Professional Documents

Culture Documents

Budget Choices Table Fy 11 12

Uploaded by

jhsmalanka0 ratings0% found this document useful (0 votes)

161 views1 page$1. BILLION in tax loopholes and Special tax Breaks vs. A BUDGET of CHOICES. $88 million cut to University of Pittsburgh and $7 million cut to Lincoln University. $169 million cut to Penn State $90 million cut to Temple university.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document$1. BILLION in tax loopholes and Special tax Breaks vs. A BUDGET of CHOICES. $88 million cut to University of Pittsburgh and $7 million cut to Lincoln University. $169 million cut to Penn State $90 million cut to Temple university.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

161 views1 pageBudget Choices Table Fy 11 12

Uploaded by

jhsmalanka$1. BILLION in tax loopholes and Special tax Breaks vs. A BUDGET of CHOICES. $88 million cut to University of Pittsburgh and $7 million cut to Lincoln University. $169 million cut to Penn State $90 million cut to Temple university.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

A BUDGET OF CHOICES

Devastating Cuts vs. $1.8 Billion in Tax Loopholes and Special Tax Breaks

PROPOSED BUDGET CUT LOOPHOLE CLOSURE

$550 Million: PUBLIC SCHOOLS $500 MILLION

Cut to basic education for 500 school districts Close the Delaware Loophole

$271 Million: STATE SYSTEM OF HIGHER ED $200 MILLION

Cut to 14 public universities Tax on gas drillers in the Marcellus Shale

$259 Million: ACCOUNTABILITY BLOCK GRANTS $235 MILLION

Full day kindergarten for 88,000 students Eliminate the bonus depreciation tax break

$95 Million: STATE-RELATED UNIVERSITIES $90 MILLION

$88 million cut to University of Pittsburgh Postpone the 35% rate cut in Capital Stock and

$7 million cut to Lincoln University Franchise Tax

$125 Million: HEALTH CARE FOR THE

$80 MILLION

UNINSURED Close the loopholes on cigars and smokeless tobacco

adultBasic health insurance

$259 Million: PENN STATE AND TEMPLE

$350 MILLION

$169 million cut to Penn State

Recapture 10% of Bush tax cut to top 5%

$90 million cut to Temple University

$66 Million: LONG TERM LIVING

$74 MILLION

Cuts to services for seniors and people with

Sales tax giveaway loophole

disabilities

$88 Million: BUILDING OUR WORKFORCE

$24 million in cuts to community colleges

$220 MILLION

$27 million in cuts to New Directions training

Liberty Loan Fund

$30 million reduction in student loans

$7 million Industry Partnerships

$40 Million:VULNERABLE PENNSYLVANIANS

$24 million Human Services Development Fund $52 MILLION

$10 million Emergency Mortgage Assistance (HEMAP) Close the Amazon sales tax loophole

$3 million adult literacy

$6 million autism services

$ 1.75 Billion $1.8 Billion

You might also like

- Wealth of IdeasDocument1 pageWealth of IdeasThe London Free PressNo ratings yet

- Spencer Cox 2021 Budget RecommendationDocument124 pagesSpencer Cox 2021 Budget RecommendationThe Salt Lake TribuneNo ratings yet

- Budget Book FinalDocument124 pagesBudget Book FinalMcKenzie StaufferNo ratings yet

- A Cosmopolitan Approach To Balancing BudgetsDocument21 pagesA Cosmopolitan Approach To Balancing BudgetsLil-SolNo ratings yet

- Progressive Caucus Budget Survey Results (June 2010)Document4 pagesProgressive Caucus Budget Survey Results (June 2010)NewsFromMelissaNo ratings yet

- NYS Inequality & Struggle For RedistributionDocument54 pagesNYS Inequality & Struggle For RedistributionFrancesco CroccoNo ratings yet

- Ny Ultra Millionaires Taxes Poll MemoDocument3 pagesNy Ultra Millionaires Taxes Poll Memocbs6albanyNo ratings yet

- Common Ground On Debt LimitDocument2 pagesCommon Ground On Debt LimitCommittee For a Responsible Federal BudgetNo ratings yet

- Site C Cabinet Briefing UpdatedDocument18 pagesSite C Cabinet Briefing UpdatedRoger BryentonNo ratings yet

- Robbers On The Loot (0812-19A)Document3 pagesRobbers On The Loot (0812-19A)Anil SelarkaNo ratings yet

- A Campaign of The Coalition For A Strong UCDocument17 pagesA Campaign of The Coalition For A Strong UCsswanbeck6022No ratings yet

- Repealing The Death Tax Will Create Jobs and Boost EconomyDocument22 pagesRepealing The Death Tax Will Create Jobs and Boost EconomyFamily Research CouncilNo ratings yet

- Budget Cuts Facts Sheet 10-29-09final1Document3 pagesBudget Cuts Facts Sheet 10-29-09final1Elizabeth SotoNo ratings yet

- May 12 Coalition Pay Back Time FinalDocument32 pagesMay 12 Coalition Pay Back Time FinalProgressive Caucus of the New York City CouncilNo ratings yet

- An Economy For The 1%: How Privilege and Power in The Economy Drive Extreme Inequality and How This Can Be StoppedDocument44 pagesAn Economy For The 1%: How Privilege and Power in The Economy Drive Extreme Inequality and How This Can Be StoppedOxfamNo ratings yet

- Department of Budget & Management: T. Eloise Foster, Secretary Martin O'Malley, Governor Anthony G. Brown, Lt. GovernorDocument38 pagesDepartment of Budget & Management: T. Eloise Foster, Secretary Martin O'Malley, Governor Anthony G. Brown, Lt. GovernorAnonymous Feglbx5No ratings yet

- Tallman August 2010 Budget Slide ShowDocument36 pagesTallman August 2010 Budget Slide ShowPAHouseGOPNo ratings yet

- PLCB Alternatives MemoDocument47 pagesPLCB Alternatives MemoCommonwealth FoundationNo ratings yet

- Agriculture Law: RS21493Document6 pagesAgriculture Law: RS21493AgricultureCaseLawNo ratings yet

- BILLIONS FOR BANKERS, DEBTS FOR PEOPLEDocument35 pagesBILLIONS FOR BANKERS, DEBTS FOR PEOPLEjwarswolvesNo ratings yet

- WH On Plan BDocument4 pagesWH On Plan BZeke MillerNo ratings yet

- Statement: The People of Wisconsin Our House 1-800-MAD-BAJRDocument3 pagesStatement: The People of Wisconsin Our House 1-800-MAD-BAJRLaura ChernNo ratings yet

- Beyond Bailouts, Let's Put Life Ahead of MoneyDocument4 pagesBeyond Bailouts, Let's Put Life Ahead of MoneyDaisyNo ratings yet

- 02-28-08 MoJo-Primer - Obama Vs Clinton On The Top 10 EconomicDocument4 pages02-28-08 MoJo-Primer - Obama Vs Clinton On The Top 10 EconomicMark WelkieNo ratings yet

- PolBrief - American Rescue Plan and Its Impact On BroadbandDocument3 pagesPolBrief - American Rescue Plan and Its Impact On BroadbandKiarra LouisNo ratings yet

- October, 2012: Propositions 30 & 38 in Context - California Funding For Public SchoolsDocument40 pagesOctober, 2012: Propositions 30 & 38 in Context - California Funding For Public Schoolsk12newsnetworkNo ratings yet

- Hit Budget CutsDocument5 pagesHit Budget CutscherylberylNo ratings yet

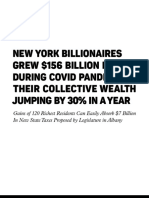

- Investinournewyork BillionairepandemicprofitDocument9 pagesInvestinournewyork BillionairepandemicprofitZacharyEJWilliamsNo ratings yet

- The Texas Budget: An UpdateDocument14 pagesThe Texas Budget: An UpdateJason RobertsNo ratings yet

- Calpine Corporation: Case SummaryDocument3 pagesCalpine Corporation: Case SummaryUtkarsh TiwariNo ratings yet

- Umact Cra Multi-Party 2012-06-11Document2 pagesUmact Cra Multi-Party 2012-06-11Phil KerpenNo ratings yet

- Trump GoatDocument25 pagesTrump GoatCyberPunk.Lawyer0% (1)

- Workers Vanguard No 754 - 16 March 2001Document12 pagesWorkers Vanguard No 754 - 16 March 2001Workers VanguardNo ratings yet

- The Big Idea CompilationDocument30 pagesThe Big Idea CompilationCarolyn McClendon100% (2)

- Economic Recovery ViewDocument2 pagesEconomic Recovery ViewStuart Elliott100% (2)

- 12 Inflation Ideas From Experts - The Washington Post PDFDocument16 pages12 Inflation Ideas From Experts - The Washington Post PDFSukrit BirmaniNo ratings yet

- Pandemic Billionaires: What Happened? Great Injustice, Great InequalityFrom EverandPandemic Billionaires: What Happened? Great Injustice, Great InequalityNo ratings yet

- 4th Quarter 2001 Calulating The Cost of TerrorDocument4 pages4th Quarter 2001 Calulating The Cost of TerrorAntiCleptocratNo ratings yet

- Canadian Life & Health Insurance Facts 2019 EditionDocument28 pagesCanadian Life & Health Insurance Facts 2019 Editioncasa blancaNo ratings yet

- How The U.S. Became A GlobalDocument3 pagesHow The U.S. Became A Globalbeng LEENo ratings yet

- Budget cuts opening gapsDocument2 pagesBudget cuts opening gapsHazar YükselNo ratings yet

- The 10 Stealth Economic Trends That Rule The World TodayDocument4 pagesThe 10 Stealth Economic Trends That Rule The World TodayKartik VoraNo ratings yet

- When and How We Were BetrayedDocument2 pagesWhen and How We Were BetrayedJustin ThymeNo ratings yet

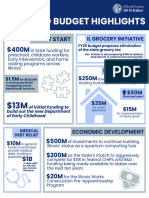

- FY25 Budget Highlights One-PagerDocument1 pageFY25 Budget Highlights One-PagerAnn DwyerNo ratings yet

- Gov. Jerry Brown's Trigger CutsDocument1 pageGov. Jerry Brown's Trigger CutsThe Press-Enterprise / pressenterprise.comNo ratings yet

- A Campaign of The Coalition For A Strong UCDocument20 pagesA Campaign of The Coalition For A Strong UCsswanbeck6022No ratings yet

- Revenue Raising and Cost Saving Options DescriptionDocument5 pagesRevenue Raising and Cost Saving Options DescriptionrkarlinNo ratings yet

- Mts 0923Document40 pagesMts 0923Veronica SilveriNo ratings yet

- Labor Markets and Health Care Refor M: New Results: Executive SummaryDocument6 pagesLabor Markets and Health Care Refor M: New Results: Executive Summaryapi-27836025No ratings yet

- Stand The Proper Role of The Government in The Economy. On The Expenditures Side ofDocument1 pageStand The Proper Role of The Government in The Economy. On The Expenditures Side ofpenelopegerhardNo ratings yet

- Updated Heroes Act SummaryDocument87 pagesUpdated Heroes Act SummaryZerohedge100% (1)

- Work Shop in EnglishDocument4 pagesWork Shop in EnglishYulianna Vergel HerreraNo ratings yet

- GST and PovertyDocument16 pagesGST and PovertyHafiz AhmadNo ratings yet

- Solutions To Poverty & Excessive Inequality: October 25, 2006Document15 pagesSolutions To Poverty & Excessive Inequality: October 25, 2006Hamza RashedNo ratings yet

- MECEP Tax Plan Review 10 May 2011Document2 pagesMECEP Tax Plan Review 10 May 2011gerald7783No ratings yet

- The Spirit Level: Why Greater Equality Makes Societies StrongerFrom EverandThe Spirit Level: Why Greater Equality Makes Societies StrongerRating: 4 out of 5 stars4/5 (234)

- The Great Revenue Robbery: How to Stop the Tax Cut Scam and Save CanadaFrom EverandThe Great Revenue Robbery: How to Stop the Tax Cut Scam and Save CanadaNo ratings yet

- False Profits: Recovering from the Bubble EconomyFrom EverandFalse Profits: Recovering from the Bubble EconomyRating: 3 out of 5 stars3/5 (2)

- United Way Advocacy-LetterCampaignDocument1 pageUnited Way Advocacy-LetterCampaignjhsmalankaNo ratings yet

- ShreddingDocument1 pageShreddingjhsmalankaNo ratings yet

- Profil Perkembangan Penduduka Kab - Kapuas Hulu Akhir Tahun 2010Document10 pagesProfil Perkembangan Penduduka Kab - Kapuas Hulu Akhir Tahun 2010Bang MohtarNo ratings yet

- AnnualReport FinalDocument12 pagesAnnualReport FinaljhsmalankaNo ratings yet

- MLK FlyerDocument1 pageMLK FlyerjhsmalankaNo ratings yet

- Special Care and Adultbasic: Comparison ChartDocument1 pageSpecial Care and Adultbasic: Comparison ChartjhsmalankaNo ratings yet

- MLK FlyerDocument1 pageMLK FlyerjhsmalankaNo ratings yet

- MLK FlyerDocument1 pageMLK FlyerjhsmalankaNo ratings yet

- Direct Expense Indirect ExpenseDocument4 pagesDirect Expense Indirect Expensejeetu_x9No ratings yet

- Coca-Cola Co. 2019 Net Income of $8.92BDocument2 pagesCoca-Cola Co. 2019 Net Income of $8.92BDBNo ratings yet

- TAX05 - First Preboard ExaminationDocument13 pagesTAX05 - First Preboard ExaminationMIMI LANo ratings yet

- Difference Between Tax and FeeDocument4 pagesDifference Between Tax and FeeAbhay KushwahaNo ratings yet

- View Payslip OnlineDocument1 pageView Payslip OnlineArlene D. Panaligan44% (52)

- Assignment 2Document6 pagesAssignment 2TAWHID ARMANNo ratings yet

- Landmark New Eu Vat Ecommerce Rules GuideDocument16 pagesLandmark New Eu Vat Ecommerce Rules GuideBrian WangNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sajine DNo ratings yet

- Summer Internship ReportDocument47 pagesSummer Internship ReportBijal Mehta43% (7)

- M6 - Capital Gains TaxationDocument31 pagesM6 - Capital Gains TaxationTERRIUS AceNo ratings yet

- 03 27 21Document18 pages03 27 21버니 모지코No ratings yet

- CPA Review School of The Philippines Manila General Principles of Taxation Dela Cruz/De Vera/LlamadoDocument10 pagesCPA Review School of The Philippines Manila General Principles of Taxation Dela Cruz/De Vera/LlamadoAbraham Marco De GuzmanNo ratings yet

- Wall Street Courier Services, Inc. PayslipDocument1 pageWall Street Courier Services, Inc. PayslipAimee TorresNo ratings yet

- Chapter 4 - TaxesDocument28 pagesChapter 4 - TaxesabandcNo ratings yet

- CIR vs. Arnoldus Carpentry Shop, Inc., G.R. No. 71122, March 25, 1988 Tax AmnestyDocument2 pagesCIR vs. Arnoldus Carpentry Shop, Inc., G.R. No. 71122, March 25, 1988 Tax AmnestyEim Balt MacmodNo ratings yet

- Tugasan Kumpulan Dasar & Analisis FiskalDocument10 pagesTugasan Kumpulan Dasar & Analisis FiskalthonyNo ratings yet

- FAQ For PIC and Cash GrantDocument4 pagesFAQ For PIC and Cash GrantSathis KumarNo ratings yet

- Cir v. Acesite DigestDocument3 pagesCir v. Acesite DigestkathrynmaydevezaNo ratings yet

- Ratios and Proportions Unit PlanDocument4 pagesRatios and Proportions Unit Planapi-377808688No ratings yet

- Eligibility Results NoticeDocument12 pagesEligibility Results NoticeNinaPintaSantaMariaNo ratings yet

- Leave W/ Pay Leave W/ Pay Holiday Pay Holiday Pay: Total Deductions Total DeductionsDocument1 pageLeave W/ Pay Leave W/ Pay Holiday Pay Holiday Pay: Total Deductions Total DeductionsVic CumpasNo ratings yet

- Instructions For Form 709: United States Gift (And Generation-Skipping Transfer) Tax ReturnDocument12 pagesInstructions For Form 709: United States Gift (And Generation-Skipping Transfer) Tax ReturnIRSNo ratings yet

- Quotation For Scrap & E Waste-Orica1Document2 pagesQuotation For Scrap & E Waste-Orica1Rakesh Singh100% (3)

- Smietanka v. First Trust & Savings BankDocument3 pagesSmietanka v. First Trust & Savings BankPaul Joshua SubaNo ratings yet

- Solution Aassignments CH 13Document2 pagesSolution Aassignments CH 13RuturajPatilNo ratings yet

- Taco 0294334031000005Document1 pageTaco 0294334031000005Govinda RajuluNo ratings yet

- 3232 Void Corrected: Copy A W-2GDocument8 pages3232 Void Corrected: Copy A W-2GSrujan KumarNo ratings yet

- CTA Case Phil Am Life V CTA and CommissionerDocument4 pagesCTA Case Phil Am Life V CTA and Commissionersaintkarri100% (3)

- Cpar 2016Document6 pagesCpar 2016Rosemarie Miano TrabucoNo ratings yet

- Agricultural Income Tax Exemption GuideDocument6 pagesAgricultural Income Tax Exemption GuideAbhijeet TalwarNo ratings yet