Professional Documents

Culture Documents

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright:

Available Formats

Mizuho Corporate Bank

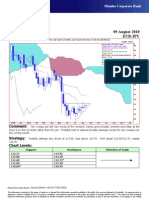

Technical Analysis 28 January 2010

EUR

EUR=EBS, Last Quote [Candle] EUR=, Bid [Ichimoku 9, 26, 52, 26] Daily

09Oct09 - 05Mar10

Pr

EUR=EBS , Last Quote, Candle

28Jan10 1.4025 1.4040 1.3930 1.4016 1.51

EUR= , Bid, Tenkan Sen 9

28Jan10 1.4174

EUR= , Bid, Kijun Sen 26

1.5

28Jan10 1.4259

EUR= , Bid, Senkou Span(a) 52

04Mar10 1.4216

EUR= , Bid, Senkou Span(b) 52 1.49

04Mar10 1.4540

EUR= , Bid, Chikou Span 26

24Dec09 1.4013

1.48

1.47

1.46

1.45

1.44

1.43

1.42

1.41

38.2

1.4

15Oct09 22Oct 29Oct 05Nov 12Nov 19Nov 26Nov 03Dec 10Dec 17Dec 24Dec 31Dec 07Jan 14Jan 21Jan 28Jan 04Feb 11Feb 18Feb 25Feb 04Mar

Comment: Dropping below Fibonacci retracement support and the psychological level at 1.4000, but be

careful because other currencies are not following suit (though of course the US Dollar Index is). Over the next few

weeks we feel the Euro should stabilise and form a new interim low but this could be a slow, nerve-wracking process

with a series of cautious downside probes. There is a chance that we will form a reversal candle (‘hammer’) today.

Watch and wait patiently.

Strategy: Attempt small longs at 1.4015; stop below 1.3930. Short term target 1.4100, then 1.4180.

Chart Levels:

Support Resistance Direction of Trade

1.4023 1.4040

1.3993 1.4088

1.3930* 1.4110

1.3900 1.4180

1.3800* 1.4195*

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 27 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 27 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Eur-Usd-04 January 2010 DailyDocument1 pageEur-Usd-04 January 2010 DailyMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 14 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 14 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- Technical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- Technical Analysis 19 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 19 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- AUG-05 Mizuho Technical Analysis EUR USDDocument1 pageAUG-05 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- GBP Usd 01 19 2010Document1 pageGBP Usd 01 19 2010Miir ViirNo ratings yet

- Gbp-Usd-05 January 2010 DailyDocument1 pageGbp-Usd-05 January 2010 DailyMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Esquema Prueba Viga Vpt-1aDocument1 pageEsquema Prueba Viga Vpt-1aVictor HerreraNo ratings yet

- Gbp-Usd-04 January 2010 DailyDocument1 pageGbp-Usd-04 January 2010 DailyMiir ViirNo ratings yet

- Elevacion Frontal Elevacion Trasera: Gspublisherversion 0.50.100.100Document1 pageElevacion Frontal Elevacion Trasera: Gspublisherversion 0.50.100.100nickarq37No ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Bucatarie Living+ Loc de Luat Masa Dormitor: P P P PDocument1 pageBucatarie Living+ Loc de Luat Masa Dormitor: P P P PRoxana CiobanuNo ratings yet

- MyFXForecastsforTHURSDAY July29thDocument2 pagesMyFXForecastsforTHURSDAY July29thapi-26441337No ratings yet

- AUG-04 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-04 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- Technical Analysis 15 September 2010 JPY: CommentDocument1 pageTechnical Analysis 15 September 2010 JPY: CommentPlan B EconomicsNo ratings yet

- TV Glorietta DysonDocument1 pageTV Glorietta DysonJean Lindley JosonNo ratings yet

- BM 09 - Jalan Revolusi Kiri - Long & Cross (Iik)Document7 pagesBM 09 - Jalan Revolusi Kiri - Long & Cross (Iik)Rizky Wahyu SyaputraNo ratings yet

- MyFXForecastsforMONDAY August2ndDocument2 pagesMyFXForecastsforMONDAY August2ndapi-26441337No ratings yet

- AUG-02 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-02 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- Ars-Pak Maruap SilabanDocument1 pageArs-Pak Maruap SilabanMochamad Ridwan AfandiNo ratings yet

- Pak Maruap RevisiDocument1 pagePak Maruap RevisiMochamad Ridwan AfandiNo ratings yet

- AUDITORIO CASA DE LA CULTURA HUANCAYO-ModelDocument1 pageAUDITORIO CASA DE LA CULTURA HUANCAYO-ModelBrandon RiveraNo ratings yet

- My Latest FXForecastsfor JULY5Document2 pagesMy Latest FXForecastsfor JULY5api-26441337No ratings yet

- My FX Forecasts For MAY 14th: Euro/Us Dollar - Medium Term ViewDocument3 pagesMy FX Forecasts For MAY 14th: Euro/Us Dollar - Medium Term Viewapi-26441337No ratings yet

- My LATESTFXForecastsfor MAY13Document2 pagesMy LATESTFXForecastsfor MAY13api-26441337No ratings yet

- MyFXForecastsforWEDNESDAY August18thDocument2 pagesMyFXForecastsforWEDNESDAY August18thapi-26441337No ratings yet

- Arquitectonico PaDocument1 pageArquitectonico PaPedro MárquezNo ratings yet

- One Page The New Eco-Friendly and Layered Decentralized EconomyDocument1 pageOne Page The New Eco-Friendly and Layered Decentralized EconomyNandar SuhendarNo ratings yet

- Longines TimingDocument6 pagesLongines TimingArturo Moya BustillosNo ratings yet

- Instalatii EtajDocument1 pageInstalatii EtajOana RusuNo ratings yet

- EUR USDUPDATEApril23Document2 pagesEUR USDUPDATEApril23api-26441337No ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- MyFXForecastsforTHURSDAY August12thDocument2 pagesMyFXForecastsforTHURSDAY August12thapi-26441337No ratings yet

- Technical Analysis 05 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 05 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Pak Maruap Silaban Revisi Kamar Mandi Dan Tempat CuciDocument1 pagePak Maruap Silaban Revisi Kamar Mandi Dan Tempat CuciMochamad Ridwan AfandiNo ratings yet

- ANEXA NR. 1.37 La Regulament Plan Etaj Releveu Imobil: RecapitulatieDocument1 pageANEXA NR. 1.37 La Regulament Plan Etaj Releveu Imobil: RecapitulatieSandu Denis-SorinNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- AUG-09 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-09 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR USDDocument1 pageAUG-10 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirNo ratings yet

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirNo ratings yet

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocument1 pageAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

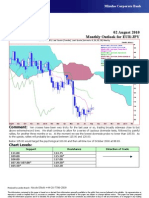

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirNo ratings yet

- The Egyptian Center for Studies of Export & Import ادDocument3 pagesThe Egyptian Center for Studies of Export & Import ادMedhat Saad EldinNo ratings yet

- SCN83 PEN Identity CardDocument3 pagesSCN83 PEN Identity CardJorge CaceresNo ratings yet

- All Countries Flags of CountriesDocument6 pagesAll Countries Flags of CountriesWelkin Sky100% (1)

- Unit 10.3Document15 pagesUnit 10.3Amal IbrahimNo ratings yet

- 2 IJEPA PresentationDocument15 pages2 IJEPA PresentationRaysa Nick ValdoNo ratings yet

- Export-Import Management PDFDocument1 pageExport-Import Management PDFNidhi BahotNo ratings yet

- Advantages of Free TradeDocument8 pagesAdvantages of Free TradeRittika_Kat_Go_5148No ratings yet

- Phiel Daphine Nacionales BSA-BACDocument1 pagePhiel Daphine Nacionales BSA-BACedrianclydeNo ratings yet

- The GATT: Law and International Economic Organization: Kenneth W DamDocument2 pagesThe GATT: Law and International Economic Organization: Kenneth W Damjosf princeNo ratings yet

- Lesson 6 8 INTERNATIONAL BUSINESS AND TRADE - MODULEDocument24 pagesLesson 6 8 INTERNATIONAL BUSINESS AND TRADE - MODULEJomar Quinonez GallardoNo ratings yet

- Perez Valdovinos Karla Vianey M2T1Document27 pagesPerez Valdovinos Karla Vianey M2T1KarlyValdovinosNo ratings yet

- The Political Economy of International Trade: By: Ms. Adina Malik (ALK)Document23 pagesThe Political Economy of International Trade: By: Ms. Adina Malik (ALK)Mr. HaroonNo ratings yet

- ACTIVITY - Sales Listing PDFDocument30 pagesACTIVITY - Sales Listing PDFLyka LagunsinNo ratings yet

- 29 Dec 2022Document1 page29 Dec 2022Greg Carri Li OrtizNo ratings yet

- Nafta PresentationDocument32 pagesNafta Presentationfaisal abdulleNo ratings yet

- Cecm 4455bis 12122015 CF 4221306Document1 pageCecm 4455bis 12122015 CF 4221306Iordache G. IulianNo ratings yet

- Regional Market Characteristics and Preferential Trade AgreementsDocument32 pagesRegional Market Characteristics and Preferential Trade AgreementsÖmer DoganNo ratings yet

- CHP 24Document2 pagesCHP 24Eeva The DivaNo ratings yet

- Currency Exchange Rate and International Trade and Capital FlowsDocument39 pagesCurrency Exchange Rate and International Trade and Capital FlowsudNo ratings yet

- Green Coffee Contract: C F, CifDocument4 pagesGreen Coffee Contract: C F, CifcoffeepathNo ratings yet

- Halimani Notes Exchange RatesDocument3 pagesHalimani Notes Exchange RatesMalvin D GarabhaNo ratings yet

- RULE Profit Maker (KingOfPips) SWINGDocument4 pagesRULE Profit Maker (KingOfPips) SWINGKenzoe ManuelNo ratings yet

- Monetary Standard CHP 3Document7 pagesMonetary Standard CHP 3MD. IBRAHIM KHOLILULLAHNo ratings yet

- Globalisation, WTO and GATTDocument27 pagesGlobalisation, WTO and GATTyash100% (2)

- Jurnal: Ekonomi PembangunanDocument14 pagesJurnal: Ekonomi PembangunanAgus MelasNo ratings yet

- GattDocument8 pagesGattPallav PatodiaNo ratings yet

- Exchange RateDocument6 pagesExchange RateSumit LalwaniNo ratings yet

- Direction of International Trade of KuwaitDocument3 pagesDirection of International Trade of Kuwaitsaurabh chhadiNo ratings yet

- Anti Dump ch-84Document36 pagesAnti Dump ch-84Tanwar KeshavNo ratings yet

- Af Cost Averaging WorksheetDocument150 pagesAf Cost Averaging WorksheetPanduNo ratings yet