Professional Documents

Culture Documents

Monthly TOT Report

Uploaded by

Anonymous n8ubBzv6p0 ratings0% found this document useful (0 votes)

9 views1 pagelksdl;kwjeopiwjefoiwjefopiwefoiwjefoiwefoiwjeF

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentlksdl;kwjeopiwjefoiwjefopiwefoiwjefoiwefoiwjeF

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageMonthly TOT Report

Uploaded by

Anonymous n8ubBzv6plksdl;kwjeopiwjefoiwjefopiwefoiwjefoiwefoiwjeF

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

CITY OF PALM SPRINGS

January 14, 2016

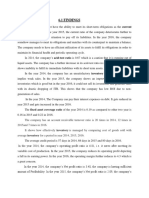

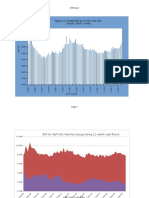

The following is a monthly analysis of Transient Occupancy Tax collections by hotels in

Palm Springs for the month of November, 2015 compared with the same month for the prior two

fiscal years.

The Department of Finance has estimated TOT collections in the case of a few hotels which

have not yet reported for the month in order to present this report. Otherwise, all amounts

are actual. The TOT collections represent 13.5% for Group Meeting Hotels and 11.5% for all

other hotels, on rentals of 28 days or less, and are net of withholding for hotel incentive payments.

Based on actual reports and a few Finance Department estimates, the TOT collections for

November, 2015 were 10.18% less than November, 2014.

Fiscal Year

2013-14

Month

July

August

September

October

November

December

January

February

March

April

May

June

Fiscal Year

2014-15

Fiscal Year

2015-16 **

Increase (Decrease) vs Pr-Yr

Amount

% Change

1,140,053

1,107,575

1,131,490

1,488,957

1,700,617

1,462,499

1,818,620

2,227,977

3,114,847

3,410,057

1,971,374

1,303,870

1,367,238

1,394,495

1,222,473

1,664,808

2,037,777

1,701,740

2,126,168

2,589,923

3,302,211

3,490,391

2,185,052

1,404,972

1,512,002

1,419,761

1,321,426

1,738,831

1,830,412

144,764

25,266

98,953

74,023

(207,365)

21,877,936

24,487,248

7,822,433

135,642

Geoffrey S. Kiehl

Director of Finance and Treasurer

** Amounts for the current month are subject to change when final reports are received.

10.59%

1.81%

8.09%

4.45%

-10.18%

1.76%

You might also like

- US e-commerce sales increase 4.2% in Q3 2015Document3 pagesUS e-commerce sales increase 4.2% in Q3 2015ErikaRuizANo ratings yet

- Formula NPVDocument1 pageFormula NPVRajkumar ReguntaNo ratings yet

- Staff Turnover CalculatorDocument25 pagesStaff Turnover CalculatorAmjad AbroNo ratings yet

- ID Kontribusi Pajak Hotel Dan Pajak ReklameDocument8 pagesID Kontribusi Pajak Hotel Dan Pajak Reklamereza lestariNo ratings yet

- Unit - Iv Budgeting and Evaluating Front Office Operation Budgeting For Fo Operations Making A Front Office BudgetDocument11 pagesUnit - Iv Budgeting and Evaluating Front Office Operation Budgeting For Fo Operations Making A Front Office BudgetArrow PrasadNo ratings yet

- May Financial Report 2016Document26 pagesMay Financial Report 2016Anonymous Jrvijv4bRANo ratings yet

- Shakopee Quarterly Financial Update Q1-2016Document6 pagesShakopee Quarterly Financial Update Q1-2016Brad TabkeNo ratings yet

- Document Karthi Ratio - 5 - 16.5Document10 pagesDocument Karthi Ratio - 5 - 16.5raj kumarNo ratings yet

- Front Office - FormulaSDocument5 pagesFront Office - FormulaSsushanta21100% (1)

- Cash Flow and Budgetary ControlDocument9 pagesCash Flow and Budgetary ControlpRiNcE DuDhAtRaNo ratings yet

- Public Debt Management: Quarterly Report January-March 2014Document40 pagesPublic Debt Management: Quarterly Report January-March 2014AnnaNo ratings yet

- ID Analisis Rasio Keuangan Anggaran PendapaDocument12 pagesID Analisis Rasio Keuangan Anggaran PendapaTyaInvincibleNo ratings yet

- History of Bank of PunjabDocument32 pagesHistory of Bank of PunjabMahrukh AlTafNo ratings yet

- EasyJet CompanyDocument21 pagesEasyJet CompanyHassan ZaryabNo ratings yet

- Ratio AnalysisDocument8 pagesRatio AnalysisikramNo ratings yet

- Financial analysis of Apple and Fortune ShoesDocument26 pagesFinancial analysis of Apple and Fortune ShoesMd Borhan Uddin 2035097660No ratings yet

- Bull2016 2Document1 pageBull2016 2jspectorNo ratings yet

- Amal RajDocument6 pagesAmal Rajdr_shaikhfaisalNo ratings yet

- Mauritius Bank Lending Rate 1998-2016Document1 pageMauritius Bank Lending Rate 1998-2016AbhiRishiNo ratings yet

- AAIB Fixed Income Fund (Gozoor) : Fact Sheet JanuaryDocument2 pagesAAIB Fixed Income Fund (Gozoor) : Fact Sheet Januaryapi-237717884No ratings yet

- Edited Transcript: Thomson Reuters StreeteventsDocument15 pagesEdited Transcript: Thomson Reuters StreeteventsVivath LyNo ratings yet

- Investor Presentation (Company Update)Document34 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- Bull2014 2Document1 pageBull2014 2jspectorNo ratings yet

- Faisal Spinning Mills EPS, Dividends & RatiosDocument11 pagesFaisal Spinning Mills EPS, Dividends & Ratiosaitzaz ahmedNo ratings yet

- Grant Thornton Hotel Survey 2017Document10 pagesGrant Thornton Hotel Survey 2017Tyson NguyenNo ratings yet

- Facebook Q3 2014 EarningsDocument26 pagesFacebook Q3 2014 EarningsWanHeöNo ratings yet

- IRR Computation Excel Function & NPV VerificationDocument2 pagesIRR Computation Excel Function & NPV VerificationMohammed Zahin O VNo ratings yet

- Loan ElegibilityDocument17 pagesLoan ElegibilityAbdul Hakim ShaikhNo ratings yet

- University of Dhaka Department of International Business Course Code: IB-206 Assignment On Financial StatementsDocument3 pagesUniversity of Dhaka Department of International Business Course Code: IB-206 Assignment On Financial StatementsMd. Sakib HossainNo ratings yet

- Aet Jefferson BuyDocument11 pagesAet Jefferson BuysinnlosNo ratings yet

- Facebook Q4 2012 Investor Slide DeckDocument25 pagesFacebook Q4 2012 Investor Slide DeckJoshLowensohnNo ratings yet

- t1 Ovp 15eDocument4 pagest1 Ovp 15etstscribdNo ratings yet

- Thu AssetDocument3 pagesThu AssetThu Võ ThịNo ratings yet

- Morrison L ResumeDocument2 pagesMorrison L Resumeapi-459079302No ratings yet

- Rap2x Love Taka SobraDocument18 pagesRap2x Love Taka SobraRalph Christer MaderazoNo ratings yet

- Premium Monitor Nov11Document4 pagesPremium Monitor Nov11tomas.kujal8455No ratings yet

- 6.1 Findings: Ratio Is 1.5 in 2014. in The Year 2015, The Current Ratio of The Company Deteriorates Further ToDocument3 pages6.1 Findings: Ratio Is 1.5 in 2014. in The Year 2015, The Current Ratio of The Company Deteriorates Further TolkNo ratings yet

- Group Project: MGT 527 - 05WDocument19 pagesGroup Project: MGT 527 - 05WNaushilMaknojiaNo ratings yet

- Hotel Marketing KPIsDocument45 pagesHotel Marketing KPIsSPHM HospitalityNo ratings yet

- Financial Performance Analysis On: Uttara Bank LimitedDocument6 pagesFinancial Performance Analysis On: Uttara Bank LimitedAshik RahmanNo ratings yet

- CV - Manoranjan SamantarayDocument2 pagesCV - Manoranjan SamantarayAshis barmaNo ratings yet

- Marketing Analytics Tanking Bank Case Analysis: Presented by Shanya Rastogi M18-184Document6 pagesMarketing Analytics Tanking Bank Case Analysis: Presented by Shanya Rastogi M18-184ShanyaRastogiNo ratings yet

- CV Vilas LatestDocument3 pagesCV Vilas LatestSandeep FulhamNo ratings yet

- Figure 12: Implied ERP by Month: S&P 500 January 2009-CurrentDocument11 pagesFigure 12: Implied ERP by Month: S&P 500 January 2009-CurrentSteve sNo ratings yet

- Financial Analysis of PTCLDocument13 pagesFinancial Analysis of PTCLAhmad YounasNo ratings yet

- Ratio Analysis: Liquidity RatiosDocument5 pagesRatio Analysis: Liquidity RatiosVanshGuptaNo ratings yet

- Cash Flow For (Business Name) in (Financial Year) : Cash Flow July August September October November DecemberDocument5 pagesCash Flow For (Business Name) in (Financial Year) : Cash Flow July August September October November DecemberNishit SapatNo ratings yet

- Group 4-Revmgt Summary (Partial!!!!!!)Document3 pagesGroup 4-Revmgt Summary (Partial!!!!!!)Alyana Jean BabaoNo ratings yet

- Report PresentationDocument23 pagesReport PresentationdigitycoonNo ratings yet

- MirrDocument9 pagesMirralexandremorenoasuarNo ratings yet

- Analyze Financial Performance RelianceDocument19 pagesAnalyze Financial Performance RelianceAnjali KumariNo ratings yet

- Doing Financial ProjectionsDocument6 pagesDoing Financial ProjectionsJitendra Nagvekar50% (2)

- Analysis of Gulf Hotels (Oman) Company Limited's Financial RatiosDocument20 pagesAnalysis of Gulf Hotels (Oman) Company Limited's Financial RatiosRajshekhar BoseNo ratings yet

- Donald Lalangui - CV-Contabilidad-2023-ENGLISHDocument2 pagesDonald Lalangui - CV-Contabilidad-2023-ENGLISHDonald Lalangui D.No ratings yet

- Analysis of Hotel and Restaurant Tax Collection in MataramDocument6 pagesAnalysis of Hotel and Restaurant Tax Collection in MataramBajang Rafiq Zham-ZhameyNo ratings yet

- 4 PDFDocument11 pages4 PDFdiahNo ratings yet

- WNS Announces Q2 2014 EarningsDocument11 pagesWNS Announces Q2 2014 EarningssusegaadNo ratings yet

- Accounts Receivable NarrativeDocument3 pagesAccounts Receivable NarrativeCaterina De LucaNo ratings yet

- Course Title: Fundamentals of Banking Subject Code: BNK-201Document23 pagesCourse Title: Fundamentals of Banking Subject Code: BNK-201Shaon Chandra Saha 181-11-5802No ratings yet

- Textbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsFrom EverandTextbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsNo ratings yet