocument33 pagesList of English Verbs in All TensesRamanNo ratings yet

- Dictogloss Strategy and Listening Comprehension Performance of Secondary School StudentsDocument12 pagesDictogloss Strategy and Listening Comprehension Performance of Secondary School StudentsSilvi AlizaNo ratings yet

- Coso-Based Auditing Risk Assessment: - Next Slide, Please.Document11 pagesCoso-Based Auditing Risk Assessment: - Next Slide, Please.Ma. Fatima NisayNo ratings yet

- Cardiohelp System Brochure-En-Non Us JapanDocument16 pagesCardiohelp System Brochure-En-Non Us JapanAnar MaharramovNo ratings yet

- Week 3 CPAR Day 1Document4 pagesWeek 3 CPAR Day 1zessicrel mejiasNo ratings yet

- Stages of LaborDocument3 pagesStages of Laborkatzuhmee leeNo ratings yet

- Nguyễn Thành Tín SPA-K42B Robinson Crusoe 1. Tell briefly of Enlightenment and Daniel Defoe. - The Age of EnlightenmentDocument4 pagesNguyễn Thành Tín SPA-K42B Robinson Crusoe 1. Tell briefly of Enlightenment and Daniel Defoe. - The Age of EnlightenmentnguyenthanhtinNo ratings yet

- IDENTIFYING AND FORMING EQUIVALENT FRACTIONS 3RD CO Mrs BiscaydaDocument68 pagesIDENTIFYING AND FORMING EQUIVALENT FRACTIONS 3RD CO Mrs BiscaydaLilibeth BiscaydaNo ratings yet

- Right On 1Document2 pagesRight On 1Lingva Lingva BinestNo ratings yet

- Before Tree of LifeDocument155 pagesBefore Tree of LifeAugusto Meloni100% (1)

- Haroon a. Khan (Auth.)- Globalization and the Challenges of Public Administration_ Governance, Human Resources Management, Leadership, Ethics, E-Governance and Sustainability in the 21st Century-PalgrDocument216 pagesHaroon a. Khan (Auth.)- Globalization and the Challenges of Public Administration_ Governance, Human Resources Management, Leadership, Ethics, E-Governance and Sustainability in the 21st Century-PalgrGraham Herrick50% (2)

- Raghavendra Letter To Judge Hon. PitmanDocument10 pagesRaghavendra Letter To Judge Hon. PitmanIvyGateNo ratings yet

- 5 Minute Spotlight - Vacuum Extraction and Forceps DeliveryDocument2 pages5 Minute Spotlight - Vacuum Extraction and Forceps DeliveryMikeNo ratings yet

- Sharm o Hayaa-AshaarDocument127 pagesSharm o Hayaa-Ashaarbari bhattiNo ratings yet