Professional Documents

Culture Documents

Morning Brief2-14

Uploaded by

Eli Radke0 ratings0% found this document useful (0 votes)

97 views2 pagesThe market continues to rise without consolidation, baffling short sellers. Volume was good when previous resistance at 1326.70 was broken, likely triggering stop losses and exiting short positions. The analyst remains bullish as long as the market stays above 1320.50-1319.00, which provides support. Resistance was found at 1330.50 overnight, so a pullback to test the 1320.50 pivot is possible.

Original Description:

Original Title

Morning Brief2-14 (1)

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe market continues to rise without consolidation, baffling short sellers. Volume was good when previous resistance at 1326.70 was broken, likely triggering stop losses and exiting short positions. The analyst remains bullish as long as the market stays above 1320.50-1319.00, which provides support. Resistance was found at 1330.50 overnight, so a pullback to test the 1320.50 pivot is possible.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

97 views2 pagesMorning Brief2-14

Uploaded by

Eli RadkeThe market continues to rise without consolidation, baffling short sellers. Volume was good when previous resistance at 1326.70 was broken, likely triggering stop losses and exiting short positions. The analyst remains bullish as long as the market stays above 1320.50-1319.00, which provides support. Resistance was found at 1330.50 overnight, so a pullback to test the 1320.50 pivot is possible.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

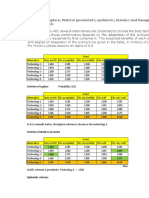

February, 14 2011

Morning Brief by Anthony Crudele

I was wrong about the market struggling to get through 1326.70 in the cash on Friday. There was good volume when we took out

1326.70 in the cash which tells me that some stops were set off getting shorts out. The market is very strong and continues to

baffle the shorts. There is no consolidation on any of these rallies. We just keep going higher making a range for the year. Today I

am bullish as long as trade stays above 1320.50-1319.00. The market hit resistance at 1330.50 overnight so we might go back and

test the pivot at 1320.50. I will be a buyer there but we left single ticks from Friday from 1320.25 to 1319.25 so I will be a buyer

down to 1319.25. The bottom of value from Friday was also 1319.00 so there are a couple reasons why there should be support in

this area. Failure to hold that area we could trade down to support at 1310.25 which would test Friday’s low of 1310.00. No data

today.

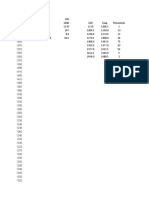

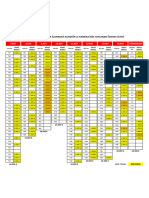

S&P Cash Top of Value 132850

E-Mini Daily E-Mini Weekly

Weekly

Bottom of Value 131900

• 135000 • 136525 • 134750

• 134125 • 134125 • 133544 Point of Control 131450

• 133075 • 131775 • 132670 High Volume Bar 132350

• 132050 Pivot • 129425 Pivot • 131144Pivot

• 131025 • 127075 • 129943 Prior Day’s 132725

Settlement

• 129975 • 124725 • 128744

Average Trading 1267

• 128950 • 122375 • 127550

Range

10 Day Moving Average 131425 Prior Day High 132875

20 Day Moving Average 129954 Prior Day Low 131000

50 Day Moving Average 127163 Weekly High 132875

200 Day Moving Average 115231 Weekly Low 130600

Yearly High 2-12-2011 133050

Yearly Low 1-13-2011 125525

2010 Closing Price 125300

2011 Opening Price 125600

February, 14 2011

Source: CQG Inc. 2011 All rights reserved worldwide.

You might also like

- Options Trading Strategies - Book Review - Sheldon Natenberg, Option Volatility and PricingDocument3 pagesOptions Trading Strategies - Book Review - Sheldon Natenberg, Option Volatility and PricingHome Options Trading100% (2)

- Super Structure TradingDocument97 pagesSuper Structure Tradingsan Ray93% (14)

- M1A Ver 48 Feb 2022#Document185 pagesM1A Ver 48 Feb 2022#Cc Hy100% (1)

- Chapter 3 PPTs Hedging Strategies Using FuturesDocument19 pagesChapter 3 PPTs Hedging Strategies Using FuturesMrunaal NaseryNo ratings yet

- VIX Futures Prices PredictabilityDocument37 pagesVIX Futures Prices PredictabilityElmar ReichmannNo ratings yet

- Financial Market SummaryDocument21 pagesFinancial Market SummaryJorufel Tomo PapasinNo ratings yet

- NIFTY Options Open Interest AnalysisDocument26 pagesNIFTY Options Open Interest AnalysisindianroadromeoNo ratings yet

- TAS PRO Indicator Suite: User Manual and Applications GuideDocument112 pagesTAS PRO Indicator Suite: User Manual and Applications Guidesiva5256No ratings yet

- Derivatives and Hedging Risk: Multiple Choice QuestionsDocument36 pagesDerivatives and Hedging Risk: Multiple Choice Questionsbaashii4100% (1)

- Crib Sheet FinalDocument2 pagesCrib Sheet FinalJordanDouce100% (2)

- Motilal Oswal Securities Limited Analysis of Derivative and Stock MarketDocument104 pagesMotilal Oswal Securities Limited Analysis of Derivative and Stock MarketJitendra Virahyas100% (3)

- Morning Brief2 23Document1 pageMorning Brief2 23Eli RadkeNo ratings yet

- Morning Brief2 17Document1 pageMorning Brief2 17Eli RadkeNo ratings yet

- Morning Brief 2-22Document1 pageMorning Brief 2-22Eli RadkeNo ratings yet

- Morning Brief 2-8 $ES - FDocument2 pagesMorning Brief 2-8 $ES - FEli RadkeNo ratings yet

- High Frequency List. American CorpusDocument7 pagesHigh Frequency List. American CorpusBhaskarNo ratings yet

- Moving AveragesDocument8 pagesMoving AveragesShakambhari KumariNo ratings yet

- 2022 Ashbourne Industies Inc. TB - TEMPLATEDocument22 pages2022 Ashbourne Industies Inc. TB - TEMPLATEekambonga2No ratings yet

- MyPakapaka Graph Report 3rd May 2020Document85 pagesMyPakapaka Graph Report 3rd May 2020Benzyl OmzyNo ratings yet

- Office 1 - Pile ReactionDocument10 pagesOffice 1 - Pile ReactionPhạm Quốc ViệtNo ratings yet

- Open Interest Analysis: Trend Actio N Interpretatio N OI Change Price ChangeDocument23 pagesOpen Interest Analysis: Trend Actio N Interpretatio N OI Change Price ChangeAkki vaidNo ratings yet

- Linf Lsup FrecuenciaDocument7 pagesLinf Lsup FrecuenciaCarlos Gabriel Navas CasallasNo ratings yet

- MyPakapaka Graph Report 19th April 2020Document84 pagesMyPakapaka Graph Report 19th April 2020Benzyl OmzyNo ratings yet

- Phase Diagram Ge-Si: (WT% Si) (°C) (°C)Document2 pagesPhase Diagram Ge-Si: (WT% Si) (°C) (°C)Ferhat PeynirciNo ratings yet

- 15 Day Analysis Part 2Document4 pages15 Day Analysis Part 2Siddharttha RoyNo ratings yet

- ACT308 Case StudyDocument4 pagesACT308 Case StudySherab ZangmoNo ratings yet

- Tecnología Del Concreto - Notas de LaboratorioDocument1 pageTecnología Del Concreto - Notas de LaboratorioBilington deza barrientosNo ratings yet

- MyPakapaka Graph Report 9th May 2020Document84 pagesMyPakapaka Graph Report 9th May 2020Benzyl OmzyNo ratings yet

- Trabajo Colaborativo 2Document42 pagesTrabajo Colaborativo 2Ivan OrellanosNo ratings yet

- Rabb Making Engineered Completions An Every Well EventDocument21 pagesRabb Making Engineered Completions An Every Well EventcloserforeverNo ratings yet

- JC2 Mid Year Examination 2022: Subject: Date Paper No. TimeDocument1 pageJC2 Mid Year Examination 2022: Subject: Date Paper No. TimePROgamer GTNo ratings yet

- User NameDocument2 pagesUser NamemohanamotorsNo ratings yet

- NSE Option Strategy PDFDocument31 pagesNSE Option Strategy PDFchanduanu2007No ratings yet

- Tugas Perencanaan Pengendalian ProduksiDocument4 pagesTugas Perencanaan Pengendalian Produksihelthy sihalohoNo ratings yet

- Options Open Interest Analysis SimplifiedDocument17 pagesOptions Open Interest Analysis SimplifiedMOBILE FRIENDNo ratings yet

- University of The East Caloocan Graph 1 College of Business AdministrationDocument3 pagesUniversity of The East Caloocan Graph 1 College of Business AdministrationClarisse AlimotNo ratings yet

- PC DepotDocument26 pagesPC Depotvishakha AGRAWALNo ratings yet

- SSE MSE Date Demand Naïve 1 AVG WMA WMA WMADocument5 pagesSSE MSE Date Demand Naïve 1 AVG WMA WMA WMAAnonymous W4PwcjGUJgNo ratings yet

- QraftjjfppkefDocument3 pagesQraftjjfppkeflorenzo ejeNo ratings yet

- Qraftjjfppkef 6 UDocument3 pagesQraftjjfppkef 6 Ulorenzo ejeNo ratings yet

- Test FlightsDocument2 pagesTest FlightsBlossom HuesNo ratings yet

- Online-FinalExams - First 2023-2024 - JED-MaleDocument2 pagesOnline-FinalExams - First 2023-2024 - JED-MaleYusuf mohammedNo ratings yet

- Tata Power - FNO AnalysisDocument19 pagesTata Power - FNO AnalysisritomdNo ratings yet

- 心算挑战1(加法)Document301 pages心算挑战1(加法)ZaiXiang FuanNo ratings yet

- EFS SPM Proba 1 Traseu Aplicatljv 20 Iulie 2023Document3 pagesEFS SPM Proba 1 Traseu Aplicatljv 20 Iulie 2023Georgiana FlaviaNo ratings yet

- En Gold 20171006 ADocument1 pageEn Gold 20171006 AMauricio GonzálezNo ratings yet

- Ice Cream Delivery Operation CostDocument2 pagesIce Cream Delivery Operation CostFarhanur RahmanNo ratings yet

- Blank SpreadsheetbudgetDocument7 pagesBlank SpreadsheetbudgetChris HansenNo ratings yet

- Güncel RakamDocument1 pageGüncel RakamrealpapaNo ratings yet

- ECOBLAST ProductSheet ENDocument1 pageECOBLAST ProductSheet ENahmed migoNo ratings yet

- 1 StandardReportDocument17 pages1 StandardReportFadilNo ratings yet

- 26 PP Price Circular Wef 19th May 2022 DomesticDocument5 pages26 PP Price Circular Wef 19th May 2022 DomesticMohit MohataNo ratings yet

- X Codigo Notas Tea Dem S-005Document1 pageX Codigo Notas Tea Dem S-005isabel :3No ratings yet

- Find The Value of and Make A Verbal Interpretation of The Following Scores. (WithDocument2 pagesFind The Value of and Make A Verbal Interpretation of The Following Scores. (WithCharryna Yesha ArevaloNo ratings yet

- Kas Piutang B. Laundry B.iklan P.PengantinDocument75 pagesKas Piutang B. Laundry B.iklan P.PengantinReinaldi MarbunNo ratings yet

- Paranormal Forex Jilid 3Document8 pagesParanormal Forex Jilid 3Muhammad Hafiz100% (3)

- New Microsoft Excel WorksheetDocument2 pagesNew Microsoft Excel WorksheetDelilah MooreNo ratings yet

- Fuel Filter and Piping With AiDocument1 pageFuel Filter and Piping With Aieshopmanual limaNo ratings yet

- Sample Salary Aka PayrollDocument2 pagesSample Salary Aka PayrollRavi DhimanNo ratings yet

- Arrears Due To Sixth PCDocument17 pagesArrears Due To Sixth PCkmurali1962No ratings yet

- Venta de Gas Licuado 2003-2005 (Galones) Años Tipo de Gas 2003 2004 2005Document12 pagesVenta de Gas Licuado 2003-2005 (Galones) Años Tipo de Gas 2003 2004 2005David Vitor GómezNo ratings yet

- Aman Tawarw NeDocument4 pagesAman Tawarw NeOmkar pharaneNo ratings yet

- Consortium of National Law Universities: Provisional 2nd List - CLAT 2024 - UGDocument4 pagesConsortium of National Law Universities: Provisional 2nd List - CLAT 2024 - UGCounter Strike VideosNo ratings yet

- World Metals Market Watch: Tue., Jan. 14, 2014Document2 pagesWorld Metals Market Watch: Tue., Jan. 14, 2014nirav87404No ratings yet

- Refit Web 2015 AprilDocument1 pageRefit Web 2015 AprilBen DoverNo ratings yet

- Banana (MJ)Document7 pagesBanana (MJ)Jim LindaNo ratings yet

- STA Code Data Tembakan Data Asli Pindah Alat Elevasi Beda TinggiDocument17 pagesSTA Code Data Tembakan Data Asli Pindah Alat Elevasi Beda TinggiMiftakul KhoirudinNo ratings yet

- FMDocument26 pagesFMGaurav Jain BaidNo ratings yet

- Add Math Project Work SPMDocument25 pagesAdd Math Project Work SPMRavind VijayandranNo ratings yet

- Review Problems Mechanics of Option MarketsDocument7 pagesReview Problems Mechanics of Option Marketsonenet15one0% (1)

- Sub: Derivatives and Risk Management Case Study No.2Document2 pagesSub: Derivatives and Risk Management Case Study No.2ankit palNo ratings yet

- Commodity Derivative Market in IndiaDocument16 pagesCommodity Derivative Market in IndiaNaveen K. JindalNo ratings yet

- Interview Special-2016Document36 pagesInterview Special-2016Sneha Abhash SinghNo ratings yet

- P12 Fac RTPDocument50 pagesP12 Fac RTPFashion StarNo ratings yet

- Forex Virtuoso PDFDocument19 pagesForex Virtuoso PDFHARISH_IJTNo ratings yet

- Health Care Schemes Project at KamineniDocument78 pagesHealth Care Schemes Project at KamineniVenugopal VutukuruNo ratings yet

- DGPR-The Death of Portfolio DiversificationDocument6 pagesDGPR-The Death of Portfolio DiversificationdevnevNo ratings yet

- The Sumitomo Copper FraudDocument4 pagesThe Sumitomo Copper FraudAlan ZhouNo ratings yet

- Ppfas MF Factsheet For September 2023Document16 pagesPpfas MF Factsheet For September 2023arunkumar arjunanNo ratings yet

- Derivative SeiesDocument18 pagesDerivative SeiesCourage Craig KundodyiwaNo ratings yet

- Mansi2 PDFDocument85 pagesMansi2 PDFMansi SriNo ratings yet

- Project Report - DseDocument33 pagesProject Report - DseHarsha Vardhan ReddyNo ratings yet

- Homework 1 - With SolutionsDocument3 pagesHomework 1 - With SolutionsRabia Raiz 1386-FMS/BBAIT/F19No ratings yet

- Udemy Python Financial Analysis SlidesDocument35 pagesUdemy Python Financial Analysis SlidesWang ShenghaoNo ratings yet

- Option Trading Strategies in Indian Stock Market: Dr. Rashmi RathiDocument10 pagesOption Trading Strategies in Indian Stock Market: Dr. Rashmi RathiAmitabh GairolaNo ratings yet

- Industry Profile: Rajkot Nagarik Sahakari BankDocument117 pagesIndustry Profile: Rajkot Nagarik Sahakari BankBhavika PatelNo ratings yet

- Book - IFM - Lecture NotesDocument261 pagesBook - IFM - Lecture NotesasadNo ratings yet

- Cip 2.0Document1 pageCip 2.0JitendraBhartiNo ratings yet

- FD FeaturesDocument4 pagesFD FeaturesSitaKumari100% (1)