Professional Documents

Culture Documents

Sureshbhai (Challan)

Uploaded by

Ketan Dhameliya0 ratings0% found this document useful (0 votes)

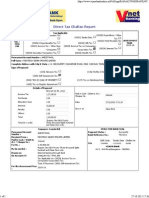

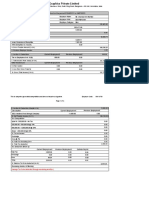

20 views1 pageThis document is a challan form submitted by Sureshbhai Gandalal Patel for income tax payment for the 2015-2016 assessment year. It indicates a self-assessment tax type of payment of Rs. 94,960 consisting of income tax of Rs. 76,396, surcharge of Rs. 0, education cess of Rs. 2,292, and interest of Rs. 16,272 with no penalty or other amounts. The form provides details of the taxpayer including PAN number and address as well as banking details of the tax payment.

Original Description:

Sureshbhai [Challan]

Original Title

Sureshbhai [Challan]

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a challan form submitted by Sureshbhai Gandalal Patel for income tax payment for the 2015-2016 assessment year. It indicates a self-assessment tax type of payment of Rs. 94,960 consisting of income tax of Rs. 76,396, surcharge of Rs. 0, education cess of Rs. 2,292, and interest of Rs. 16,272 with no penalty or other amounts. The form provides details of the taxpayer including PAN number and address as well as banking details of the tax payment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views1 pageSureshbhai (Challan)

Uploaded by

Ketan DhameliyaThis document is a challan form submitted by Sureshbhai Gandalal Patel for income tax payment for the 2015-2016 assessment year. It indicates a self-assessment tax type of payment of Rs. 94,960 consisting of income tax of Rs. 76,396, surcharge of Rs. 0, education cess of Rs. 2,292, and interest of Rs. 16,272 with no penalty or other amounts. The form provides details of the taxpayer including PAN number and address as well as banking details of the tax payment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Single Copy (to be sent to the ZAO)

Tax Applicable (Tick one)

CHALLAN

(0020)Income Tax on Comapanies (Corporation Tax)

NO./ ITNS 280

(0021) INCOME TAX (OTHER THAN COMPANIES)

[a]

PAN :-

Assessment Year

2015-2016

*ABCPP1758M

ABCPP1758M

ABCPP1758M

Name :-

SURESHBHAI GANDALAL PATEL

Address :-

21, NALKUNJ SOCIETY, CAMP ROAD, SHAHIBAUG, AHMEDABAD, GUJARAT-380004

Type of Payment (Tick One)

[ ]

[a ]

[ ]

Advance Tax (100)

Self Assessment Tax (300)

Tax on Regular Assessment (400)

Surtax (102)

Tax on Distributed Profits of Domestic Companies (106)

Tax on Distributed Income to Unit Holders (107)

DETAIL OF PAYMENTS

Amount (In `. Only)

Income Tax

[

[

[

]

]

]

FOR USE IN RECEIVING BANK

Debit to A/c / Cheque credited on

76396

Surcharge

0

DD

Education Cess

MM

YY

2292

Interest

16272

Penalty

Others

Total

SPACE FOR BANK SEAL

94960

Total (in words):

CRORES

LACS

THOUSANDS

Ninty Four

Paid in Cash/Debit to A/c/Cheque

No.

HUNDERDS

Nine

TENS

Six

UNITS

Zero

Dated

Drawn on

(Name of the Bank and Branch)

Date:

Signature of the Person making payment

Taxpayers Counterfoil (To be filled up by tax payer)

SPACE FOR BANK SEAL

PAN

ABCPP1758M

Received from

SURESHBHAI GANDALAL PATEL

Cash/Debit to A/c/Cheque No.

`. (in Words)

For `.

94960

Ninty Four Thousand Nine Hundred Sixty Only.

Drawn on

(Name of the Bank and Branch)

On account of income Tax on

Type of Payment

For the Assessment Year

Income Tax (Other than Company)

Self Assessment

Tax

2015-2016

ZenIT - A KDK Software Product

You might also like

- 27180Document1 page27180nupursingh604No ratings yet

- RSD3Document1 pageRSD3Thaneshwar MishraNo ratings yet

- Challan 280-3Document1 pageChallan 280-3KamalNo ratings yet

- Challan 280Document1 pageChallan 280purepuneetNo ratings yet

- ChallanDocument1 pageChallanRAVINDERNo ratings yet

- Challan NO./ ITNS 280: A D G P M 4 8 2 8 BDocument1 pageChallan NO./ ITNS 280: A D G P M 4 8 2 8 BKarur KumarNo ratings yet

- Challan 280Document1 pageChallan 280Mohit MehtaNo ratings yet

- Anita SahgalDocument3 pagesAnita SahgalNaveen AsthanaNo ratings yet

- CHALLAN 280 For 2013-14Document1 pageCHALLAN 280 For 2013-14mohanktvmNo ratings yet

- Axis Bank Axis Bank Axis Bank Axis Bank: Challan No./Itns 280Document1 pageAxis Bank Axis Bank Axis Bank Axis Bank: Challan No./Itns 280bha_goNo ratings yet

- TDS TDSChallan280Document1 pageTDS TDSChallan280sikander1990No ratings yet

- Challan No. / Itns 280: Tax Applicable (Tick One) Assessment YearDocument1 pageChallan No. / Itns 280: Tax Applicable (Tick One) Assessment Yearanaga1982No ratings yet

- 15-16 Self Assesment TaxDocument1 page15-16 Self Assesment TaxmohanNo ratings yet

- VP Goyalt Tds ChallanDocument1 pageVP Goyalt Tds Challanverma619No ratings yet

- Challan NO./ ITNS 280Document2 pagesChallan NO./ ITNS 280amritaasraaNo ratings yet

- AQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001Document1 pageAQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001pavanNo ratings yet

- Challan NO./ ITNS 280: Crores Hundreds Tens Thousands Units LacsDocument2 pagesChallan NO./ ITNS 280: Crores Hundreds Tens Thousands Units LacsDharmeshNo ratings yet

- CBDT Tax Payment Return ReceiptDocument1 pageCBDT Tax Payment Return ReceiptAppurva ShahNo ratings yet

- April 1Document1 pageApril 1Dhaneswar MajhiNo ratings yet

- 2011 ITR1 r2Document3 pages2011 ITR1 r2Zafar IqbalNo ratings yet

- Financial Results For December 31, 2015 (Result)Document3 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Retail / Tax Invoice: Gstin Pan/ItDocument1 pageRetail / Tax Invoice: Gstin Pan/ItPriya MenonNo ratings yet

- Form PDF 690991540220622Document10 pagesForm PDF 690991540220622Vijay BhaipNo ratings yet

- Gross Total Income (1+2c) 4: Import Previous VersionDocument4 pagesGross Total Income (1+2c) 4: Import Previous Versionbalajiv_mailNo ratings yet

- Gross Total Income (1+2c) 4: System CalculatedDocument3 pagesGross Total Income (1+2c) 4: System CalculatedDHARAMSONINo ratings yet

- Invoice SampleDocument1 pageInvoice Sampleolgutza123No ratings yet

- ITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamDocument11 pagesITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamcachandhiranNo ratings yet

- Form PDF 768656890080722Document10 pagesForm PDF 768656890080722naveen kumarNo ratings yet

- Assessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DateDocument3 pagesAssessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DatethakurrobinNo ratings yet

- IT Return 2011 2012Document3 pagesIT Return 2011 2012swapnil6121986No ratings yet

- Harley Davidson I.S CS 2010Document1 pageHarley Davidson I.S CS 2010Rich ChuaNo ratings yet

- Income TaxDocument6 pagesIncome TaxKuldeep HoodaNo ratings yet

- ITNS 280: Challan No. Challan No. ITNS 281Document1 pageITNS 280: Challan No. Challan No. ITNS 281Saravana KumarNo ratings yet

- Sri Ram SilksDocument1 pageSri Ram SilksMathanagopal KNo ratings yet

- Super Bakers (India) LTD.: Ref: Company Code No. 530735Document3 pagesSuper Bakers (India) LTD.: Ref: Company Code No. 530735Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Return of Total Income/Statement of Final TaxationDocument1 pageReturn of Total Income/Statement of Final TaxationJazzy BadshahNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- 201111320114552152IT-2 2011withSurchargeWithoutformulawithPEFDocument7 pages201111320114552152IT-2 2011withSurchargeWithoutformulawithPEFOmer PashaNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Shug Am 42223Document11 pagesShug Am 42223Daman SharmaNo ratings yet

- J.B. Pardiwala and A.C. Rao, Jj. R/TAX APPEAL NO.192 OF 2019 JUNE 24, 2019Document25 pagesJ.B. Pardiwala and A.C. Rao, Jj. R/TAX APPEAL NO.192 OF 2019 JUNE 24, 2019baviv70579No ratings yet

- Challan F.Y 2012-13Document1 pageChallan F.Y 2012-13amit22505No ratings yet

- Form PDF 784967040061122Document10 pagesForm PDF 784967040061122Asfa rehmanNo ratings yet

- Assessment Year Indian Income Tax Return SahajDocument7 pagesAssessment Year Indian Income Tax Return SahajallipraNo ratings yet

- BSNL Mobile Bill: Current Invoice Details RsDocument1 pageBSNL Mobile Bill: Current Invoice Details Rsk v reddyNo ratings yet

- Ahmad Hassan Textile Mills Limited: Income StatementDocument6 pagesAhmad Hassan Textile Mills Limited: Income StatementYasir SaleemNo ratings yet

- Challan 280Document2 pagesChallan 280ravibhartia1978No ratings yet

- Form 1620092010Document5 pagesForm 1620092010Chidurala KrishnaNo ratings yet

- IT-2 2011 With Formula and Surcharge and Annex DDocument15 pagesIT-2 2011 With Formula and Surcharge and Annex DPatti DaudNo ratings yet

- April 3Document1 pageApril 3Dhaneswar MajhiNo ratings yet

- Sachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Document3 pagesSachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Sachin KumarNo ratings yet

- Financial Statement Model For Colgate General AssumptionDocument4 pagesFinancial Statement Model For Colgate General AssumptioncphanhuyNo ratings yet

- Single (Copy To Be Sent The ZAO)Document1 pageSingle (Copy To Be Sent The ZAO)James GonzalezNo ratings yet

- Oct 1Document1 pageOct 1Dhaneswar MajhiNo ratings yet

- Income Tax Calculation For The Period 01/04/2015 To 24/07/2015Document4 pagesIncome Tax Calculation For The Period 01/04/2015 To 24/07/2015ChandanNo ratings yet

- Itr 4 - Ay 2022-23 - VarunDocument10 pagesItr 4 - Ay 2022-23 - VarunAkash AggarwalNo ratings yet

- Feb 6Document1 pageFeb 6Dhaneswar MajhiNo ratings yet

- Sagar B. Purohit: Curriculum VitaeDocument3 pagesSagar B. Purohit: Curriculum VitaeKetan DhameliyaNo ratings yet

- Candle Stick PatternsDocument77 pagesCandle Stick PatternsKetan Dhameliya100% (3)

- Endorsement R N Ghaduli Santalpur ProjectDocument2 pagesEndorsement R N Ghaduli Santalpur ProjectKetan DhameliyaNo ratings yet

- Design Features of A Unique Swing Bridge Hydraulic and Control SystemDocument19 pagesDesign Features of A Unique Swing Bridge Hydraulic and Control SystemKetan DhameliyaNo ratings yet

- Chapter02structural Design Using Staad Pro 195Document32 pagesChapter02structural Design Using Staad Pro 195satoni12No ratings yet

- Topics: Pore Water Pressure and Shear Strength (Lectures 17 To 26)Document4 pagesTopics: Pore Water Pressure and Shear Strength (Lectures 17 To 26)Ketan DhameliyaNo ratings yet

- Celebrity GreenDocument20 pagesCelebrity GreenKetan DhameliyaNo ratings yet

- Design of SlabDocument3 pagesDesign of SlabKetan Dhameliya100% (2)

- AMC Recruitment Advt No 13 1516 Town Planning Specialist Urban Planner OtherDocument8 pagesAMC Recruitment Advt No 13 1516 Town Planning Specialist Urban Planner OtherKetan DhameliyaNo ratings yet

- Design of SlabDocument3 pagesDesign of SlabKetan Dhameliya100% (2)

- Kashmir Earthquake Case Study 29024 2Document10 pagesKashmir Earthquake Case Study 29024 2Ketan DhameliyaNo ratings yet

- Phase-2 Voided SlabDocument16 pagesPhase-2 Voided SlabKetan DhameliyaNo ratings yet