Professional Documents

Culture Documents

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright:

Available Formats

Mizuho Corporate Bank

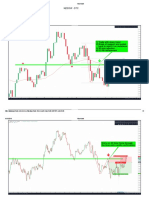

Technical Analysis 25 January 2010

GBP

GBP=D3, Last Quote [Candle], Last Quote [Ichimoku 9, 26, 52, 26] Daily

06Oct09 - 02Mar10

Pr

GBP=D3 , Last Quote, Candle

25Jan10 1.6107 1.6144 1.6090 1.6142

GBP=D3 , Last Quote, Tenkan Sen 9 1.68

25Jan10 1.6268

GBP=D3 , Last Quote, Kijun Sen 26

25Jan10 1.6146

GBP=D3 , Last Quote, Senkou Span(a) 52 1.67

01Mar10 1.6207

GBP=D3 , Last Quote, Senkou Span(b) 52

01Mar10 1.6356 1.66

GBP=D3 , Last Quote, Chikou Span 26

21Dec09 1.6142

1.65

1.64

1.63

1.62

1.61

1.6

1.59

1.58

1.57

12Oct09 19Oct 26Oct 02Nov 09Nov 16Nov 23Nov 30Nov 07Dec 14Dec 21Dec 28Dec 04Jan 11Jan 18Jan 25Jan 01Feb 08Feb 15Feb 22Feb 01Mar

Comment: Still suck between the Ichimoku ‘cloud’ and 61% Fibonacci support. Daily and weekly ‘clouds’

become very thin Tuesday and mid-February so watch for upside breaks then.

Strategy: Attempt very small longs at 1.6130; stop below 1.6070. Short term target 1.6240, then 1.6300.

Chart Levels:

Support Resistance Direction of Trade

1.6120 1.6155

1.6090 1.6245

1.6077 1.6300

1.6000 1.6380

1.5945 1.6459*

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- Real Traders II: How One CFO Trader Used the Power of Leverage to make $110k in 9 WeeksFrom EverandReal Traders II: How One CFO Trader Used the Power of Leverage to make $110k in 9 WeeksNo ratings yet

- Traders' Almanac 20180116Document7 pagesTraders' Almanac 20180116annisa najuwahNo ratings yet

- Traders' Almanac: Palm Oil - The August RallyDocument7 pagesTraders' Almanac: Palm Oil - The August RallyfendyNo ratings yet

- 11th Annual Real Estate Investment World Asia 2012Document15 pages11th Annual Real Estate Investment World Asia 2012LfaFerrariNo ratings yet

- Abhijeet PatilDocument25 pagesAbhijeet PatilAbhijeet PatilNo ratings yet

- MicroCap Review Spring 2018Document110 pagesMicroCap Review Spring 2018Planet MicroCap Review MagazineNo ratings yet

- bsDSIJ3409 PDFDocument84 pagesbsDSIJ3409 PDFSheikh AbdullahNo ratings yet

- Why Barley Is Good For Following Illnesses....Document2 pagesWhy Barley Is Good For Following Illnesses....jayarninianNo ratings yet

- Hong Kong Stock Market for Beginners: Hang Seng Index Basics GuideFrom EverandHong Kong Stock Market for Beginners: Hang Seng Index Basics GuideRating: 1 out of 5 stars1/5 (1)

- Ontario Farmer - Rural Properties and MarketplaceDocument8 pagesOntario Farmer - Rural Properties and MarketplaceThe London Free PressNo ratings yet

- Excavating Real Estate:Alan W. Moore, With The Artists of The Real Estate Show (1980)Document13 pagesExcavating Real Estate:Alan W. Moore, With The Artists of The Real Estate Show (1980)Guilherme CuoghiNo ratings yet

- FXCM New To Forex Guide LTD en PDFDocument27 pagesFXCM New To Forex Guide LTD en PDFRODRIGO TROCONISNo ratings yet

- DSIJ3121Document68 pagesDSIJ3121Navin ChandarNo ratings yet

- Quasidb - Live Data APIDocument428 pagesQuasidb - Live Data APIOndrášek ChaloudupkaNo ratings yet

- Micro-Cap Review Winter 2011Document96 pagesMicro-Cap Review Winter 2011Planet MicroCap Review MagazineNo ratings yet

- Micro-Cap Review Magazine Fall/Winter 2013Document96 pagesMicro-Cap Review Magazine Fall/Winter 2013Planet MicroCap Review MagazineNo ratings yet

- Ask HN - Your Best Passive Income Sources - Hacker NewsDocument35 pagesAsk HN - Your Best Passive Income Sources - Hacker Newsresearch45No ratings yet

- Private Equity in The 2000sDocument4 pagesPrivate Equity in The 2000sfunmastiNo ratings yet

- RngerDocument5 pagesRngerLeon Heart100% (1)

- Forex Quotations and ArbitrageDocument25 pagesForex Quotations and Arbitragerohitpatil699No ratings yet

- Chart Formation ADXDocument7 pagesChart Formation ADXmiltonericksonsNo ratings yet

- $100 Forex Planning: Primary Account Size Profit Per Week (%) Max Lot Per Trade Weeks BalanceDocument4 pages$100 Forex Planning: Primary Account Size Profit Per Week (%) Max Lot Per Trade Weeks BalanceAli RidhaNo ratings yet

- Currency Trader 0105Document54 pagesCurrency Trader 0105albertblant100% (1)

- TWSGuide PDFDocument1,689 pagesTWSGuide PDFDiana Carolina Martinez100% (1)

- 2652 Theory of Day TradingDocument5 pages2652 Theory of Day Tradingherbak100% (1)

- Real Estate Agent Profiles 2016 WewDocument2 pagesReal Estate Agent Profiles 2016 WewtimesnewspapersNo ratings yet

- NZDCHF - DTCDocument3 pagesNZDCHF - DTCAnonymousNo ratings yet

- IFCMarketsBook PDFDocument12 pagesIFCMarketsBook PDFDondee Sibulo AlejandroNo ratings yet

- "20 Pips Are Welcome": Simple GBPUSD StrategyDocument5 pages"20 Pips Are Welcome": Simple GBPUSD StrategyNikos KarpathakisNo ratings yet

- USDCAD - DTC (Advanced Entry)Document3 pagesUSDCAD - DTC (Advanced Entry)cedric anvoNo ratings yet

- My Secrets of Day Trading in Stocks by Richard D Wyckoff 2014-06-10 PDF 9f52e0b53Document2 pagesMy Secrets of Day Trading in Stocks by Richard D Wyckoff 2014-06-10 PDF 9f52e0b53DeepakNo ratings yet

- Silo - Tips - Japanese Candlestick Charts PDFDocument29 pagesSilo - Tips - Japanese Candlestick Charts PDFFour LanternsNo ratings yet

- How To Conduct An Effective Trading Session Review: by Lance BeggsDocument13 pagesHow To Conduct An Effective Trading Session Review: by Lance BeggsNishantNo ratings yet

- Home Business - Fall 2017Document52 pagesHome Business - Fall 2017m0k123_112640140No ratings yet

- Forteus Research - Emergence of Crypto Hedge Funds - Feb23Document23 pagesForteus Research - Emergence of Crypto Hedge Funds - Feb23Ryan EbnerNo ratings yet

- Executive Summary: Growing Importance of Money and To Manage This Most Essential Item Is An Art, ScienceDocument63 pagesExecutive Summary: Growing Importance of Money and To Manage This Most Essential Item Is An Art, ScienceSushant NewalkarNo ratings yet

- Futures Junctures: SoftsDocument6 pagesFutures Junctures: SoftsBudi MulyonoNo ratings yet

- Noor Azizah - Exponential Moving Average1Document7 pagesNoor Azizah - Exponential Moving Average1Azizah NoorNo ratings yet

- wp2012 20Document1 pagewp2012 20Peter FrankNo ratings yet

- Trader Nexus - Advanced Trailing Stop Metastock Stop Loss PluginDocument6 pagesTrader Nexus - Advanced Trailing Stop Metastock Stop Loss PluginlenovojiNo ratings yet

- How To Trade BotcoinDocument15 pagesHow To Trade BotcoinMohammadreza HeidariNo ratings yet

- 3-Strategies Spreads Guy BowerDocument15 pages3-Strategies Spreads Guy BowerNicoLazaNo ratings yet

- Improve Your FX Trading System: How To Avoid "Dredging" P. 18Document32 pagesImprove Your FX Trading System: How To Avoid "Dredging" P. 18markchenoNo ratings yet

- Forex TradingDocument5 pagesForex TradingLanguage Breakers ENGLISHNo ratings yet

- How To Be 100% Sure of A Chart SignalDocument5 pagesHow To Be 100% Sure of A Chart SignalbhushanNo ratings yet

- Stock-Option-Trading-Tips-Provided-By-Theequicom-For Today-24-September-2014Document7 pagesStock-Option-Trading-Tips-Provided-By-Theequicom-For Today-24-September-2014Riya VermaNo ratings yet

- Market Technician No40Document20 pagesMarket Technician No40ppfahd100% (1)

- Hot Key MT-4Document3 pagesHot Key MT-4swetha reddyNo ratings yet

- MarkDocument5 pagesMarkShubhamSetiaNo ratings yet

- Also Read:: ERC20 Tether Transactions Flip Their Omni EquivalentDocument5 pagesAlso Read:: ERC20 Tether Transactions Flip Their Omni Equivalentong0625No ratings yet

- Money ManagementDocument8 pagesMoney ManagementHemed AllyNo ratings yet

- TradeDocument3 pagesTradeRadu GabrielNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR USDDocument1 pageAUG-10 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirNo ratings yet

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirNo ratings yet

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirNo ratings yet

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocument1 pageAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirNo ratings yet

- Q&A-Accounts & Finance (Optional Included)Document109 pagesQ&A-Accounts & Finance (Optional Included)Madan G Koushik100% (1)

- Decisionth 1Document66 pagesDecisionth 1Vijayant Panda100% (1)

- Financial Analysis Ratio - Formula ElaborationDocument11 pagesFinancial Analysis Ratio - Formula ElaborationBen AzarelNo ratings yet

- Global Briefing Sept. 2010Document12 pagesGlobal Briefing Sept. 2010Absolute ReturnNo ratings yet

- Fibe Insta LoanDocument17 pagesFibe Insta LoanAshwani KumarNo ratings yet

- PT Aldenio: Memorial Journal (ADJUSTMENT)Document7 pagesPT Aldenio: Memorial Journal (ADJUSTMENT)Laela LitaNo ratings yet

- Appendix 26 - Instructions - RCDDocument2 pagesAppendix 26 - Instructions - RCDthessa_starNo ratings yet

- Kalac Becirovic Plojovic The Role of Financial Intermediaries-LibreDocument8 pagesKalac Becirovic Plojovic The Role of Financial Intermediaries-LibreSampatVHallikeriNo ratings yet

- Corporate Finance and Investment AnalysisDocument80 pagesCorporate Finance and Investment AnalysisCristina PopNo ratings yet

- Federal Urdu University of Arts, Science and Technology, IslamabadDocument4 pagesFederal Urdu University of Arts, Science and Technology, IslamabadQasim Jahangir WaraichNo ratings yet

- Building Social Business Muhammad YunusDocument186 pagesBuilding Social Business Muhammad YunusGisele Dottori Barreto100% (2)

- Loan Defaults and Credit Default Swaps: Tee Chwee MingDocument42 pagesLoan Defaults and Credit Default Swaps: Tee Chwee Mingyip33No ratings yet

- Certificate of Registration of A Russian Organization With A Tax Authority at Its LocationDocument2 pagesCertificate of Registration of A Russian Organization With A Tax Authority at Its Locationdaniel100% (1)

- Financial Institutions and MarketDocument19 pagesFinancial Institutions and MarketNilesh MotwaniNo ratings yet

- Central Bank of India Recruitment 2013, Vice President, Manager, Executive Officer - Sep 2013Document10 pagesCentral Bank of India Recruitment 2013, Vice President, Manager, Executive Officer - Sep 2013malaarunNo ratings yet

- Evaluation of Shareholder Value and Market Evaluation of Equity For UnileverDocument42 pagesEvaluation of Shareholder Value and Market Evaluation of Equity For UnileverAbdul Khadar MohammedNo ratings yet

- LIC New Endowment Plus 9 Inch X 8 Inch EngDocument20 pagesLIC New Endowment Plus 9 Inch X 8 Inch EngMexico EnglishNo ratings yet

- Aman Jain Itr (A.y.2017-18)Document1 pageAman Jain Itr (A.y.2017-18)ramanNo ratings yet

- Aman Jaiswal MRPDocument59 pagesAman Jaiswal MRPAli ShaikhNo ratings yet

- Ratio of Sasbadi Holdings Berhad For Group 2016 1. Liquidity RatioDocument7 pagesRatio of Sasbadi Holdings Berhad For Group 2016 1. Liquidity RatioizzhnsrNo ratings yet

- FIN424 - Assignment 1-2nd Term-2021-22Document7 pagesFIN424 - Assignment 1-2nd Term-2021-22Memoona NawazNo ratings yet

- Search EnginesDocument43 pagesSearch EnginesSrinivas Kumar KoradaNo ratings yet

- Manual Steps SAPNote 1699985Document3 pagesManual Steps SAPNote 1699985chandrasekha3975No ratings yet

- CFA Exam Locations (And Can I Change My Test Center - )Document10 pagesCFA Exam Locations (And Can I Change My Test Center - )Sudipto PaulNo ratings yet

- Introduction To Investment BankingDocument45 pagesIntroduction To Investment BankingHuế ThùyNo ratings yet

- On KajariaDocument16 pagesOn KajariaPOORVICHIBNo ratings yet

- MATHINVS - Simple Annuities 3.2Document9 pagesMATHINVS - Simple Annuities 3.2Kathryn SantosNo ratings yet

- Deloitte CN CSG Guide To Taxation in Se Asia 2019 Bilingual 190806 PDFDocument228 pagesDeloitte CN CSG Guide To Taxation in Se Asia 2019 Bilingual 190806 PDFLevina WijayaNo ratings yet

- Portfolio ManagementDocument45 pagesPortfolio ManagementSukesh Nair100% (1)

- Invoice - INNOPARKDocument1 pageInvoice - INNOPARKAnkit SinghNo ratings yet