Professional Documents

Culture Documents

Seminar No 12 - Corporate Finance

Uploaded by

Cristina IonescuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Seminar No 12 - Corporate Finance

Uploaded by

Cristina IonescuCopyright:

Available Formats

Course: Corporate Finance

Year of Study: II, REI, First Semester

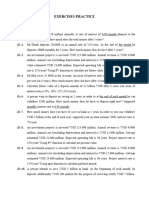

SEMINAR NO 12 - INVESTMENTS

1. A company wants to make an investment and it has to decide between two possible

alternatives:

a) Project A:

Initial Investment = 85.000

Marginal Cash-flows generated by the project:

Year

CF

1

2

10.000

5.000

Residual Value: 5.000

3

65.000

4

75.000

5

30.000

4

15.000

5

25.000

b) Project B:

Initial Investment = 75.000

Marginal Cash-flows generated by the project:

Year

CF

1

2

45.000

50.000

Residual Value: 35.000

3

20.000

The required rate of return for any project is 10%. Decide what project should the

manager decide to do according to the criterion:

a) NPV

b) RIR

c) Payback Period (1.Static and 2.Dynamic)

d) Profitability Index

2. A company, characterized by a ROA of 12% undertakes an investment project with an

initial investment of 1000 . The CF generated by the project are 250 per year for each

of the next 10 years. The return rate required by the investors is 10%. If the residual value

of the project is 0, what is the MIRR for this project?

Course: Corporate Finance

Year of Study: II, REI, First Semester

3. An investment project requires an initial investment of 1000 and it will generate sales

of 1900 in the first year. The sales will grow then by 1% per year for the following 3

years (the total life time of the project is 4 years). Variable cost are 1500 in the first year

and fixed costs are 350 (which include the depreciation, calculated with the straight-line

method during the life-time of the project). The income tax rate is 16%. Well assume

that the investment will generate an increase in NWC of 50 in the first year. The

residual value (net cash-flow obtained form disinvesting) is 500 . If the investors require

a return of 10%, what is the NPV for this project?

You might also like

- TVM Practice QuestionsDocument10 pagesTVM Practice QuestionsSalvador RiestraNo ratings yet

- Unit 2 - Problem 1Document1 pageUnit 2 - Problem 1Ivana BalijaNo ratings yet

- Project Appraisal ExamDocument4 pagesProject Appraisal ExamVasco CardosoNo ratings yet

- Assignment 2: Business Value Management: Show Detailed Calculations in The Spaces ProvidedDocument4 pagesAssignment 2: Business Value Management: Show Detailed Calculations in The Spaces Providedelmin mammadovNo ratings yet

- Excel - Project Exercise 1 (4)Document11 pagesExcel - Project Exercise 1 (4)thaithanh.tdhtNo ratings yet

- Acc14 Exercise Capital-BudgetingDocument3 pagesAcc14 Exercise Capital-BudgetingyeezzzzNo ratings yet

- Assgnt Acfn 3202 2020extDocument2 pagesAssgnt Acfn 3202 2020extbethelhemNo ratings yet

- Training Program: Subject:: Final ProjectDocument7 pagesTraining Program: Subject:: Final Projectgadde viegas0% (2)

- ) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%Document4 pages) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%kfbhgikNo ratings yet

- Attachment 1Document7 pagesAttachment 1carlton jacksonNo ratings yet

- Capital Budgeting QuizDocument3 pagesCapital Budgeting QuizJen Zabala100% (1)

- Chap11_quiz5_MI2Document15 pagesChap11_quiz5_MI2lynvuong101299No ratings yet

- Capital Budgeting 2Document1 pageCapital Budgeting 2leo_emanueleNo ratings yet

- Financial Maths II Annuities and Investment Appraisal TutorialsDocument18 pagesFinancial Maths II Annuities and Investment Appraisal TutorialsPelah Wowen DanielNo ratings yet

- GU EKF201 Exercises III QuestionsDocument2 pagesGU EKF201 Exercises III Questionsamandakleijn1No ratings yet

- Financial Management - Hamza MudassarDocument15 pagesFinancial Management - Hamza Mudassarangelicalumboy11No ratings yet

- Prob 11Document2 pagesProb 11VncdorNo ratings yet

- Additional Problems NPV and Others - Principle FinanceDocument4 pagesAdditional Problems NPV and Others - Principle FinanceSorryTakenAlreadyLOLNo ratings yet

- Corporate FinanceDocument87 pagesCorporate FinanceXiao PoNo ratings yet

- Lecture 6 QuestionsDocument1 pageLecture 6 QuestionsSuzana RubayetNo ratings yet

- 2017 Seminar6StudentsDocument2 pages2017 Seminar6StudentsLizzyNo ratings yet

- Griffith College Dublin financial management past examDocument5 pagesGriffith College Dublin financial management past examLuísaNegriNo ratings yet

- TEST PROJECT FINANCE AND COST MANAGEMENT Section BDocument6 pagesTEST PROJECT FINANCE AND COST MANAGEMENT Section BNyasha MakovaNo ratings yet

- Assignment 2Document4 pagesAssignment 2Jayanth Appi KNo ratings yet

- CIMA F3 Workbook Q PDFDocument67 pagesCIMA F3 Workbook Q PDFjjNo ratings yet

- Project A Project B: Payback PeriodDocument8 pagesProject A Project B: Payback PeriodTudor AndreiNo ratings yet

- Non-Discounted Capital Budgeting TechniquesDocument4 pagesNon-Discounted Capital Budgeting TechniquesLloyd ReglosNo ratings yet

- Goals, Functions of Finance Manager, Working Capital RequirementsDocument3 pagesGoals, Functions of Finance Manager, Working Capital RequirementsISLAMICLECTURESNo ratings yet

- Capital Budgeting Decisions for Business InvestmentsDocument6 pagesCapital Budgeting Decisions for Business InvestmentsLinus AhlgrenNo ratings yet

- Capital Budgeting Seatwork 2 MWFDocument1 pageCapital Budgeting Seatwork 2 MWFnelle de leonNo ratings yet

- Block 3 Adjustments To Company AccountsDocument49 pagesBlock 3 Adjustments To Company AccountsNguyễn Hạnh Linh100% (1)

- Addis Ababa Science and Technology University engineering economics group assignmentDocument4 pagesAddis Ababa Science and Technology University engineering economics group assignmentrobel pop100% (1)

- 1 - 9 QuestionDocument1 page1 - 9 QuestionBùi Thị Thu HoàiNo ratings yet

- Tutorial Set 1Document8 pagesTutorial Set 1Jephthah BansahNo ratings yet

- Non-Discounted Capital Budgeting TechniquesDocument2 pagesNon-Discounted Capital Budgeting TechniquesKristineTwo CorporalNo ratings yet

- Numericals On Capital Budgeting TechniquesDocument5 pagesNumericals On Capital Budgeting TechniquesKritikaNo ratings yet

- Engineering Economics ProblemsDocument9 pagesEngineering Economics Problemsjac bnvstaNo ratings yet

- Module 3 - Capital Budgeting - 3A - Questions 2022-23Document10 pagesModule 3 - Capital Budgeting - 3A - Questions 2022-23Manya GargNo ratings yet

- Project Selection MethodDocument42 pagesProject Selection Methodjeon100% (1)

- Contract Accounting Journal EntriesDocument3 pagesContract Accounting Journal Entrieskawasakidude21100% (2)

- 2 - CH 16 (ICAP Book) - Introduction To Project Appraisal - FinalDocument93 pages2 - CH 16 (ICAP Book) - Introduction To Project Appraisal - FinalArslanNo ratings yet

- Sheet1: Accounting Rate of Return (11000/30000) 100 36.67%Document12 pagesSheet1: Accounting Rate of Return (11000/30000) 100 36.67%David DavidNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1Bigbi Kumar100% (1)

- Multiple Choice Questions - Week 1+2 - NPVDocument10 pagesMultiple Choice Questions - Week 1+2 - NPVtran thanhNo ratings yet

- Adv Issues in CapBud - Gr2 9-02 wip (4)Document24 pagesAdv Issues in CapBud - Gr2 9-02 wip (4)Himanshu GuptaNo ratings yet

- R35 Capital Budgeting Q BankDocument15 pagesR35 Capital Budgeting Q BankAhmedNo ratings yet

- Tutorial 4 Capital Investment Decisions 1Document4 pagesTutorial 4 Capital Investment Decisions 1phillip HaulNo ratings yet

- Tutorial 4 - Capital Investment DecisionsDocument4 pagesTutorial 4 - Capital Investment DecisionsIbrahim HussainNo ratings yet

- AE23 Capital BudgetingDocument4 pagesAE23 Capital BudgetingCheska AgrabioNo ratings yet

- 2015-Spring-F18-CIA Revision Practice QuestionsDocument2 pages2015-Spring-F18-CIA Revision Practice QuestionsMayal AhmedNo ratings yet

- Planning and Evaluationl English 2Document38 pagesPlanning and Evaluationl English 2Absa TraderNo ratings yet

- Module I: Introduction To Financial ManagementDocument10 pagesModule I: Introduction To Financial ManagementPruthvi BalekundriNo ratings yet

- Engineering EconomyDocument2 pagesEngineering EconomyMichelle MariposaNo ratings yet

- 18 HomeworkDocument4 pages18 HomeworkAbdullah MajeedNo ratings yet

- Assignment QuestionDocument1 pageAssignment QuestionMori KashizukuNo ratings yet

- Time Value and Capital BudgetingDocument9 pagesTime Value and Capital BudgetingaskdgasNo ratings yet

- Things You Must NoticeDocument2 pagesThings You Must NoticeKezia N. ApriliaNo ratings yet

- European Investment Bank Activity Report 2018: Opportunity deliveredFrom EverandEuropean Investment Bank Activity Report 2018: Opportunity deliveredNo ratings yet

- Economic and Social Cohesion PolicyDocument12 pagesEconomic and Social Cohesion PolicyCristina IonescuNo ratings yet

- Misogyny - From History To NowadaysDocument13 pagesMisogyny - From History To NowadaysCristina IonescuNo ratings yet

- Press Release en 2011Document8 pagesPress Release en 2011Cristina IonescuNo ratings yet

- GEOPOLITICAL CONTEXT OF THE BLACK SEADocument15 pagesGEOPOLITICAL CONTEXT OF THE BLACK SEACristina IonescuNo ratings yet

- The Effect of The VAT Rate Change On Aggregate Consumption and Economic GrowthDocument31 pagesThe Effect of The VAT Rate Change On Aggregate Consumption and Economic GrowthCristina IonescuNo ratings yet

- Lecture VDocument30 pagesLecture VCristina IonescuNo ratings yet

- 2015 Half Yearly Report enDocument23 pages2015 Half Yearly Report enCristina IonescuNo ratings yet

- The Effect of The VAT Rate Change On Aggregate Consumption and Economic GrowthDocument31 pagesThe Effect of The VAT Rate Change On Aggregate Consumption and Economic GrowthCristina IonescuNo ratings yet

- Ireland benefits Single MarketDocument3 pagesIreland benefits Single MarketCristina IonescuNo ratings yet

- Course 3-Corporate FinanceDocument2 pagesCourse 3-Corporate FinanceCristina IonescuNo ratings yet

- Economic and Social Cohesion PolicyDocument12 pagesEconomic and Social Cohesion PolicyCristina IonescuNo ratings yet

- Lecture IDocument16 pagesLecture ICristina IonescuNo ratings yet

- Seminar Nr.10Document6 pagesSeminar Nr.10Cristina IonescuNo ratings yet

- Lecture 9 InvestmentDocument34 pagesLecture 9 InvestmentCristina IonescuNo ratings yet

- SEMINAR NO 6 - Financial Ratios 1. The Following Data Is Known For Kaiser & CoDocument3 pagesSEMINAR NO 6 - Financial Ratios 1. The Following Data Is Known For Kaiser & CoCristina IonescuNo ratings yet

- Course 3-Corporate FinanceDocument2 pagesCourse 3-Corporate FinanceCristina IonescuNo ratings yet

- Corporate Finance Seminar Income Statement AnalysisDocument2 pagesCorporate Finance Seminar Income Statement AnalysisCristina IonescuNo ratings yet

- Seminar 2.Document2 pagesSeminar 2.Cristina IonescuNo ratings yet

- Criza, Politicile Comerciale Și Schimbările În Configuraţia ProtecţionismuluiDocument19 pagesCriza, Politicile Comerciale Și Schimbările În Configuraţia ProtecţionismuluiCristina IonescuNo ratings yet

- Communication in International ManagementDocument14 pagesCommunication in International ManagementCristina IonescuNo ratings yet

- PlanningDocument10 pagesPlanningCristina IonescuNo ratings yet

- Marketing 30 MartieDocument1 pageMarketing 30 MartieCristina IonescuNo ratings yet

- Intercultural CommunicationDocument22 pagesIntercultural CommunicationCristina IonescuNo ratings yet

- HRMenglDocument11 pagesHRMenglCristina IonescuNo ratings yet

- c5 Coal and Natural GasDocument20 pagesc5 Coal and Natural GasCristina IonescuNo ratings yet

- Culture Concept in ManagementDocument10 pagesCulture Concept in ManagementCristina IonescuNo ratings yet

- Industrialization: City Break Ljubljana 3Document7 pagesIndustrialization: City Break Ljubljana 3Cristina IonescuNo ratings yet

- Lecture5 6 Ratio Analysis 13Document39 pagesLecture5 6 Ratio Analysis 13Cristina IonescuNo ratings yet