Professional Documents

Culture Documents

Corporate Restructuring For Value Creation

Uploaded by

Krishna VyasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Restructuring For Value Creation

Uploaded by

Krishna VyasCopyright:

Available Formats

Corporate Restructuring for Value Creation

Introduction

Restructuring is widely used in both the developed and developing countries nowadays. Companies and economies are restructuring to achieve a higher level of performance or to survive when the given structure becomes dysfunctional. Restructuring takes place at different levels. At the level of the whole economy, it is a long-term response to market trends, technological change, and macroeconomic policies. At the sector level, restructuring causes change in the production structure and new arrangements across enterprises. At the enterprise level, firms restructure through new business strategies and internal reorganization in order to adapt to new market requirements. The "Corporate restructuring" is an umbrella term that includes mergers and consolidations, divestitures and liquidations and various types of battles for corporate control. The essence of corporate restructuring lies in achieving the long run goal of wealth maximization. This study is an attempt to highlight the impact of corporate restructuring on the shareholders value in the Indian context. Thus, it helps us to know, if restructuring generates value gains for shareholders (both those who own the firm before the restructuring and those who own the firm after the restructuring), how these value gains have be created and achieved or failed.

Evolution

Last year, M&A activities were largely restricted to IT and telecom sectors. They have now spread across the economy. As BusinessWorld recently reported, this is the fourth wave of corporate deal-making in India. The first happened in the 1980s, led by corporate raiders such as Swaraj Paul, Manu Chhabria and R P Goenka, in the very early days of reforms. In view of the license raj prevailing then, buying a company was one of the best ways to generate growth, for ambitious corporates. In the early 1990s, in the liberalized economy, Indian business houses began to feel the heat of competition. Conglomerates that had lost focus were forced to sell non-core businesses that could not withstand competitive pressures. The Tatas, for instance, sold TOMCO to Hindustan Lever. Corporate restructuring, largely drove this second wave of M&As. The third wave started about five to ten years ago, driven by consolidation in key sectors like cement and telecommunications. Companies like Bharti TeleVentures and Hutch bought smaller competitors to establish a national presence. What makes the most recent wave of M&As different from the three previous ones is the involvement of global players. Foreign private equity is

Krishna Kant Vyas

Page 1

coming into Indian companies, like Newbridge's recent investment in Shriram Holdings. Multinational corporations are also entering India. Swiss cement major Holcim's investment in ACC and Oracle's purchase of a 41 per cent stake in i-flex solutions are good examples. Meanwhile, Indian companies, sensing attractive opportunities outside the country are also venturing abroad. Tata Steel has bought Singapore-based NatSteel for $486 million. Videocon has bought the colour picture tubes business of Thomson for $290 million.

Definition of Restructuring and Value Creation

The word structure used in an economic context implies a specific, stable relationship among the key elements of a particular function or process. To restructure means the (hopefully) purposeful process of changing the structure of an institution (a company, an industry, a market, a country, the world economy, etc.). The structure defines the constraints under which institutions function in their day-to-day operations and in pursuit of better economic performance. Restructuring can, therefore, be defined as a set of discrete decisive measures taken in order to increase the competitiveness of the enterprise and thereby to enhance its value. In this study, we define restructuring as a change in the operational structures, investment structures, financing structures and governance structure of a company. The objective of restructuring is to transform the company into an enterprise that is of high value to its owners. Value Creation can be interpreted as managing the performance of individual business units with respect to the cash flow generated or rates of return earned over time. In our study, the term Value Creation refers to improvements of the return on investment of owners by increasing the cash inflows and reducing risk. The value created in a business is measured by comparing the rate of return on assets (ROA) to the cost of capital (k) of a company.

Corporate Restructuring

Corporate Restructuring is the corporate management term for the act of partially dismantling and reorganizing the legal, ownership, operational, or other structures of a company for the purpose of making it more profitable, or better organized for its present needs. The process of reorganizing a company may be implemented due to a number of different factors, viz., a change of ownership or ownership structure, demerger, or a response to a crisis or major change in the business such as bankruptcy, repositioning, or buyout or poise the corporation to move in an entirely new direction.

Krishna Kant Vyas

Page 2

Executives involved in restructuring often hire financial and legal advisors to assist in the transaction details and negotiation. It may also be done by a new CEO hired specifically to make the difficult and controversial decisions required to save or reposition the company. It generally involves financing debt, selling portions of the company to investors, and reorganizing or reducing operations.

Activities involved under Corporate Restructuring

Corporate Restructuring, in a broad sense, encompasses two distinct groups of activities: 1. Business Restructuring: Expansions- including mergers and consolidations, tender offers, joint ventures, and acquisitions: Contraction- including sell offs, spin offs, equity carve outs, abandonment of assets, and liquidation. 2. Financial Restructuring: Value Engineering- Subsidiarisation, De-subsidiarisation. Ownership and Control- including the market for corporate control, stock repurchases program, exchange offers and going private.

Type of Corporate Restructuring

1

Mergers and Consolidations:

Consolidation is a type of corporate restructuring and occurs when two or more organizations come together to form a completely new corporation. This new corporation typically includes all assets and liabilities of the combined separate companies. Consolidations usually occur between organizations of similar size. Merger is also a type of corporate restructuring and occurs when two or more organizations merge into one, usually involves one or more smaller organizations merging into a larger organization and becoming part of that larger organization. Within a merger, the acquiring company (generally large and more important company) usually will approach a target company (smaller and less important company) to arrange a merger. Sometimes, however, the target company may approach acquiring company. The key outcome that the acquiring company seeks from a merger is synergy, leverage, key staff, technology or even preventing a competitor from acquiring a particular company.

Joint Venture:

Joint Venture is an entity formed by two or more companies for a specific period with a specific objective. Joint ventures are useful for a company to enter into new segment of market. Joint venture creates a new entity,

Krishna Kant Vyas

Page 3

however, Strategic Alliance allows companies to remain independent while perusing agreed goal. 3

Acquisitions:

An acquisition is another ambiguous term. At the most general, it means an attempt by one firm, called the acquiring firm to gain a majority interest in another firm called the target firm. The effort to gain control may be a prelude to a subsequent merger. The strategies that can be employed in corporate acquisitions are friendly takeovers & hostile takeovers. Hostile takeover usually occurs when the acquiring company approaches Target Company but management of the target company or the board of directors of the target company do not support the proposal for acquisition. Hence it occurs when acquiring company approached shareholders directly without firstly approaching the management and board of directors of the target company. Acquiring company then attempts to obtain the required amount of shares in the market place via tender offers. Tender offers refer to formal offers made to the shareholders in the market place to obtain a certain amount of shares at a given price which is above the current market price. The acquiring company may also undertake a creeping tender offer by silently purchasing enough shares in the market place before making their intentions known. Friendly takeover involves a situation where the acquiring company approaches the management of the target company with the proposal for acquisition. If management supports such an acquisition and if the board of directors sees a takeover to be in best interests of shareholders, then the board makes such a recommendation to the shareholders. If shareholders approval is obtained then a friendly takeover occurs and it is completed by the acquiring company obtaining shares in the target company.

4 Sell offs

A sell-off, also known as a divestiture, is the outright sale of a company subsidiary. A divestiture is the sale of a portion of the firms assets to a third partytypically another company or a private equity fundin a private transaction. The assets sold may be a division, segment, subsidiary, or product line. Normally, sell-offs are done because the subsidiary doesn't fit into the parent company's core strategy. The market may be undervaluing the combined businesses due to a lack of synergy between the parent and subsidiary. Besides getting rid of an unwanted subsidiary, seller typically receives cash, sometimes also securities or a combination of both. The proceeds from the sale are reinvested in the remaining business or distributed to Krishna Kant Vyas Page 4

the firms claim holders. Divestitures may trigger a substantial tax liability.

5 Equity Carve outs

An equity carve out is a partial initial public offering (IPO) of the stock in a subsidiary. The subsidiary gets its own management team and a separate board of directors. It becomes subject to all financial and other reporting requirements of public companies. The parent company often retains a controlling interest, creating a public minority interest in the subsidiary. There are several reasons for the retention of a majority ownership of the voting rights: Retention of at least 80% allows consolidation for tax purposes and the opportunity to subsequently undertake a tax-free spinoff, while retention of 50% or more permits consolidation for accounting purposes. Of course, since the subsidiary becomes a publicly traded company of its own, thus, carve out reduce the parents control over its former wholly owned subsidiary. The shares offered in the IPO may be sold either by the subsidiary itself (a primary issue) or by the parent company (a secondary issue). A primary issue has no tax consequence, while a secondary issue is taxable to the parent as a capital gain. Because of this difference in tax treatment, the majority of equity carve outs are primary issues.

6 Spin offs

A spinoff occurs when a subsidiary becomes an independent entity. The parent firm distributes shares of the subsidiary to its shareholders through a stock dividend. Since this transaction is a dividend distribution, no cash is generated. In contrast to a divestiture, a spinoff does not generate any cash proceeds for the parent company. Also, since the spinoff involves a public listing of shares, it has higher transaction costs and takes longer time than a divestiture. Thus, spinoffs are unlikely to be used when a firm needs to finance growth or deals. After the spinoff, the subsidiary becomes a separate legal entity with a distinct management and board. Like carve-outs, spinoffs are usually about separating a healthy operation. In most cases, spinoffs unlock hidden shareholder value. For the parent company, it sharpens management focus.

7 Tracking Stocks

A tracking stock is a special type of stock issued by a publicly held company to track the value of one segment of that company. The stock allows the different segments of the company to be valued differently by investors. The company might issue a tracking stock so the market can value the new business separately from the old.

Krishna Kant Vyas

Page 5

Why would a firm issue a tracking stock rather than spinning-off or carving-out its fast growth business for shareholders? The company retains control over the subsidiary; the two businesses can continue to enjoy synergies and share marketing, administrative support functions, a headquarters and so on. Finally, and most importantly, if the tracking stock climbs in value, the parent company can use the tracking stock it owns to make acquisitions. Still, shareholders need to remember that tracking stocks are class B, meaning they don't grant shareholders the same voting rights as those of the main stock. Each share of tracking stock may have only a half or a quarter of a vote. In rare cases, holders of tracking stock have no vote at all. There are several ways to distribute tracking stock. It can be issued to current shareholders as a dividend or used as payment in an acquisition. The most common way, however, is to sell the tracking stock in a public offering, raising cash for the parent firm. Once the tracking stock is listed, the underlying division files separate financial statements with the SEC. Thus, tracking stock creates a type of quasi-pure play, where the tracked division files its own financial statements and has its own stock, while still being part of the diversified firm. Since tracking stock is an issue of the companys own stock, it has no tax implications.

8 Leveraged recapitalizations

A leveraged recapitalization (henceforth recap) is a significant payout to shareholders financed by new debt borrowed against the firms future cash flow. The company remains publicly traded, but with a substantially higher debt level. The cash distribution to shareholders is typically structured as a large, special onetime dividend. Alternatively, the distribution could be in the form of a share repurchase or exchange offer. Management often forfeits the cash distribution on their shareholdings and instead takes additional stock. Consequently, leveraged recaps typically result in a substantial increase in managerial equity ownership. A leveraged recapitalization triggers a tax liability at the investor level. The tax depends on how the payout to shareholders is structured. For a special dividend, the amount distributed from the firms retained earnings is taxed as a dividend. If the special dividend exceeds the retained earnings on the firms balance sheet, the remaining cash distribution is a return of capital, treated as a capital gain. If the recap is structured as a share repurchase, the entire distribution is taxed as a capital gain.

9 Leverage Buyouts (LBO)

A leveraged buyout is the acquisition and delisting of an entire company or a division, financed primarily with debt. The buyer is typically a private Krishna Kant Vyas Page 6

equity fund managed by an LBO sponsoror recently sometimes a consortium of funds. The sponsor raises debt to finance the majority of the purchase price and contributes an equity investment from the fund. The equity is injected into a shell company, which simultaneously borrows the debt and acquires the target. The sponsor relies on the companys cash flow, often supplemented by assets sales, to service the debt. The objective is to improve operating efficiency and grow revenue for a 35 year period before divesting the firm. Debt is paid down over time and all excess returns accrue to the equity holders. The exit may be in the form of an IPO, a sale to a strategic buyer, or a sale to another LBO fund. While an IPO typically generates a higher valuation, it could take several years for the LBO fund to entirely unwind its holdings through the public markets. A management buyout (MBO) is a leveraged buyout of a segment, a division or a subsidiary of a large corporation in which key corporate executives play a critical role. MBOs are generally smaller than traditional LBOs and, depending on the size of the transaction, a sponsor need not be involved. An LBO is financed with a mix of bank loans, high-yield debt, mezzanine debt, and private equity. The bank debt, which is often syndicated in the leveraged loan market, is secured and most senior in the capital structure. The bank debt has to be amortized before any other claimholders are paid off. At times, cash sweeps are common, requiring the firm to use any excess cash flow for accelerated amortization of the bank loans. Private equity is the most junior in the capital structure. It typically has voting rights but no dividends. This equity is raised from pension funds, endowments, insurance companies, and wealthy individuals into a fund managed by a private equity partnership (the sponsor).

Restructuring and Value Creation Models

In the Literature of restructuring and which could give a relevant general studied in order to identify important empirically investigated in enterprises value creation, we identified four models, framework for analysis. The models are factors for creating value that need to be in transition. These models are:

a. Restructuring Pentagon of Copeland, Koller and Murrin [1990] b. The Potential and Resilience Evaluation (PARE) model of Crum and Goldberg [1998] c. Value Chain Model of Porters [1985] d. Value Network Model of Rappaport [1986]

Copeland, Koller and Murrins Restructuring Pentagon

Copeland, Koller and Murrin [1990] have provided a valuation framework for calculating the value of a single or multi-business company and a Krishna Kant Vyas Page 7

restructuring pentagon framework for analyzing value creation. Their valuation framework based on an analysis of the companys free cash flow and key value. The value of a business is the sum of the value of assets in place and the value of growth opportunities. The value of assets in place is determined by the level of net operating profit after taxes (NOPAT), as well as the weighted average cost of capital (WACC). The value of growth opportunities is determined by the key value drivers of the rate of return on invested capital, the amount of new investment, the period of competitive advantage, the investment rate and the weighted average cost of capital. The most important key value drivers in this valuation framework are the rate of return on invested capital relative to the weighted average cost of capital and the amount the company invests in new capital. Understanding the value drivers helps to develop insight into the likely behavior of free cash flows and value creation in the future. The return on total invested capital indicates the overall performance of the company. The return on incremental invested capital also indicates whether new capital is creating value or not. The Copeland, Koller and Murrin [1990] model of restructuring also shows that internal and external restructuring activities are needed to create value in a business. One way to create value is to undertake internal improvements, i.e., increasing operating margins and sales growth, and decreasing working-capital requirements. By taking advantage of strategic and operating opportunities, the company can realize its potential value as a portfolio of assets. These are the myriad fine-tuning opportunities that arise from understanding the relationship between operating parameters of each business unit (key value drivers) and value creation. Another way of creating value is determining the value enhancement potential that arises from external opportunities, that is, shrinking the company via sell-offs, expanding it through acquisitions or both. Some business units, even though fine tuned, can be more valuable in alternative uses, and should be sold. Divestiture can enhance value to the seller which can then redeploy the cash received to improve its own core business. In acquisitions, combinations that provide real synergies can enhance value.

Crum and Goldbergs Potential and Resilience Evaluation (PARE) model

Crum and Goldberg [1998] developed a framework for the assessment of enterprise viability known as Potential and Resilience Evaluation (PARE). They argued that taking actions that increase the potential and the resilience of a company create value. Potential, according to them, refers to the companys ability to generate cash flows. High returns come when managers allocate the resources of the firm Krishna Kant Vyas Page 8

to investments that generate increment in net. The potential of a company depends on the innovation ability and the implementation capacity of the firm. The assessment of these two factors indicates the preferred position. If the position of company is strong in one of the dimensions and weak in the other, corrective action need to be focused on in the problem area. It the firm is weak in both innovation ability and implementation capacity, serious consideration might be given to liquidation. Management then needs to assess the companys resilience before deciding to liquidate a company. Resilience refers to the risk associated with the future cash flows. It is used as a surrogate concept of risk. Risk can be viewed as the hostile forces that erode the firms competitive position and perhaps even threat its continued existence. Two strategically significant dimensions of risk, focus on different aspects of this possible erosion: the vulnerability position and the reserve capacity of the firm. The resilience position of a company is assessed using the combination of the threat side-the vulnerability position-and the defensive side-the reserve capacity. The overall evaluation of the firm is done by assessing, the potential and resilience dimensions. Strong potential and strong resilience, according to Crum and Goldberg [1998], shows that the company is strong competitor and vigilance is required to maintain that position. On the other hand, low resilience and low potential shows that the management should consider liquidation or, at a minimum, severe restructuring. Creation Evaluation of a company in terms of its potential and resilience helps in identifying problems and indicates corrections needed to create value.

Porters Value Chain Model

According to Porter, [1985], the profitability of a firm is influenced by its industry structure and by the strategic choice it makes in positioning itself in the industry. The first fundamental determinant of a firms profitability is industry attractiveness. In any industry the rules of competition are embodied in five competitive forces: i. ii. iii. iv. v. Entry of new competitors; Threat of substitutes; Bargaining power of buyers; Bargaining power of suppliers; and Rivalry among the existing competitors.

These five forces determine industry profitability because they influence the prices, costs and required investment of firms in an industry.

Krishna Kant Vyas

Page 9

The second basic determinant of a firms profitability is its relative position within its industry. Positioning determines whether a firms profitability is above or below the industry average. A firm that can position itself well may earn high rates of return even though industry structure is unfavorable and the average profitability is therefore modest. The fundamental basis of above average performance in the long run is sustainable competitive advantage. There are two basic types of competitive advantages: cost leadership and differentiation. A primary reason for pursuing forward, backward, and horizontal integration strategies is to gain cost leadership benefits. But cost leadership generally must be pursued in conjunction with differentiation. Summarizing we find that industry attractiveness and competitive advantage are principal sources of value creation. The more favorable these are, the more likely the company will create value.

Rappaports Value Network Model

Rappaport provided a framework analysis for value creation, which is indicated by him as a shareholder value network. The shareholder value approach estimates the economic value of an investment by discounting forecasted cash flows by the cost of capital. The total economic value of an entity such as a company or business unit is the sum of the value of its debt and its equity. The shareholder value is the difference of the value of the total firm and the market value of debt. The total value of the firm consists of three components, that is, the present value of cash flow from operations during the forecast period, residual value which represents the present value of the business attributable to the period beyond the forecast period and the current value of marketable securities and other investments that can be converted to cash. The shareholder value network depicts the essential link between the corporate objective of creating shareholder value and the basic valuation parameters or value drivers: sales growth rate, operating profit margin, income tax rate, working capital investments, fixed capital investment, cost of capital, and value growth duration. In such study, we have used the value creation models as a framework to identify the variables that need to be studied in increasing the value of companies. The aim is to apply the concepts of operations, investments and financing and their measures to the issue of restructuring companies for higher values. It also helps to more sharply focus managements attention on lines of activity it can competently manage to create value. Therefore, when the term value creation is used in this study in connection with the financial data it means the excess of the return on total capital (ROTC) over the cost of capital (k) as used in the Rappaport model.

Krishna Kant Vyas

Page 10

You might also like

- Corporate RestructuringDocument58 pagesCorporate RestructuringHarshNo ratings yet

- Corporate Restructuring - Meaning, Types, and CharacteristicsDocument6 pagesCorporate Restructuring - Meaning, Types, and CharacteristicsPrajwalNo ratings yet

- Corporate RestructuringDocument10 pagesCorporate RestructuringArpit Jain100% (1)

- Public Issue Mgt.Document5 pagesPublic Issue Mgt.vijay_fca4718No ratings yet

- Types of Corporate RestructuringDocument2 pagesTypes of Corporate Restructuringrohitboy123100% (2)

- Chapter 2 - Profit Prior To Incorporation NEW v2Document15 pagesChapter 2 - Profit Prior To Incorporation NEW v2SonamNo ratings yet

- Narayan Murthy Committee Report, 2003Document12 pagesNarayan Murthy Committee Report, 2003Gaurav Kumar50% (2)

- Regulatory Framework For Merger and AcquisitionDocument5 pagesRegulatory Framework For Merger and AcquisitionkavitaNo ratings yet

- Structure and Framework of Venture Capital Financing in IndiaDocument11 pagesStructure and Framework of Venture Capital Financing in Indiabrackishsea88% (8)

- Amalgamation and Absorption of CompaniesDocument89 pagesAmalgamation and Absorption of CompaniesHarshit Kumar GuptaNo ratings yet

- Module 2-EDDocument26 pagesModule 2-EDNikhil RankaNo ratings yet

- Introduction To Mergers and AcquisitionDocument90 pagesIntroduction To Mergers and AcquisitionmpsrishaNo ratings yet

- Legal Aspects M & ADocument15 pagesLegal Aspects M & ATwinkal chakradhari100% (1)

- Corporate RestructuringDocument19 pagesCorporate RestructuringVaibhav KaushikNo ratings yet

- Anti Takeover Amendments - MergersDocument7 pagesAnti Takeover Amendments - MergersBalajiNo ratings yet

- Introduction About IpoDocument29 pagesIntroduction About IpoShasha Pareek100% (6)

- Solution MERGER & ACQUISITION, CA-FINAL-SFM by CA PRAVINN MAHAJANDocument51 pagesSolution MERGER & ACQUISITION, CA-FINAL-SFM by CA PRAVINN MAHAJANPravinn_Mahajan80% (5)

- Merger and AquiseationDocument13 pagesMerger and AquiseationBabasab Patil (Karrisatte)100% (1)

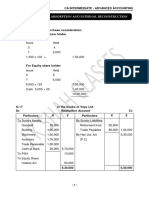

- Unit: I Lesson: 1 Amalgamation and External ReconstructionDocument43 pagesUnit: I Lesson: 1 Amalgamation and External ReconstructionVandana SharmaNo ratings yet

- Financial Management of Sick UnitsDocument12 pagesFinancial Management of Sick UnitsTeena PoonachaNo ratings yet

- Financial Management in Psu'sDocument14 pagesFinancial Management in Psu'sAkshaya Mali100% (1)

- Buyback of SharesDocument75 pagesBuyback of SharesVinodNo ratings yet

- Theories of MergersDocument17 pagesTheories of MergersDamini ManiktalaNo ratings yet

- Meaning and Importance of Financial Services 1&2 UNITDocument11 pagesMeaning and Importance of Financial Services 1&2 UNITAvinash KumarNo ratings yet

- Unit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationDocument17 pagesUnit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationPaulomi LahaNo ratings yet

- Project Report - Merger, Amalgamation, TakeoverDocument18 pagesProject Report - Merger, Amalgamation, TakeoverRohan kedia0% (1)

- Amalgamation of CompaniesDocument22 pagesAmalgamation of CompaniesSmit Shah0% (1)

- AmalgamationDocument14 pagesAmalgamationKrishnakant Mishra100% (1)

- Other Forms of Corporate RestructuringDocument16 pagesOther Forms of Corporate RestructuringDominic100% (1)

- Mergers & Acquisition in Banking SectorDocument21 pagesMergers & Acquisition in Banking SectorHimani HarsheNo ratings yet

- Anti Takeover StrategiesDocument13 pagesAnti Takeover StrategiesAmarinder SinghNo ratings yet

- Cost of CapitalDocument20 pagesCost of CapitalGagan RajpootNo ratings yet

- Buy Back PowerPoint Presentation CompleteDocument22 pagesBuy Back PowerPoint Presentation CompleteRaj GandhiNo ratings yet

- New PPT For Euro Issue 1Document28 pagesNew PPT For Euro Issue 1Bravoboy Johny83% (6)

- Competition Act 2002Document19 pagesCompetition Act 2002Vatsal ChauhanNo ratings yet

- M&a QuesDocument4 pagesM&a QuesRiya GargNo ratings yet

- Chapter 7 CapitalisationDocument19 pagesChapter 7 CapitalisationPooja SheoranNo ratings yet

- Defense Mechanism Against Hostile TakeoversDocument7 pagesDefense Mechanism Against Hostile Takeoversyoungarien100% (1)

- AmalgamationDocument35 pagesAmalgamationKaran VyasNo ratings yet

- Takeover and AcquisitionsDocument42 pagesTakeover and Acquisitionsparasjain100% (1)

- Primary MarketDocument27 pagesPrimary MarketMrunal Chetan Josih0% (1)

- Chapter 6 - Portfolio Evaluation and RevisionDocument26 pagesChapter 6 - Portfolio Evaluation and RevisionShahrukh ShahjahanNo ratings yet

- Mergers, Acquisitions and Corporate RestructuringDocument15 pagesMergers, Acquisitions and Corporate RestructuringSubrahmanya100% (2)

- Mergers & AcquisitionsDocument5 pagesMergers & Acquisitionsharesh100% (2)

- DCF Valuation: Merger Is A Special Type of Capital Budgeting DecisionDocument13 pagesDCF Valuation: Merger Is A Special Type of Capital Budgeting DecisionAkhilesh Kumar100% (1)

- Narayan Murthy Role Model of Corporate GovernanceDocument32 pagesNarayan Murthy Role Model of Corporate GovernanceRahul RafaliyaNo ratings yet

- Further Issue of SharesDocument4 pagesFurther Issue of SharesMaithili SUBRAMANIANNo ratings yet

- Naresh Chandra Committe, PresentationDocument14 pagesNaresh Chandra Committe, Presentationrjruchirocks100% (9)

- Capital BudgetingDocument12 pagesCapital BudgetingKhadar50% (4)

- Anti Takeover MeasuresDocument54 pagesAnti Takeover MeasuresParvesh Aghi50% (2)

- Merchant BankingDocument6 pagesMerchant BankingVivek TathodNo ratings yet

- Final PPT Reforms in Financial SystemDocument25 pagesFinal PPT Reforms in Financial SystemUSDavidNo ratings yet

- FM - Dividend Policy and Dividend Decision Models (Cir 18.3.2020)Document129 pagesFM - Dividend Policy and Dividend Decision Models (Cir 18.3.2020)Rohit PanpatilNo ratings yet

- Companies Act 2013 - Ppt-1Document21 pagesCompanies Act 2013 - Ppt-1raj kumar100% (2)

- Emotional Factors & Social ForcesDocument25 pagesEmotional Factors & Social ForcesDhaval ShahNo ratings yet

- Mergers and Acquisition in Telecom Sector in IndiaDocument21 pagesMergers and Acquisition in Telecom Sector in IndiaRishi GoenkaNo ratings yet

- Tax PlanDocument2 pagesTax PlanMrigendra MishraNo ratings yet

- Various Forms of RestructuringDocument43 pagesVarious Forms of RestructuringAnkita GaikwadNo ratings yet

- Merger Acquisition and Corporate RestructuringDocument30 pagesMerger Acquisition and Corporate Restructuringtafese kuracheNo ratings yet

- 1CR NotesDocument30 pages1CR NotesYASHIRA PATELNo ratings yet

- AFFIDAVIT For After Marriage Name ChangeDocument2 pagesAFFIDAVIT For After Marriage Name ChangeKrishna VyasNo ratings yet

- Manual For Permissions For New Industry Setup in MaharashtraDocument38 pagesManual For Permissions For New Industry Setup in MaharashtraKrishna VyasNo ratings yet

- Planning For Business Continuity and Disaster RecoveryDocument7 pagesPlanning For Business Continuity and Disaster RecoveryKrishna VyasNo ratings yet

- Crowdsourcing PaperDocument8 pagesCrowdsourcing PaperKrishna VyasNo ratings yet

- Cloud ComputingDocument10 pagesCloud ComputingKrishna VyasNo ratings yet

- Knowledge Process OutsourcingDocument9 pagesKnowledge Process OutsourcingKrishna VyasNo ratings yet

- Human Resource AcountingDocument7 pagesHuman Resource AcountingKrishna VyasNo ratings yet

- Griffith Ratio AnalysisDocument6 pagesGriffith Ratio AnalysisGeo J100% (1)

- Balance Sheet ExampleDocument2 pagesBalance Sheet ExampleKC XitizNo ratings yet

- In-Class Exercise Chapter 2 FA 21Document8 pagesIn-Class Exercise Chapter 2 FA 21Thomas TermoteNo ratings yet

- Income Statement, Changes in Equity, Balance Sheet (Doctora)Document6 pagesIncome Statement, Changes in Equity, Balance Sheet (Doctora)kianna doctoraNo ratings yet

- P 13 2. Law Question Bank PDFDocument41 pagesP 13 2. Law Question Bank PDFColms JoseNo ratings yet

- Merger of Bank of Rajasthan With ICICI BankDocument11 pagesMerger of Bank of Rajasthan With ICICI Banku409023No ratings yet

- FINC512 Assignement QuestionsDocument37 pagesFINC512 Assignement QuestionsNaina Malhotra0% (1)

- Home Depot Financial Statement Analysis ReportDocument6 pagesHome Depot Financial Statement Analysis Reportapi-301173024No ratings yet

- CFA560Document20 pagesCFA560goyalabhiNo ratings yet

- Full Download Fundamentals of Corporate Finance Australian 3rd Edition Berk Solutions ManualDocument36 pagesFull Download Fundamentals of Corporate Finance Australian 3rd Edition Berk Solutions Manualhone.kyanize.gnjijj100% (37)

- 5 Amalgamation, Absorption and External Reconstruction - HomeworkDocument21 pages5 Amalgamation, Absorption and External Reconstruction - HomeworkYash ShewaleNo ratings yet

- IFRS 10 Consolidated Financial StatementsDocument20 pagesIFRS 10 Consolidated Financial StatementsGround ZeroNo ratings yet

- Ch02 Financial Statements, Taxes, and Cash FlowsDocument34 pagesCh02 Financial Statements, Taxes, and Cash FlowsAndrew BruceNo ratings yet

- Financial Ratio AnalysisDocument29 pagesFinancial Ratio AnalysisAbubakar Danmashi81% (16)

- Zekarias YohannesDocument88 pagesZekarias YohannesadamNo ratings yet

- Chapter 6 Financial AssetsDocument6 pagesChapter 6 Financial AssetsJoyce Mae D. FloresNo ratings yet

- Chapter 1-Bài TậpDocument8 pagesChapter 1-Bài Tậplinhnk234111eNo ratings yet

- 01 - Title - SoudhgangaDocument330 pages01 - Title - SoudhgangaVinod BCNo ratings yet

- Assignment 1 Front Sheet: Qualification BTEC Level 4 HND Diploma in BusinessDocument17 pagesAssignment 1 Front Sheet: Qualification BTEC Level 4 HND Diploma in BusinessLe Hai Anh - FAID HNNo ratings yet

- San Miguel CorporationDocument7 pagesSan Miguel CorporationRay marNo ratings yet

- Statement of Changes in Equity - ExampleDocument3 pagesStatement of Changes in Equity - ExampleTami ChitandaNo ratings yet

- Modern Advanced Accounting in Canada Canadian 8th Edition Hilton Test BankDocument36 pagesModern Advanced Accounting in Canada Canadian 8th Edition Hilton Test Bankviviankellerbv5yy8No ratings yet

- FR Test 2 Full Syllabus Question Paper1655723440Document12 pagesFR Test 2 Full Syllabus Question Paper1655723440Nakul GoyalNo ratings yet

- Financial Accounting Part 1Document5 pagesFinancial Accounting Part 1Christopher Price100% (1)

- Purefoods Financial Statements 2018-2021Document8 pagesPurefoods Financial Statements 2018-2021Kyle Denise Castillo VelascoNo ratings yet

- India Business QuizDocument10 pagesIndia Business QuizDeep Patel100% (1)

- AccountingDocument13 pagesAccountingRialeeNo ratings yet

- FIN4717 FIN4717 Entrepreneurial Entrepreneurial Finance FinanceDocument69 pagesFIN4717 FIN4717 Entrepreneurial Entrepreneurial Finance Financedaniel_foo_16No ratings yet

- BAAE Financial Transaction WorksheetDocument1 pageBAAE Financial Transaction WorksheetjepsyutNo ratings yet

- Assignment (PGPM-14) - Infrastructure DevelopmentDocument42 pagesAssignment (PGPM-14) - Infrastructure DevelopmentSaurabh Kumar Sharma100% (1)

- Summary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessFrom EverandSummary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessNo ratings yet

- The Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessFrom EverandThe Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessRating: 5 out of 5 stars5/5 (456)

- The One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsFrom EverandThe One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsRating: 4.5 out of 5 stars4.5/5 (709)

- Can't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsFrom EverandCan't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsRating: 4.5 out of 5 stars4.5/5 (383)

- The Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaFrom EverandThe Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaRating: 4.5 out of 5 stars4.5/5 (266)

- Summary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesFrom EverandSummary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesRating: 5 out of 5 stars5/5 (1635)

- How To Win Friends and Influence People by Dale Carnegie - Book SummaryFrom EverandHow To Win Friends and Influence People by Dale Carnegie - Book SummaryRating: 5 out of 5 stars5/5 (556)

- The Whole-Brain Child by Daniel J. Siegel, M.D., and Tina Payne Bryson, PhD. - Book Summary: 12 Revolutionary Strategies to Nurture Your Child’s Developing MindFrom EverandThe Whole-Brain Child by Daniel J. Siegel, M.D., and Tina Payne Bryson, PhD. - Book Summary: 12 Revolutionary Strategies to Nurture Your Child’s Developing MindRating: 4.5 out of 5 stars4.5/5 (57)

- Summary of 12 Rules for Life: An Antidote to ChaosFrom EverandSummary of 12 Rules for Life: An Antidote to ChaosRating: 4.5 out of 5 stars4.5/5 (294)

- The War of Art by Steven Pressfield - Book Summary: Break Through The Blocks And Win Your Inner Creative BattlesFrom EverandThe War of Art by Steven Pressfield - Book Summary: Break Through The Blocks And Win Your Inner Creative BattlesRating: 4.5 out of 5 stars4.5/5 (273)

- Summary of The Algebra of Wealth by Scott Galloway: A Simple Formula for Financial SecurityFrom EverandSummary of The Algebra of Wealth by Scott Galloway: A Simple Formula for Financial SecurityNo ratings yet

- Summary of Atomic Habits by James ClearFrom EverandSummary of Atomic Habits by James ClearRating: 5 out of 5 stars5/5 (169)

- Book Summary of Ego Is The Enemy by Ryan HolidayFrom EverandBook Summary of Ego Is The Enemy by Ryan HolidayRating: 4.5 out of 5 stars4.5/5 (387)

- Mindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessFrom EverandMindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessRating: 4.5 out of 5 stars4.5/5 (328)

- Summary of The Galveston Diet by Mary Claire Haver MD: The Doctor-Developed, Patient-Proven Plan to Burn Fat and Tame Your Hormonal SymptomsFrom EverandSummary of The Galveston Diet by Mary Claire Haver MD: The Doctor-Developed, Patient-Proven Plan to Burn Fat and Tame Your Hormonal SymptomsNo ratings yet

- Steal Like an Artist by Austin Kleon - Book Summary: 10 Things Nobody Told You About Being CreativeFrom EverandSteal Like an Artist by Austin Kleon - Book Summary: 10 Things Nobody Told You About Being CreativeRating: 4.5 out of 5 stars4.5/5 (128)

- Essentialism by Greg McKeown - Book Summary: The Disciplined Pursuit of LessFrom EverandEssentialism by Greg McKeown - Book Summary: The Disciplined Pursuit of LessRating: 4.5 out of 5 stars4.5/5 (187)

- Make It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningFrom EverandMake It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningRating: 4.5 out of 5 stars4.5/5 (55)

- Designing Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeFrom EverandDesigning Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeRating: 4.5 out of 5 stars4.5/5 (62)

- We Were the Lucky Ones: by Georgia Hunter | Conversation StartersFrom EverandWe Were the Lucky Ones: by Georgia Hunter | Conversation StartersNo ratings yet

- Sell or Be Sold by Grant Cardone - Book Summary: How to Get Your Way in Business and in LifeFrom EverandSell or Be Sold by Grant Cardone - Book Summary: How to Get Your Way in Business and in LifeRating: 4.5 out of 5 stars4.5/5 (86)

- How Not to Die by Michael Greger MD, Gene Stone - Book Summary: Discover the Foods Scientifically Proven to Prevent and Reverse DiseaseFrom EverandHow Not to Die by Michael Greger MD, Gene Stone - Book Summary: Discover the Foods Scientifically Proven to Prevent and Reverse DiseaseRating: 4.5 out of 5 stars4.5/5 (84)

- Summary of When Things Fall Apart: Heart Advice for Difficult Times by Pema ChödrönFrom EverandSummary of When Things Fall Apart: Heart Advice for Difficult Times by Pema ChödrönRating: 4.5 out of 5 stars4.5/5 (22)

- Summary of Million Dollar Weekend by Noah Kagan and Tahl Raz: The Surprisingly Simple Way to Launch a 7-Figure Business in 48 HoursFrom EverandSummary of Million Dollar Weekend by Noah Kagan and Tahl Raz: The Surprisingly Simple Way to Launch a 7-Figure Business in 48 HoursNo ratings yet

- The 5 Second Rule by Mel Robbins - Book Summary: Transform Your Life, Work, and Confidence with Everyday CourageFrom EverandThe 5 Second Rule by Mel Robbins - Book Summary: Transform Your Life, Work, and Confidence with Everyday CourageRating: 4.5 out of 5 stars4.5/5 (329)

- Summary, Analysis, and Review of Daniel Kahneman's Thinking, Fast and SlowFrom EverandSummary, Analysis, and Review of Daniel Kahneman's Thinking, Fast and SlowRating: 3.5 out of 5 stars3.5/5 (2)

- Blink by Malcolm Gladwell - Book Summary: The Power of Thinking Without ThinkingFrom EverandBlink by Malcolm Gladwell - Book Summary: The Power of Thinking Without ThinkingRating: 4.5 out of 5 stars4.5/5 (114)

- Tiny Habits by BJ Fogg - Book Summary: The Small Changes That Change EverythingFrom EverandTiny Habits by BJ Fogg - Book Summary: The Small Changes That Change EverythingRating: 4.5 out of 5 stars4.5/5 (111)