Professional Documents

Culture Documents

Overview Slide 1Q11

Uploaded by

Josemari CuervoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Overview Slide 1Q11

Uploaded by

Josemari CuervoCopyright:

Available Formats

PHILIPPINES/ Manila - Real Estate

Market Overview – Office Buildings in Metro Manila

Market Snapshot Market Overview Grade-A Building Statistics

Sub- Supply Vacancy Ave. Ave. Rent

• The 1st quarter of 2011 saw the office market market Rent

gradually recovering after bottoming out last year. (sf) US$ psf/

There were a few landlords who increased, although US$ annum

Rental

psf/mth

conservatively, their lease rates, but little changes in Peak

vacancy rates were noted.

2009 1Q

• Recovery is expected to continue, albeit slowly. Makati 29,000,000 8.75% $1.79 $21.48

While global economic conditions are less than CBD

Market Market 2009 2Q

desirable, investor sentiment in the country and local

Slowing Recession Ortigas 12,000,000 3.2% $1.16 $13.92

economic fundamentals improve, leading to gradual

increases in lease rates for most of the business Strengthening Weakening Center

districts in Metro Manila are expected. These Market Market

increases are likely to be within the 5% to 10% Fort 17,000,000 6% $1.27 $15.24

Market Market

range. Recovery Bottoming Bonifacio

2009 3Q

• Restrictions in supply are also likely to be felt by 2011 1Q $0.95 $11.4

2009 4Q Filinvest 7,000,000 22%

mid- to late 2011 as demands increase while little 2010 4Q Corp City

2010 1Q

new supply will be available within the year. The

market has begun its gradual shift from being tenant- 2010 3Q 2010 2Q

Quezon 10,000,000 6% $1.16 $13.92

favorable to neutral. Rental

Trough City

•Based on 1Q 2011 available market info

Makati CBD Lease Rates vs. Vacancy Average Office Rents by Cities Asking Rents

US$psfpa

Proposed Site 2010

US$ psf/ mth

Enterprise Center 1.90

Bonifacio E-Services 1.37

One Corporate Center 1.06

- Ortigas

UP Ayala Technohub 1.12

I-hub 1 0.95

•US$ = Php44

Net Effective Rents (US$/psf/mth) •1Q2011 figures are indicative only based on available info

1 | Philippines / Manila Real Estate April 2011

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Multifamily EbookDocument15 pagesMultifamily EbookLloydMandrellNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- ARISE Spa Struggles to Keep Employees SatisfiedDocument21 pagesARISE Spa Struggles to Keep Employees Satisfiedarjunparekh100% (6)

- (Ebook) Wiley Microsoft Office Access 2007 VBA BibleDocument707 pages(Ebook) Wiley Microsoft Office Access 2007 VBA Biblecastille1956No ratings yet

- Tour Packaging & Sales StrategyDocument20 pagesTour Packaging & Sales StrategyWhena RiosNo ratings yet

- Math and Logic Problems with Multiple Choice AnswersDocument4 pagesMath and Logic Problems with Multiple Choice AnswersTamara Gutierrez100% (3)

- Overview - PrintingDocument10 pagesOverview - Printingemman carlNo ratings yet

- Cathay Pacific v. VasquezDocument2 pagesCathay Pacific v. Vasquezrgtan3No ratings yet

- Forex Signals Success PDF - Forex Trading Lab (PDFDrive)Document30 pagesForex Signals Success PDF - Forex Trading Lab (PDFDrive)scorp nxNo ratings yet

- DESIGNER BASKETS Vs Air Sea TransportDocument1 pageDESIGNER BASKETS Vs Air Sea TransportMarco CervantesNo ratings yet

- Bukit Asam Anual ReportDocument426 pagesBukit Asam Anual Reportwandi_borneo8753No ratings yet

- Southern Manila West Growth AreaDocument28 pagesSouthern Manila West Growth AreaJosemari CuervoNo ratings yet

- Batangas Risk - TSUNAMI HAZARD MAPDocument1 pageBatangas Risk - TSUNAMI HAZARD MAPJosemari CuervoNo ratings yet

- 2011 1Q Manila Office Market BeatDocument2 pages2011 1Q Manila Office Market BeatJosemari CuervoNo ratings yet

- Enterprise ValuationDocument1 pageEnterprise ValuationJosemari CuervoNo ratings yet

- PPH Small Business Review5Document18 pagesPPH Small Business Review5Josemari CuervoNo ratings yet

- EU Demographic CrisisDocument7 pagesEU Demographic CrisisJosemari CuervoNo ratings yet

- BIR Revenue Regulation No. 6-2013Document2 pagesBIR Revenue Regulation No. 6-2013Josemari CuervoNo ratings yet

- Marketview: 2012: The Year of Government Deleveraging MARCH 2012Document9 pagesMarketview: 2012: The Year of Government Deleveraging MARCH 2012Josemari CuervoNo ratings yet

- 2011 3Q Manila Office Market BeatDocument2 pages2011 3Q Manila Office Market BeatJosemari CuervoNo ratings yet

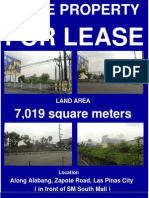

- 7,000 Sqm. Prime Property For Long-Term LeaseDocument2 pages7,000 Sqm. Prime Property For Long-Term LeaseJosemari CuervoNo ratings yet

- Office Space Across The World 2011 - Low ResDocument20 pagesOffice Space Across The World 2011 - Low ResJosemari CuervoNo ratings yet

- Manila Office 3Q10 Market BeatDocument2 pagesManila Office 3Q10 Market BeatJosemari CuervoNo ratings yet

- Manila Office 4Q10 Market BeatDocument2 pagesManila Office 4Q10 Market BeatJosemari CuervoNo ratings yet

- Why The Philippines Is A BPO DestinationDocument67 pagesWhy The Philippines Is A BPO DestinationJosemari Cuervo67% (3)

- Manila Office Market Beat 2Q10Document1 pageManila Office Market Beat 2Q10Josemari CuervoNo ratings yet

- Philippines Leasing Guidelines (12 Oct 2010)Document8 pagesPhilippines Leasing Guidelines (12 Oct 2010)Josemari Cuervo100% (14)

- 100,000 Per SQMDocument2 pages100,000 Per SQMJosemari CuervoNo ratings yet

- BB Philippines Potential GC Aug08 enDocument6 pagesBB Philippines Potential GC Aug08 enJosemari CuervoNo ratings yet

- Philippines Leasing Guidelines 2010Document8 pagesPhilippines Leasing Guidelines 2010Josemari CuervoNo ratings yet

- IRR RESA (PRBRESVer.1) (Consultation Draft)Document12 pagesIRR RESA (PRBRESVer.1) (Consultation Draft)Josemari CuervoNo ratings yet

- Manila Office Market Beat 1Q10Document1 pageManila Office Market Beat 1Q10Josemari Cuervo0% (1)

- Marketing Manager Coordinator Programs in Dallas FT Worth TX Resume KeJaun DuBoseDocument2 pagesMarketing Manager Coordinator Programs in Dallas FT Worth TX Resume KeJaun DuBoseKeJuanDuBoseNo ratings yet

- Financial Accounting I Assignment #2Document3 pagesFinancial Accounting I Assignment #2Sherisse' Danielle WoodleyNo ratings yet

- Glass Manufacture BrochureDocument4 pagesGlass Manufacture BrochureCristian Jhair PerezNo ratings yet

- Chapter07 - AnswerDocument18 pagesChapter07 - AnswerkdsfeslNo ratings yet

- Condition Classification For New GST ConditionsDocument3 pagesCondition Classification For New GST ConditionsVenugopal PNo ratings yet

- P15 Business Strategy Strategic Cost Management PDFDocument4 pagesP15 Business Strategy Strategic Cost Management PDFkiran babuNo ratings yet

- Case 1 Is Coca-Cola A Perfect Business PDFDocument2 pagesCase 1 Is Coca-Cola A Perfect Business PDFJasmine Maala50% (2)

- JKGKJDocument2 pagesJKGKJYing LiuNo ratings yet

- EMBMDocument14 pagesEMBMapi-19882665No ratings yet

- Platinum Gazette 29 July 2011Document12 pagesPlatinum Gazette 29 July 2011Anonymous w8NEyXNo ratings yet

- Resume PDFDocument1 pageResume PDFAlejandro LopezNo ratings yet

- Consumers Research MethodsDocument20 pagesConsumers Research MethodsEunice AdjeiNo ratings yet

- Edmonton Commerce News June-July 2010Document28 pagesEdmonton Commerce News June-July 2010Venture PublishingNo ratings yet

- Affidavit of GiftDocument2 pagesAffidavit of GiftAnonymous puqCYDnQNo ratings yet

- Shriram Discharge Voucher PDFDocument4 pagesShriram Discharge Voucher PDFAnonymous hFDCuqw100% (1)

- Agency v4Document59 pagesAgency v4Roxanne Daphne Ocsan LapaanNo ratings yet

- Adv1 16-4Document1 pageAdv1 16-4M_Sarudi_Putra_4335No ratings yet

- Study Case WalMart A Worldwide CompanyDocument14 pagesStudy Case WalMart A Worldwide CompanyMarie Reynaud-GagnaireNo ratings yet

- This Question Has Been Answered: Find Study ResourcesDocument3 pagesThis Question Has Been Answered: Find Study ResourcesChau NguyenNo ratings yet

- Chapter 10 Cost Planning For The ProductDocument44 pagesChapter 10 Cost Planning For The ProductMuhamad SyofrinaldiNo ratings yet