Professional Documents

Culture Documents

Netscape Case Solution

Uploaded by

Maksym MalovichkoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Netscape Case Solution

Uploaded by

Maksym MalovichkoCopyright:

Available Formats

Georgii Meshcheriakov 0939950

Marina Poluianova 0986821

Maksym Malovichko 0986794

Loc Minh Nguyen 0948398

Kateryna Rylova 0986764

Case 2

Netscape

Hand-in date:

01.03.16

Campus:

BI Oslo

Course code and name:

GRA6538 Applied Valuation

Executive summary

Netscape has a leading position in quickly growing IT-industry. Its strategy, give

away today, make money tomorrow, has lead to a negative bottom line. IPO was

chosen as remedy to the funding problem and the lead underwriters suggested

changing the offering price from $14 to $28 per share. The aim of the analysis is

to determine whether such a change is appropriate given potential risks and

rewards. The discounted future cash flow analysis suggests stock value of $30.91,

implying that, a price of $28 per share is reasonable and should be approved by

the Board.

Analysis

By offering the browser free of charge for the business-to-customer (B2C) and

selling server software Business-to-Business (B2B) the company has gained 75%

of the market. Despite its first mover advantage stemming from the innovativeness

and user-friendliness brought by the click-and-point browser, Netscapes

position is rather fragile and revenue growth is likely to gradually deteriorate in

1996-2005. Quick IT development and threat of entry will not allow for stable

revenue growth (g) without additional investments in research and development

(R&D) to bring new innovative solutions to the demanding market. Therefore,

before reaching the steady state, g is assumed to follow a pattern: 95%, 80%,

75%, 60%, 55%, 50%, 35%, 15%, 12%, 8% (the analysis assumptions in the

exhibit 1). Using Microsoft as a benchmark, other operating expenses and Capital

expenditure(CAPEX) are assumed to decline to 20% and 10% of revenue

respectively in 2001. To see if the new IPO price suggested by the underwriter is

reasonable a discounted cash flow (DCF) analysis was conducted.

First, Netscapes cost of capital (WACC) 7.81% was calculated (exhibit 2) using

the cost of equity from the CAPM model 11.09%, cost of debt calculated as ratio

between interest expenses and average 2-year debt 8.69% (cost of debt is close to

8.8% - lending interest rate of the US banks in 1995 which proves that the

calculation is correct), debt and equity values from the balance sheet, and the tax

rate 34%.

Next, total equity value was found as the sum of net present value of free cash

flows in the explicit forecast period (NPV FCF) and the discounted terminal value

(NPV TV). The first one is calculated using the indirect method, discounting by

WACC. The second one is found using the key value driver formula assuming 4%

perpetual growth rate following 2005 (exhibit 3 provides all the calculations).

Netscape market value of equity is thus $1.175 billion implying a price per share

of $30.91. This provides evidence that increasing the price to $28 is reasonable.

This price ($28) could also be obtained in a scenario where revenue growth was

constant at approximately 43.61%, which is highly unrealistic in a quickly

changing environment of software industry.

$161 million of capital can be raised after going on IPO, excluding the

underwriter fees. This should allow Netscape to divert necessary cash to product

development to retain its market share and grow revenues. Netscape needs $ 975

mln to cover other operational expenses over 10 years (1995-2005) and $ 11.27

mln as IPO cost (fees to underwriters).

All in call, we recommend accepting the offer of increasing the price to 28$ per

share and believe it is still slightly underpriced, however we believe that future

market fluctuations might disrupt the reasonably high projected growth rate.

Exhibit 1

The analysis assumptions

Assumptions

Cost of revenues

10.4% of revenues

R&D

36.8% of revenues

Other operating expenses

decline to 20% of revenues by 2001

Capital expenditures

decline to 10% of revenues by 2001

Depreciation

straight-line depreciation over 10 years

Changes in Net Working Capital

Long-term steady-state growth

4% annually after 2005

Growth rate of sales

95%, 80% ,75%, 60%, 55%, 50% ,35%, 15%,

12%, 8%

Long-term risk-free rate

6.71%

Tax rate

34%

Risk-premium

6%

Exhibit 2

Weighted average cost of capital calculation

WACC calculation

Long-term risk-free rate

6.71%

Risk-premium

6%

Market beta

0.73

Cost of equity

11.09%

Interest expenses

$ 128655

Average 2-year debt

$ 1480665.5

Cost of debt

8.69%

Debt

$ 26056682

Equity

$ 16474521

Tax rate

34%

WACC

7.81%

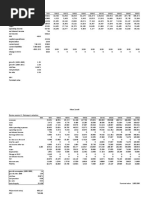

Exhibit 3

Free cash flow and total value calculation

You might also like

- Netscape HomeworkDocument3 pagesNetscape HomeworkJaime Zulueta0% (2)

- Netscape Valuation For IPO... PV of FCFs-2Document1 pageNetscape Valuation For IPO... PV of FCFs-2aveenobeatnikNo ratings yet

- Netscape Growth Rate Needed to Justify $28 Share PriceDocument9 pagesNetscape Growth Rate Needed to Justify $28 Share PriceRasheeq Rayhan100% (1)

- 1.2. Netscape Sample Soln by A Student in A Previous Offering of The CourseDocument5 pages1.2. Netscape Sample Soln by A Student in A Previous Offering of The CoursehadeshungNo ratings yet

- Analysis of Historical Financials and Projections to Calculate Stock PriceDocument2 pagesAnalysis of Historical Financials and Projections to Calculate Stock Pricemc1012No ratings yet

- Netscape IPO ExcelDocument7 pagesNetscape IPO Exceldchristensen5100% (1)

- Netscape's Groundbreaking $1 Billion IPODocument28 pagesNetscape's Groundbreaking $1 Billion IPOfjvillegas0% (1)

- Netscape's $140 Million IPO in 1995Document5 pagesNetscape's $140 Million IPO in 1995Anonymous F2NHsfqNo ratings yet

- Netscape CaseDocument6 pagesNetscape CaseVikram RathiNo ratings yet

- NetscapeDocument3 pagesNetscapeulix1985No ratings yet

- Netscape ProformaDocument6 pagesNetscape ProformabobscribdNo ratings yet

- Bidding For Antamina - : Applied Valuation Case at Handelshøyskolen BIDocument6 pagesBidding For Antamina - : Applied Valuation Case at Handelshøyskolen BIAnh ThoNo ratings yet

- Investment Banking: Individual Assignment 2Document5 pagesInvestment Banking: Individual Assignment 2Aakash Ladha100% (3)

- Tire City AnalysisDocument3 pagesTire City AnalysisKailash HegdeNo ratings yet

- Tire City IncDocument12 pagesTire City Incdownloadsking100% (1)

- Mercury AthleticDocument13 pagesMercury Athleticarnabpramanik100% (1)

- UST Debt Policy and Capital Structure AnalysisDocument10 pagesUST Debt Policy and Capital Structure AnalysisIrfan MohdNo ratings yet

- Financial analysis of American Chemical Corporation plant acquisitionDocument9 pagesFinancial analysis of American Chemical Corporation plant acquisitionBenNo ratings yet

- S2 G9 Hanson CaseDocument2 pagesS2 G9 Hanson CaseShraddha PandyaNo ratings yet

- American Chemical CorporationDocument8 pagesAmerican Chemical CorporationAnastasiaNo ratings yet

- Assignment 7 - Clarkson LumberDocument5 pagesAssignment 7 - Clarkson Lumbertesttest1No ratings yet

- Tire City Case Financial ForecastDocument14 pagesTire City Case Financial ForecastXRiloXNo ratings yet

- Mercury AthleticDocument17 pagesMercury Athleticgaurav100% (1)

- Tottenham Case HBS Financials ValuationDocument14 pagesTottenham Case HBS Financials ValuationPaco Colín0% (2)

- Hampton Machine Tool CompanyDocument2 pagesHampton Machine Tool CompanySam Sheehan100% (1)

- Lecture 6 Clarkson LumberDocument8 pagesLecture 6 Clarkson LumberDevdatta Bhattacharyya100% (1)

- Ameritrade Case PDFDocument6 pagesAmeritrade Case PDFAnish Anish100% (1)

- Netscape Initial Public OfferingDocument1 pageNetscape Initial Public Offeringaruncec2001No ratings yet

- Year 1979 1980 1981 1982 1983 1984 Period 0 1 2 3 4 5Document30 pagesYear 1979 1980 1981 1982 1983 1984 Period 0 1 2 3 4 5shardullavande33% (3)

- Interco CaseDocument12 pagesInterco CaseRyan LamNo ratings yet

- Netscape: Simulation Techniques For Company Valuation: CentreDocument4 pagesNetscape: Simulation Techniques For Company Valuation: CentreRia MehtaNo ratings yet

- Tire City CaseDocument12 pagesTire City CaseAngela ThorntonNo ratings yet

- Whether Merck Should Take Licensing of DavanrikrugDocument19 pagesWhether Merck Should Take Licensing of DavanrikrugratishmayankNo ratings yet

- Tire - City AnalysisDocument17 pagesTire - City AnalysisJustin HoNo ratings yet

- Cadillac Cody CaseDocument13 pagesCadillac Cody CaseKiran CheriyanNo ratings yet

- Hampton Suggested AnswersDocument5 pagesHampton Suggested Answersenkay12100% (3)

- Mercury Athletic Footwear Acquisition AnalysisDocument9 pagesMercury Athletic Footwear Acquisition Analysisandy117950% (2)

- NetscapeDocument17 pagesNetscapeaquel19830% (1)

- Fonderia Di Torino FinancialsDocument4 pagesFonderia Di Torino Financialspeachrose12No ratings yet

- 13 American Chemical Corporation - Group 13Document5 pages13 American Chemical Corporation - Group 13Anonymous MpSSPQi0% (1)

- Financial Performance Comparison of Tobacco CompaniesDocument9 pagesFinancial Performance Comparison of Tobacco Companiesjchodgson0% (2)

- Tire City Case Study SolutionDocument2 pagesTire City Case Study SolutionPrathap Sankar0% (1)

- TCI's Financial Performance and Forecasts 1993-1997Document8 pagesTCI's Financial Performance and Forecasts 1993-1997Kyeli TanNo ratings yet

- Sampa Video CaseDocument6 pagesSampa Video CaseRahul BhatnagarNo ratings yet

- Yell Case Exhibits Growth RatesDocument12 pagesYell Case Exhibits Growth RatesJames MorinNo ratings yet

- Tire City Spreadsheet SolutionDocument6 pagesTire City Spreadsheet Solutionalmasy99100% (1)

- MscBA 2012 - Advanced Corporate Finance Coursework-2Document78 pagesMscBA 2012 - Advanced Corporate Finance Coursework-2joaopsmt100% (1)

- Mercury Athletic Case SectionBDocument15 pagesMercury Athletic Case SectionBVinith VemanaNo ratings yet

- Sampa Video Home Delivery ProjectDocument26 pagesSampa Video Home Delivery ProjectFaradilla Karnesia100% (2)

- RJR NabiscoDocument22 pagesRJR Nabiscokriteesinha100% (2)

- Tire City AssignmentDocument7 pagesTire City AssignmentShivam Kanojia100% (1)

- Case BBBYDocument7 pagesCase BBBYgregordejong100% (1)

- Color ScopeDocument12 pagesColor Scopeprincemech2004100% (1)

- Tire City IncDocument12 pagesTire City IncMahesh Kumar Meena100% (1)

- Chap 016Document8 pagesChap 016Bobby MarionNo ratings yet

- Calculating AHC's Cost of Capital Using CAPMDocument9 pagesCalculating AHC's Cost of Capital Using CAPMElaineKongNo ratings yet

- McKinsey - Creating Value in Semiconductor IndustryDocument10 pagesMcKinsey - Creating Value in Semiconductor Industrybrownbag80No ratings yet

- Financial Institutions ManagementDocument8 pagesFinancial Institutions ManagementJesmon RajNo ratings yet

- Capital Bank considers new ATM network optionsDocument10 pagesCapital Bank considers new ATM network optionsAnita GaoNo ratings yet

- DR-M260 User Manual ENDocument87 pagesDR-M260 User Manual ENMasa NourNo ratings yet

- A Compilation of Thread Size InformationDocument9 pagesA Compilation of Thread Size Informationdim059100% (2)

- Interactive Architecture Adaptive WorldDocument177 pagesInteractive Architecture Adaptive Worldhoma massihaNo ratings yet

- APLICACIONES PARA AUTOS Y CARGA LIVIANADocument50 pagesAPLICACIONES PARA AUTOS Y CARGA LIVIANApancho50% (2)

- LTE EPC Technical OverviewDocument320 pagesLTE EPC Technical OverviewCristian GuleiNo ratings yet

- Retaining Wall-Masonry Design and Calculation SpreadsheetDocument6 pagesRetaining Wall-Masonry Design and Calculation SpreadsheetfarrukhNo ratings yet

- NDE Procedure - Radiographic TestingDocument43 pagesNDE Procedure - Radiographic TestingJeganeswaranNo ratings yet

- Caterpillar Ep15krtDocument37 pagesCaterpillar Ep15krtIvan MajikNo ratings yet

- Survey Report on Status of Chemical and Microbiological Laboratories in NepalDocument38 pagesSurvey Report on Status of Chemical and Microbiological Laboratories in NepalGautam0% (1)

- Revolutionizing Energy Harvesting Harnessing Ambient Solar Energy For Enhanced Electric Power GenerationDocument14 pagesRevolutionizing Energy Harvesting Harnessing Ambient Solar Energy For Enhanced Electric Power GenerationKIU PUBLICATION AND EXTENSIONNo ratings yet

- Gauss Contest: Grade 8Document4 pagesGauss Contest: Grade 8peter100% (1)

- Application of Fertility Capability Classification System in Rice Growing Soils of Damodar Command Area, West Bengal, IndiaDocument9 pagesApplication of Fertility Capability Classification System in Rice Growing Soils of Damodar Command Area, West Bengal, IndiaDr. Ranjan BeraNo ratings yet

- Maureen L. Walsh - Re-Imagining Redemption. Universal Salvation in The Theology of Julian of NorwichDocument20 pagesMaureen L. Walsh - Re-Imagining Redemption. Universal Salvation in The Theology of Julian of NorwichAni LupascuNo ratings yet

- Front Wheel Steering System With Movable Hedlights Ijariie5360Document6 pagesFront Wheel Steering System With Movable Hedlights Ijariie5360Ifra KhanNo ratings yet

- Lec9-Rock Cutting ToolsDocument35 pagesLec9-Rock Cutting ToolsAmraha NoorNo ratings yet

- Background of The Study Statement of ObjectivesDocument4 pagesBackground of The Study Statement of ObjectivesEudelyn MelchorNo ratings yet

- Patent for Fired Heater with Radiant and Convection SectionsDocument11 pagesPatent for Fired Heater with Radiant and Convection Sectionsxyz7890No ratings yet

- Reflection 2: WHAT DOES It Mean To Be A Pacific Islander Today and in The Future To Me?Document5 pagesReflection 2: WHAT DOES It Mean To Be A Pacific Islander Today and in The Future To Me?Trishika NamrataNo ratings yet

- CP 343-1Document23 pagesCP 343-1Yahya AdamNo ratings yet

- Feline DermatologyDocument55 pagesFeline DermatologySilviuNo ratings yet

- Juan Martin Garcia System Dynamics ExercisesDocument294 pagesJuan Martin Garcia System Dynamics ExercisesxumucleNo ratings yet

- CAE The Most Comprehensive and Easy-To-Use Ultrasound SimulatorDocument2 pagesCAE The Most Comprehensive and Easy-To-Use Ultrasound Simulatorjfrías_2No ratings yet

- ML AiDocument2 pagesML AiSUYASH SHARTHINo ratings yet

- Hypophosphatemic Rickets: Etiology, Clinical Features and TreatmentDocument6 pagesHypophosphatemic Rickets: Etiology, Clinical Features and TreatmentDeysi Blanco CohuoNo ratings yet

- Answer Key p2 p1Document95 pagesAnswer Key p2 p1Nafisa AliNo ratings yet

- Madeleine Ker - TakeoverDocument91 pagesMadeleine Ker - Takeover66677785100% (1)

- Sradham ChecklistDocument9 pagesSradham ChecklistpswaminathanNo ratings yet

- Tutorial On The ITU GDocument7 pagesTutorial On The ITU GCh RambabuNo ratings yet

- Who will buy electric vehicles Segmenting the young Indian buyers using cluster analysisDocument12 pagesWho will buy electric vehicles Segmenting the young Indian buyers using cluster analysisbhasker sharmaNo ratings yet

- Pitch Manual SpecializedDocument20 pagesPitch Manual SpecializedRoberto Gomez100% (1)