Professional Documents

Culture Documents

43735rmc No. 5-2009 - Annex A

Uploaded by

Gedan TanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

43735rmc No. 5-2009 - Annex A

Uploaded by

Gedan TanCopyright:

Available Formats

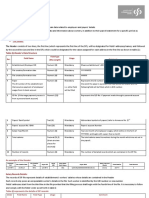

TECHNICAL ANNEX A-2009

STEPS IN CREATING THE DATA FILE:

I. Using Microsoft Excel to Create The File

a) File must contain three (3) portions: HEADERS, DETAILS, CONTROLS. The first row must contain the

HEADERS. (Please see the HEADERS portion of Technical Annex A)

b) The succeeding rows, the number of which depends upon the number of payees/employees, should contain

DETAILS. (If you have fifty (50) payees/employees for a particular schedule, there should be fifty (50)

DETAILS lines). Follow the format outlined in the DETAILS portion for the applicable form/schedule of

Technical Annex A.

c) The last row should contain the CONTROLS. Please refer to the CONTROLS portion of the applicable

form/schedule in Technical Annex A.

d) Do not use header column names.

e) Follow the column sequence and the specified field format.

f)

All information must not contain any special characters (commas, apostrophes, quotes, colons and periods).

Periods can only be used in amount fields when serving as decimal points.

g) All amounts must not contain commas or special characters except decimal point for the centavos. The

amount P 123,456,789.12 should be encoded as 123456789.12. If the amount field pertains to a null or a

blank value, encode the value as zero, as in 0, i.e., zero when blank.

h) The following information should be formatted with leading zeros (0), if necessary:

Example:

If Branch Code is 1, it should appear as 0001 (not as 1)

If Return Period is December 31, 2000, it should appear as 12/31/2008 (not as

12/31/08)

i)

Save the filename as a Comma Separated Value file (99999999.CSV, where 99999999 is the first eight (8)

digits of the Withholding Agents TIN) and not as an EXCEL file (99999999.xls)

j)

Close the Excel session and open 99999999.csv using NotePad or WordPad. Save 99999999.csv as

99999999.s99, where 99999999 is the first eight (8) digits of the Withholding Agents TIN, and s99 is

replaced using the following convention:

s3

Schedule 3, Form 1604E

s4

Schedule 4, Form 1604E

s5

Schedule 5, Form 1604CF

s6

Schedule 6, Form 1604CF

s71

Schedule 7.1, Form 1604CF

s72

Schedule 7.2, Form 1604CF

s73

Schedule 7.3, Form 1604CF

s74

Schedule 7.4, Form 1604CF

s75

Schedule 7.5, Form 1604CF

Technical Specifications: Form 1604CF ALPHALIST (July 2008 ENCS)

Page 1 of 18

Printed :01/27/09

TECHNICAL ANNEX A-2009

II.

III.

Using Other Formats to Create the File

a)

Follow steps a-h of Part I.

b)

Separate each column with a comma.

c)

Save the file as 99999999.s99, where 99999999 is the first eight (8) digits of the Withholding

Agents TIN, and s99 is replaced using the following convention:

s3

Schedule 3, Form 1604E

s4

Schedule 4, Form 1604E

s5

Schedule 5, Form 1604CF

s6

Schedule 6, Form 1604CF

s71

Schedule 7.1, Form 1604CF

s72

Schedule 7.2, Form 1604CF

s73

Schedule 7.3, Form 1604CF

s74

Schedule 7.4, Form 1604CF

s75

Schedule 7.5, Form 1604CF

Diskette Labelling and Submission

a)

Use a sticker label when labelling the outside part of the CD/diskette. Indicate the Form Type Code,

Schedule Number, Return Period, TIN, Registered Name and Branch Code of the Withholding Agent.

b)

Each CD/diskette may contain several files as may be accommodated in the CD/diskette, provided that

the file-naming standard outlined in I-j and II-c is strictly followed.

c)

CDs/Diskettes submitted should be accompanied by a duly accomplished Information Return and

Transmittal Form (Annex C).

Technical Specifications: Form 1604CF ALPHALIST (July 2008 ENCS)

Page 2 of 18

Printed :01/27/09

TECHNICAL ANNEX A-2009

1604CF (July 2008 ENCS)

ANNUAL INFORMATION RETURN OF INCOME TAX

WITHHELD ON COMPENSATION AND FINAL WITHHOLDING TAXES

NOTE:

Shaded areas contain ACTUAL VALUES.

Header:

TYPE

WIDTH

1.

FIELD NAME

FTYPE_CODE

TEXT

2.

3.

4.

TIN

BRANCH_CODE

RETRN_PERIOD

TEXT

TEXT

DATE

9

4

10

FORMAT

DESCRIPTION

H1604E or

H1604CF

999999999

9999

MM/DD/YYYY

Form type code

Employers TIN

Employers Branch Code

Return Period

SCHEDULE 5

Alphabetical List of Payees subject to Final Withholding Tax (Reported under Form 2306)

Details:

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

FIELD NAME

SCHEDULE_NUM

FTYPE_CODE

TIN_EMPYR

BRANCH_CODE_EMPLYR

RETRN_PERIOD

SEQ_NUM

TIN

BRANCH_CODE

REGISTERED_NAME

LAST_NAME

FIRST_NAME

MIDDLE_NAME

STATUS_CODE

ATC_CODE

INCOME_PYMT

TAX_RATE

ACTUAL_AMT_WTHLD

TYPE

TEXT

TEXT

TEXT

TEXT

DATE

NUMBER

TEXT

TEXT

TEXT

TEXT

TEXT

TEXT

TEXT

TEXT

NUMBER

NUMBER

NUMBER

WIDTH

4

6

9

4

10

6

9

4

50

30

30

30

1

5

14

5

14

FORMAT

D5

1604CF

999999999

9999

MM/DD/YYYY

999999

999999999

9999

X(50)

X(30)

X(30)

X(30)

X

X(5)

9(11).99

9(2).99

9(11).99

DESCRIPTION

Schedule number

Form Type

Employers TIN

Employers Branch Code

Return Period

Sequence Number

Payees TIN

Payees Branch Code

Payees Registered Name

Payees Last Name

Payees First Name

Payees Middle Name

Status Code

ATC Code

Amount of Income Payment

Rate of Tax

Amount of Tax Withheld

Controls:

1.

2.

3.

4.

5.

6.

7.

FIELD NAME

SCHEDULE_NUM

FTYPE_CODE

TIN_EMPYR

BRANCH_CODE_EMPLYR

RETRN_PERIOD

INCOME_PYMT

ACTUAL_AMT_WTHLD

TYPE

TEXT

TEXT

TEXT

TEXT

DATE

NUMBER

NUMBER

WIDTH

4

6

9

4

10

14

14

Technical Specifications: Form 1604CF ALPHALIST (July 2008 ENCS)

FORMAT

C5

1604CF

999999999

9999

MM/DD/YYYY

9(11).99

9(11).99

DESCRIPTION

Schedule Number

Form Type

Employers TIN

Employers Branch Code

Return Period

Amount of Income Payment

Total Amount of Tax

Withheld

Page 3 of 18

Printed :01/27/09

TECHNICAL ANNEX A-2009

Form 1604CF Schedule 6:

Alphalist of Employees Other Than Rank and File who were given Fringe Benefits During the Year (Reported under

Form 2306)

Details:

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

FIELD NAME

SCHEDULE_NUM

FTYPE_CODE

TIN_EMPYR

BRANCH_CODE_EMPLYR

RETRN_PERIOD

SEQ_NUM

TIN

BRANCH_CODE

LAST_NAME

FIRST_NAME

MIDDLE_NAME

ATC_CODE

FRINGE_BENEFIT_AMT

GROSS_MONETARY

15. ACTUAL_AMT_WTHLD

TYPE

TEXT

TEXT

TEXT

TEXT

DATE

NUMBER

TEXT

TEXT

TEXT

TEXT

TEXT

TEXT

NUMBER

NUMBER

WIDTH

4

6

9

4

10

6

9

4

30

30

30

5

14

14

FORMAT

D6

1604CF

999999999

9999

MM/DD/YYYY

999999

999999999

9999

X(30)

X(30)

X(30)

X(5)

9(11).99

9(11).99

NUMBER

14

9(11).99

DESCRIPTION

Schedule number

Form Type

Employers TIN

Employers Branch Code

Return Period

Sequence Number

Payees TIN

Payees Branch Code

Payees Last Name

Payees First Name

Payees Middle Name

ATC Code

Amount of Fringe Benefit

Grossed-up Monetary

Value

Amount of Tax Withheld

Controls:

1.

2.

3.

4.

5.

6.

FIELD NAME

SCHEDULE_NUM

FTYPE_CODE

TIN_EMPYR

BRANCH_CODE_EMPLYR

RETRN_PERIOD

FRINGE_BENEFIT_AMT

7.

8.

TYPE

TEXT

TEXT

TEXT

TEXT

DATE

NUMBER

WIDTH

4

6

9

4

10

14

C6

1604CF

999999999

9999

MM/DD/YYYY

9(11).99

GROSS_MONETARY

NUMBER

14

9(11).99

ACTUAL_AMT_WTHLD

NUMBER

14

9(11).99

Technical Specifications: Form 1604CF ALPHALIST (July 2008 ENCS)

FORMAT

DESCRIPTION

Schedule Number

Form Type

Employers TIN

Employers Branch Code

Return Period

Total Amount of Fringe

Benefit

Total Grossed-up Monetary

Value

Total Amount of Tax

Withheld

Page 4 of 18

Printed :01/27/09

TECHNICAL ANNEX A-2009

Form 1604CF - Schedule 7.1

Alphalist of Employees Terminated before December 31 (Reported under Form 2316, July 2008 ENCS)

Details:

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

FIELD NAME

SCHEDULE_NUM

FTYPE_CODE

TIN_EMPYR

BRANCH_CODE_EMPLYR

RETRN_PERIOD

SEQ_NUM

TIN

BRANCH_CODE

LAST_NAME

FIRST_NAME

MIDDLE_NAME

EMPLOYMENT_FROM

EMPLOYMENT_TO

GROSS_COMP_INCOME

15. PRES_NONTAX_13TH_M

ONTH

16. PRES_NONTAX_DE_MINI

MIS

17. PRES_NONTAX_SSS_ET

C

18. PRES_NONTAX_SALARIE

S

19. TOTAL_NONTAX_COMP_I

NCOME

20. PRES_TAXABLE_BASIC_

SALARY

21. PRES_TAXABLE_13TH_M

ONTH

22. PRES_TAXABLE_SALARI

ES

23. TOTAL_TAXABLE_COMP_

INCOME

24. EXMPN_CODE

25. EXMPN_AMT

26. PREMIUM_PAID

TYPE

TEXT

TEXT

TEXT

TEXT

DATE

NUMBER

TEXT

TEXT

TEXT

TEXT

TEXT

DATE

DATE

NUMBER

WIDTH

4

6

9

4

10

6

9

4

30

30

30

10

10

14

FORMAT

D7.1

1604CF

999999999

9999

MM/DD/YYYY

999999

999999999

9999

X(30)

X(30)

X(30)

MM/DD/YYYY

MM/DD/YYYY

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

TEXT

NUMBER

NUMBER

2

14

14

X(2)

9(11).99

9(11).99

27. NET_TAXABLE_COMP_IN

COME

28. TAX_DUE

29. PRES_TAX_WTHLD

30. AMT_WTHLD_DEC

31. OVER_WTHLD

NUMBER

14

9(11).99

NUMBER

NUMBER

NUMBER

NUMBER

14

14

14

14

9(11).99

9(11).99

9(11).99

9(11).99

32. ACTUAL_AMT_WTHLD

33. SUBS_FILING

NUMBER

TEXT

14

1

9(11).99

X

Technical Specifications: Form 1604CF ALPHALIST (July 2008 ENCS)

DESCRIPTION

Schedule Number

Form Type

Employers TIN

Employers Branch Code

Return Period

Sequence Number

Employees TIN

Employees Branch Code

Employees Last Name

Employees First Name

Employees Middle Name

Employment From

Employment To

Gross Compensation

Income

th

13 month pay and other

benefits (non-taxable)

Nontaxable De Minimis

Benefits

SSS, GSIS, PHIC,

PAGIBIG and Union Dues

Non-taxable Salaries and

other Compensation

Total Nontaxable/Exempt

Compensation Income

Taxable Basic Salary

th

Taxable 13 month pay and

other benefits

Taxable Salaries and other

Compensation

Total Taxable

Compensation Income

Exemption Code

Amount of Exemption

Premium paid on Health

and Hospital insurance

Net Taxable Compensation

Income

Tax Due

Tax Withheld

Tax Withheld in December

Overwithheld tax refunded

to employee

Actual amount withheld

Substituted Filing? Yes/No

Page 5 of 18

Printed :01/27/09

TECHNICAL ANNEX A-2009

Form 1604CF - Schedule 7.1

Controls:

FIELD NAME

1.

SCHEDULE_NUM

2.

FTYPE_CODE

3.

TIN_EMPYR

4.

BRANCH_CODE_EMPLYR

5.

RETRN_PERIOD

6.

GROSS_COMP_INCOME

TYPE

TEXT

TEXT

TEXT

TEXT

DATE

NUMBER

WIDTH

4

6

9

4

10

14

FORMAT

C7.1

1604CF

999999999

9999

MM/DD/YYYY

9(11).99

7.

PRES_NONTAX_13TH_MONTH

NUMBER

14

9(11).99

8.

PRES_NONTAX_DE_MINIMIS

NUMBER

14

9(11).99

9.

PRES_NONTAX_SSS_ETC

NUMBER

14

9(11).99

10. PRES_NONTAX_SALARIES

NUMBER

14

9(11).99

11. TOTAL_NONTAX_COMP_INCOM

E

12. PRES_TAXABLE_BASIC_SALARY

13. PRES_TAXABLE_13TH_MONTH

NUMBER

14

9(11).99

NUMBER

NUMBER

14

14

9(11).99

9(11).99

14. PRES_TAXABLE_SALARIES

NUMBER

14

9(11).99

15. TOTAL_TAXABLE_COMP_INCOM

E

16. EXMPN_AMT

17. PREMIUM_PAID

NUMBER

14

9(11).99

NUMBER

NUMBER

14

14

9(11).99

9(11).99

18. NET_TAXABLE_COMP_INCOME

NUMBER

14

9(11).99

19. TAX_DUE

20. PRES_TAX_WTHLD

21. AMT_WTHLD_DEC

NUMBER

NUMBER

NUMBER

14

14

14

9(11).99

9(11).99

9(11).99

22. OVER_WTHLD

NUMBER

14

9(11).99

23. ACTUAL_AMT_WTHLD

NUMBER

14

9(11).99

Technical Specifications: Form 1604CF ALPHALIST (July 2008 ENCS)

DESCRIPTION

Schedule Number

Form Type

Employers TIN

Employers Branch Code

Return Period

Total Gross Compensation

Income

th

Total 13 month pay and

other benefits (non-taxable)

Total Nontaxable De

Minimis Benefits

Total SSS, GSIS, PHIC,

PAGIBIG and Union Dues

Total Non-taxable Salaries

and other Compensation

Total Nontaxable/Exempt

Compensation Income

Total Taxable Basic Salary

th

Total Taxable 13 month

pay and other benefits

Total Taxable Salaries and

other Compensation

Total Taxable

Compensation Income

Total Amount of Exemption

Total Premium paid on

Health and Hospital

insurance

Total Net Taxable

Compensation Income

Total Tax Due

Total Tax Withheld

Total Tax Withheld in

December

Total Overwithheld tax

refunded to employee

Total Actual amount

withheld

Page 6 of 18

Printed :01/27/09

TECHNICAL ANNEX A-2009

Form 1604CF - Schedule 7.2

Alphalist of Employess whose Compensation Income are Exempt from Withholding Tax but subject to Income Tax

(Reported under Form 2316, July 2008 ENCS)

Details:

TEXT

TEXT

TEXT

TEXT

DATE

NUMBER

TEXT

TEXT

TEXT

TEXT

TEXT

NUMBER

WIDTH

4

6

9

4

10

6

9

4

30

30

30

14

FORMAT

D7.2

1604CF

999999999

9999

MM/DD/YYYY

999999

999999999

9999

X(30)

X(30)

X(30)

9(11).99

13. PRES_NONTAX_13TH_MO

NTH

14. PRES_NONTAX_DE_MINIMI

S

15. PRES_NONTAX_SSS_ETC

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

16. PRES_NONTAX_SALARIES

NUMBER

14

9(11).99

17. TOTAL_NONTAX_COMP_IN

COME

18. PRES_TAXABLE_BASIC_SA

LARY

19. PRES_TAXABLE_SALARIES

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

20. EXMPN_CODE

21. EXMPN_AMT

22. PREMIUM_PAID

TEXT

NUMBER

NUMBER

2

14

14

X(2)

9(11).99

9(11).99

23. NET_TAXABLE_COMP_INC

OME

24. TAX_DUE

NUMBER

14

9(11).99

NUMBER

14

9(11).99

TEXT

TEXT

TEXT

TEXT

DATE

NUMBER

WIDTH

4

6

9

4

10

14

FORMAT

C7.2

1604CF

999999999

9999

MM/DD/YYYY

9(11).99

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

FIELD NAME

SCHEDULE_NUM

FTYPE_CODE

TIN_EMPYR

BRANCH_CODE_EMPLYR

RETRN_PERIOD

SEQ_NUM

TIN

BRANCH_CODE

LAST_NAME

FIRST_NAME

MIDDLE_NAME

GROSS_COMP_INCOME

TYPE

DESCRIPTION

Schedule Number

Form Type

Employers TIN

Employers Branch Code

Return Period

Sequence Number

Employees TIN

Employees Branch Code

Employees Last Name

Employees First Name

Employees Middle name

Gross Compensation

Income

th

Nontaxable 13 month pay

and other benefits

Nontaxable De Minimis

Benefits

Nontaxable SSS,GSIS,

PAGIBIG and Union Dues

Nontaxable Salaries and

other Compensation

Total Nontaxable/Exempt

Compensation Income

Taxable Basic Salary

Taxable Salaries and other

Compensation

Exemption Code

Amount of Exemption

Premium paid on Health

and other Hospital

Insurance

Net Taxable Compensation

Income

Tax Due

Controls:

1.

2.

3.

4.

5.

6.

FIELD NAME

SCHEDULE_NUM

FTYPE_CODE

TIN_EMPYR

BRANCH_CODE_EMPLYR

RETRN_PERIOD

GROSS_COMP_INCOME

TYPE

7.

PRES_NONTAX_13TH_MO

NTH

NUMBER

14

9(11).99

8.

PRES_NONTAX_DE_MINIMI

NUMBER

14

9(11).99

Technical Specifications: Form 1604CF ALPHALIST (July 2008 ENCS)

DESCRIPTION

Schedule Number

Form Type

Employers TIN

Employers Branch Code

Return Period

Total Gross Compensation

Income

th

Total Nontaxable 13

month pay and other

benefits

Total Nontaxable De

Page 7 of 18

Printed :01/27/09

TECHNICAL ANNEX A-2009

9.

S

PRES_NONTAX_SSS_ETC

NUMBER

14

9(11).99

10. PRES_NONTAX_SALARIES

NUMBER

14

9(11).99

11. TOTAL_NONTAX_COMP_IN

COME

12. PRES_TAXABLE_BASIC_SA

LARY

13. PRES_TAXABLE_SALARIES

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

14. EXMPN_AMT

15. PREMIUM_PAID

NUMBER

NUMBER

14

14

9(11).99

9(11).99

16. NET_TAXABLE_COMP_INC

OME

17. TAX_DUE

NUMBER

14

9(11).99

NUMBER

14

9(11).99

Technical Specifications: Form 1604CF ALPHALIST (July 2008 ENCS)

Minimis Benefits

Total Nontaxable SSS,

GSIS, PAGIBIG and Union

Dues

Total nontaxable Salaries

and other Compensation

Total Nontaxable/Exempt

Compensation Income

Total Taxable Basic Salary

Total Taxable Salaries and

other compensation

Total Amount of exemption

Total Premium paid on

Health and other Hospital

Insurance

Total Net Taxable

Compensation Income

Total Tax Due

Page 8 of 18

Printed :01/27/09

TECHNICAL ANNEX A-2009

Form 1604CF - Schedule 7.3:

Alphalist of Employees as of December 31 with no Previous Employers (Reported under BIR Form 2316, July 2008

ENCS)

Details:

TEXT

TEXT

TEXT

TEXT

DATE

NUMBER

TEXT

TEXT

TEXT

TEXT

TEXT

NUMBER

WIDTH

4

6

9

4

10

6

9

4

30

30

30

14

FORMAT

D7.3

1604CF

999999999

9999

MM/DD/YYYY

999999

999999999

9999

X(30)

X(30)

X(30)

9(11).99

13. PRES_NONTAX_13TH_MO

NTH

14. PRES_NONTAX_DE_MINIMI

S

15. PRES_NONTAX_SSS_ETC

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

16. PRES_NONTAX_SALARIES

NUMBER

14

9(11).99

17. TOTAL_NONTAX_COMP_IN

COME

18. PRES_TAXABLE_BASIC_SA

LARY

19. PRES_TAXABLE_13TH_MO

NTH

20. PRES_TAXABLE_SALARIES

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

21. TOTAL_TAXABLE_COMP_I

NCOME

22. EXMPN_CODE

23. EXMPN_AMT

24. PREMIUM_PAID

NUMBER

14

9(11).99

TEXT

NUMBER

NUMBER

2

14

14

X(2)

9(11).99

9(11).99

25. NET_TAXABLE_COMP_INC

OME

26. TAX_DUE

27. PRES_TAX_WTHLD

28. AMT_WTHLD_DEC

29. OVER_WTHLD

NUMBER

14

9(11).99

NUMBER

NUMBER

NUMBER

NUMBER

14

14

14

14

9(11).99

9(11).99

9(11).99

9(11).99

30. ACTUAL_AMT_WTHLD

31. SUBS_FILING

NUMBER

TEXT

14

1

9(11).99

X(1)

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

FIELD NAME

SCHEDULE_NUM

FTYPE_CODE

TIN_EMPYR

BRANCH_CODE_EMPLYR

RETRN_PERIOD

SEQ_NUM

TIN

BRANCH_CODE

LAST_NAME

FIRST_NAME

MIDDLE_NAME

GROSS_COMP_INCOME

TYPE

Technical Specifications: Form 1604CF ALPHALIST (July 2008 ENCS)

DESCRIPTION

Schedule number

Form Type

Employers TIN

Employers Branch code

Return Period

Sequence number

Employees TIN

Employees Branch code

Employees Last Name

Employees First Name

Employees Middle name

Gross Compensation

Income

th

Nontaxable 13 month pay

and other benefits

Nontaxable De Minimis

Benefits

Nontaxable SSS, GSIS,

PAGIBIG and Union Dues

Nontaxable Salaries and

other Compensation

Total Nontaxable/Exempt

Compensation Income

Taxable Basic Salary

th

Taxable 13 month pay and

other benefits

Taxable Salaries and other

Compensation

Total Taxable

Compensation Income

Exemption Code

Amount of Exemption

Premium paid on Health

and Hospital insurance

Net Taxable Compensation

Income

Tax Due

Tax Withheld

Tax Withheld in December

Overwithheld tax refunded

to employee

Actual amount withheld

Substituted Filing? Yes/No

Page 9 of 18

Printed :01/27/09

TECHNICAL ANNEX A-2009

Form 1604CF - Schedule 7.3:

Controls:

FIELD NAME

1.

SCHEDULE_NUM

2.

FTYPE_CODE

3.

TIN_EMPYR

4.

BRANCH_CODE_EMPLYR

5.

RETRN_PERIOD

6.

GROSS_COMP_INCOME

TYPE

TEXT

TEXT

TEXT

TEXT

DATE

NUMBER

WIDTH

4

6

9

4

10

14

FORMAT

D7.3

1604CF

999999999

9999

MM/DD/YYYY

9(11).99

7.

PRES_NONTAX_13TH_MO

NTH

NUMBER

14

9(11).99

8.

PRES_NONTAX_DE_MINIMI

S

PRES_NONTAX_SSS_ETC

NUMBER

14

9(11).99

NUMBER

14

9(11).99

10. PRES_NONTAX_SALARIES

NUMBER

14

9(11).99

11. TOTAL_NONTAX_COMP_IN

COME

12. PRES_TAXABLE_BASIC_SA

LARY

13. PRES_TAXABLE_13TH_MO

NTH

14. PRES_TAXABLE_SALARIES

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

15. TOTAL_TAXABLE_COMP_I

NCOME

16. EXMPN_AMT

17. PREMIUM_PAID

NUMBER

14

9(11).99

NUMBER

NUMBER

14

14

9(11).99

9(11).99

9.

18. NET_TAXABLE_COMP_INC

OME

19. TAX_DUE

20. PRES_TAX_WTHLD

21. AMT_WTHLD_DEC

NUMBER

14

9(11).99

NUMBER

NUMBER

NUMBER

14

14

14

9(11).99

9(11).99

9(11).99

22. OVER_WTHLD

NUMBER

14

9(11).99

23. ACTUAL_AMT_WTHLD

NUMBER

14

9(11).99

Technical Specifications: Form 1604CF ALPHALIST (July 2008 ENCS)

DESCRIPTION

Schedule number

Form Type

Employers TIN

Employers Branch Code

Return period

Total Gross Compensation

Income

th

Total Nontaxable 13

month pay and other

benefits

Total Nontaxable De

Minimis Benefits

Total Nontaxable SSS,

GSIS, PAGIBIG and Union

dues

Total Nontaxable Salaries

and other Compensation

Total Nontaxable/Exempt

Compensation Income

Total Taxable Basic Salary

th

Total Taxable 13 month

pay and other benefits

Total Taxable salaries and

other compensation

Total Taxable

Compensation Income

Total Amount of exemption

Total Premium paid on

Health and hospital

insurance

Total Net Taxable

Compensation Income

Total Amount due

Total Amount withheld

Total amount withheld in

December

Total overwithheld tax

refunded to employee

Total actual tax withheld

Page 10 of 18

Printed :01/27/09

TECHNICAL ANNEX A-2009

Form 1604CF SCHEDULE 7.4

Alphalist of Employees as of December 31 with Previous Employers within the year (Reported under Form 2316, July

2008 ENCS)

Details:

TEXT

TEXT

TEXT

TEXT

DATE

NUMBER

TEXT

TEXT

TEXT

TEXT

TEXT

NUMBER

WIDTH

4

6

9

4

10

6

9

4

30

30

30

14

FORMAT

D7.4

1604CF

999999999

9999

MM/DD/YYYY

999999

999999999

9999

X(30)

X(30)

X(30)

9(11).99

13. PREV_NONTAX_13TH_MO

NTH

NUMBER

14

9(11).99

14. PREV_NONTAX_DE_MINIMI

S

NUMBER

14

9(11).99

15. PREV_NONTAX_SSS_ETC

NUMBER

14

9(11).99

16. PREV_NONTAX_SALARIES

NUMBER

14

9(11).99

17. PREV_TOTAL_NONTAX_CO

MP_INCOME

NUMBER

14

9(11).99

18. PREV_TAXABLE_BASIC_SA

LARY

19. PREV_TAXABLE_13TH_MO

NTH

NUMBER

14

9(11).99

NUMBER

14

9(11).99

20. PREV_TAXABLE_SALARIES

NUMBER

14

9(11).99

21. PREV_TOTAL_TAXABLE

NUMBER

14

9(11).99

22. PRES_NONTAX_13TH_MO

NTH

NUMBER

14

9(11).99

23. PRES_NONTAX_DE_MINIMI

S

24. PRES_NONTAX_SSS_ETC

NUMBER

14

9(11).99

NUMBER

14

9(11).99

25. PRES_NONTAX_SALARIES

NUMBER

14

9(11).99

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

FIELD NAME

SCHEDULE_NUM

FTYPE_CODE

TIN_EMPYR

BRANCH_CODE_EMPLYR

RETRN_PERIOD

SEQ_NUM

TIN

BRANCH_CODE

LAST_NAME

FIRST_NAME

MIDDLE_NAME

GROSS_COMP_INCOME

TYPE

Technical Specifications: Form 1604CF ALPHALIST (July 2008 ENCS)

DESCRIPTION

Schedule number

Form type

Employers TIN

Employers branch code

Return period

Sequence Number

Employees TIN

Employees Branch code

Employees last name

Employees First name

Employees middle name

Gross Compensation

Income

th

Nontaxable 13 month pay

and other benefits from

previous employer

Nontaxable De Minimis

Benefits from previous

employer

Nontaxable SSS, GSIS,

PAGIBIG and Union dues

from previous employer

Nontaxable salaries and

other compensation from

previous employer

Total Nontaxable/Exempt

Compensation Income from

previous employer

Taxable Basic Salary from

previous employer

th

Taxable 13 month pay and

other benefits from previous

employer

Taxable salaries and other

compensation from

previous employer

Total Taxable from

Previous Employer

th

Nontaxable 13 month pay

and other benefits from

present employer

Nontaxable De Minimis

Benefits

Nontaxable SSS, GSIS,

PAGIBIG and Union dues

from present employer

Nontaxable salaries and

other compensation from

present employer

Page 11 of 18

Printed :01/27/09

TECHNICAL ANNEX A-2009

FIELD NAME

26. PRES_TOTAL_NONTAX_CO

MP_INCOME

TYPE

NUMBER

WIDTH

14

FORMAT

9(11).99

27. PRES_TAXABLE_BASIC_SA

LARY

28. PRES_TAXABLE_13TH_MO

NTH

NUMBER

14

9(11).99

NUMBER

14

9(11).99

29. PRES_TAXABLE_SALARIES

NUMBER

14

9(11).99

30. PRES_TOTAL_COMP

NUMBER

14

9(11).99

31. TOTAL_TAXABLE_COMP_I

NCOME

32. EXMPN_CODE

33. EXMPN_AMT

34. PREMIUM_PAID

NUMBER

14

9(11).99

TEXT

NUMBER

NUMBER

2

14

14

X(2)

9(11).99

9(11).99

35. NET_TAXABLE_COMP_INC

OME

36. TAX_DUE

37. PREV_TAX_WTHLD

NUMBER

14

9(11).99

NUMBER

NUMBER

14

14

9(11).99

9(11).99

38. PRES_TAX_WTHLD

NUMBER

14

9(11).99

39. AMT_WTHLD_DEC

NUMBER

14

9(11).99

40. OVER_WTHLD

NUMBER

14

9(11).99

41. ACTUAL_AMT_WTHLD

NUMBER

14

9(11).99

Technical Specifications: Form 1604CF ALPHALIST (July 2008 ENCS)

DESCRIPTION

Total Nontaxable/Exempt

Compensation Income from

present employer

Taxable Basic Salary from

present employer

th

Taxable 13 month pay and

other benefits from present

employer

Taxable salaries and other

compensation from present

employer

Total Compensation

Present

Total Taxable(Previous &

Present Employers)

Exemption Code

Amount of exemption

Premium paid on health

and hospital insurance

Net Taxable Compensation

Income

Amount due

Amount withheld by

previous employer

Amount withheld by present

employer

Amount withheld & paid in

December

Overwithheld tax refunded

to employee

Actual amount withheld

Page 12 of 18

Printed :01/27/09

TECHNICAL ANNEX A-2009

Form 1604CF SCHEDULE 7.4

Controls:

FIELD NAME

1.

SCHEDULE_NUM

2.

FTYPE_CODE

3.

TIN_EMPYR

4.

BRANCH_CODE_EMPLYR

5.

RETRN_PERIOD

6.

GROSS_COMP_INCOME

TYPE

TEXT

TEXT

TEXT

TEXT

DATE

NUMBER

WIDTH

4

6

9

4

10

14

FORMAT

C7.4

1604CF

999999999

9999

MM/DD/YYYY

9(11).99

7.

PREV_NONTAX_13TH_MO

NTH

NUMBER

14

9(11).99

8.

PREV_NONTAX_DE_MINIMI

S

PREV_NONTAX_SSS_ETC

NUMBER

14

9(11).99

NUMBER

14

9(11).99

10. PREV_NONTAX_SALARIES

NUMBER

14

9(11).99

11. PREV_TOTAL_NONTAX_CO

MP_INCOME

12. PREV_TAXABLE_BASIC_SA

LARY

13. PREV_TAXABLE_13TH_MO

NTH

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

14. PREV_TAXABLE_SALARIES

NUMBER

14

9(11).99

15. PREV_TOTAL_TAXABLE

NUMBER

14

9(11).99

16. PRES_NONTAX_13TH_MO

NTH

NUMBER

14

9(11).99

17. PRES_NONTAX_DE_MINIMI

S

18. PRES_NONTAX_SSS_ETC

NUMBER

14

9(11).99

NUMBER

14

9(11).99

19. PRES_NONTAX_SALARIES

NUMBER

14

9(11).99

20. PRES_TOTAL_NONTAX_CO

MP_INCOME

NUMBER

14

9(11).99

21. PRES_TAXABLE_BASIC_SA

LARY

22. PRES_TAXABLE_13TH_MO

NTH

NUMBER

14

9(11).99

NUMBER

14

9(11).99

23. PRES_TAXABLE_SALARIES

NUMBER

14

9(11).99

9.

Technical Specifications: Form 1604CF ALPHALIST (July 2008 ENCS)

DESCRIPTION

Schedule number

Form type

Employers TIN

Employers Branch code

Return period

Gross Compensation

Income

th

Total Nontaxable 13

month pay and other

benefits from previous

employer

Nontaxable De Minimis

Benefits

Total Nontaxable SSS,

GSIS, PAGIBIG and Union

dues from previous

employer

Total Nontaxable salaries

and other compensation

from previous employer

Total Nontaxable/Exempt

Compensation Income

Taxable Basic Salary

th

Total Taxable 13 month

pay and other benefits from

previous employer

Total Taxable salaries and

other compensation from

previous employer

Total Taxable from

Previous Employer

th

Total Nontaxable 13

month pay and other

benefits from present

employer

Nontaxable De Minimis

Benefits

Total Nontaxable SSS,

GSIS, PAGIBIG and Union

dues from present employer

Total Nontaxable salaries

and other compensation

from present employer

Total Nontaxable/Exempt

Compensation Income from

present employer

Taxable Basic Salary

th

Taxable 13 month pay and

other benefits from present

employer

Total Taxable salaries and

other compensation from

Page 13 of 18

Printed :01/27/09

TECHNICAL ANNEX A-2009

FIELD NAME

TYPE

WIDTH

FORMAT

24. PRES_TOTAL_COMP

NUMBER

14

9(11).99

25. TOTAL_TAXABLE_COMP_I

NCOME

26. EXMPN_AMT

27. PREMIUM_PAID

NUMBER

14

9(11).99

NUMBER

NUMBER

14

14

9(11).99

9(11).99

28. NET_TAXABLE_COMP_INC

OME

29. TAX_DUE

30. PREV_TAX_WTHLD

NUMBER

14

9(11).99

NUMBER

NUMBER

14

14

9(11).99

9(11).99

31. PRES_TAX_WTHLD

NUMBER

14

9(11).99

32. AMT_WTHLD_DEC

NUMBER

14

9(11).99

33. OVER_WTHLD

NUMBER

14

9(11).99

34. ACTUAL_AMT_WTHLD

NUMBER

14

9(11).99

Technical Specifications: Form 1604CF ALPHALIST (July 2008 ENCS)

DESCRIPTION

present employer

Total Compensation

Present

Total Taxable(Previous &

Present Employers)

Total Amount of exemption

Total Premium paid on

health and hospital

insurance

Net Taxable Compensation

Income

Total Amount due

Total Amount withheld by

previous employer

Total Amount withheld by

present employer

Total Amount withheld &

paid in December

Total Overwithheld tax

refunded to employee

Total Actual amount

withheld

Page 14 of 18

Printed :01/27/09

TECHNICAL ANNEX A-2009

Form 1604CF SCHEDULE 7.5

Alphalist of Minimum Wage Earners (Reported under Form 2316, July 2008 ENCS)

Details:

TEXT

TEXT

TEXT

TEXT

DATE

NUMBER

TEXT

TEXT

TEXT

TEXT

TEXT

TEXT

WIDTH

4

6

9

4

10

6

9

4

30

30

30

4

FORMAT

D7.5

1604CF

999999999

9999

MM/DD/YYYY

999999

999999999

9999

X(30)

X(30)

X(30)

9999

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

20. PREV_NONTAX_DE_MINIMI

S

NUMBER

14

9(11).99

21. PREV_NONTAX_SSS_ETC

NUMBER

14

9(11).99

22. PREV_NONTAX_SALARIES

NUMBER

14

9(11).99

23. PREV_TOTAL_NONTAX_CO

MP_INCOME

TH

24. PREV_TAXABLE_13 _MON

TH

NUMBER

14

9(11).99

NUMBER

14

9(11).99

25. PREV_TAXABLE_SALARIES

NUMBER

14

9(11).99

26. PREV_TOTAL_TAXABLE

NUMBER

14

9(11).99

27. EMPLOYMENT_FROM

28. EMPLOYMENT_TO

29. PRES_NONTAX_GROSS_C

OMP_INCOME

DATE

DATE

NUMBER

10

10

14

MM/DD/YYYY

MM/DD/YYYY

9(11).99

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

FIELD NAME

SCHEDULE_NUM

FTYPE_CODE

TIN_EMPYR

BRANCH_CODE_EMPLYR

RETRN_PERIOD

SEQ_NUM

TIN

BRANCH_CODE

LAST_NAME

FIRST_NAME

MIDDLE_NAME

REGION_NUM

13. PREV_NONTAX_GROSS_C

OMP_INCOME

14. PREV_NONTAX_BASIC_SM

W

15. PREV_NONTAX_HOLIDAY_

PAY

16. PREV_NONTAX_OVERTIME

_PAY

17. PREV_NONTAX_NIGHT_DIF

F

18. PREV_NONTAX_HAZARD_

PAY

TH

19. PREV_NONTAX_13 _MON

TH

TYPE

Technical Specifications: Form 1604CF ALPHALIST (July 2008 ENCS)

DESCRIPTION

Schedule number

Form type

Employers TIN

Employers branch code

Return period

Sequence Number

Employees TIN

Employees Branch code

Employees last name

Employees First name

Employees middle name

Region No. Where

Assigned

Gross Compensation

Income Previous

Basic/Statutory Minimum

Wage

Holiday Pay from previous

employer

Overtime Pay from previous

employer

Night Shift Differential from

previous employer

Hazard Pay from previous

employer

th

Nontaxable 13 month pay

and other benefits from

previous employer

Nontaxable De Minimis

Benefits from previous

employer

Nontaxable SSS, GSIS,

PAGIBIG and Union dues

from previous employer

NonTaxable salaries and

other compensation from

previous employer

Total Nontaxable/Exempt

Compensation Income

th

Taxable 13 month pay and

other benefits from previous

employer

Taxable salaries and other

compensation from

previous employer

Total Taxable from previous

employer

Present Employment From

Present Employment To

Nontaxable Gross

Compensation Income from

Page 15 of 18

Printed :01/27/09

TECHNICAL ANNEX A-2009

FIELD NAME

TYPE

WIDTH

FORMAT

DESCRIPTION

present employer

30. PRES_NONTAX_BASIC_SM

W_DAY

31. PRES_NONTAX_BASIC_SM

W_MONTH

32. PRES_NONTAX_BASIC_SM

W_YEAR

33. FACTOR_USED

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

999

34. PRES_NONTAX_HOLIDAY_

PAY

35. PRES_NONTAX_OVERTIME

_PAY

36. PRES_NONTAX_NIGHT_DIF

F

37. PRES_NONTAX_HAZARD_

PAY

TH

38. PRES_NONTAX_13 _MON

TH

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

39. PRES_NONTAX_DE_MINIMI

S

NUMBER

14

9(11).99

40. PRES_NONTAX_SSS_ETC

NUMBER

14

9(11).99

41. PRES_NONTAX_SALARIES

NUMBER

14

9(11).99

42. PRES_TAXABLE_13 _MON

TH

NUMBER

14

9(11).99

43. PRES_TAXABLE_SALARIES

NUMBER

14

9(11).99

44. PRES_TOTAL_COMP

NUMBER

14

9(11).99

45. GROSS_COMP_INCOME

NUMBER

14

9(11).99

46. EXMPN_CODE

47. EXMPN_AMT

48. PREMIUM_PAID

TEXT

NUMBER

NUMBER

2

14

14

X(2)

9(11).99

9(11).99

49. NET_TAXABLE_COMP_INC

OME

50. TAX_DUE

51. PREV_TAX_WTHLD

NUMBER

14

9(11).99

NUMBER

NUMBER

14

14

9(11).99

9(11).99

52. PRES_TAX_WTHLD

NUMBER

14

9(11).99

53. AMT_WTHLD_DEC

NUMBER

14

9(11).99

54. OVER_WTHLD

NUMBER

14

9(11).99

TH

Technical Specifications: Form 1604CF ALPHALIST (July 2008 ENCS)

Basic/Statutory Minimum

Wage Per Day

Basic/Statutory Minimum

Wage Per Month

Basic/Statutory Minimum

Wage Per Year

Factor Used (No. of

Days/Year)

Holiday Pay from present

employer

Overtime Pay from present

employer

Night Shift Differential from

present employer

Hazard Pay from present

employer

th

Total Nontaxable 13

month pay and other

benefits from present

employer

Nontaxable De Minimis

Benefits from present

employer

Nontaxable SSS, GSIS,

PAGIBIG and Union dues

from present employer

Total Nontaxable Salaries

and other Compensation

th

Taxable 13 month pay and

other benefits from present

employer

Total Taxable salaries and

other compensation from

present employer

Total Compensation

Present

Total Compensation

Income (Previous & Present

Employers)

Exemption Code

Amount of exemption

Premium paid on health

and hospital insurance

Net Taxable Compensation

Income

Amount Due

Amount withheld by

previous employer

Amount withheld by present

employer

Amount withheld and in

December

Over withheld tax refunded

Page 16 of 18

Printed :01/27/09

TECHNICAL ANNEX A-2009

FIELD NAME

55. ACTUAL_AMT_WTHLD

Form 1604CF SCHEDULE 7.5

Controls:

FIELD NAME

1.

SCHEDULE_NUM

2.

FTYPE_CODE

3.

TIN_EMPYR

4.

BRANCH_CODE_EMPLYR

5.

RETRN_PERIOD

6.

PREV_NONTAX_GROSS_

COMP_INCOME

7.

PREV_NONTAX_BASIC_S

MW

8.

PREV_NONTAX_HOLIDAY

_PAY

9.

PREV_NONTAX_OVERTI

ME_PAY

10. PREV_NONTAX_NIGHT_D

IFF

11. PREV_NONTAX_HAZARD

_PAY

12. PREV_NONTAX_13TH_M

ONTH

TYPE

WIDTH

NUMBER

TYPE

14

FORMAT

9(11).99

TEXT

TEXT

TEXT

TEXT

DATE

NUMBER

WIDTH

4

6

9

4

10

14

FORMAT

C7.5

1604CF

999999999

9999

MM/DD/YYYY

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

13. PREV_NONTAX_DE_MINI

MIS

14. PREV_NONTAX_SSS_ET

C

NUMBER

14

9(11).99

NUMBER

14

9(11).99

15. PREV_NONTAX_SALARIE

S

NUMBER

14

9(11).99

16. PREV_TOTAL_NONTAX_

COMP_INCOME

17. PREV_TAXABLE_13TH_M

ONTH

NUMBER

14

9(11).99

NUMBER

14

9(11).99

18. PREV_TAXABLE_SALARI

ES

NUMBER

14

9(11).99

19. PREV_TOTAL_TAXABLE

NUMBER

14

9(11).99

20. PRES_NONTAX_GROSS_

COMP_INCOME

NUMBER

14

9(11).99

21. PRES_NONTAX_BASIC_S

MW_DAY

22. PRES_NONTAX_BASIC_S

MW_MONTH

23. PRES_NONTAX_BASIC_S

MW_YEAR

24. PRES_NONTAX_HOLIDAY

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

Technical Specifications: Form 1604CF ALPHALIST (July 2008 ENCS)

DESCRIPTION

to employee

Actual amount withheld

DESCRIPTION

Schedule number

Form type

Employers TIN

Employers Branch code

Return period

Gross Compensation

Income previous employer

Basic/Statutory Minimum

Wage

Holiday Pay from previous

employer

Overtime Pay from previous

employer

Night Shift Differential from

previous employer

Hazard Pay from previous

employer

Nontaxable 13th month pay

and other benefits from

previous employer

Nontaxable De Minimis

Benefits

Nontaxable SSS, GSIS,

PAGIBIG and Union dues

from previous employer

NonTaxable salaries and

other compensation from

previous employer

Total Nontaxable/Exempt

Compensation Income

Taxable 13th month pay

and other benefits from

previous employer

Taxable salaries and other

compensation from

previous employer

Total Taxable from previous

employer

Total Nontaxable Gross

Compensation Income from

present employer

Total Basic/Statutory

Minimum Wage Per Day

Total Basic/Statutory

Minimum Wage Per Month

Total Basic/Statutory

Minimum Wage Per Year

Total Holiday Pay from

Page 17 of 18

Printed :01/27/09

TECHNICAL ANNEX A-2009

25.

FIELD NAME

_PAY

PRES_NONTAX_OVERTI

ME_PAY

PRES_NONTAX_NIGHT_D

IFF

PREV_NONTAX_HAZARD

_PAY

PRES_NONTAX_13TH_M

ONTH

TYPE

WIDTH

FORMAT

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

NUMBER

14

9(11).99

29. PRES_NONTAX_DE_MINI

MIS

30. PRES_NONTAX_SSS_ET

C

NUMBER

14

9(11).99

NUMBER

14

9(11).99

31. PRES_NONTAX_SALARIE

S

32. PRES_TAXABLE_13TH_M

ONTH

NUMBER

14

9(11).99

NUMBER

14

9(11).99

33. PRES_TAXABLE_SALARI

ES

NUMBER

14

9(11).99

34. PRES_TOTAL_COMP

NUMBER

14

9(11).99

35. GROSS_COMP_INCOME

NUMBER

14

9(11).99

36. EXMPN_AMT

37. PREMIUM_PAID

NUMBER

NUMBER

14

14

9(11).99

9(11).99

38. NET_TAXABLE_COMP_IN

COME

39. TAX_DUE

40. PREV_TAX_WTHLD

NUMBER

14

9(11).99

NUMBER

NUMBER

14

14

9(11).99

9(11).99

41. PRES_TAX_WTHLD

NUMBER

14

9(11).99

42. AMT_WTHLD_DEC

NUMBER

14

9(11).99

43. OVER_WTHLD

NUMBER

14

9(11).99

44. ACTUAL_AMT_WTHLD

NUMBER

14

9(11).99

26.

27.

28.

Technical Specifications: Form 1604CF ALPHALIST (July 2008 ENCS)

DESCRIPTION

present employer

Total Overtime Pay from

present employer

Total Night Shift Differential

from present employer

Total Hazard Pay from

present employer

Total Nontaxable 13th

month pay and other

benefits from present

employer

Total Nontaxable De

Minimis Benefits

Total Nontaxable SSS,

GSIS, PAGIBIG and Union

dues from present employer

Total Nontaxable Salaries

and other Compensation

Total Taxable 13th month

pay and other benefits from

present employer

Total Taxable salaries and

other compensation from

present employer

Total Compensation

Present

Total Compensation

Income (Previous & Present

Employers)

Total Amount of Exemption

Total Premium paid on

health and hospital

insurance

Total Net Taxable

Compensation Income

Total Amount Due

Total Amount withheld by

previous employer

Total Amount withheld by

present employer

Total Amount withheld &

paid in December

Total Over withheld tax

refunded to employee

Total Actual amount

withheld

Page 18 of 18

Printed :01/27/09

You might also like

- Modeling and Simulation of Logistics Flows 2: Dashboards, Traffic Planning and ManagementFrom EverandModeling and Simulation of Logistics Flows 2: Dashboards, Traffic Planning and ManagementNo ratings yet

- AnnexDocument15 pagesAnnexannNo ratings yet

- Modeling and Simulation of Logistics Flows 3: Discrete and Continuous Flows in 2D/3DFrom EverandModeling and Simulation of Logistics Flows 3: Discrete and Continuous Flows in 2D/3DNo ratings yet

- 00 Introduction ATR 72 600Document12 pages00 Introduction ATR 72 600destefani150% (2)

- Production and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesFrom EverandProduction and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesNo ratings yet

- DB2 Program PreperationDocument6 pagesDB2 Program PreperationSudheer.rbNo ratings yet

- Business Management for Scientists and Engineers: How I Overcame My Moment of Inertia and Embraced the Dark SideFrom EverandBusiness Management for Scientists and Engineers: How I Overcame My Moment of Inertia and Embraced the Dark SideNo ratings yet

- 9713 s16 QP 02Document4 pages9713 s16 QP 02musthakali_sNo ratings yet

- SORT TricksDocument123 pagesSORT TricksShinoy SansilavoseNo ratings yet

- A Classification System to Describe Workpieces: DefinitionsFrom EverandA Classification System to Describe Workpieces: DefinitionsW. R. MacconnellNo ratings yet

- SBMessageFormatVer1 4Document60 pagesSBMessageFormatVer1 4arun.gautam15No ratings yet

- EnquiryDocument37 pagesEnquiryGodwin Ofoe100% (1)

- Fabricated Steel Plate Work World Summary: Market Values & Financials by CountryFrom EverandFabricated Steel Plate Work World Summary: Market Values & Financials by CountryNo ratings yet

- Guides For Shoes CalculationDocument16 pagesGuides For Shoes CalculationgopaltryNo ratings yet

- Applied Process Design for Chemical and Petrochemical Plants: Volume 1From EverandApplied Process Design for Chemical and Petrochemical Plants: Volume 1Rating: 3.5 out of 5 stars3.5/5 (3)

- JBASE Query LanguageDocument23 pagesJBASE Query LanguageAreefNo ratings yet

- Steps To Follow:: Chowdary SDocument7 pagesSteps To Follow:: Chowdary Schandu_as400100% (3)

- Specifications MT940 BNPP BelgiumDocument63 pagesSpecifications MT940 BNPP BelgiumljsilvercoolNo ratings yet

- Bis 345 Entire CourseDocument19 pagesBis 345 Entire CourseJohn TaylorNo ratings yet

- Create The New DMEE FormatDocument18 pagesCreate The New DMEE Formatsaipuppala100% (1)

- Advanced Spreadsheets Sample TestDocument5 pagesAdvanced Spreadsheets Sample Testdune0083No ratings yet

- Capacity Verification Run at Rate IpaDocument4 pagesCapacity Verification Run at Rate IpaIram ChaviraNo ratings yet

- Parts Reference List: Model: DCP-8080DN / DCP-8085DN / MFC-8480DN / MFC-8880DN / MFC-8890DWDocument37 pagesParts Reference List: Model: DCP-8080DN / DCP-8085DN / MFC-8480DN / MFC-8880DN / MFC-8890DWAlessandro Rocha de OliveiraNo ratings yet

- WPS File FormatDocument10 pagesWPS File Formatanwarali1975No ratings yet

- Ada462130 PDFDocument149 pagesAda462130 PDFmaxpattNo ratings yet

- CIE Applied ICT O/N 2010 Question Paper 2Document4 pagesCIE Applied ICT O/N 2010 Question Paper 2Fattyma97No ratings yet

- Cps Report File - Docx (1) - 1Document17 pagesCps Report File - Docx (1) - 1Tilak NeemaNo ratings yet

- Be Advised, The Worksheet and Workbooks Are Not ProtectedDocument12 pagesBe Advised, The Worksheet and Workbooks Are Not ProtectedJaquie AngNo ratings yet

- Attach A. Supplier Registration FormDocument11 pagesAttach A. Supplier Registration FormAbu HumairaNo ratings yet

- Optional Logic, If Any Subject Is Below 35 Marks Should Be Failed and Grade Should Be F and 35 and Above Should Be PassedDocument2 pagesOptional Logic, If Any Subject Is Below 35 Marks Should Be Failed and Grade Should Be F and 35 and Above Should Be PassedmohanNo ratings yet

- Section Product AND Documentation ID E Nti Fi Cat1 NDocument45 pagesSection Product AND Documentation ID E Nti Fi Cat1 NtedNo ratings yet

- Mca MGTDocument105 pagesMca MGTAkshansh Pal SinghNo ratings yet

- Section 1: Document Information: Functional Design SpecificationDocument6 pagesSection 1: Document Information: Functional Design SpecificationDoniRomdoniNo ratings yet

- 26 18 00 MV Circuit Protection Devices SicamDocument21 pages26 18 00 MV Circuit Protection Devices SicamRahul S.JagtapNo ratings yet

- 2.3 ABAP Basics - Internal TablesDocument11 pages2.3 ABAP Basics - Internal TableseswarscribdNo ratings yet

- ABAP Basics - ModularizationDocument5 pagesABAP Basics - Modularizationgraj4690% (1)

- MFC 8370 8380Document36 pagesMFC 8370 8380Владимир ИвановNo ratings yet

- 2014 MFE2201 Advanced Manufacturing SystemsDocument5 pages2014 MFE2201 Advanced Manufacturing SystemsBernice JohnsonNo ratings yet

- Line Stop Welded To Shoe CalculationDocument16 pagesLine Stop Welded To Shoe CalculationmohdnazirNo ratings yet

- University of Cambridge International Examinations General Certificate of Education Advanced Subsidiary Level and Advanced LevelDocument5 pagesUniversity of Cambridge International Examinations General Certificate of Education Advanced Subsidiary Level and Advanced LevelHussain AyoubNo ratings yet

- Paper Size DrawingDocument6 pagesPaper Size DrawinggembulflowNo ratings yet

- 9713 w08 QP 2Document5 pages9713 w08 QP 2Ahmad Al-MubaydinNo ratings yet

- Unit Test Report: RS203558 CPAUXREF Design RefDocument27 pagesUnit Test Report: RS203558 CPAUXREF Design Refgskn4u7183No ratings yet

- Talend - Case StudyDocument5 pagesTalend - Case StudyRahul Birla100% (1)

- Manual de Partes TransmisionDocument48 pagesManual de Partes TransmisionLuis Alberto Morales LimaNo ratings yet

- COBOL Lectures 2nd WeekDocument22 pagesCOBOL Lectures 2nd WeekAngel BallesterosNo ratings yet

- Galileo Format EmdDocument24 pagesGalileo Format EmdGay DelgadoNo ratings yet

- CFOAM 2.0 UserGuide PDFDocument43 pagesCFOAM 2.0 UserGuide PDFDanielle HaysNo ratings yet

- CobolDocument69 pagesCobolMoulikplNo ratings yet

- T24 Field FormatsDocument13 pagesT24 Field FormatsHamza SandliNo ratings yet

- 945 v1 8-1Document36 pages945 v1 8-1mail_tonitinNo ratings yet

- San Fs SD Qty Discount 005-006 1.0Document9 pagesSan Fs SD Qty Discount 005-006 1.0Amarnath Reddy100% (2)

- Atlas - Tech Data SheetsDocument20 pagesAtlas - Tech Data SheetsJAY PARIKHNo ratings yet

- EDI 810 Invoice Segment LayoutDocument31 pagesEDI 810 Invoice Segment LayoutuurNo ratings yet

- Exam Papers With AnswersDocument13 pagesExam Papers With AnswersSappa Suresh100% (1)

- S7 Timers Display On WINCC FlexDocument9 pagesS7 Timers Display On WINCC Flexayman qunaibiNo ratings yet

- BAI File Format ExplanationDocument12 pagesBAI File Format ExplanationThatra K ChariNo ratings yet

- Ece-Vii-dsp Algorithms & Architecture (10ec751) - Question PaperDocument9 pagesEce-Vii-dsp Algorithms & Architecture (10ec751) - Question PaperVinay Nagnath JokareNo ratings yet

- Laws Govern The Insurance Policy: P.D. No. 612Document1 pageLaws Govern The Insurance Policy: P.D. No. 612Gedan TanNo ratings yet

- Case Title Page No. Aspects of Due Process Police PowerDocument2 pagesCase Title Page No. Aspects of Due Process Police PowerGedan TanNo ratings yet

- GR No. l-11600Document22 pagesGR No. l-11600Gedan TanNo ratings yet

- MotionDocument1 pageMotionGedan TanNo ratings yet

- Continuation of Jurisdiction Page 1Document1 pageContinuation of Jurisdiction Page 1Gedan TanNo ratings yet

- Legal Ethics.....Document87 pagesLegal Ethics.....Gedan TanNo ratings yet

- No. of Shares Name of Issuing Company Stock Certificate No. Par Value Book Value Selling PriceDocument2 pagesNo. of Shares Name of Issuing Company Stock Certificate No. Par Value Book Value Selling PriceGedan TanNo ratings yet

- Labor Cases - Illegal DismissalDocument117 pagesLabor Cases - Illegal DismissalGedan TanNo ratings yet

- Copi, Irving M. and Cohen, Carl (2014) - Introduction To Logic. Pearson Education LimitedDocument1 pageCopi, Irving M. and Cohen, Carl (2014) - Introduction To Logic. Pearson Education LimitedGedan TanNo ratings yet

- Jurisdiction ReviewerDocument96 pagesJurisdiction ReviewerGedan TanNo ratings yet

- The Heirs of Pedro Escanlar Et Al v. CA 281 Scra 176 (1997)Document3 pagesThe Heirs of Pedro Escanlar Et Al v. CA 281 Scra 176 (1997)Gedan TanNo ratings yet

- 47.rosenlor Development v. Paterno InquingDocument15 pages47.rosenlor Development v. Paterno InquingGedan TanNo ratings yet

- Odyssey Park v. CADocument3 pagesOdyssey Park v. CAGedan TanNo ratings yet

- Islamic Directorate of The Philippines v. CADocument2 pagesIslamic Directorate of The Philippines v. CAGedan TanNo ratings yet

- Jasmin Soler vs. Court of AppealsDocument3 pagesJasmin Soler vs. Court of AppealsGedan TanNo ratings yet

- Heirs of Luis Bacus Vs Court of Appeals, Spouses Faustino Duray and Victoriana DurayDocument2 pagesHeirs of Luis Bacus Vs Court of Appeals, Spouses Faustino Duray and Victoriana DurayGedan TanNo ratings yet

- G.R. No. 185829 April 25, 2012Document25 pagesG.R. No. 185829 April 25, 2012Gedan TanNo ratings yet

- Supreme Court: Tipon & Fernandez For Petitioners. Andres B. Plan For RespondentsDocument5 pagesSupreme Court: Tipon & Fernandez For Petitioners. Andres B. Plan For RespondentsGedan TanNo ratings yet

- 46.rillo v. CADocument5 pages46.rillo v. CAGedan TanNo ratings yet

- Supreme Court: Statement of The CaseDocument10 pagesSupreme Court: Statement of The CaseGedan TanNo ratings yet

- 44.bank of BPI v. PinedaDocument9 pages44.bank of BPI v. PinedaGedan TanNo ratings yet

- Maria Cristina v. CADocument5 pagesMaria Cristina v. CAGedan TanNo ratings yet

- Jasmin Soler, Petitioner, vs. Court of Appeals, Commercial BANK OF MANILA, and NIDA LOPEZ, Respondents. DecisionDocument5 pagesJasmin Soler, Petitioner, vs. Court of Appeals, Commercial BANK OF MANILA, and NIDA LOPEZ, Respondents. DecisionGedan TanNo ratings yet

- 04 Spec Sheet PWM Controller ChipDocument16 pages04 Spec Sheet PWM Controller Chipxuanhiendk2No ratings yet

- Lecture 3 - Enzyme and Enzyme Kinetics PDFDocument8 pagesLecture 3 - Enzyme and Enzyme Kinetics PDFJulius BersabeNo ratings yet

- Binomial Expansion Calculator - EMathHelpDocument4 pagesBinomial Expansion Calculator - EMathHelpjerome_weirNo ratings yet

- Group 15 - The Elements NitrogenDocument19 pagesGroup 15 - The Elements NitrogenHarold Isai Silvestre GomezNo ratings yet

- S Cubed DatasheetDocument2 pagesS Cubed DatasheetGulf JobzNo ratings yet

- QuestionsDocument9 pagesQuestionsPlutoNo ratings yet

- Non Trailable2EnglishDocument6 pagesNon Trailable2EnglishSuman ThakurNo ratings yet

- MA5616 AddinitionalDocument16 pagesMA5616 AddinitionalMostafa A.SalamNo ratings yet

- Siesta TutorialDocument14 pagesSiesta TutorialCharles Marcotte GirardNo ratings yet

- SRV1 Q4-05 PDFDocument484 pagesSRV1 Q4-05 PDFalexNo ratings yet

- Sorting in ALV Using CL - SALV - TABLE - SAP Fiori, SAP HANA, SAPUI5, SAP Netweaver Gateway Tutorials, Interview Questions - SAP LearnersDocument4 pagesSorting in ALV Using CL - SALV - TABLE - SAP Fiori, SAP HANA, SAPUI5, SAP Netweaver Gateway Tutorials, Interview Questions - SAP LearnerssudhNo ratings yet

- Reviews QuestionsDocument6 pagesReviews QuestionsBerryNo ratings yet

- Colgate PalmoliveDocument8 pagesColgate PalmoliveRahul MaddikuntaNo ratings yet

- Datasheet Solis 110K 5GDocument2 pagesDatasheet Solis 110K 5GAneeq TahirNo ratings yet

- ISODRAFT Reference ManualDocument248 pagesISODRAFT Reference Manualgabi_nanaNo ratings yet

- Synchronous MachinesDocument10 pagesSynchronous MachinesarnabNo ratings yet

- JEE Mains (2024) AprilDocument129 pagesJEE Mains (2024) Aprilsophos408No ratings yet

- Irc 89 PDFDocument49 pagesIrc 89 PDFShashank SrivastavaNo ratings yet

- Design and Analysis of Single Patch Antenna For Radar ApplicationsDocument4 pagesDesign and Analysis of Single Patch Antenna For Radar ApplicationsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- RedBrand Answers 1Document3 pagesRedBrand Answers 1Karthikeyan VelusamyNo ratings yet

- A.Van - Dam and Zegeling RobustFVM1DHyperbolicfromMagnetohydrodynamicsDocument30 pagesA.Van - Dam and Zegeling RobustFVM1DHyperbolicfromMagnetohydrodynamicsSedanur Mazı GözenNo ratings yet

- Sand ControlDocument12 pagesSand ControlNIRAJ DUBEYNo ratings yet

- Convergence and Divergence of SequencesDocument12 pagesConvergence and Divergence of SequencesUnexpected TheoryNo ratings yet

- Case StudyDocument8 pagesCase Studymilan GandhiNo ratings yet

- Linear Partial Differential Equations of High Order With Constant CoefficientsDocument58 pagesLinear Partial Differential Equations of High Order With Constant CoefficientsShahin Kauser ZiaudeenNo ratings yet

- Structural SteelDocument17 pagesStructural SteelliNo ratings yet

- Diagnostic Trouble Code Index AllisonDocument16 pagesDiagnostic Trouble Code Index AllisonLuis Gongora100% (6)

- In Context: Subject Area: Organic Chemistry Level: 14-16 Years (Higher) Topic: Addition Polymers Source: RSC - Li/2GrwsijDocument5 pagesIn Context: Subject Area: Organic Chemistry Level: 14-16 Years (Higher) Topic: Addition Polymers Source: RSC - Li/2GrwsijRajlaxmi JainNo ratings yet

- A Tale of Two Cultures: Contrasting Quantitative and Qualitative Research - Mahoney e GoertzDocument24 pagesA Tale of Two Cultures: Contrasting Quantitative and Qualitative Research - Mahoney e Goertzandre_eiras2057No ratings yet

- 24/10/2017. ",, IssnDocument2 pages24/10/2017. ",, IssnMikhailNo ratings yet