Professional Documents

Culture Documents

Morning Brief2 17

Uploaded by

Eli Radke0 ratings0% found this document useful (0 votes)

50 views1 pageThis is happening due to lack of volume and the VIX just hanging around 15-17. The support and resistance numbers for today are really tight. If we hold trade above 1332. We should trade up to 1337.00 and then possibly 1341.50.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis is happening due to lack of volume and the VIX just hanging around 15-17. The support and resistance numbers for today are really tight. If we hold trade above 1332. We should trade up to 1337.00 and then possibly 1341.50.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

50 views1 pageMorning Brief2 17

Uploaded by

Eli RadkeThis is happening due to lack of volume and the VIX just hanging around 15-17. The support and resistance numbers for today are really tight. If we hold trade above 1332. We should trade up to 1337.00 and then possibly 1341.50.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

February, 17 2011

Morning Brief by Anthony Crudele

The average trading range continues to shrink every day. This is happening due to lack of volume and the VIX just hanging around

15-17. Although yesterday’s volume was o.k. we still cannot make a reasonable trading range. You have to be very patient when it

trades like this. The support and resistance numbers for today are really tight. I will be a seller in front of 1332.50 looking for us to

trade down to 1328.00, where I will be a buyer. If we hold trade above 1332.50 we should trade up to 1337.00 and then possibly

1341.50. Failing to hold 1328.00 should take us down to 1323.75 or even 1319.25. We have Ben Bernanke speaking today along

with data from Philly Fed and Leading Indicators. I will staying on the sidelines until this data is out.

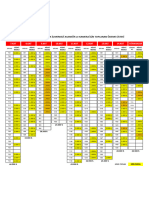

S&P Cash Top of Value 133500

E-Mini Daily E-Mini Weekly

Weekly

Bottom of Value 133100

• 134150 • 136525 • 136180

• 133700 • 134125 • 134025 Point of Control 133100

• 133250 • 131775 • 131890 High Volume Bar 133475

• 132800 Pivot • 129425 Pivot • 129754 Pivot

• 132375 • 127075 • 127619 Prior Day’s 133300

Settlement

• 131925 • 124725 • 125483

Average Trading 1017

• 131475 • 122375 • 123348

Range

10 Day Moving Average 132297 Prior Day High 133600

20 Day Moving Average 130675 Prior Day Low 132575

50 Day Moving Average 127831 Weekly High 133600

200 Day Moving Average 115509 Weekly Low 132450

Source: CQG Inc. 2011 All rights reserved worldwide.

Yearly High 2-16-2011 133600

Yearly Low 1-03-2011 125525

2010 Closing Price 125300

2011 Opening Price 125600

You might also like

- Morning Brief 2-22Document1 pageMorning Brief 2-22Eli RadkeNo ratings yet

- Morning Brief2 23Document1 pageMorning Brief2 23Eli RadkeNo ratings yet

- Morning Brief2-14Document2 pagesMorning Brief2-14Eli RadkeNo ratings yet

- Morning Brief 2-8 $ES - FDocument2 pagesMorning Brief 2-8 $ES - FEli RadkeNo ratings yet

- Moving AveragesDocument8 pagesMoving AveragesShakambhari KumariNo ratings yet

- Office Tower 1 pile capacity analysisDocument10 pagesOffice Tower 1 pile capacity analysisPhạm Quốc ViệtNo ratings yet

- Ice Cream Delivery Operation CostDocument2 pagesIce Cream Delivery Operation CostFarhanur RahmanNo ratings yet

- GKFX Prime Reversal PatternsDocument7 pagesGKFX Prime Reversal PatternselgamleNo ratings yet

- NSE Option Strategy PDFDocument31 pagesNSE Option Strategy PDFchanduanu2007No ratings yet

- Ss ProjectDocument9 pagesSs ProjectNilan PatelNo ratings yet

- ECOPETROL Oil Production Frequency DistributionDocument7 pagesECOPETROL Oil Production Frequency DistributionCarlos Gabriel Navas CasallasNo ratings yet

- 2022 Ashbourne Industies Inc. TB - TEMPLATEDocument22 pages2022 Ashbourne Industies Inc. TB - TEMPLATEekambonga2No ratings yet

- Pivots and trading bias for major currency pairsDocument11 pagesPivots and trading bias for major currency pairsTimothy T McginnisNo ratings yet

- En Gold 20171006 ADocument1 pageEn Gold 20171006 AMauricio GonzálezNo ratings yet

- FMDocument26 pagesFMGaurav Jain BaidNo ratings yet

- Banana (MJ)Document7 pagesBanana (MJ)Jim LindaNo ratings yet

- New Microsoft Excel WorksheetDocument2 pagesNew Microsoft Excel WorksheetDelilah MooreNo ratings yet

- ECOBLAST ProductSheet ENDocument1 pageECOBLAST ProductSheet ENahmed migoNo ratings yet

- NSJPDocument2 pagesNSJPFarhan AuliaNo ratings yet

- Digi-Flat: For Investing / Rental YieldDocument8 pagesDigi-Flat: For Investing / Rental Yieldshoba vNo ratings yet

- Downtime v2Document3 pagesDowntime v2Math20No ratings yet

- Güncel RakamDocument1 pageGüncel RakamrealpapaNo ratings yet

- MyPakapaka Graph Report 3rd May 2020Document85 pagesMyPakapaka Graph Report 3rd May 2020Benzyl OmzyNo ratings yet

- Investment Analysis & Portfolio Management Chart TypesDocument35 pagesInvestment Analysis & Portfolio Management Chart TypesMuhammad TalhaNo ratings yet

- Phase Diagram Ge-Si: (WT% Si) (°C) (°C)Document2 pagesPhase Diagram Ge-Si: (WT% Si) (°C) (°C)Ferhat PeynirciNo ratings yet

- Umberto-Pesavento-08 10 14Document26 pagesUmberto-Pesavento-08 10 14Victor DonNo ratings yet

- Locco GOLD Price Analysis and ForecastDocument5 pagesLocco GOLD Price Analysis and ForecastHaris LatifNo ratings yet

- Investments: Analysis and Behavior: Chapter 1-IntroductionDocument26 pagesInvestments: Analysis and Behavior: Chapter 1-IntroductionJeralyn MacarealNo ratings yet

- 心算挑战1(加法)Document301 pages心算挑战1(加法)ZaiXiang FuanNo ratings yet

- Open Interest Analysis: Trend Actio N Interpretatio N OI Change Price ChangeDocument23 pagesOpen Interest Analysis: Trend Actio N Interpretatio N OI Change Price ChangeAkki vaidNo ratings yet

- Percent Exposure Donchian ChannelDocument6 pagesPercent Exposure Donchian Channelcoreyrittenhouse3866No ratings yet

- User NameDocument2 pagesUser NamemohanamotorsNo ratings yet

- Brokerage CalculatorDocument5 pagesBrokerage CalculatorJay KewatNo ratings yet

- Investment Analysis & Portfolio ManagementDocument29 pagesInvestment Analysis & Portfolio ManagementMuhammad TalhaNo ratings yet

- Add Math Project Work SPMDocument25 pagesAdd Math Project Work SPMRavind VijayandranNo ratings yet

- Day Trading The World Risk Increse SchemeDocument3 pagesDay Trading The World Risk Increse Scheme1c796e65b8a4c8No ratings yet

- Template GajiDocument5 pagesTemplate Gajirubber artNo ratings yet

- PC DepotDocument26 pagesPC Depotvishakha AGRAWALNo ratings yet

- Consortium of National Law Universities: Provisional 2nd List - CLAT 2024 - UGDocument4 pagesConsortium of National Law Universities: Provisional 2nd List - CLAT 2024 - UGCounter Strike VideosNo ratings yet

- 26 PP Price Circular Wef 19th May 2022 DomesticDocument5 pages26 PP Price Circular Wef 19th May 2022 DomesticMohit MohataNo ratings yet

- REBAR v1.01Document4 pagesREBAR v1.01Cassandra DunnNo ratings yet

- Aman Tawarw NeDocument4 pagesAman Tawarw NeOmkar pharaneNo ratings yet

- User LoginDocument26 pagesUser LoginDira Ayu MeigasariNo ratings yet

- Carmel Ca Homes Market Action Report Real Estate Sales For August 2014Document4 pagesCarmel Ca Homes Market Action Report Real Estate Sales For August 2014Nicole TruszkowskiNo ratings yet

- Carmel Ca Homes Market Action Report Real Estate Sales For September 2014Document4 pagesCarmel Ca Homes Market Action Report Real Estate Sales For September 2014Nicole TruszkowskiNo ratings yet

- Analysis of FS 3Document8 pagesAnalysis of FS 3ALPHANo ratings yet

- The Case of Vanishing InventoryDocument4 pagesThe Case of Vanishing InventoryKushagra SinghaniaNo ratings yet

- Carmel Ca Homes Market Action Report Real Estate Sales For July 2014Document4 pagesCarmel Ca Homes Market Action Report Real Estate Sales For July 2014Nicole TruszkowskiNo ratings yet

- Tata Power - FNO AnalysisDocument19 pagesTata Power - FNO AnalysisritomdNo ratings yet

- 2018-19 A BA4006NI A3 CW Individual Work Prajwal Bikram BasnetDocument10 pages2018-19 A BA4006NI A3 CW Individual Work Prajwal Bikram Basnetpratik bansyatNo ratings yet

- Daily transaction analysisDocument84 pagesDaily transaction analysisBenzyl OmzyNo ratings yet

- TTD NewDocument4 pagesTTD NewB.R. GulshanNo ratings yet

- SAmple DataDocument2 pagesSAmple DataRey Marc VillanuevaNo ratings yet

- Direct Method Local-Prices Local - Ret US-Prices US-Ret: Column D and F Must Be SameDocument2 pagesDirect Method Local-Prices Local - Ret US-Prices US-Ret: Column D and F Must Be SameMohsin SadaqatNo ratings yet

- Venta de Gas Licuado 2003-2005 (Galones) Años Tipo de Gas 2003 2004 2005Document12 pagesVenta de Gas Licuado 2003-2005 (Galones) Años Tipo de Gas 2003 2004 2005David Vitor GómezNo ratings yet

- Fuel Filter and Piping With AiDocument1 pageFuel Filter and Piping With Aieshopmanual limaNo ratings yet

- 15 Day Analysis Part 2Document4 pages15 Day Analysis Part 2Siddharttha RoyNo ratings yet

- Civil Examinatiol: & Examination For of ToDocument9 pagesCivil Examinatiol: & Examination For of ToPankajNo ratings yet

- Pure Competition: DR Ayesha Afzal Assistant ProfessorDocument24 pagesPure Competition: DR Ayesha Afzal Assistant ProfessorFady RahoonNo ratings yet

- Morning Brief3-15Document2 pagesMorning Brief3-15Eli RadkeNo ratings yet

- Morning Brief3 03Document2 pagesMorning Brief3 03Eli RadkeNo ratings yet

- Morning Brief 3 04Document2 pagesMorning Brief 3 04Eli RadkeNo ratings yet

- Morning Brief2 28Document2 pagesMorning Brief2 28Eli RadkeNo ratings yet

- Morning Brief 3 01Document2 pagesMorning Brief 3 01Eli RadkeNo ratings yet

- Morning Brief3 02Document2 pagesMorning Brief3 02Eli RadkeNo ratings yet

- Morning Brief 2-24Document2 pagesMorning Brief 2-24Eli RadkeNo ratings yet

- Morning Brief 2 16Document2 pagesMorning Brief 2 16Eli RadkeNo ratings yet

- Morning Brief 2-18Document2 pagesMorning Brief 2-18Eli RadkeNo ratings yet

- Morning Brief 2 16Document2 pagesMorning Brief 2 16Eli RadkeNo ratings yet

- Morning Brief2 15Document2 pagesMorning Brief2 15Eli RadkeNo ratings yet

- Morning Brief2-11Document2 pagesMorning Brief2-11Eli RadkeNo ratings yet

- Morning Brief2 10Document2 pagesMorning Brief2 10Eli RadkeNo ratings yet

- Morning Brief2 9Document2 pagesMorning Brief2 9Eli RadkeNo ratings yet

- Volume Trading Strategy: Use Indicators to Find High Probability TradesDocument11 pagesVolume Trading Strategy: Use Indicators to Find High Probability TradesEdbertiscoming25% (4)

- Net Income Calculation for Multiple ProblemsDocument3 pagesNet Income Calculation for Multiple ProblemsChris Tian FlorendoNo ratings yet

- FM 107 - SG3Document17 pagesFM 107 - SG3Lovely CabuangNo ratings yet

- Kerastase System Professional E-commerce Market ResearchDocument6 pagesKerastase System Professional E-commerce Market ResearchAna Maria PetreNo ratings yet

- Latihan AFLDocument15 pagesLatihan AFLNyamo SuendroNo ratings yet

- Sakshi Gaikar SYBMS A 68 BPEM AssighnmentDocument8 pagesSakshi Gaikar SYBMS A 68 BPEM AssighnmentAaon EnterprisesNo ratings yet

- Financial Management:: Stock ValuationDocument57 pagesFinancial Management:: Stock ValuationSarah SaluquenNo ratings yet

- Group Assignment MKT420Document26 pagesGroup Assignment MKT420Eylah Fadilah100% (7)

- Domain Model Document ExampleDocument48 pagesDomain Model Document ExampleSankara KumarNo ratings yet

- Philips Lighting 2011Document21 pagesPhilips Lighting 2011Nitesh Kumar0% (1)

- How Loyalty Programs Differ Across Top Indian RetailersDocument29 pagesHow Loyalty Programs Differ Across Top Indian Retailersnitesh kumarNo ratings yet

- Overview of MARKETING PLANDocument27 pagesOverview of MARKETING PLANjoanne riveraNo ratings yet

- ECON1101 Microeconomics 1 PartsAandB S12016Document17 pagesECON1101 Microeconomics 1 PartsAandB S12016sachin rolaNo ratings yet

- Knowledge Management Model Exam Case StudyDocument6 pagesKnowledge Management Model Exam Case StudyShanthiNo ratings yet

- Comparative Study of Cefpodoxime and To Study The Market Potential For RANBAXY's Product PortfolioDocument77 pagesComparative Study of Cefpodoxime and To Study The Market Potential For RANBAXY's Product PortfolioUttam Kr PatraNo ratings yet

- Prospects of Cattle Feed Industry in Ind PDFDocument12 pagesProspects of Cattle Feed Industry in Ind PDFAnurag Singh RajavatNo ratings yet

- Chap - 21 The Theory of Consumer ChoiceDocument97 pagesChap - 21 The Theory of Consumer Choiceruchit2809100% (1)

- CA Final SFM New Syllabus Full Chalisa Book by Aaditya Jain SirDocument48 pagesCA Final SFM New Syllabus Full Chalisa Book by Aaditya Jain SirYedu KrishnanNo ratings yet

- Case Study 4Document4 pagesCase Study 4Nenad MazicNo ratings yet

- Global Real Estate Securities Fund: Goldman SachsDocument2 pagesGlobal Real Estate Securities Fund: Goldman SachsЗолоNo ratings yet

- Binary Options Strategy PDFDocument21 pagesBinary Options Strategy PDFByron Rodriguez0% (1)

- Chapter 13 Preparing For and Evaluating The Challenges of Growth Compatibility ModeDocument26 pagesChapter 13 Preparing For and Evaluating The Challenges of Growth Compatibility ModeSharif Md. Yousuf BhuiyanNo ratings yet

- Module 2Document34 pagesModule 2Ethyl Marie Matuco MarNo ratings yet

- Classification of TaxesDocument3 pagesClassification of TaxesRomela Jean OcarizaNo ratings yet

- Understanding Key Factors in Mango Contractual ArrangementsDocument13 pagesUnderstanding Key Factors in Mango Contractual ArrangementsAtul sharmaNo ratings yet

- Prepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Document20 pagesPrepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Pdf FilesNo ratings yet

- Lecture 11Document33 pagesLecture 11Shaharyar AsgharNo ratings yet

- Chapter 1 Introduction: Marketing For Hospitality and TourismDocument20 pagesChapter 1 Introduction: Marketing For Hospitality and TourismGuchy0984% (19)

- Assignment Unit 4 Fernando LichuchaDocument29 pagesAssignment Unit 4 Fernando LichuchaflichuchaNo ratings yet

- Alternative Investments and StrategiesDocument414 pagesAlternative Investments and StrategiesJeremiahOmwoyoNo ratings yet