Professional Documents

Culture Documents

Suzuki's US Market Entry and Marketing Strategy Analysis

Uploaded by

Adarsh Manish TiggaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Suzuki's US Market Entry and Marketing Strategy Analysis

Uploaded by

Adarsh Manish TiggaCopyright:

Available Formats

Suzuki Motor Company Market Strategy Analysis

Analysis of marketing strategy of Suzuki Motor Company, Ltd. (Suzuki) Company Background: Michio Suzuki founded Suzuki Loom Works, a privately owned loom manufacturing company, in 1909 in Hamamatsu, Japan. In 1952, the company began manufacturing and marketing a 2-cycle, 36 cubic centimetre (cc) motorcycle, which became so popular that in 1954 the company introduced a second motorcycle and changed its name to Suzuki Motor Company, Ltd. (Suzuki).In 1985, American Suzuki opened its automotive division and was the first manufacturer in the United States compact utility Vehicle. SUZUKI'S MARKETING STRATEGY IN THE U.S. MARKET ENTRY STATEGY: Suzuki changes its policy many times according to the market requirements. At first they entered in the US market as exporter of a single product (only motor cycle) with pure vertical integration. In 1964 Suzuki began exporting motorcycles to the United States. It established a wholly owned subsidiary, U.S Suzuki Motor Company, Ltd., to serve as the exclusive importer and distributor of Suzuki motorcycles. Then it began to export multi products and out sources its one brand: In 1983, General Motors (GM) purchase 5% of Suzuki hand helped the company a subcompact car for the US market. The car name was Chevrolet Sprint, it was the first entry into the continental US automobile market. And it was introduced regional basis only in the West Coast. At last they decide to go for manufacturing in foreign land: GM's success with Sprint showed Suzuki that a market existed for its cars in the continental of United States. So the company planned to introduce several unique vehicles into the U.S market over time. Suzuki had no guarantee, how ever, the GM would be willing to market the vehicles. Therefore, Suzuki decided to establish its own presence in the US automobile industry. Japan's voluntary restrain agreement (VRA) quotas made it impossible for Suzuki to export any cars other than the Sprint to USA in future. So in 1985, Suzuki and GM began negotiations with the Canadian government to build a plant in Ontario that could produce approximately 200,000 subcompact cars per year. Suzuki management expected the plant to be on line by early 1989, and the company could then begin selling cars in the USA under its own name. But the US market was growing market and was very lubricated for both Japanese and other foreign competitors, and Suzuki managers believed that clutter might limit their success if they waited until 1989, they were convince that it was the right time to enter in USA. And in 1985 Suzuki introduced the SJ413 an upgraded model of SJ 410 and designed specially for US market. On May 10,1985 Suzuki hired Douglas Mazza to organize and to head of its subsidiary ASMC, he was responsible for both developing dealer network and making marketing plan for SJ413. Suzuki planned to market two versions of the Samurai in USA, a convertible and a hard top. DISTRIBUTION: Mazza's goal was to establish ASMC as a major car company in U.S. To accomplish this objective he adopted the following steps: Convince prospective dealers to build separate showrooms for the Samurai. Then he designed a dealer agreement that required prospective Samurai dealers to build an exclusive sales facility for the Samurai including a showroom, sales offices, and a customer waiting and accessory display area. The dealers were required to dedicate minimum of two service stalls to Suzuki, which had to be operated by Suzuki-trained mechanics. Required dealership to display specific signs and outside the sales office and in the service stalls.

A minimum of three salespeople, two service technicians, one general manager, and one general clerk had to be dedicated to the Suzuki dealership. The bullet points above are illustrating the fact that the company followed the selective distribution (close to exclusive distribution) It allowed the company to achieve higher profitability, dealer loyalty, greater sales support and also higher degree of control over the retail market. PRICING POLICY FOR DEALERS: Price is the only marketing variable that generates revenue. Though it is close to exclusive distribution that is characterized by high margin, high profit and low volume, Mazza adopted with an opposite view. The company aimed to gain market response for its high quality with low price advantage. Thus their strategy was to sell high volume with low profit margin. Thus ASMC's planned retail price for the basis Samurai was $5,995. The planned dealer invoice price was $5095, only 7.5% higher than ASMC's own landed cost for the vehicle. Additionally they planned to offer about 50 dealer installed option, the sale of which would boost a dealer's unit profit. Each dealership's needed to sell approximately 30 Samurai per month to cover its investment and operating expenses. ALLOTMENT TO DEALER: Mazza planned to limit the number of samurai dealers so that ASMC could guarantee a minimum supply of 37 units. Suzuki had set Mazza the goal of selling 6000 Samurais in first six month. But later realizing far more potential of the market, Suzuki raised its commitment to ASMC to 10,500 vehicles for the same time period. Finally, Mazza decided to limit his initial dealer network to no more than 47 dealers. Mazza chose to introduce Samurai into California, Florida and Georgia, which have higher usage of, imported vehicles. POSITIONING STRATEGY: Positioning is placing a brand in that particular part of the market where it will receive a favorable reception compared to competing products. From the point of view of Leonard Pearlstein, president and CEO of keye/ donna/ pearlstein advertising agency, positioning is," The unique way we want prospects to think about a product." Douglas Mazza wanted a fresh approach for his company's new product so he gave the responsibility to that advertising agency, which had no experience in developing campaign for automobiles. After accepting the offer, Pearlstein and his associates scanned the industry practice for automobile advertising. They found out that the industry practice was to position vehicles according their physical characteristics. They also found out that most advertising was feature/ benefit or price oriented. Based on its physical characteristics, the major three positioning options for Samurai SJ413 were: *Position as a compact sport utility vehicle. *Position as a compact pickup truck. *Position as a subcompact car. The pros and cons of positioning the samurai in each of these segments individually are given below: COMPACT SPORT UTILITY VEHICLE: The most obvious position for the samurai was as a sport utility vehicle. It looked like a "mini- jeep" and had 4-wheel drive capability. PROS: *The features matched exactly with the attributes of compact sport utility vehicle. *Designed to drive well off road. *Positioning as a sport utility vehicle is consistent with the samurai' heritage. *Praising of foreign owners because of samurai's reliability. It had the ability to go anywhere where larger vehicles could not and ease of repair. *Smaller and lighter than the other vehicles. *It's price and size made it distinct from all other sport utility vehicles in the U.S. market. It was sold below the price of the other vehicles.

Thus the positioning of Samurai as sport utility vehicle solely concentrated on the low price and its ability to squeeze through places where bigger vehicles could not go. So, it needed to be advertised as a " Tough little cheap Jeep." CONS: There seemed to be a problem of whether the positioning could generate the envisioned sales volume. *The market for sport utility vehicle was relatively small. In 1984 it was less than 3% in the U.S market. The goal was to build as annual sales of 30,000 units within 2 years of its introduction. To achieve this it was required to exceed the combined 1984 sales of all imported sport vehicles. COMPACT PICKUP TRUCK: The advertising copy should emphasize the vehicle's looks. PROS: *It would tap a market two and one-half times the size of that for compact sport utility vehicles. *It also had the advantage that Japanese trucks sold well in the U.S accounting for 54% of total 1984 compact pickup trucks. *It had the high level of US consumers' acceptance. *The Samurai could be used as a truck when purchased without back seat or when its back seat was folded up. *The price was also set at the retail price to keep it in comparison with Japanese imported trucks. Thus the positioning strategy would only indicate uniformity with other truck prices but rather uphold a serious, practical, male-targeted tough truck. SUBCOMPACT CAR: PROS: *Positioning the Samurai as a subcompact car would open up the largest of the three possible markets. *A trend had been developed that professional like lawyers, doctors drove it to their offices leaving their Mercedes at home. *The Samurai boasted an average 28 miles per gallon in combined city and highway driving, was priced lower than many subcompact cars, and offered more versatility. *Those who were shopping for an economy car could consider it. *Thus the positioning strategy should give emphasis upon looks and style of the car. CONS: *But if it was positioned as a car then it might not meet the expectations of the consumers because the Samurai was built on a truck platform, its ride was stiffer and less comfortable than the least-expensive subcompact cars. UNPOSITIONING STRATEGY: Unpositioning is just the opposite of positioning. It is offering a single product to the entire market. Each person can define the product in his or her owns way and can rationalize the purchase decision in his or he owns terms. Pearlstein Ad agency suggests that Samurai SJ 413 should be unpositioned in the market to cover all three possible segments; compact sport utility vehicle, compact pickup truck and subcompact car. ADVANTAGES OF UNPOSITIONING: Larger Target Customers: Due to unpositioning Suzuki Samurai American Suzuki Motor Corporation (ASMC) gets the opportunity to target the ent ire potential consumers segment. The Unpositioned Suzuki Samurai will appeal the users of pick up truck, subcompact cars and sports utility vehicle. That ensures higher consumer acceptance by offering a car for various needs. Customer satisfaction: If each consumer is allowed to personally define the Samurai, this would lead to greater similarity between the vehicle's promise and its delivery if Suzuki told customers what the Samurai was by clearly defining the image of the vehicle.

Higher Profitability: As unpositioning will target a larger customer segments, it will definitely increase sales and thus add larger profit to the company's income statement also. Thus this strategy is perfectly compatible with company's goal that is to establish ASMC as a major car company in the US. Threat to Competitors: Unpositioning will offer a car with different purpose. Also it will serve the purpose of versatile transportation. The broader appeal of the car can reduce its competitors' sales and thus can guarantee sales more than 6000 units in the first six months. So, in the mean time, competitors' sales might deteriorate. DISADVANTAGES OF UNPOSITIONING: Losing Customers: Suzuki Samurai already had its brand appeal as a rugged utility vehicle in Canada. The stylish looking little jeep along with its stylish looks made the car popular as the utility jeep to handle driving in rain, snow and off-road. The jeep is popular for going to fishing, camping and skiing. So, if other consumers start to use it as subcompact car or pick up truck, it will lose its brand image. It might also happen that the present consumers might reject the jeep with different appeals. Thus losing customers will be a greater loss. Loosing Potential Market: The other possibility is if Samurai SJ 413 could try to be the nicher in the "Tough-LittleCheap Jeep" segment they might land up as a market leader in that particular segment. So, the company needs to sacrifice the possibility of being number one in the niche market by accepting the "Unpositioning" strategy. Trouble for the Sales People: Due to unpositioning strategy sales people will suffer for explaining the various use of the car and it will be difficult for them to emphasize upon one particular need to the buyers. If two buyers with different perceptions contact one salesman at a time, the salesman need to be expert enough to sell two cars for two different reasons at one single time. Increased Confusion: Confusion will arise among consumers if Suzuki avoid positioning. People usually use vehicles that they feel as the car for their own convenient. So, when they see that the car is also meant for different segment of people, obviously they will be confused. Thus sales might dropped out. The advertising agency wanted the car to be positioned as "antidote to traditional transportation" and thought an "alternative to small-car-boredom". Therefore, unpositioning could therefore attract buyers from all three-vehicle segments. But, in the long run the company needs to highlight a more specific need to motivate the consumers to purchase Samurai SJ 413. RECOMMENDED STRATEGY: In recommending the strategies for Suzuki Samurai in USA, we are going to suggest some comments about some of the strategic issues. These are: Market Targeting Positioning Relationship Distribution Pricing Promotion and Advertising MARKET TARGETING: Suzuki wants its Samurai to sell extensively in the US market. So to target market it should follow extensive targeting strategy. The car should not be for any specific Suzuki's Marketing Strategy in the U.S. segment but for all who needs a car. It will maximize the sales of the car and thus will increase revenue and profit. Moreover, it is likely to build customer awareness and eagerness to buy a Samurai in every potential car buyer. There are less risk as the research showed that there is huge demand for the earlier model and the market was preferring the Japanese vehicle as they were ensured about the quality of Japanese product and these vehicles were economical (Both mileage and price). POSITIONING: Three alternatives, including sport utility vehicle, compact pick-up truck, and a subcompact car, are mentioned earlier to position Samurai among the clients which. But research shows that customers perceive the car in different ways. To achieve higher market share and sales it will be unwise for Suzuki to impose any perception on consumers mind. And that is why it should avoid positioning the Samurai as a specific type of vehicle so as not to exclude large groups of potential buyers. From the research the agency found out that a young or young-at-heart person is a prospect for Samurai. Any sport utility buyer can be attracted by just looking at the vehicle, it can be perceived as a alternative to dull automobiles for small-car buyers and small truck purchaser were buying them to use as cars as the we less expensive many and more versatile than import subcompact cars. Although there are disadvantages regarding unpositioning the car but the 80-20 rule is more applicable here. As the vehicle has every characteristic to attract every possible market segment, adoption from ay of the segments would get the job done. RELATIONSHIP: Relationship strategy should also be planned among the organizations, dealers and customers. In the modern world of business it is very hard for a single organization to run with the technology, financial

constraint, access to market etc alone. So, Suzuki should take measures to build strategic alliance with potential companies in US. Relationship among dealers and customers are also important. Customer satisfaction and after sales servicing is two major issues that can play an effective role in positive attitude and perception towards Samurai. Brand image: As Samurai is a new product in the market it should build a strong brand image among the potential customers. The matter to consider is Suzuki, the maker of Samurai, is not new in the market and already it has a place in customers mind. The strategy that Suzuki should take is to make efficient use of that identity to make the new brand stable and reliable. DISTRIBUTION: Suzuki can go for vertical marketing system (VMS) for distribution. VMSs dominate the retailing sector. A primary feature of VMS is the management of the distribution of the distribution channel by one organization. The firm that is the channel manager directs programming and coordination of channel activities and functions. Operating rules and guidelines indicate the functions of responsibilities of each participant. Management assistance and services are supplied to the participating organizations by the firm that is the channel leader. ASMC can also practice competitive channel strategy simultaneously to increase sales of Samurai. Addition intensive may be offered to sell certain numbers of Samurai to each dealer in this regard. PRICING: As Suzuki already fixes price of the Samurai, there is very low option to offer any pricing strategy for this car. But still price can be used in various ways n the marketing program positioning strategy. These are: Price may be used as a signal to buyer because the price of Samurai is visible to the buyer and provides a basis of comparison between brands. It may be used to position the brand as a high-quality product at a less price. It may be used as an instrument of competition. In the US market all of the similar cars are selling at $8000 $13000 while Samurai is priced at $5995. So, undoubtedly it is a competitive factor. It may be used to improve financial performance of the company also. And productivity, expansion, investment etc. mostly depends on financial performance. The low price of the Samurai can be used as penetration pricing strategy to capture great share of the market. Penetration pricing reflects a long-term perspective in which short-term profits are sacrificed in order to establish sustainable competitive advantage. At the same time Samurai can enjoy the advantages of one-price strategy also that includes administrative convenience, easier pricing process etc. PROMOTION AND ADVERTISING: The advertising and promotion budget of ASMC for the first six month is $2.5 million. Typically an automobile manufacturer spent 77% of its advertising dollars on television ads, 10% on print ads, and 3% on highway billboards. The print ads were to run in both general-interest magazines and enthusiast magazines. To establish Samurai as a car of customers' perception a comprehensive/integrated promotion strategy is badly required. The objective of this strategy for Samurai should be as follows: Creating or increasing buyer awareness of the car Influencing buyer attitude toward the company Suzuki and the brand Samurai. Achieving increases in sales and market share for specific customer or prospect target. Generating repeat purchase of the car. Encouraging trial of the car. Attracting new customers with existing Suzuki clients. Encouraging long term relationship. Suzuki should follow the IMC (integrated marketing communication) strategies to integrate the promotion tools because: IMC programs are comprehensive. Advertising, personal selling, publicity, direct marketing, sales promotion and other forms are all considered in the planning of an IMC.

IMC programs are unified. The messages delivered by all media are the same or supportive of a unified theme. IMC programs are targeted. The public relation programs, advertising programs, and dealer/distributor programs all have the same or related target markets. IMC programs coordinated execution of all the communication components of the organization. Suzuki may also apply sales promotion activities to the following groups to achieve its goal of selling designated number of Samurai. These are: Promotion to consumer targets: consumers may be offered free servicing for certain time period, or some gifts with the purchase. Promotion to industrial/sports team target: Discounts may be given for big orders from such organizations. Promotion to channel members: Intensive or bonus may be announced to the channel members for selling certain number of vehicles.

You might also like

- Ford ProjectDocument46 pagesFord ProjectSanchit JasujaNo ratings yet

- Rural Perception of SUV CarsDocument29 pagesRural Perception of SUV CarsritusinNo ratings yet

- ToyotaDocument53 pagesToyotaFĂrhẳn ŞĂrwẳr100% (1)

- MG Motors Updated 1Document9 pagesMG Motors Updated 1Shivam JadhavNo ratings yet

- RunnerDocument35 pagesRunnerMd. Tarikul IslamNo ratings yet

- Channel Conflict Group16v0 2Document14 pagesChannel Conflict Group16v0 2Joan DelNo ratings yet

- Models For Setting Advertising ObjectivesDocument8 pagesModels For Setting Advertising ObjectivesSabeer HamsaNo ratings yet

- Consumer Behavior Small Cars DelhiDocument6 pagesConsumer Behavior Small Cars DelhisahibaultimateNo ratings yet

- Rural Marketing ResearchDocument24 pagesRural Marketing ResearchAnonymous d3CGBMzNo ratings yet

- MARKET SEGMENTATION, TARGETING AND POSITIONING OF BGI BREWERIESDocument11 pagesMARKET SEGMENTATION, TARGETING AND POSITIONING OF BGI BREWERIESYared DemissieNo ratings yet

- Sales & Distribution ProjectDocument14 pagesSales & Distribution ProjectAmitNo ratings yet

- Customer Perception of Maruthi SuzukiDocument9 pagesCustomer Perception of Maruthi SuzukiOm Prakash100% (1)

- Analysis of Marketing Mix of Honda Cars in IndiaDocument25 pagesAnalysis of Marketing Mix of Honda Cars in Indiaamitkumar_npg7857100% (5)

- Bus 221 Professional Selling Assignment #1Document6 pagesBus 221 Professional Selling Assignment #1Karanveer Singh100% (1)

- Bajaj Project - 2000Document115 pagesBajaj Project - 2000Patel BhargavNo ratings yet

- Marketing Stratergies of Maruti SuzukiDocument58 pagesMarketing Stratergies of Maruti SuzukiAniket YadavNo ratings yet

- Final Report Passenger CarsDocument20 pagesFinal Report Passenger CarsAditya Nagpal100% (1)

- Hatchback CarDocument13 pagesHatchback Carmrunal mehtaNo ratings yet

- Mega Presentation On Bajaj Auto LTDDocument22 pagesMega Presentation On Bajaj Auto LTDraunak0% (1)

- Yamaha ReportDocument15 pagesYamaha ReportCheshta NavalNo ratings yet

- Naba Hussain Indus Motor Company Limited Internship Report PDFDocument31 pagesNaba Hussain Indus Motor Company Limited Internship Report PDFMuzammil Aslam0% (1)

- An Empirical Study On Organic Products and Services at Organic Mandya - A Case Study With Special Reference To Mandya DistrictDocument8 pagesAn Empirical Study On Organic Products and Services at Organic Mandya - A Case Study With Special Reference To Mandya DistrictGowtham RaajNo ratings yet

- The Evolution and Structure of The Two-Wheeler Industry in IndiaDocument1 pageThe Evolution and Structure of The Two-Wheeler Industry in IndiaSuman KumarNo ratings yet

- RUDI - The Gujarat Model of Rural Distribution NetworkDocument4 pagesRUDI - The Gujarat Model of Rural Distribution NetworkNikeeta Parikh100% (1)

- BAJAJ PlatinaDocument83 pagesBAJAJ PlatinaushadgsNo ratings yet

- King NARZARY BBA PROJECT 6Document80 pagesKing NARZARY BBA PROJECT 6Sunny SinghNo ratings yet

- Understanding Consumer Behavior Towards Bundling of BiscuitsDocument4 pagesUnderstanding Consumer Behavior Towards Bundling of BiscuitsAneesh Kumar100% (1)

- Marketing AuditDocument20 pagesMarketing AuditpsivathmikaNo ratings yet

- Marketing Strategy of Maruti SuzukiDocument3 pagesMarketing Strategy of Maruti SuzukiManas Chitransh0% (1)

- BMW Films Campaign AnalysisDocument14 pagesBMW Films Campaign Analysisyudhie_7100% (2)

- This Case Study Details The Entrepreneurial Success Story of Hero HondaDocument4 pagesThis Case Study Details The Entrepreneurial Success Story of Hero HondaSantosh KumarNo ratings yet

- Assignment No 3 STPDocument9 pagesAssignment No 3 STPHarshad TupsaundarNo ratings yet

- CONCLUSIONSDocument7 pagesCONCLUSIONSujvalda0% (1)

- RubcoDocument93 pagesRubcoAfeel KallingalNo ratings yet

- NikeDocument33 pagesNikeRocking Heartbroker DebNo ratings yet

- BajajDocument29 pagesBajajggeettNo ratings yet

- Suzuki Project NewDocument92 pagesSuzuki Project Newshradha870% (1)

- Hero Honda's Rural Market StrategyDocument29 pagesHero Honda's Rural Market StrategySaurabh SanchetiNo ratings yet

- Marketing Project Report On Measuring Success of New Product in Indian Auto Mobile Industry1Document66 pagesMarketing Project Report On Measuring Success of New Product in Indian Auto Mobile Industry1sneyadavNo ratings yet

- Marketing Strategy of Micromaxx MbaDocument57 pagesMarketing Strategy of Micromaxx MbaPrints BindingsNo ratings yet

- Janata Bank Micro CreditDocument25 pagesJanata Bank Micro CreditMahfoz KazolNo ratings yet

- Dabur ProjectDocument66 pagesDabur ProjectSachin BhorNo ratings yet

- Moo Milk Marketing Communication PlanDocument14 pagesMoo Milk Marketing Communication PlanIan Kiprop100% (1)

- Contemporary Marketing Project On Walls Pakistan: Instructor: Mr. Imran QamarDocument35 pagesContemporary Marketing Project On Walls Pakistan: Instructor: Mr. Imran QamarOasama BatlaNo ratings yet

- Two Wheeler Industry HERO MOTO CORP & BAJAJ AUTO LTD (ROLL NO 39)Document16 pagesTwo Wheeler Industry HERO MOTO CORP & BAJAJ AUTO LTD (ROLL NO 39)sakshiNo ratings yet

- Addidas Marketing Experiment in IndiaDocument2 pagesAddidas Marketing Experiment in IndiaHimanshu YadavNo ratings yet

- Pak Suzuki AssignmentDocument25 pagesPak Suzuki AssignmentAsif AliNo ratings yet

- SIP On MicromaxDocument75 pagesSIP On MicromaxPrashant Kumar AryaNo ratings yet

- Amazon Market StrategyDocument4 pagesAmazon Market StrategyHarshit gargNo ratings yet

- Consumer PerceptionDocument43 pagesConsumer PerceptionKunal Rajput100% (1)

- BCG Matrix PPT of AppleDocument15 pagesBCG Matrix PPT of AppleHEMANSHU JOSHI0% (1)

- Report On Maruti Suzaki Ltd.Document54 pagesReport On Maruti Suzaki Ltd.rony guy100% (1)

- Case Study On Suzuki Samurai: Course: Strategic Marketing (EMB620)Document14 pagesCase Study On Suzuki Samurai: Course: Strategic Marketing (EMB620)sg8397No ratings yet

- Case Study On Suzuki Samurai: Course: Strategic Marketing (EMB620)Document14 pagesCase Study On Suzuki Samurai: Course: Strategic Marketing (EMB620)Keerthi NarayananNo ratings yet

- Case Study On Suzuki SamuraiDocument38 pagesCase Study On Suzuki SamuraiKeerthi Narayanan100% (2)

- Suzuki Samuri Case Study AnalysisDocument5 pagesSuzuki Samuri Case Study Analysisbinzidd007100% (1)

- Suzuki Samurai CaseDocument4 pagesSuzuki Samurai CaseSiddharth SinghNo ratings yet

- Suzuki Samurai Case Analysis080114Document51 pagesSuzuki Samurai Case Analysis080114Hari Gopal100% (1)

- Suzuki Motor Corporation Change AnalysisDocument21 pagesSuzuki Motor Corporation Change Analysismclawson1No ratings yet

- Suzuki Samurai Case Analysis GROUP 03Document52 pagesSuzuki Samurai Case Analysis GROUP 03Maddala Srinivasa Rao50% (2)

- Power of Business Models PDFDocument9 pagesPower of Business Models PDFAdarsh Manish Tigga100% (1)

- Morgan Stanley's $1.5M 360 Degree Feedback SystemDocument3 pagesMorgan Stanley's $1.5M 360 Degree Feedback SystemAdarsh Manish TiggaNo ratings yet

- CB Group3 Senat BankDocument2 pagesCB Group3 Senat BankAdarsh Manish TiggaNo ratings yet

- Transportation Problem 1Document26 pagesTransportation Problem 1catchsachitaNo ratings yet

- RedBrand Answers 1Document3 pagesRedBrand Answers 1Karthikeyan VelusamyNo ratings yet

- MAK-I Assignment Sales Soft Section D Group 3Document5 pagesMAK-I Assignment Sales Soft Section D Group 3Adarsh Manish TiggaNo ratings yet

- FP 587 JIMNYTANZANIE CFAO en BD-1Document2 pagesFP 587 JIMNYTANZANIE CFAO en BD-1Jesse TungarazaNo ratings yet

- Brochure Jimny SierraDocument8 pagesBrochure Jimny SierraΖαχος ΤσελιοςNo ratings yet

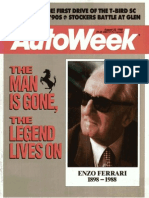

- Aug. 22, 1988 Autoweek - The Death of Enzo FerrariDocument64 pagesAug. 22, 1988 Autoweek - The Death of Enzo FerrariAutoweekUSANo ratings yet

- Suzuki Suzuki Worldwide Automotive Epc5!05!2019 Spare Part Catalog Full UpdateDocument23 pagesSuzuki Suzuki Worldwide Automotive Epc5!05!2019 Spare Part Catalog Full Updatebriandaniels130398nsz100% (120)

- Suzuki Samurai Case Analysis080114Document51 pagesSuzuki Samurai Case Analysis080114Hari Gopal100% (1)

- Jimny Technical SpecsDocument2 pagesJimny Technical SpecsImran KhanNo ratings yet

- Suzuki Jimny Brochure AustraliaDocument11 pagesSuzuki Jimny Brochure AustraliaAnthony Baker100% (1)

- Case Study On Suzuki Samurai: Course: Strategic Marketing (EMB620)Document14 pagesCase Study On Suzuki Samurai: Course: Strategic Marketing (EMB620)Keerthi NarayananNo ratings yet

- Price ListDocument6 pagesPrice Listalaric gothNo ratings yet

- Suzuki sj410 Workshop Manual PDFDocument4 pagesSuzuki sj410 Workshop Manual PDFAditya Hendra0% (3)

- Suspension Cat Vol 15.3 No Price 131015 PDFDocument96 pagesSuspension Cat Vol 15.3 No Price 131015 PDFLeonardo A. Muñoz DominguezNo ratings yet

- Fit for SUZUKI /スズキ enginesDocument3 pagesFit for SUZUKI /スズキ enginesEdixo ReyesNo ratings yet

- 7 GAIKINDO Import Data Janmay2023Document1 page7 GAIKINDO Import Data Janmay2023afuNo ratings yet

- Special ToolsDocument2 pagesSpecial ToolsAdrian Nicolas Macaya BarriaNo ratings yet

- Suzuki sj410 Workshop Manual PDFDocument4 pagesSuzuki sj410 Workshop Manual PDFAditya Hendra0% (4)

- Suzuki / Alto: Oem Number Oem NumberDocument15 pagesSuzuki / Alto: Oem Number Oem NumberBobCavNo ratings yet

- Suzuki Jimny BrochureDocument13 pagesSuzuki Jimny Brochurecolourhut100% (1)

- Ramejosh SuzukiDocument63 pagesRamejosh SuzukiAnguto PeseyieNo ratings yet

- Case Study On Suzuki SamuraiDocument38 pagesCase Study On Suzuki SamuraiKeerthi Narayanan100% (2)

- Jimny BrochureDocument20 pagesJimny BrochureThongminlal KhongsaiNo ratings yet

- JB43-Little Monsters EvolvedDocument9 pagesJB43-Little Monsters EvolvedrizalziNo ratings yet

- Suzuki 4x4 Rock LobsterDocument9 pagesSuzuki 4x4 Rock LobsterDavid BainNo ratings yet

- Suzuki LJ Back Up Lamp Search Result EbayDocument1 pageSuzuki LJ Back Up Lamp Search Result EbayOscar GomezNo ratings yet

- 40th Anniversary Suzuki Jimny Sierra PDFDocument12 pages40th Anniversary Suzuki Jimny Sierra PDFabyzenNo ratings yet

- Suzuki Suzuki: A A A A A A A ADocument9 pagesSuzuki Suzuki: A A A A A A A AEleazar PavonNo ratings yet

- (TM) Suzuki Manual de Taller Suzuki Samurai 2000Document266 pages(TM) Suzuki Manual de Taller Suzuki Samurai 2000Antonio Jose Delgado RodriguezNo ratings yet

- Suzuki Jimny BrochureZADocument19 pagesSuzuki Jimny BrochureZAgolden-eagleNo ratings yet

- Manual Book Suzuki Katana sj410 PDFDocument2 pagesManual Book Suzuki Katana sj410 PDFweki noy100% (1)

- Suzuki Jimny BrochureDocument32 pagesSuzuki Jimny BrochureAlya MaulidaNo ratings yet

- Suzuki Samuri Case Study AnalysisDocument5 pagesSuzuki Samuri Case Study Analysisbinzidd007100% (1)