Professional Documents

Culture Documents

Answerrs

Uploaded by

ahaziz1Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answerrs

Uploaded by

ahaziz1Copyright:

Available Formats

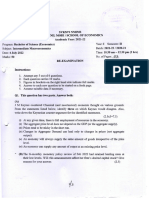

1.

Which of the following did New Classical macroeconomists use as the centerpiece of

their model?

-2-2

The inductive reasoning method.

Regression analysis.

The decision process of a rational self-interested individual.

The flows of aggregates.

2. Between 2007 and 2009, the U.S. unemployment rate rose from under 5 percent to over 8

percent. A Keynesian economist would most likely blame this increase in unemployment

on:

-2-2

a decline in the level of aggregate demand.

a decline in aggregate supply.

an increase in the bargaining power of labor unions.

an increase in the minimum wage.

3. Housing prices fell sharply in 2008 and 2009, contributing to a severe recession as the

AD curve shifted leftward. The ordinary AS/AD model would predict that falling short-

run aggregate supply would bring deflation and move the economy back to potential

output. Which of the following describes the impact of dynamic feedback effects on this

return to potential output?

-2-2

Expectations that prices might fall further could cause people to reduce spending,

shifting the AD curve further to the left.

The deflation will be counteracted by increases in the money supply from the Federal

Reserve, preventing the price adjustment and keeping the economy below potential

output.

Falling house prices could cause people to buy more house than they really need,

creating a further crisis as another wave of foreclosures and bankruptcies occurs.

As the SAS curve shifts downward, firms respond by increasing their investment in

capital equipment, but re-hire few of the laid-off workers, so that employment does not

return to normal.

4. The paradox of thrift will not arise if:

-2-2

increases in saving are translated into identical increases in investment.

decreases in saving are translated into identical increases in investment.

decreases in saving are translated into identical decreases in consumption.

increases in saving are translated into identical decreases in consumption.

5. Which of the following statements would a Classical economist of the 1930s most likely

disagree with?

-2-2

Wages and prices will adjust to eliminate unemployment.

In the short-run the economy might experience some problems.

Unions do not impede wage and price adjustment.

The market, left to its own devices, is self-adjusting

6. Which of the following could not be explained by the Keynesian model in the 1970s?

-2-2

Stagflation.

Expansionary fiscal policy.

Budget deficits.

Oil price shocks.

7. An increase in the price level:

-2-2

increases the purchasing power of money, leading to lower interest rates and increases

investment.

decreases the purchasing power of money, leading to lower interest rates and increases

investment.

increases the purchasing power of money, leading to higher interest rates and decreases

investment.

decreases the purchasing power of money, leading to higher interest rates and decreases

investment.

8. An agent in the DSGE model is assumed to know:

-2-2

all the things that might happen but does not know the probability with which each of

them will happen.

all the things that might happen and the probability with which each of them will

happen.

only a small portion of things that might happen and the probability with which each of

them will happen.

nothing at all, and has to constantly change his thinking about situations.

9. If total income remains the same but profits fall and real wages rise, the aggregate

demand curve will most likely:

-2-2

shift to the left.

shift to the right.

become steeper.

become flatter.

10. Keynes believed equilibrium income was:

-2-2

not fixed at the economy's potential income.

always above the economy's potential income.

fixed at the economy's potential income.

always below the economy's potential income.

11. If an economist is focusing on whether a model works or not, rather than how it works,

then this economist would want to work with a(n):

-2-2

regression model.

deductive scientific model.

engineering model.

butterfly-effect model.

12. The multiplier effect makes the aggregate demand curve:

-2-2

flatter.

steeper.

horizontal.

vertical.

13. Refer to the graph above. If the economy is at point D, which of the following policies is

most appropriate to bring the economy to potential?

-2-2

no change in taxes or government spending

increase in taxes

cut in government spending

cut in taxes

14. What will likely happen to the SAS curve in each of the following instances?

15.

a) Productivity rises 6 percent; wages rise 8 percent.

-2-2

The SAS curve will remain unchanged.

The SAS curve will shift down.

The SAS curve will shift up.

16.

b) Productivity rises 9 percent; wages rise 7 percent.

-2-2

The SAS curve will shift up.

The SAS curve will remain unchanged.

The SAS curve will shift down.

17.

c) Productivity declines 9 percent; wages rise 9 percent.

-2-2

The SAS curve will shift up.

The SAS curve will remain unchanged.

The SAS curve will shift down.

18.

d) Productivity rises 9 percent; wages rise 9 percent.

-2-2

The SAS curve will remain unchanged.

The SAS curve will shift down.

The SAS curve will shift up.

19. Which of the following would shift the aggregate demand curve to the left?

-2-2

a higher future expected price level.

a depreciation in the value of the country's currency.

a decrease in exports.

an increase in foreign income.

20. "Classical economist" is often used interchangeably with which term?

-2-2

Activist economist.

Keynesian economist.

Laissez-faire economist.

Marxian economist.

If total income remains the same but profits fall and real wages rise, the aggregate demand curve

will most likely:

-2-2

shift to the left.

become steeper.

shift to the right.

become flatter.

If the multiplier effect is 4, a $15 billion increase in government expenditures will shift the AD

curve:

-2-2

to the right by $15 billion.

to the left by $60 billion.

to the left by $15 billion.

to the right by $60 billion.

You might also like

- Monetary FiscalDocument4 pagesMonetary FiscalKiranNo ratings yet

- 312 PS4 AnsDocument7 pages312 PS4 AnsAnne LamedicaNo ratings yet

- Macro Final 2021Document6 pagesMacro Final 2021Phương Anh NguyễnNo ratings yet

- AD AS Headline ActivityDocument16 pagesAD AS Headline ActivitysaragakannanNo ratings yet

- MACRO - as-AD Keynsian-Classic ModelDocument30 pagesMACRO - as-AD Keynsian-Classic ModelUrBaN-xGaMeRx TriicKShOtZNo ratings yet

- Jen - Eco11 Online Test 1 Sp1 2011 - Essy Mark UpsDocument11 pagesJen - Eco11 Online Test 1 Sp1 2011 - Essy Mark Upsdragonsstudyt2010No ratings yet

- CH 25 - Aggregate Demand SupplyDocument11 pagesCH 25 - Aggregate Demand SupplyTrent BranchNo ratings yet

- Instructions: LiberallyDocument4 pagesInstructions: LiberallyFinmonkey. InNo ratings yet

- E - Portfolio Assignment-1Document7 pagesE - Portfolio Assignment-1api-280064053No ratings yet

- Trade Foreign UniversiDocument7 pagesTrade Foreign Universi22070615No ratings yet

- Ugba 101b Test 2 2008Document12 pagesUgba 101b Test 2 2008Minji KimNo ratings yet

- Chapter 11 Dornbusch Fisher SolutionsDocument13 pagesChapter 11 Dornbusch Fisher Solutions22ech040No ratings yet

- LRAS SRAS Review and ExplainationsDocument6 pagesLRAS SRAS Review and Explainationsstarlitsymphony100% (1)

- Chap11 12 Extra PDFDocument8 pagesChap11 12 Extra PDFpuspa khanalNo ratings yet

- Macroeconomics Part 1Document205 pagesMacroeconomics Part 1jaxx_xavior100% (2)

- Intermediate Macroeconomic xTAzPHMrokDocument3 pagesIntermediate Macroeconomic xTAzPHMrokjumaina.fatimaNo ratings yet

- Chapter 15 Practice QuestionsDocument10 pagesChapter 15 Practice QuestionsAbigail CubasNo ratings yet

- Introductory To Macroeconomics UAS Exercise + Answers-1Document4 pagesIntroductory To Macroeconomics UAS Exercise + Answers-1gracia arethaNo ratings yet

- Q& A 1Document6 pagesQ& A 1Mohannad HijaziNo ratings yet

- The Orthodox Keynesian SchoolDocument22 pagesThe Orthodox Keynesian Schoolasjad100% (2)

- E - Portfolio Assignment MacroDocument8 pagesE - Portfolio Assignment Macroapi-316969642No ratings yet

- Assignment 2 Answer Key F17Document2 pagesAssignment 2 Answer Key F17JamesNo ratings yet

- 2Document3 pages2dinauy88No ratings yet

- PracticDocument7 pagesPracticyourmaxaluslifeNo ratings yet

- 1081 CFAEXAMlv 1Document0 pages1081 CFAEXAMlv 1Hoang VinhNo ratings yet

- TBS Final Exam MACRO 2017Document6 pagesTBS Final Exam MACRO 2017OussemaNo ratings yet

- Some Hard Concept in ECON 101Document4 pagesSome Hard Concept in ECON 101Richard LiNo ratings yet

- E - Portfolio Assignment Mike KaelinDocument9 pagesE - Portfolio Assignment Mike Kaelinapi-269409142No ratings yet

- Chapter 08 Aggregate Demand and Supply HW Attempt 1Document5 pagesChapter 08 Aggregate Demand and Supply HW Attempt 1Pat100% (1)

- Monetary PolicyDocument10 pagesMonetary PolicykafiNo ratings yet

- EportfolioassignmentDocument9 pagesEportfolioassignmentapi-311464761No ratings yet

- Final Econ e PortfolioDocument7 pagesFinal Econ e Portfolioapi-317164511No ratings yet

- Thiếu Hụt Ngân Sách Nhà NướcDocument71 pagesThiếu Hụt Ngân Sách Nhà Nướccocghe2No ratings yet

- Contoh Uts PIEDocument6 pagesContoh Uts PIEWeirdels21No ratings yet

- tham khảo ECO kì 2Document49 pagestham khảo ECO kì 2Vũ Nhi AnNo ratings yet

- CHAP12Document61 pagesCHAP12Samantha XerosNo ratings yet

- A2 Macro Past Papers Questions' Solutions PDFDocument41 pagesA2 Macro Past Papers Questions' Solutions PDFUzair SiddiquiNo ratings yet

- WKSHT Macro Unit3 Lesson3 Act23 KeyDocument10 pagesWKSHT Macro Unit3 Lesson3 Act23 KeyCarl WeinfieldNo ratings yet

- Final Exam Short Answer Questions - AnswersDocument5 pagesFinal Exam Short Answer Questions - AnswersAshish RajNo ratings yet

- Macsg12: Aggregate Demand in The Money Goods and Current MarketsDocument30 pagesMacsg12: Aggregate Demand in The Money Goods and Current MarketsJudithNo ratings yet

- E-Portfolio - Signature Assignment: Professor: Heather A SchumackerDocument9 pagesE-Portfolio - Signature Assignment: Professor: Heather A Schumackerapi-213470756No ratings yet

- Economic Mega Trends That Will Drive Our FutureDocument12 pagesEconomic Mega Trends That Will Drive Our FutureexpertllcNo ratings yet

- Ec103 Week 09 and 10 s14Document44 pagesEc103 Week 09 and 10 s14юрий локтионовNo ratings yet

- Macroeconomics Chapter 34cDocument8 pagesMacroeconomics Chapter 34cThiha Kaung SettNo ratings yet

- Assignment 1 of Macroeconomics: Chapter 10: Measuring A Nation's IncomeDocument8 pagesAssignment 1 of Macroeconomics: Chapter 10: Measuring A Nation's IncomeLeo ChristNo ratings yet

- MarketingDocument4 pagesMarketingjyotiprakash giriNo ratings yet

- Keynesian vs. Classical Income ModelDocument70 pagesKeynesian vs. Classical Income ModelNitish KhatanaNo ratings yet

- 2012 352finalsolutionDocument7 pages2012 352finalsolutionBill ZeeNo ratings yet

- Labadan, Lyka Mae S. CBET-01-502A: Economic DevelopmentDocument3 pagesLabadan, Lyka Mae S. CBET-01-502A: Economic DevelopmentLyka mae LabadanNo ratings yet

- CH 5Document26 pagesCH 5Voka Xx19No ratings yet

- Semester Test 1 With Memo 2022Document3 pagesSemester Test 1 With Memo 2022HappinessNo ratings yet

- IS LM Labor AssignmentDocument6 pagesIS LM Labor AssignmentNICHIKATAZI ENTERTAINMENTNo ratings yet

- Final-Term Review - ExplanationDocument6 pagesFinal-Term Review - ExplanationElwinda SeptiandhanyNo ratings yet

- Tutorial 3Document5 pagesTutorial 3Tu QuyenNo ratings yet

- Unit 3 Review Practice Set (Modules 16-21)Document9 pagesUnit 3 Review Practice Set (Modules 16-21)Samuel JayNo ratings yet

- Econ 1p92 Final Exam ReviewDocument3 pagesEcon 1p92 Final Exam ReviewLisa CapostagnoNo ratings yet

- Economics AQA Section2 Workbook AnswersDocument27 pagesEconomics AQA Section2 Workbook AnswersABDULLAH KhanNo ratings yet

- Ugba 101B - Exam - 3 Answers - Spring 2013Document12 pagesUgba 101B - Exam - 3 Answers - Spring 2013jessica_1292No ratings yet

- TS - Grewal - DEBK - Class - XII - Vol. - 1 - NPO - and - Partnership - Chapter - 2 - Fundamentals 3 PDFDocument100 pagesTS - Grewal - DEBK - Class - XII - Vol. - 1 - NPO - and - Partnership - Chapter - 2 - Fundamentals 3 PDFVinay Naraniwal100% (3)

- Power Query-Transforming Work Processes Using Excel PDocument2 pagesPower Query-Transforming Work Processes Using Excel PJia Xin0% (3)

- On Marketing Strategy of HaldiramDocument36 pagesOn Marketing Strategy of Haldiramsumit.avistar90% (10)

- The Nelson System Catalouge Version 2 2017 Shear StudsDocument8 pagesThe Nelson System Catalouge Version 2 2017 Shear StudsMacNo ratings yet

- Leadership PracticeDocument25 pagesLeadership PracticeTahir AhmadNo ratings yet

- Modes of Transportation in LogisticsDocument11 pagesModes of Transportation in LogisticsSarfaraz Khan67% (3)

- HBS Application FormDocument11 pagesHBS Application Formnaveena115No ratings yet

- Wal-Mart Activity System MapDocument1 pageWal-Mart Activity System MapWan Wan HushNo ratings yet

- Lesson 2 The Secret To Consistent Forex Trading Profits: by Adam KhooDocument15 pagesLesson 2 The Secret To Consistent Forex Trading Profits: by Adam Khoodaysan100% (3)

- Smart Investment (E-Copy) Vol 15 Issue No. 44 (11th December 2022)Document81 pagesSmart Investment (E-Copy) Vol 15 Issue No. 44 (11th December 2022)MittapalliUdayKumarReddyNo ratings yet

- Basic Knowledge in Construction ManagementDocument32 pagesBasic Knowledge in Construction ManagementKhaing SuNo ratings yet

- Corporate Law of Malaysia: Statutory Meetings in Malaysia CompaniesDocument14 pagesCorporate Law of Malaysia: Statutory Meetings in Malaysia CompaniesJitha RithaNo ratings yet

- Publix Super Markets Inc.Document13 pagesPublix Super Markets Inc.Nazish Sohail80% (5)

- Unleash Your Trading Potential With FXDD by Investing - Com StudiosDocument2 pagesUnleash Your Trading Potential With FXDD by Investing - Com StudiosNutthakarn WisatsiriNo ratings yet

- Proposal On Banking & InstrumentDocument29 pagesProposal On Banking & InstrumentSwati WalandeNo ratings yet

- Career Air Force-India (Candidate Section)Document1 pageCareer Air Force-India (Candidate Section)Aditya GaurNo ratings yet

- GR 12 - Mathematical Literacy Term 1 Investigation 1Document9 pagesGR 12 - Mathematical Literacy Term 1 Investigation 1tinashe chirukaNo ratings yet

- Rapidfire Fulfillment-Zara: A Case StudyDocument6 pagesRapidfire Fulfillment-Zara: A Case Studyekta agarwalNo ratings yet

- Addmrpt 1 36561 36562Document5 pagesAddmrpt 1 36561 36562Anonymous ZGcs7MwsLNo ratings yet

- Research Paper On Buying BehaviourDocument5 pagesResearch Paper On Buying Behaviourh0251mhq100% (1)

- KSPF Application FormDocument2 pagesKSPF Application FormTu oouNo ratings yet

- My Courses: Home BAED-FABM2121-2016S 2nd Quarter ExamDocument15 pagesMy Courses: Home BAED-FABM2121-2016S 2nd Quarter ExamGlynness QuirosNo ratings yet

- Tradex Cs Project MFDocument35 pagesTradex Cs Project MFVibots TechnologyNo ratings yet

- Jet AirwaysDocument2 pagesJet AirwaysVaibhav PardeshiNo ratings yet

- PICOP Resources v. de GuilaDocument3 pagesPICOP Resources v. de GuilaCourtney TirolNo ratings yet

- Professor Born Valuation Cheat Sheet 2018Document12 pagesProfessor Born Valuation Cheat Sheet 2018Brian DongNo ratings yet

- Tamayo v. Manila Hotel, 101 Phil. 810 (1957)Document4 pagesTamayo v. Manila Hotel, 101 Phil. 810 (1957)Jessica Melle GaliasNo ratings yet

- Lesson 6: Contemporary Economic Issues Facing The Filipino EntrepreneurDocument14 pagesLesson 6: Contemporary Economic Issues Facing The Filipino EntrepreneurApril Joy DelacruzNo ratings yet

- LTRT-31621 SBC Design GuideDocument32 pagesLTRT-31621 SBC Design GuideersindirNo ratings yet

- Password Management Security ProcedureDocument3 pagesPassword Management Security ProcedureShyam_Nair_9667No ratings yet