Professional Documents

Culture Documents

Chap 18 - Selected Ex & Prob

Uploaded by

Steven SandersonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 18 - Selected Ex & Prob

Uploaded by

Steven SandersonCopyright:

Available Formats

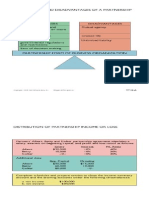

EXERCISE 183 BLUES TRAVELER CO. Partial Statement of Cash Flows For the Year Ended December 31, 2005 Cash flows from operating activities Net income......................................................... $163,000 Adjustments to reconcile net income to net cash provided by operating activities Depreciation expense................................ Increase in accounts receivable............... Decrease in inventory............................... Decrease in prepaid expenses................. Increase in accrued expenses payable....

Decrease in accounts payable.................. 31,000 Net cash provided by operating activities.................................................. $194,000

$30,000) (25,000) 15,000) 5,000) 10,000) (4,000 )

EXERCISE 185 (a) WILL SMITH COMPANY Statement of Cash Flows For the Year Ended December 31, 2005 Cash flows from operating activities Net income................................................. $125,000 ) Adjustments to reconcile net income to net cash provided by operating

activities Depreciation expense........................ Increase in accounts receivable....... Decrease in inventories..................... Decrease in accounts payable.......... 11,000 ) Net cash provided by operating activities.......................................... 136,000 ) Cash flows from investing activities Sale of land................................................. Purchase of equipment............................. Net cash used by investing activities.......................................... (40,000 ) Cash flows from financing activities Payment of cash dividends....................... Redemption of bonds................................ Issuance of common stock....................... Net cash used by financing activities.......................................... (60,000 ..................................................... ) Net increase in cash.......................................... 36,000 ) Cash at beginning of period............................. 22,000 ) Cash at end of period........................................ 58,000 ) (b)

$24,000) (9,000) 9,000) (13,000 ) 20,000) (60,000 ) (40,000) (50,000) 30,000)

$

Free cash flow: Cash from operations – capital expenditures – cash dividends $136,000 – $60,000 – $40,000 = $36,000

PROBLEM 185B (a) JAMES LYMAN COMPANY Statement of Cash Flows For the Year Ended December 31, 2005 Cash flows from operating activities Net income............................................................. $18,000 Adjustments to reconcile net income to net cash provided by operating activities Depreciation expense............................ Increase in accounts receivable........... Increase in inventory............................. Decrease in accounts payable.............. Decrease in income taxes payable....... (17,000 ............................................................) Net cash provided by operating activities.............................................. 1,000 Cash flows from investing activities Sale of equipment.......................................... Purchase of equipment................................. Net cash provided by investing activities.............................................. 4,000 Cash flows from financing activities Issuance of bonds......................................... Payment of cash dividends.......................... Net cash provided by financing activities.............................................. 3,000 ............................................................ Net increase in cash............................................. 8,000

$10,000 (9,000) (3,000) (10,000) (5,000)

11,000 (7,000 )

10,000 (7,000 )

Cash at beginning of period................................. 16,000 Cash at end of period............................................ $24,000 (b) $1,000 – $7,000 – $7,000 = ($13,000)

You might also like

- Reaction Paper To Chapter 6Document3 pagesReaction Paper To Chapter 6Steven Sanderson100% (1)

- Chapter 10 Reactioin PaperDocument2 pagesChapter 10 Reactioin PaperSteven SandersonNo ratings yet

- Chapter 19,20,21,22 Assesment QuestionsDocument19 pagesChapter 19,20,21,22 Assesment QuestionsSteven Sanderson100% (3)

- Chapters 3,4,5 and 6 Assesment QuestionsDocument10 pagesChapters 3,4,5 and 6 Assesment QuestionsSteven Sanderson100% (4)

- Chapters 10,11 and 12 Assessment QuestionsDocument10 pagesChapters 10,11 and 12 Assessment QuestionsSteven Sanderson100% (1)

- Reaction Report To Student OrientationDocument1 pageReaction Report To Student OrientationSteven SandersonNo ratings yet

- Reaction Paper To Chater 13Document2 pagesReaction Paper To Chater 13Steven Sanderson100% (5)

- Chapters 13, 14, 15, 16 Assessment QuestionsDocument11 pagesChapters 13, 14, 15, 16 Assessment QuestionsSteven Sanderson100% (5)

- Accounting II - Chap 14 Lecture NotesDocument6 pagesAccounting II - Chap 14 Lecture NotesSteven Sanderson100% (4)

- Chapter 19,20,21,22 Assesment QuestionsDocument19 pagesChapter 19,20,21,22 Assesment QuestionsSteven Sanderson100% (3)

- Chapter One and 2 Assessment QuestionsDocument6 pagesChapter One and 2 Assessment QuestionsSteven Sanderson100% (3)

- Chapter 20 Reaction PaperDocument3 pagesChapter 20 Reaction PaperSteven Sanderson100% (4)

- Acct II - Chapter 15 Lecture NotesDocument4 pagesAcct II - Chapter 15 Lecture NotesSteven Sanderson100% (1)

- Chapters 7,8,9 Assesment QuestionsDocument9 pagesChapters 7,8,9 Assesment QuestionsSteven Sanderson100% (3)

- Chapter 21 Reaction PaperDocument4 pagesChapter 21 Reaction PaperSteven Sanderson100% (1)

- Acounting II - Chap 12 Accounting Principles - Part II - SLNDocument12 pagesAcounting II - Chap 12 Accounting Principles - Part II - SLNSteven Sanderson100% (2)

- Chap 15 - Selected Ex & ProbDocument7 pagesChap 15 - Selected Ex & ProbSteven SandersonNo ratings yet

- Chap 16 - Selected Ex & ProbDocument3 pagesChap 16 - Selected Ex & ProbSteven SandersonNo ratings yet

- CH 14Document54 pagesCH 14Steven SandersonNo ratings yet

- Chap 12 - Selected Ex & ProbDocument2 pagesChap 12 - Selected Ex & ProbSteven SandersonNo ratings yet

- Chap. 23 - Selected Ex. & Prob.Document5 pagesChap. 23 - Selected Ex. & Prob.Steven SandersonNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Chap 13 - Selected Ex & ProbDocument1 pageChap 13 - Selected Ex & ProbSteven SandersonNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Chapter 13 - Teaching ExhibitsDocument6 pagesChapter 13 - Teaching ExhibitsSteven SandersonNo ratings yet

- Chap 14 - Selected Ex & ProbDocument8 pagesChap 14 - Selected Ex & ProbSteven SandersonNo ratings yet

- Chapter 13 - Lecture NotesDocument6 pagesChapter 13 - Lecture NotesSteven Sanderson100% (3)

- Chap 20 - Selected Ex & ProbDocument3 pagesChap 20 - Selected Ex & ProbSteven SandersonNo ratings yet

- Chap 19 - Selected Ex & ProbDocument6 pagesChap 19 - Selected Ex & ProbSteven Sanderson100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Introduction To Computing (COMP-01102) Telecom 1 Semester: Lab Experiment No.05Document7 pagesIntroduction To Computing (COMP-01102) Telecom 1 Semester: Lab Experiment No.05ASISNo ratings yet

- Canine Guided Occlusion and Group FuntionDocument1 pageCanine Guided Occlusion and Group Funtionlittlestar35100% (3)

- Transformation of Chinese ArchaeologyDocument36 pagesTransformation of Chinese ArchaeologyGilbert QuNo ratings yet

- Irony in Language and ThoughtDocument2 pagesIrony in Language and Thoughtsilviapoli2No ratings yet

- Independent Study of Middletown Police DepartmentDocument96 pagesIndependent Study of Middletown Police DepartmentBarbara MillerNo ratings yet

- Business Law Module No. 2Document10 pagesBusiness Law Module No. 2Yolly DiazNo ratings yet

- Housekeeping NC II ModuleDocument77 pagesHousekeeping NC II ModuleJoanne TolopiaNo ratings yet

- Auto TraderDocument49 pagesAuto Tradermaddy_i5100% (1)

- Red Orchid - Best PracticesDocument80 pagesRed Orchid - Best PracticeslabiaernestoNo ratings yet

- Apple NotesDocument3 pagesApple NotesKrishna Mohan ChennareddyNo ratings yet

- An Analysis of Students Pronounciation Errors Made by Ninth Grade of Junior High School 1 TengaranDocument22 pagesAn Analysis of Students Pronounciation Errors Made by Ninth Grade of Junior High School 1 TengaranOcta WibawaNo ratings yet

- Labov-DIFUSÃO - Resolving The Neogrammarian ControversyDocument43 pagesLabov-DIFUSÃO - Resolving The Neogrammarian ControversyGermana RodriguesNo ratings yet

- Markle 1999 Shield VeriaDocument37 pagesMarkle 1999 Shield VeriaMads Sondre PrøitzNo ratings yet

- Administrative Law SyllabusDocument14 pagesAdministrative Law SyllabusKarl Lenin BenignoNo ratings yet

- Icici Bank FileDocument7 pagesIcici Bank Fileharman singhNo ratings yet

- Sigma Chi Foundation - 2016 Annual ReportDocument35 pagesSigma Chi Foundation - 2016 Annual ReportWes HoltsclawNo ratings yet

- Otto F. Kernberg - Transtornos Graves de PersonalidadeDocument58 pagesOtto F. Kernberg - Transtornos Graves de PersonalidadePaulo F. F. Alves0% (2)

- Food Product Development - SurveyDocument4 pagesFood Product Development - SurveyJoan Soliven33% (3)

- EAPP Q2 Module 2Document24 pagesEAPP Q2 Module 2archiviansfilesNo ratings yet

- Environmental Science PDFDocument118 pagesEnvironmental Science PDFJieyan OliverosNo ratings yet

- Episode 8Document11 pagesEpisode 8annieguillermaNo ratings yet

- Meta Trader 4Document2 pagesMeta Trader 4Alexis Chinchay AtaoNo ratings yet

- The Wild PartyDocument3 pagesThe Wild PartyMeganMcArthurNo ratings yet

- TAX & DUE PROCESSDocument2 pagesTAX & DUE PROCESSMayra MerczNo ratings yet

- GDJMDocument1 pageGDJMRenato Alexander GarciaNo ratings yet

- Toshiba l645 l650 l655 Dabl6dmb8f0 OkDocument43 pagesToshiba l645 l650 l655 Dabl6dmb8f0 OkJaspreet Singh0% (1)

- Ejercicio 1.4. Passion Into ProfitDocument4 pagesEjercicio 1.4. Passion Into ProfitsrsuaveeeNo ratings yet

- Obtaining Workplace InformationDocument4 pagesObtaining Workplace InformationJessica CarismaNo ratings yet

- Earth Drill FlightsDocument2 pagesEarth Drill FlightsMMM-MMMNo ratings yet

- Jesus' Death on the Cross Explored Through Theological ModelsDocument13 pagesJesus' Death on the Cross Explored Through Theological ModelsKhristian Joshua G. JuradoNo ratings yet