Professional Documents

Culture Documents

Maslow Therory On Car

Uploaded by

Apoorv GuptaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Maslow Therory On Car

Uploaded by

Apoorv GuptaCopyright:

Available Formats

It’s all in the brand

S A N K A R R A D H A K R I S H N A N

F

OR many Indians owning a

car was just a dream till the

Maruti 800 came along in the

mid 1980s and shook the industry

out of its stupor. The fifteen-odd

years since then have seen a virtu-

al car revolution in the country;

both the number of brands avail-

able and the number of cars on the

road have increased in geometric

progression. Today, almost every

major international car manufac-

turer is present in the country. Methodology

But what is it that makes an

increasing number of Indians Urban Pulse is Business Line’s research-based publication, with each issue

decide to buy a car, despite hav- examining a different theme. The focus of the current issue is ‘buying a car’.

ing, in many instances, to borrow The study, conducted in October-November 2000 by Indica Research

substantial sums of money for Bangalore, had two modules: a qualitative round followed by a quantitative

this? How do potential car buyers round. The qualitative segment, which was conducted in New Delhi, took the

go about the task of buying a car? form of four focus group discussions. While two separate focus groups were

What are their sources of informa- conducted for the owners of Maruti 800s and Maruti Esteems, the third

tion on the various brands of cars group targeted the owners of cars such as the Matiz, the Zen, the Santro and

in the market? How do they actu- the Ikon. The final group focused on the owners of the Lancer, the

ally decide on a particular car Opel and the City.

brand or model? Does advertising The quantitative module covered 875 respondents in five cities – Bangalore,

influence their choice of brand? Chennai, Hyderabad, Mumbai and New Delhi. Approximately 80 per cent of

Where do they find the money to the respondents from the five centres belonged to the SEC A classification. Of

buy a car? Questions such as these these 52 per cent were from the SEC A1 segment and the remaining 26 per cent

abound. from the SEC A2 segment.

To provide an answer to these The results of the qualitative and quantitative modules were distilled

questions, Business Line commis- to obtain information on issues such as why people buy a car, factors that

sioned Project Beatle, a Business affect the purchase process, how people go about buying a car, the factors

Line-Indica Research survey, to that influence the choice of brands, how car purchases are financed, consumer

decipher the mind of the Indian perceptions of the different car finance companies and so on. ■

car buyer. The findings of the

study are the basis of this issue of

Urban Pulse.

The study drives home the point

that branding is here to stay. This

r

k u ma

is especially true of a category

such as cars, where it is often dif-

ficult to distinguish between com-

r em

peting models on purely technical

Graphic by J. A .P

or functional parameters. The

brand thus becomes the most

meaningful differentiator and a

‘safe’ choice.

And while functional factors do

trigger the decision to purchase a

Urban Pulse ✦ Business Line ✦ June 2001 5

The study found A point thrown up

that both rational by the study is that

and emotional ads do not have

factors trigger the any perceptible

decision to buy a impact on the

car and also operate choice of a specific

throughout the brand by the

purchase process. prospective buyer.

car, the wheels are most often set in of the conventional four. At the bot- feels it’s an expression of his per- the primary source for most buyers,

motion by emotional need-based tom of the pyramid is the first-time sonality. Thus a wealthy person followed by loans from private

factors. The study found that the buyer, for whom a car conveys a could drive a jeep because he banks and public sector banks.

more rational reasons for buying a sense of belonging. For those at this believes that it is a reflection of his With more car brands set to enter

car are frequently sparked off by level factors such as family and zest for the road less travelled. the country, and existing players

the psychological benefits that peer pressure and the need to A thought-provoking point planning to launch new models, the

owning a car bring. Emotions also upgrade from a two-wheeler exert a thrown up by the survey is the view options available to the prospective

work throughout the purchase great deal of influence. Also work- that advertising does not have any buyer are going to increase.

process, right down to the choice of ing on the minds of those at this impact on the choice of a particular However, taking a decision on

the brand. stage of the hierarchy of needs is brand by the prospective buyer. which model to buy is also going to

A slight variation of Maslow’s the craving to own a car. And once While a fair proportion of the get more challenging. For the

hierarchy of needs operates in this this craving has been satisfied the respondents declared that they did Indian car buyer it’s perhaps time

category, with three levels instead result is a feeling of belonging, take a dekko at car ads, only a very to get more market savvy. ■

achievement and confidence. small number said that they believe

At the next level is the desire for a the information in these ads. Also a

car as a status symbol. Here, owner- cause for thought is the sentiment

ship of a car is a reflection of who expressed by a good number of the

Size of car owned you are. At this level, choice of a car respondents that advertising is real- Ownership: New vs second-hand cars

is influenced by factors such as per- ly not needed in a category such as 100

80 formance, quality and after-sales cars. New Second-hand (%)

Small Mid-range Luxury (%)

70 service. In addition to that is the The study also had bad news for 80

need to move up the social ladder all those Web sites on cars. Only a

60

and to be seen to be doing so. A car very small proportion of the

50 60

ceases to be merely a mode of trans- respondents used this medium to

40 port, but also becomes a message to gather information prior to pur-

the world. So aspects such as luxu- chase, and still fewer actually trust 40

30

ry and comfort matter to those at the information they got off the

20 this level. Net. 20

10 And at the top of the pyramid is And for financing their purchase

the desire for self expression most of the respondents opted to 0

0 through the car one owns. A person use multiple sources, with some All Del Mum Chn Blr Hyd

All Del Mum Chn Blr Hyd

at this level is more likely to be dri- respondents going in for as many as

In some cases column totals may not add up to 100 per cent as multiple responses were elicited from respondents. ving a particular car because he four sources. Personal savings were In some cases column totals may not add up to 100 per cent as multiple responses were elicited from respondents.

6 Urban Pulse ✦ Business Line ✦ June 2001 Urban Pulse ✦ Business Line ✦ June 2001 7

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Powershift TransmissionsDocument27 pagesPowershift TransmissionsJonathanDavidDeLosSantosAdornoNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Surging & Blow Out of Loop Seals in A CFBC BoilerDocument9 pagesSurging & Blow Out of Loop Seals in A CFBC Boilermohamed faragNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Control and On-Off Valves GuideDocument87 pagesControl and On-Off Valves Guidebaishakhi_b90100% (3)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- LogDocument27 pagesLogmilli0chilliNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Varco Manual ElevatorDocument54 pagesVarco Manual ElevatorJohn Jairo Simanca Castillo100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Gsxp07er Opera1tion Manual PDFDocument94 pagesGsxp07er Opera1tion Manual PDFMohamed SaadAllahNo ratings yet

- AMG ActuatorsDocument12 pagesAMG ActuatorsMohan ArumugavallalNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Man Power PlanningDocument5 pagesMan Power PlanningKarthik AchinNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Unit4questions 100415042439 Phpapp01Document4 pagesUnit4questions 100415042439 Phpapp01Mohamad HishamNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- DS450 Shop Manual (Prelim)Document94 pagesDS450 Shop Manual (Prelim)GuruRacerNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- InductorsDocument13 pagesInductorsManish AnandNo ratings yet

- VHF Low Loss Band-Pass Helical Filter For 145 MHZ - English NewDocument33 pagesVHF Low Loss Band-Pass Helical Filter For 145 MHZ - English NewSharbel AounNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 1893 Shadow RunDocument6 pages1893 Shadow RungibbamonNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Project Hydraulics and HydrologyDocument17 pagesProject Hydraulics and HydrologyEiyra NadiaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Updated After 11th BoS Course Curriculum - B.tech CSEDocument120 pagesUpdated After 11th BoS Course Curriculum - B.tech CSEAnonymous 9etQKwWNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Basicline BL 21t9stDocument28 pagesBasicline BL 21t9stgabriel6276No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

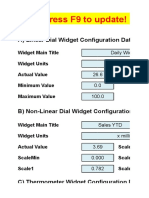

- Excel Dashboard WidgetsDocument47 pagesExcel Dashboard WidgetskhincowNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Msds Thinner 21-06Document8 pagesMsds Thinner 21-06ridhowibiiNo ratings yet

- Design of A 120 In.-Diameter Steel Bifurcation With A Small Acute Angle For A High-Pressure PenstockDocument10 pagesDesign of A 120 In.-Diameter Steel Bifurcation With A Small Acute Angle For A High-Pressure PenstockStalynMEcNo ratings yet

- LTE Advanced - Leading in Chipsets and Evolution: August 2013Document33 pagesLTE Advanced - Leading in Chipsets and Evolution: August 2013Muneeb JavedNo ratings yet

- Selection ToolsDocument13 pagesSelection ToolsDominador Gaduyon DadalNo ratings yet

- Star S07FS32DR Water Softener Repair PartsDocument1 pageStar S07FS32DR Water Softener Repair PartsBillNo ratings yet

- Transmission ImpairmentsDocument49 pagesTransmission ImpairmentsLaurentiuStanciuNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Fuels and Heat Power: A Guide to Fuels, Furnaces, and FiringDocument101 pagesFuels and Heat Power: A Guide to Fuels, Furnaces, and FiringAlyssa Clarizze MalaluanNo ratings yet

- The Causes of Shear Cracking in Prestressed Concrete Box Girder BridgesDocument10 pagesThe Causes of Shear Cracking in Prestressed Concrete Box Girder BridgesVipin Kumar ParasharNo ratings yet

- INFRARED BASED VISITOR COUNTER TECHNOLOGYDocument21 pagesINFRARED BASED VISITOR COUNTER TECHNOLOGYRahul KumarNo ratings yet

- Design Rules CMOS Transistor LayoutDocument7 pagesDesign Rules CMOS Transistor LayoututpalwxyzNo ratings yet

- Dissertation ErsatzteilmanagementDocument7 pagesDissertation ErsatzteilmanagementWriteMyEnglishPaperForMeCanada100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Data Visualization Q&A With Dona Wong, Author of The Wall Street Journal Guide To Information Graphics - Content Science ReviewDocument14 pagesData Visualization Q&A With Dona Wong, Author of The Wall Street Journal Guide To Information Graphics - Content Science ReviewSara GuimarãesNo ratings yet

- D72140GC10 46777 UsDocument3 pagesD72140GC10 46777 UsWilliam LeeNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)