Professional Documents

Culture Documents

Technical Analysis 29 January 2010 JPY: Comment: Strategy: Chart Levels

Uploaded by

Miir ViirOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Technical Analysis 29 January 2010 JPY: Comment: Strategy: Chart Levels

Uploaded by

Miir ViirCopyright:

Available Formats

Mizuho Corporate Bank

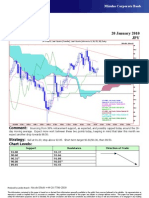

Technical Analysis 29 January 2010

JPY

JPY=EBS, Last Quote [Candle], Last Quote [Ichimoku 9, 26, 52, 26] Daily

29Oct09 - 08Mar10

Pr

93.5

93

92.5

92

91.5

91

90.5

90

89.5

89

88.5

88

JPY=EBS , Last Quote, Candle 87.5

29Jan10 89.90 90.06 89.57 89.94

JPY=EBS , Last Quote, Tenkan Sen 9

29Jan10 90.51 87

JPY=EBS , Last Quote, Kijun Sen 26

29Jan10 91.46 86.5

JPY=EBS , Last Quote, Senkou Span(a) 52

05Mar10 90.99

86

JPY=EBS , Last Quote, Senkou Span(b) 52

05Mar10 89.30

JPY=EBS , Last Quote, Chikou Span 26 85.5

25Dec09 89.94

85

04Nov09 11Nov 18Nov 25Nov 02Dec 09Dec 16Dec 23Dec 30Dec 06Jan 13Jan 20Jan 27Jan 03Feb 10Feb 17Feb 24Feb 03Mar

Comment: Hovering above the 50% Fibonacci retracement support and the top of a relatively thin Ichimoku

‘cloud’. Yesterday the 9-day moving average capped and might well do so again today. Next month we still expect a

drop to 61% retracement (88.25).

Strategy: Sell at 89.95, adding to 90.45; stop above 90.85. Short term target 89.65, eventually 88.50/88.25.

Chart Levels:

Support Resistance Direction of Trade

89.71 90.20

89.57 90.57

89.14/89.00* 90.78

88.80 91.00*

88.25* 91.46

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- PolyFish Fox FreeDocument22 pagesPolyFish Fox FreeBayronMayguaCaballero50% (2)

- 2022 - Notice - Bill of Particulars DemandDocument5 pages2022 - Notice - Bill of Particulars DemandbrandonNo ratings yet

- Fundamentals of Accounting I Accounting For Manufacturing BusinessDocument14 pagesFundamentals of Accounting I Accounting For Manufacturing BusinessBenedict rivera100% (2)

- Jose Ferreira Criminal ComplaintDocument4 pagesJose Ferreira Criminal ComplaintDavid Lohr100% (1)

- SOP Customer ComplaintDocument2 pagesSOP Customer ComplaintMohd Kamil77% (52)

- Bond ValuationDocument49 pagesBond Valuationmehnaz kNo ratings yet

- Were The Peace Treaties of 1919-23 FairDocument74 pagesWere The Peace Treaties of 1919-23 FairAris Cahyono100% (1)

- 1/7 (Row1 Col1)Document7 pages1/7 (Row1 Col1)renato_aleman_1No ratings yet

- Bow IwrbsDocument4 pagesBow IwrbsRhenn Bagtas SongcoNo ratings yet

- CRM AssignmentDocument43 pagesCRM Assignmentharshdeep mehta100% (2)

- B16. Project Employment - Bajaro vs. Metro Stonerich Corp.Document5 pagesB16. Project Employment - Bajaro vs. Metro Stonerich Corp.Lojo PiloNo ratings yet

- Exercise 4Document45 pagesExercise 4Neal PeterosNo ratings yet

- Suez CanalDocument7 pagesSuez CanalUlaş GüllenoğluNo ratings yet

- Technical Analysis 28 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 28 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

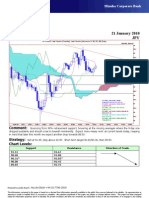

- Technical Analysis 21 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 21 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

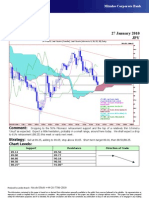

- Technical Analysis 27 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 27 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

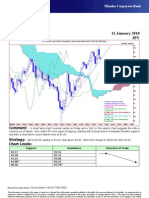

- Technical Analysis 12 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 12 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 20 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 20 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 19 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 19 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 11 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 11 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 15 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 15 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 05 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 05 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 15 September 2010 JPY: CommentDocument1 pageTechnical Analysis 15 September 2010 JPY: CommentPlan B EconomicsNo ratings yet

- Technical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- My LATESTFXForecastsfor JUNE30Document3 pagesMy LATESTFXForecastsfor JUNE30api-26441337No ratings yet

- PCPL: Lito Pumicpic: Effectivity Date: February 2020Document1 pagePCPL: Lito Pumicpic: Effectivity Date: February 2020Jieza May MarquezNo ratings yet

- Site Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatanDocument1 pageSite Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatandejomarlubNo ratings yet

- Power Point Cakupan PHBSDocument3 pagesPower Point Cakupan PHBSnovita sariNo ratings yet

- Group Leader Development 14-7-2022Document10 pagesGroup Leader Development 14-7-2022Lancar Jaya PrintingNo ratings yet

- Residential Area: 10 M Wide RoadDocument1 pageResidential Area: 10 M Wide RoadharishNo ratings yet

- A B C E F G H C D D: AzoteaDocument1 pageA B C E F G H C D D: AzoteaGustavo Róssiter VargasNo ratings yet

- F&O ROLLOVER Jun - 2019 PDFDocument7 pagesF&O ROLLOVER Jun - 2019 PDFcdranuragNo ratings yet

- CNN Features Off-The-shelf: An Astounding Baseline For RecognitionDocument8 pagesCNN Features Off-The-shelf: An Astounding Baseline For RecognitionAkash GuptaNo ratings yet

- Site Plan S6 - 4-1-2020Document1 pageSite Plan S6 - 4-1-2020harishNo ratings yet

- Sewer Line Profile - Line Mh7-Mh19: RevisionsDocument1 pageSewer Line Profile - Line Mh7-Mh19: RevisionsBernie QuepNo ratings yet

- PP-001 Universal2 Pump Seal Reference ChartDocument1 pagePP-001 Universal2 Pump Seal Reference Chartandres roblezNo ratings yet

- Indian Railways: Trends, Issues, Opportunities and Outlook: G Raghuram Indian Institute of Management, AhmedabadDocument33 pagesIndian Railways: Trends, Issues, Opportunities and Outlook: G Raghuram Indian Institute of Management, AhmedabadmakbimhrdNo ratings yet

- 2008 4GGSM 4G#RO MDO294 0164 - eSQAC - Clear - AlarmDocument23 pages2008 4GGSM 4G#RO MDO294 0164 - eSQAC - Clear - Alarmkhina luthfiNo ratings yet

- Kurva S PT - Etsa Hari Ke 30Document5 pagesKurva S PT - Etsa Hari Ke 30Ariwibowo SuparnadiNo ratings yet

- Khadi Chowk To Bridge Part - 2Document1 pageKhadi Chowk To Bridge Part - 2naman jainNo ratings yet

- Cake - I Will SurviveDocument6 pagesCake - I Will SurviveJazz QuevedoNo ratings yet

- Eis Me Aqui TromboneDocument2 pagesEis Me Aqui TromboneIury AugustoNo ratings yet

- Kontur FixDocument1 pageKontur FixIpan YopaniNo ratings yet

- Merry Christmas Mr. LawrenceDocument1 pageMerry Christmas Mr. Lawrenceckun kit yipNo ratings yet

- 1-Cluster 03 Sewer Drawings 11-04-2018Document1 page1-Cluster 03 Sewer Drawings 11-04-2018Bernie QuepNo ratings yet

- Worton Creek Marina: Slip DiagramDocument1 pageWorton Creek Marina: Slip DiagramjacoNo ratings yet

- Trombone IIDocument8 pagesTrombone IIKirs YoshikageNo ratings yet

- Leg Profile-AP-63-AP-63Document1 pageLeg Profile-AP-63-AP-63Hikmat B. Ayer - हिक्मत ब. ऐरNo ratings yet

- Mika C - ADocument2 pagesMika C - AJean-Claude BourletNo ratings yet

- Cell Availability: Kpi InformationDocument23 pagesCell Availability: Kpi InformationHaryadi syamsuddinNo ratings yet

- Site Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatanDocument1 pageSite Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatandejomarlubNo ratings yet

- UntitledDocument18 pagesUntitledImri TalgamNo ratings yet

- Walls 2017 Undergrad Research Day at The Capitol FinalDocument1 pageWalls 2017 Undergrad Research Day at The Capitol Finaldario susanoNo ratings yet

- Board SchematicDocument1 pageBoard SchematicJOSE LENIN RIVERA VILLALOBOS0% (1)

- Rhino HeadDocument8 pagesRhino HeadSARABIA papeleria y regalosNo ratings yet

- Rhino HeadDocument8 pagesRhino HeadALEJANDRONo ratings yet

- CNN Features Off-the-Shelf - An Astounding Baseline For RecognitionDocument8 pagesCNN Features Off-the-Shelf - An Astounding Baseline For RecognitionhiriNo ratings yet

- Chart - Stitch FiddleDocument1 pageChart - Stitch FiddleCharlotte CrouchNo ratings yet

- Pemodelan EksitingDocument1 pagePemodelan EksitingAyah AlealanaNo ratings yet

- Merry Christmas Mr. Lawrence-FluteDocument2 pagesMerry Christmas Mr. Lawrence-FluteBruno Del BenNo ratings yet

- 55m - 36mps - Cat. II-C-3-40PA 13m2Document1 page55m - 36mps - Cat. II-C-3-40PA 13m2MaryNo ratings yet

- Kurva S PT - Etsa Hari Ke 25Document1 pageKurva S PT - Etsa Hari Ke 25Ariwibowo SuparnadiNo ratings yet

- Genelec Monitor Focusing Template 231221 213837Document2 pagesGenelec Monitor Focusing Template 231221 213837pakypaky33No ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR USDDocument1 pageAUG-10 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirNo ratings yet

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirNo ratings yet

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocument1 pageAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirNo ratings yet

- Cover LetterDocument2 pagesCover LetterAditya Singh0% (1)

- PrecedentialDocument41 pagesPrecedentialScribd Government DocsNo ratings yet

- Chap 2 Tanner - The Sales Function & Multi Sales Channels 280516Document17 pagesChap 2 Tanner - The Sales Function & Multi Sales Channels 280516Shahzain RafiqNo ratings yet

- The History of Sewing MachinesDocument5 pagesThe History of Sewing Machinesizza_joen143100% (2)

- Schonsee Square Brochure - July 11, 2017Document4 pagesSchonsee Square Brochure - July 11, 2017Scott MydanNo ratings yet

- User Manual: RAID 5 and RAID 10 Setup in Windows 10Document31 pagesUser Manual: RAID 5 and RAID 10 Setup in Windows 10Ical RedHatNo ratings yet

- The Ethiopian Electoral and Political Parties Proclamation PDFDocument65 pagesThe Ethiopian Electoral and Political Parties Proclamation PDFAlebel BelayNo ratings yet

- Department of Environment and Natural Resources: Niño E. Dizor Riza Mae Dela CruzDocument8 pagesDepartment of Environment and Natural Resources: Niño E. Dizor Riza Mae Dela CruzNiño Esco DizorNo ratings yet

- RA 9072 (National Cave Act)Document4 pagesRA 9072 (National Cave Act)Lorelain ImperialNo ratings yet

- D0683SP Ans5Document20 pagesD0683SP Ans5Tanmay SanchetiNo ratings yet

- Gps DVR FlierDocument2 pagesGps DVR FlierShankar PandaNo ratings yet

- 2015 BT Annual ReportDocument236 pages2015 BT Annual ReportkernelexploitNo ratings yet

- CentipedeDocument2 pagesCentipedeMaeNo ratings yet

- Excerpted From Watching FoodDocument4 pagesExcerpted From Watching Foodsoc2003No ratings yet

- MOTORESDocument6 pagesMOTORESAlberto Israel MartínezNo ratings yet

- Statistik API Development - 080117 AHiADocument6 pagesStatistik API Development - 080117 AHiAApdev OptionNo ratings yet

- Indicator - Individual Dietary Diversity ScoreDocument3 pagesIndicator - Individual Dietary Diversity Scorehisbullah smithNo ratings yet

- Nittscher vs. NittscherDocument4 pagesNittscher vs. NittscherKeej DalonosNo ratings yet

- Historical Allusions in The Book of Habakkuk: Aron PinkerDocument10 pagesHistorical Allusions in The Book of Habakkuk: Aron Pinkerstefa74No ratings yet