Professional Documents

Culture Documents

Sched - Taxes and Licenses

Uploaded by

maenelle_mmtc0 ratings0% found this document useful (0 votes)

16 views2 pagesVALUE ADDED TAX (VAT) 1. VAT output tax 2. VAT input taxes a. B. Beginning of the year Current year's domestic purchases / payments for: goods for resale / manufacture or further processing.

Original Description:

Original Title

sched_taxes and licenses

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentVALUE ADDED TAX (VAT) 1. VAT output tax 2. VAT input taxes a. B. Beginning of the year Current year's domestic purchases / payments for: goods for resale / manufacture or further processing.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views2 pagesSched - Taxes and Licenses

Uploaded by

maenelle_mmtcVALUE ADDED TAX (VAT) 1. VAT output tax 2. VAT input taxes a. B. Beginning of the year Current year's domestic purchases / payments for: goods for resale / manufacture or further processing.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

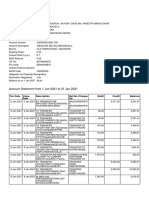

(Company)

SCHEDULE OF TAXES AND LICENSES

FOR THE YEAR ENDED DECEMBER 31, 2010

Official Receipt No. Date Paid Amount Remarks

A. VALUE ADDED TAX (VAT)

1. VAT output tax AGGREGATE

2. VAT input taxes AGGREGATE

a. Beginning of the year

b. Current year's domestic purchases/payments for:

1) Goods for resale/manufacture or further processing

2) Goods other than for resale or manufacture

3) Capital goods subject to amortization

4) Capital goods not subject to amortization

5) Services lodged under cost of goods sold

6) Services lodged under other accounts

c. Claims for tax credit/refund and other adjustment

d. Balance at the end of the year

3. Landed cost of imports and the amount of custom duties and tariff fees AGGREGATE

B. EXCISE TAX AGGREGATE

1. Locally produced excisable items (per product category)

a.

b.

c.

2. Imported excisable items (per product category)

a.

b.

c.

C. DOCUMENTARY STAMP TAX (DST) AGGREGATE

1. Loan instruments

2. Shares of stock

3. Others

D. WITHHOLDING TAXES AGGREGATE

Official Receipt No. Date Paid Amount Remarks

1. Tax on compensation & benefits

2. Creditable withholding tax/es

3. Final withholding tax/es

E. OTHER TAXES (LOCAL AND NATIONAL) AGGREGATE

1. Fixed taxes

2. Specific taxes (basic deficiency taxes)

3. Percentage taxes:

a. Gross receipts tax

b. Other percentage taxes

4. Residence tax -- basic and additional

5. Real estate taxes

6. Business taxes

7. Occupation taxes

8. Custom Duties

9. Mayor's permit

10. Business license

11. Others

a. Annual VAT Registration Fee

b. Registration of ledgers

c. Motor vehicle registration fees

d. Registration fees with:

1) Securities and Exchange Commission

2) Board of Investments

e. Miscellaneous

F. TAX ASSESSMENT AGGREGATE

Period covered __________________________________

G. TAX CASES AGGREGATE

TOTAL TAXES AND LICENSES

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Assignment CTP Dr. Shipra JindalDocument6 pagesAssignment CTP Dr. Shipra JindalAbhishek AroraNo ratings yet

- Accounting for Income Taxes Multiple Choice QuestionsDocument42 pagesAccounting for Income Taxes Multiple Choice QuestionsMarcus MonocayNo ratings yet

- Tax Mod 3Document7 pagesTax Mod 3Ayushi TiwariNo ratings yet

- Course Registration Form: Phi Tech SolutionsDocument3 pagesCourse Registration Form: Phi Tech SolutionsAaniozNo ratings yet

- ISO20022 MDRPart2 PaymentsInitiation 2018 2019 v1Document271 pagesISO20022 MDRPart2 PaymentsInitiation 2018 2019 v1shaziyaNo ratings yet

- IRS Seminar Level 3, Form #12.034Document452 pagesIRS Seminar Level 3, Form #12.034Sovereignty Education and Defense Ministry (SEDM)No ratings yet

- CtaDocument31 pagesCtaDominique VasalloNo ratings yet

- V. Commissioner of Internal Revenue, RespondentDocument3 pagesV. Commissioner of Internal Revenue, RespondentJenifferRimandoNo ratings yet

- Other Percentage Taxes (OPT) : By: Donna Lerma Janica A. PacoDocument48 pagesOther Percentage Taxes (OPT) : By: Donna Lerma Janica A. PacoNiña PacoNo ratings yet

- Medicare Part B Premium Fact SheetDocument2 pagesMedicare Part B Premium Fact SheetTerry PetersonNo ratings yet

- GST/CST & VAT: Karnataka HC rules input tax credit cannot be denied based on tax period or timing of claimDocument16 pagesGST/CST & VAT: Karnataka HC rules input tax credit cannot be denied based on tax period or timing of claimShashwat JoshiNo ratings yet

- Sbi Account Jan 2021Document2 pagesSbi Account Jan 2021Manoj GaurNo ratings yet

- PAGE - 216 (DAY - 16: Date Sales Executives Product Customer QTY Sold (In Boxes)Document5 pagesPAGE - 216 (DAY - 16: Date Sales Executives Product Customer QTY Sold (In Boxes)sourabh6chakrabort-1No ratings yet

- Tax EvasionDocument5 pagesTax EvasionAbhiramNo ratings yet

- Receipt of Payment & Appointment: DSFDSF SDFSDFDFSDFSDFSDFDocument1 pageReceipt of Payment & Appointment: DSFDSF SDFSDFDFSDFSDFSDFRahul GargNo ratings yet

- MIIA vs. Court of Appeals GR No. 155650Document2 pagesMIIA vs. Court of Appeals GR No. 155650ClarickJoshuaVijandreNo ratings yet

- Hospitality Payroll Accounting (Chapter 5Document9 pagesHospitality Payroll Accounting (Chapter 5Atif KhosoNo ratings yet

- 2021 TIMTA-ANNEX B Form (With Sample)Document27 pages2021 TIMTA-ANNEX B Form (With Sample)Mark Kevin IIINo ratings yet

- Preview 31Document16 pagesPreview 31kakabadzebaiaNo ratings yet

- Memorandum of Understanding For Service Bereau: Pt. Rifa Jannah WisataDocument4 pagesMemorandum of Understanding For Service Bereau: Pt. Rifa Jannah WisatasafruddinNo ratings yet

- BCOM HONS 5 Income Tax Law PracticeHDocument36 pagesBCOM HONS 5 Income Tax Law PracticeHPurushottam RathoreNo ratings yet

- Capital OneDocument6 pagesCapital Oneapi-285064294No ratings yet

- CP575Notice 1645023110303Document2 pagesCP575Notice 1645023110303MannatechESNo ratings yet

- Reo Rit - Dealings in PropertiesDocument7 pagesReo Rit - Dealings in PropertiesJohn MaynardNo ratings yet

- JIB-PMES Promulgation No. 163 Rates of Hourly Pay and Allowances 2011-2012Document2 pagesJIB-PMES Promulgation No. 163 Rates of Hourly Pay and Allowances 2011-2012mtipladyNo ratings yet

- Bank Reconciliation StatementDocument16 pagesBank Reconciliation StatementBilal Ali SyedNo ratings yet

- Ingles IIDocument6 pagesIngles IIReport JunglaNo ratings yet

- Basis of ChargeDocument21 pagesBasis of Chargemonirba48No ratings yet

- 03 Asset Rental Invoice and Receipt Daily v1Document10 pages03 Asset Rental Invoice and Receipt Daily v1vijay sainiNo ratings yet

- HDFC Bank Statement Summary for M/S. VIASTAR IMPEX PVT LTDDocument5 pagesHDFC Bank Statement Summary for M/S. VIASTAR IMPEX PVT LTDFIERY TrackNo ratings yet