Professional Documents

Culture Documents

CH 08

Uploaded by

api-274120622Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 08

Uploaded by

api-274120622Copyright:

Available Formats

2255T_c08_063-071.

qxd 1/17/07 1:25 PM Page 63 Team B TeamB_04:Desktop Folder:17/01/07:WEYGOND WEB:

Exercises: Set B

63

EXERCISES: SET B

E8-1B Joshua Michaels is the owner of Joshs Burgers. Joshs Burgers is operated strictly on a carryout basis. Customers pick up their orders at a counter where a clerk exchanges the food for cash.

While at the counter, the customer can see other employees making the food at different stations.

Identify the principles of

internal control.

(SO 2)

Instructions

Identify the six principles of internal control and give an example of each principle that you might

observe when picking up your food. (Note: It may not be possible to observe all the principles.)

E8-2B The following control procedures are used at Jiminez Company for over-the-counter

cash receipts.

1. All over-the-counter receipts are registered by four clerks who use a cash register with a single

cash drawer (till).

2. To minimize the risk of robbery, cash in excess of $200 is stored in an unlocked drawer in a

desk in the back room.

3. Each clerk counts his/her own receipts at the end of the day and reconciles that amount to the

cash register total.

4. A bookkeeper prepares a journal entry to record the days cash receipts, then deposits the receipts in the bank.

5. To save funds, cashiers do not get vacation days.

Identify internal control

weaknesses over cash receipts

and suggest improvements.

(SO 2, 3)

Instructions

(a) For each procedure, explain the weakness in internal control, and identify the control principle that is violated.

(b) For each weakness, suggest a change in procedure that will result in good internal control.

E8-3B The following control procedures are used in Andys Antiques for cash disbursements.

1. The store manager approves all payments before she signs and issues checks.

2. The bookkeeper reconciles the bank statement and reports any discrepancies to the owner.

3. Andy drops off new antiques on the loading dock. They are processed throughout the week

and brought in to the store.

4. The company checks are unnumbered.

5. After payment, bills are filed in a paid invoice folder.

Identify internal control weaknesses over cash disbursements

and suggest improvements.

(SO 2, 4)

Instructions

(a) For each procedure, explain the weakness in internal control, and identify the internal control principle that is violated.

(b) For each weakness, suggest a change in the procedure that will result in good internal control.

E8-4B At Leah Company, checks are not prenumbered because both the purchasing agent and

the treasurer are authorized to issue checks. Each signer has access to unissued checks kept in an

unlocked file cabinet. The purchasing agent pays all bills pertaining to goods purchased for resale.

Prior to payment, the purchasing agent determines that the goods have been received and verifies

the mathematical accuracy of the vendors invoice. After payment, the invoice is filed by vendor,

and the purchasing agent records the payment in the cash disbursements journal. The treasurer

pays all other bills following approval by authorized employees. After payment, the treasurer

stamps all bills PAID, files them by payment date, and records the checks in the cash disbursements

journal. Leah Company maintains one checking account that is reconciled by the treasurer.

Identify internal control weaknesses for cash disbursements

and suggest improvements.

(SO 4)

Instructions

(a) List the weaknesses in internal control over cash disbursements.

(b)

Write a memo to the company treasurer indicating your recommendations for

improvement.

E8-5B Listed below are five procedures followed by Paul Collins Company.

1. Each individual who operates the cash register uses his or her own register drawer and register code.

2. A monthly bank reconciliation is prepared by the bookkeeper.

3. Ellen May writes checks and Jethro Bodine records cash payment journal entries.

4. Jed Clampett orders inventory and authorizes payments for inventory.

5. Unnumbered sales invoices from credit sales are forwarded to the accounting department

every 4 weeks for recording.

Indicate whether procedure is

good or weak internal control.

(SO 2, 3, 4)

2255T_c08_063-071.qxd 1/17/07 1:25 PM Page 64 Team B TeamB_04:Desktop Folder:17/01/07:WEYGOND WEB:

64

Chapter 8 Internal Control and Cash

Instructions

Indicate whether each procedure is an example of good internal control or of weak internal control. If it is an example of good internal control, indicate which internal control principle is being

followed. If it is an example of weak internal control, indicate which internal control principle is

violated. Use the table below.

Procedure

IC Good or Weak?

Related Internal Control Principle

1.

2.

3.

4.

5.

Indicate whether procedure is

good or weak internal control.

(SO 2, 3, 4)

E8-6B Listed below are five procedures followed by A Different Kind of Company.

1. As a cost-saving measure, employees do not take vacations.

2. Only the sales manager can approve credit sales.

3. Three different employees are assigned one task each related to inventory: ships goods to customers, bills customers, and receives payment from customers.

4. Total cash receipts are compared to bank deposits daily by Missy Hathaway, who receives

cash over the counter.

5. Employees write down hours worked and turn in the sheet to the cashiers office.

Instructions

Indicate whether each procedure is an example of good internal control or of weak internal control. If it is an example of good internal control, indicate which internal control principle is being

followed. If it is an example of weak internal control, indicate which internal control principle is

violated. Use the table below.

Procedure

IC Good or Weak?

Related Internal Control Principle

1.

2.

3.

4.

5.

Prepare journal entries for a

petty cash fund.

E8-7B Billy McKinney Company established a petty cash fund on May 1, cashing a check for

$200. The company reimbursed the fund on June 1 and July 1 with the following results.

(SO 5)

June 1: Cash in fund $13.00. Receipts: delivery expense $73.30; postage expense $75.50;

and miscellaneous expense $40.40.

July 1: Cash in fund $11.50. Receipts: delivery expense $43.00; entertainment expense

$98.50; and miscellaneous expense $47.00.

On July 10, Billy McKinney decreased the fund from $200 to $150.

Instructions

Prepare journal entries for Billy McKinney Company for May 1, June 1, July 1, and July 10.

Prepare journal entries for a

petty cash fund.

(SO 5)

E8-8B Abraham Company uses an imprest petty cash system. The fund was established on

March 1 with a balance of $150. During March the following petty cash receipts were found in the

petty cash box.

Date

Receipt

No.

For

Amount

3/5

7

9

11

14

1

2

3

4

5

Stamp Inventory

Freight-out

Miscellaneous Expense

Travel Expense

Miscellaneous Expense

$35

19

10

20

11

The fund was replenished on March 15 when the fund contained $58 in cash. On March 20, the

amount in the fund was decreased to $100.

2255T_c08_063-071.qxd 1/17/07 1:25 PM Page 65 Team B TeamB_04:Desktop Folder:17/01/07:WEYGOND WEB:

Exercises: Set B

65

Instructions

Journalize the entries in March that pertain to the operation of the petty cash fund.

E8-9B Stefan Pagnucci is unable to reconcile the bank balance at January 31. Stefans reconciliation is as follows.

Cash balance per bank

Add: NSF check

Less: Bank service charge

$4,714.60

930.00

30.00

Adjusted balance per bank

$5,614.60

Cash balance per books

Less: Deposits in transit

Add: Outstanding checks

$5,190.60

730.00

1,214.00

Adjusted balance per books

$5,674.60

Prepare bank reconciliation

and adjusting entries.

(SO 7)

Instructions

(a) Prepare a correct bank reconciliation.

(b) Journalize the entries required by the reconciliation.

E8-10B On April 30, the bank reconciliation of Savana Company shows three outstanding

checks: no. 254, $400, no. 255, $510, and no. 257, $255. The May bank statement and the May cash

payments journal show the following.

Bank Statement

Checks Paid

Determine outstanding checks.

(SO 7)

Cash Payments Journal

Checks Issued

Date

Check No.

Amount

Date

Check No.

Amount

5/4

5/2

5/17

5/12

5/20

5/29

5/30

254

257

258

259

261

263

262

400

255

100

170

310

300

465

5/2

5/5

5/10

5/15

5/22

5/24

5/29

258

259

260

261

262

263

264

100

170

550

310

465

300

350

Instructions

Using step 2 in the reconciliation procedure, list the outstanding checks at May 31.

E8-11B The following information pertains to Vinces Video Company.

1.

2.

3.

4.

5.

Cash balance per bank, July 31, $2,542.

July bank service charge not recorded by the depositor $10.

Cash balance per books, July 31, $2,549.

Deposits in transit, July 31, $525.

Bank collected $300 note for Vinces in July, plus interest $36, less fee $15. The collection has

not been recorded by Vinces, and no interest has been accrued.

6. Outstanding checks, July 31, $207.

Prepare bank reconciliation

and adjusting entries.

(SO 7)

Instructions

(a) Prepare a bank reconciliation at July 31.

(b) Journalize the adjusting entries at July 31 on the books of Vinces Video Company.

E8-12B The information below relates to the Cash account in the ledger of Pat Company.

Balance September 1$9,947; Cash deposited$37,120.

Balance September 30$10,094; Checks written$36,973.

The September bank statement shows a balance of $9,525 on September 30 and the following

memoranda.

Prepare bank reconciliation

and adjusting entries.

(SO 7)

2255T_c08_063-071.qxd 1/17/07 1:25 PM Page 66 Team B TeamB_04:Desktop Folder:17/01/07:WEYGOND WEB:

66

Chapter 8 Internal Control and Cash

Credits

Collection of $850 note plus interest $34

Interest earned on checking account

Debits

$884

$26

NSF check: J. Jackson

Safety deposit box rent

$245

$35

At September 30, deposits in transit were $2,581, and outstanding checks totaled $1,382.

Instructions

(a) Prepare the bank reconciliation at September 30.

(b) Prepare the adjusting entries at September 30, assuming (1) the NSF check was from a

customer on account, and (2) no interest had been accrued on the note.

Compute deposits in transit

and outstanding checks for two

bank reconciliations.

(SO 7)

E8-13B The cash records of Dwight Company show the following four situations.

1. The June 30 bank reconciliation indicated that deposits in transit total $1,100. During July the

general ledger account Cash shows deposits of $18,940, but the bank statement indicates that

only $18,200 in deposits were received during the month.

2. The June 30 bank reconciliation also reported outstanding checks of $1,275. During the month

of July, Givens Company books show that $17,850 of checks were issued. The bank statement

showed that $17,050 of checks cleared the bank in July.

3. In September, deposits per the bank statement totaled $24,900, deposits per books were

$23,950, and deposits in transit at September 30 were $1,900.

4. In September, cash disbursements per books were $22,300, checks clearing the bank were

$22,800, and outstanding checks at September 30 were $3,200.

There were no bank debit or credit memoranda. No errors were made by either the bank or

Dwight Company.

Instructions

Answer the following questions.

(a)

(b)

(c)

(d)

Show presentation of cash in

financial statements.

In situation (1), what were the deposits in transit at July 31?

In situation (2), what were the outstanding checks at July 31?

In situation (3), what were the deposits in transit at August 31?

In situation (4), what were the outstanding checks at August 31?

E8-14B Pork Chop Company has recorded the following items in its financial records.

Cash in bank

Cash in plant expansion fund

Cash on hand

Highly liquid investments

Petty cash

Receivables from customers

Stock investments

(SO 8)

$20,000

75,000

5,000

17,000

400

79,000

50,000

The cash in bank is subject to a compensating balance of $5,000. The highly liquid investments

had maturities of 3 months or less when they were purchased. The stock investments will be sold

in the next 6 to 12 months. The plant expansion project will begin in 3 years.

Instructions

(a) What amount should Pork Chop report as Cash and cash equivalents on its balance sheet?

(b) Where should the items not included in part (a) be reported on the balance sheet?

(c) What disclosures should Pork Chop make in its financial statements concerning cash and

cash equivalents?

PROBLEMS: SET C

Identify internal control weaknesses over cash receipts.

(SO 2, 3)

P8-1C Discount Theater is located in the Mishawaka Mall. A cashiers booth is located near

the entrance to the theater. Three cashiers are employed. One works from 15 P.M., another from

59 P.M.The shifts are rotated among the three cashiers. The cashiers receive cash from customers

and operate a machine that ejects serially numbered tickets. The rolls of tickets are inserted and

locked into the machine by the theater manager at the beginning of each cashiers shift.

2255T_c08_063-071.qxd 1/17/07 1:25 PM Page 67 Team B TeamB_04:Desktop Folder:17/01/07:WEYGOND WEB:

Problems: Set C

67

After purchasing a ticket, the customer takes the ticket to an usher stationed at the entrance

of the theater lobby some 60 feet from the cashiers booth. The usher tears the ticket in half, admits the customer, and returns the ticket stub to the customer. The other half of the ticket is

dropped into a locked box by the usher.

At the end of each cashiers shift, the theater manager removes the ticket rolls from the machine and makes a cash count. The cash count sheet is initialed by the cashier. At the end of the

day, the manager deposits the receipts in total in a bank night deposit vault located in the mall.

The manager also sends copies of the deposit slip and the initialed cash count sheets to the theater company treasurer for verification and to the companys accounting department. Receipts

from the first shift are stored in a safe located in the managers office.

Instructions

(a) Identify the internal control principles and their application to the cash receipts transactions

of the Discount Theater.

(b) If the usher and cashier decide to collaborate to misappropriate cash, what actions might

they take?

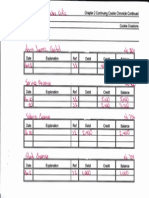

P8-2C Loganberry Company maintains a petty cash fund for small expenditures. The following transactions occurred over a 2-month period.

July

1 Established petty cash fund by writing a check on Rock Point Bank for $100.

15 Replenished the petty cash fund by writing a check for $96.90. On this date the fund consisted of $3.10 in cash and the following petty cash receipts: freight-out $51.00, postage expense $20.50, entertainment expense $23.10, and miscellaneous expense $4.10.

31 Replenished the petty cash fund by writing a check for $95.90. At this date, the fund consisted of $4.10 in cash and the following petty cash receipts: freight-out $43.50, charitable

contributions expense $20.00, postage expense $20.10, and miscellaneous expense $12.30.

Aug. 15 Replenished the petty cash fund by writing a check for $98.00. On this date, the fund

consisted of $2.00 in cash and the following petty cash receipts: freight-out $40.20, entertainment expense $21.00, postage expense $14.00, and miscellaneous expense $19.80.

16 Increased the amount of the petty cash fund to $150 by writing a check for $50.

31 Replenished petty cash fund by writing a check for $137.00. On this date, the fund consisted of $13 in cash and the following petty cash receipts: freight-out $74.00, entertainment expense $43.20, and postage expense $17.70.

Instructions

(a) Journalize the petty cash transactions.

(b) Post to the Petty Cash account.

(c) What internal control features exist in a petty cash fund?

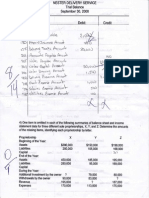

CASH

May 31

Explanation

Ref.

NO. 101

Debit

Credit

Balance

Balance

13,287

The bank statement from Flint State Bank on that date showed the following balance.

FLINT STATE BANK

Checks and Debits

Deposits and Credits

XXX

XXX

(SO 5)

(a) July 15 Cash over $1.80

(b) Aug. 31 balance $150

P8-3C Wolverine Genetics Company of Flint, Michigan, spreads herbicides and applies liquid

fertilizer for local farmers. On May 31, 2008, the companys cash account per its general ledger

showed the following balance.

Date

Journalize and post petty cash

fund transactions.

Daily Balance

5/31

13,332

A comparison of the details on the bank statement with the details in the cash account revealed

the following facts.

1. The statement included a debit memo of $35 for the printing of additional company checks.

2. Cash sales of $1,720 on May 12 were deposited in the bank. The cash receipts journal entry

and the deposit slip were incorrectly made for $1,820. The bank credited Wolverine Genetics

Company for the correct amount.

Prepare a bank reconciliation

and adjusting entries.

(SO 7)

2255T_c08_063-071.qxd 1/17/07 1:25 PM Page 68 Team B TeamB_04:Desktop Folder:17/01/07:WEYGOND WEB:

68

Chapter 8 Internal Control and Cash

3. Outstanding checks at May 31 totaled $1,225, and deposits in transit were $2,100.

4. On May 18, the company issued check no. 1181 for $911 to G. Fischer, on account. The check,

which cleared the bank in May, was incorrectly journalized and posted by Wolverine Genetics

Company for $119.

5. A $4,000 note receivable was collected by the bank for Wolverine Genetics Company on May

31 plus $80 interest. The bank charged a collection fee of $25. No interest has been accrued on

the note.

6. Included with the cancelled checks was a check issued by Carr Company to Henry Ford for

$900 that was incorrectly charged to Wolverine Genetics Company by the bank.

7. On May 31, the bank statement showed an NSF charge of $1,308 for a check issued by Bo

Sclembech, a customer, to Wolverine Genetics Company on account.

(a) Adj. cash bal. $15,107

Instructions

(a) Prepare the bank reconciliation at May 31, 2008.

(b) Prepare the necessary adjusting entries for Wolverine Genetics Company at May 31, 2008.

Prepare a bank reconciliation

and adjusting entries from detailed data.

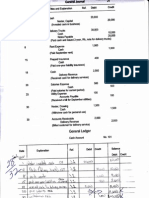

P8-4C The bank portion of the bank reconciliation for Chapin Company at October 31, 2008,

was as follows.

(SO 7)

CHAPIN COMPANY

Bank Reconciliation

October 31, 2008

Cash balance per bank

Add: Deposits in transit

$6,000

842

6,842

Less: Outstanding checks

Check Number

Check Amount

2451

2470

2471

2472

2474

$700

396

464

270

578

2,408

Adjusted cash balance per bank

$4,434

The adjusted cash balance per bank agreed with the cash balance per books at October 31.

The November bank statement showed the following checks and deposits:

Bank Statement

Checks

Date

Number

11-1

11-2

11-5

11-4

11-8

11-10

11-15

11-18

11-27

11-30

11-29

2470

2471

2474

2475

2476

2477

2479

2480

2481

2483

2486

Total

Deposits

Amount

Date

Amount

$ 396

464

578

903

1,556

330

980

714

382

317

495

11-1

11-4

11-8

11-13

11-18

11-21

11-25

11-28

11-30

$ 842

666

545

1,416

810

1,624

1,412

908

652

Total

$8,875

$7,115

The cash records per books for November showed the following.

2255T_c08_063-071.qxd 1/17/07 1:25 PM Page 69 Team B TeamB_04:Desktop Folder:17/01/07:WEYGOND WEB:

Problems: Set C

Cash Receipts

Journal

Cash Payments Journal

Date

Number

11-1

11-2

11-2

11-4

11-8

11-10

11-15

11-18

2475

2476

2477

2478

2479

2480

2481

2482

69

Amount

Date

Number

$ 903

1,556

330

300

890

714

382

350

11-20

11-22

11-23

11-24

11-29

11-30

2483

2484

2485

2486

2487

2488

Total

Amount

Date

Amount

$ 317

460

525

495

210

635

11-3

11-7

11-12

11-17

11-20

11-24

11-27

11-29

11-30

$ 666

545

1,416

810

1,642

1,412

908

652

1,541

Total

$9,592

$8,067

The bank statement contained two bank memoranda:

1. A credit of $1,375 for the collection of a $1,300 note for Chapin Company plus interest of

$91 and less a collection fee of $16. Chapin Company has not accrued any interest on the note.

2. A debit for the printing of additional company checks $34.

At November 30, the cash balance per books was $5,958, and the cash balance per the bank statement was $9,100. The bank did not make any errors, but two errors were made by Chapin

Company.

Instructions

(a) Using the four steps in the reconciliation procedure described on page 357, prepare a bank

reconciliation at November 30.

(b) Prepare the adjusting entries based on the reconciliation. (Hint: The correction of any errors

pertaining to recording checks should be made to Accounts Payable. The correction of any

errors relating to recording cash receipts should be made to Accounts Receivable).

P8-5C Bummer Companys bank statement from Fifth National Bank at August 31, 2008,

shows the following information.

Balance, August 1

August deposits

Checks cleared in August

Balance, August 31

$11,284

47,521

46,475

16,856

Bank credit memoranda:

Collection of note

receivable plus $105

interest

Interest earned

Bank debit memorandum:

Safety deposit box rent

(a) Adjusted cash balance per

bank $7,191

Prepare a bank reconciliation

and adjusting entries.

(SO 7)

$4,505

41

20

A summary of the Cash account in the ledger for August shows: Balance,August 1, $10,959; receipts

$50,050; disbursements $47,794; and balance, August 31, $13,215. Analysis reveals that the only reconciling items on the July 31 bank reconciliation were a deposit in transit for $2,600 and outstanding

checks of $2,925. The deposit in transit was the first deposit recorded by the bank in August. In addition, you determine that there were two errors involving company checks drawn in August: (1) A

check for $340 to a creditor on account that cleared the bank in August was journalized and posted

for $430. (2) A salary check to an employee for $275 was recorded by the bank for $277.

Instructions

(a) Prepare a bank reconciliation at August 31.

(b) Journalize the adjusting entries to be made by Bummer Company at August 31. Assume that

interest on the note has not been accrued by the company.

P8-6C Gazarra Company is a very profitable small business. It has not, however, given much

consideration to internal control. For example, in an attempt to keep clerical and office expenses

to a minimum, the company has combined the jobs of cashier and bookkeeper. As a result,

Johnny Stacatto handles all cash receipts, keeps the accounting records, and prepares the

monthly bank reconciliations.

The balance per the bank statement on October 31, 2008, was $15,453. Outstanding checks

were: no. 62 for $107.74, no. 183 for $127.50, no. 284 for $215.26, no. 862 for $162.10, no. 863 for

(a) Adjusted balance per

books $17,831

Prepare comprehensive bank

reconciliation with theft and

internal control deficiencies.

(SO 2, 3, 4, 7)

2255T_c08_063-071.qxd 1/17/07 1:25 PM Page 70 Team B TeamB_04:Desktop Folder:17/01/07:WEYGOND WEB:

70

Chapter 8 Internal Control and Cash

$192.78, and no. 864 for $140.49. Included with the statement was a credit memorandum of $340

indicating the collection of a note receivable for Gazarra Company by the bank on October 25.

This memorandum has not been recorded by Gazarra Company.

The companys ledger showed one cash account with a balance of $18,608.81. The balance

included undeposited cash on hand. Because of the lack of internal controls, Stacatto took for

personal use all of the undeposited receipts in excess of $3,226.18. He then prepared the following bank reconciliation in an effort to conceal his theft of cash.

BANK RECONCILIATION

Cash balance per books, October 31

Add: Outstanding checks

No. 862

No. 863

No. 864

$162.10

192.78

140.49

410.31

Less: Undeposited receipts

19,019.18

3,226.18

Unadjusted balance per bank, October 31

Less: Bank credit memorandum

15,793.00

340.00

Cash balance per bank statement, October 31

(a) Adjusted balance per

books $17,733.31

$18,608.81

$15,453.00

Instructions

(a) Prepare a correct bank reconciliation. (Hint: Deduct the amount of the theft from the adjusted balance per books.)

(b) Indicate the three ways that Stacatto attempted to conceal the theft and the dollar amount

pertaining to each method.

(c) What principles of internal control were violated in this case?

CONTINUING COOKIE CHRONICLE

(Note: This is a continuation of the Cookie Chronicle from Chapters 1 through 6.)

CCC8 Part 1 Natalie is struggling to keep up with the recording of her accounting transactions. She is spending a lot of time marketing and selling mixers and giving her cookie classes.

Her friend John is an accounting student who runs his own accounting service. He has asked

Natalie if she would like to have him do her accounting.

John and Natalie meet and discuss her business. John suggests that he do the following

for Natalie.

1. Hold cash until there is enough to be deposited. (He would keep the cash locked up in his vehicle). He would also take all of the deposits to the bank at least twice a month.

2. Write and sign all of the checks.

3. Record all of the deposits in the accounting records.

4. Record all of the checks in the accounting records.

5. Prepare the monthly bank reconciliation.

6. Transfer all of Natalies manual accounting records to his computer accounting program. John

maintains all of the accounting information that he keeps for his clients on his laptop computer.

7. Prepare monthly financial statements for Natalie to review.

8. Write himself a check every month for the work he has done for Natalie.

Instructions

Identify the weaknesses in internal control that you see in the system John is recommending.

Can you suggest any improvements if Natalie hires John to do the accounting?

Part 2 Natalie decides that she cannot afford to hire John to do her accounting. One way that

she can ensure that her cash account does not have any errors and is accurate and up-to-date is

to prepare a bank reconciliation at the end of each month.

Natalie would like you to help her. She asks you to prepare a bank reconciliation for June

2008 using the following information.

2255T_c08_063-071.qxd 1/17/07 1:25 PM Page 71 Team B TeamB_04:Desktop Folder:17/01/07:WEYGOND WEB:

Continuing Cookie Chronicle

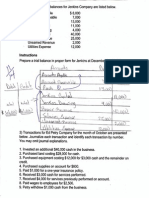

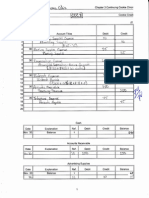

GENERAL LEDGERCOOKIE CREATIONS

Cash

Date

Explanation

2008

June 1

1

3

3

8

9

13

20

28

28

Ref.

Debit

Credit

Balance

750

Check #600

Check #601

Check #602

625

95

56

Check #603

425

Check #604

247

1,050

155

110

Balance

2,657

3,407

2,782

2,687

2,631

3,681

3,256

3,411

3,164

3,274

PREMIER BANK

Statement of AccountCookie Creations

June 30, 2008

Date

Explanation

May 31

June 1

6

6

8

9

10

10

14

20

23

28

30

Balance

Deposit

Check #600

Check #601

Check #602

Deposit

NSF check

NSFfee

Check #603

Deposit

EFTTelus

Check #599

Bank charges

Checks and

Other Debits

Deposits

750

625

95

56

1,050

100

35

452

125

85

361

13

Balance

3,256

4,066

3,381

3,286

3,230

4,280

4,145

3,693

3,818

3,733

3,372

3,359

Additional information:

1. On May 31, there were two outstanding checks: #595 for $238 and #599 for $361.

2. Premier Bank made a posting error to the bank statement: check #603 was issued for $425, not

$452.

3. The deposit made on June 20 was for $125 that Natalie received for teaching a class. Natalie

made an error in recording this transaction.

4. The electronic funds transfer (EFT) was for Natalies cellphone use. Remember that she uses

this phone only for business.

5. The NSF check was from Ron Black. Natalie received this check for teaching a class to Rons

children. Natalie contacted Ron, and he assured her that she will receive a check in the mail

for the outstanding amount of the invoice and the NSF bank charge.

Instructions

(a) Prepare Cookie Creations bank reconciliation for June 30.

(b) Prepare any necessary adjusting entries at June 30.

(c) If a balance sheet is prepared for Cookie Creations at June 30, what balance will be reported

as cash in the current assets section?

71

You might also like

- ACC101 Chapter6newxcxDocument18 pagesACC101 Chapter6newxcxAhmed RawyNo ratings yet

- 2100 Solutions - CH7Document59 pages2100 Solutions - CH7Rantih RahmadaniNo ratings yet

- CH 08Document4 pagesCH 08vivienNo ratings yet

- Accounting For Business (15 Credits)Document3 pagesAccounting For Business (15 Credits)cuongaccNo ratings yet

- 5f388b962f84e - BANK RECONCILIATION STATEMENT PDFDocument4 pages5f388b962f84e - BANK RECONCILIATION STATEMENT PDFYogesh ChaulagaiNo ratings yet

- Bank Reconciliation StatementDocument3 pagesBank Reconciliation StatementzB13No ratings yet

- Accounts - Bank Reconciliation StatementDocument18 pagesAccounts - Bank Reconciliation StatementAnuj KutalNo ratings yet

- 293 Financial Accounting - COURSE OUTLINEDocument7 pages293 Financial Accounting - COURSE OUTLINEsilenteyesNo ratings yet

- Rancho Foods Deposits All Cash Receipts Each Wednesday and FridayDocument1 pageRancho Foods Deposits All Cash Receipts Each Wednesday and FridayAmit PandeyNo ratings yet

- MB0025 Financial Management AccountingDocument10 pagesMB0025 Financial Management AccountingTaran Deep SinghNo ratings yet

- ACCY 201 Exam 2 Study GuideDocument42 pagesACCY 201 Exam 2 Study GuideKelly WilliamsNo ratings yet

- Bank Reconciliation AprilDocument3 pagesBank Reconciliation AprilAnonymous FAlrXF100% (1)

- Peak Performance Instruction SheetDocument2 pagesPeak Performance Instruction SheetnamnblobNo ratings yet

- Mathematics III MAY2003 or 220556Document2 pagesMathematics III MAY2003 or 220556Nizam Institute of Engineering and Technology LibraryNo ratings yet

- Principle of EngineeringDocument206 pagesPrinciple of EngineeringbmhshNo ratings yet

- Business English SamplesDocument13 pagesBusiness English SamplesMarina PeshovskaNo ratings yet

- ACTBAS 2 - Lecture 7 Internal Control and Cash, Bank ReconciliationDocument5 pagesACTBAS 2 - Lecture 7 Internal Control and Cash, Bank ReconciliationJason Robert MendozaNo ratings yet

- Nov07 Mathematics IIIDocument8 pagesNov07 Mathematics IIIandhracollegesNo ratings yet

- Cse Iv Engineering Mathematics Iv 10mat41 Notes PDFDocument132 pagesCse Iv Engineering Mathematics Iv 10mat41 Notes PDFSNEHANo ratings yet

- Bank Recon - QUESTIONSDocument3 pagesBank Recon - QUESTIONSgkem1014No ratings yet

- Chapter 6 MC Employee Fraud and The Audit of CashDocument7 pagesChapter 6 MC Employee Fraud and The Audit of CashJames HNo ratings yet

- 4 - 1 and 4 - 2Document1 page4 - 1 and 4 - 2Ankita T. Moore100% (1)

- The Accounting Process (The Accounting Cycle) : 2. Prepare The Transaction'sDocument3 pagesThe Accounting Process (The Accounting Cycle) : 2. Prepare The Transaction'sGanesh ZopeNo ratings yet

- Engineering MathematicsDocument1 pageEngineering MathematicsTommyVercettiNo ratings yet

- Mechanics of Fluids r05220302Document8 pagesMechanics of Fluids r05220302Nizam Institute of Engineering and Technology LibraryNo ratings yet

- 3 Semeste R Mathematics 111 L-T-P 3-0-0 3 Credits: Reference BookDocument1 page3 Semeste R Mathematics 111 L-T-P 3-0-0 3 Credits: Reference Bookrajakishore mohapatraNo ratings yet

- Engineering Mathematics Topic 5Document2 pagesEngineering Mathematics Topic 5cyclopsoctopusNo ratings yet

- Financial Accounting: A: How To Study AccountingDocument29 pagesFinancial Accounting: A: How To Study Accountingrishi_positive1195No ratings yet

- EngineeringMathematics II (SP) PDFDocument1 pageEngineeringMathematics II (SP) PDFrahul m nairNo ratings yet

- Anna University Question Papers Engineering Mathematics 1Document22 pagesAnna University Question Papers Engineering Mathematics 1Clement JosephNo ratings yet

- Chapter 08Document46 pagesChapter 08Ivo_NichtNo ratings yet

- Engineering Mathematics Iv Question Bank PDFDocument8 pagesEngineering Mathematics Iv Question Bank PDFJinuRoyNo ratings yet

- Engineering Mathematics Statistics Finance ProposalDocument8 pagesEngineering Mathematics Statistics Finance ProposalXiaokang WangNo ratings yet

- Data InterpretationDocument3 pagesData InterpretationNavdeep AhlawatNo ratings yet

- Chapter 2b Bank ReconciliationDocument17 pagesChapter 2b Bank ReconciliationFreziel Jade NatividadNo ratings yet

- ACC 211 - Review 2 (Chapters 5, 6, & 7) SolutionDocument5 pagesACC 211 - Review 2 (Chapters 5, 6, & 7) SolutionBrennan Patrick WynnNo ratings yet

- Tutorial 6Document3 pagesTutorial 6Wan LinNo ratings yet

- Midterm Bi ADocument13 pagesMidterm Bi AFabiana BarbeiroNo ratings yet

- CPT Bank Reconciliation StatementDocument7 pagesCPT Bank Reconciliation StatementIqra Mughal60% (5)

- The Bigger Wave of Hallyu in Indonesia - GlocalizationDocument12 pagesThe Bigger Wave of Hallyu in Indonesia - GlocalizationGlobal Research and Development ServicesNo ratings yet

- Chapter 1 ExerciseDocument11 pagesChapter 1 ExerciseUsama MukhtarNo ratings yet

- ACCT 2001 Exam 2 Review ProblemsDocument11 pagesACCT 2001 Exam 2 Review Problemsdpa7020No ratings yet

- Civil I Engineering Mathematics I (15mat11) AssignmentDocument13 pagesCivil I Engineering Mathematics I (15mat11) AssignmentDAVIDNo ratings yet

- Computerized AccountingDocument14 pagesComputerized Accountinglayyah2013No ratings yet

- Catholic Bible: Midterm Performance Task "Catholic and Protestant Bible: Advantages and Disadvantages"Document3 pagesCatholic Bible: Midterm Performance Task "Catholic and Protestant Bible: Advantages and Disadvantages"kaitNo ratings yet

- 401 Engineering Mathematics IIIDocument10 pages401 Engineering Mathematics IIISreejith VenugopalNo ratings yet

- Bank Reconciliation Statement - Process - Format - ExampleDocument5 pagesBank Reconciliation Statement - Process - Format - ExampleCykee100% (1)

- MAS Upgrade 4.50 Information PackageDocument98 pagesMAS Upgrade 4.50 Information PackageWayne SchulzNo ratings yet

- Flujo de Pulpa en Molinos-ParrillasDocument24 pagesFlujo de Pulpa en Molinos-ParrillasJavier OyarceNo ratings yet

- ch01 ProblemsDocument7 pagesch01 Problemsapi-274120622No ratings yet

- Question On Bank ReconciliationDocument2 pagesQuestion On Bank ReconciliationNor AmalinaNo ratings yet

- Cyber CrimeDocument2 pagesCyber CrimeDondi de MesaNo ratings yet

- Background Information2Document6 pagesBackground Information2Karen Laccay50% (2)

- Pismo Maria Draghija Zvonku FišerjuDocument2 pagesPismo Maria Draghija Zvonku FišerjuFinanceNo ratings yet

- Chapter 2 - Accounting PrinciplesDocument36 pagesChapter 2 - Accounting PrinciplesIbni Amin100% (2)

- 10 Bank Reconciliation Statement-1Document9 pages10 Bank Reconciliation Statement-1Abdul SamadNo ratings yet

- 2017.EngineeringMathematics - Differentialequations 2Document16 pages2017.EngineeringMathematics - Differentialequations 2Tanvir HasanNo ratings yet

- ch08 PDFDocument4 pagesch08 PDFRabie HarounNo ratings yet

- IFRS Edition (2nd) : Fraud, Internal Control, and CashDocument54 pagesIFRS Edition (2nd) : Fraud, Internal Control, and CashLilis100% (2)

- Accounting Assignment 05A 207Document11 pagesAccounting Assignment 05A 207Aniyah's RanticsNo ratings yet

- Examen 1 6Document1 pageExamen 1 6api-281193111No ratings yet

- Taller Ocho Acco 111Document29 pagesTaller Ocho Acco 111api-274120622No ratings yet

- Taller Seis Acco 111Document44 pagesTaller Seis Acco 111api-274120622No ratings yet

- CH 05Document9 pagesCH 05api-274120622No ratings yet

- Examen 1 7Document1 pageExamen 1 7api-281193111No ratings yet

- Taller Cinco Acco 111Document41 pagesTaller Cinco Acco 111api-274120622No ratings yet

- ccc3 2Document1 pageccc3 2api-281193111No ratings yet

- Examen1 2Document1 pageExamen1 2api-281193111No ratings yet

- Examen 1 5Document1 pageExamen 1 5api-281193111No ratings yet

- CH 04Document10 pagesCH 04api-274120622No ratings yet

- The Ethics of EarningsDocument26 pagesThe Ethics of Earningsapi-281193111No ratings yet

- p2'2c CDocument1 pagep2'2c Capi-281193111No ratings yet

- Examen 1 4Document1 pageExamen 1 4api-281193111No ratings yet

- ccc3 5Document1 pageccc3 5api-281193111No ratings yet

- Chronicle: Cookie OontinDocument1 pageChronicle: Cookie Oontinapi-281193111No ratings yet

- ccc3 4Document1 pageccc3 4api-281193111No ratings yet

- p3'1c DDocument1 pagep3'1c Dapi-281193111No ratings yet

- p3'1c CDocument1 pagep3'1c Capi-281193111No ratings yet

- Cookie 2 4Document1 pageCookie 2 4api-281193111No ratings yet

- p2'2c BDocument1 pagep2'2c Bapi-281193111No ratings yet

- Cookie 2 3Document1 pageCookie 2 3api-281193111No ratings yet

- ccc3 1Document1 pageccc3 1api-281193111No ratings yet

- P2'2a 3Document1 pageP2'2a 3api-281193111No ratings yet

- P2'2a 4Document1 pageP2'2a 4api-281193111No ratings yet

- ch01 ProblemsDocument7 pagesch01 Problemsapi-274120622No ratings yet

- Test Dashy 2Document1 pageTest Dashy 2api-281193111No ratings yet

- Ch02 AccountingDocument7 pagesCh02 AccountingThirdyOjela0% (1)

- AlHuda CIBE - Corporate Bonds With Sukuk by Naim FarooquiDocument11 pagesAlHuda CIBE - Corporate Bonds With Sukuk by Naim FarooquiAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Economcssem 1Document5 pagesEconomcssem 1Kamran JaveedNo ratings yet

- Standard Liner and General Agency Agreement: The Federation of National Associations of Ship Brokers and AgentsDocument5 pagesStandard Liner and General Agency Agreement: The Federation of National Associations of Ship Brokers and AgentsKannan C ChandranNo ratings yet

- PNB V CA, GR No. L-60208, Dec. 5, 1985Document3 pagesPNB V CA, GR No. L-60208, Dec. 5, 1985Nikko AzordepNo ratings yet

- OG-1 4 Batch Test Questions:: IdiomsDocument12 pagesOG-1 4 Batch Test Questions:: IdiomsHaseeb AhmedNo ratings yet

- Islamic Banking Operations-2019Document20 pagesIslamic Banking Operations-2019Sharifah Faizah As SeggafNo ratings yet

- Purchased Goods - Cheque DishonourDocument2 pagesPurchased Goods - Cheque DishonourNagarjunNo ratings yet

- 28 Usc 3002 Federal Debt Collection DefinitionsDocument10 pages28 Usc 3002 Federal Debt Collection Definitionsruralkiller100% (1)

- IDRBT Conference DeckDocument12 pagesIDRBT Conference DeckAbhinav GargNo ratings yet

- 1342018013071212Document16 pages1342018013071212CoolerAdsNo ratings yet

- ATS TriumphDocument4 pagesATS TriumphsandeeprazzNo ratings yet

- Wulf & Mintz (1957) Haciendas and Plantations in Middle America and The AntillesDocument34 pagesWulf & Mintz (1957) Haciendas and Plantations in Middle America and The AntillesMiguel MorillasNo ratings yet

- Capital MarketsDocument40 pagesCapital MarketsItronix MohaliNo ratings yet

- U BL Financial Statements Ann DecDocument122 pagesU BL Financial Statements Ann DecRehan NasirNo ratings yet

- Bachrach V LaProtectoraDocument3 pagesBachrach V LaProtectoraDino Roel De GuzmanNo ratings yet

- Future Vector Care-Proposal Form (Single Member)Document2 pagesFuture Vector Care-Proposal Form (Single Member)Arup GhoshNo ratings yet

- Hallmark ImportantDocument3 pagesHallmark ImportantSourav GhoshNo ratings yet

- Boundless Lecture Slides: Available On The Boundless Teaching PlatformDocument54 pagesBoundless Lecture Slides: Available On The Boundless Teaching PlatformAugustNo ratings yet

- Working Capital Management of INDIAN OVERSEAS bANK. Completed by Sarath NairdocDocument66 pagesWorking Capital Management of INDIAN OVERSEAS bANK. Completed by Sarath Nairdocsarathspark100% (5)

- Insurance Fin InclusionDocument17 pagesInsurance Fin InclusionbhavyaNo ratings yet

- Closed End Fund CompanyDocument33 pagesClosed End Fund CompanyIvy LiewNo ratings yet

- Assignment 1 - Individual Assignment Fin430Document7 pagesAssignment 1 - Individual Assignment Fin430NURMISHA AQMA SOFIA SELAMATNo ratings yet

- MCDONALD'S PHILIPPINES REALTY CORPORATION (MPRC) vs. CIRDocument2 pagesMCDONALD'S PHILIPPINES REALTY CORPORATION (MPRC) vs. CIRMhaliNo ratings yet

- Plaridel Surety Insurance Co. V.Document5 pagesPlaridel Surety Insurance Co. V.EdwardArribaNo ratings yet

- Banking The Customer Experience Dividend PDFDocument32 pagesBanking The Customer Experience Dividend PDFAlex DincoviciNo ratings yet

- The Euromarkets1Document22 pagesThe Euromarkets1Shruti AshokNo ratings yet

- 23 MergersDocument44 pages23 MergerssiaapaNo ratings yet

- TAX OutlineDocument42 pagesTAX Outlineabmo33No ratings yet

- 1st InternalDocument20 pages1st InternalAmrit TejaniNo ratings yet

- Bank Notes SecretsDocument99 pagesBank Notes Secretssavedsoul2266448100% (12)