Professional Documents

Culture Documents

Technical Analysis 27 January 2010 EUR: Comment: Strategy: Chart Levels

Uploaded by

Miir ViirOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Technical Analysis 27 January 2010 EUR: Comment: Strategy: Chart Levels

Uploaded by

Miir ViirCopyright:

Available Formats

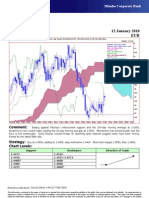

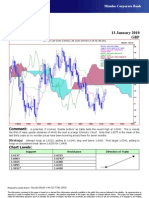

Mizuho Corporate Bank

Technical Analysis 27 January 2010

EUR

EUR=EBS, Last Quote [Candle] EUR=, Bid [Ichimoku 9, 26, 52, 26] Daily

14Oct09 - 05Mar10

Pr

EUR=EBS , Last Quote, Candle

1.51

27Jan10 1.4072 1.4096 1.4054 1.4061

EUR= , Bid, Tenkan Sen 9 1.505

27Jan10 1.4268

EUR= , Bid, Kijun Sen 26 1.5

27Jan10 1.4304

EUR= , Bid, Senkou Span(a) 52 1.495

03Mar10 1.4286

EUR= , Bid, Senkou Span(b) 52 1.49

03Mar10 1.4585

EUR= , Bid, Chikou Span 26 1.485

23Dec09 1.4060

1.48

1.475

1.47

1.465

1.46

1.455

1.45

1.445

1.44

1.435

1.43

38.2

1.425

1.42

1.415

1.41

1.405

50.0

1.4

20Oct09 27Oct 03Nov 10Nov 17Nov 24Nov 01Dec 08Dec 15Dec 22Dec 29Dec 05Jan 12Jan 19Jan 26Jan 02Feb 09Feb 16Feb 23Feb 02Mar

Comment: Stuck, for the time being, in a surprisingly small range just above the 50% Fibonacci retracement

from April 2009’s low (not October 2008’s low). Over the next few weeks we feel the Euro should stabilise and form

a new interim low but this could be a slow, nerve-wracking process with a series of cautious downside probes.

Strategy: Possibly attempt very small longs at 1.4060; stop below 1.4000. Short term target 1.4180 but be

ready to re-buy on a sustained break above 1.4225 for 1.4400.

Chart Levels:

Support Resistance Direction of Trade

1.4050 1.4100

1.4042 1.4182/1.4195*

1.4029* 1.4220

1.4000** 1.4311

1.3900 1.4415

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 14 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 14 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- Technical Analysis 19 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 19 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Eur-Usd-04 January 2010 DailyDocument1 pageEur-Usd-04 January 2010 DailyMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Gbp-Usd-05 January 2010 DailyDocument1 pageGbp-Usd-05 January 2010 DailyMiir ViirNo ratings yet

- GBP Usd 01 19 2010Document1 pageGBP Usd 01 19 2010Miir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- AUG-05 Mizuho Technical Analysis EUR USDDocument1 pageAUG-05 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Esquema Prueba Viga Vpt-1aDocument1 pageEsquema Prueba Viga Vpt-1aVictor HerreraNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- BM 09 - Jalan Revolusi Kiri - Long & Cross (Iik)Document7 pagesBM 09 - Jalan Revolusi Kiri - Long & Cross (Iik)Rizky Wahyu SyaputraNo ratings yet

- Bucatarie Living+ Loc de Luat Masa Dormitor: P P P PDocument1 pageBucatarie Living+ Loc de Luat Masa Dormitor: P P P PRoxana CiobanuNo ratings yet

- MyFXForecastsforTHURSDAY July29thDocument2 pagesMyFXForecastsforTHURSDAY July29thapi-26441337No ratings yet

- Ars-Pak Maruap SilabanDocument1 pageArs-Pak Maruap SilabanMochamad Ridwan AfandiNo ratings yet

- Pak Maruap RevisiDocument1 pagePak Maruap RevisiMochamad Ridwan AfandiNo ratings yet

- MyFXForecastsforMONDAY August2ndDocument2 pagesMyFXForecastsforMONDAY August2ndapi-26441337No ratings yet

- Area-250 SQ.M Kitchen Area - 510 SQ.M Restaurant: SLOPE - 1:10Document1 pageArea-250 SQ.M Kitchen Area - 510 SQ.M Restaurant: SLOPE - 1:10mathivananNo ratings yet

- TV Glorietta DysonDocument1 pageTV Glorietta DysonJean Lindley JosonNo ratings yet

- Technical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- ANEXA NR. 1.37 La Regulament Plan Etaj Releveu Imobil: RecapitulatieDocument1 pageANEXA NR. 1.37 La Regulament Plan Etaj Releveu Imobil: RecapitulatieSandu Denis-SorinNo ratings yet

- Credit Cards Table of Fees & Charges and Sample Finance Charge ComputationDocument1 pageCredit Cards Table of Fees & Charges and Sample Finance Charge ComputationApril IsidroNo ratings yet

- My Latest FXForecastsfor JULY5Document2 pagesMy Latest FXForecastsfor JULY5api-26441337No ratings yet

- One Page The New Eco-Friendly and Layered Decentralized EconomyDocument1 pageOne Page The New Eco-Friendly and Layered Decentralized EconomyNandar SuhendarNo ratings yet

- MyFXForecastsforTHURSDAY August12thDocument2 pagesMyFXForecastsforTHURSDAY August12thapi-26441337No ratings yet

- Ars - L1 & l2 Pak Maruap Silaban Rev.2-Rev BaruDocument1 pageArs - L1 & l2 Pak Maruap Silaban Rev.2-Rev BaruMochamad Ridwan AfandiNo ratings yet

- MyFXForecastsforWEDNESDAY August18thDocument2 pagesMyFXForecastsforWEDNESDAY August18thapi-26441337No ratings yet

- Thesun 2009-08-05 Page15 Global Automakers Beat Forecasts Remain CautiousDocument1 pageThesun 2009-08-05 Page15 Global Automakers Beat Forecasts Remain CautiousImpulsive collectorNo ratings yet

- ATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewDocument1 pageATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewKAR WEI LEENo ratings yet

- ATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewDocument1 pageATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewKAR WEI LEENo ratings yet

- 3 2 PDFDocument1 page3 2 PDFghafaisilyasNo ratings yet

- BotellaDocument1 pageBotellaJES JNo ratings yet

- Elevacion Frontal Elevacion Trasera: Gspublisherversion 0.50.100.100Document1 pageElevacion Frontal Elevacion Trasera: Gspublisherversion 0.50.100.100nickarq37No ratings yet

- Work Estima TE: Date: Estimate #Document2 pagesWork Estima TE: Date: Estimate #lara myzaraNo ratings yet

- Measuring Building Sections Floor PlansDocument1 pageMeasuring Building Sections Floor PlanselzaNo ratings yet

- 01 PlanDocument1 page01 Plan22 B prerna KshirsagarNo ratings yet

- Ars - L1 & l2 Pak Maruap Silaban Rev.2-ModelDocument1 pageArs - L1 & l2 Pak Maruap Silaban Rev.2-ModelMohammad AndiNo ratings yet

- Balcon B equipment layout and dimensionsDocument1 pageBalcon B equipment layout and dimensionsOana RusuNo ratings yet

- Presentation Schedule2010BWFLYER FinalDocument1 pagePresentation Schedule2010BWFLYER FinalRamon Salsas EscatNo ratings yet

- MyFXForecastsforMONDAY August23rdDocument2 pagesMyFXForecastsforMONDAY August23rdapi-26441337No ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR USDDocument1 pageAUG-10 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirNo ratings yet

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirNo ratings yet

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocument1 pageAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirNo ratings yet

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirNo ratings yet

- Data Structures LightHall ClassDocument43 pagesData Structures LightHall ClassIwuchukwu ChiomaNo ratings yet

- M Audio bx10s Manuel Utilisateur en 27417Document8 pagesM Audio bx10s Manuel Utilisateur en 27417TokioNo ratings yet

- RPH Sains DLP Y3 2018Document29 pagesRPH Sains DLP Y3 2018Sukhveer Kaur0% (1)

- AE3212 I 2 Static Stab 1 AcDocument23 pagesAE3212 I 2 Static Stab 1 AcRadj90No ratings yet

- NYU Stern Evaluation NewsletterDocument25 pagesNYU Stern Evaluation NewsletterCanadianValueNo ratings yet

- Documentation Control HandbookDocument9 pagesDocumentation Control Handbookcrainvictor 45No ratings yet

- Eurapipe ABS Pipe - Fittings ManualDocument52 pagesEurapipe ABS Pipe - Fittings ManualLê Minh ĐứcNo ratings yet

- Blink CodesDocument3 pagesBlink CodesNightin VargheseNo ratings yet

- Ballari City Corporation: Government of KarnatakaDocument37 pagesBallari City Corporation: Government of KarnatakaManish HbNo ratings yet

- Neuroimaging - Methods PDFDocument372 pagesNeuroimaging - Methods PDFliliana lilianaNo ratings yet

- Wall Street Expose: Monkey Business Reveals Investment Banking RealitiesDocument2 pagesWall Street Expose: Monkey Business Reveals Investment Banking Realitiestorquewip100% (1)

- Fisiologia de KatzDocument663 pagesFisiologia de KatzOscar Gascon100% (1)

- Ground Floor 40X80 Option-1Document1 pageGround Floor 40X80 Option-1Ashish SrivastavaNo ratings yet

- FloridaSharkman ProtocolsDocument14 pagesFloridaSharkman ProtocolsgurwaziNo ratings yet

- PQ of Vial Washer Ensures Removal of ContaminantsDocument25 pagesPQ of Vial Washer Ensures Removal of ContaminantsJuan DanielNo ratings yet

- Primary Checkpoint - Science (0846) October 2016 Paper 2 MSDocument12 pagesPrimary Checkpoint - Science (0846) October 2016 Paper 2 MSdinakarc78% (9)

- Approach by Health Professionals To The Side Effects of Antihypertensive Therapy: Strategies For Improvement of AdherenceDocument10 pagesApproach by Health Professionals To The Side Effects of Antihypertensive Therapy: Strategies For Improvement of AdherenceSabrina JonesNo ratings yet

- Construction Internship ReportDocument8 pagesConstruction Internship ReportDreaminnNo ratings yet

- Texas LS Notes 19-20Document2 pagesTexas LS Notes 19-20Jesus del CampoNo ratings yet

- Dxgbvi Abdor Rahim OsmanmrDocument1 pageDxgbvi Abdor Rahim OsmanmrSakhipur TravelsNo ratings yet

- First Aid Emergency Action PrinciplesDocument7 pagesFirst Aid Emergency Action PrinciplesJosellLim67% (3)

- 2016-08-03 Iot Global Forecast Analysis 2015-2025Document65 pages2016-08-03 Iot Global Forecast Analysis 2015-2025Hoang ThanhhNo ratings yet

- The Standard 09.05.2014Document96 pagesThe Standard 09.05.2014Zachary Monroe100% (1)

- Anna University CTDocument3 pagesAnna University CTprayog8No ratings yet

- WFP-Remote Household Food Security Survey Brief-Sri Lanka Aug 2022Document18 pagesWFP-Remote Household Food Security Survey Brief-Sri Lanka Aug 2022Adaderana OnlineNo ratings yet

- Interviews: Personal Interview. Advantages and Disadvantages Business Is Largely A Social PhenomenonDocument8 pagesInterviews: Personal Interview. Advantages and Disadvantages Business Is Largely A Social PhenomenonSanjeev JayaratnaNo ratings yet

- Pneapple Waste To Bioethanol Casabar - Et - Al-2019-Biomass - Conversion - and - BiorefineryDocument6 pagesPneapple Waste To Bioethanol Casabar - Et - Al-2019-Biomass - Conversion - and - Biorefineryflorian willfortNo ratings yet

- CEA-2010 by ManishDocument10 pagesCEA-2010 by ManishShishpal Singh NegiNo ratings yet

- #1Document7 pages#1Ramírez OmarNo ratings yet

- Adjectives Weekly Plan1Document10 pagesAdjectives Weekly Plan1RItta MariaNo ratings yet