Professional Documents

Culture Documents

Chap 16 - Selected Ex & Prob

Uploaded by

Steven SandersonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 16 - Selected Ex & Prob

Uploaded by

Steven SandersonCopyright:

Available Formats

EXERCISE 163 (a) Jan. 1 200,000 (b) July 1 8,000 (c) Dec. 31 8,000 Cash........................................................ Bonds Payable................................ Bond Interest Expense.......................... Cash ($200,000 X 8% X 1/2)........... Bond Interest Expense..........................

Bond Interest Payable.................... 200,000

8,000

8,000

EXERCISE 164 (a) Jan. 1 2004 Cash....................................................... Bonds Payable............................... 300,000

300,000 (b) July 1

13,500 (c) Dec. 31 13,500 (d) Jan. 1

Bond Interest Expense......................... Cash ($300,000 X 9% X 1/2)..........

13,500

Bond Interest Expense......................... Bond Interest Payable................... 2014 Bonds Payable...................................... Cash...............................................

13,500

300,000

300,000

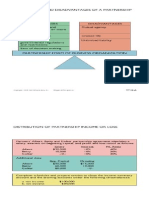

*PROBLEM 169B (a) 2006 Bond Interest Payable.................... Cash......................................... Bond Interest Expense................... Premium on Bonds Payable.......... ($200,000 ÷ 20) Cash......................................... Bonds Payable................................ Premium on Bonds Payable.......... Gain on Bond Redemption.... ($1,914,000 – $1,818,000) Cash ($1,800,000 X 101%)......

*($200,000 – $10,000) X .60 = $114,000

Jan. 1

120,000**

120,000 (b) July 1

110,000** 10,000** 1,800,000** 114,000**

120,000 (c) July 1 96,000 1,818,000

(d) Dec. 31 48,000

Bond Interest Expense................... Premium on Bonds Payable.......... Bond Interest Payable............ ($1,200,000 X 8% X 1/2)

44,000** 4,000**

**$200,000 – $10,000 – $114,000 = $76,000; $10,000 X .40.

$76,000 = $4,000 or 19

You might also like

- Chapter 19,20,21,22 Assesment QuestionsDocument19 pagesChapter 19,20,21,22 Assesment QuestionsSteven Sanderson100% (3)

- Reaction Paper To Chater 13Document2 pagesReaction Paper To Chater 13Steven Sanderson100% (5)

- Reaction Paper To Chapter 6Document3 pagesReaction Paper To Chapter 6Steven Sanderson100% (1)

- Chapters 13, 14, 15, 16 Assessment QuestionsDocument11 pagesChapters 13, 14, 15, 16 Assessment QuestionsSteven Sanderson100% (5)

- Chapters 10,11 and 12 Assessment QuestionsDocument10 pagesChapters 10,11 and 12 Assessment QuestionsSteven Sanderson100% (1)

- Chapter 10 Reactioin PaperDocument2 pagesChapter 10 Reactioin PaperSteven SandersonNo ratings yet

- Reaction Report To Student OrientationDocument1 pageReaction Report To Student OrientationSteven SandersonNo ratings yet

- Chapters 7,8,9 Assesment QuestionsDocument9 pagesChapters 7,8,9 Assesment QuestionsSteven Sanderson100% (3)

- Acounting II - Chap 12 Accounting Principles - Part II - SLNDocument12 pagesAcounting II - Chap 12 Accounting Principles - Part II - SLNSteven Sanderson100% (2)

- Chapter 19,20,21,22 Assesment QuestionsDocument19 pagesChapter 19,20,21,22 Assesment QuestionsSteven Sanderson100% (3)

- Chapters 3,4,5 and 6 Assesment QuestionsDocument10 pagesChapters 3,4,5 and 6 Assesment QuestionsSteven Sanderson100% (4)

- Acct II - Chapter 15 Lecture NotesDocument4 pagesAcct II - Chapter 15 Lecture NotesSteven Sanderson100% (1)

- Chapter 21 Reaction PaperDocument4 pagesChapter 21 Reaction PaperSteven Sanderson100% (1)

- Chapter One and 2 Assessment QuestionsDocument6 pagesChapter One and 2 Assessment QuestionsSteven Sanderson100% (3)

- Chapter 20 Reaction PaperDocument3 pagesChapter 20 Reaction PaperSteven Sanderson100% (4)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Accounting II - Chap 14 Lecture NotesDocument6 pagesAccounting II - Chap 14 Lecture NotesSteven Sanderson100% (4)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Chap 18 - Selected Ex & ProbDocument6 pagesChap 18 - Selected Ex & ProbSteven SandersonNo ratings yet

- CH 14Document54 pagesCH 14Steven SandersonNo ratings yet

- Chap 12 - Selected Ex & ProbDocument2 pagesChap 12 - Selected Ex & ProbSteven SandersonNo ratings yet

- Chapter 13 - Lecture NotesDocument6 pagesChapter 13 - Lecture NotesSteven Sanderson100% (3)

- Chap 15 - Selected Ex & ProbDocument7 pagesChap 15 - Selected Ex & ProbSteven SandersonNo ratings yet

- Chapter 13 - Teaching ExhibitsDocument6 pagesChapter 13 - Teaching ExhibitsSteven SandersonNo ratings yet

- Chap 13 - Selected Ex & ProbDocument1 pageChap 13 - Selected Ex & ProbSteven SandersonNo ratings yet

- Chap 14 - Selected Ex & ProbDocument8 pagesChap 14 - Selected Ex & ProbSteven SandersonNo ratings yet

- Chap 19 - Selected Ex & ProbDocument6 pagesChap 19 - Selected Ex & ProbSteven Sanderson100% (1)

- Chap. 23 - Selected Ex. & Prob.Document5 pagesChap. 23 - Selected Ex. & Prob.Steven SandersonNo ratings yet

- Chap 20 - Selected Ex & ProbDocument3 pagesChap 20 - Selected Ex & ProbSteven SandersonNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)