Professional Documents

Culture Documents

Abstract Capital Market Sharkhan

Uploaded by

saiyuvatechCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Abstract Capital Market Sharkhan

Uploaded by

saiyuvatechCopyright:

Available Formats

ABSTRACT

The Capital market is a market for financial assets which have a long or

indefinite maturity. Generally, it deals with long term securities which have a maturity

period of above one year. Capital market may be further divided into three types

Industrial securities market, Government securities market and Long term loans market.

Industrial securities market is further divided into two types primary market or new issue

market and secondary market or stock exchange. Government securities market is also

called as Gilt-Edged securities market. It is the market where Government securities are

traded. Long term loans market is divided into three types Term loans market, Mortgages

market and Financial guarantees market.

Absence of capital market instruments acts as a deterrent to capital formation and

economic growth. Resources would remain idle if finances are not funneled through the

capital market.

The capital market instruments serves as an important source for the productive

use of the economys savings. It mobilizes the savings of the peoples for further

investment and thus avoids their wastage in unproductive uses.

It provides incentives to saving and facilitates capital formation by offering

suitable rates of interest as the price of capital.

It provides an avenue for investors, particularly the household sector to invest in

financial assets which are more productive than physical assets.

It facilitates increase in production and productivity in the economy and thus,

enhances the economic welfare of the society. Thus, it facilitates the movement

of stream of command over capital to the point of highest yield .

A healthy capital market instrument consisting of expert intermediaries promotes

stability in values of securities representing capital funds.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Guidelines and Joining Kit For New JoineesDocument3 pagesGuidelines and Joining Kit For New JoineesGaurav KumarNo ratings yet

- Sap Fico SatyanarayanaDocument0 pagesSap Fico Satyanarayanasubbavelama100% (3)

- Project Report For MBA StudentDocument74 pagesProject Report For MBA StudentSuman Das100% (1)

- Project Title1Document1 pageProject Title1saiyuvatechNo ratings yet

- Ilovepdf MergedDocument100 pagesIlovepdf MergedsaiyuvatechNo ratings yet

- Cost and Management Accounting and Quandative TechniqueDocument86 pagesCost and Management Accounting and Quandative TechniquesaiyuvatechNo ratings yet

- Indian Financial System OverviewTITLEDocument10 pagesIndian Financial System OverviewTITLEsaiyuvatechNo ratings yet

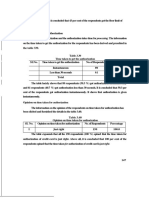

- Inferred: The Variables Age and Satisfaction With TheDocument1 pageInferred: The Variables Age and Satisfaction With ThesaiyuvatechNo ratings yet

- 001 - Scan13 26-41Document16 pages001 - Scan13 26-41saiyuvatechNo ratings yet

- 006 - Scan12 New5Document5 pages006 - Scan12 New5saiyuvatechNo ratings yet

- SBI Has Business Target Given SignificantDocument30 pagesSBI Has Business Target Given SignificantsaiyuvatechNo ratings yet

- Table 3.68 Education and Rating ICICI Bank Card Chi Square Card TotalDocument5 pagesTable 3.68 Education and Rating ICICI Bank Card Chi Square Card TotalsaiyuvatechNo ratings yet

- Time & Settlement Opinions for Credit Card EDC MachinesDocument5 pagesTime & Settlement Opinions for Credit Card EDC MachinessaiyuvatechNo ratings yet

- Diploma / Deg Telecom Urgent Opening Mumbai 13,200Document2 pagesDiploma / Deg Telecom Urgent Opening Mumbai 13,200saiyuvatechNo ratings yet

- Country Code Name Separator Expiration Date or Separator Discretionary Three Characters Two To 26 One Character Four CharactersDocument11 pagesCountry Code Name Separator Expiration Date or Separator Discretionary Three Characters Two To 26 One Character Four CharacterssaiyuvatechNo ratings yet

- SBI Has Business Target Given SignificantDocument30 pagesSBI Has Business Target Given SignificantsaiyuvatechNo ratings yet

- Table 3,77 Occupation and Satisfaction With The SchemesDocument1 pageTable 3,77 Occupation and Satisfaction With The SchemessaiyuvatechNo ratings yet

- Table 3.83 Annual Income and Satisfaction With The Schemes: TotalDocument1 pageTable 3.83 Annual Income and Satisfaction With The Schemes: TotalsaiyuvatechNo ratings yet

- Hosting Services Agreement PDFDocument14 pagesHosting Services Agreement PDFsaiyuvatechNo ratings yet

- Table 3.83 Annual Income and Satisfaction With The Schemes: TotalDocument1 pageTable 3.83 Annual Income and Satisfaction With The Schemes: TotalsaiyuvatechNo ratings yet

- Skill Gap in Auto Services SectorDocument13 pagesSkill Gap in Auto Services SectorSalman MajeedNo ratings yet

- Nfo ProjectDocument75 pagesNfo Projectankitverma9716No ratings yet

- Symbiosis TopicsDocument3 pagesSymbiosis TopicsAnonymous 3DQemvNo ratings yet

- Information About Coffees, Smoothis and Mocktails: Coffee ArabicaDocument2 pagesInformation About Coffees, Smoothis and Mocktails: Coffee ArabicasaiyuvatechNo ratings yet

- Inventory MGT Zuari CementDocument81 pagesInventory MGT Zuari CementsaiyuvatechNo ratings yet

- Form 1: Employee Personal Information Name of DepartmentDocument12 pagesForm 1: Employee Personal Information Name of DepartmentRajashree PatilNo ratings yet

- Derivatives (Futures & Options) - NetworthDocument102 pagesDerivatives (Futures & Options) - NetworthsaiyuvatechNo ratings yet

- Sales & Promotions-CocacolaDocument76 pagesSales & Promotions-CocacolasaiyuvatechNo ratings yet

- Advertising L&TDocument80 pagesAdvertising L&TsaiyuvatechNo ratings yet

- History of Stock Broking IndustryDocument10 pagesHistory of Stock Broking IndustrysaiyuvatechNo ratings yet