Professional Documents

Culture Documents

Technical Analysis 28 January 2010 JPY: Comment: Strategy: Chart Levels

Uploaded by

Miir ViirOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Technical Analysis 28 January 2010 JPY: Comment: Strategy: Chart Levels

Uploaded by

Miir ViirCopyright:

Available Formats

Mizuho Corporate Bank

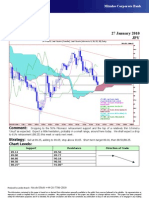

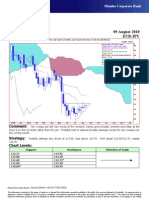

Technical Analysis 28 January 2010

JPY

JPY=EBS, Last Quote [Candle], Last Quote [Ichimoku 9, 26, 52, 26] Daily

06Nov09 - 05Mar10

Pr

93.5

93

92.5

92

91.5

91

90.5

90

89.5

89

88.5

88

JPY=EBS , Last Quote, Candle

87.5

28Jan10 89.97 90.40 89.88 90.19

JPY=EBS , Last Quote, Tenkan Sen 9

28Jan10 90.51 87

JPY=EBS , Last Quote, Kijun Sen 26

28Jan10 91.46 86.5

JPY=EBS , Last Quote, Senkou Span(a) 52

04Mar10 90.99

86

JPY=EBS , Last Quote, Senkou Span(b) 52

04Mar10 89.30

JPY=EBS , Last Quote, Chikou Span 26 85.5

24Dec09 90.19

85

09Nov09 16Nov 23Nov 30Nov 07Dec 14Dec 21Dec 28Dec 04Jan 11Jan 18Jan 25Jan 01Feb 08Feb 15Feb 22Feb 01Mar

Comment: Bouncing from 50% Fibonacci retracement support and the top of a relatively thin Ichimoku ‘cloud’.

Now let’s see whether recent highs and the 9-day moving average will cap. We still expect a drop to 61%

retracement (88.25) either this week or early next week.

Strategy: Sell at 90.15; stop above 90.85. Short term target 89.50, eventually 88.50/88.25.

Chart Levels:

Support Resistance Direction of Trade

89.88 90.40

89.71 90.57

89.14 90.78

88.80 91.00*

88.25* 91.46

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- Ba GastrectomyDocument10 pagesBa GastrectomyHope3750% (2)

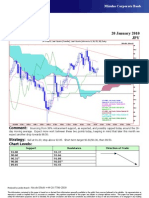

- Technical Analysis 29 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 29 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 21 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 21 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

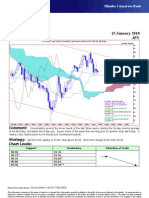

- Technical Analysis 27 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 27 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 20 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 20 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 12 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 12 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 19 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 19 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 11 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 11 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 15 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 15 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 05 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 05 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 15 September 2010 JPY: CommentDocument1 pageTechnical Analysis 15 September 2010 JPY: CommentPlan B EconomicsNo ratings yet

- Technical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- My LATESTFXForecastsfor JUNE30Document3 pagesMy LATESTFXForecastsfor JUNE30api-26441337No ratings yet

- PCPL: Lito Pumicpic: Effectivity Date: February 2020Document1 pagePCPL: Lito Pumicpic: Effectivity Date: February 2020Jieza May MarquezNo ratings yet

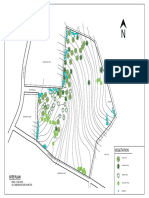

- Residential Area: 10 M Wide RoadDocument1 pageResidential Area: 10 M Wide RoadharishNo ratings yet

- Site Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatanDocument1 pageSite Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatandejomarlubNo ratings yet

- Site Plan S6 - 4-1-2020Document1 pageSite Plan S6 - 4-1-2020harishNo ratings yet

- Power Point Cakupan PHBSDocument3 pagesPower Point Cakupan PHBSnovita sariNo ratings yet

- A B C E F G H C D D: AzoteaDocument1 pageA B C E F G H C D D: AzoteaGustavo Róssiter VargasNo ratings yet

- Group Leader Development 14-7-2022Document10 pagesGroup Leader Development 14-7-2022Lancar Jaya PrintingNo ratings yet

- Khadi Chowk To Bridge Part - 2Document1 pageKhadi Chowk To Bridge Part - 2naman jainNo ratings yet

- Indian Railways: Trends, Issues, Opportunities and Outlook: G Raghuram Indian Institute of Management, AhmedabadDocument33 pagesIndian Railways: Trends, Issues, Opportunities and Outlook: G Raghuram Indian Institute of Management, AhmedabadmakbimhrdNo ratings yet

- Merry Christmas Mr. LawrenceDocument1 pageMerry Christmas Mr. Lawrenceckun kit yipNo ratings yet

- CNN Features Off-The-shelf: An Astounding Baseline For RecognitionDocument8 pagesCNN Features Off-The-shelf: An Astounding Baseline For RecognitionAkash GuptaNo ratings yet

- Cake - I Will SurviveDocument6 pagesCake - I Will SurviveJazz QuevedoNo ratings yet

- F&O ROLLOVER Jun - 2019 PDFDocument7 pagesF&O ROLLOVER Jun - 2019 PDFcdranuragNo ratings yet

- Kontur FixDocument1 pageKontur FixIpan YopaniNo ratings yet

- Kurva S PT - Etsa Hari Ke 30Document5 pagesKurva S PT - Etsa Hari Ke 30Ariwibowo SuparnadiNo ratings yet

- Sewer Line Profile - Line Mh7-Mh19: RevisionsDocument1 pageSewer Line Profile - Line Mh7-Mh19: RevisionsBernie QuepNo ratings yet

- PP-001 Universal2 Pump Seal Reference ChartDocument1 pagePP-001 Universal2 Pump Seal Reference Chartandres roblezNo ratings yet

- 1/7 (Row1 Col1)Document7 pages1/7 (Row1 Col1)renato_aleman_1No ratings yet

- PolyFish Fox FreeDocument22 pagesPolyFish Fox FreeBayronMayguaCaballero50% (2)

- Forecasting Stationary ModelsDocument22 pagesForecasting Stationary ModelsVINAY GUPTANo ratings yet

- W 75 ... P (IEC) : BonfiglioliDocument1 pageW 75 ... P (IEC) : BonfiglioliAtox BlackNo ratings yet

- Electrical Motor Efficiency Ratings PDFDocument3 pagesElectrical Motor Efficiency Ratings PDFGustavo CuatzoNo ratings yet

- Genes Genes: Aslr Elastic Net L1/2 Lasso L1/2+L2 Scadl2Document1 pageGenes Genes: Aslr Elastic Net L1/2 Lasso L1/2+L2 Scadl2viju001No ratings yet

- Genes Genes: Aslr Elastic Net L1/2 Lasso L1/2+L2 Scadl2Document1 pageGenes Genes: Aslr Elastic Net L1/2 Lasso L1/2+L2 Scadl2viju001No ratings yet

- Housing TI085-052-070 136268Document1 pageHousing TI085-052-070 136268ZEUS ARMYNo ratings yet

- CNN Features Off-the-Shelf - An Astounding Baseline For RecognitionDocument8 pagesCNN Features Off-the-Shelf - An Astounding Baseline For RecognitionhiriNo ratings yet

- Eis Me Aqui TromboneDocument2 pagesEis Me Aqui TromboneIury AugustoNo ratings yet

- Trombone IIDocument8 pagesTrombone IIKirs YoshikageNo ratings yet

- Worton Creek Marina: Slip DiagramDocument1 pageWorton Creek Marina: Slip DiagramjacoNo ratings yet

- Site Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatanDocument1 pageSite Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatandejomarlubNo ratings yet

- Merry Christmas Mr. Lawrence-FluteDocument2 pagesMerry Christmas Mr. Lawrence-FluteBruno Del BenNo ratings yet

- Diseño de Alcantarillado Sanitario Municipio de Los CordobasDocument1 pageDiseño de Alcantarillado Sanitario Municipio de Los CordobasJose Alfredo Petro NavarroNo ratings yet

- Pemodelan EksitingDocument1 pagePemodelan EksitingAyah AlealanaNo ratings yet

- UntitledDocument18 pagesUntitledImri TalgamNo ratings yet

- 1-Cluster 03 Sewer Drawings 11-04-2018Document1 page1-Cluster 03 Sewer Drawings 11-04-2018Bernie QuepNo ratings yet

- 4DDocument1 page4DFitri WahyuniNo ratings yet

- 2008 4GGSM 4G#RO MDO294 0164 - eSQAC - Clear - AlarmDocument23 pages2008 4GGSM 4G#RO MDO294 0164 - eSQAC - Clear - Alarmkhina luthfiNo ratings yet

- AF-Print Less Paper To Big ReportDocument6 pagesAF-Print Less Paper To Big ReportrannuNo ratings yet

- لەتیف هەڵمەت لە نێوان دیدگەرایی و بابەتگەری داDocument17 pagesلەتیف هەڵمەت لە نێوان دیدگەرایی و بابەتگەری داxomw xoyNo ratings yet

- El Triste: SebastianDocument1 pageEl Triste: SebastianAntonio Alexander CamposNo ratings yet

- StStepehensCutoff2018 1 PDFDocument10 pagesStStepehensCutoff2018 1 PDFMamta RaghuvanshiNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG-09 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-09 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG-09-DJ European Forex TechnicalsDocument3 pagesAUG-09-DJ European Forex TechnicalsMiir ViirNo ratings yet

- JYSKE Bank AUG 09 Market Drivers CurrenciesDocument5 pagesJYSKE Bank AUG 09 Market Drivers CurrenciesMiir ViirNo ratings yet

- ScotiaBank AUG 09 Daily FX UpdateDocument3 pagesScotiaBank AUG 09 Daily FX UpdateMiir ViirNo ratings yet

- Jyske Bank Aug 09 em DailyDocument5 pagesJyske Bank Aug 09 em DailyMiir ViirNo ratings yet

- JYSKE Bank AUG 09 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 09 Corp Orates DailyMiir ViirNo ratings yet

- Common RHU DrugsDocument56 pagesCommon RHU DrugsAlna Shelah IbañezNo ratings yet

- Business Environment Analysis (Porter's 5 Forces Model)Document9 pagesBusiness Environment Analysis (Porter's 5 Forces Model)FarihaNo ratings yet

- Endogenic Processes (Erosion and Deposition) : Group 3Document12 pagesEndogenic Processes (Erosion and Deposition) : Group 3Ralph Lawrence C. PagaranNo ratings yet

- Autobiography of A 2nd Generation Filipino-AmericanDocument4 pagesAutobiography of A 2nd Generation Filipino-AmericanAio Min100% (1)

- FA2Document6 pagesFA2yuktiNo ratings yet

- Winifred Breines The Trouble Between Us An Uneasy History of White and Black Women in The Feminist MovementDocument279 pagesWinifred Breines The Trouble Between Us An Uneasy History of White and Black Women in The Feminist MovementOlgaNo ratings yet

- Chem31.1 Experiment 2Document28 pagesChem31.1 Experiment 2Mia FernandezNo ratings yet

- ESC Cardiomyopathy ClassificationDocument7 pagesESC Cardiomyopathy Classificationvalerius83No ratings yet

- An Improved Version of The Skin Chapter of Kent RepertoryDocument6 pagesAn Improved Version of The Skin Chapter of Kent RepertoryHomoeopathic PulseNo ratings yet

- Project Report Format CSE DEPTDocument16 pagesProject Report Format CSE DEPTAnkush KoundalNo ratings yet

- Shostakovich: Symphony No. 13Document16 pagesShostakovich: Symphony No. 13Bol DigNo ratings yet

- Tutor InvoiceDocument13 pagesTutor InvoiceAbdullah NHNo ratings yet

- PDF Certificacion 3dsmaxDocument2 pagesPDF Certificacion 3dsmaxAriel Carrasco AlmanzaNo ratings yet

- Foreign Laguage Teaching - Nzjournal - 15.1wiechertDocument4 pagesForeign Laguage Teaching - Nzjournal - 15.1wiechertNicole MichelNo ratings yet

- Student Health Services - 305 Estill Street Berea, KY 40403 - Phone: (859) 985-1415Document4 pagesStudent Health Services - 305 Estill Street Berea, KY 40403 - Phone: (859) 985-1415JohnNo ratings yet

- Episode 5 The Global TeacherDocument8 pagesEpisode 5 The Global TeacherEllieza Bauto SantosNo ratings yet

- Pengaruh Kompetensi Spiritual Guru Pendidikan Agama Kristen Terhadap Pertumbuhan Iman SiswaDocument13 pagesPengaruh Kompetensi Spiritual Guru Pendidikan Agama Kristen Terhadap Pertumbuhan Iman SiswaK'lala GrianNo ratings yet

- The First Step Analysis: 1 Some Important DefinitionsDocument4 pagesThe First Step Analysis: 1 Some Important DefinitionsAdriana Neumann de OliveiraNo ratings yet

- 39 - Riyadhah Wasyamsi Waduhaha RevDocument13 pages39 - Riyadhah Wasyamsi Waduhaha RevZulkarnain Agung100% (18)

- TesisDocument388 pagesTesisHadazaNo ratings yet

- NIPMR Notification v3Document3 pagesNIPMR Notification v3maneeshaNo ratings yet

- Early Pregnancy and Its Effect On The Mental Health of Students in Victoria Laguna"Document14 pagesEarly Pregnancy and Its Effect On The Mental Health of Students in Victoria Laguna"Gina HerraduraNo ratings yet

- Chapter 5, 6Document4 pagesChapter 5, 6anmar ahmedNo ratings yet

- Mod B - HSC EssayDocument11 pagesMod B - HSC EssayAryan GuptaNo ratings yet

- Securities and Exchange Commission: Non-Holding of Annual MeetingDocument2 pagesSecurities and Exchange Commission: Non-Holding of Annual MeetingBea AlonzoNo ratings yet

- Course Hand Out Comm. Skill BSC AgDocument2 pagesCourse Hand Out Comm. Skill BSC Agfarid khanNo ratings yet

- Catibayan Reflection AR VRDocument6 pagesCatibayan Reflection AR VRSheina Marie BariNo ratings yet

- Presentation (AJ)Document28 pagesPresentation (AJ)ronaldNo ratings yet

- Appraising The Secretaries of Sweet Water UniversityDocument4 pagesAppraising The Secretaries of Sweet Water UniversityZain4uNo ratings yet