Professional Documents

Culture Documents

Atlantic Corporation Case: Free Cash Flow Residual Value NPV Wacc

Uploaded by

Rafa Alvarez-Hevia QuirósOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Atlantic Corporation Case: Free Cash Flow Residual Value NPV Wacc

Uploaded by

Rafa Alvarez-Hevia QuirósCopyright:

Available Formats

ATLANTIC CORPORATION CASE

1984

EBITDA (+)

Amortization (-)

Other Financial Costs (-)

EBIT (=)

Taxes (year 83 23,6%)

Net Profit

Amortization (+)

Interests ( 1-T ) (+)

New Investments (-)

Change WC (+/-)

1985

1986

1987

1988

1989

35.9

10.9

144.63

-119.63

-28.23

-91.40

10.9

110.50

19.2

-3.4

73.6

16.9

144.63

-87.93

-20.75

-67.18

16.9

110.50

30.5

-0.8

100.2

25

144.63

-69.43

-16.39

-53.04

25

110.50

41.7

-1.2

98.9

29.2

144.63

-74.93

-17.68

-57.25

29.2

110.50

10.2

1.3

100.9

31.3

144.63

-75.03

-17.71

-57.32

31.3

110.50

10.2

0

100.9

21.2

144.63

-64.93

-15.32

-49.61

21.2

110.50

8.2

4.1

Free Cash Flow

Residual Value

7.4

28.9

39.6

73.6

74.3

78.0

Sum

7.4

28.9

39.6

73.6

74.3

78.0

NPV

WACC

Price / Share ($)

N Shares (Exibit 5)

18.31

35.7

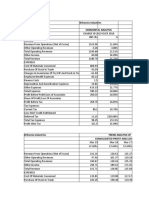

1984

Previous Amort. (5 years)

New Investment

Amort. of New Investment

Total Amort.

New Amort. % (5 years)

8

19.2

2.9

10.9

15.10%

1984

Fix WC (Exibit 4, constant)

WC New Investments (Exibit 4)

Total WC

49

3.4

52.4

1985

1986

1987

1988

1989

8

30.5

8.9

16.9

17.91%

8

41.7

17

25

18.60%

8

10.2

21.2

29.2

20.87%

8

10.2

23.3

31.3

20.84%

0

8.2

21.2

21.2

21.03%

1985

1986

1987

1988

1989

49

4.2

53.2

49

5.4

54.4

49

4.1

53.1

49

4.1

53.1

49

0

49

Change WC

Working Capital 83

-3.4

-0.8

-1.2

49

(Exibit 5)

Exibit 5

70% aprox.

E

D

Kd

Ke

Rf

MP

T

1531

1085

0.135

0.2108

0.124

1

0.0868

0.236

1.3

4.1

ATION CASE

1990

1991

1992

100.9

16.3

144.63

-60.03

-14.17

-45.86

16.3

110.50

6.2

0

100.9

9.1

144.63

-52.83

-12.47

-40.36

9.1

110.50

6.2

0

100.9

8.2

144.63

-51.93

-12.26

-39.67

8.2

110.50

6.2

0

1993

100.9

7.2

144.63

-50.93

-12.02

-38.91

7.2

110.50

6.2

0

74.7

73.0

72.8

72.6

1326.2

74.7

73.0

72.8

1398.8

653.6

16.61%

3.6

1990

1992

1993

0

0

6.2

6.2

16.3

9.1

16.3

9.1

21.31% 22.20%

0

6.2

8.2

8.2

22.16%

0

6.2

7.2

7.2

21.82%

1990

1992

1993

49

0

49

1991

1991

49

0

49

49

0

49

49

0

49

You might also like

- Preliminary: Interest Rate Futures PG09 Fri, Jun 11, 2021 PG09 Bulletin # 111@Document1 pagePreliminary: Interest Rate Futures PG09 Fri, Jun 11, 2021 PG09 Bulletin # 111@Lan HoàngNo ratings yet

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsFrom EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsNo ratings yet

- Interco CaseDocument12 pagesInterco CaseRyan LamNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Metkore Alloys & IndustriesDocument10 pagesMetkore Alloys & Industriesmukeshkumar91No ratings yet

- Ardl Quarterly Data MainDocument3 pagesArdl Quarterly Data MainFaustina NgozichukwuNo ratings yet

- Epz ExtraDocument4 pagesEpz ExtraSpriha TahsinNo ratings yet

- IntercoDocument1 pageIntercorishabh1981No ratings yet

- Revised Xcel From AvniDocument5 pagesRevised Xcel From AvniHannah BlackNo ratings yet

- Table 115: Direct and Indirect Tax Revenues of Central and State GovernmentsDocument2 pagesTable 115: Direct and Indirect Tax Revenues of Central and State GovernmentsmaddyNo ratings yet

- Daily Rainfall Deviation AnalysisDocument3 pagesDaily Rainfall Deviation AnalysisAnggun Vita MutiaraNo ratings yet

- Financial Performance: 10 Year Track RecordDocument2 pagesFinancial Performance: 10 Year Track RecordSheikh HasanNo ratings yet

- Calaveras Vineyards ExhibitsDocument9 pagesCalaveras Vineyards ExhibitsAbhishek Mani TripathiNo ratings yet

- 05 B.com 7 EconometricsDocument5 pages05 B.com 7 Econometricsarham buttNo ratings yet

- US - India ToT AnalysisDocument13 pagesUS - India ToT AnalysisKartik ChopraNo ratings yet

- Chart Title Chart Title: Axis Title Axis TitleDocument13 pagesChart Title Chart Title: Axis Title Axis TitleOscar Acuña GodoyNo ratings yet

- Dabur's P&L statement shows rising profits over 5 yearsDocument20 pagesDabur's P&L statement shows rising profits over 5 yearsAkshay Yadav Student, Jaipuria LucknowNo ratings yet

- Yahoo! Finance SpreadsheetDocument7 pagesYahoo! Finance SpreadsheetAnonymous 5lDTxtNo ratings yet

- M&M FinancialsDocument21 pagesM&M Financialsyogesh280785No ratings yet

- Ceramic High Pass Filter HFTC-16+: Typical Performance DataDocument1 pageCeramic High Pass Filter HFTC-16+: Typical Performance DatafirststudentNo ratings yet

- Metric Tolerance Chart PDFDocument6 pagesMetric Tolerance Chart PDFSinan YıldırımNo ratings yet

- Metric Tolerance Chart PDFDocument6 pagesMetric Tolerance Chart PDFSinan Yıldırım100% (1)

- Metric Tolerance ChartDocument6 pagesMetric Tolerance ChartVinoth Sang100% (1)

- Metric hole tolerance chart for machined partsDocument6 pagesMetric hole tolerance chart for machined partsSwapnilSawantNo ratings yet

- Metric Tolerance Chart PDFDocument6 pagesMetric Tolerance Chart PDFSinan Yıldırım100% (1)

- CEMEX Financials 1988-1999Document3 pagesCEMEX Financials 1988-1999William HendersonNo ratings yet

- Supreme Annual Report 15 16Document104 pagesSupreme Annual Report 15 16adoniscalNo ratings yet

- Arcadian CaseDocument18 pagesArcadian CaseYulianaXie0% (1)

- Descargas Rios LambayequeDocument36 pagesDescargas Rios LambayequeAngel AcuñaNo ratings yet

- 2013 Market in ReviewDocument14 pages2013 Market in Reviewg_nasonNo ratings yet

- Unitech Limited: CIN: L74899DL1971PLC009720 Statement of Consolidated Results For The Quarter & Year Ended March 31, 2014Document4 pagesUnitech Limited: CIN: L74899DL1971PLC009720 Statement of Consolidated Results For The Quarter & Year Ended March 31, 2014Bhuvan MalikNo ratings yet

- RJR NabiscoDocument22 pagesRJR Nabiscokriteesinha100% (2)

- AseanDocument20 pagesAseanNgọc MaiNo ratings yet

- Direction of Foreign Trade: Description Exports F.O.BDocument2 pagesDirection of Foreign Trade: Description Exports F.O.BSuniel ChhetriNo ratings yet

- Data For BDDocument8 pagesData For BDthasan_1No ratings yet

- Rosario Acero S.A - LarryDocument12 pagesRosario Acero S.A - LarryStevano Rafael RobothNo ratings yet

- Metode Tren Semi Rata-RataDocument8 pagesMetode Tren Semi Rata-RataMuh FuadNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Labft1 Post3Document17 pagesLabft1 Post3Maria Jose AyalaNo ratings yet

- MW SolutionDocument19 pagesMW SolutionDhiren GalaNo ratings yet

- Radio One - Exhibits1-4Document8 pagesRadio One - Exhibits1-4meredith12120% (1)

- Financial Data On Companies Comparable To Digital EverywhereDocument4 pagesFinancial Data On Companies Comparable To Digital EverywhereTavneet Singh100% (1)

- Case Study On Tottenham Hotspur PLCDocument5 pagesCase Study On Tottenham Hotspur PLCClaudia CarrascoNo ratings yet

- JUBlifeDocument37 pagesJUBlifeavinashtiwari201745No ratings yet

- StatisticsDocument16 pagesStatisticsshiraj_sgNo ratings yet

- Module 5 Steve Mendoza Bsentrep 1a Microeconomics Ecc 122Document6 pagesModule 5 Steve Mendoza Bsentrep 1a Microeconomics Ecc 122Steve MendozaNo ratings yet

- KirimDocument10 pagesKirimWiwik BudiawanNo ratings yet

- Econometric Submitted To: Prof. Dr. Salman RizaviDocument11 pagesEconometric Submitted To: Prof. Dr. Salman RizaviAdibaNo ratings yet

- 93-Tire-City 22 22Document26 pages93-Tire-City 22 22Daniel InfanteNo ratings yet

- NO (DWT) (Panjang Kapal) : Corelation RegressionDocument18 pagesNO (DWT) (Panjang Kapal) : Corelation RegressionMuhammadArifAzwNo ratings yet

- Case - Tottenham AnalysisDocument20 pagesCase - Tottenham AnalysisJakeJohnsonNo ratings yet

- Holly FashionDocument6 pagesHolly FashionAndreea MNo ratings yet

- Infosys VatsDocument4 pagesInfosys VatsPratham MittalNo ratings yet

- Price Per Share: AssumptionsDocument4 pagesPrice Per Share: Assumptions87018701No ratings yet

- Fy Cutoff 2023 24Document1 pageFy Cutoff 2023 24Shraddha NikamNo ratings yet

- Particulars 2014 2015 2016 2017 2018: Results For The YearDocument3 pagesParticulars 2014 2015 2016 2017 2018: Results For The YearVandita KhudiaNo ratings yet

- Latest 2010 2009 2008 2007 2006 2005 2004 2003 Year No. of CompaniesDocument9 pagesLatest 2010 2009 2008 2007 2006 2005 2004 2003 Year No. of Companieskhetan_avinakeNo ratings yet

- Models For Corporate Valuation (XLS) - Smitha P-04106Document81 pagesModels For Corporate Valuation (XLS) - Smitha P-04106panchaksharimbNo ratings yet

- Britannia Industries Financial AnalysisDocument4 pagesBritannia Industries Financial AnalysisSneha BhartiNo ratings yet