Professional Documents

Culture Documents

News Upload 1

Uploaded by

shashank_shekhar_640 ratings0% found this document useful (0 votes)

8 views1 pageNews Upload 1..

Copyright

© © All Rights Reserved

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNews Upload 1..

Copyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageNews Upload 1

Uploaded by

shashank_shekhar_64News Upload 1..

Copyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

You are on page 1of 1

The road transport and highways ministry has lined up projects worth Rs 50,000 c

rore to be awarded under public-private partnership mode in 2016-17. This will b

e the largest chunk of highways projects to be awarded by the ministry under the

PPP mode in a single financial year.

The government is targeting increasing the length of highways across the country

to 1.5 lakh km from the existing 1 lakh km in the next four years. It plans to

undertake construction of 7,000-8000 km on its own during the next fiscal. To bo

ost private sector interest in the sector, the ministry has taken a slew of meas

ures including introducing an exit policy aimed at improving the availability of

equity funds by allowing developers to monetise existing projects. The exit pol

icy framework permit

This year the government expects to garner more than Rs 20,000 crore by way of p

rivate investments in the roads sector. It has already awarded projects worth Rs

12,000 crore. "Projects will be awarded mostly under the hybrid annuity model.

Some of them will also be given out on the build-operate-transfer (BOT) model. W

e are looking at awarding close to 5,000 km to private players," a senior govern

ment official said.

India's top IT firms are bracing themselves for one of their worst quarterly res

ults in recent memory. Their performance in the typically weak quarter through D

ecember is further hurt by the floods in Chennai and a general slowdown in globa

l technology spending, several company executives and analysts said.

The setback will have further ramifications for India's $146-billion IT industry

. Homegrown giants such as TCSBSE 0.70 % and Infosys may fall short of Nasscom's

12-14% exports growth outlook for FY16.

There are worries that the current fiscal year may end as the worst in terms of

revenue growth for Indian IT. Executives at the industry lobby group are even co

ntemplating revising their projections for this year, according to people famili

ar with the discussions.

"Our modelling has factored in a certain figure for the likes of TCS (Tata Consu

ltancy Services) - now we have to wait and see how the Q3 numbers turn out befor

e we change our projections," said a Nasscom executive, who declined to be named

.

At least half-a-dozen analysts and brokerages ET spoke to are of the opinion tha

t India's top five software exporters may post a 1-2% fall in revenue - or at th

e most record a flat performance - on a sequential basis in the fiscal third qua

rter ending on December 31.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Fusion 3Document1 pageFusion 3shashank_shekhar_64No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Fusion 5Document1 pageFusion 5shashank_shekhar_64No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Fusion 4Document2 pagesFusion 4shashank_shekhar_64No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Fusion 3Document1 pageFusion 3shashank_shekhar_64No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Fusion 1Document1 pageFusion 1shashank_shekhar_64No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Fusion 2Document2 pagesFusion 2shashank_shekhar_64No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Fusion 1Document1 pageFusion 1shashank_shekhar_64No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- News Upload 1Document1 pageNews Upload 1shashank_shekhar_64No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Sanskrit Alphabet, Pronunciation and LanguageDocument3 pagesSanskrit Alphabet, Pronunciation and Languageshashank_shekhar_64100% (2)

- New Upload 6Document1 pageNew Upload 6shashank_shekhar_64No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- News Upload 5Document1 pageNews Upload 5shashank_shekhar_64No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- B.ed. Prospectus 2015-16Document61 pagesB.ed. Prospectus 2015-16shashank_shekhar_64No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- National Mission On Education Through Information andDocument5 pagesNational Mission On Education Through Information andshekhar_rpsitNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- News Upload 3Document1 pageNews Upload 3shashank_shekhar_64No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- News Upload 4Document2 pagesNews Upload 4shashank_shekhar_64No ratings yet

- News Upload 2Document1 pageNews Upload 2shashank_shekhar_64No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Kishor 2Document3 pagesKishor 2shashank_shekhar_64No ratings yet

- Sanskrit Subha Stan IDocument47 pagesSanskrit Subha Stan Ishashank_shekhar_64No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Krish orDocument3 pagesKrish orshashank_shekhar_64No ratings yet

- Science in Ancient India - 105Document21 pagesScience in Ancient India - 105shashank_shekhar_64No ratings yet

- Science in Ancient India - 105Document21 pagesScience in Ancient India - 105shashank_shekhar_64No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Science in Ancient India - 105Document21 pagesScience in Ancient India - 105shashank_shekhar_64No ratings yet

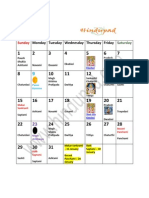

- Hindu Calendar 2012 With Tithi North Indian CalendarDocument12 pagesHindu Calendar 2012 With Tithi North Indian CalendarPradeep ShuklaNo ratings yet

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)